Embed presentation

Downloaded 10 times

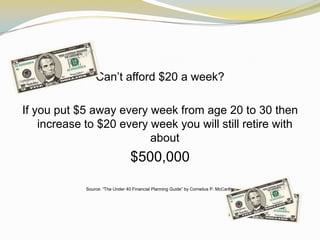

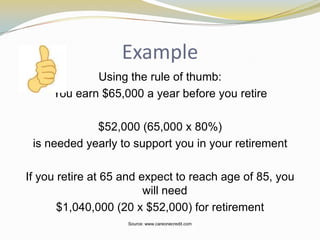

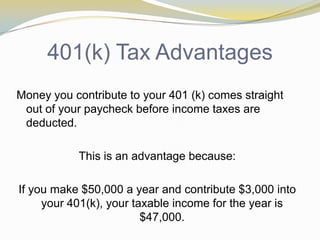

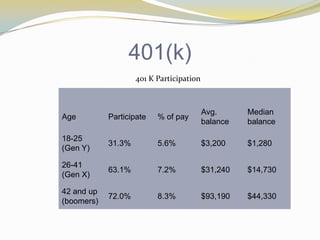

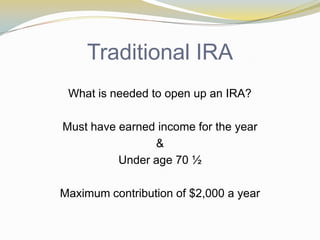

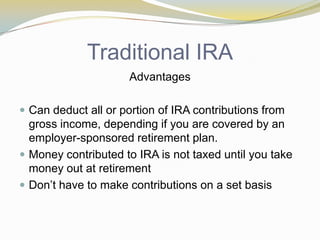

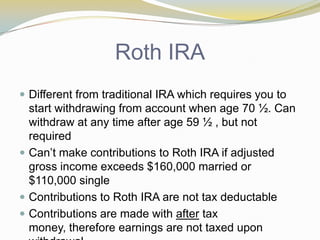

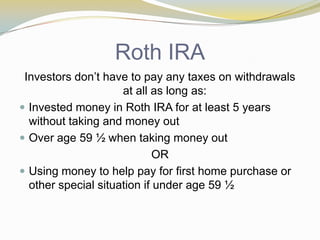

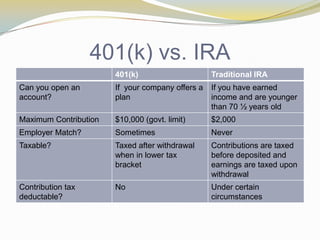

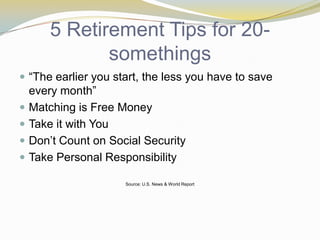

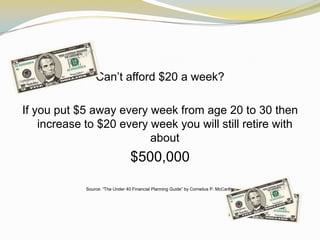

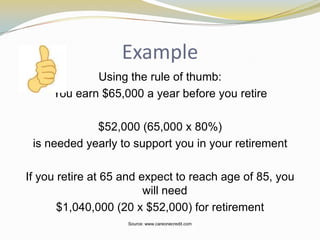

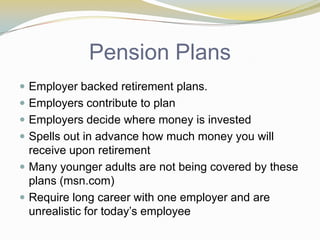

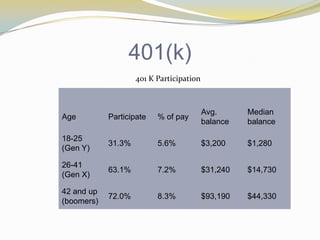

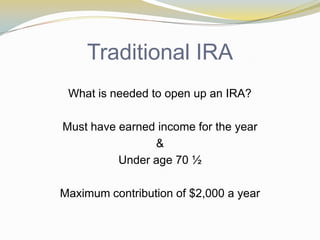

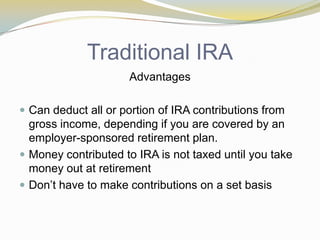

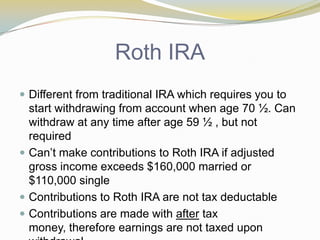

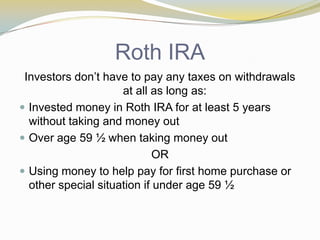

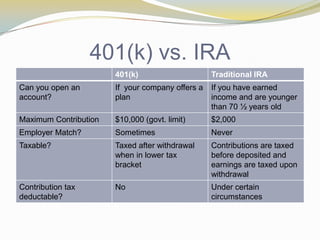

The document discusses different retirement savings options such as 401(k)s, IRAs, and pensions. It provides details on contribution limits, tax advantages, and investment growth over time for each option. The main message is that starting to save for retirement early, even in small amounts each week, can significantly increase the total savings one accumulates by retirement age.