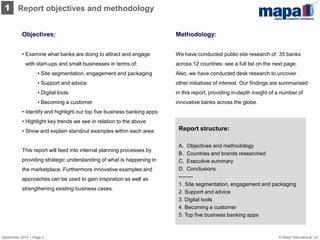

This document provides an overview and sample pages from a report by Mapa Insight Series titled "How to win start-ups: A global good practice report". The summary includes:

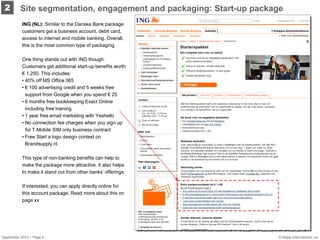

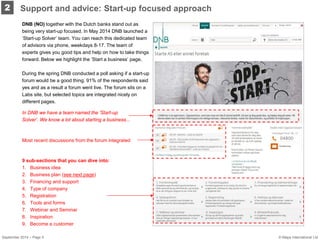

1. The report examines best practices from banks around the world in attracting and engaging with start-ups through site segmentation/packaging, support/advice, digital tools, and customer onboarding processes.

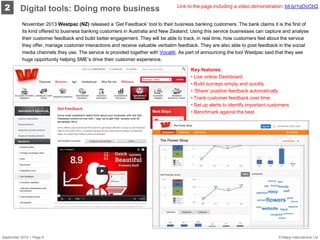

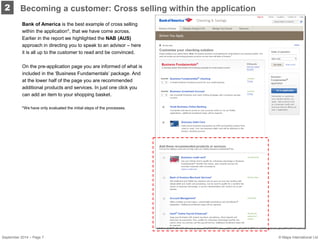

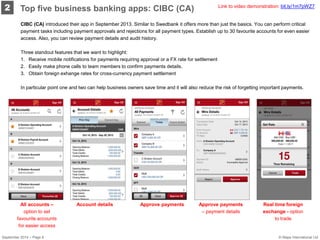

2. Sample pages show standout examples from banks like ING, DNB, and Westpac and their approaches to start-up packages, support/advice teams, and digital feedback tools.

3. Mapa produces regular reports on digital banking topics and provides an upcoming schedule covering mobile banking, digital P