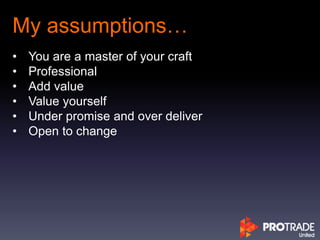

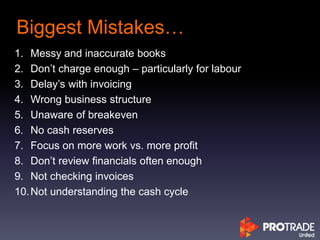

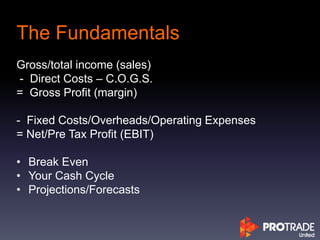

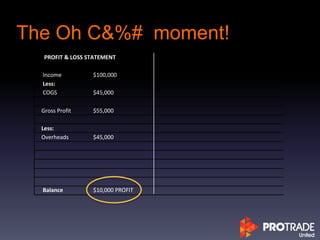

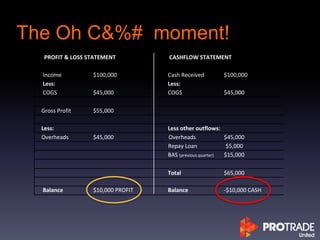

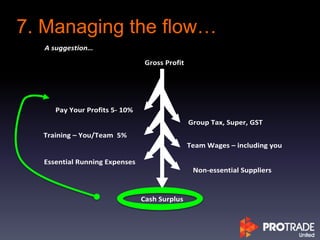

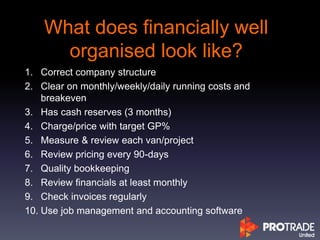

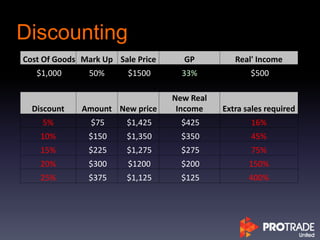

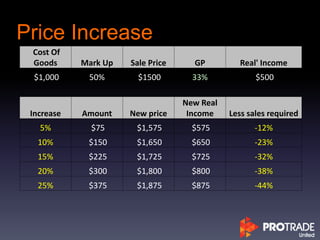

The document outlines ten creative strategies for improving cash flow and profits for trade and construction business owners, emphasizing the importance of financial understanding and effective management practices. It identifies common financial mistakes and stresses the need for consistent monitoring of income, expenses, and pricing strategies. Additionally, it highlights the necessity of setting profit targets and managing financial risks to achieve long-term success and stability.