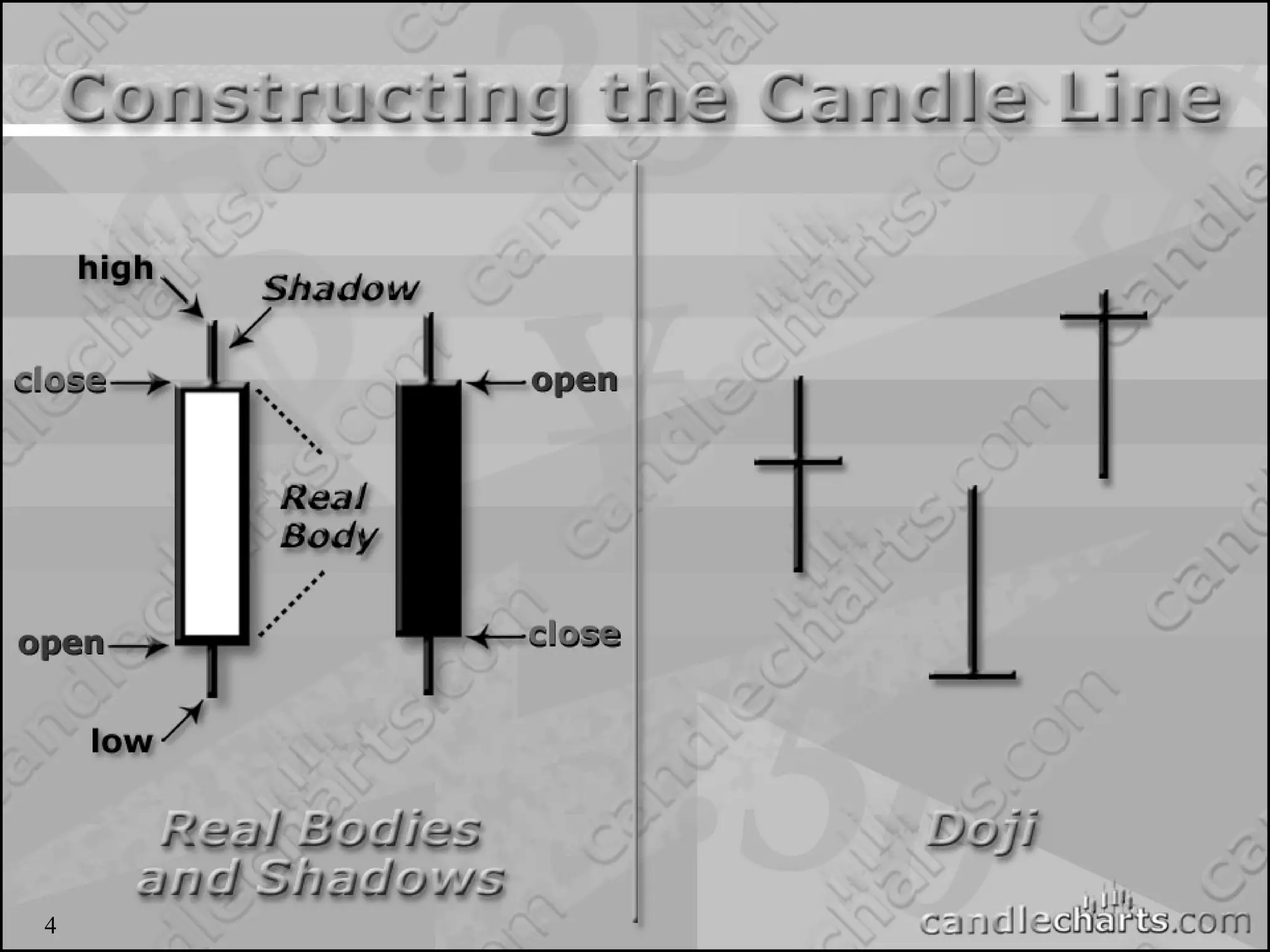

