Embed presentation

Download to read offline

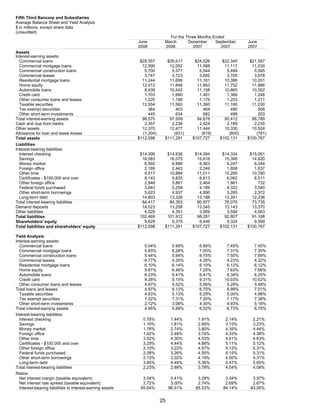

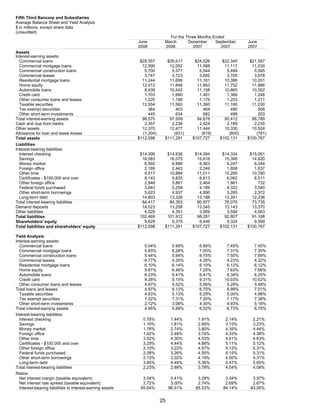

Fifth Third Bancorp reported a net loss for Q2 2008 due to charges related to leveraged leases. Excluding these charges, pre-tax earnings were up 16% year-over-year due to increases in noninterest income and average loans. However, credit costs increased significantly due to deteriorating economic conditions, particularly in real estate loans in Florida and Michigan. In response, Fifth Third raised capital levels and reduced the common dividend to strengthen its position during the economic downturn.