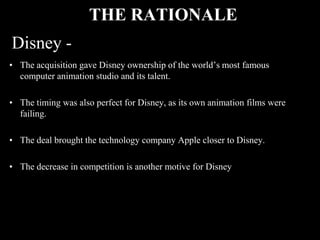

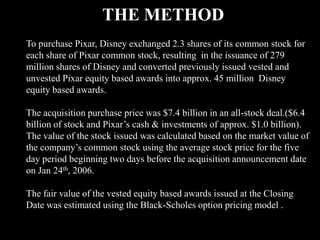

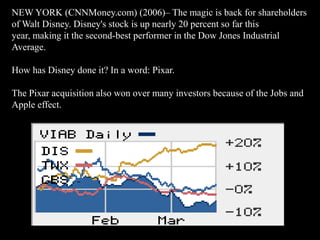

Pixar was founded by Steve Jobs and others in 1986 as a computer graphics division of Lucasfilm. It became independent in 1986 and produced highly successful animated films like Toy Story. In 2006, Disney acquired Pixar for $7.4 billion to gain access to its talent and technology. The merger brought Pixar's creative leaders like John Lasseter into Disney and reinvigorated Disney's animation business. Analysts saw it as a strategic fit that would boost revenues and human resources for both companies.