Labour legislation refers to laws enacted by governments to provide social and economic security to workers. The key objectives of labour legislation are to: protect workers from exploitation; promote good industrial relations between employers and employees; and preserve worker health, safety and welfare. Some of the major labour laws in India include the Factories Act, Employees' State Insurance Act (ESI), Employees' Provident Funds and Miscellaneous Provisions Act and Workmen's Compensation Act. These laws provide benefits like health insurance, pension plans, gratuity payments and compensation for employment injuries. Labour disputes are typically resolved through collective bargaining, conciliation or compulsory adjudication if needed.

![ESICACT-1948-

The Employee State Insurance,1948[ESIC]Act Provides A Scheme

Under Which The Employer And The Employee Must Contribute A

Certain Percentage Of The Monthly Wage To The Insurance

Corporation That Runs Dispensaries And Hospitals In Working Class

Localities. It Facilitates Both Outpatient And Inpatient Care And Freely

Dispenses Medicines And Covers Hospitalization Needs And Costs.

Leave Certificate For Health Reasons Are Forwarded To The Employer

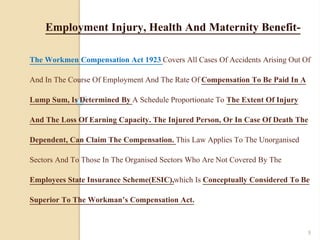

Who Is Obliged To Honour Them. Employment Injury, Including

Occupational Disease Is Compensated According To A Schedule Of

Rates Proportionate To The Extent Of Injury And Loss Of Earning

Capacity.payment,unlike In The Workmen’s Compensation Act Is Monthly.

10](https://image.slidesharecdn.com/9809a429-6416-470c-bb71-537943b8fa6e-150406043931-conversion-gate01/85/Labour-Legislation-10-320.jpg)

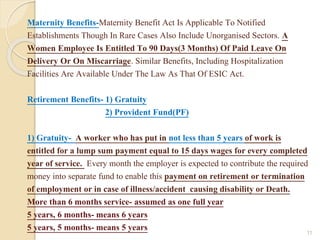

Important Terms For Gratuity-

1) Applies to employees engaged in factories, mines, oilfields, plantations,

ports, railway companies, shops or other establishments with ten or more

employees.

2)Employer need to set up gratuity fund

3) The employer shall arrange to pay the amount of gratuity within 30 days

12](https://image.slidesharecdn.com/9809a429-6416-470c-bb71-537943b8fa6e-150406043931-conversion-gate01/85/Labour-Legislation-12-320.jpg)

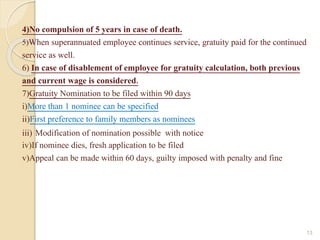

![Provident Fund Is A Fund Which Is Composed Of Contributions Made By

The Employee During The Time He/She Worked Along With An Equal

Contribution By His Employer”

RATE : PROVIDENT FUND IS CALCULATED AS 12% OF EMPLOYEES BASIC

SALARY & THE SAME AMOUNT IS CONTRIBUTED BY THE EMPLOYER. HOWEVER

EMPLOYEE HAVE A OPTION TO CONTRIBUTION MORE THAN 12%

WITH EFFECT FROM 1ST SEPTEMBER 2014 WHOEVER FALLS BELOW RS.15,000 OF

SALARY PER MONTH THEN THEY WILL HAVE TO CONTRIBUTE COMPULSORILY

TO EPF SCHEME. [PREVIOUSLY THE LIMIT WAS RS.6,500 ]

EMPLOYEE’S CONTRIBUTION OF 12% OF BASIC SALARY IS TOTALLY DEPOSITED

IN PROVIDENT FUND ACCOUNT WHEREAS OUT OF EMPLOYER’S CONTRIBUTION

OF 12% , 3.67% IS CONTRIBUTED TO PROVIDENT FUND & 8.33% OR RS.541

WHICHEVER IS LESS (RS.1,250 i.e. 8.33% OF RS.15,000. )IS DEPOSITED IN PENSION

SCHEME OF THE EMPLOYEE.

2) Provident Fund(PF)-

14](https://image.slidesharecdn.com/9809a429-6416-470c-bb71-537943b8fa6e-150406043931-conversion-gate01/85/Labour-Legislation-14-320.jpg)