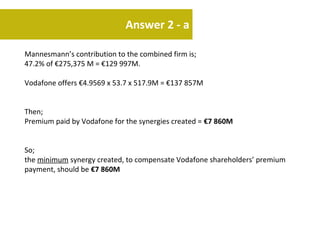

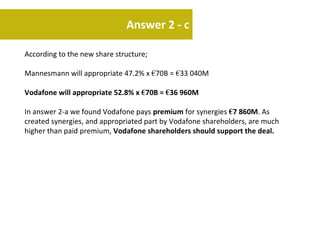

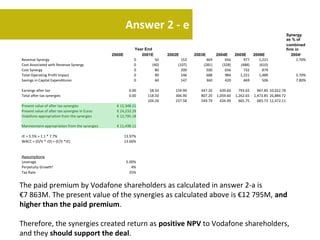

- Based on new assumptions of a higher WACC of 13.66% and lower expected synergies, the present value of synergies appropriated by Vodafone shareholders is estimated to be €12.8 billion.

- This amount is still higher than the €7.9 billion premium paid by Vodafone shareholders for the synergies.

- Therefore, even under more conservative assumptions, the synergies are expected to provide a positive return to Vodafone shareholders and they should still support the deal.