Embed presentation

Download to read offline

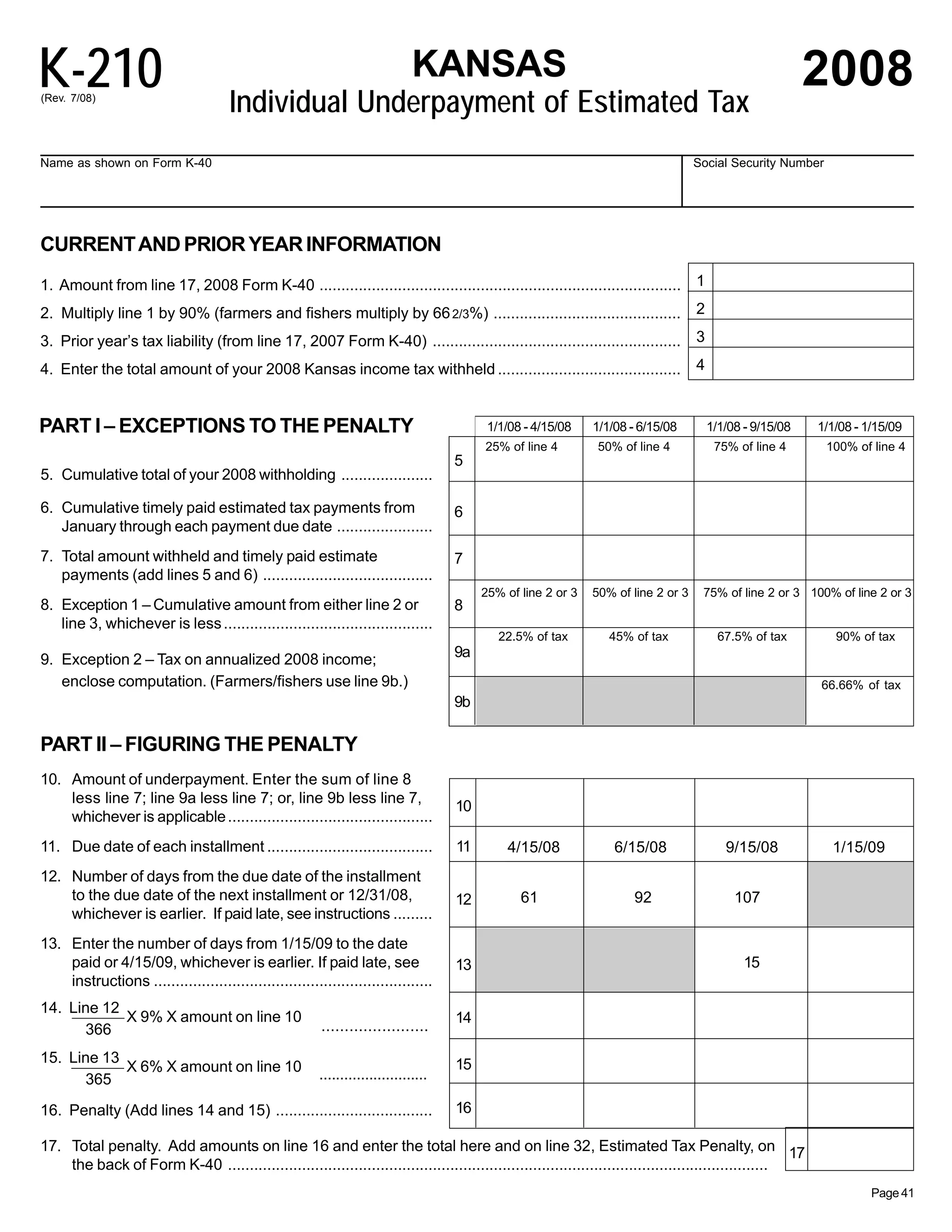

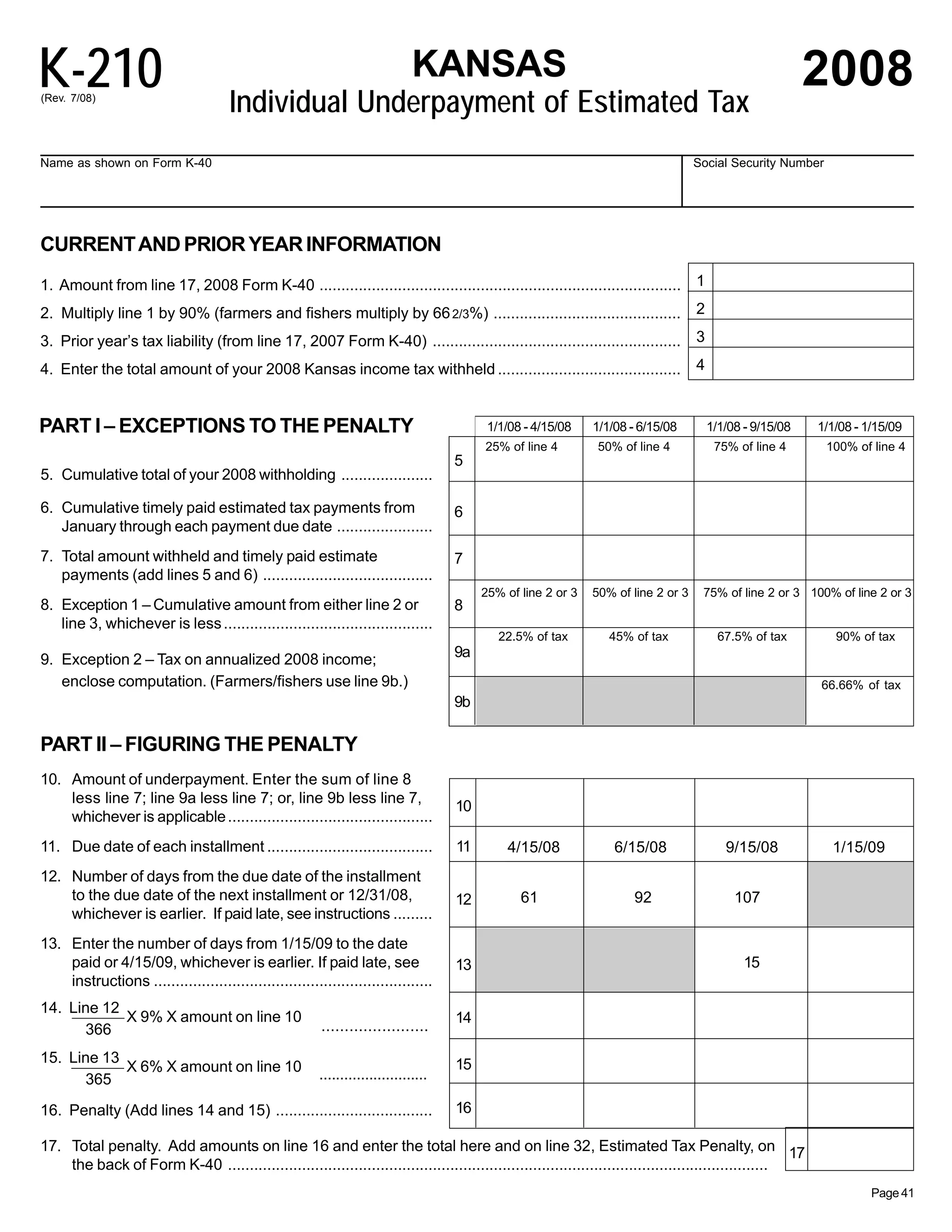

This document is instructions for calculating penalties for underpayment of estimated taxes on a Kansas individual income tax return form (K-40). It provides details on exceptions to penalties if certain payment thresholds are met. It also outlines a multi-step process for determining the amount of any penalties owed based on the dates estimated tax payments were made throughout the tax year. Key dates and percentages to use in the calculations are provided in a table for convenience.