Embed presentation

Download to read offline

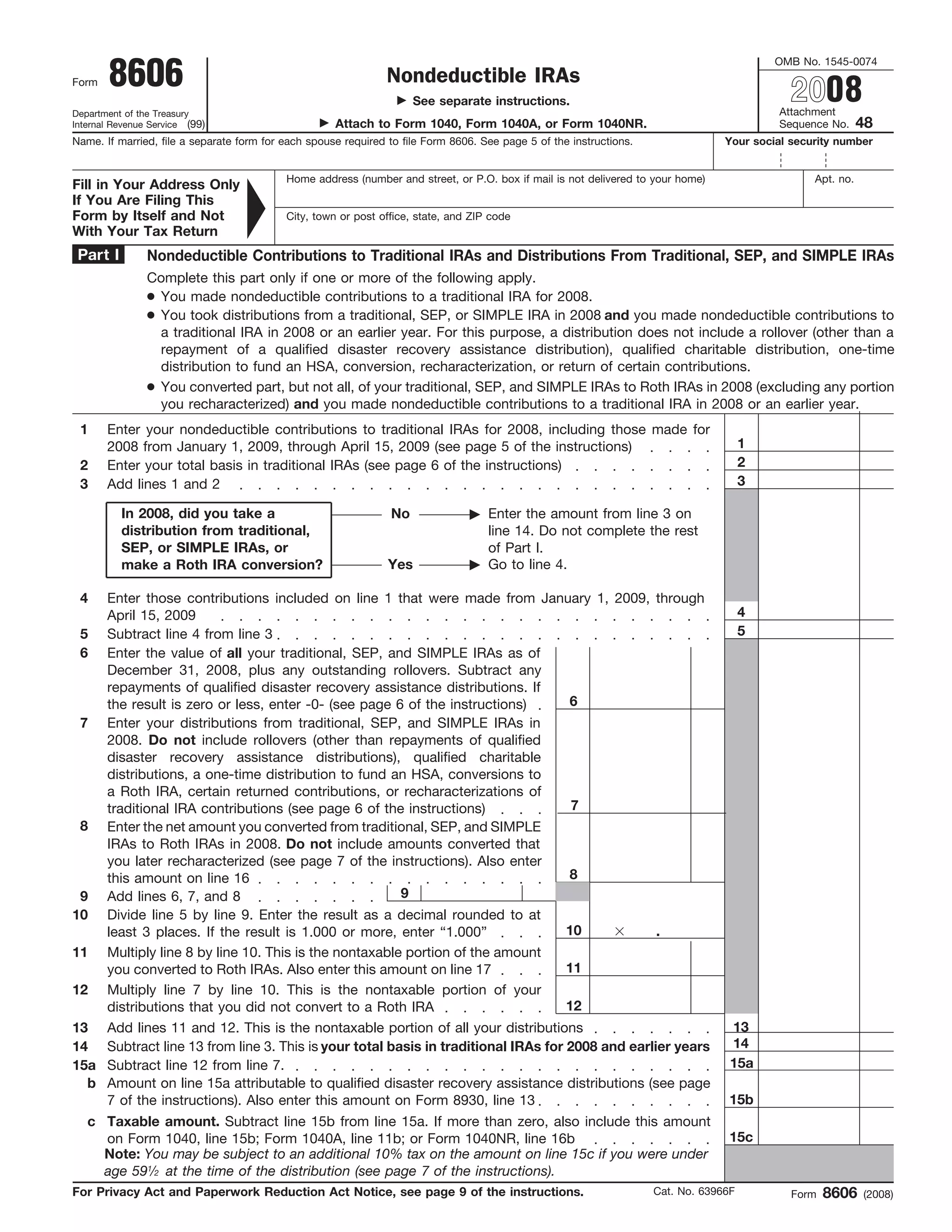

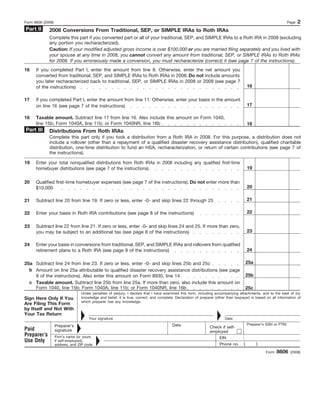

This document is an IRS form for reporting nondeductible IRA contributions and conversions. It contains instructions for reporting: [1] nondeductible traditional IRA contributions and distributions; [2] conversions from traditional IRAs to Roth IRAs; and [3] distributions from Roth IRAs. Taxpayers must provide details of nondeductible contributions, account balances, distributions, and conversions between traditional and Roth IRAs to calculate tax liability.