Embed presentation

Downloaded 37 times

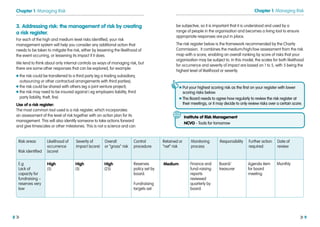

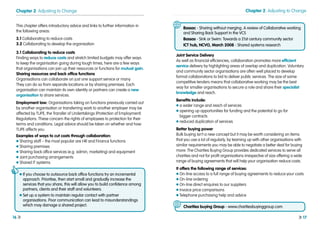

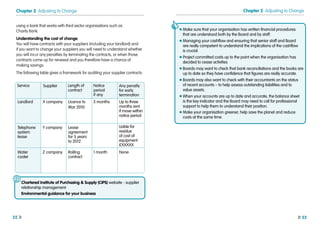

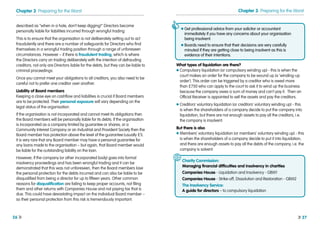

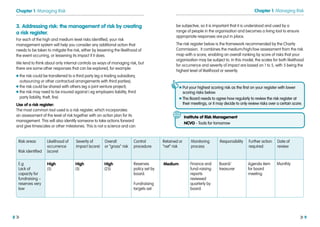

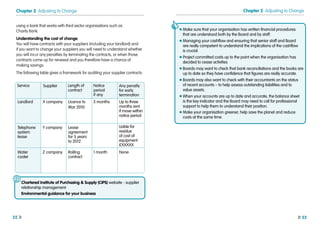

Managing in Tough Times provides guidance for third sector organizations facing financial difficulties. It covers identifying and managing risks, adjusting to changes like staffing pressures, preparing for redundancy or closure. The guide offers advice on communication, consultation, collaboration, mergers and managing finances during tough economic times. The goal is to help organizations continue providing services effectively through periods of uncertainty and change.