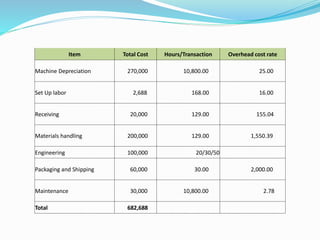

The document compares the standard costing method and transaction-based costing method to allocate overhead costs and calculate the unit cost of production of valves, pumps, and flow controllers. While the standard costing method allocates overhead based on direct labor costs, the transaction-based method allocates different overhead costs like depreciation, setup labor, receiving, etc. based on the number of transactions for each activity. This results in different unit costs and profitability for each product under the two methods.