This document provides an overview of financial statement analysis, including:

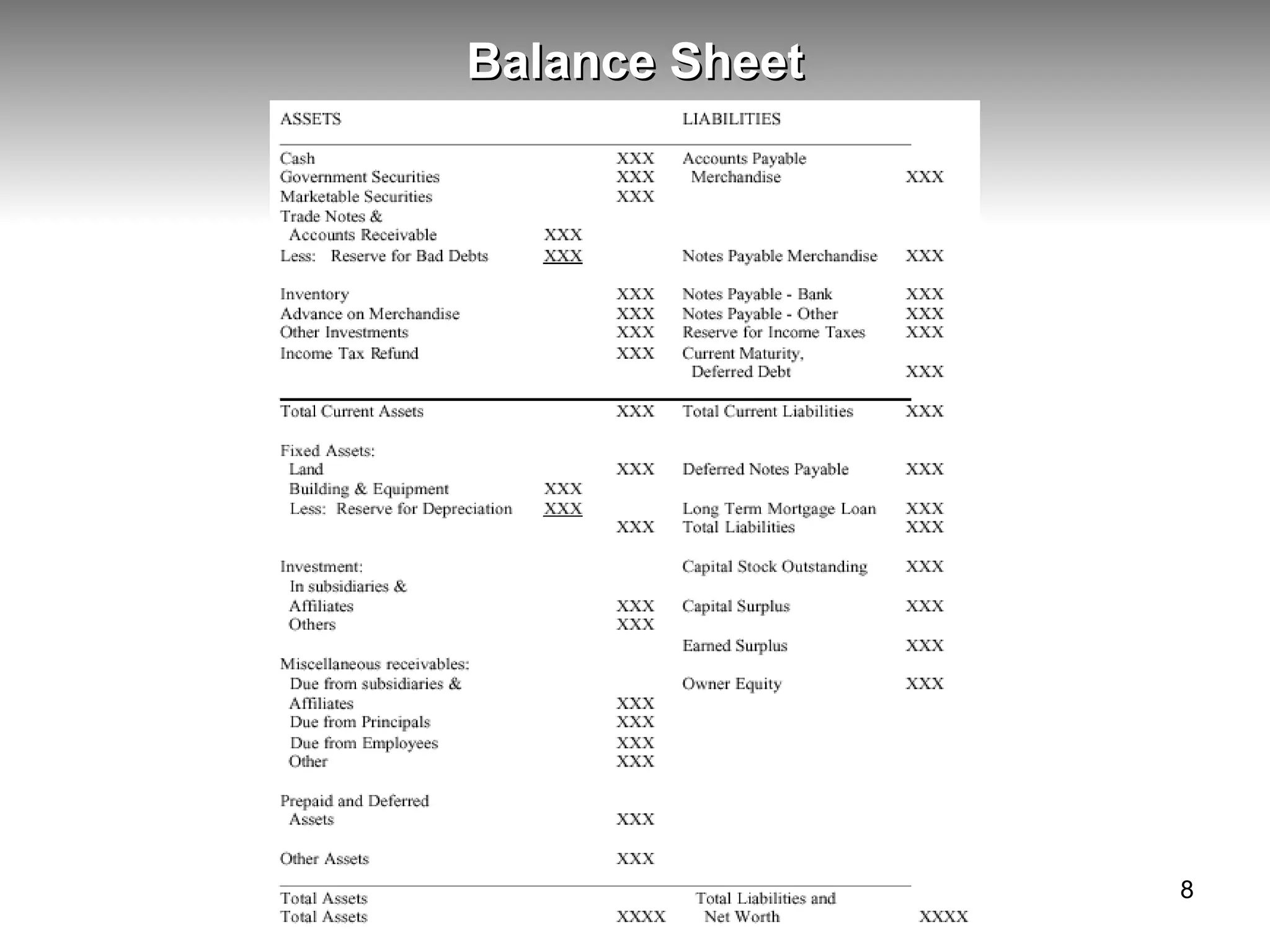

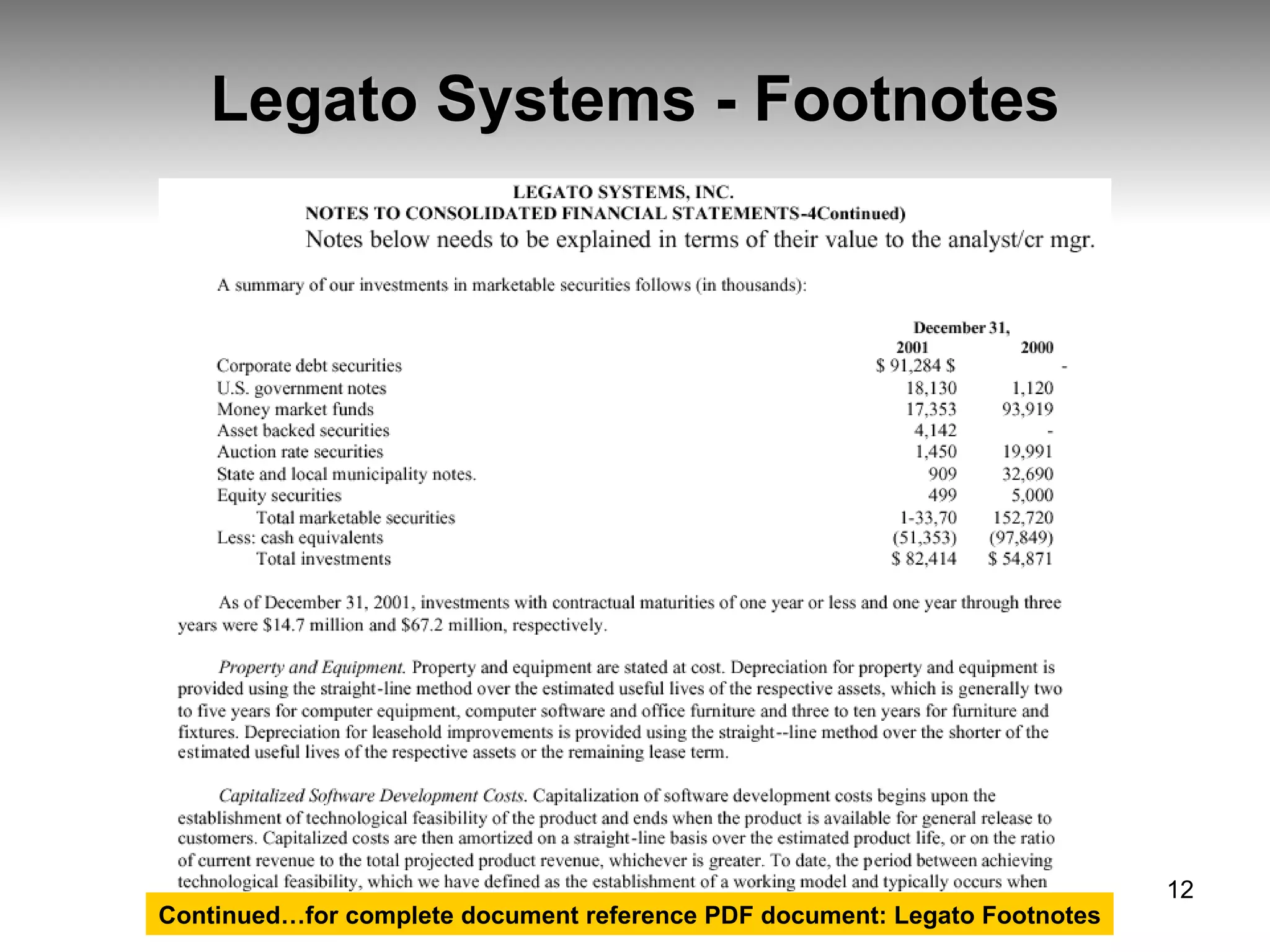

1) Financial statements form the basis for understanding a business's financial position and assessing historical and prospective performance.

