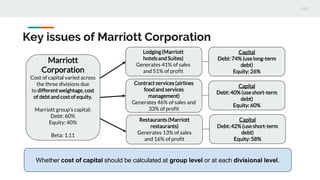

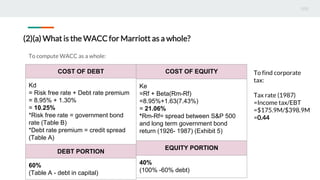

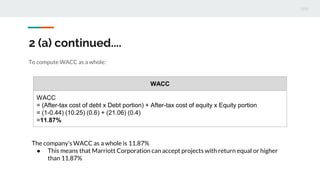

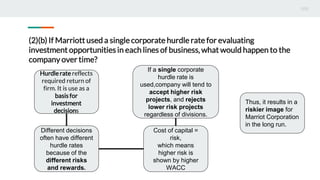

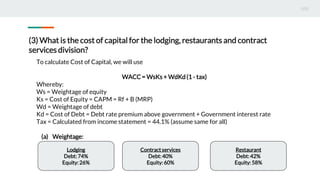

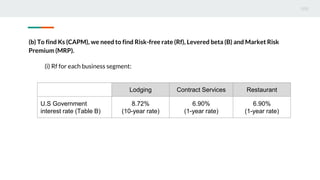

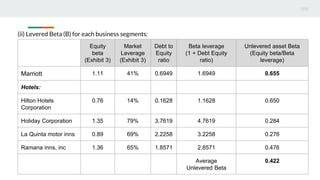

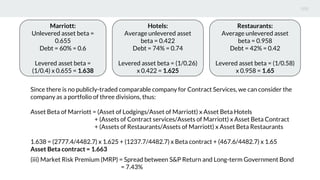

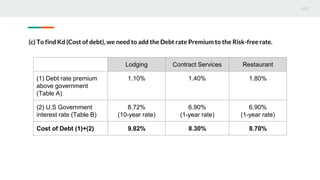

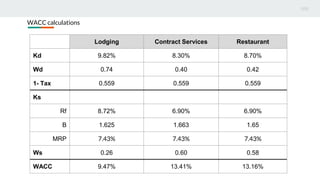

The document discusses the cost of capital calculation for Marriott Corporation's three divisions: lodging, restaurants, and contract services. It first calculates the weighted average cost of capital (WACC) for Marriott as a whole as 11.87%. It then calculates the WACC for each division separately by determining the cost of equity using CAPM and cost of debt, weighted by the capital structure of each division. The WACC is 9.47% for lodging, 13.41% for contract services, and 13.16% for restaurants. Calculating WACC at the divisional level allows each division to use a cost of capital appropriate to its risk.