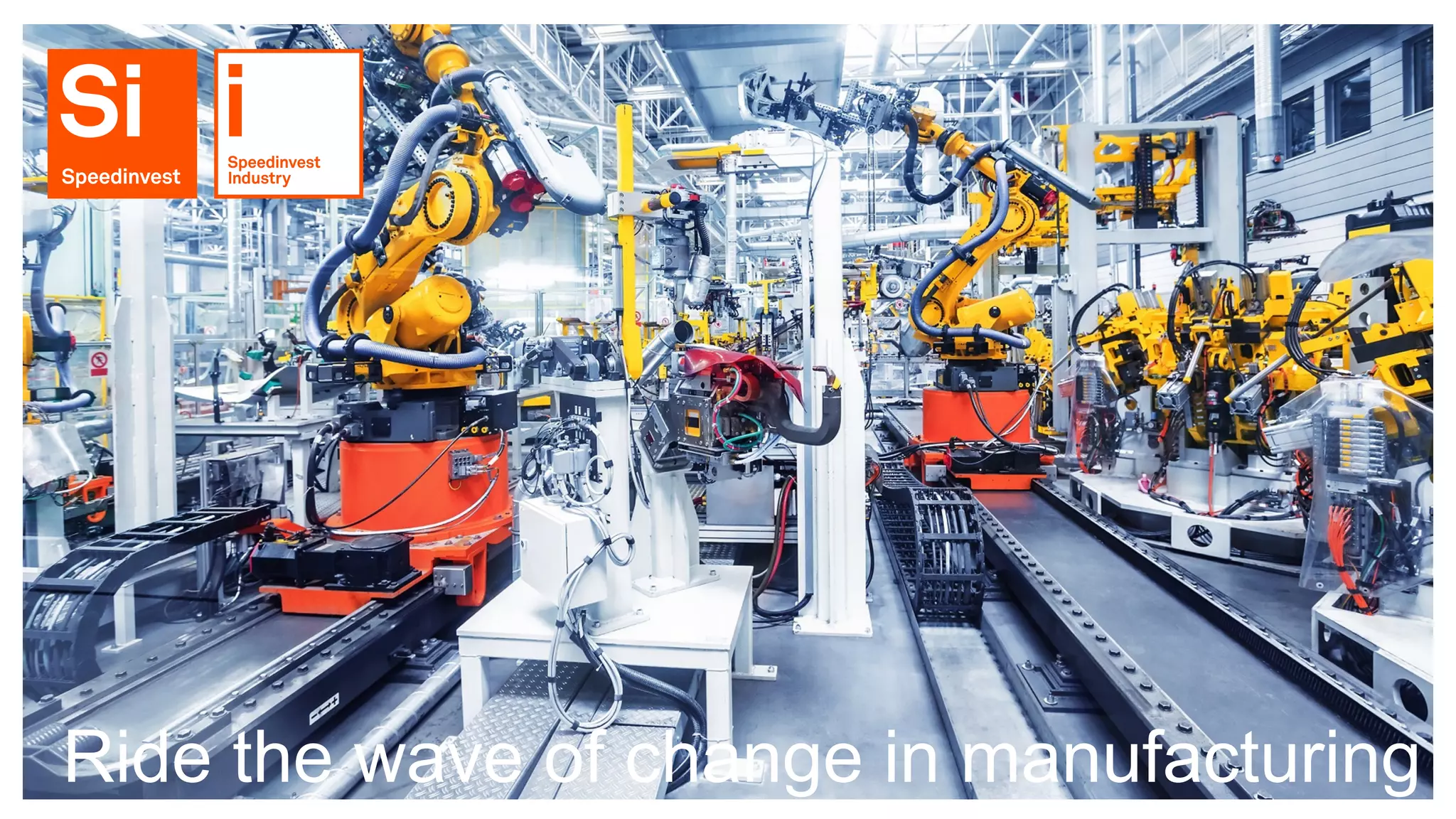

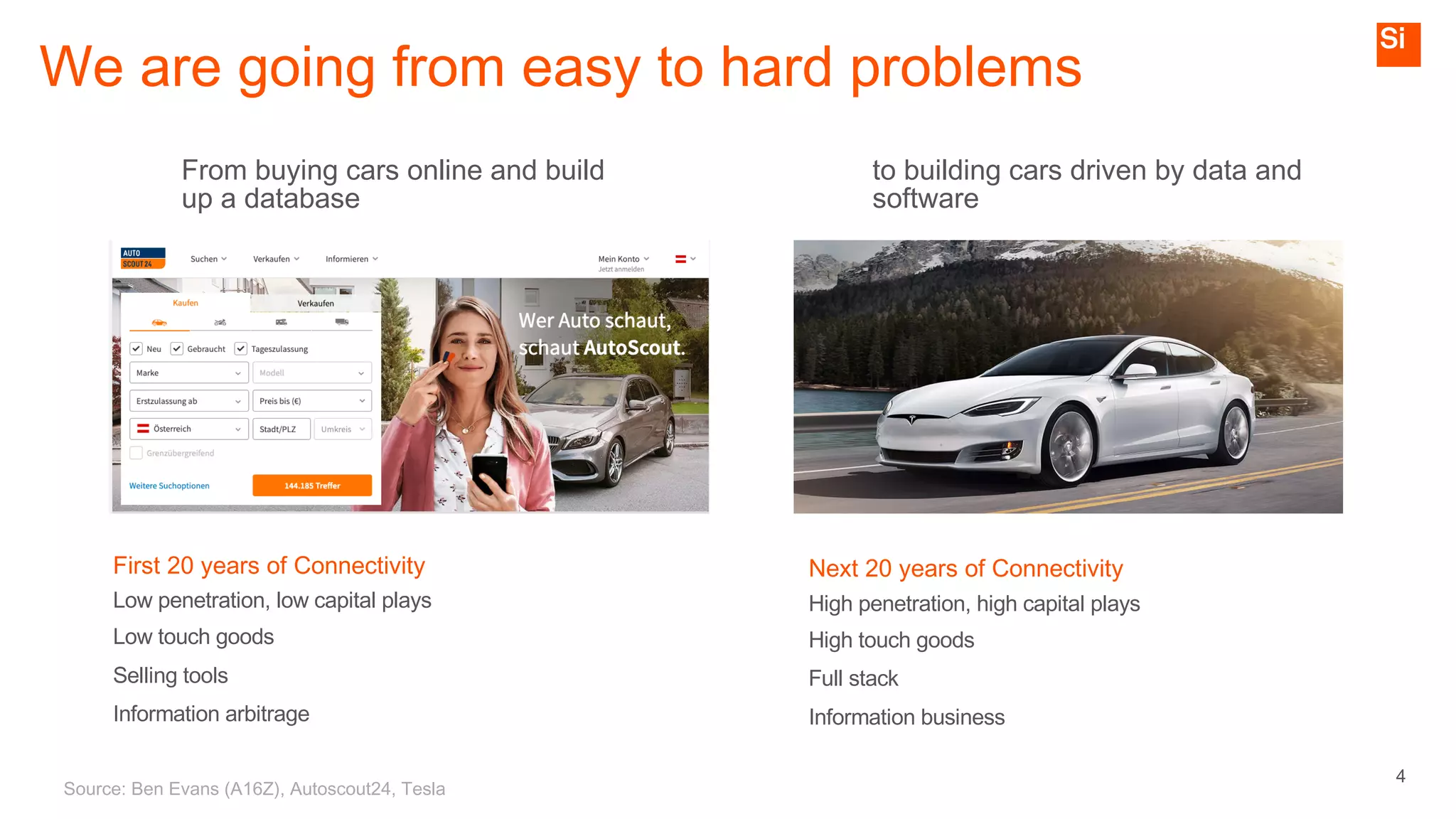

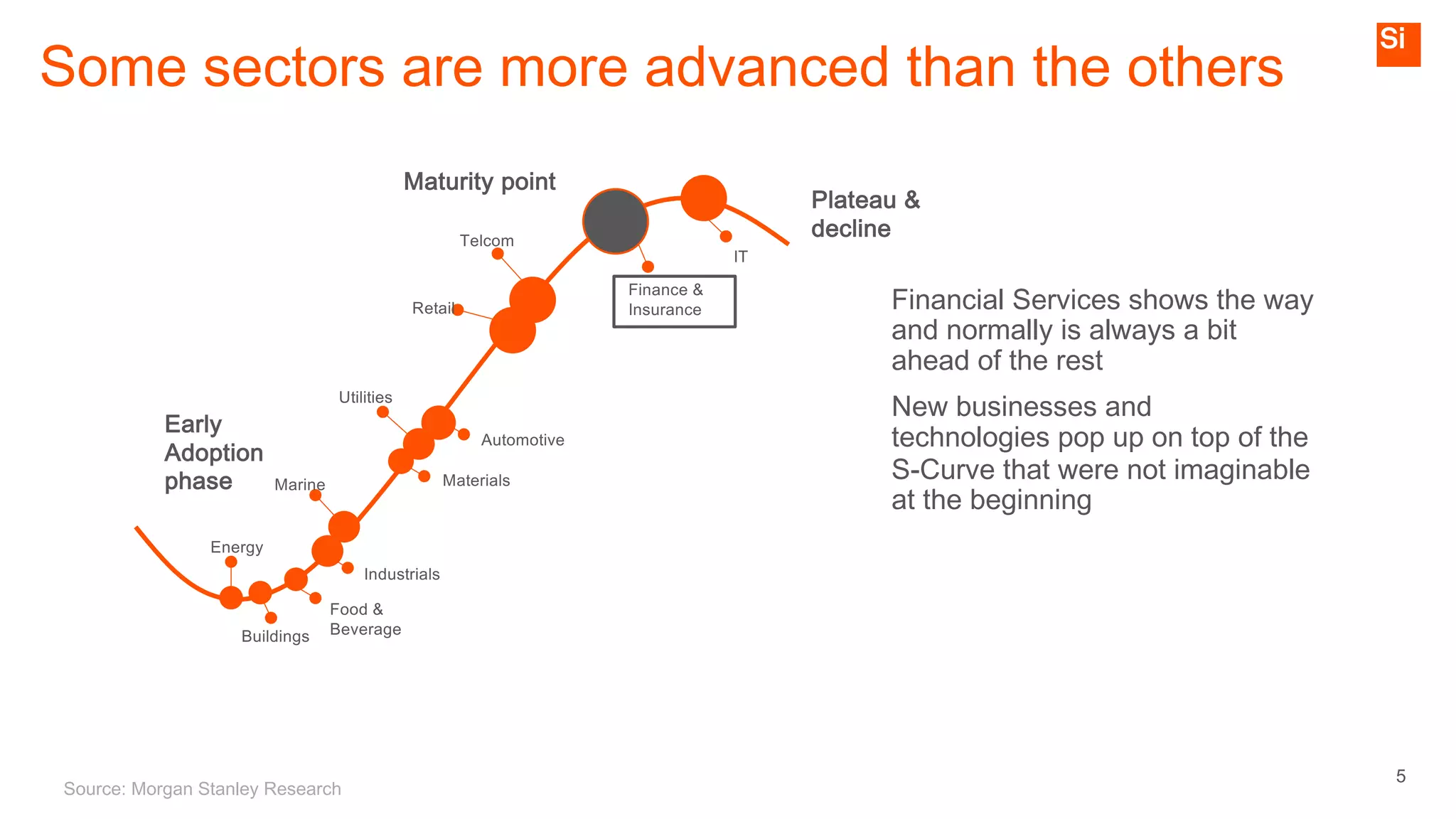

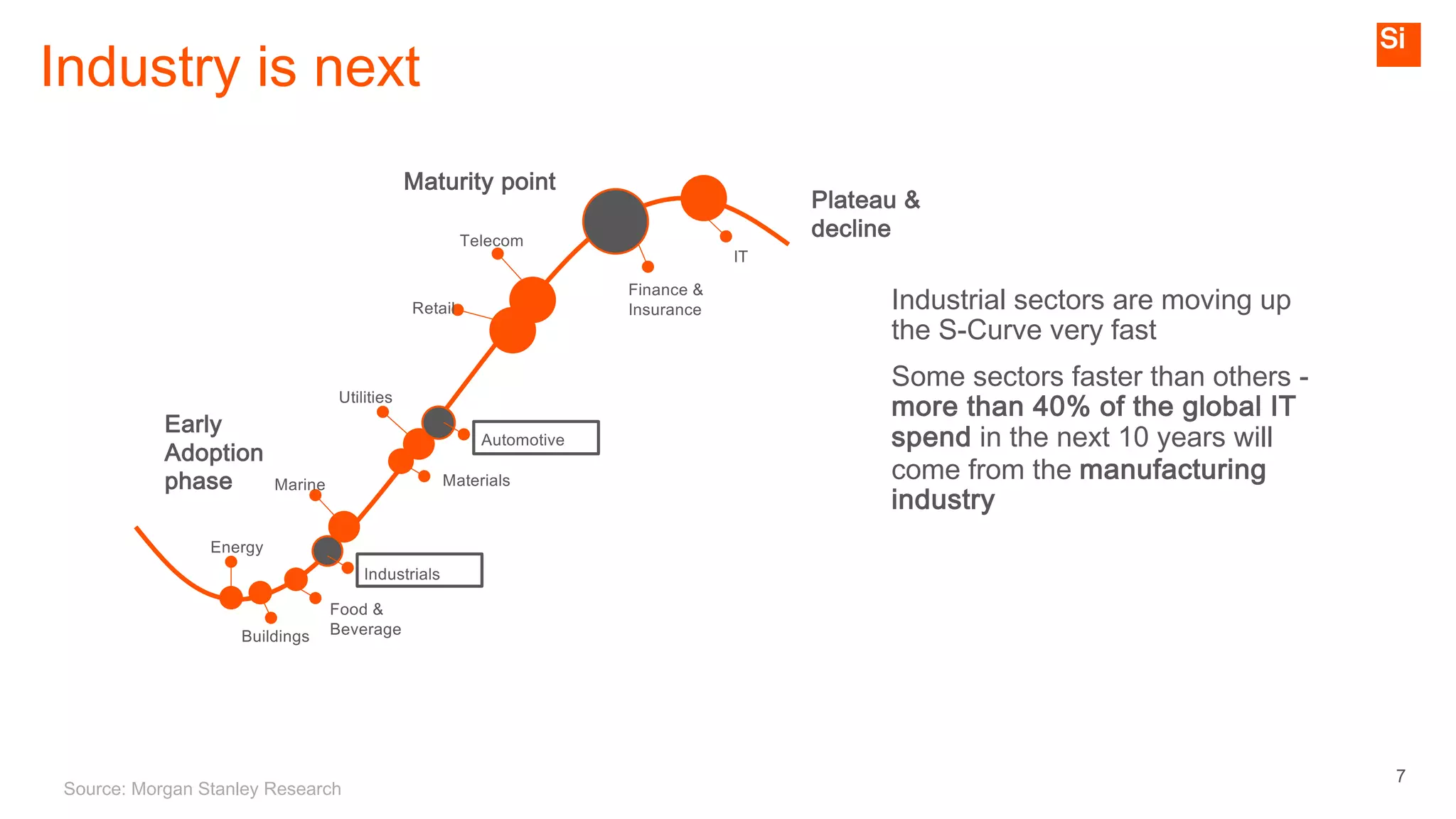

