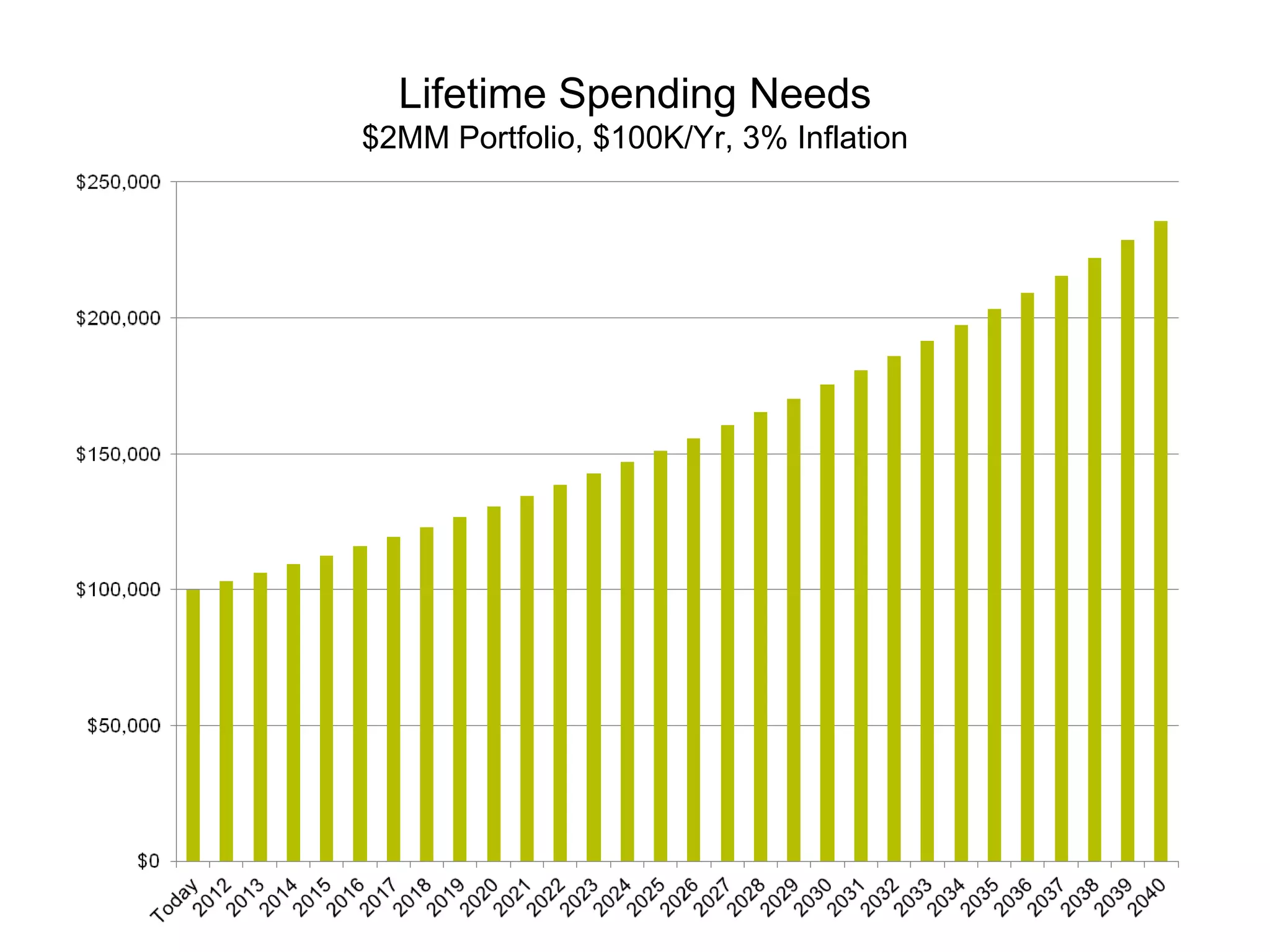

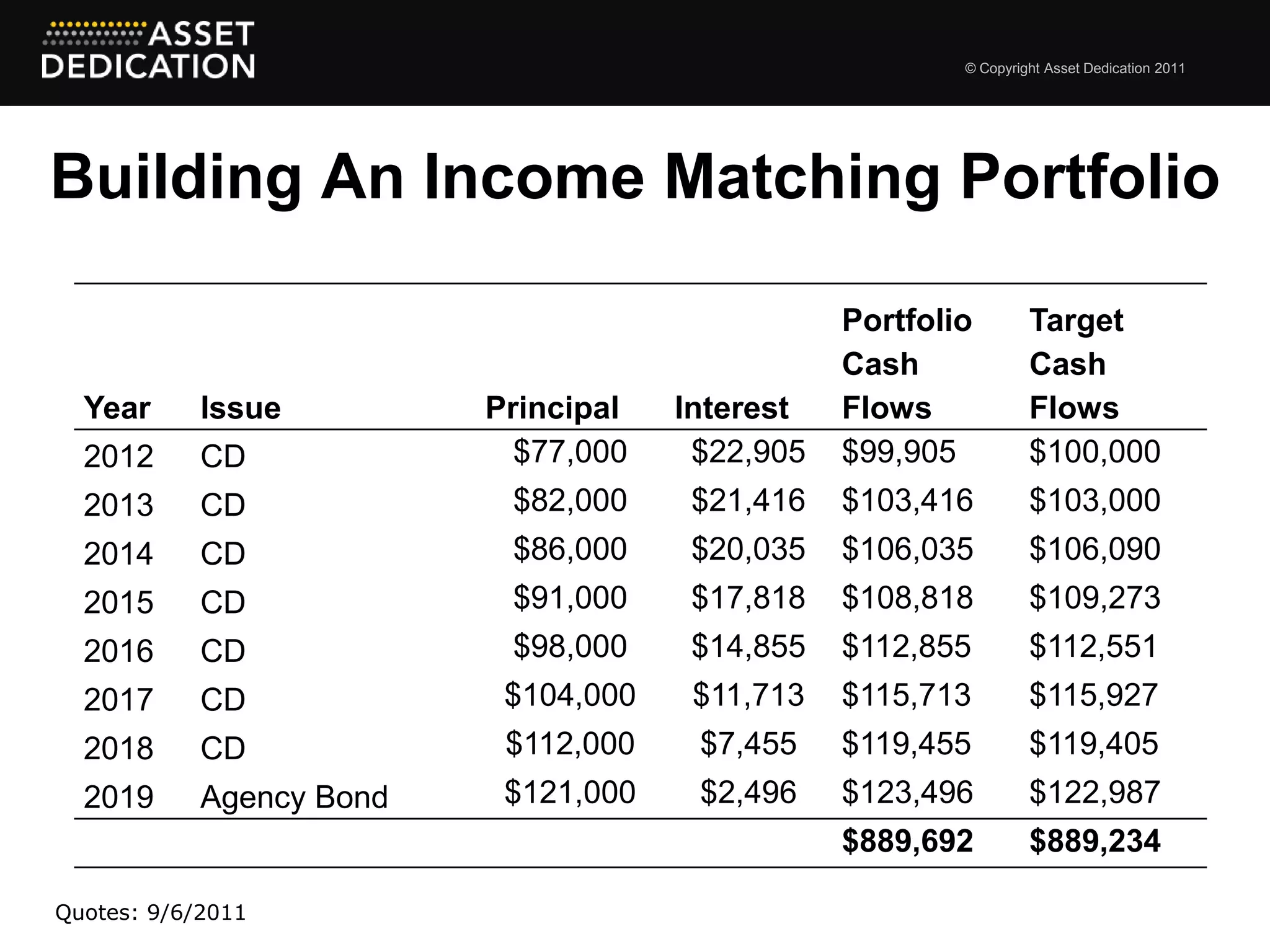

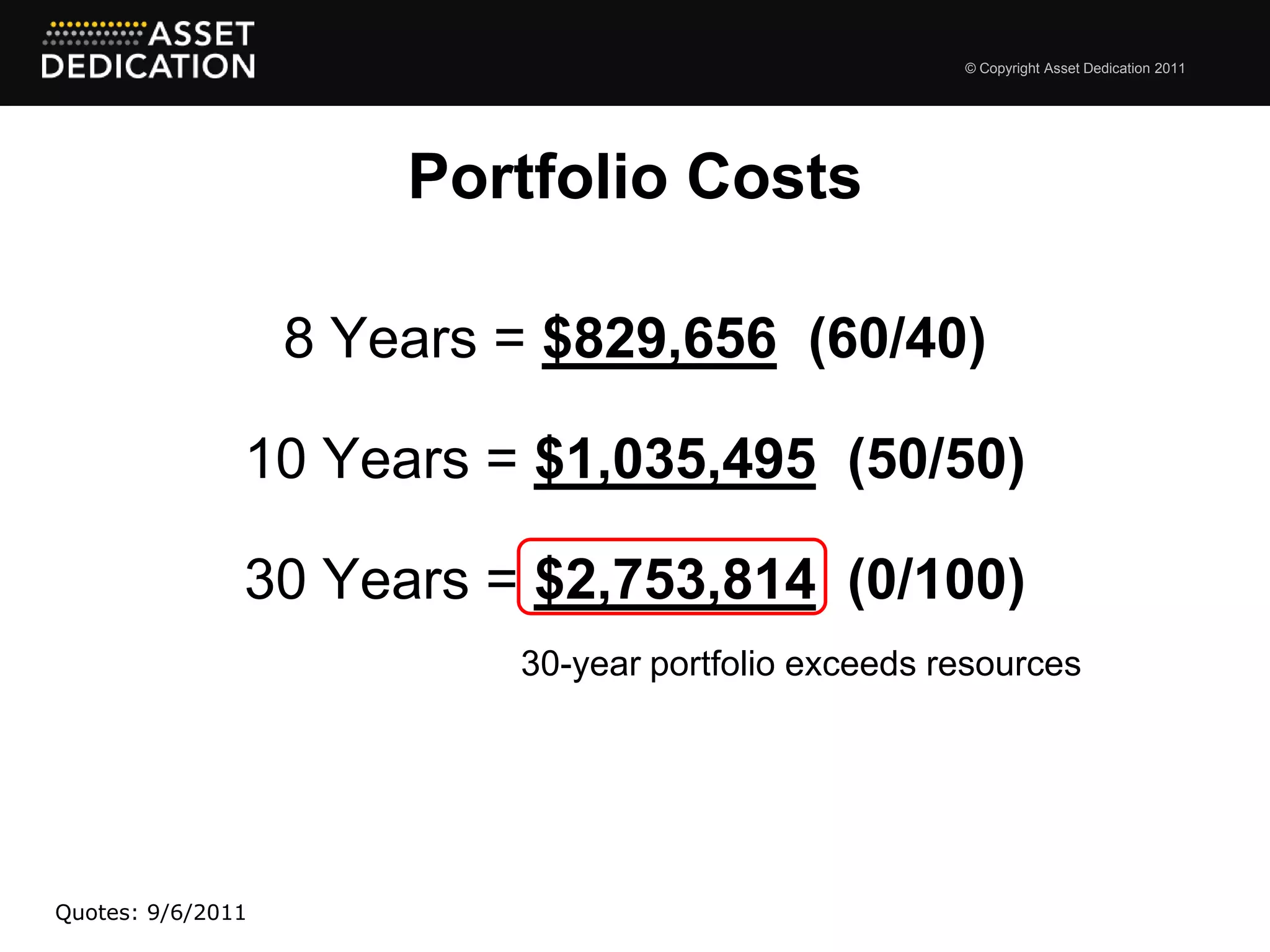

