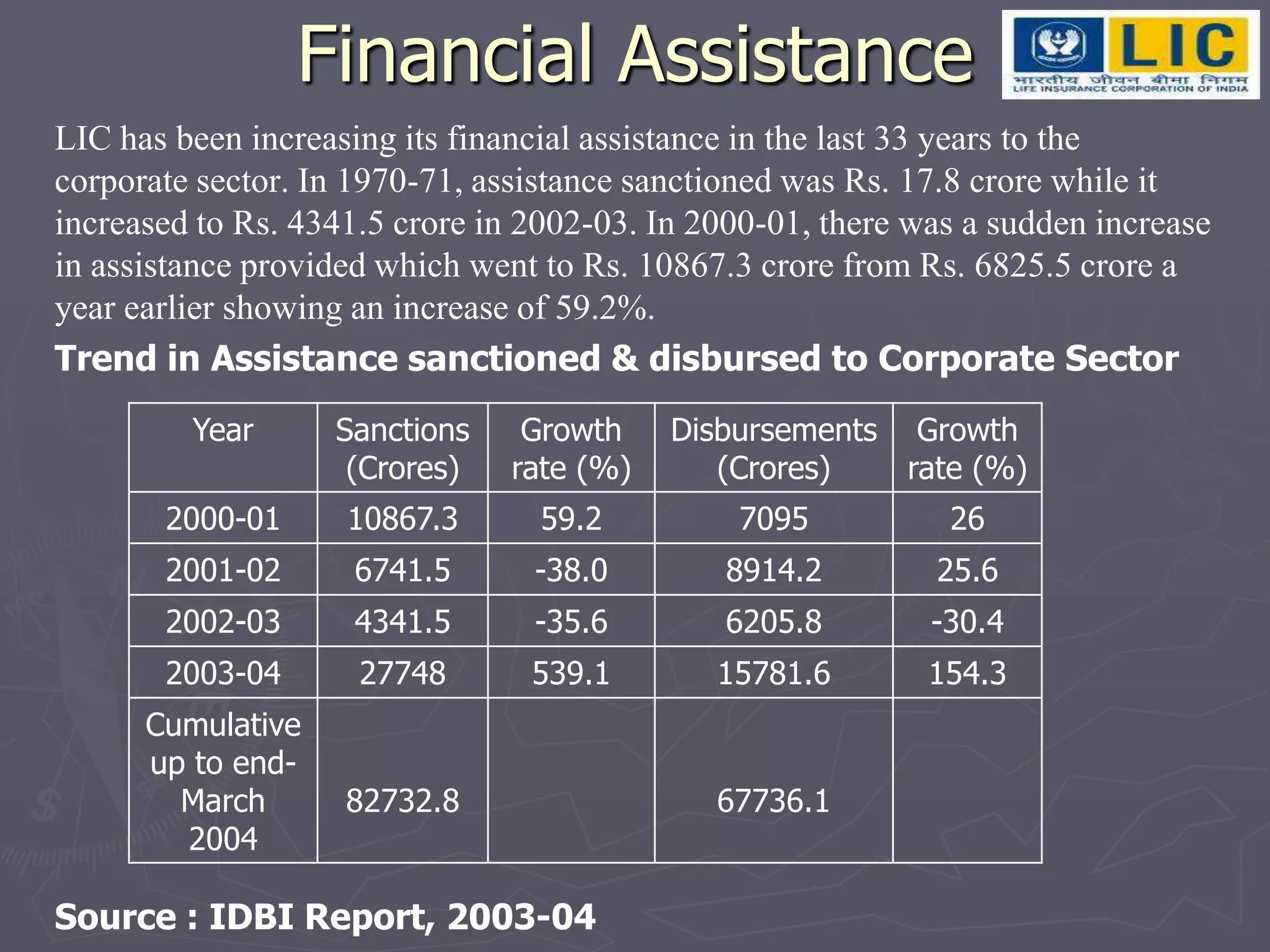

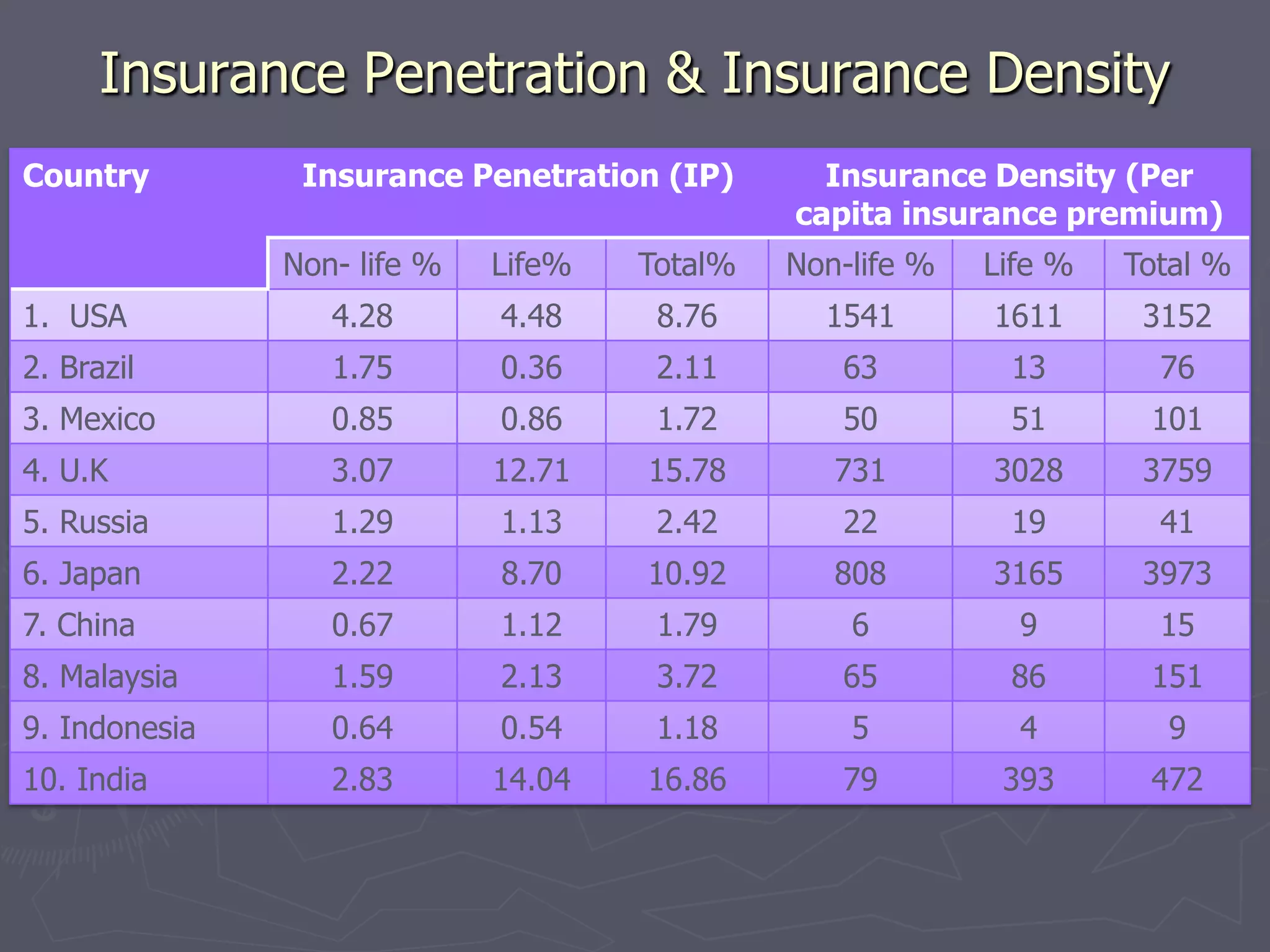

The document provides information on life insurance corporation of India (LIC) and general insurance corporation of India (GIC). It discusses that LIC was established in 1956 as a wholly owned government corporation to nationalize the private life insurance business. It discusses the mission, objectives and policies of LIC. It also provides details on establishment, subsidiaries, and services of GIC. Finally, it summarizes the role of the Insurance Regulatory and Development Authority (IRDA) in regulating the insurance sector in India.