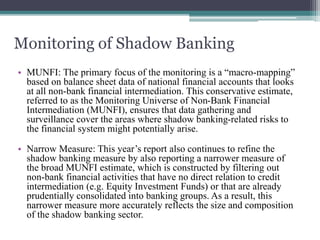

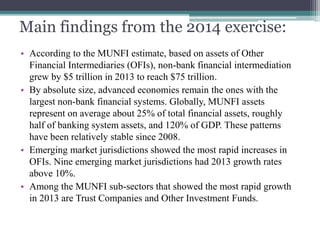

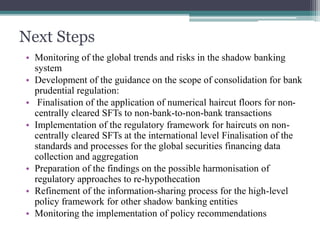

This document discusses shadow banking and efforts to regulate it. Shadow banking involves credit intermediation outside the traditional banking system. While it can expand access to credit, it also poses risks. To address these risks, authorities have adopted a two-pronged strategy involving monitoring shadow banking activities globally and strengthening oversight of specific shadow banking entities and transactions. The 2014 monitoring exercise found that non-bank financial intermediation has grown to $75 trillion globally, with emerging markets showing the most rapid growth. Next steps include continued monitoring and developing regulatory frameworks for areas like money market funds and securities financing transactions.