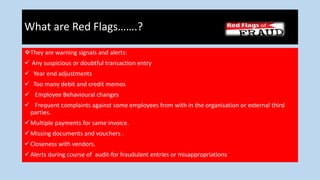

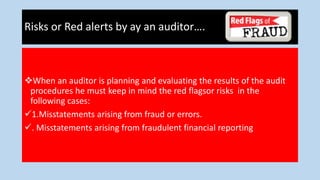

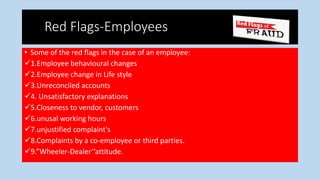

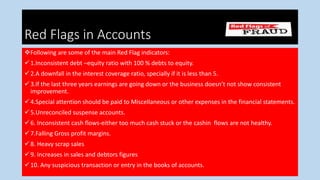

This document discusses red flags, or warning signals, that can indicate potential fraud. It notes that while no organization is completely free from fraud, paying attention to red flags can help detect fraud early. Some common red flags mentioned include suspicious transactions, behavioral changes in employees, missing documents, and inconsistencies in financial accounts. The document emphasizes that while red flags do not necessarily prove fraud, they are warning indicators that further investigation is warranted. Ignoring red flags can allow fraud to go undetected. Both auditors and management should be aware of potential red flags in employee behavior, financial accounts, and management actions.