Embed presentation

Download to read offline

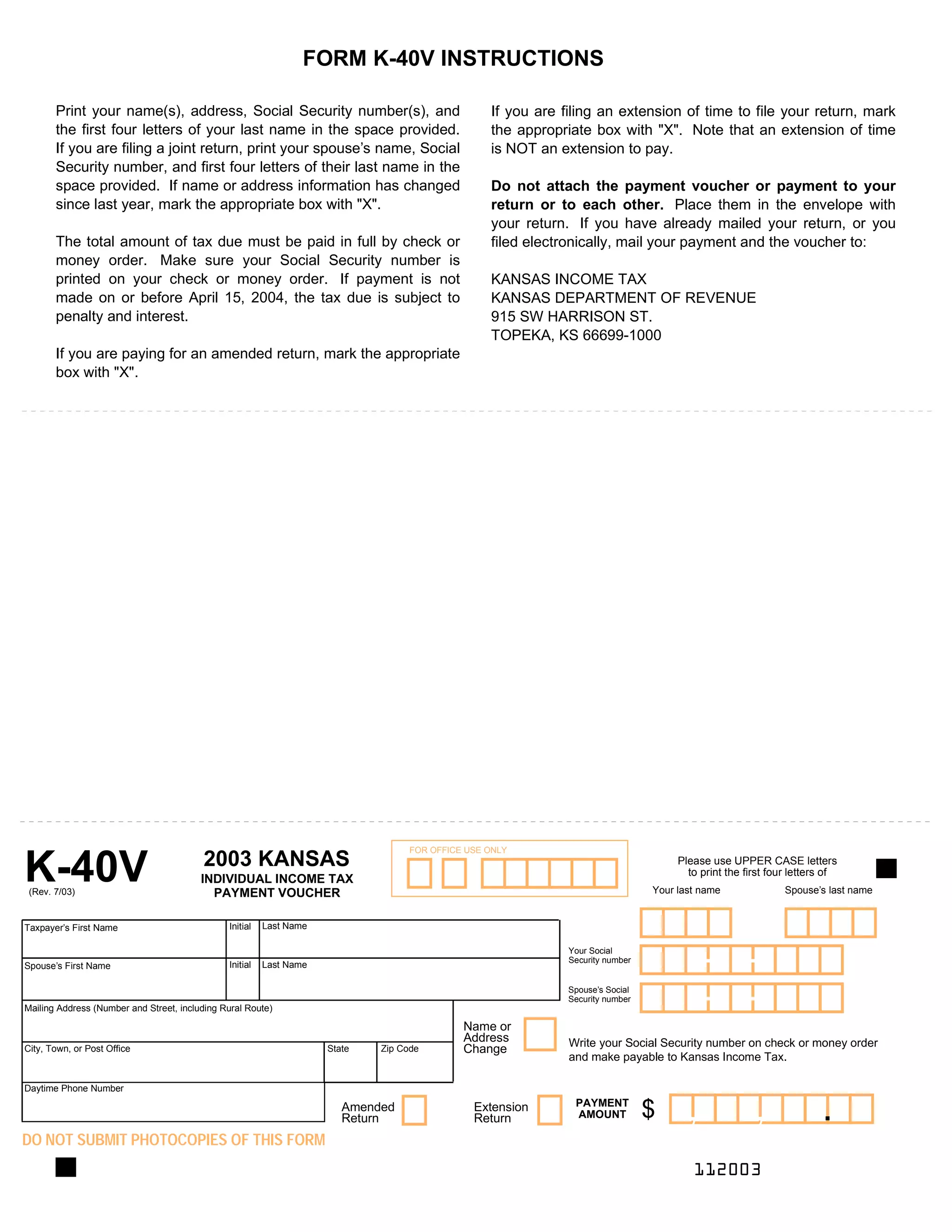

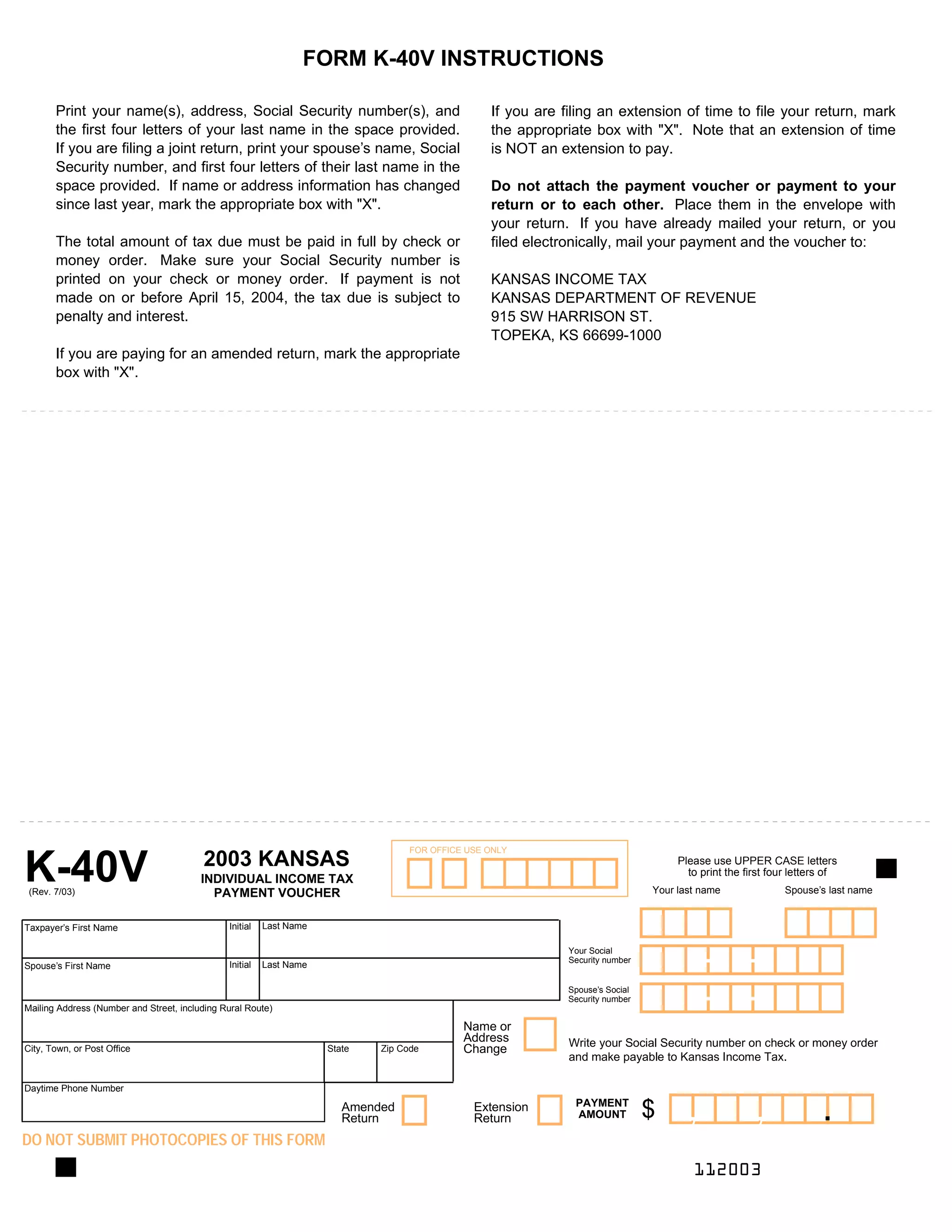

The document provides instructions for filling out a Kansas individual income tax payment voucher form (K-40V). It instructs taxpayers to print their name, address, social security number, and the first four letters of their last name. If filing jointly, the same information is required for the spouse. Taxpayers should mark a box if their name or address has changed. The full amount of tax due must be paid by check or money order with the social security number printed on it. Payment is due by April 15th to avoid penalties and interest. Taxpayers should mark a box if filing an amended return or extension.