The document discusses tax-aware investing, emphasizing the importance of after-tax returns and comparing tax-deferred annuities, life insurance, and taxable investment accounts across various scenarios. It highlights that tax-deferred annuities and life insurance are generally better for accumulating wealth, especially with ordinary income producing assets. Additionally, the text explores optimal retirement planning considerations regarding taxation and investment strategies across different vehicles.

![•

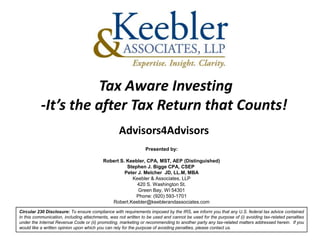

Effect of Capital Gains Incentives

Example:

– $100,000 beginning cash to invest and 28% tax bracket (15% long-term capital gains

bracket)

– Options:

• Corporate bonds (6% annual interest)

• Municipal bonds** (4.5% annual interest)

• Stocks (1% annual non-qualified dividends, 5% growth

[100% asset turnover])

After-Tax Balance of a Taxable Account (Invested in Stock, Municipal Bonds and Corporate Bonds)

$400,000

Stock (50% Turnover) Stock (100% Turnover) $65,732 of

$300,000 additional assets

Municipal Bonds Corporate Bonds (23% difference)

$200,000

$100,000

$-

1 3 5 7 9 11 13 15 17 19 21 23 25

Year

•The 15% long-term capital gain rate is only effective under current law through 2012. It is not certain that the Congress will extend the 15% rate.

•**Municipal bounds may not be suitable for a person in this low of a tax bracket.

© 2011 Keebler & Associates, LLP

Al Rights Reserved. 40](https://image.slidesharecdn.com/keebler-tax-efficient-investing-part2-111028150009-phpapp02/85/Tax-Efficient-Investing-Comparing-The-Results-Part-2-of-Tax-Efficient-Investing-Webinar-Series-40-320.jpg)