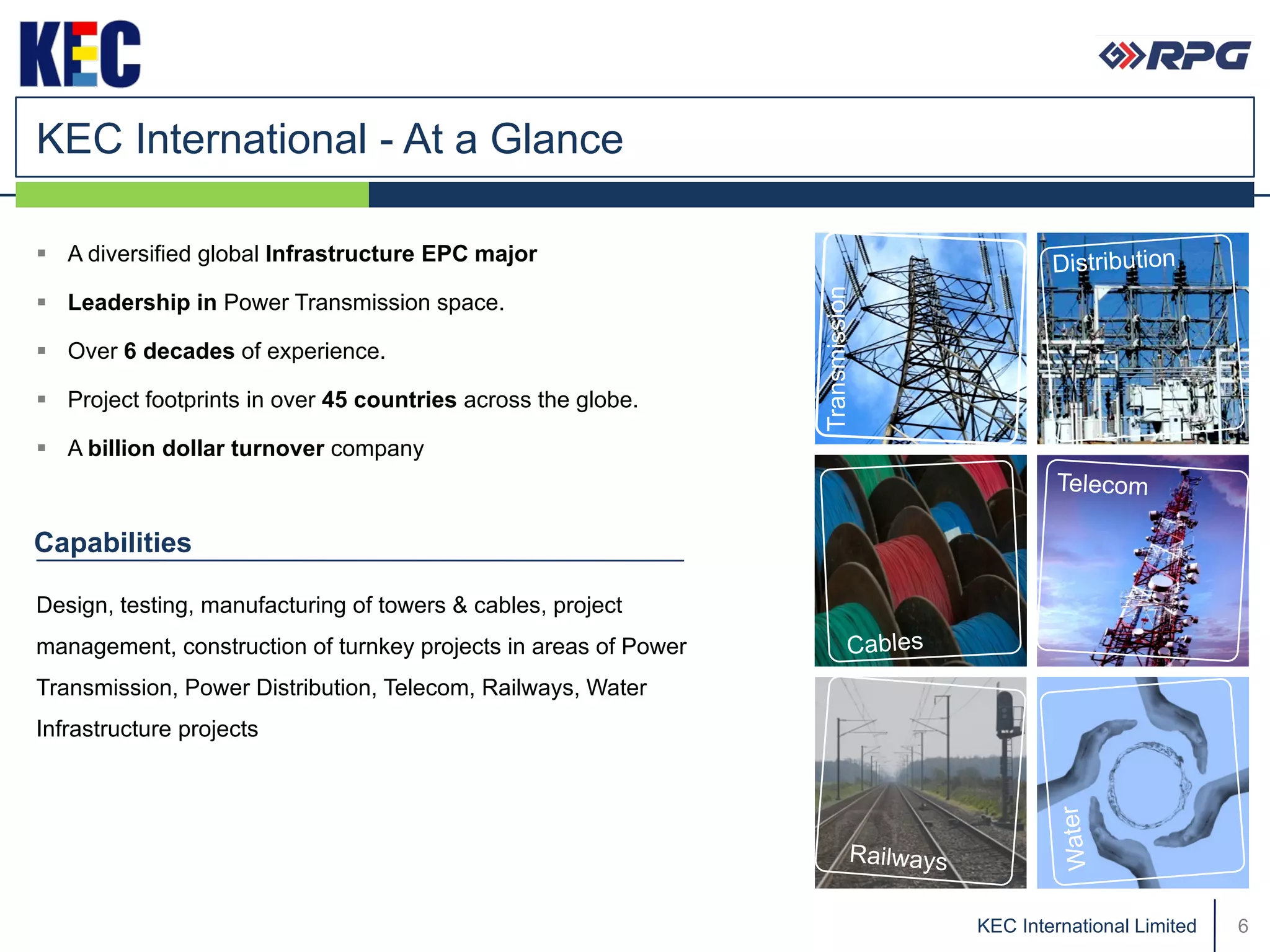

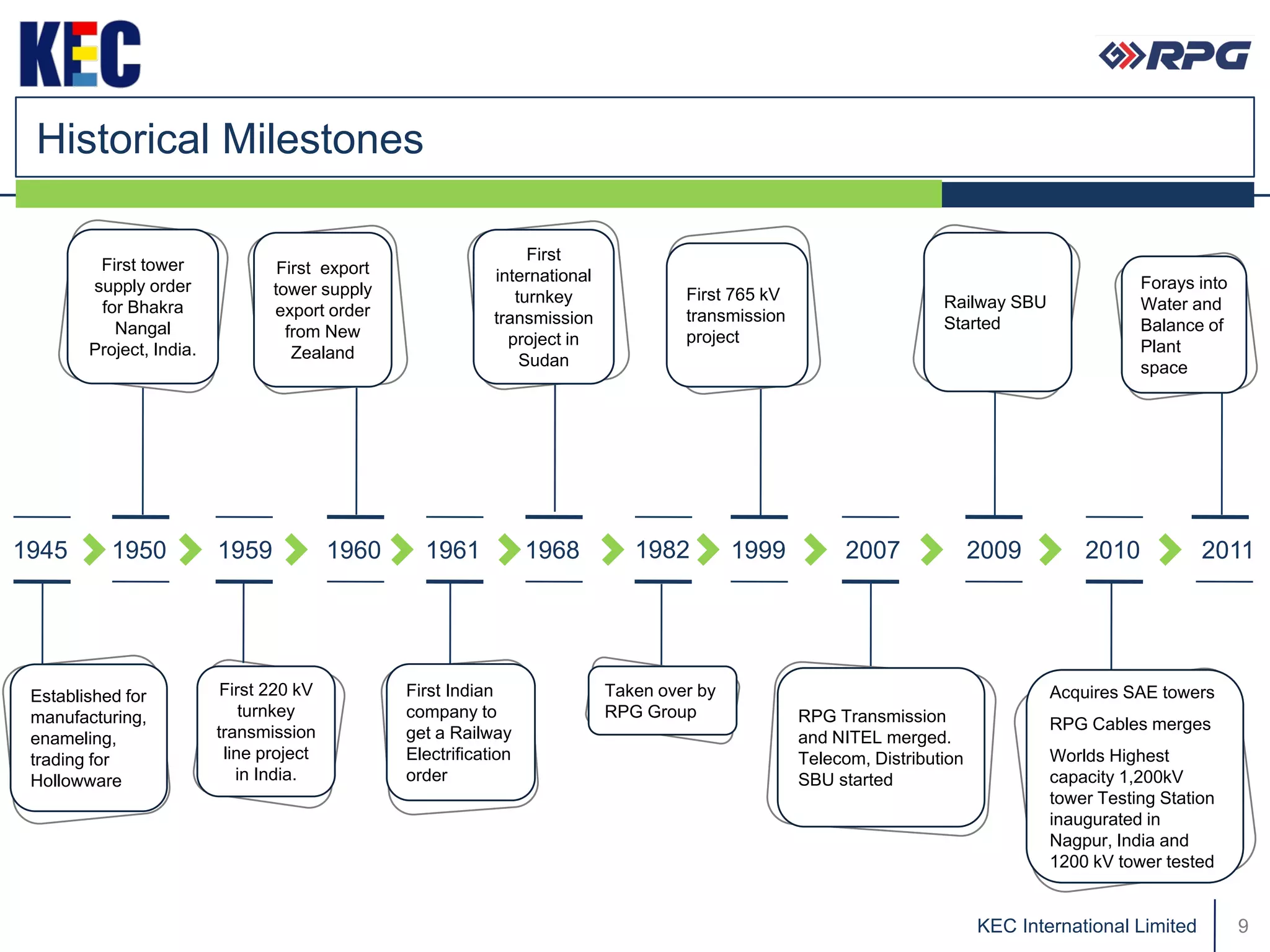

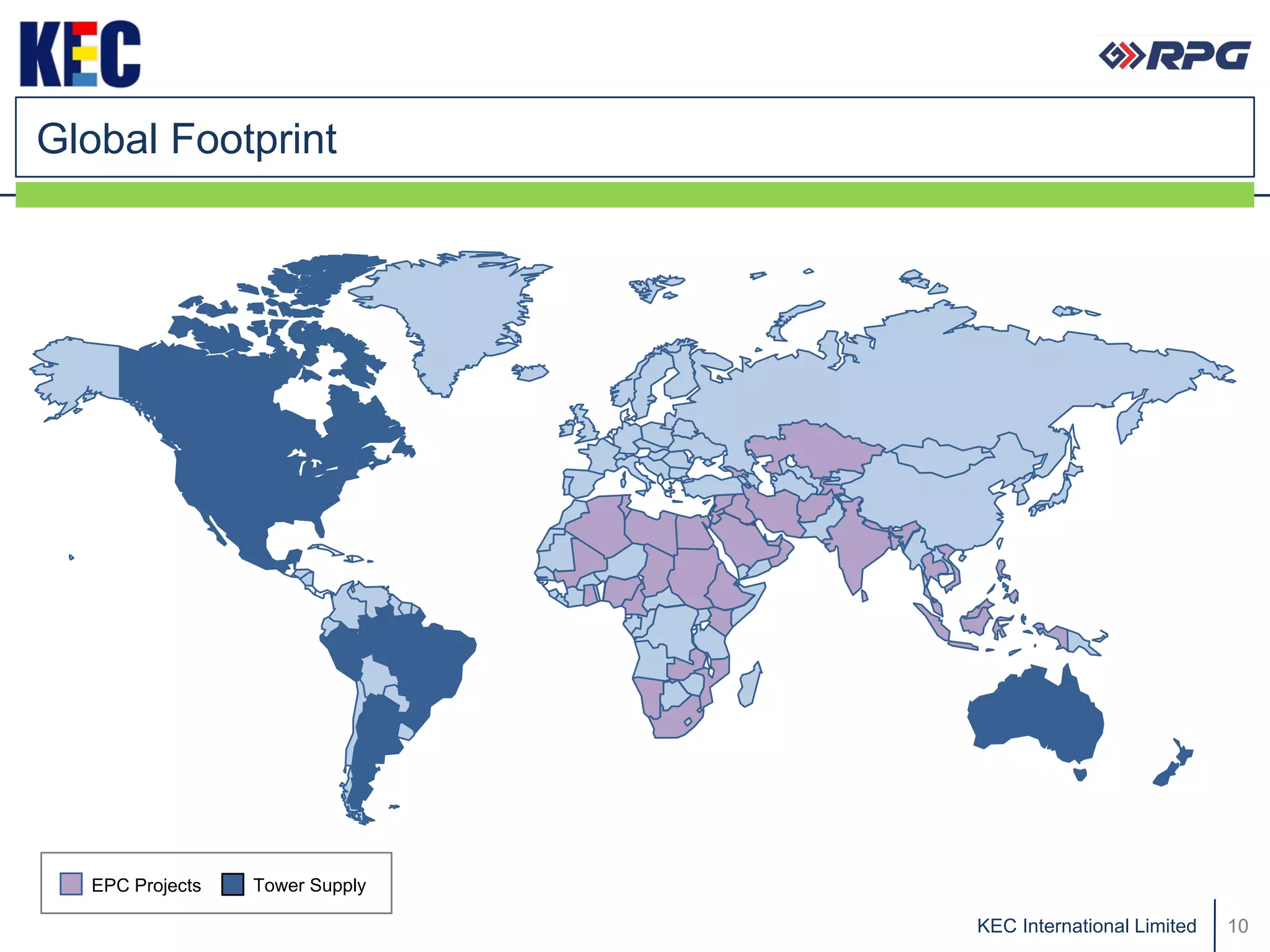