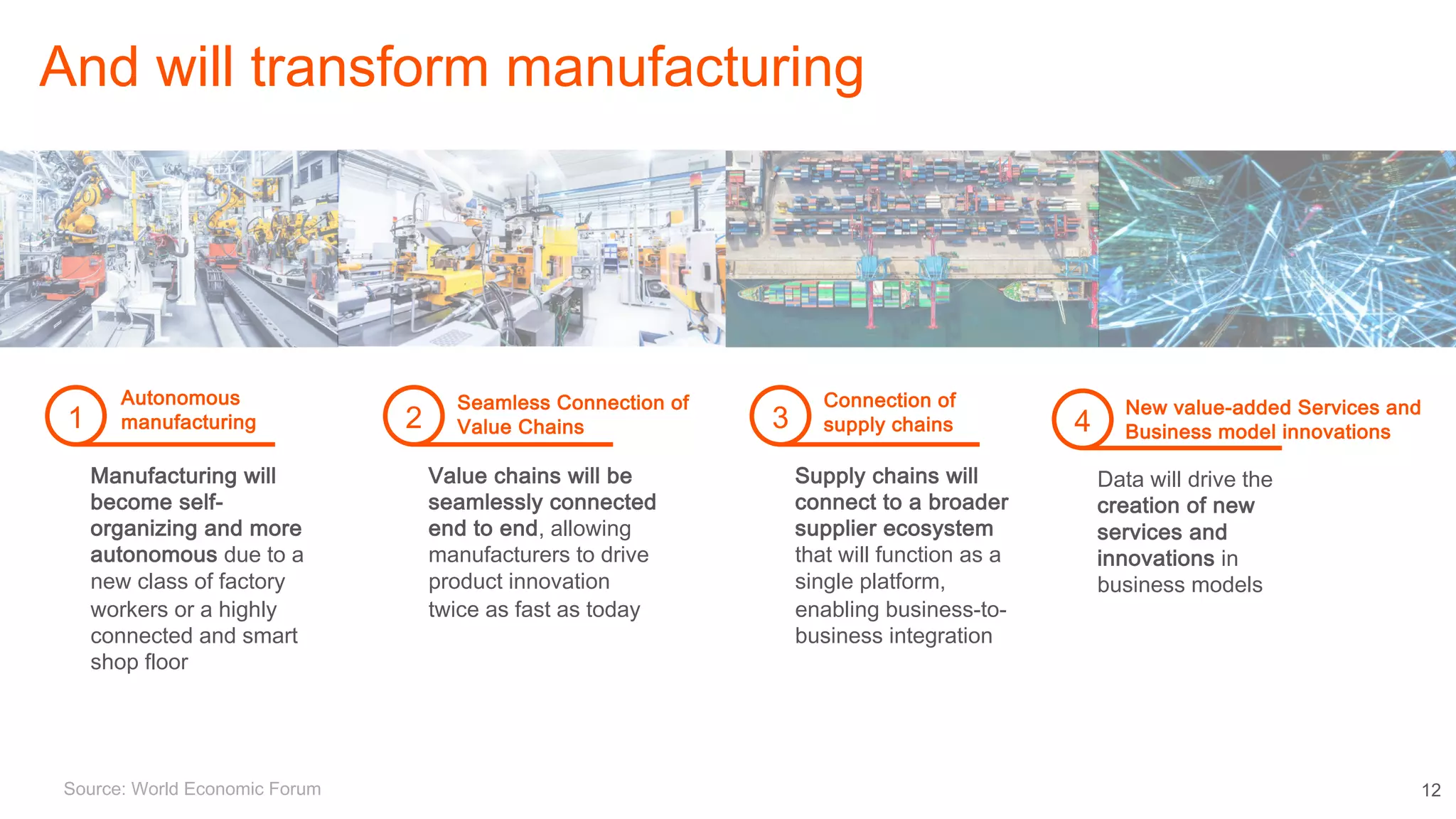

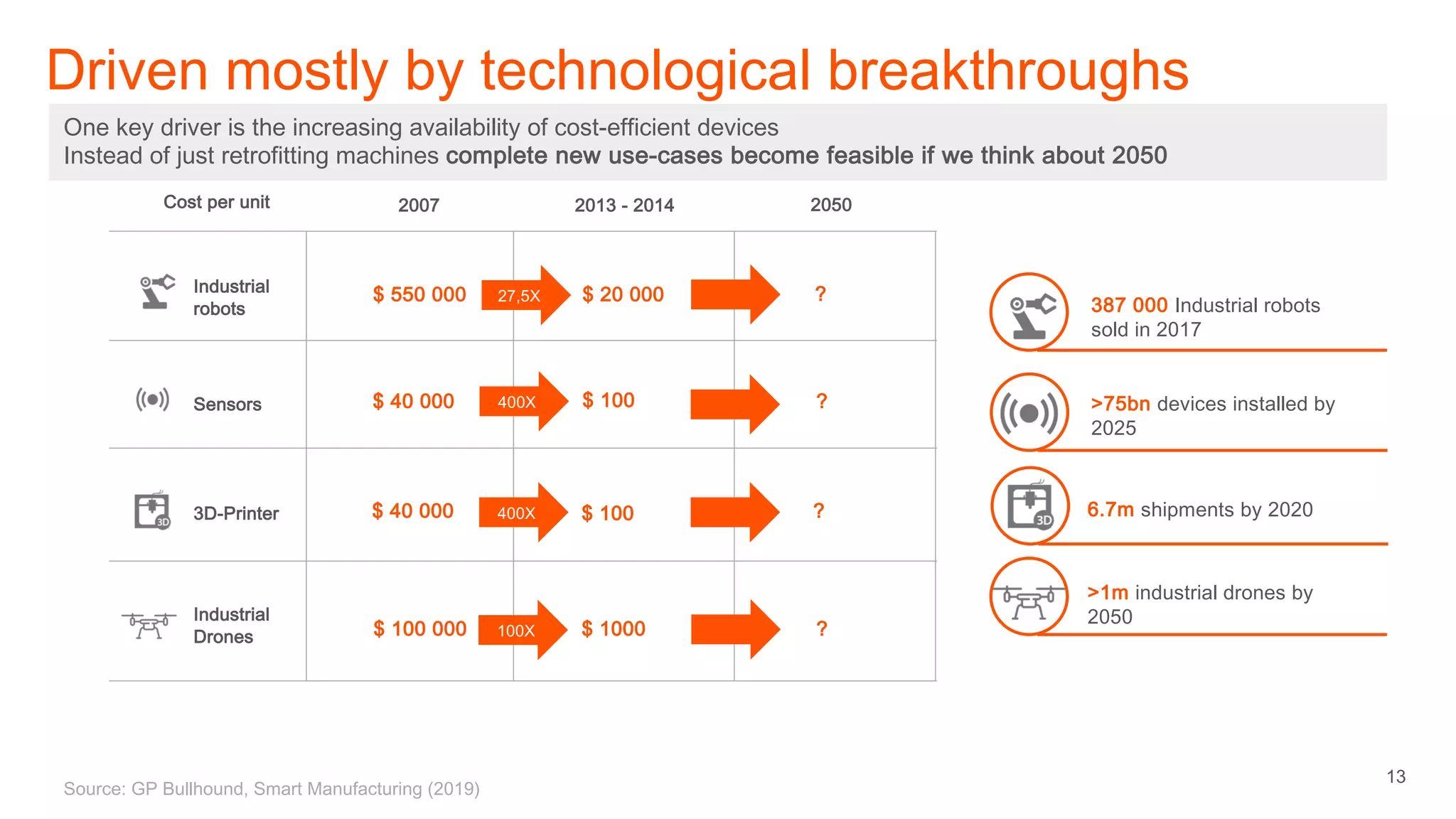

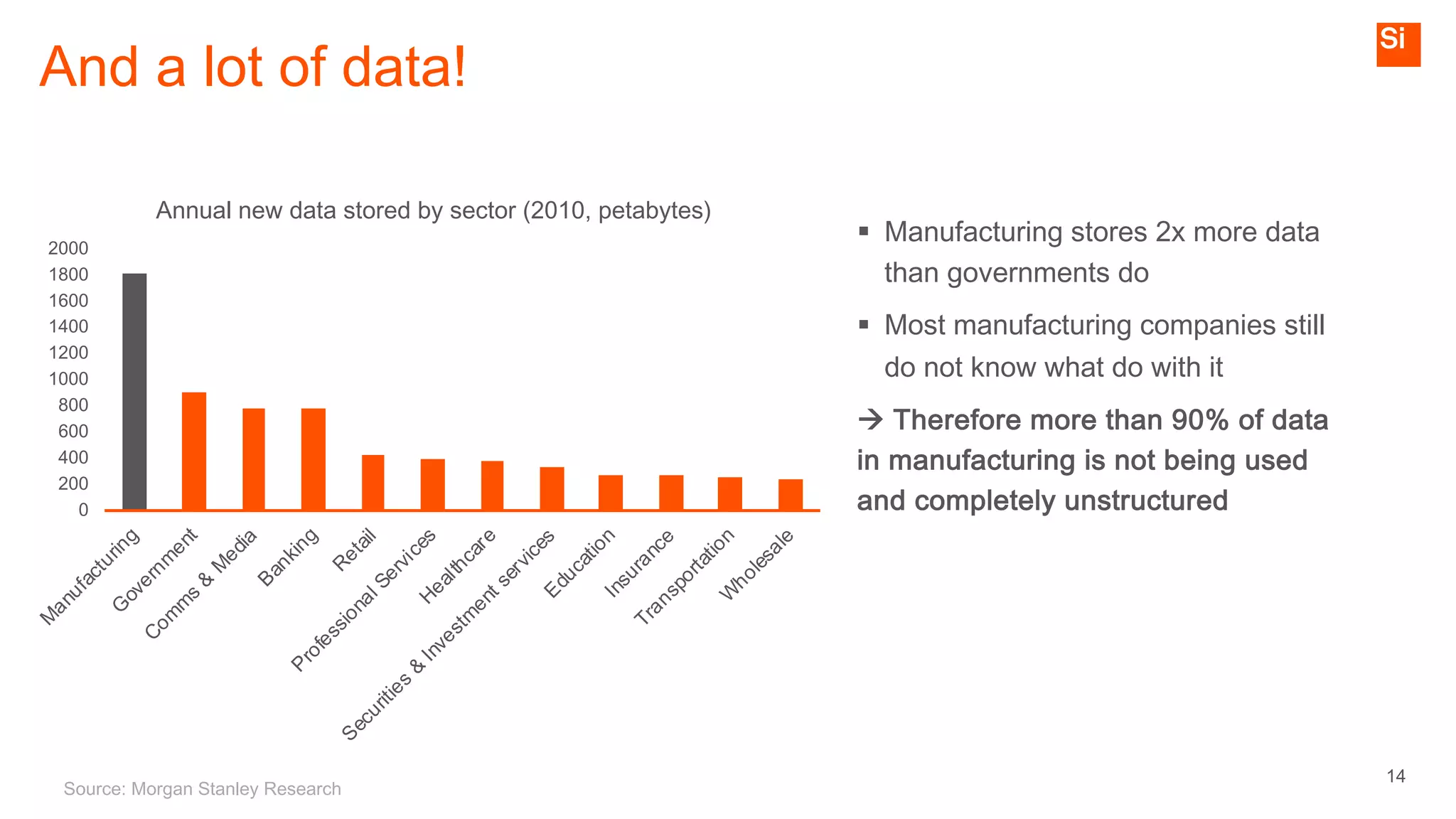

