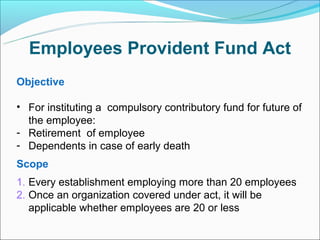

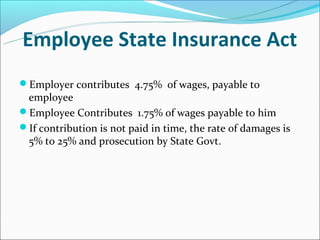

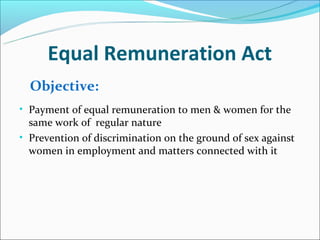

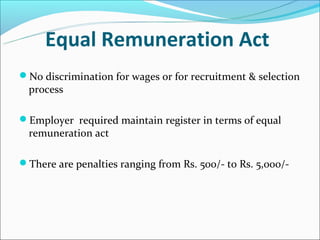

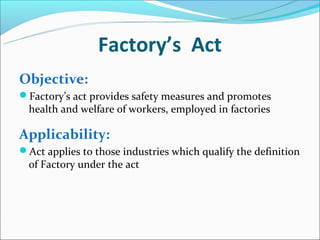

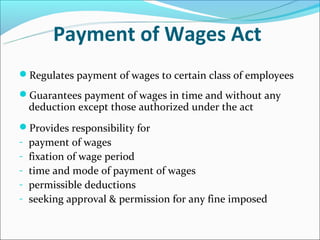

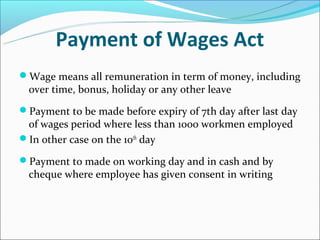

1. Several key labor laws in India require employers to provide compensation and benefits to employees. These include the Employees' Provident Fund Act, Employees State Insurance Act, Equal Remuneration Act, Payment of Wages Act, and others.

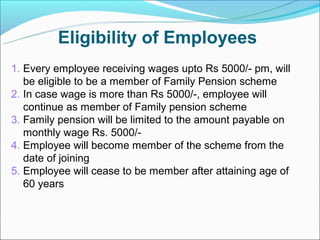

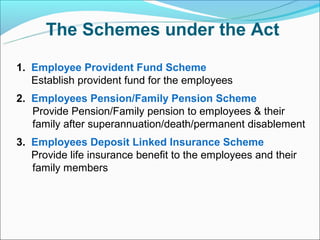

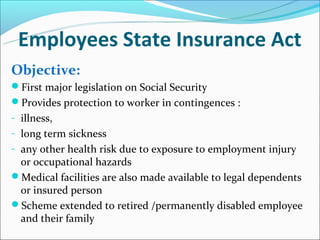

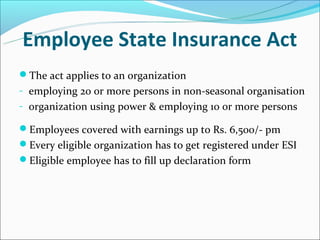

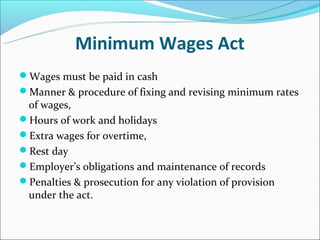

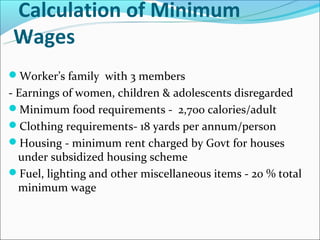

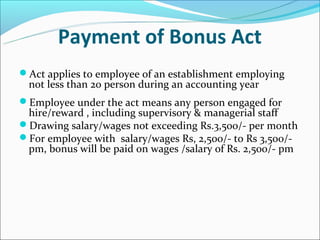

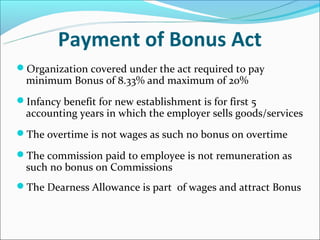

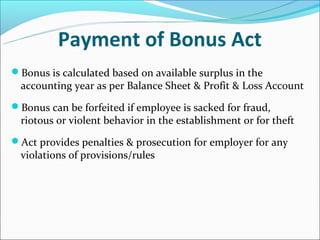

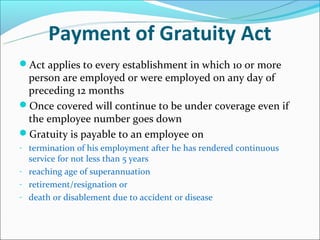

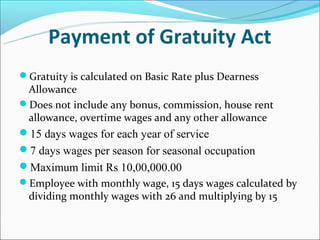

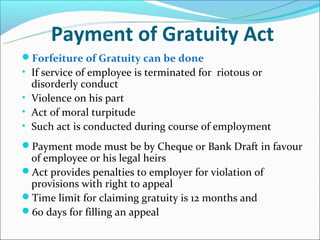

2. The laws mandate benefits such as provident funds, pension plans, health insurance, maternity leave, minimum wages, and bonus payments to help ensure job security, fair wages, and prevent exploitation of labor.

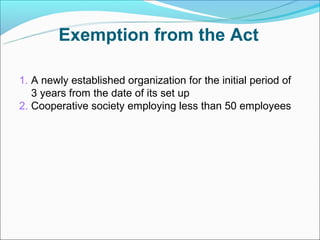

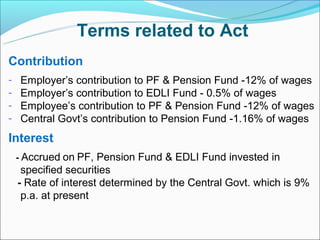

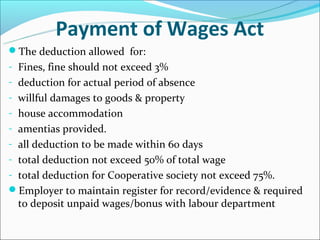

3. The acts also define rules for employer and employee contributions to funds, wage calculations, permitted deductions, and penalties for non-compliance. Ensuring compliance with these labor laws is important for the welfare of Indian workers.