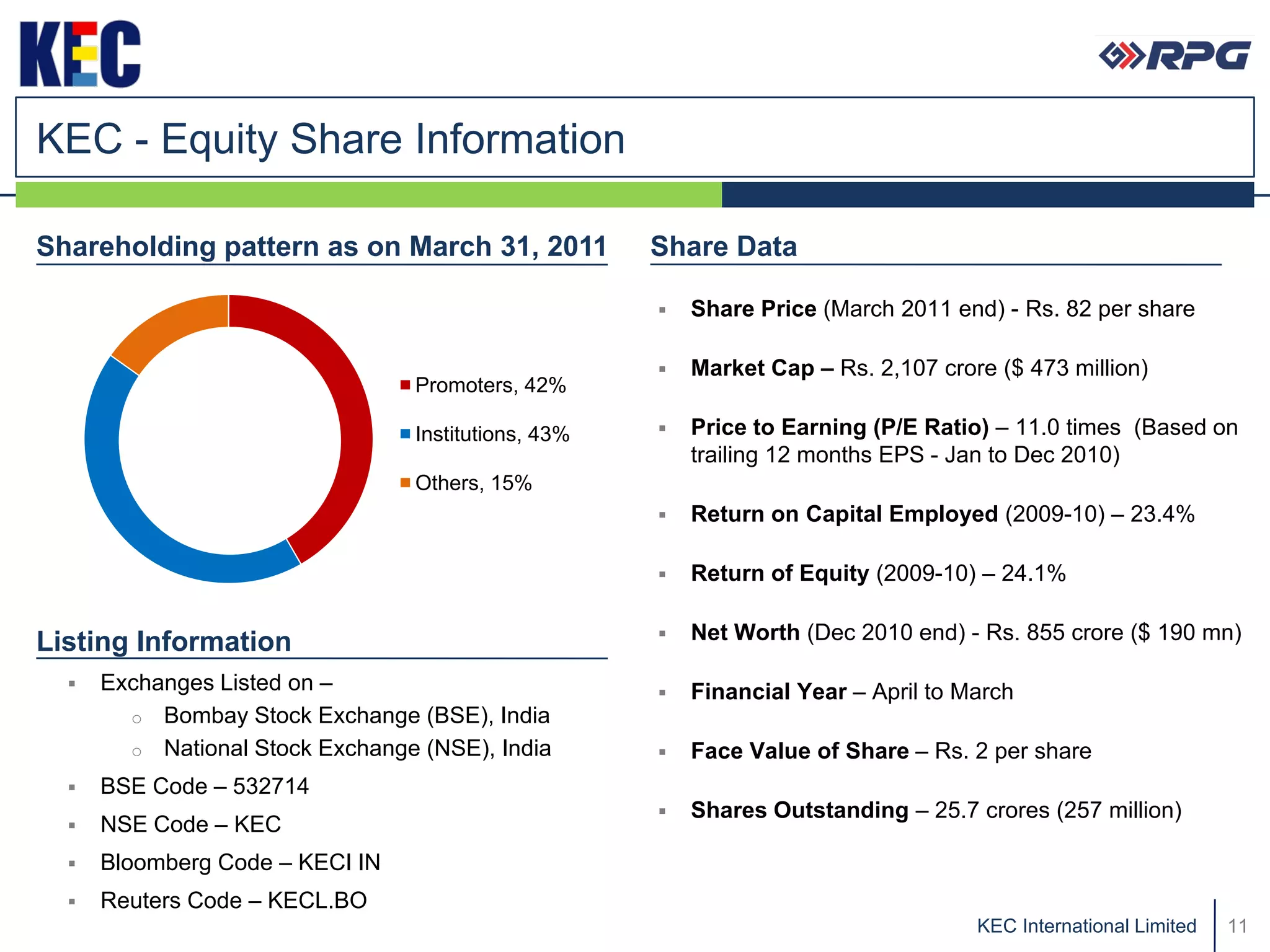

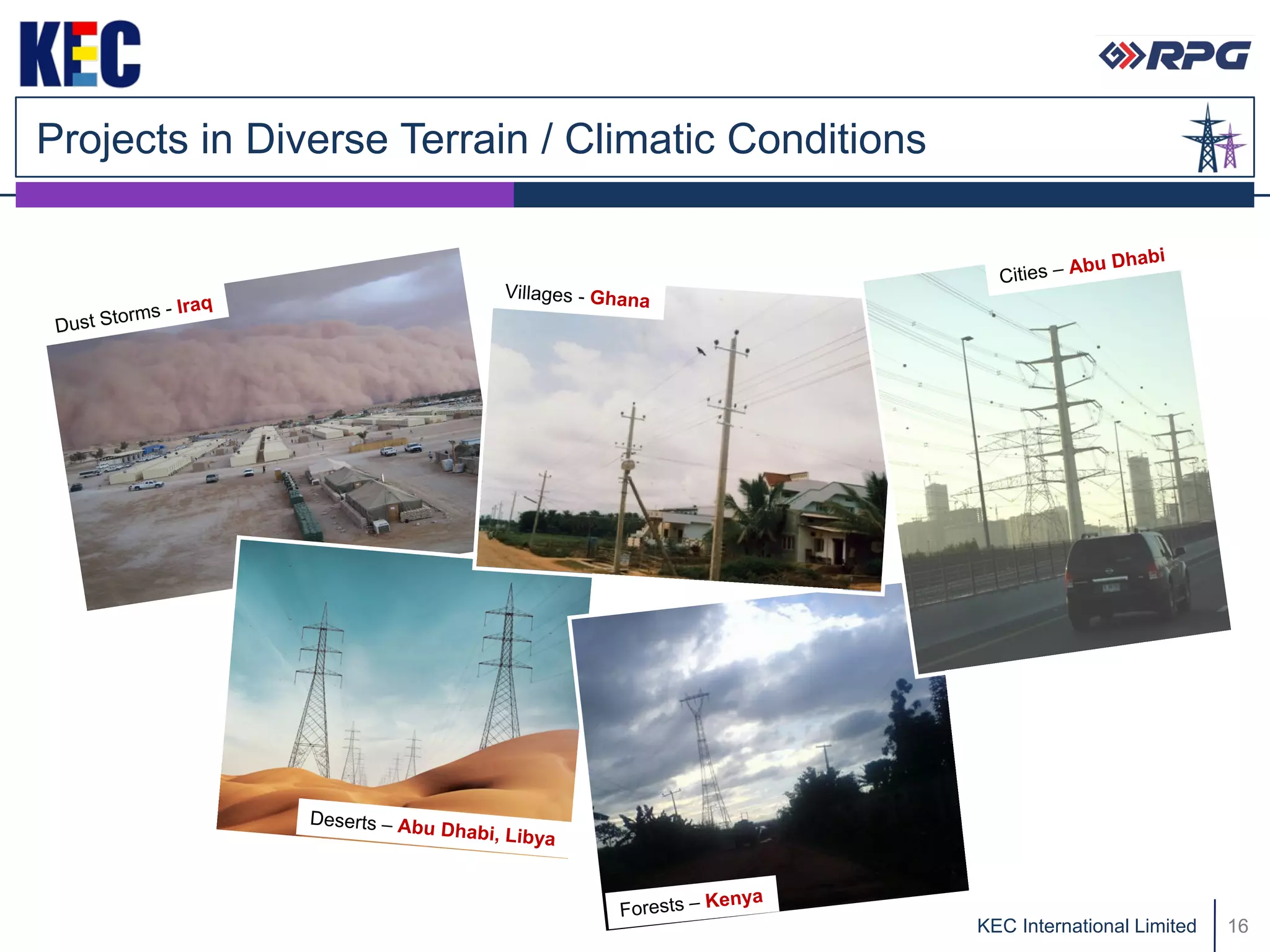

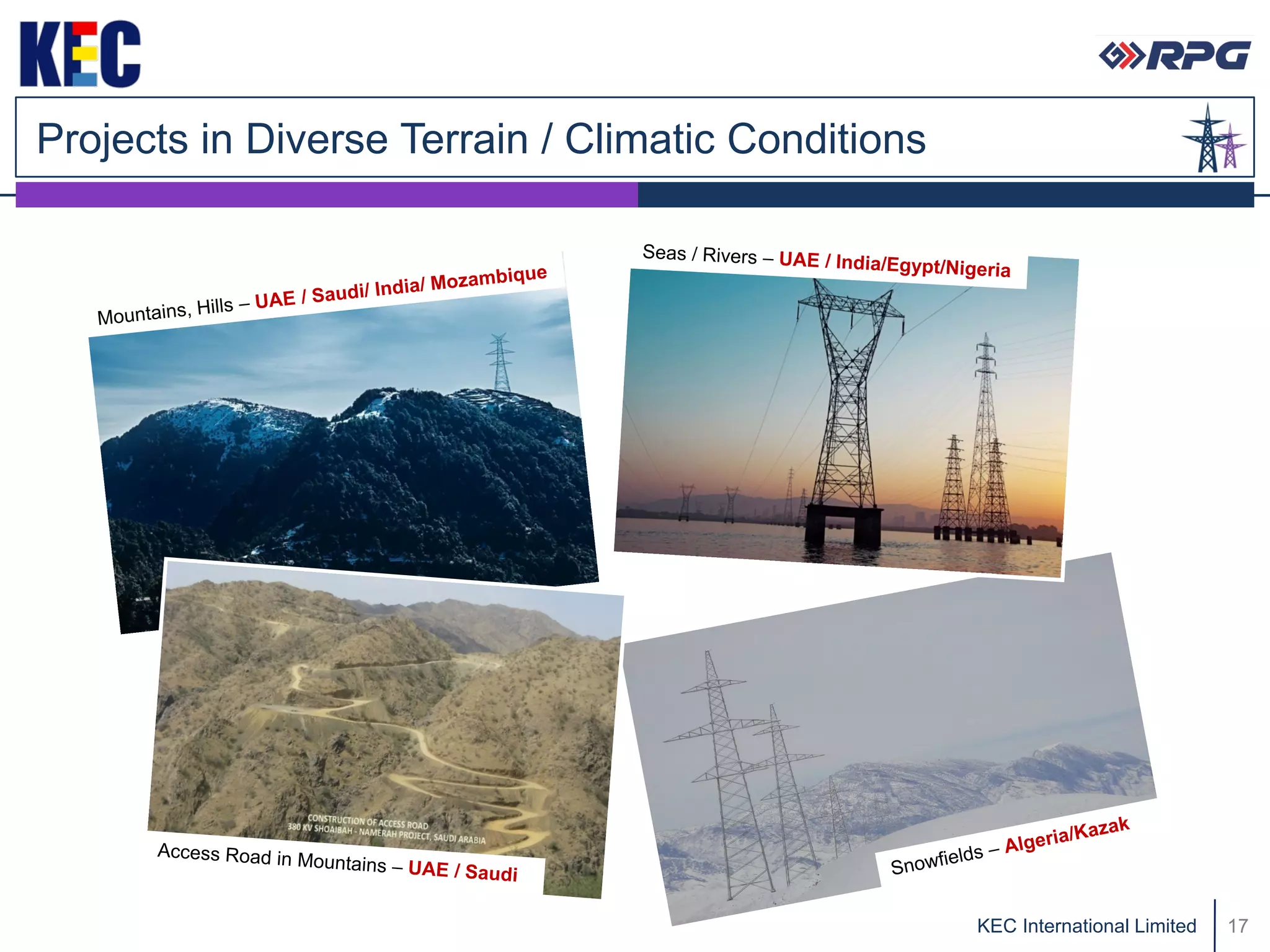