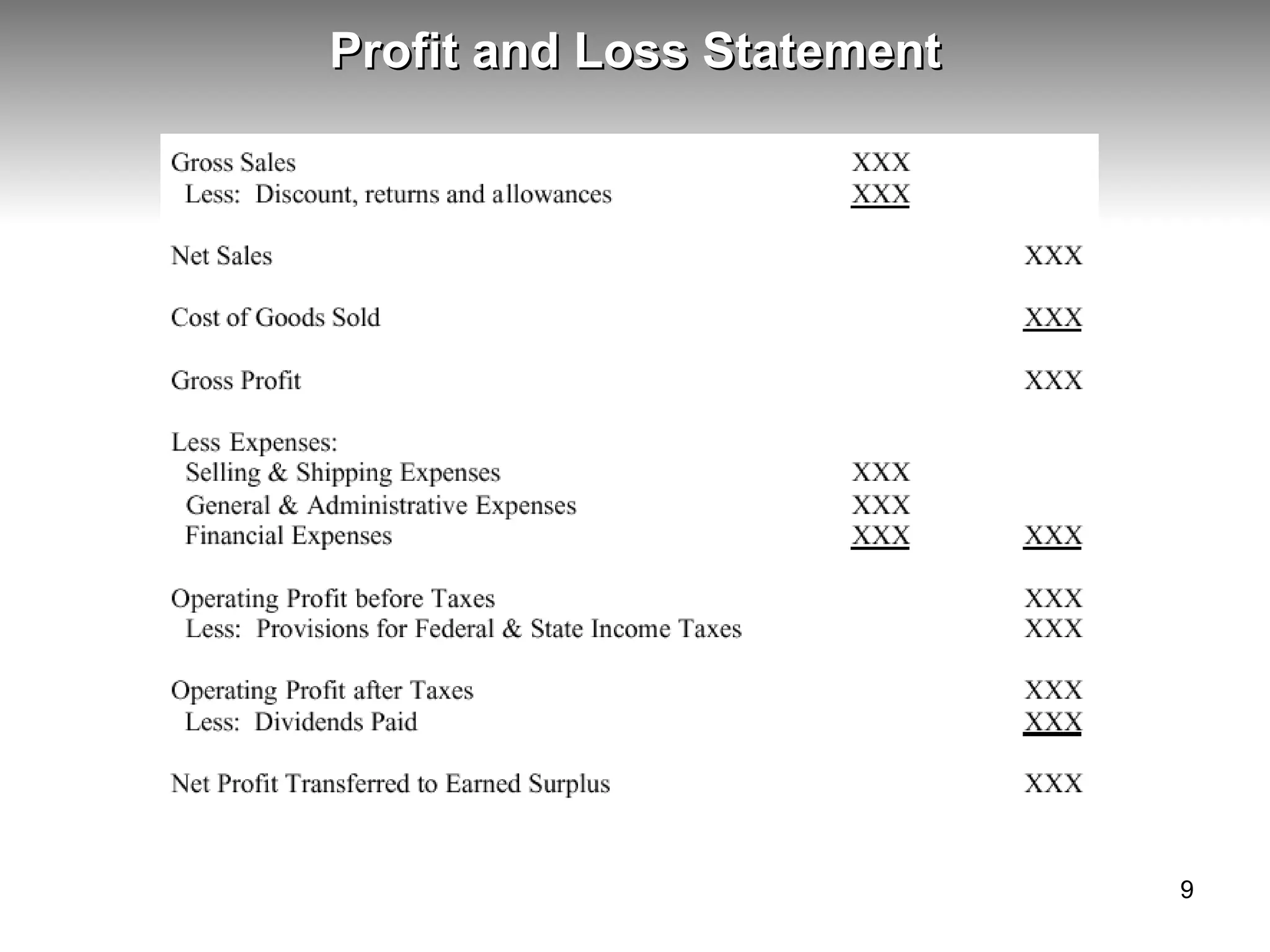

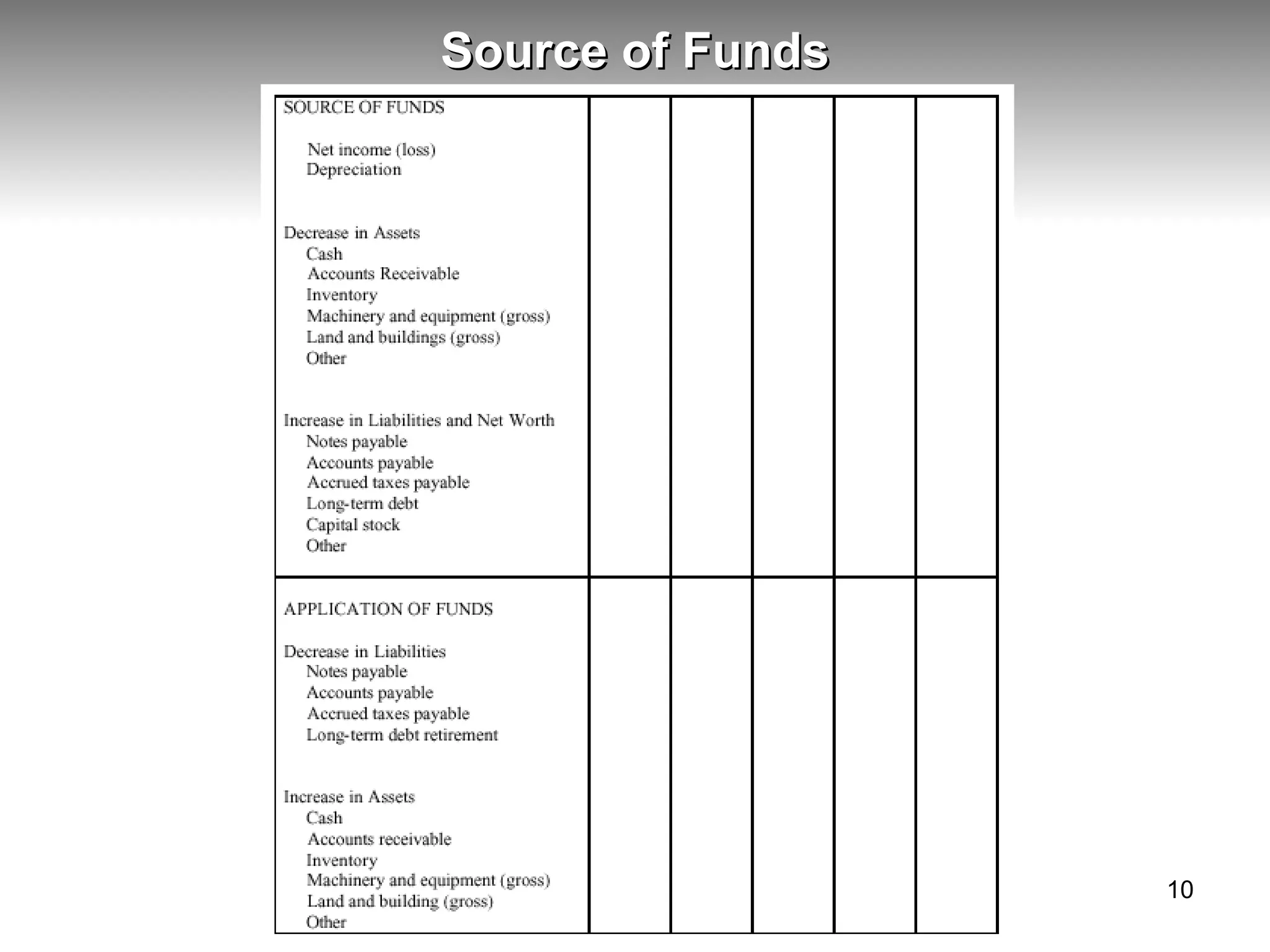

2) Financial analysis includes ratio analysis, cash flow analysis, and trend analysis to understand a business's financial soundness from different perspectives.

3) Financial statements have different meanings and uses for various stakeholders like stockholders, management, creditors, and bankers.