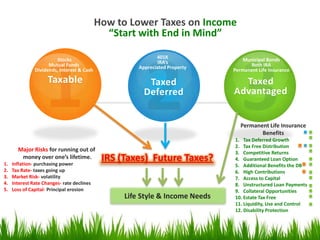

This document discusses various ways to lower taxes on income, including contributing to 401k and IRA retirement accounts, investing in stocks, mutual funds, and municipal bonds, and purchasing appreciated property or permanent life insurance. It notes that permanent life insurance offers tax-deferred growth, tax-free distributions, competitive returns, guaranteed loan options, and additional benefits. The major risks to consider for running out of money in retirement are inflation, increasing tax rates, market volatility, declining interest rates, loss of capital, and ensuring one's lifestyle and income needs are met.