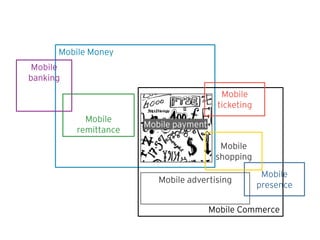

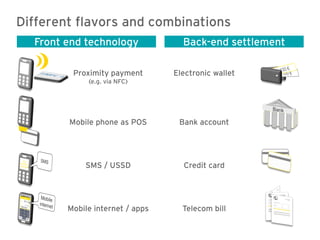

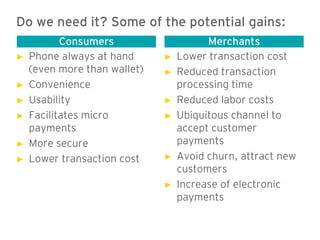

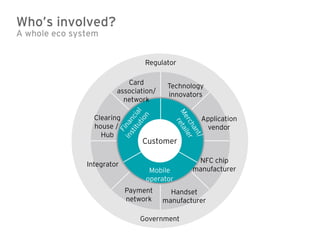

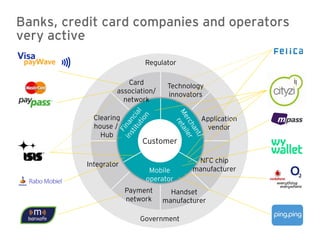

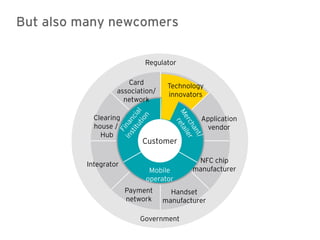

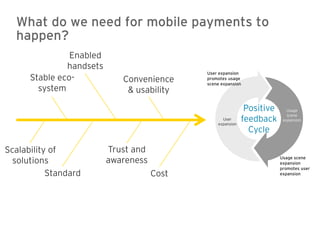

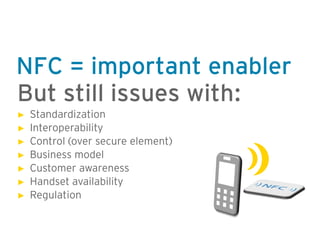

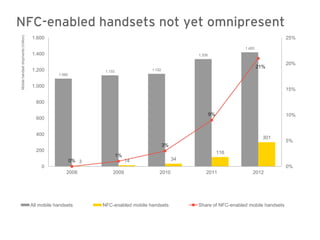

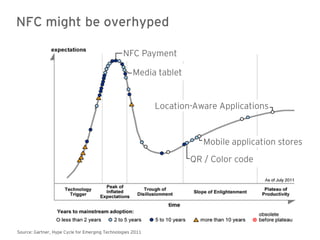

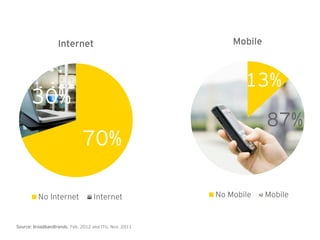

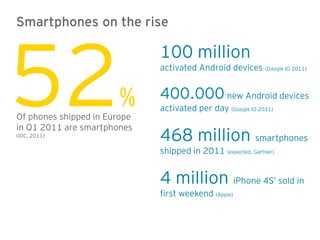

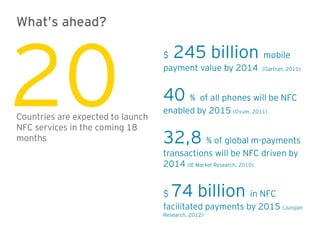

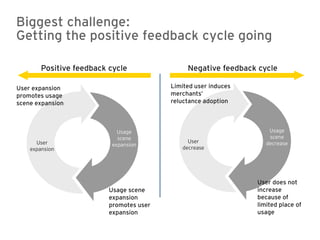

This document discusses mobile payments and the mobile commerce ecosystem. It outlines different types of mobile payments such as mobile money, mobile banking, mobile ticketing, and mobile shopping that can be enabled through technologies like NFC, electronic wallets, SMS/USSD, and mobile apps. A variety of players are involved including mobile operators, handset manufacturers, payment networks, banks, credit card companies, technology innovators, and application vendors. While the technology is still developing, factors like standardization, interoperability, handset availability, and customer awareness will influence when mobile payments see widespread adoption.