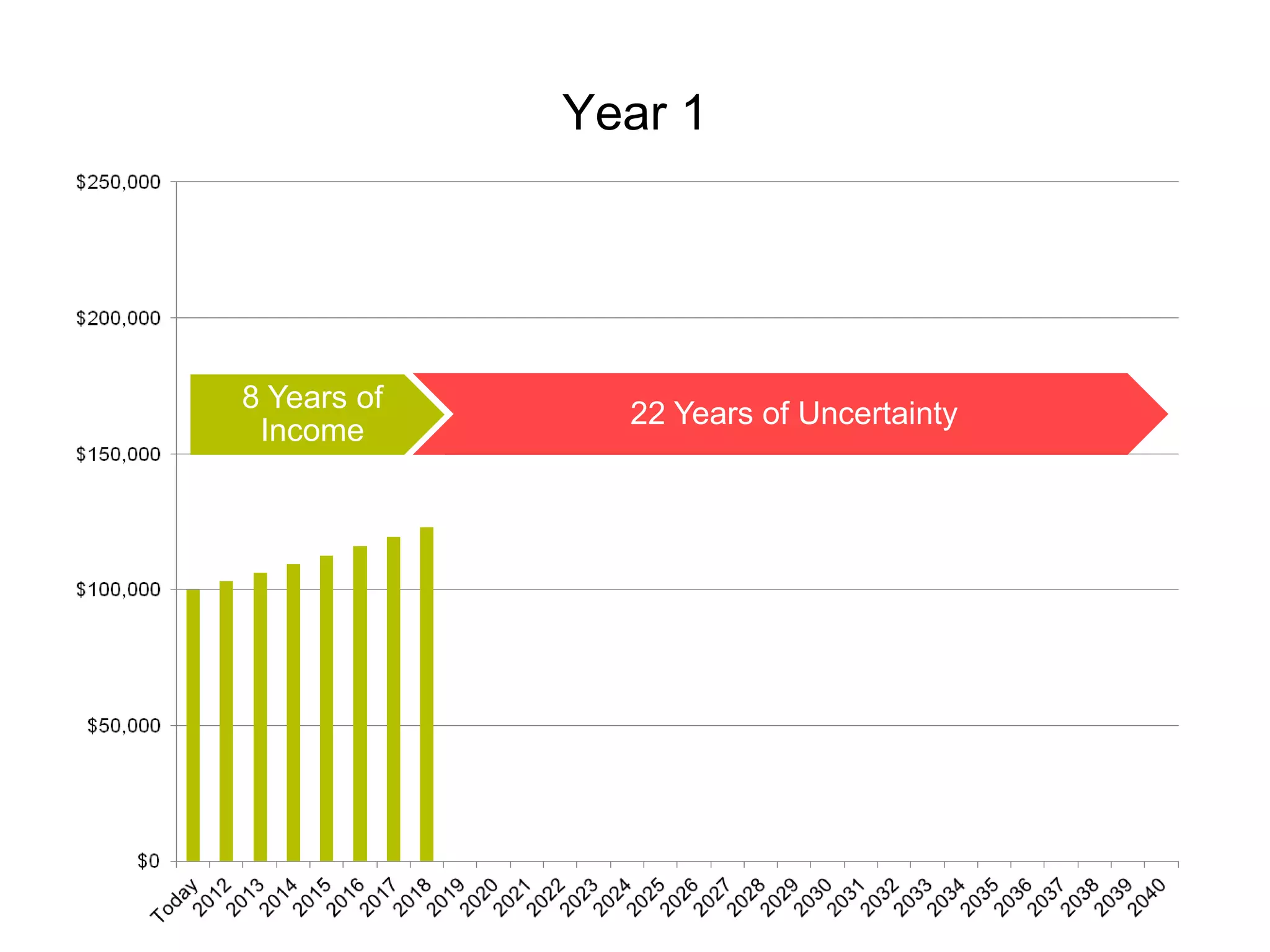

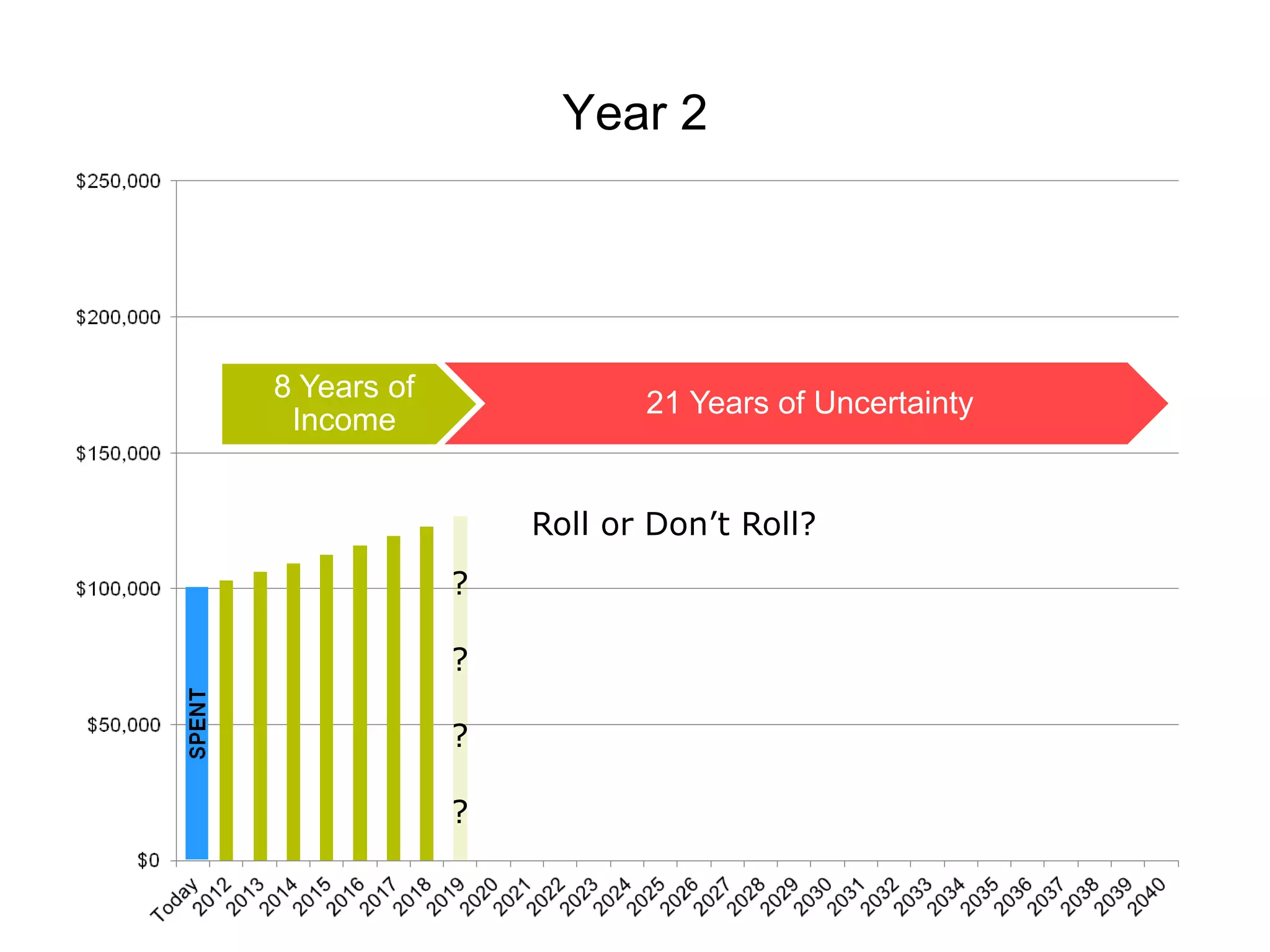

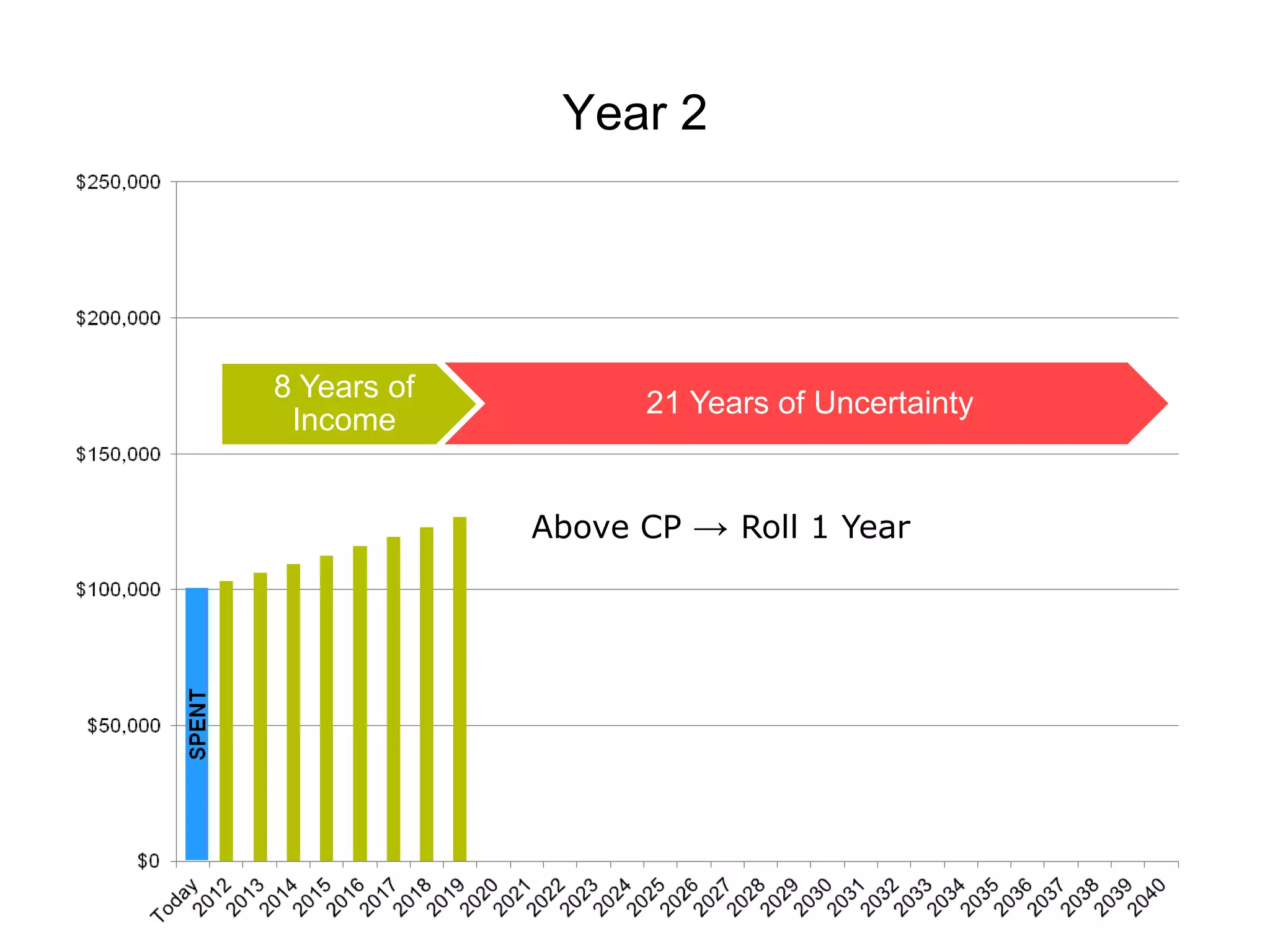

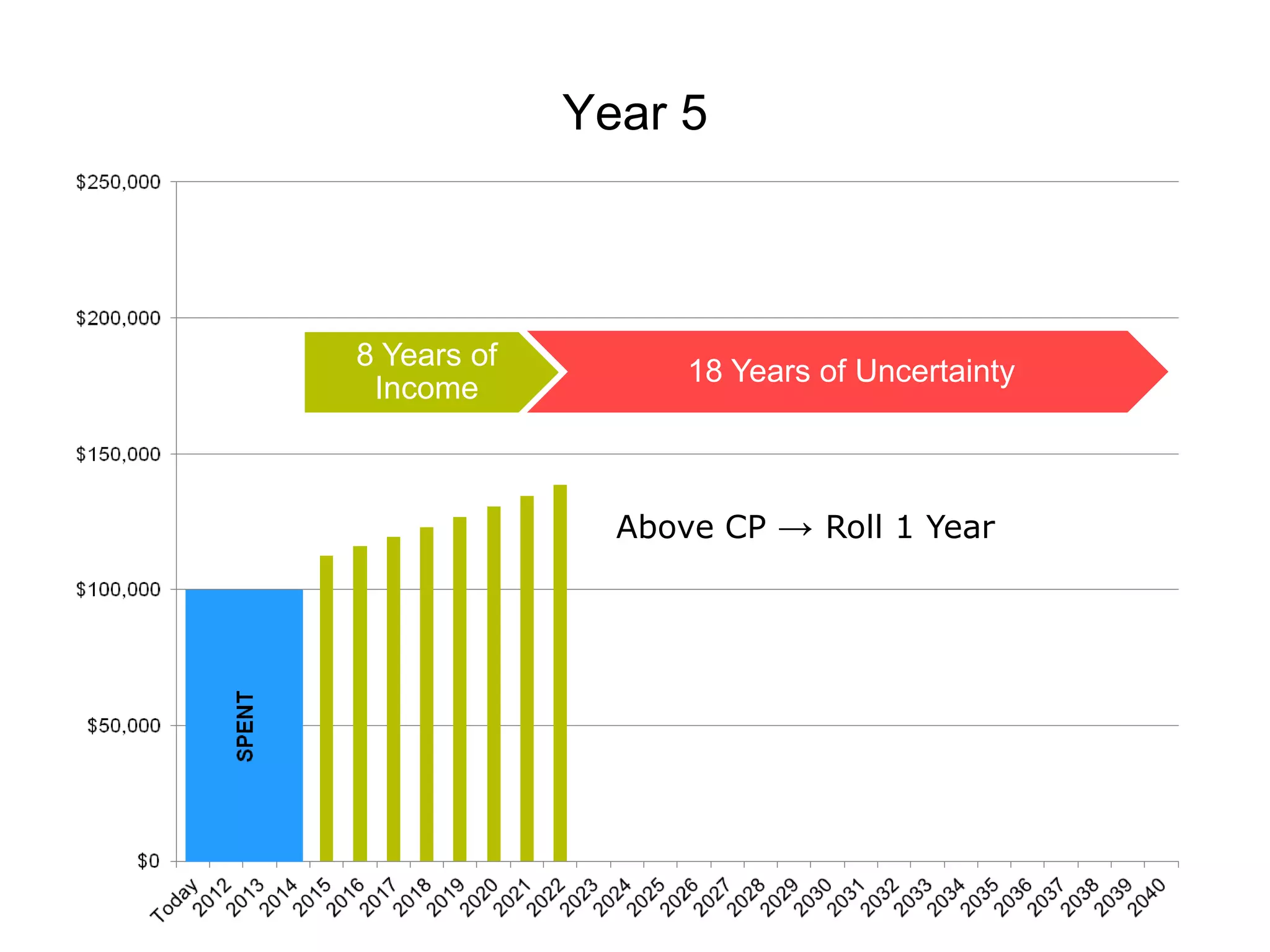

