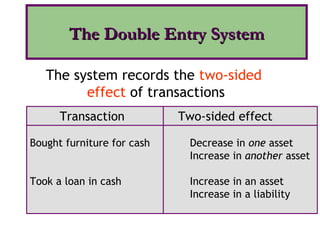

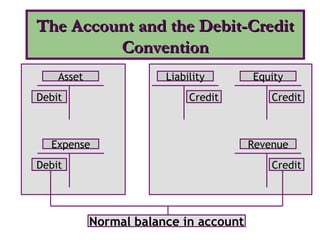

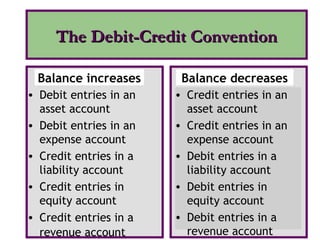

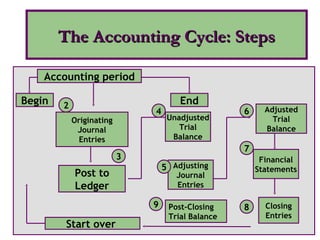

This chapter discusses accounting information systems and the accounting cycle. It covers basic accounting terminology, the double entry system, the accounting equation, and the steps in the accounting cycle including journalizing, posting, preparing an unadjusted trial balance, making adjusting and closing entries, preparing an adjusted trial balance, and financial statements. It also discusses the use of worksheets and accounting for inventories and revenues and expenses.