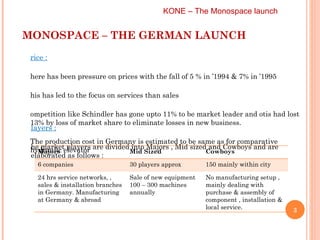

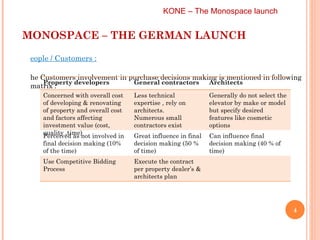

The document summarizes KONE's plan to launch the Monospace elevator in Germany. It provides background on the German elevator market, including key facts about market size, segmentation between hydraulic and traction elevators, price pressures, and the types of players. It then discusses the customer buying process and influence of different stakeholders like property developers, general contractors, and architects. Finally, it outlines KONE's promotion and launch plan to target these customers by promoting Monospace's features, return on investment, energy savings, and lower price compared to gear traction elevators.