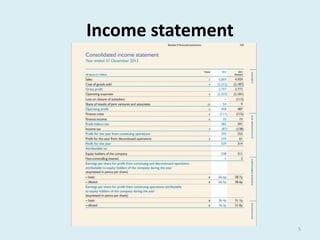

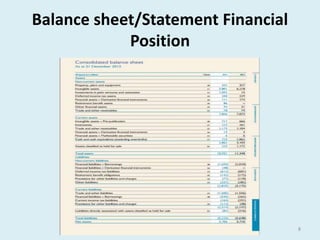

This document provides an introduction and overview of key concepts related to finance and financial statements. It discusses the components and purpose of the main financial statements: the income statement, balance sheet, and cash flow statement. The income statement measures financial performance and profit, the balance sheet measures financial position through assets, liabilities, and equity, and the cash flow statement shows actual cash inflows and outflows. Financial statements are prepared according to accounting standards and principles and are used by various stakeholders to evaluate a business's performance and financial position over time.