Embed presentation

Download to read offline

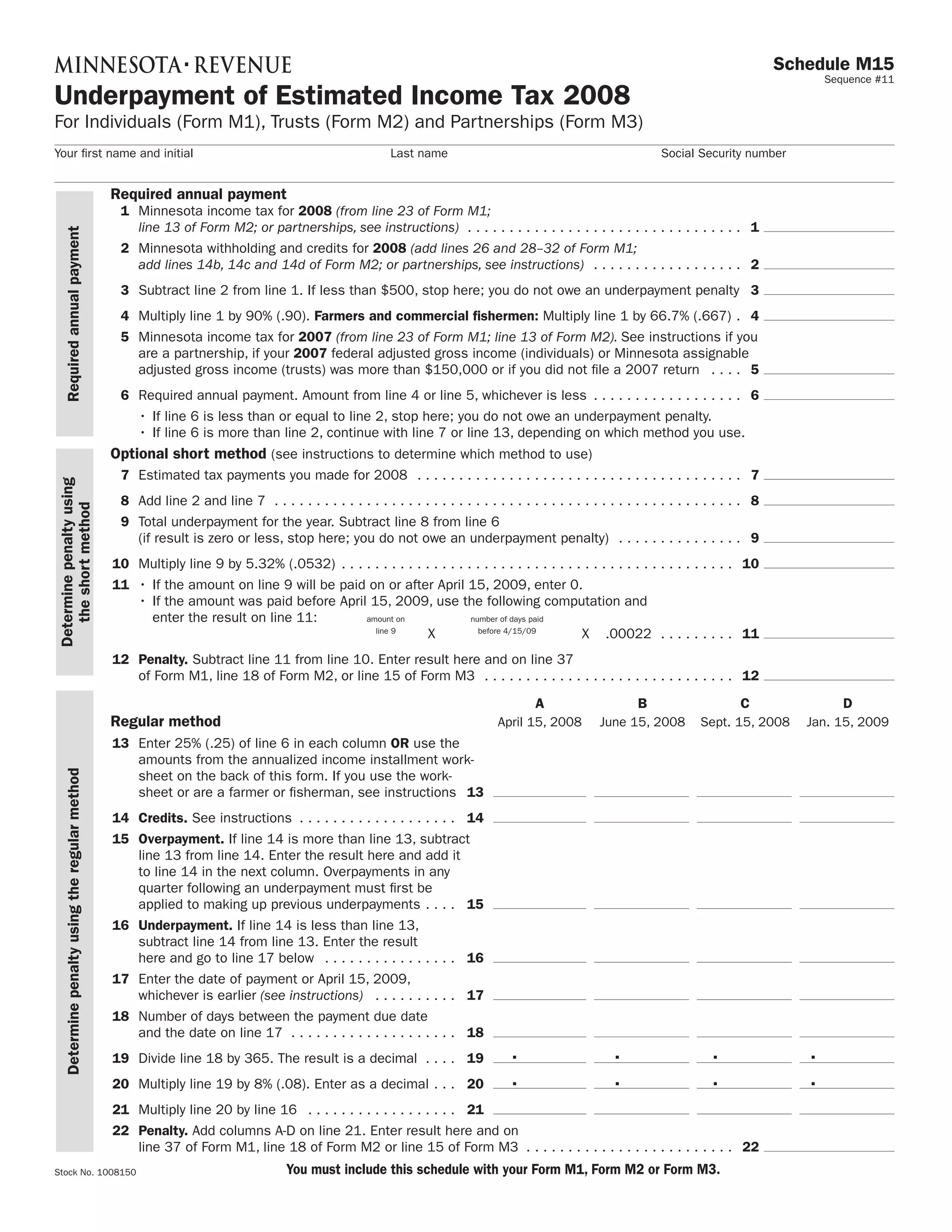

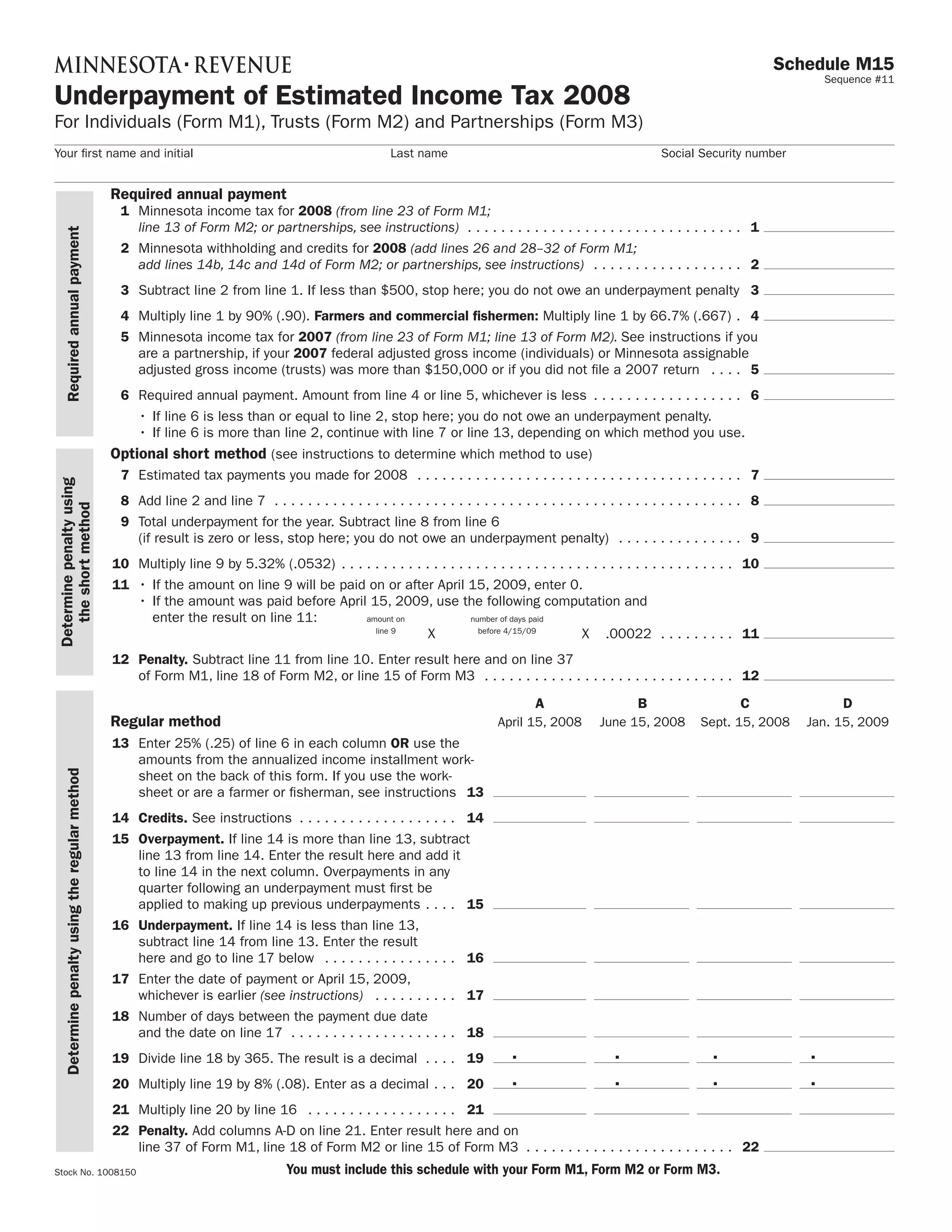

This document is a form for calculating penalties for underpayment of estimated income taxes for 2008. It provides instructions for individuals, trusts, and partnerships to calculate their required annual payment, estimated tax payments, and any penalties owed for underpaying their estimated taxes during the year. The form outlines two methods (short and regular) for calculating penalties and includes worksheets for annualizing income over the year to determine estimated tax payment amounts.