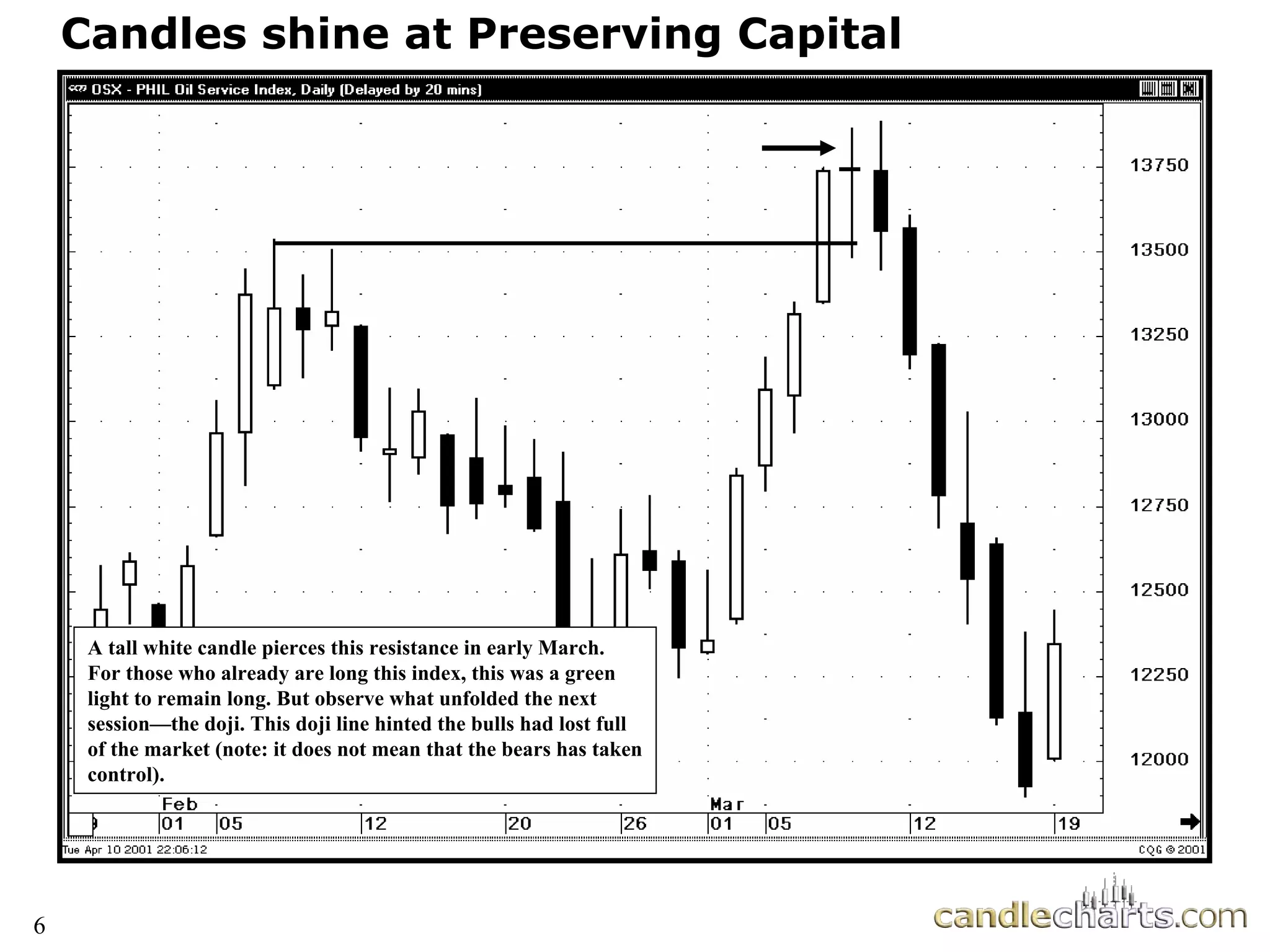