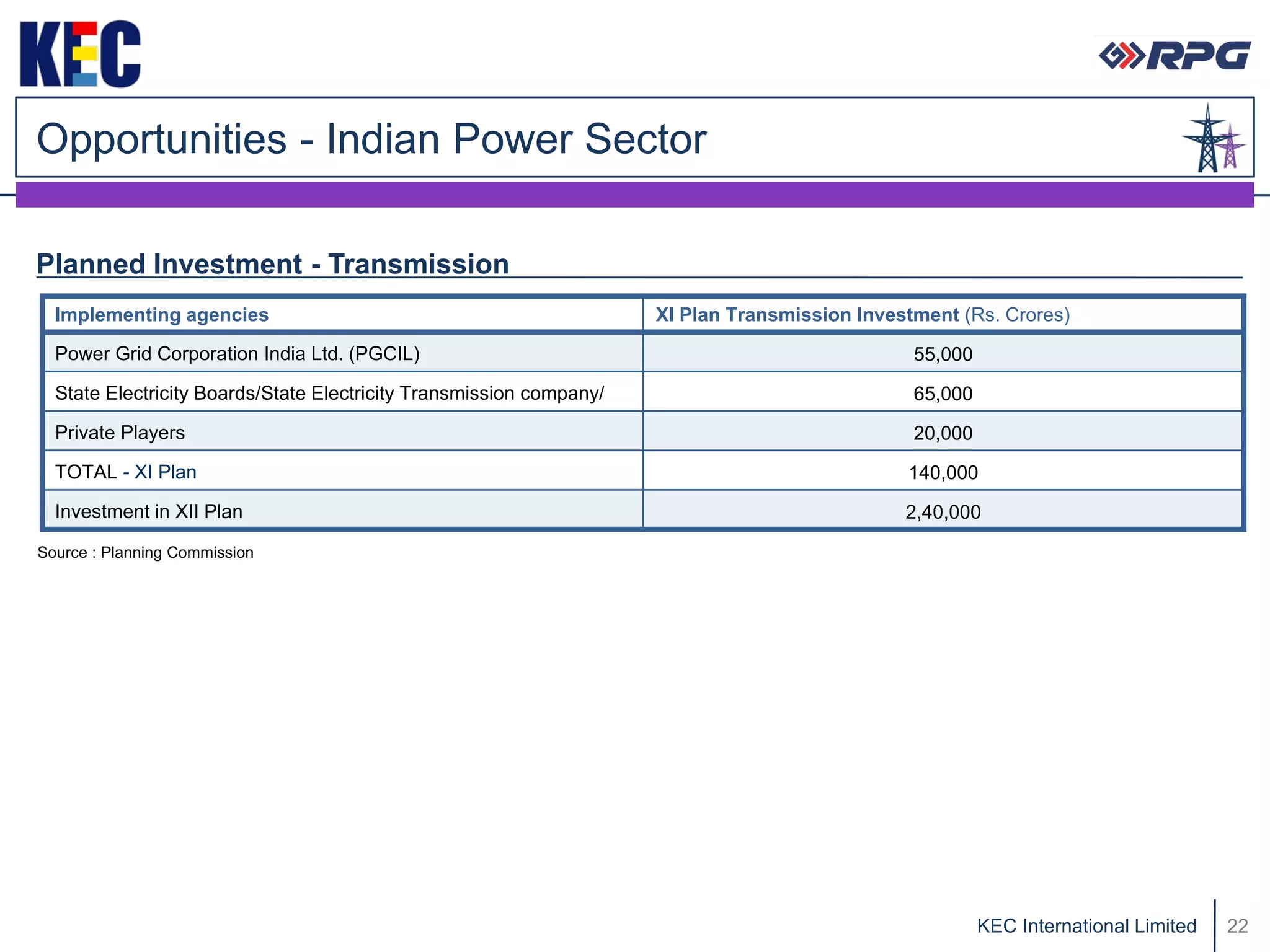

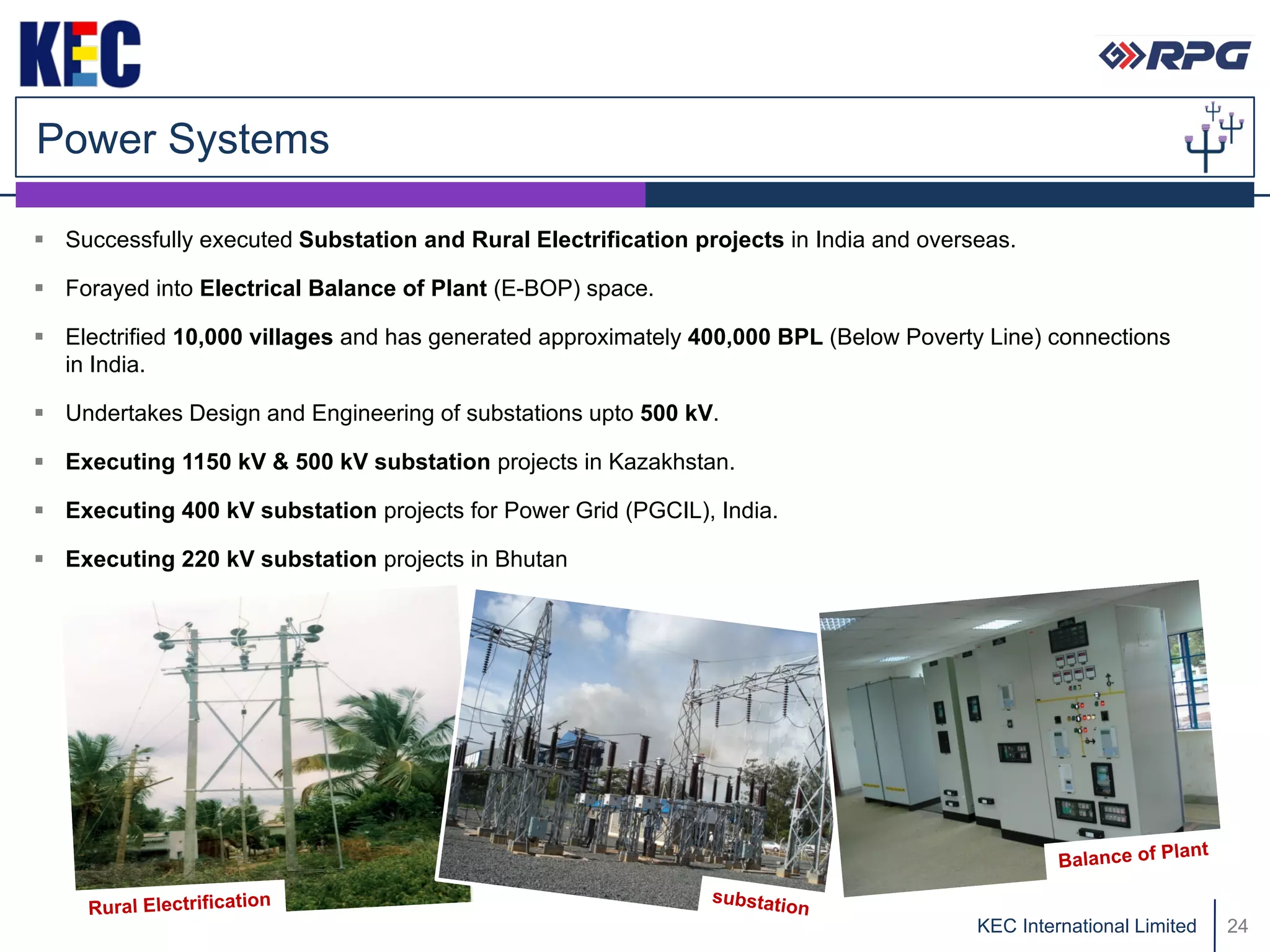

