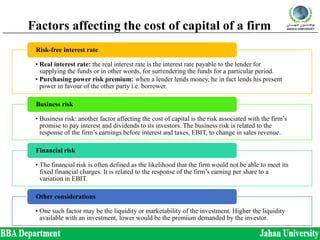

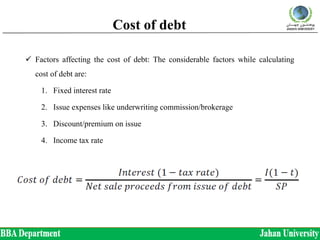

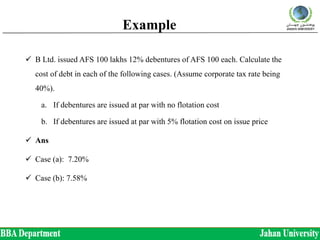

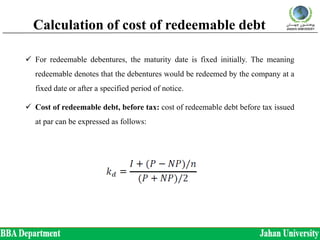

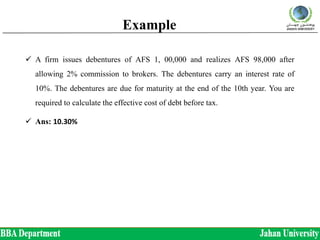

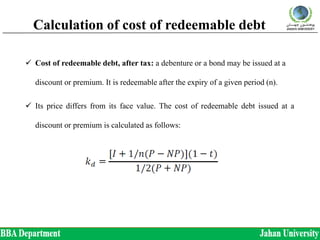

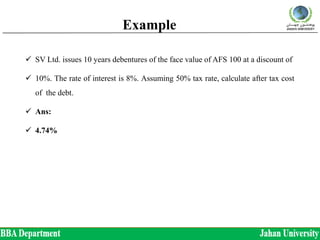

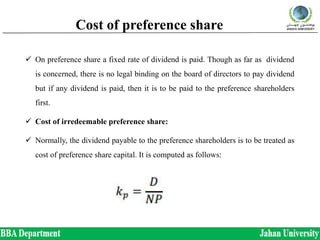

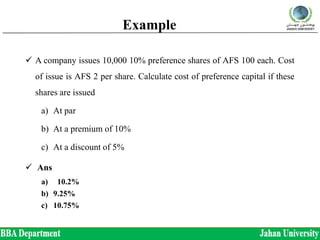

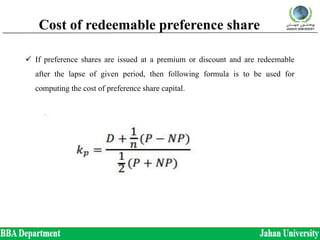

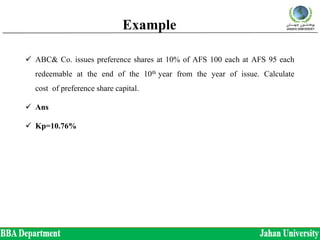

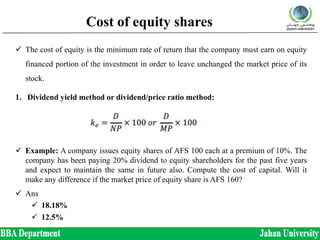

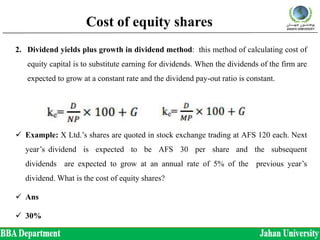

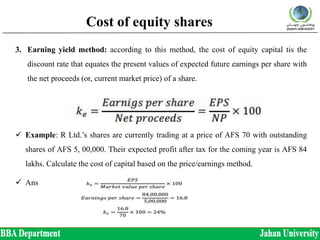

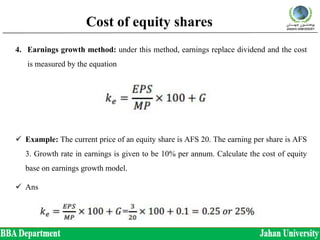

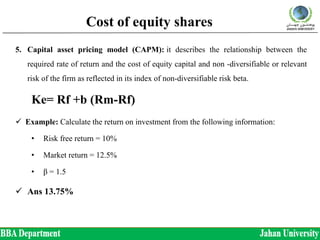

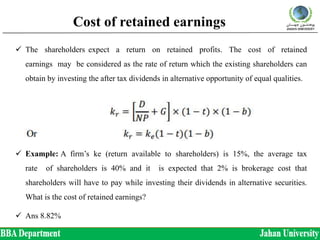

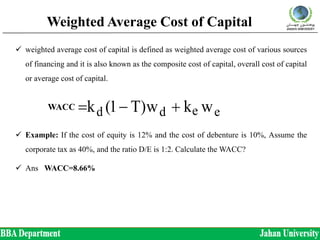

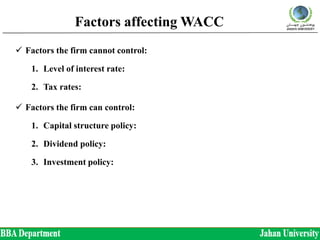

This document discusses the concept of cost of capital. It defines cost of capital as the minimum return a firm must earn on investment proposals to break even. The cost of capital consists of costs of debt, preference shares, equity, and retained earnings. It is weighted based on proportions of each type of capital. The cost depends on factors like interest rates, risk, and tax rates. Calculating costs of different capital components and weighted average cost of capital (WACC) is important for maximizing shareholder wealth and valuation.