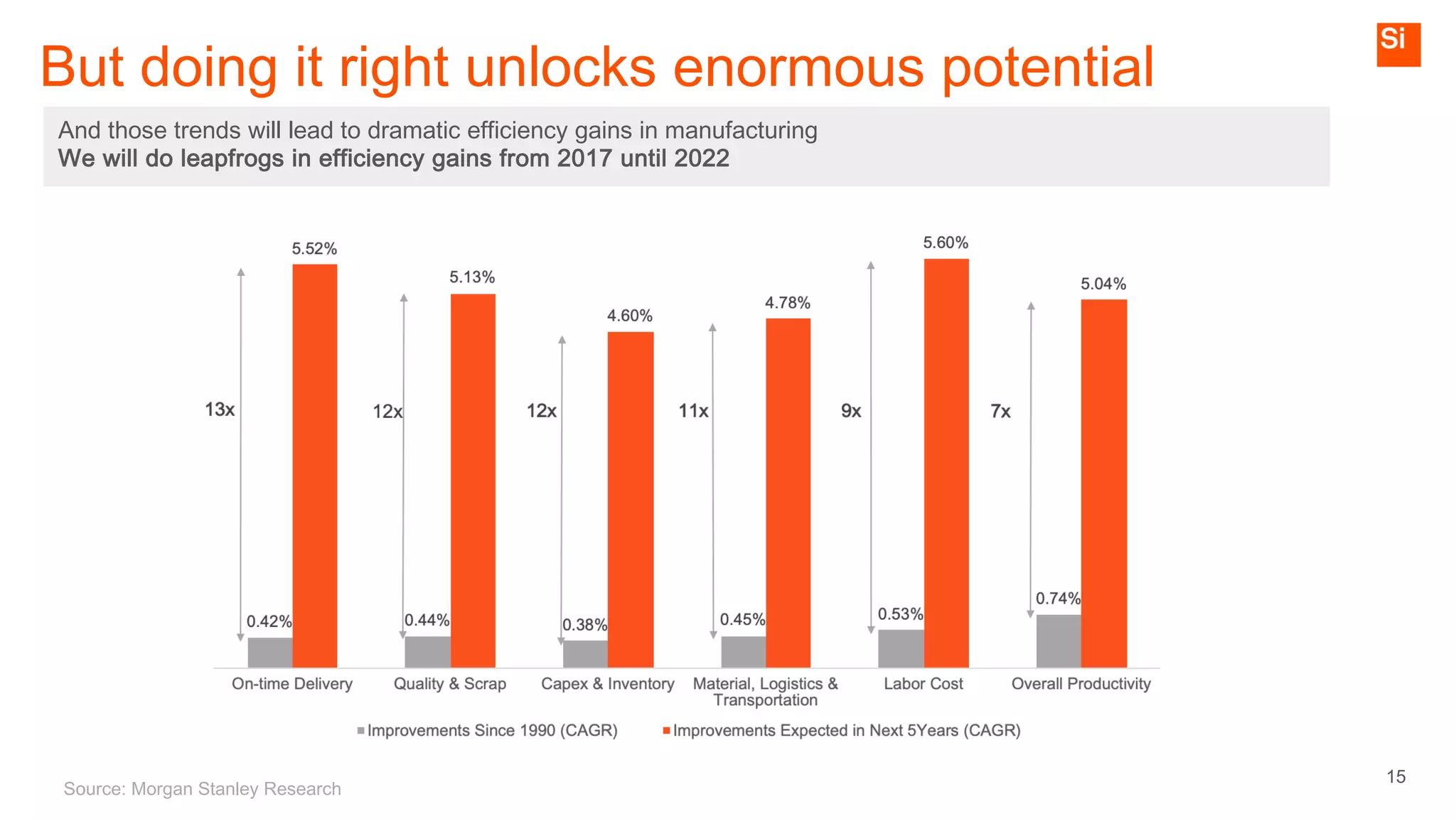

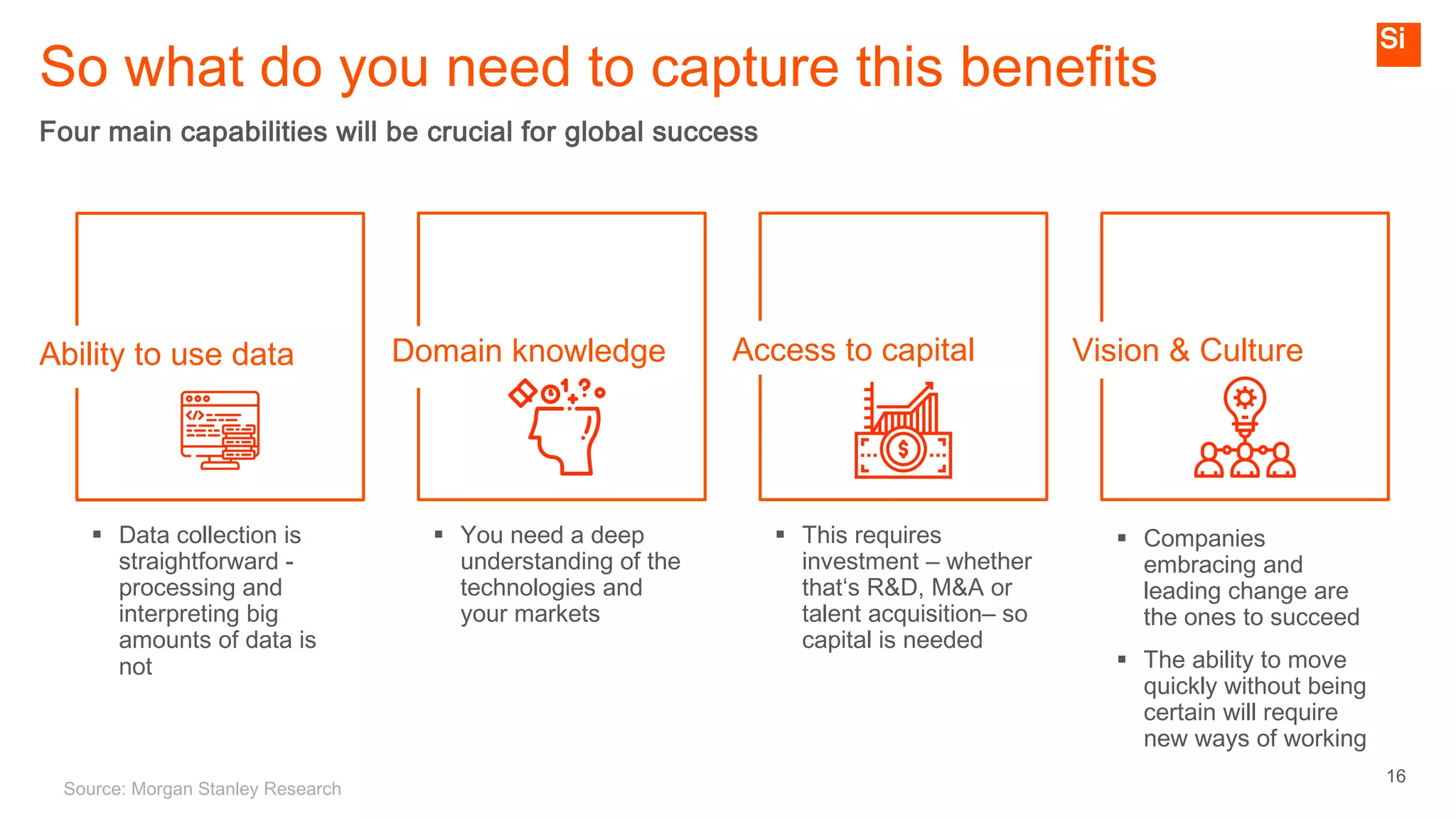

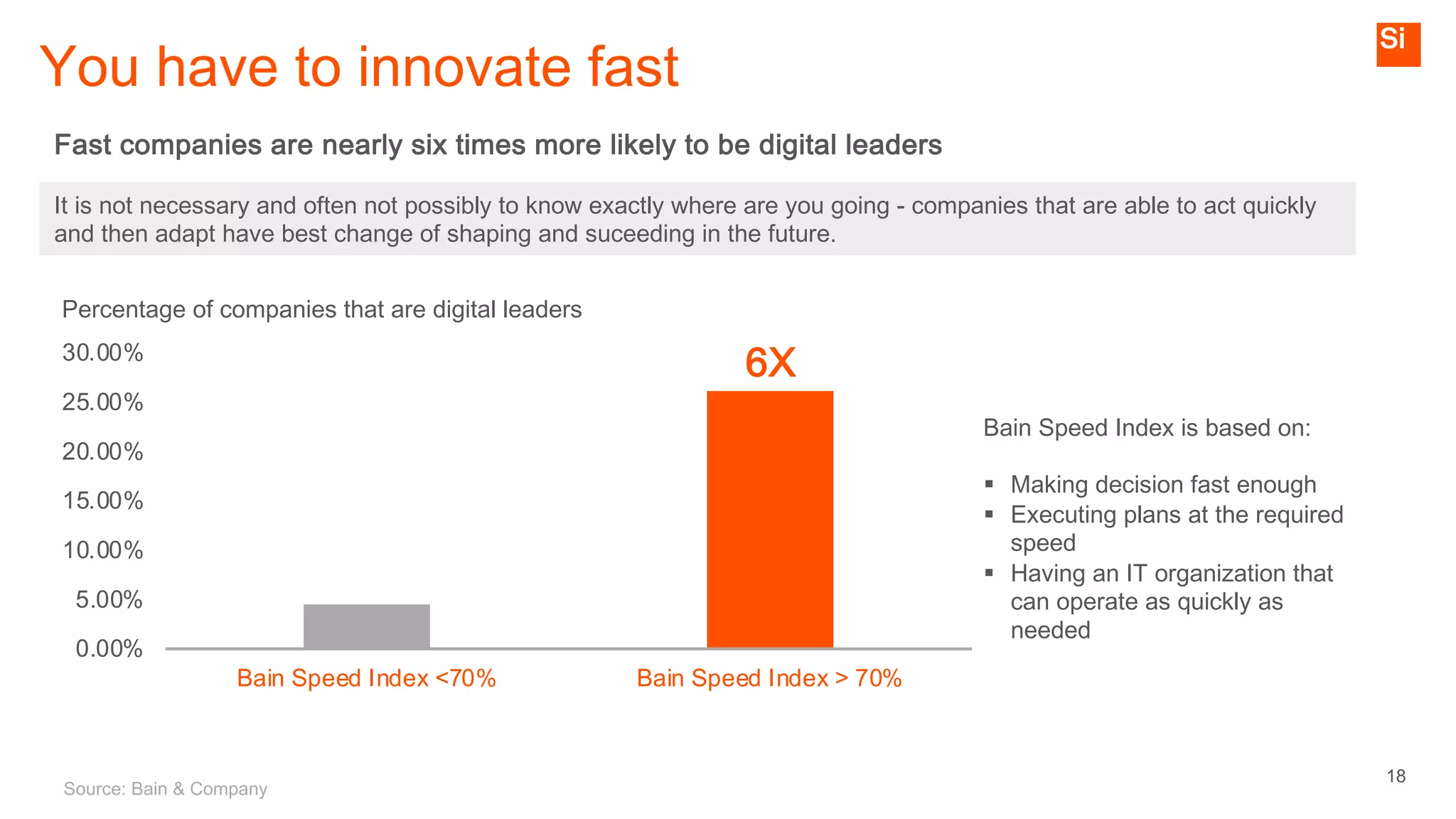

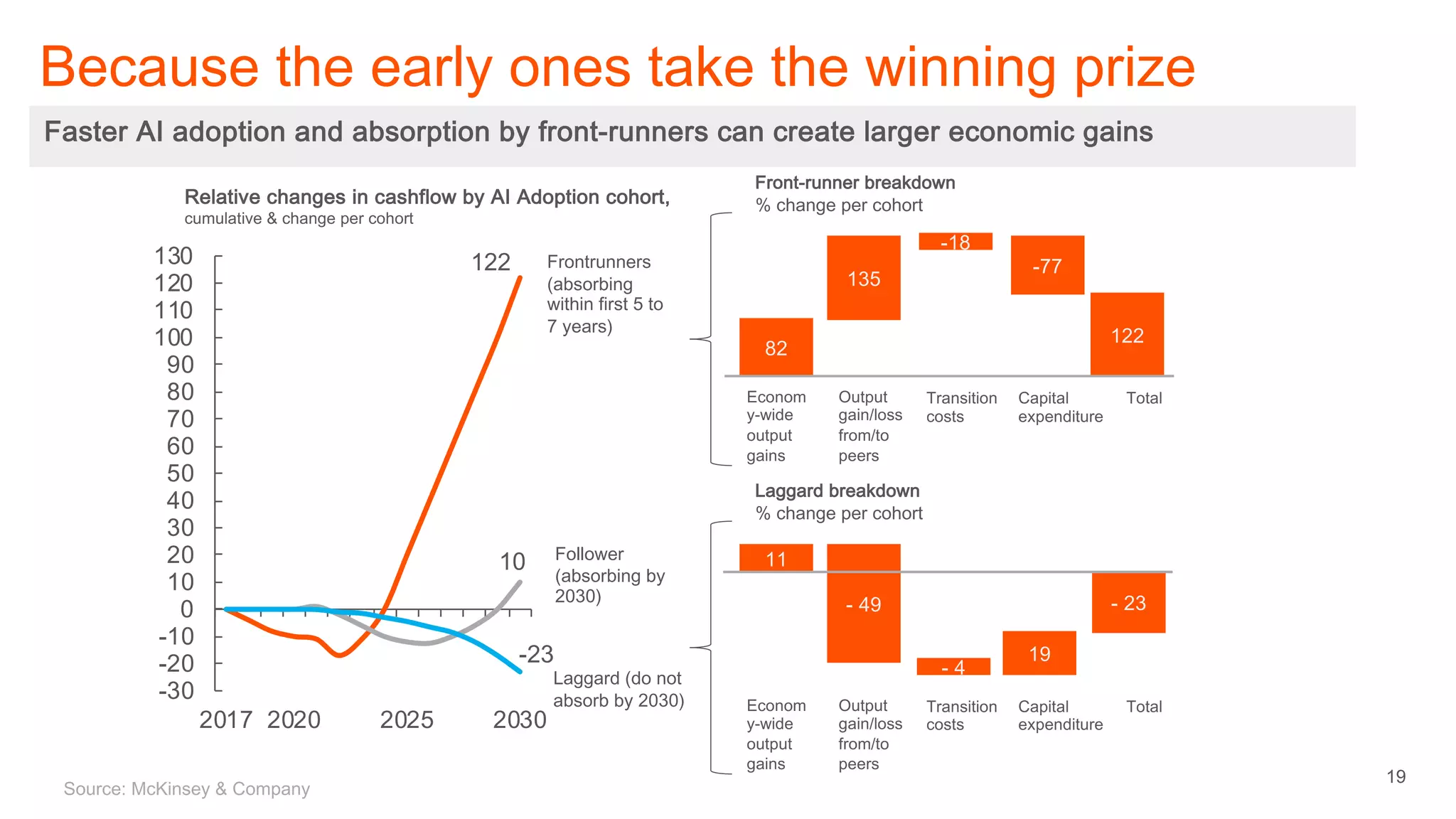

