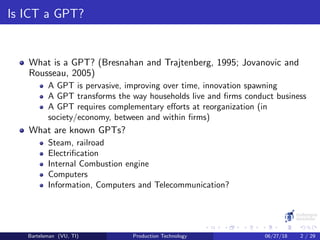

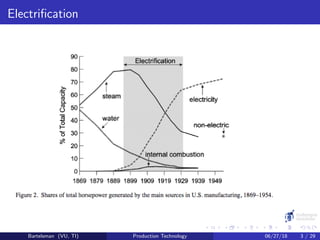

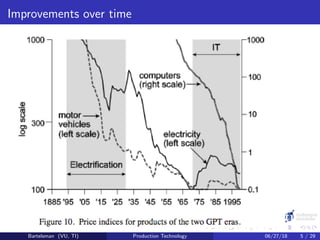

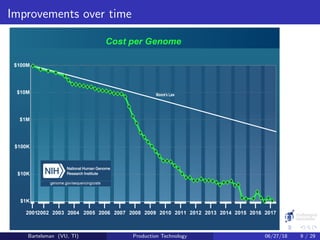

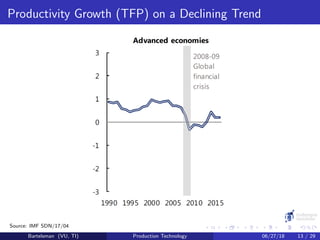

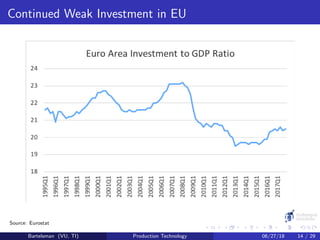

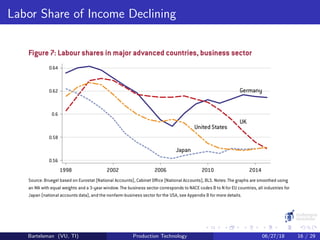

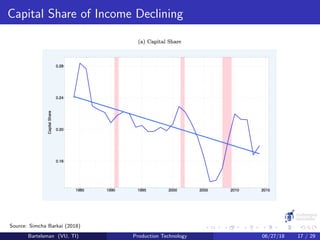

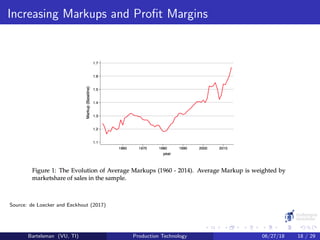

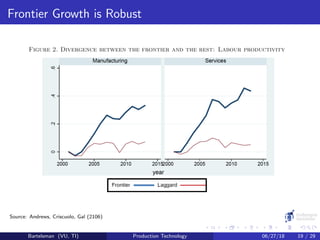

This document discusses understanding production technology and whether information and communication technology (ICT) should be considered a general purpose technology (GPT). It provides definitions of what qualifies as a GPT and lists some known GPTs like steam power, electricity, and computers. The document examines empirical patterns associated with GPT adoption and considers whether ICT meets criteria to be classified as a GPT. It also reviews emerging disruptive technologies and their development.