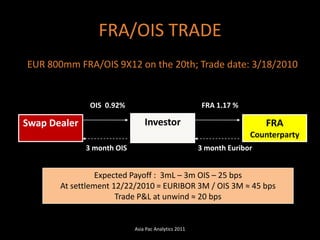

The document provides a comprehensive guide to overnight index swaps (OIS) and their trading mechanisms, detailing their structure and relationships to other interest rate derivatives like forward rate agreements (FRAs). It explains the significance of the London Interbank Offered Rate (LIBOR) as a reference rate, the nature of OIS as notional contracts minimizing counterparty risk, and their settlement processes. Additionally, it discusses the correlation between FRA/OIS spreads and the credit quality of financial institutions.