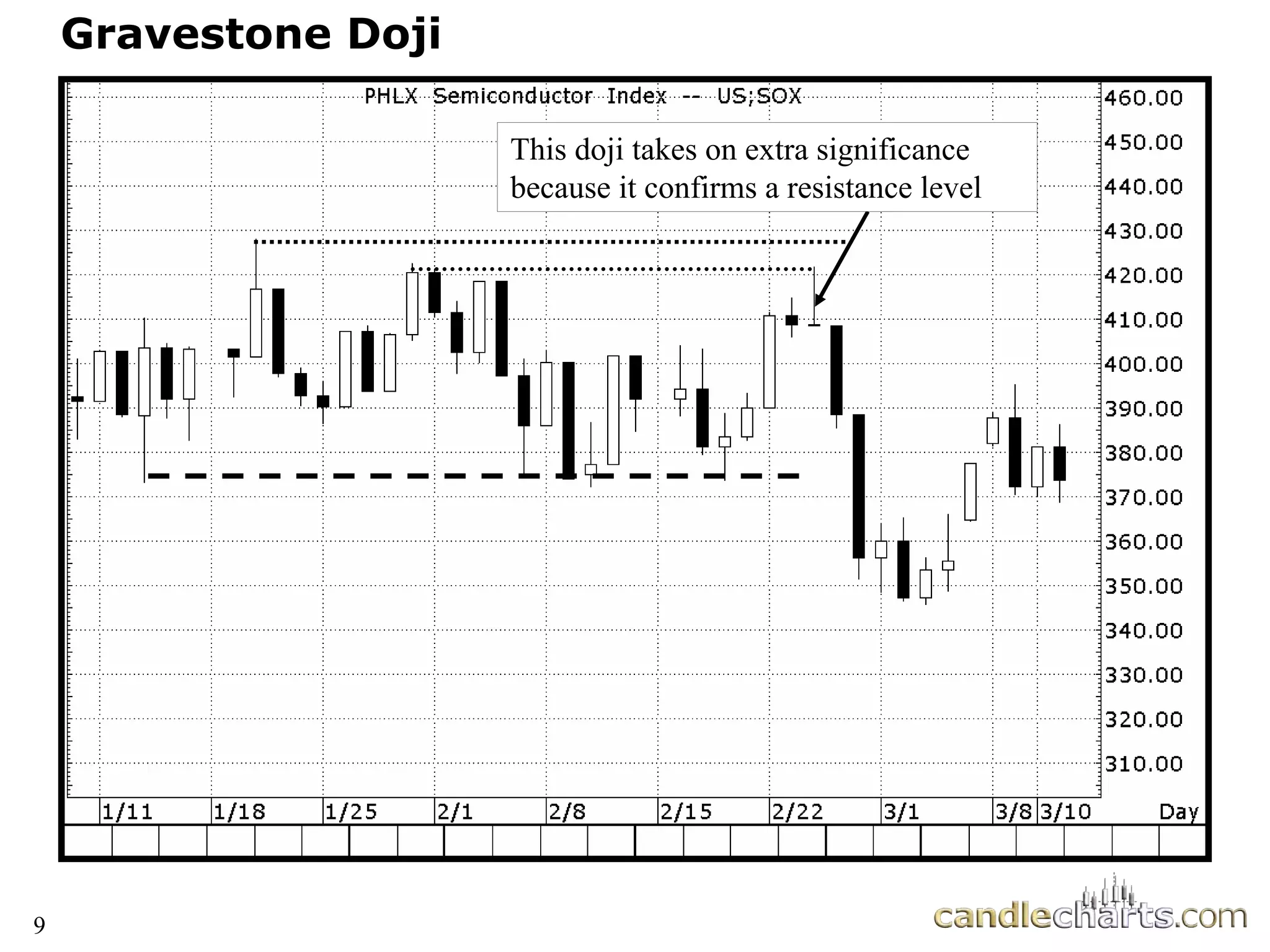