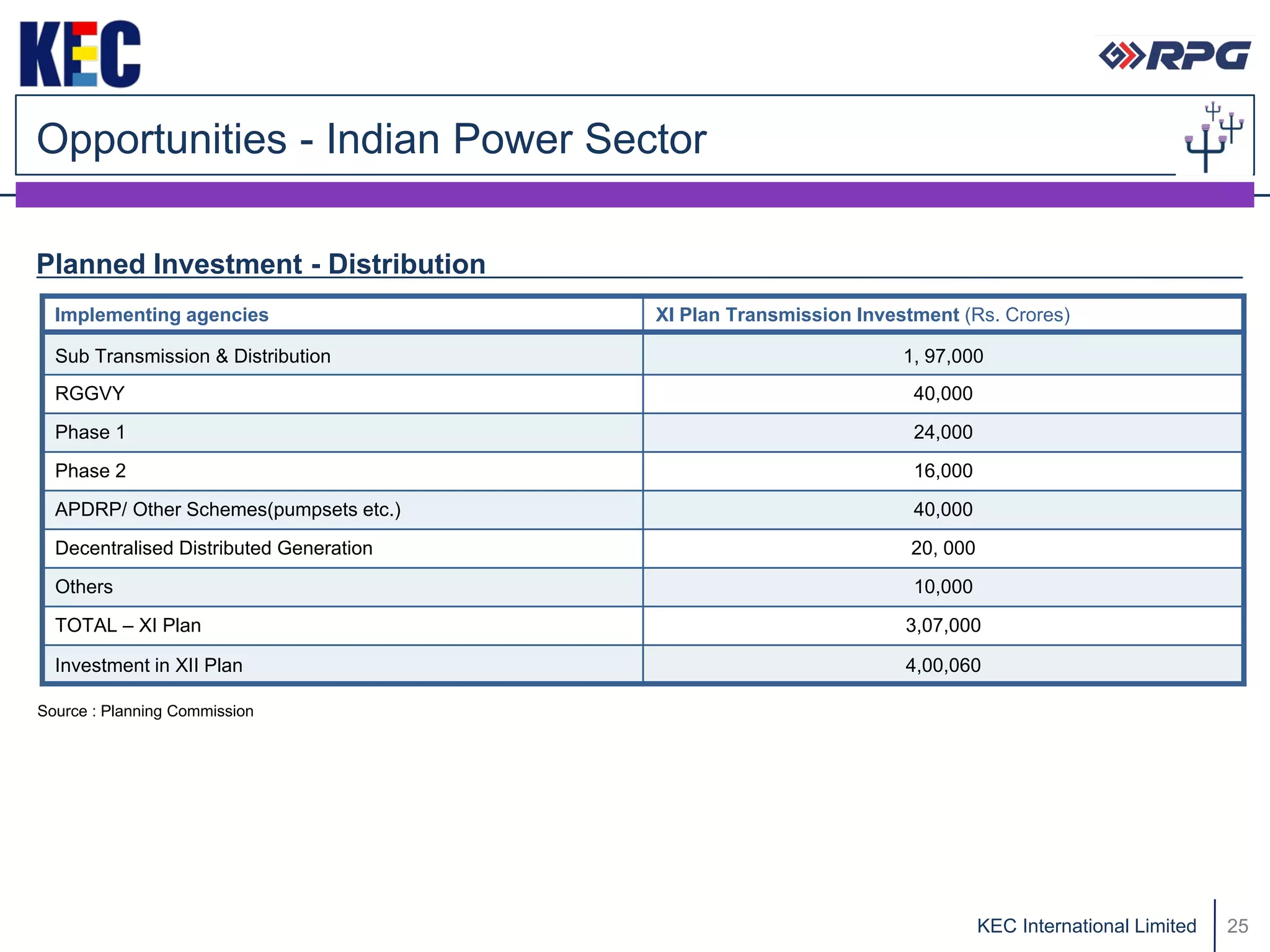

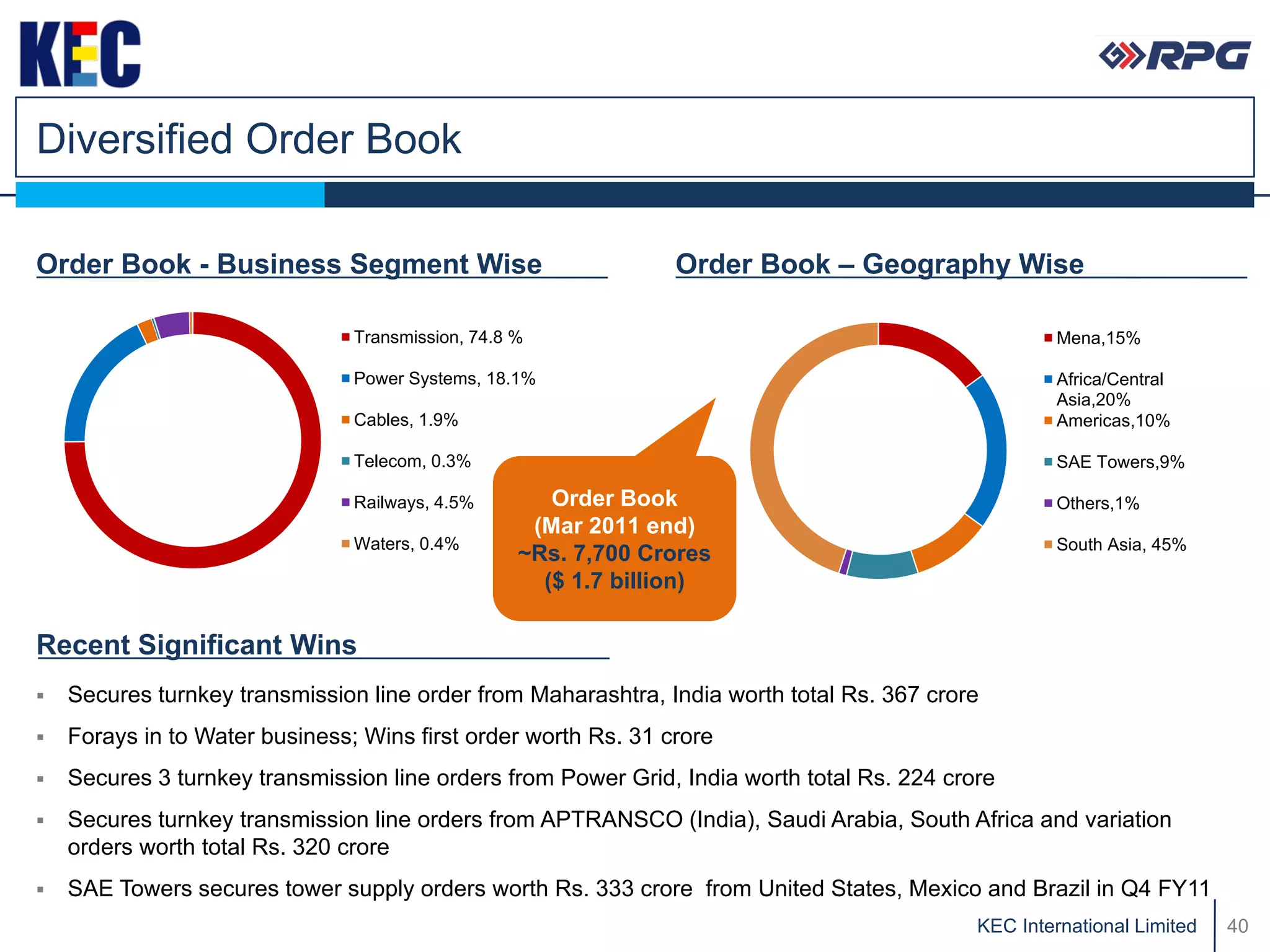

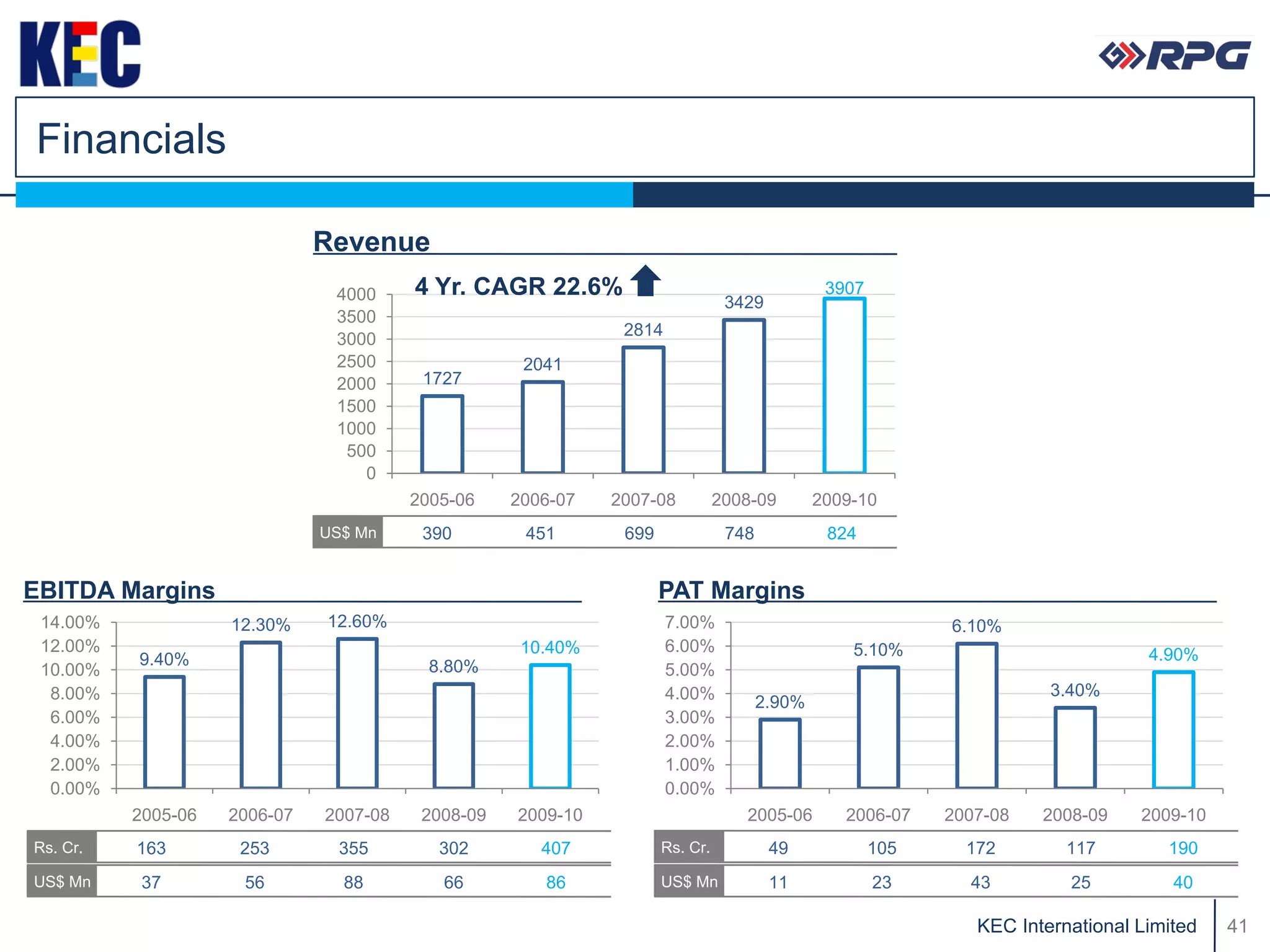

