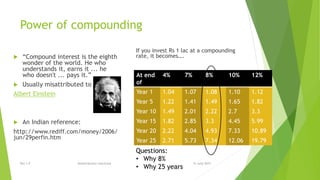

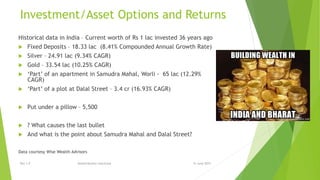

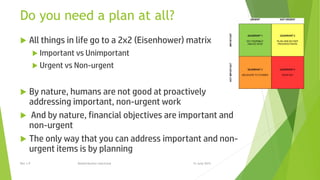

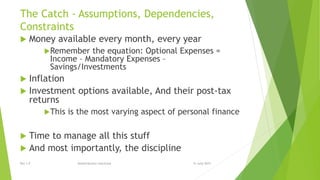

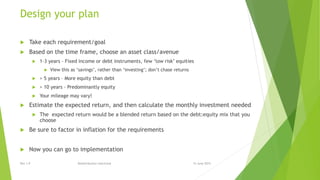

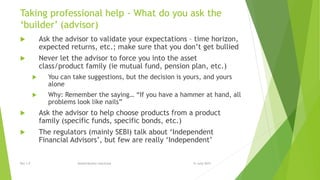

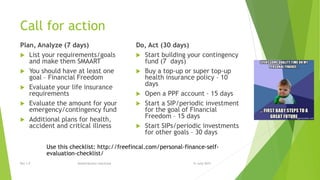

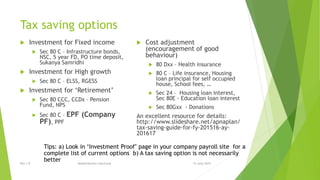

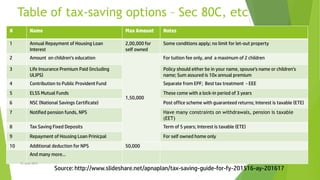

The document presents an engineering approach to achieving financial freedom through various wealth concepts, emphasizing the power of compounding, asset classes, and historical returns. It highlights the necessity of careful planning, validating assumptions, and implementing a structured investment strategy to reach financial goals. Key takeaways include avoiding common investment mistakes and understanding the relationship between returns and volatility in financial products.