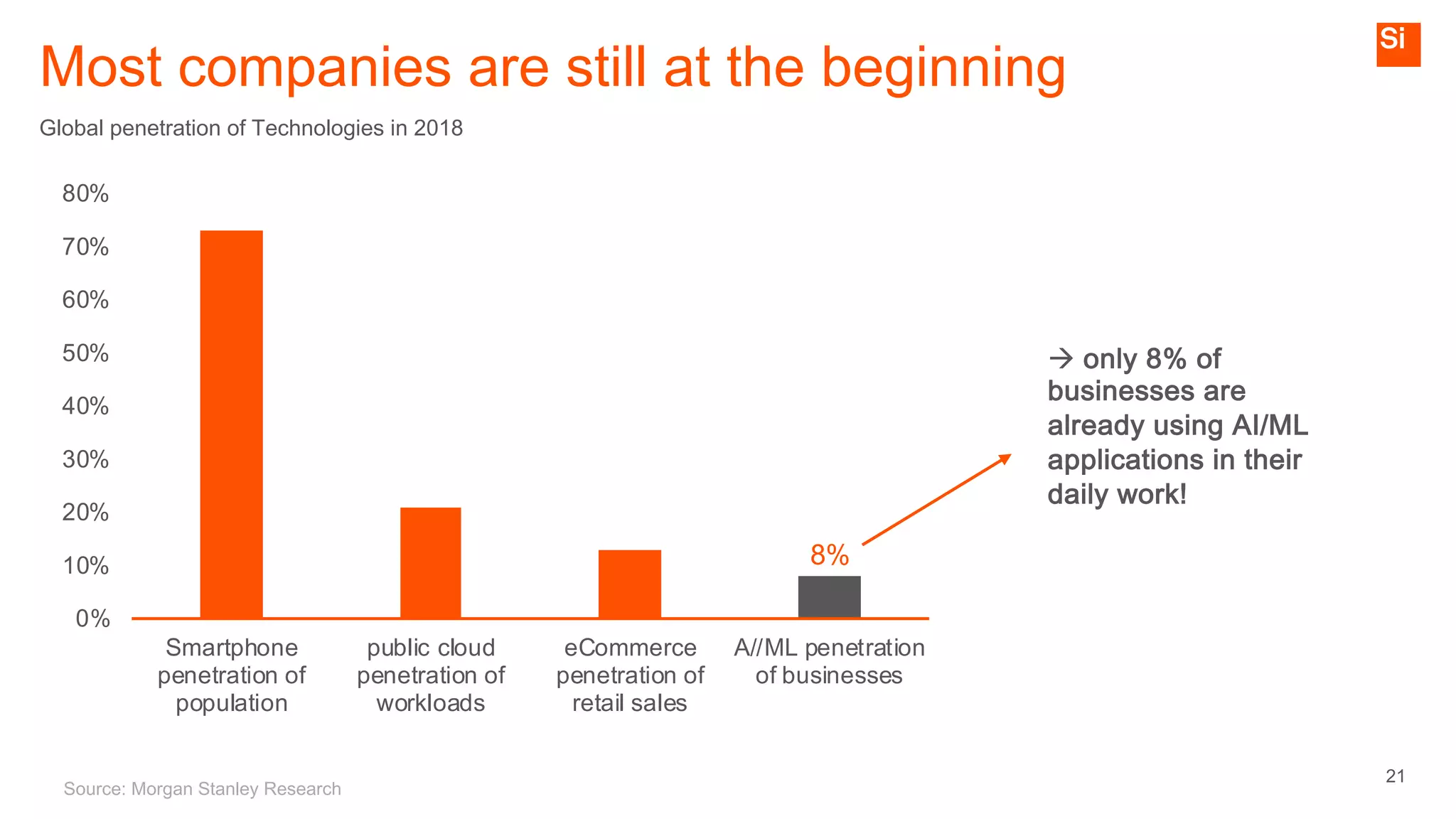

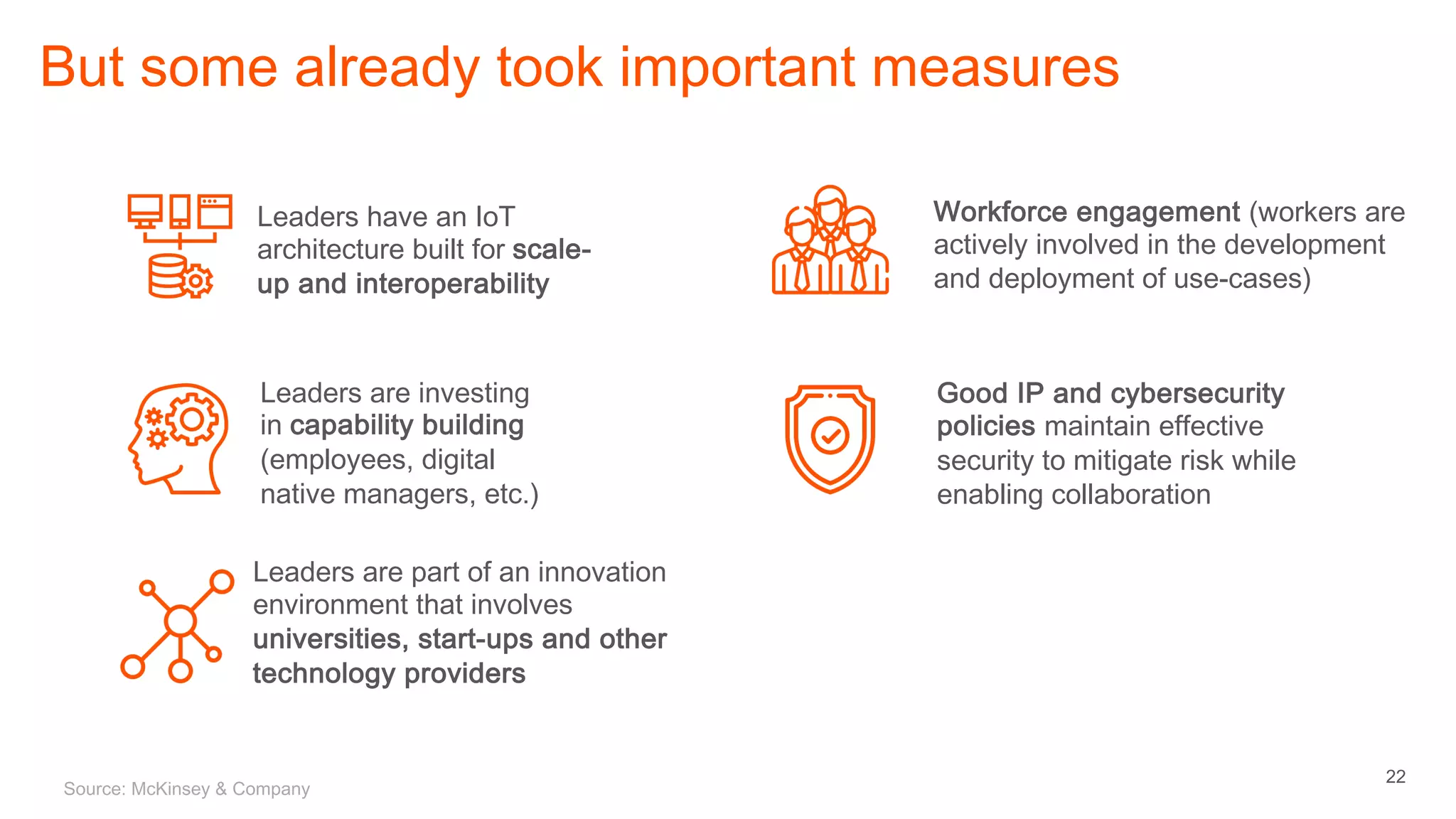

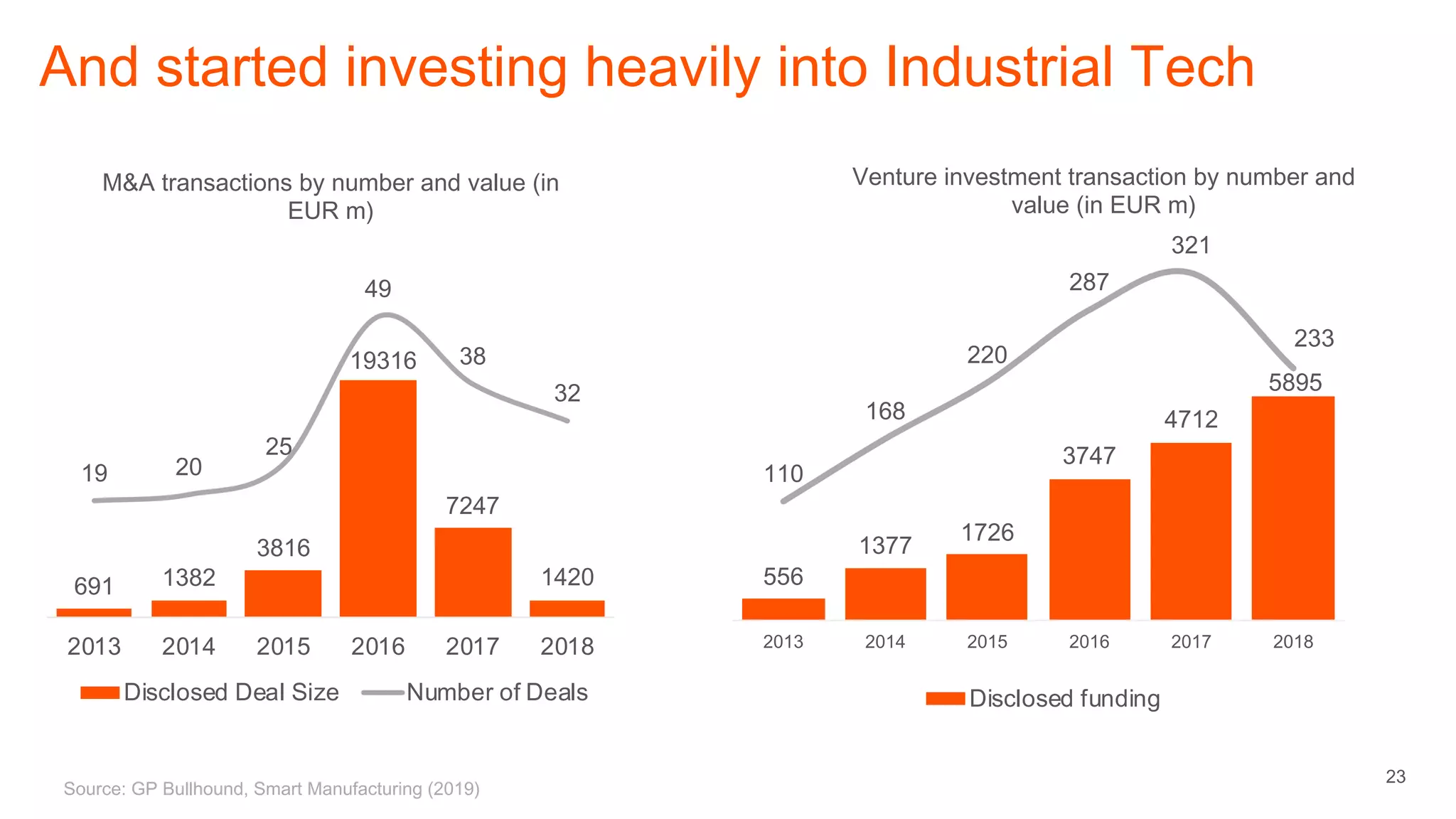