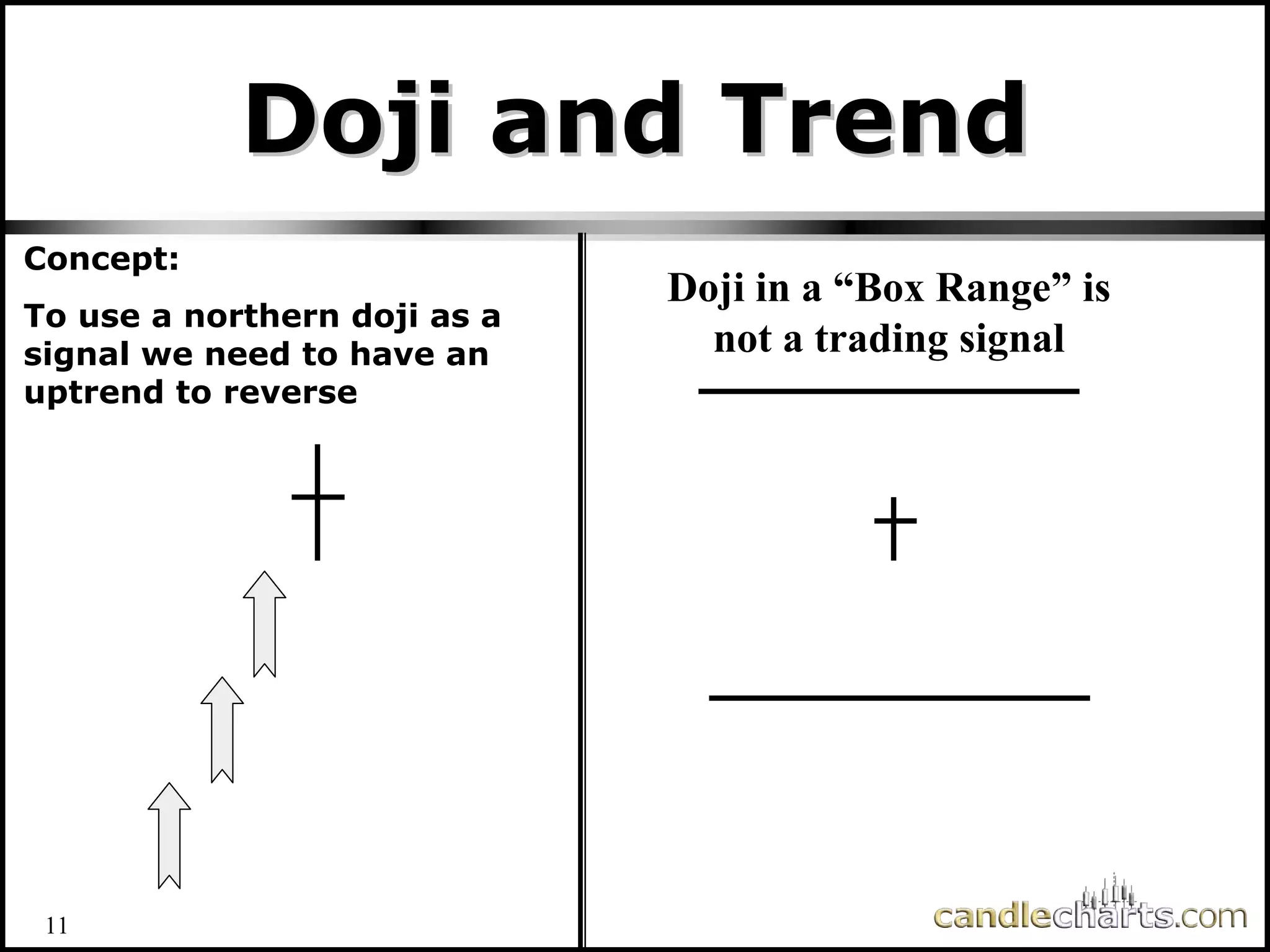

