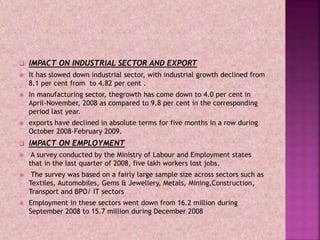

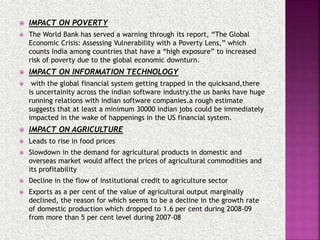

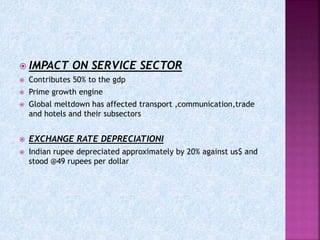

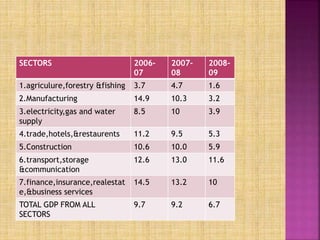

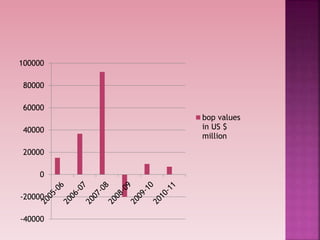

This document discusses the causes and impacts of the 2007-2008 global financial crisis. It identifies several factors that contributed to the crisis, including low interest rates, excessive lending, deregulation, and the growth of risky financial instruments. The crisis began with the collapse of the US housing market and spread globally. While India's banking system was not directly impacted, the country still experienced effects such as declines in its stock and currency markets, slower industrial and export growth, job losses, and increased poverty. Agriculture, IT, and other sectors were also negatively impacted.