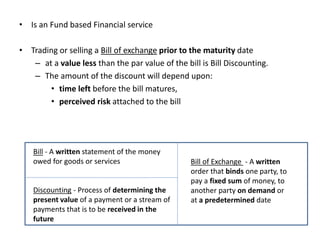

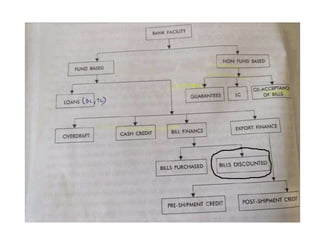

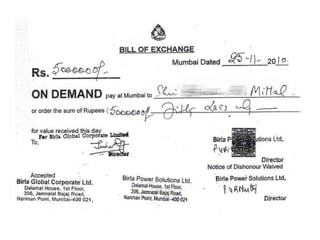

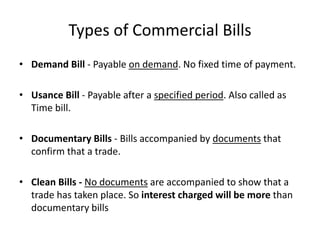

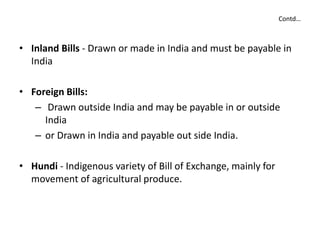

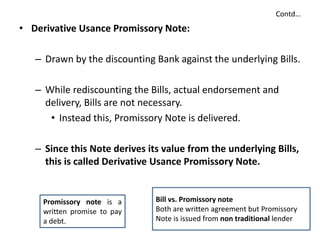

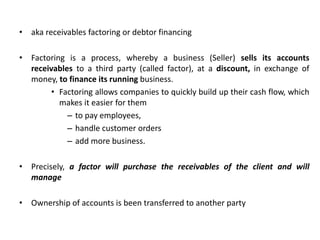

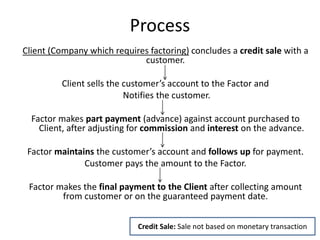

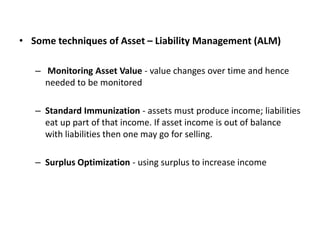

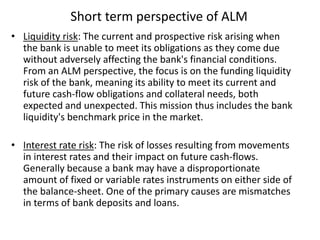

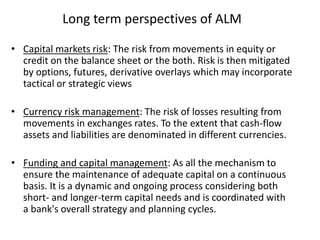

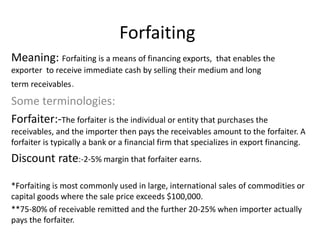

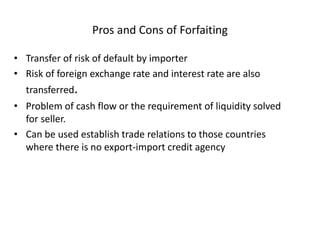

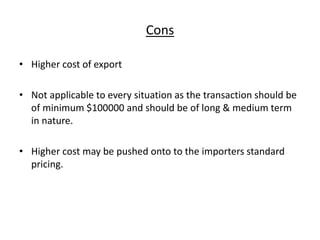

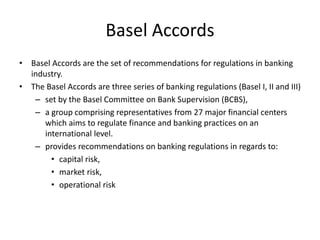

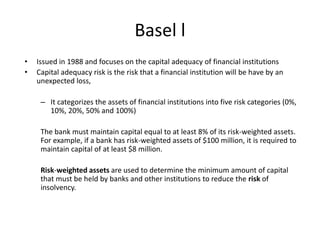

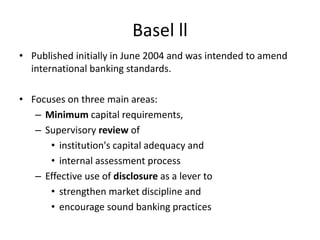

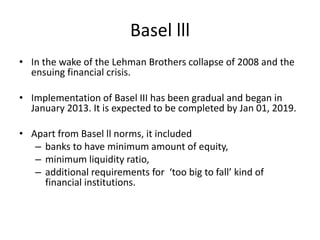

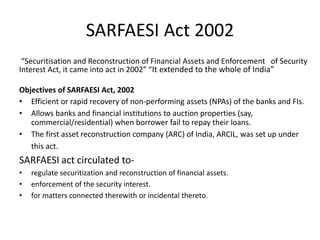

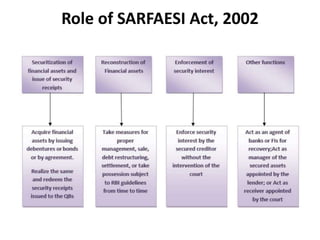

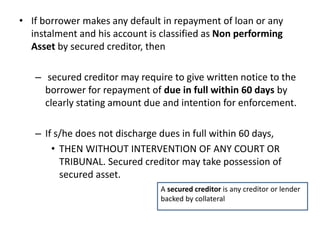

The document discusses various topics related to financial services including bill discounting, asset liability management, factoring, forfaiting, Basel accords, and the SARFAESI Act. It defines each topic and provides key details about them in 1-3 paragraphs. Bill discounting involves trading bills of exchange prior to maturity for a discounted value. Asset liability management matches a company's assets and cash flows with its obligations. Factoring involves a business selling its accounts receivables to a third party for cash. Forfaiting enables exporters to receive immediate cash by selling medium-long term receivables. The Basel accords provide international banking regulations on capital adequacy. The SARFAESI Act allows banks to