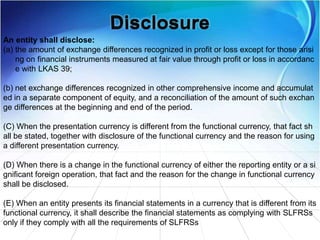

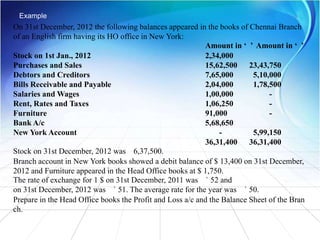

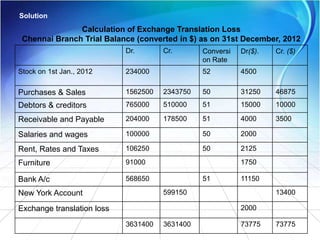

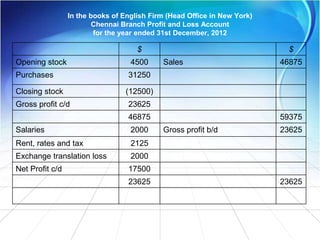

This document outlines the objective, scope, definitions, and accounting treatments relating to reporting foreign currency transactions and foreign operations according to a particular accounting standard. The objective is to prescribe how to include foreign currency transactions and foreign operations in financial statements. It applies to accounting for transactions in foreign currencies and translating financial statements of foreign operations. Key aspects covered include initial recognition of foreign currency transactions, translation of monetary and non-monetary items at period ends, recognition of exchange differences, and disclosure requirements. An example problem is also provided to demonstrate the application of translation.