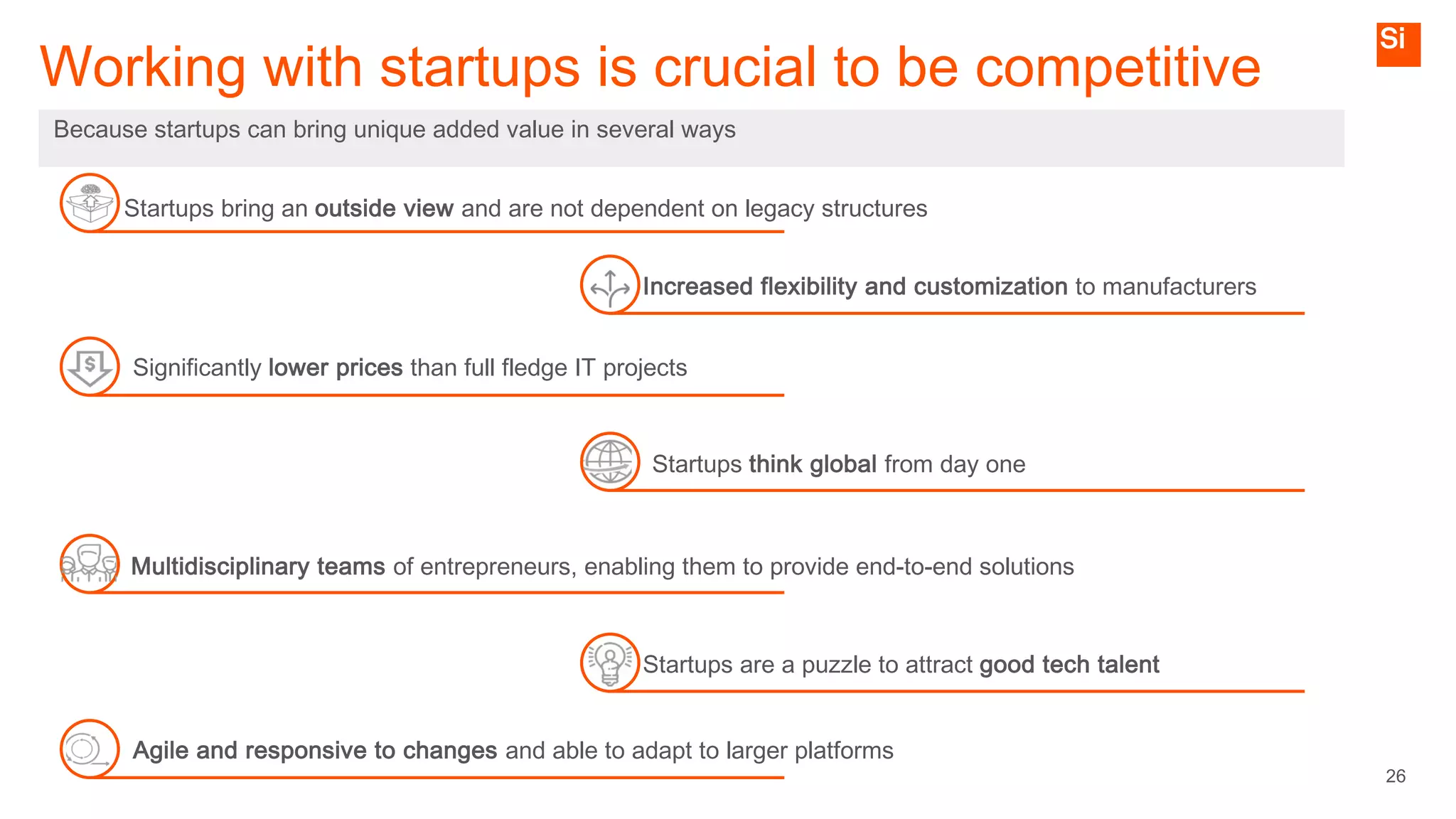

The document discusses the transformation in manufacturing due to technological advancements, emphasizing the shift towards autonomous and self-organizing factories and the integration of data-driven processes. It highlights the importance of rapid innovation and adaptability for companies to succeed and gain economic advantages in a competitive landscape. As manufacturing sectors evolve, new business models and enhanced productivity through automation and data usage will emerge, fundamentally changing the way products are created and services are delivered.