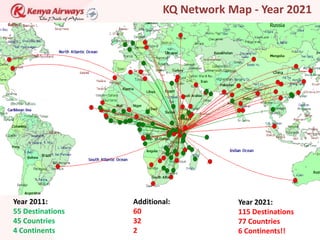

- KQ has a 10 year strategic plan called "Project Mawingu" to expand its network to 115 destinations in 77 countries across 6 continents by 2021.

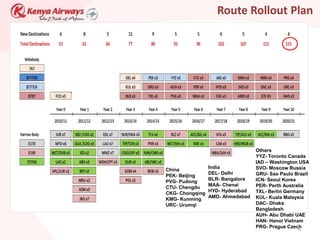

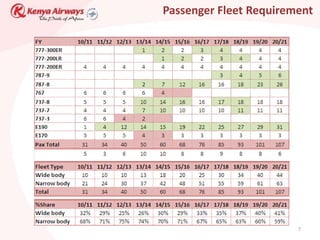

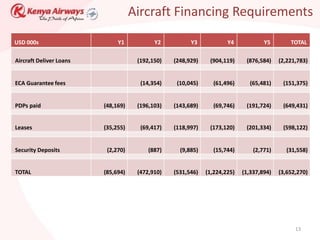

- The plan involves growing KQ's passenger and cargo fleets significantly over the next 10 years and launching new routes across Africa, Asia, Europe and the Middle East.

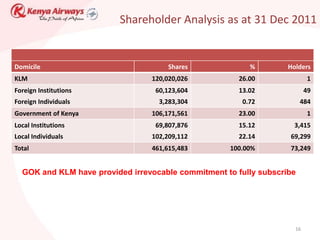

- To fund its ambitious expansion goals, KQ is raising KES 20.7 billion (USD 250 million) through a rights issue that offers existing shareholders the right to purchase additional shares at a 32% discount to the market price.