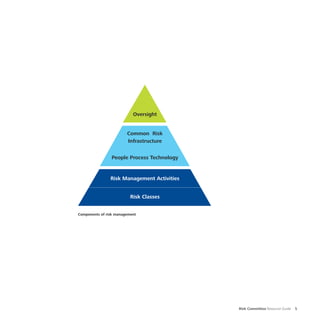

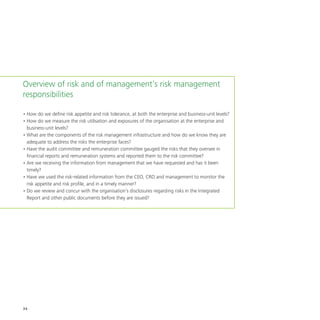

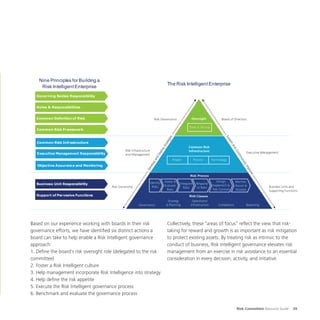

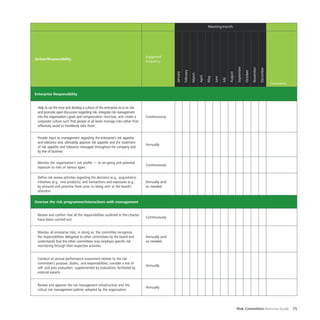

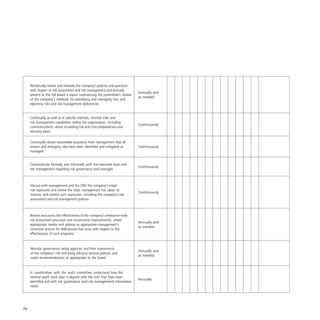

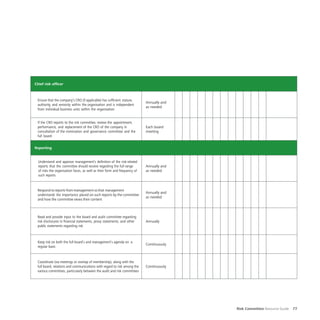

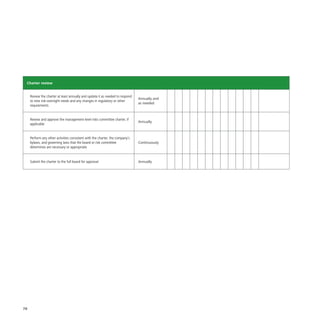

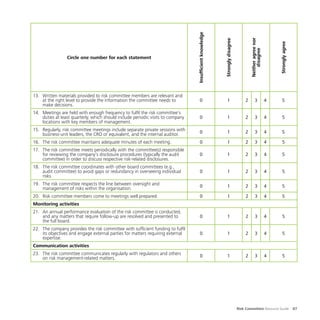

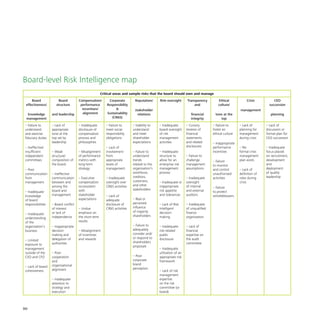

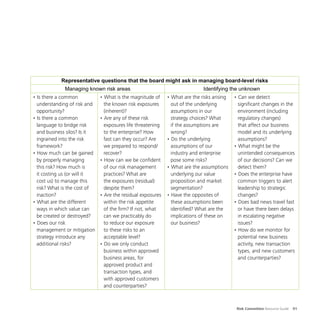

This document discusses considerations for forming a risk committee at the board level. It recommends that companies establish a separate risk committee, rather than assigning risk oversight to the audit committee, in order to ensure adequate focus on non-financial and operational risks. Key factors to consider in deciding whether to form a risk committee include the inherent risk environment of the company and complexity of risks, as well as meeting the needs of stakeholders. The risk committee should oversee the company's risk management process and receive reports from management and assurance providers on risk management effectiveness.