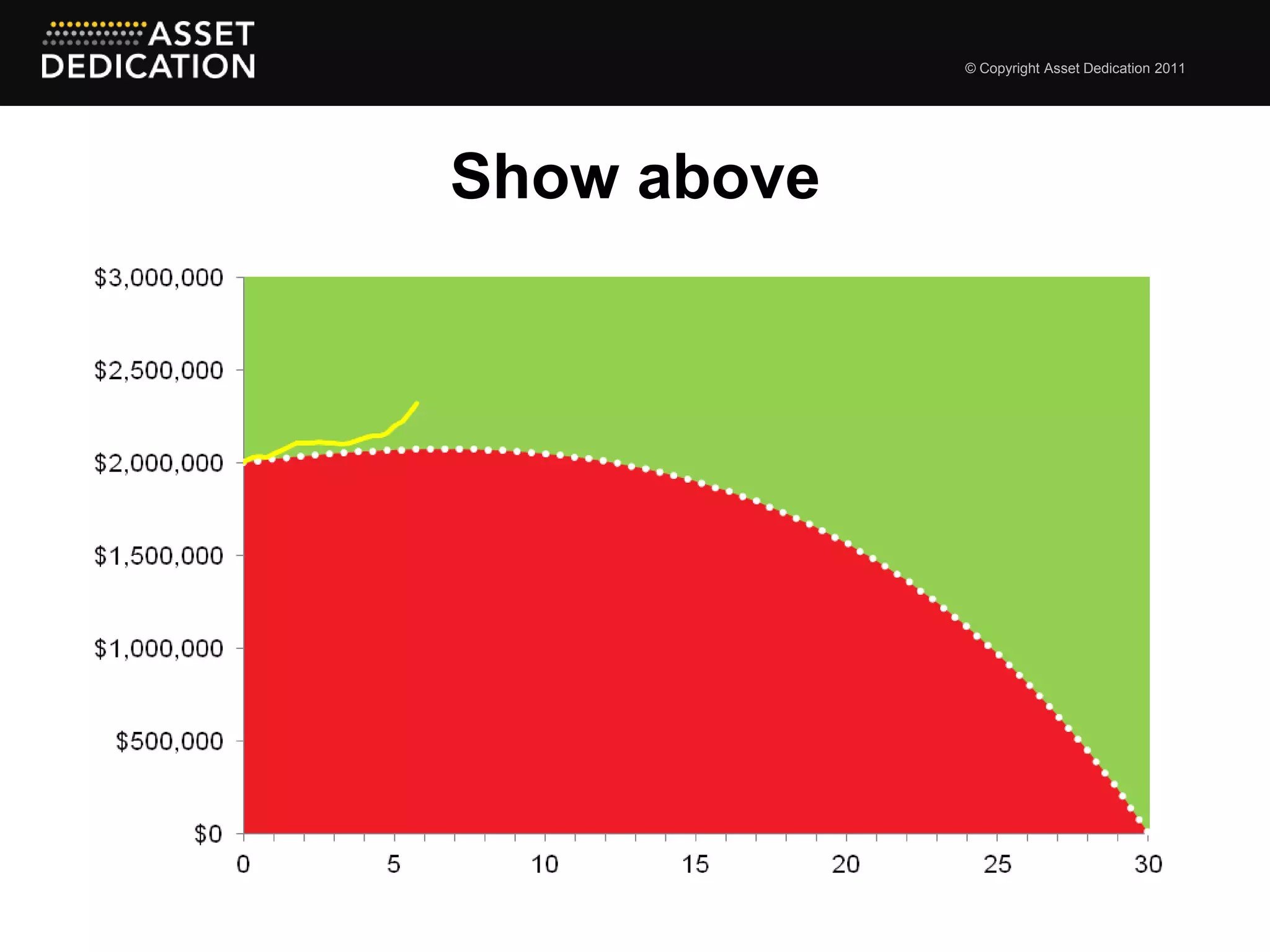

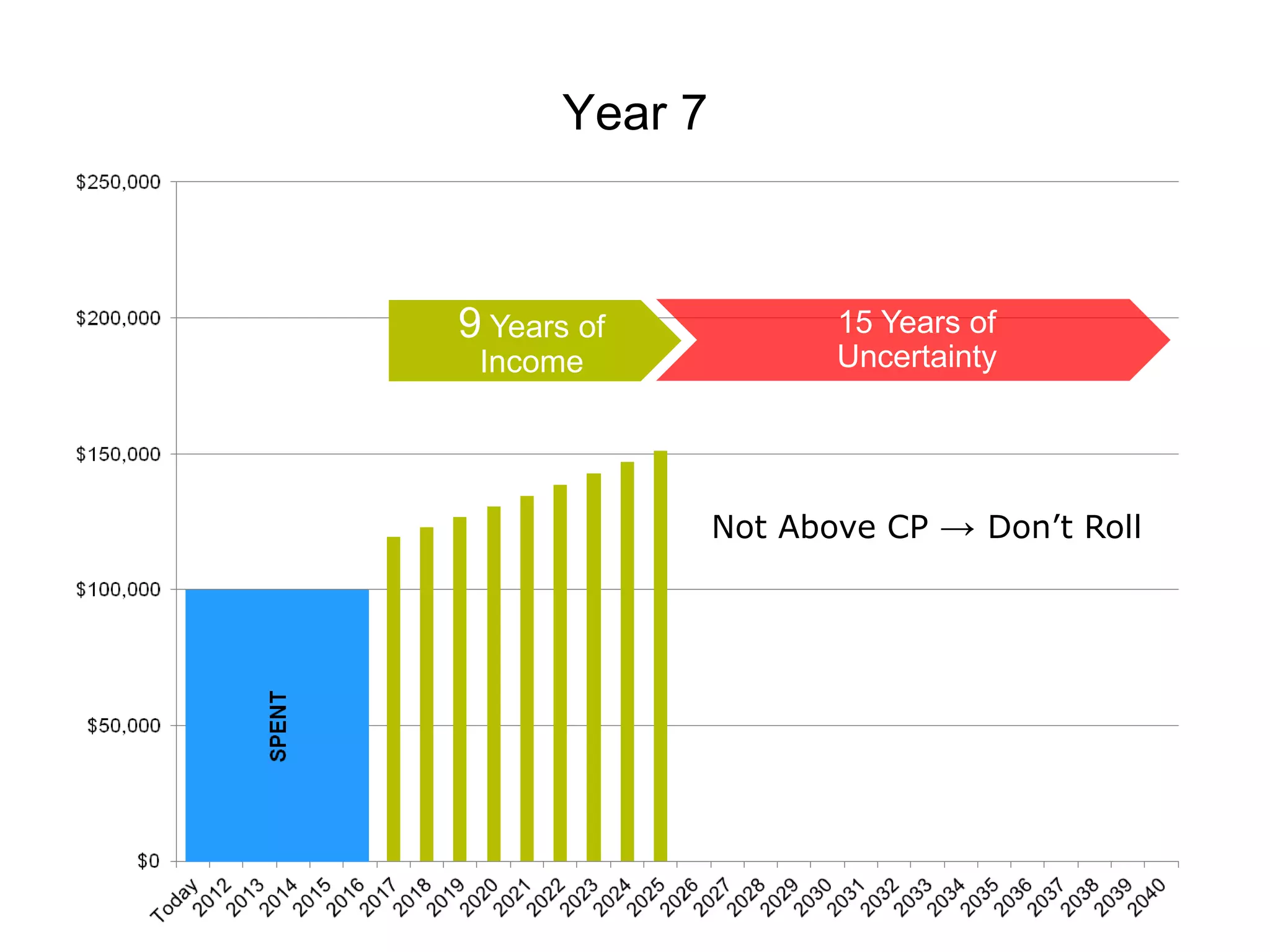

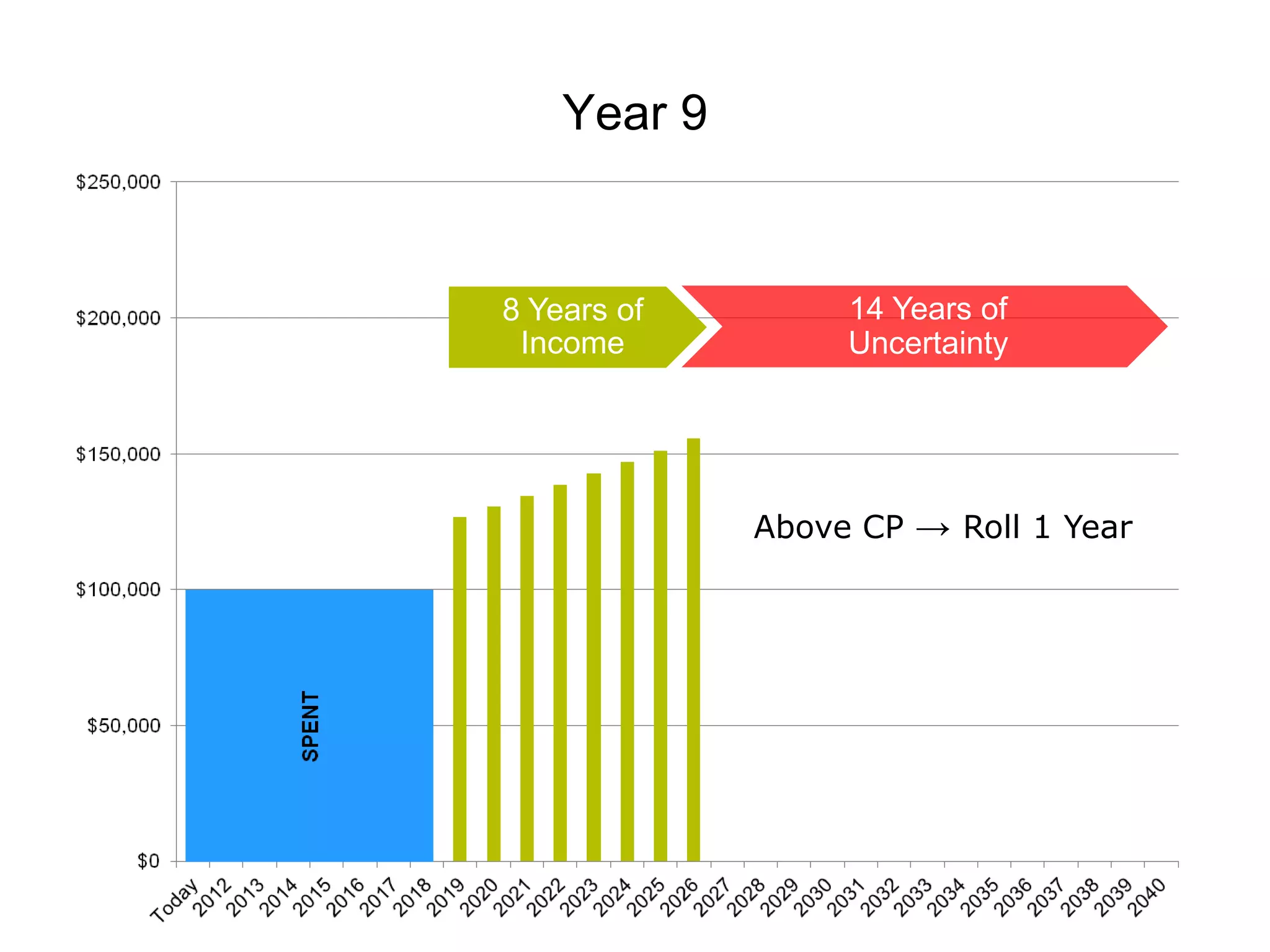

