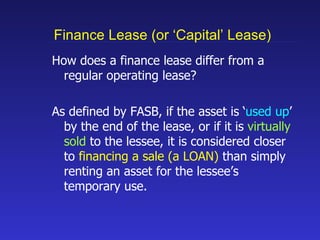

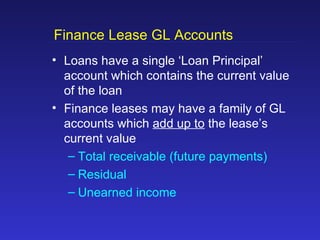

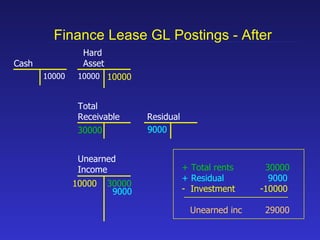

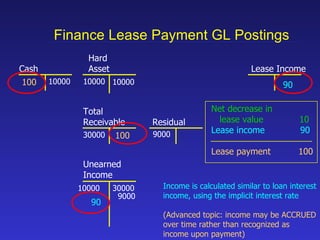

The document explains lease accounting basics, outlining different lease types and their accounting entries using T-accounts from the lessor's perspective. It distinguishes between operating and finance leases, detailing their financial implications and classification criteria according to FASB and IRS standards. Additionally, it covers the impact on general ledger accounts and how leases are recorded compared to loans.