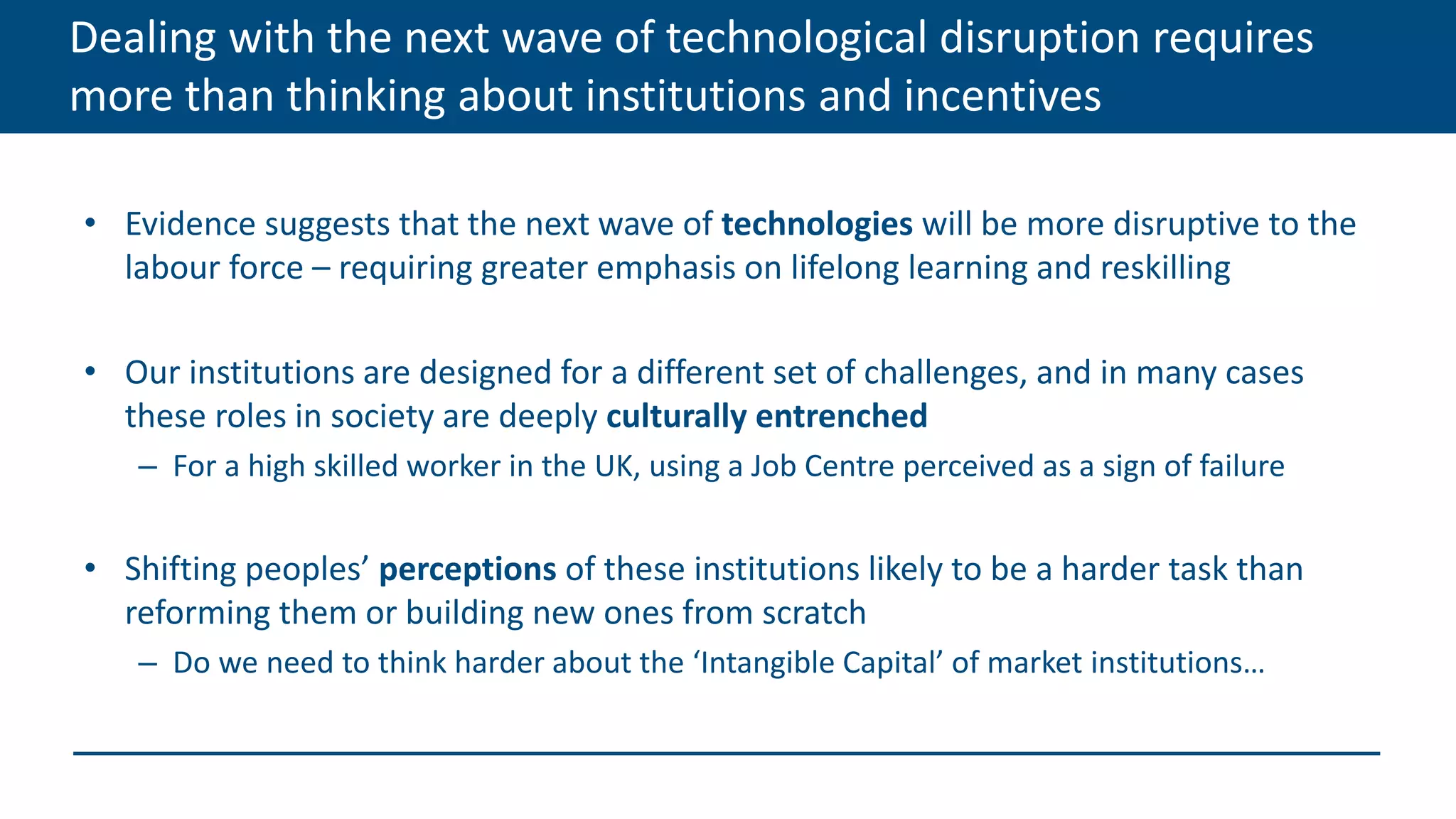

This document discusses the challenges of technological disruption and how it will require more than institutional reform alone. It notes that the next wave of technologies may be highly disruptive to the workforce. Additionally, many firms are already failing to adopt even basic technologies, and this could worsen with further disruption. The lingering effects of the financial crisis have increased economic anxiety, particularly for young people. While good market frameworks are necessary, the experience of the last 20 years shows they are not sufficient to drive private investment and address the challenges of technological disruption.