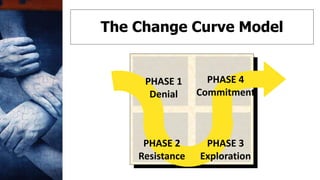

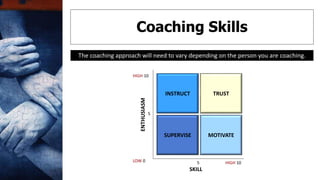

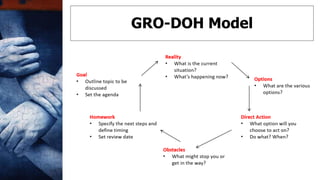

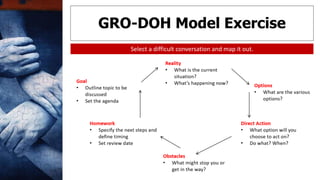

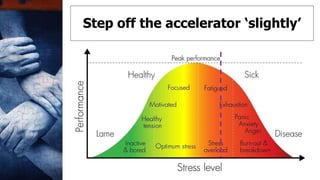

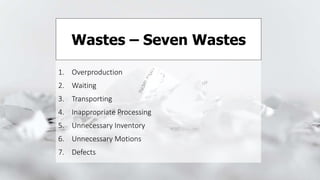

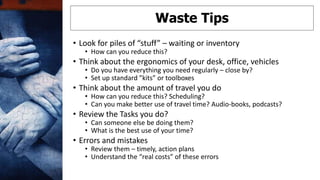

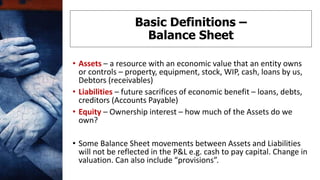

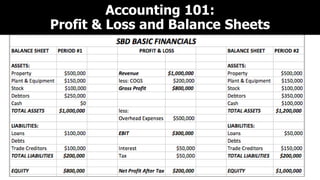

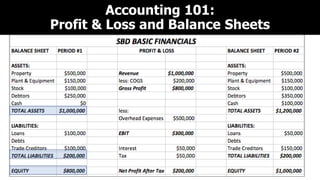

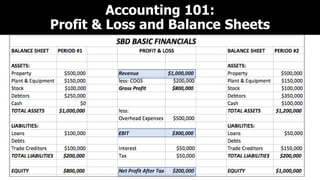

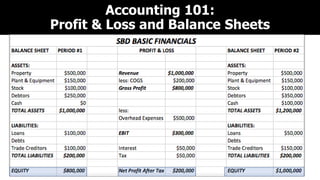

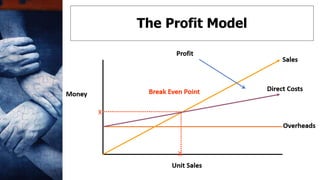

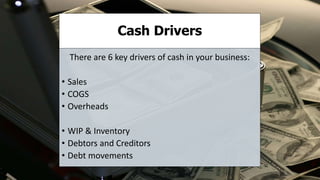

This document outlines an agenda for a webinar on coaching team members, having difficult conversations, and finding waste. It discusses change management models, coaching skills, mapping difficult conversations, slowing down to speed up, the seven types of waste, and basic accounting definitions for profit/loss statements and balance sheets. Financial levers like price, costs, overheads, and sales volume are presented as ways to increase profits. Key drivers of cash flow are identified as sales, costs of goods sold, overheads, work in progress, debtors/creditors, and debt movements.