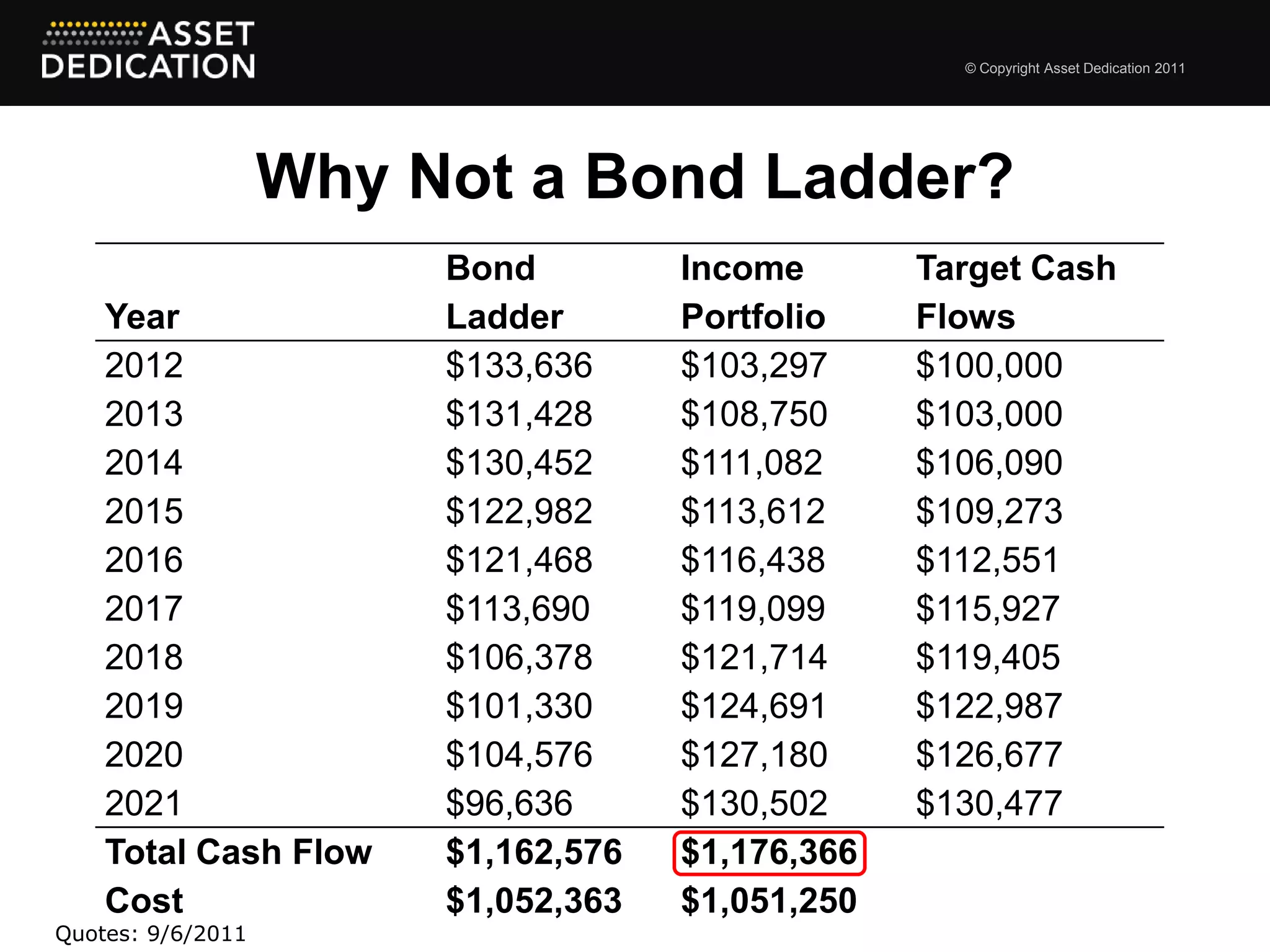

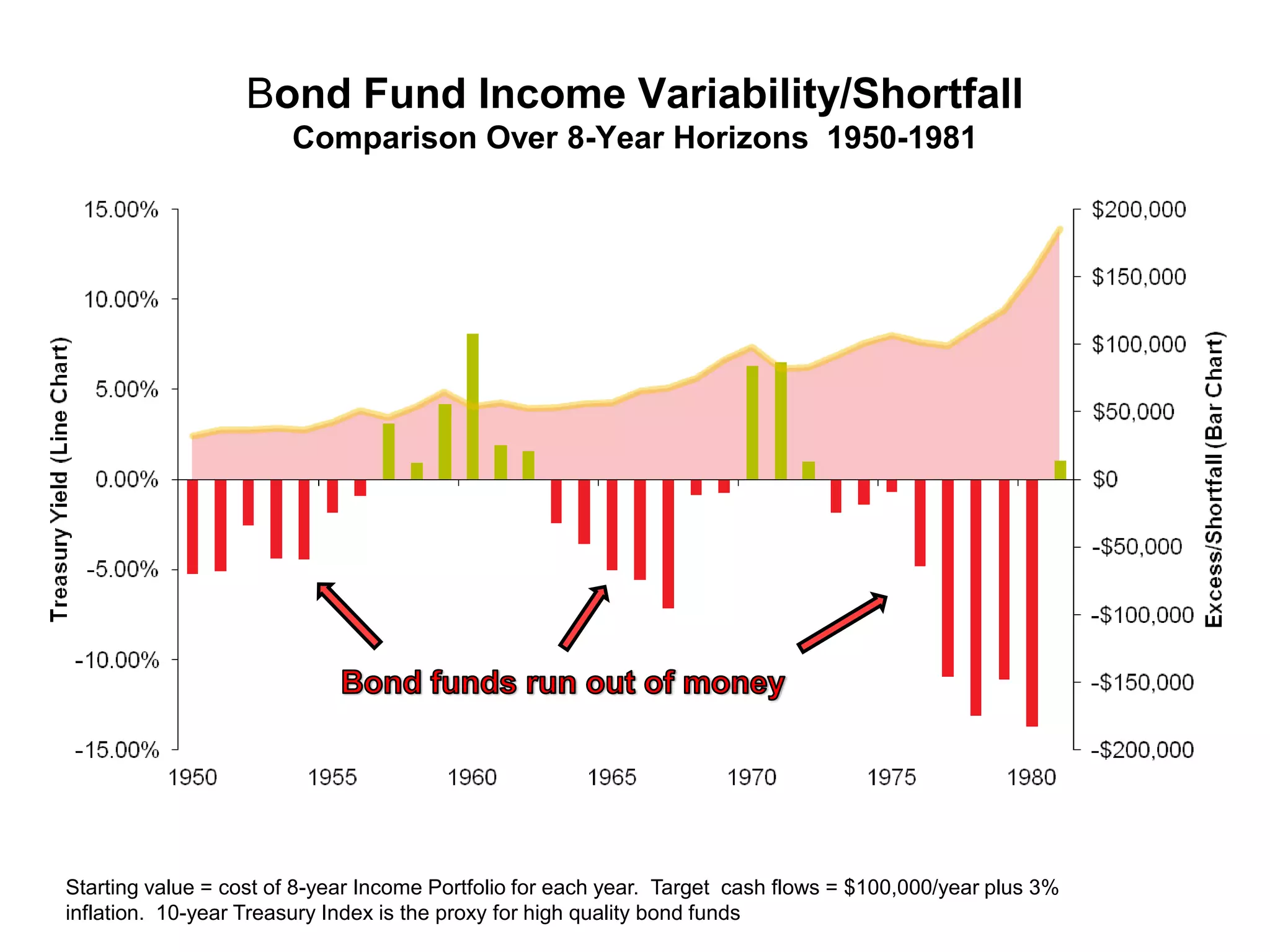

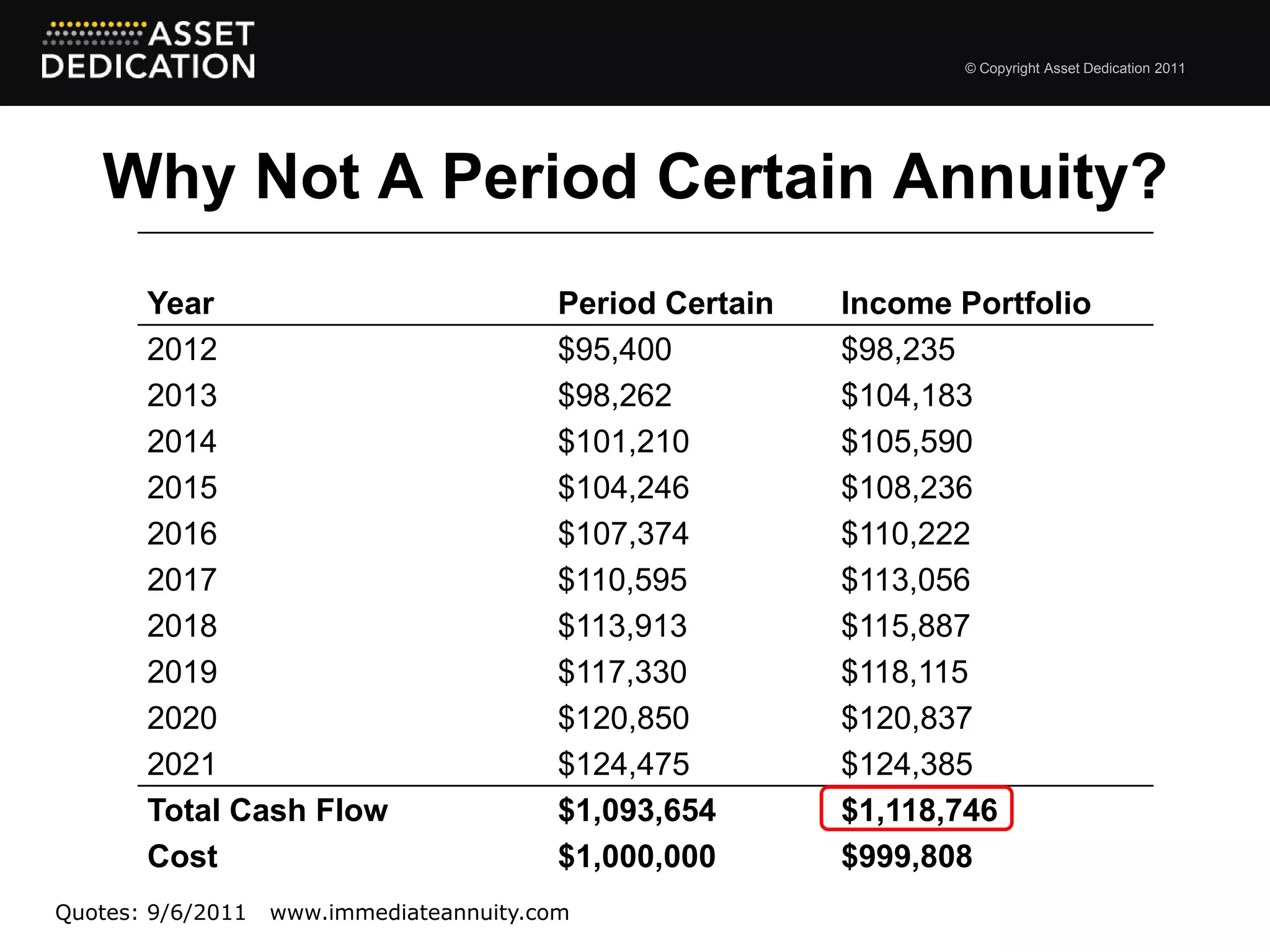

The document discusses strategies for securing retirement income, highlighting the shift from corporate pensions to 401(k)s and various investment approaches, including liability-driven investing and income matching. It provides a case study to illustrate building an income matching portfolio tailored to meet spending needs over time while minimizing risks related to market fluctuations. Additionally, it critiques traditional bond ladders and immediate annuities, emphasizing the importance of targeting predictable cash flows to ensure financial security in retirement.