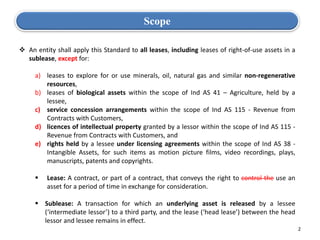

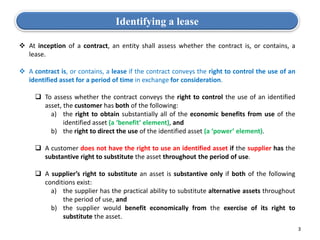

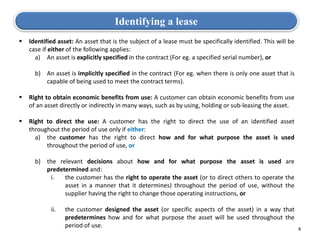

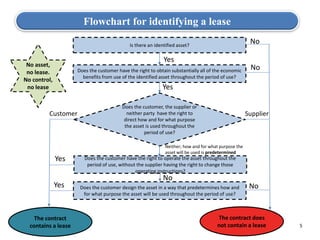

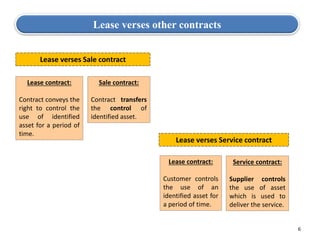

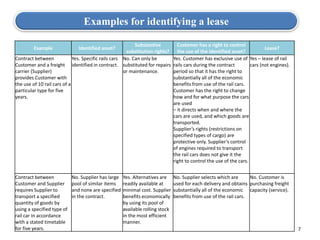

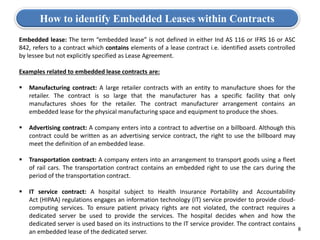

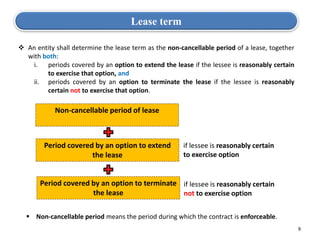

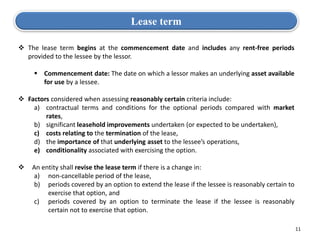

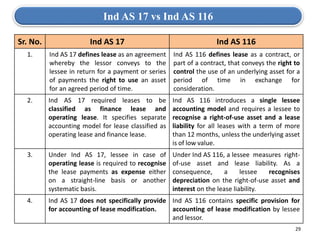

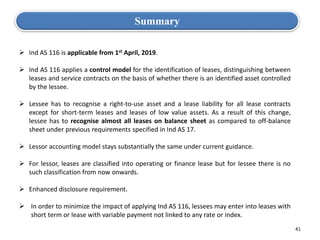

This document provides an overview of Ind AS 116 on leases. It discusses the scope of leases covered, how to identify a lease by determining if a contract conveys the right to control the use of an identified asset. It provides examples of lease vs non-lease contracts and how to identify embedded leases. It also covers determining the lease term by considering non-cancellable periods and periods covered by options to extend or terminate the lease.