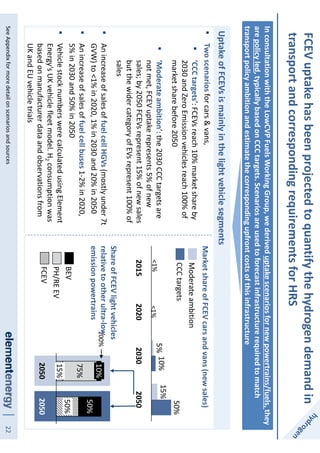

This document discusses future infrastructure requirements for hydrogen refueling stations to support the deployment of hydrogen fuel cell vehicles between 2015-2050. It outlines current hydrogen production and distribution systems, which are focused on industrial uses. Future infrastructure will need to support both large original equipment manufacturers and smaller vehicle manufacturers. Refueling station needs will depend on the deployment of different types of hydrogen fuel cell vehicles. Barriers to deployment of refueling infrastructure include a lack of standards and the high cost of building out networks before significant demand exists. The report provides recommendations to help deliver the needed infrastructure expansion.