Embed presentation

Download to read offline

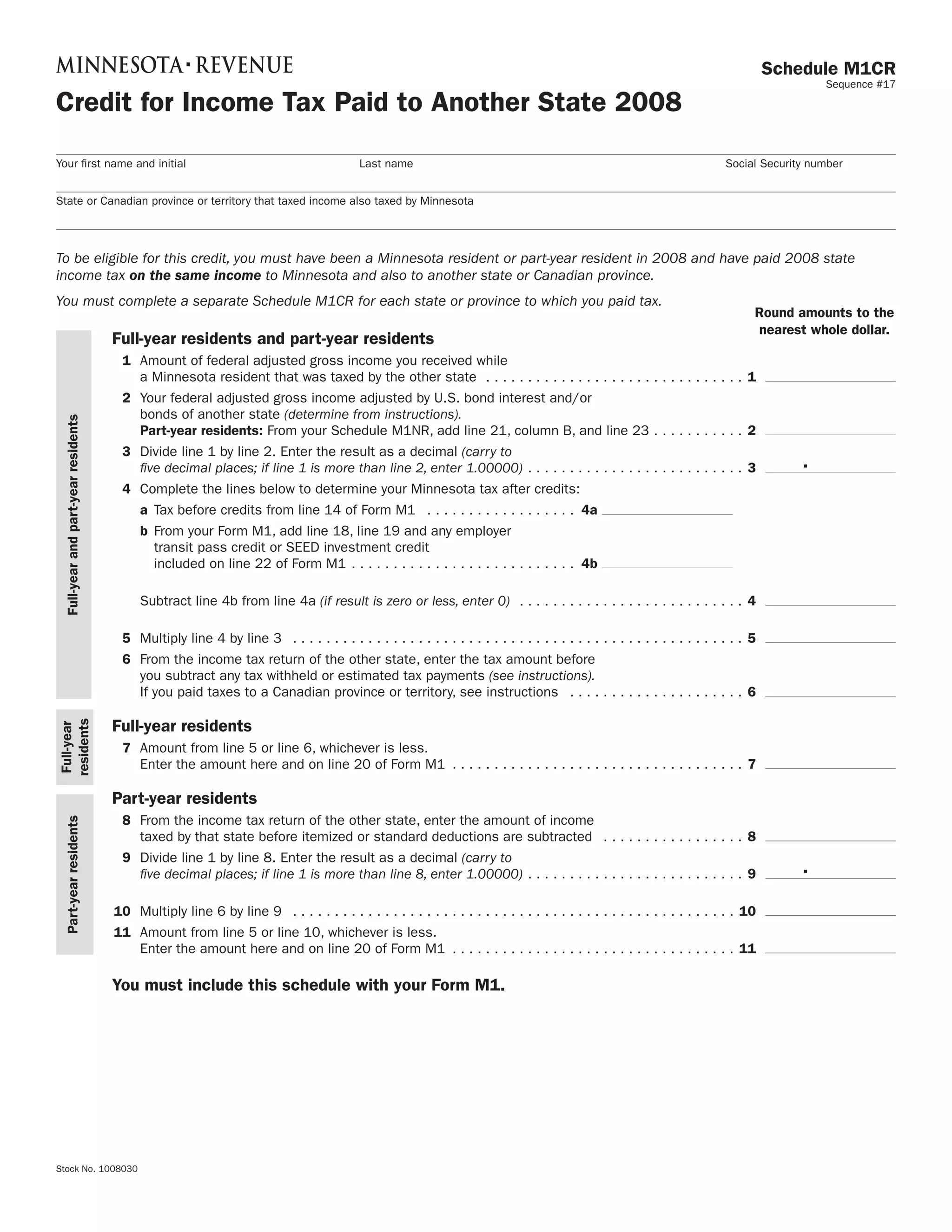

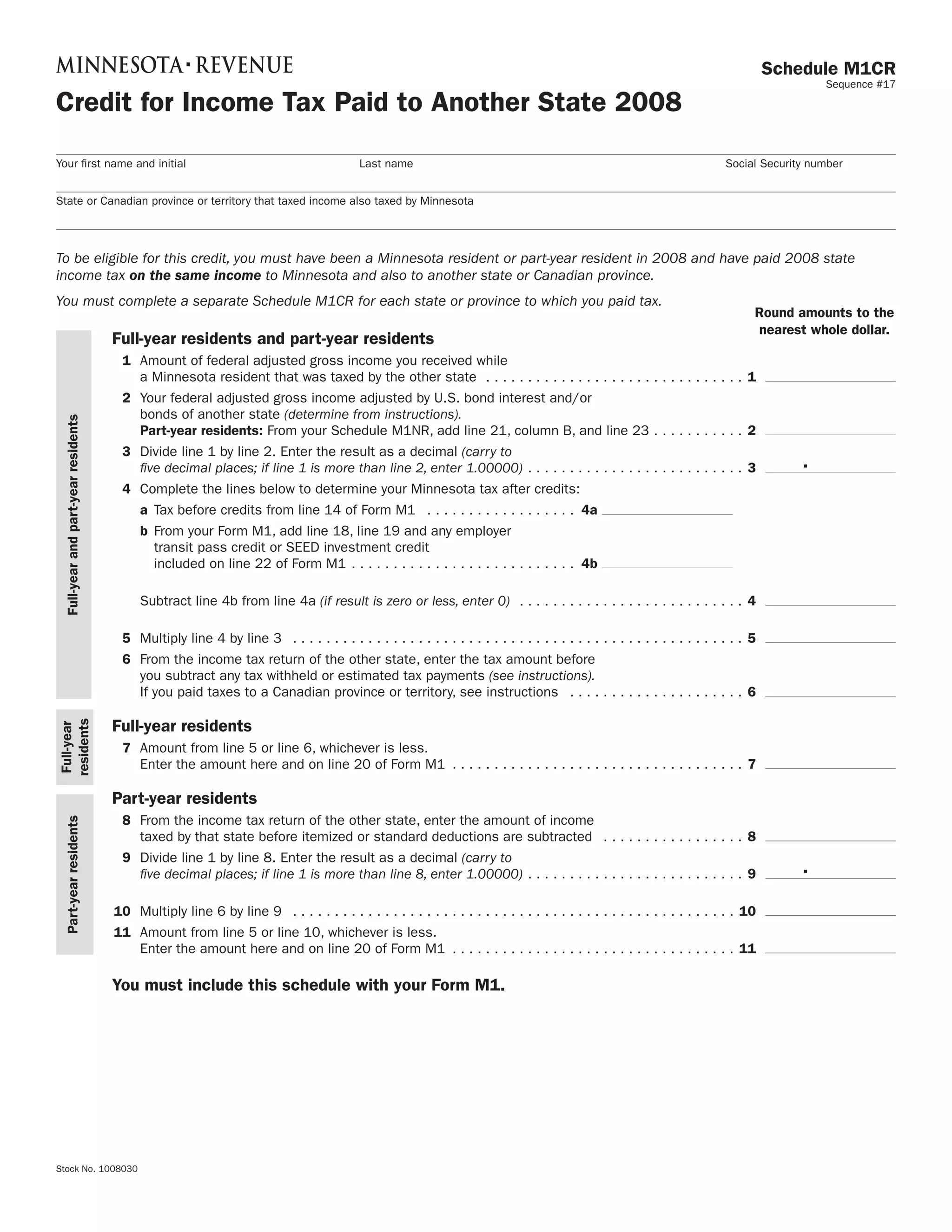

This document provides instructions for completing Schedule M1CR to claim a credit for income tax paid to another state on a Minnesota tax return. Taxpayers may be eligible if they were a Minnesota resident in 2008 and paid income tax to Minnesota and another state on the same income. The schedule walks through calculating the credit amount by determining the portion of income taxed by both states and limiting the credit to the lesser of the tax paid to the other state or a percentage of the Minnesota tax.