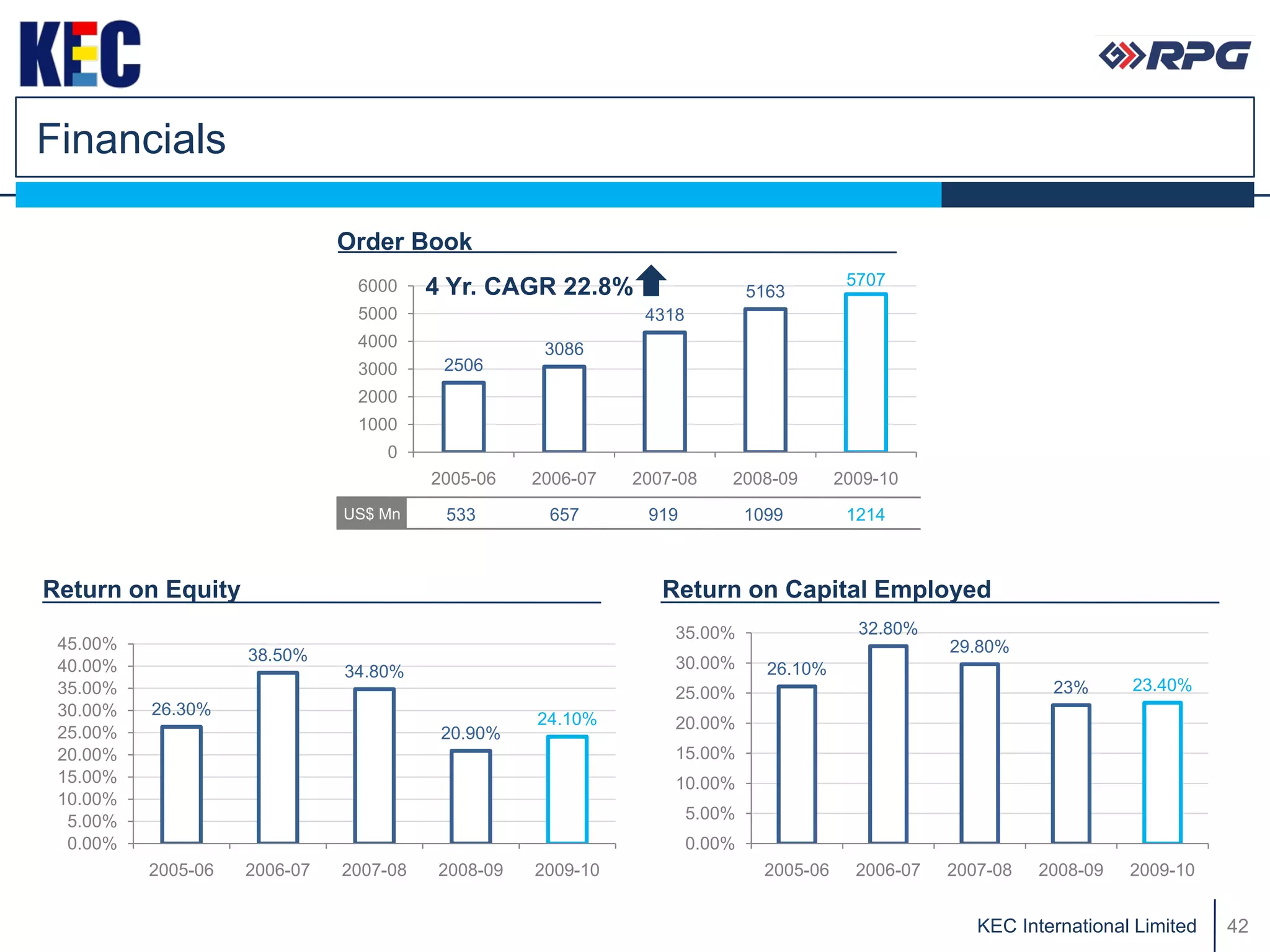

The document is a corporate presentation by KEC International Limited from April 2011. It provides an overview of KEC International, including that it is a diversified global infrastructure EPC company with over 6 decades of experience. It has a presence in over 45 countries and annual revenues of $824 million with an order book of $1.7 billion. Power transmission is its largest business area, contributing over 70% of turnover.