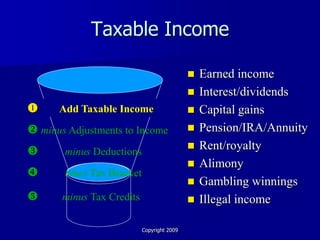

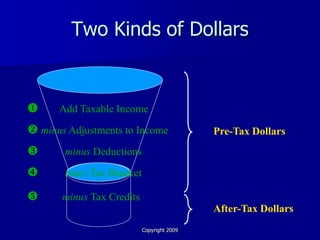

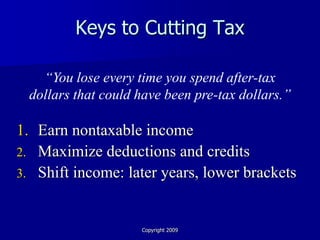

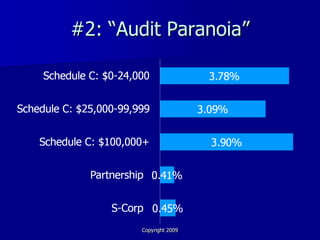

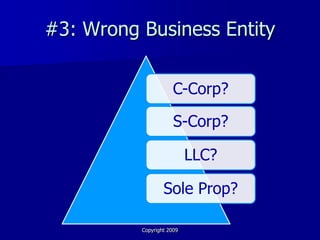

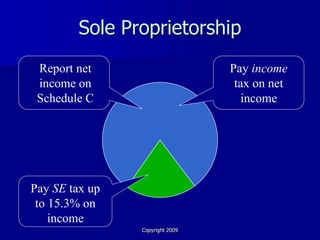

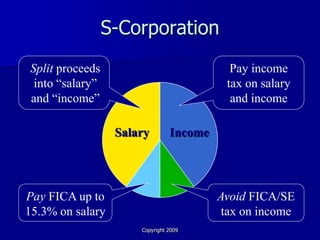

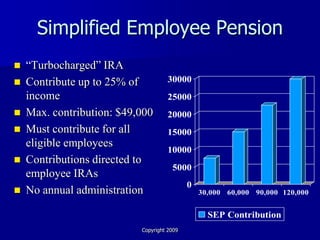

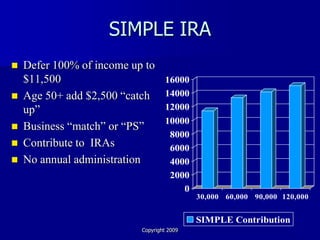

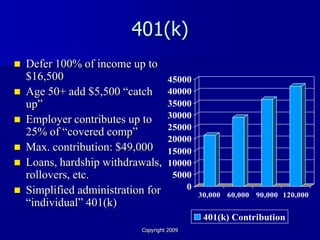

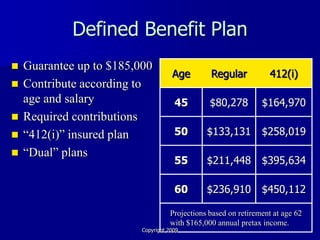

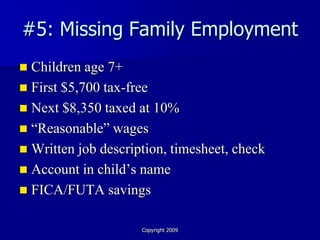

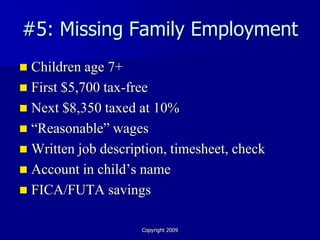

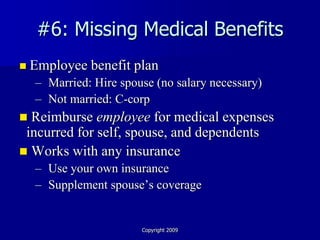

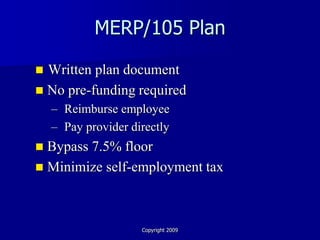

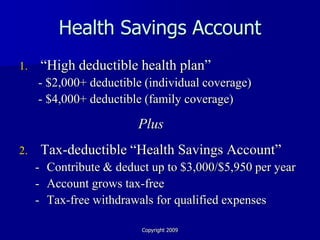

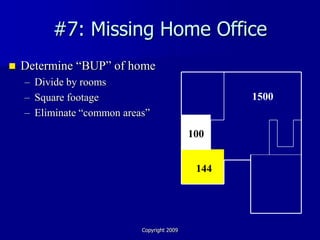

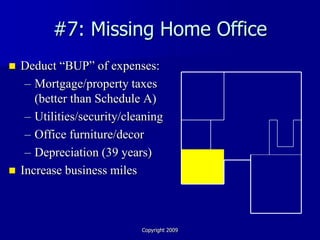

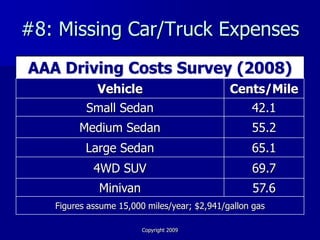

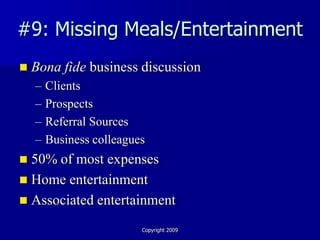

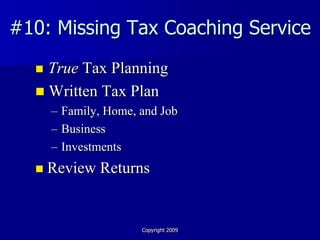

This document outlines 10 expensive tax mistakes that business owners commonly make, including failing to do tax planning, having "audit paranoia", choosing the wrong business entity, selecting the wrong retirement plan, missing opportunities for family employment deductions, failing to take advantage of medical benefits, neglecting a home office deduction, missing car and truck expense deductions, failing to deduct meals and entertainment expenses, and not using a tax coaching service.