Embed presentation

Download to read offline

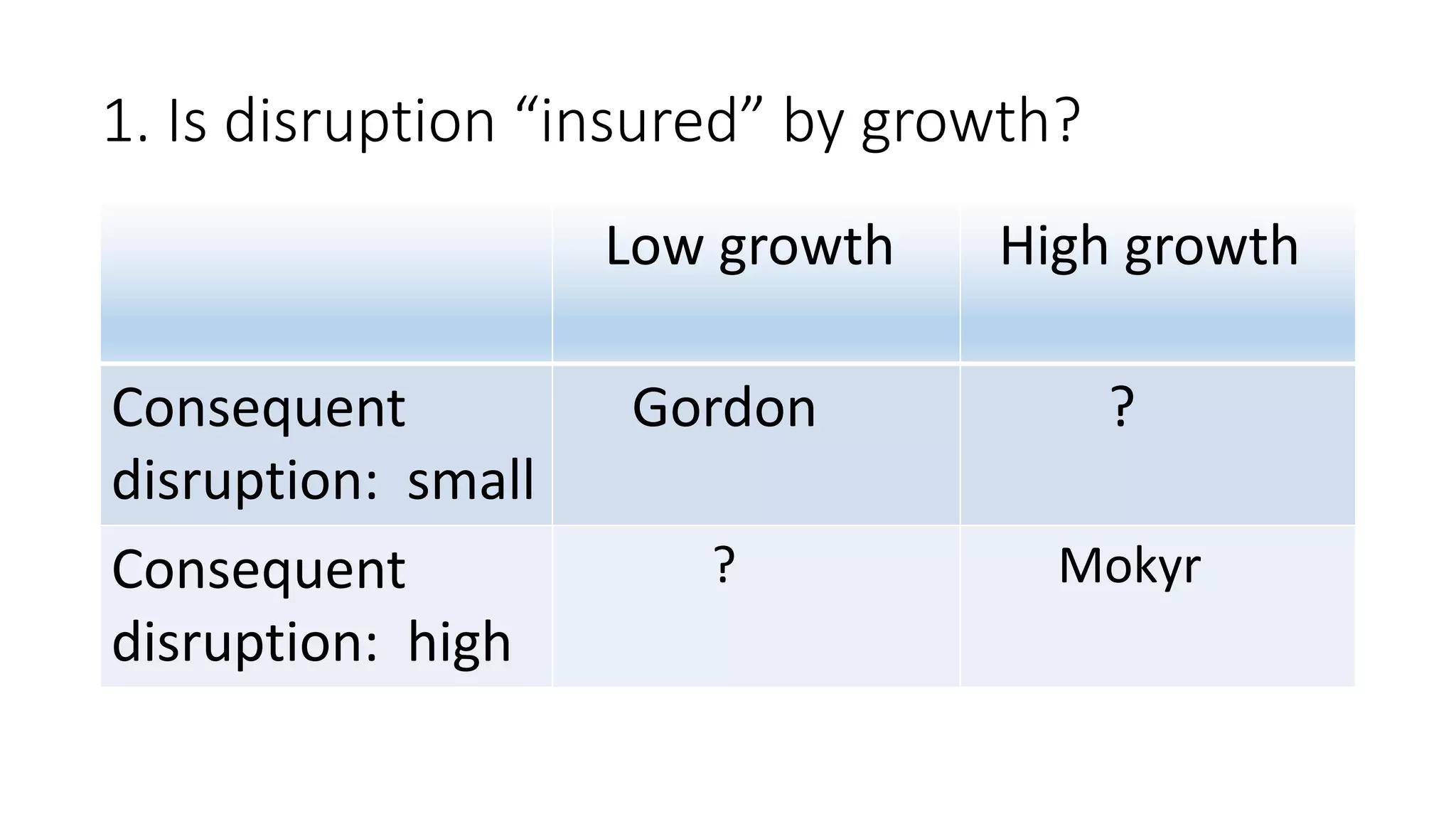

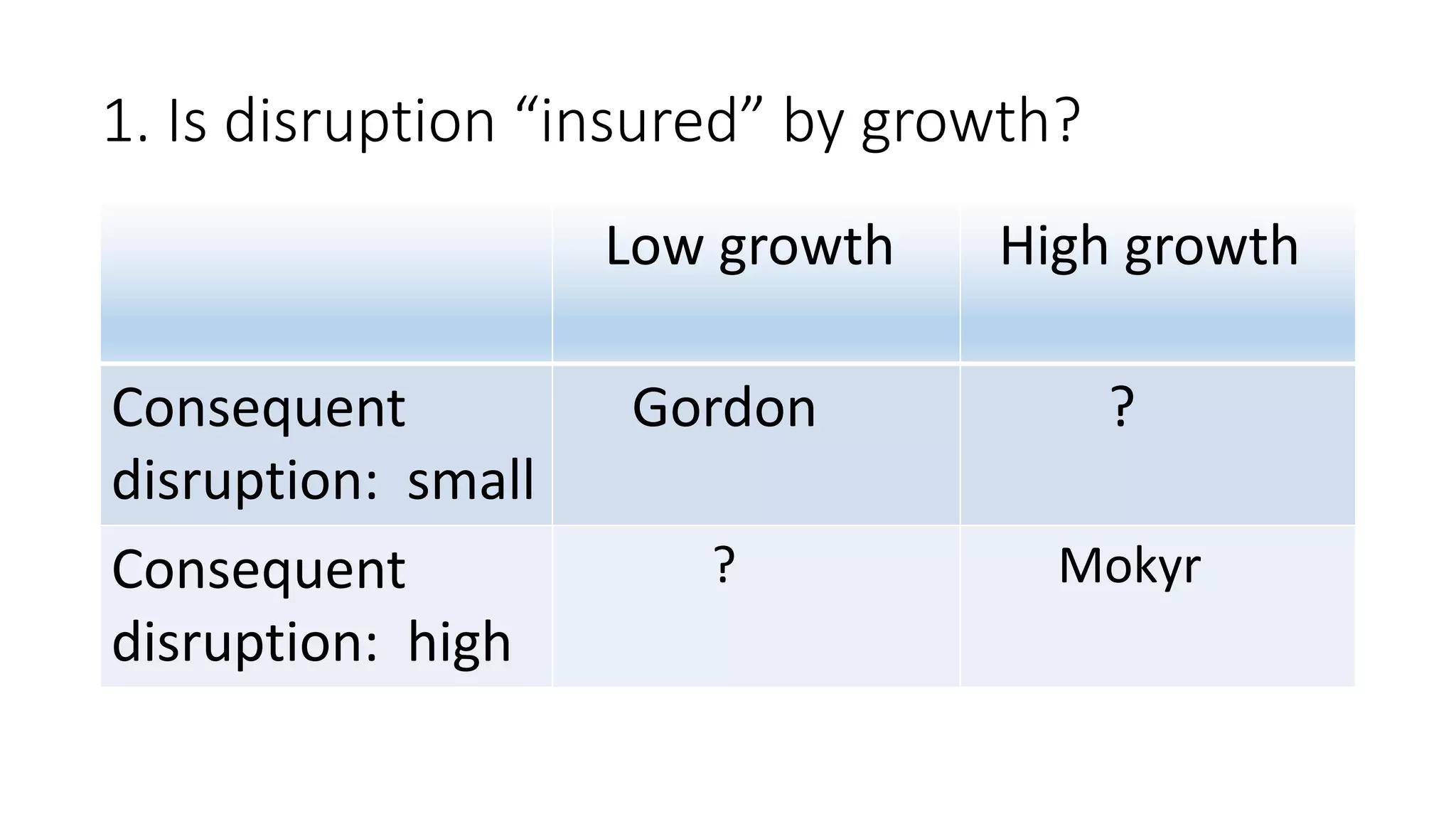

This summary provides high-level information from a document about notes from the OECD 3rd Annual Conference on the Global Forum on Productivity. The document discusses: 1) Key points from several speakers about the importance of government policy, including central banking, to a well-functioning economy. 2) The likelihood that disruptive technologies will impact productivity and growth, and that this is "more likely than not" based on several studies cited. 3) The importance of taking a common cause approach to understanding productivity growth trends across countries over time.