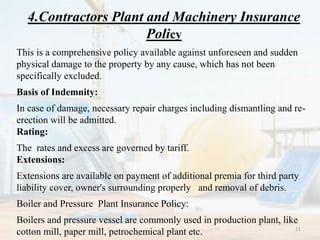

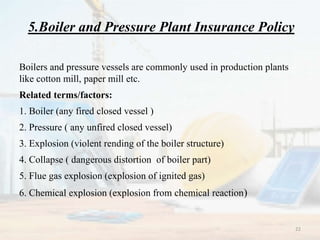

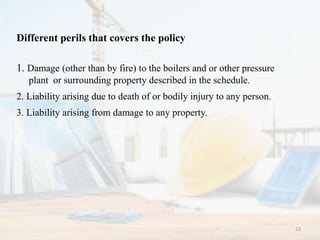

This document provides information about different types of engineering insurance policies. It discusses:

1) Construction phase insurance policies like contractors all risks policy and erection all risks policy which provide coverage during construction projects.

2) Operational phase insurance policies like machinery breakdown insurance and boiler and pressure plant insurance which provide coverage once projects are operational.

3) Key details of different engineering insurance policies including perils covered, exclusions, and policy provisions. The document aims to educate about engineering insurance for infrastructure development projects.

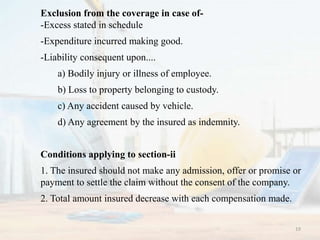

![Section-ii: Third party liability [coverage]

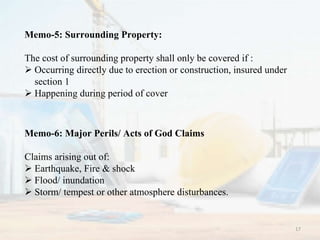

Legal liability for accidental loss or damage caused to

property of other persons, property under custody & trust.

Legal liability for fatal or non-fatal injury to any person than

insured.

All costs and expenses of litigation recovered by claim.

All costs and expenses incurred within consent of the

company.

Loss or damage to fault erection.

Loss or damage to files drawings a/c, bills, currency.

Any damage or penalties on a/c due to non-fulfillment of

terms of delivery.

18](https://image.slidesharecdn.com/engineeringinsurance1-200312053240/85/Engineering-insurance-18-320.jpg)