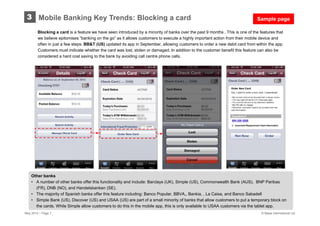

This document provides a summary of a report on the state of mobile banking apps in 2014. It discusses increasing customer engagement with mobile banking as banks add functionality previously only available on desktop. The report analyzes innovations in mobile banking over the past 9 months, identifies essential functionalities, and examines the future of mobile banking and potential disruptors. It aims to help banks understand their positioning relative to competitors and identify opportunities to strengthen mobile offerings.