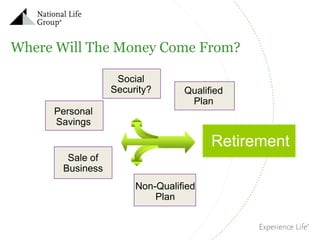

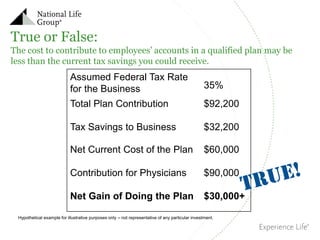

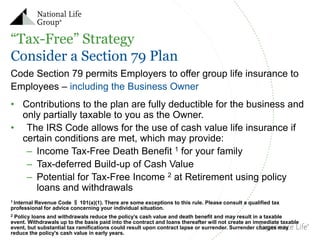

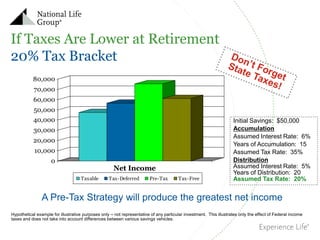

This document discusses various retirement planning strategies using your business. It begins by asking how much readers think retirement will cost and lists common estimates. It then outlines an agenda to cover accumulating money pre-tax and after-tax, different plan types, taxation of retirement income, and combining plans. The document discusses strategies like qualified plans, IRAs, annuities, and life insurance to save both pre-tax and after-tax. It emphasizes the benefits of tax-deferred growth and argues readers should diversify their strategies between taxable, pre-tax, tax-deferred, and tax-free approaches. The document suggests meeting to review the reader's goals, existing plans, and make recommendations to help achieve their retirement objectives.