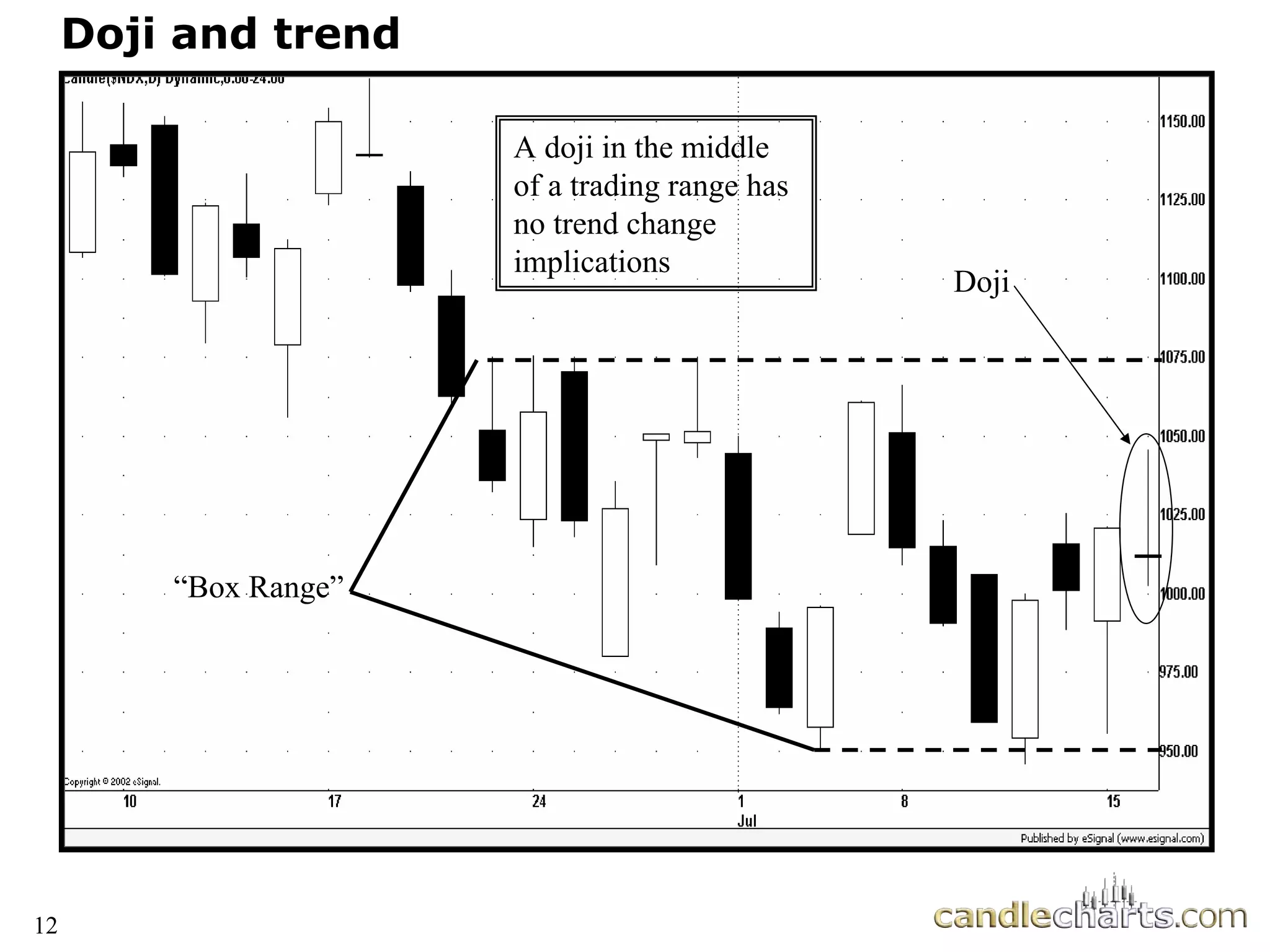

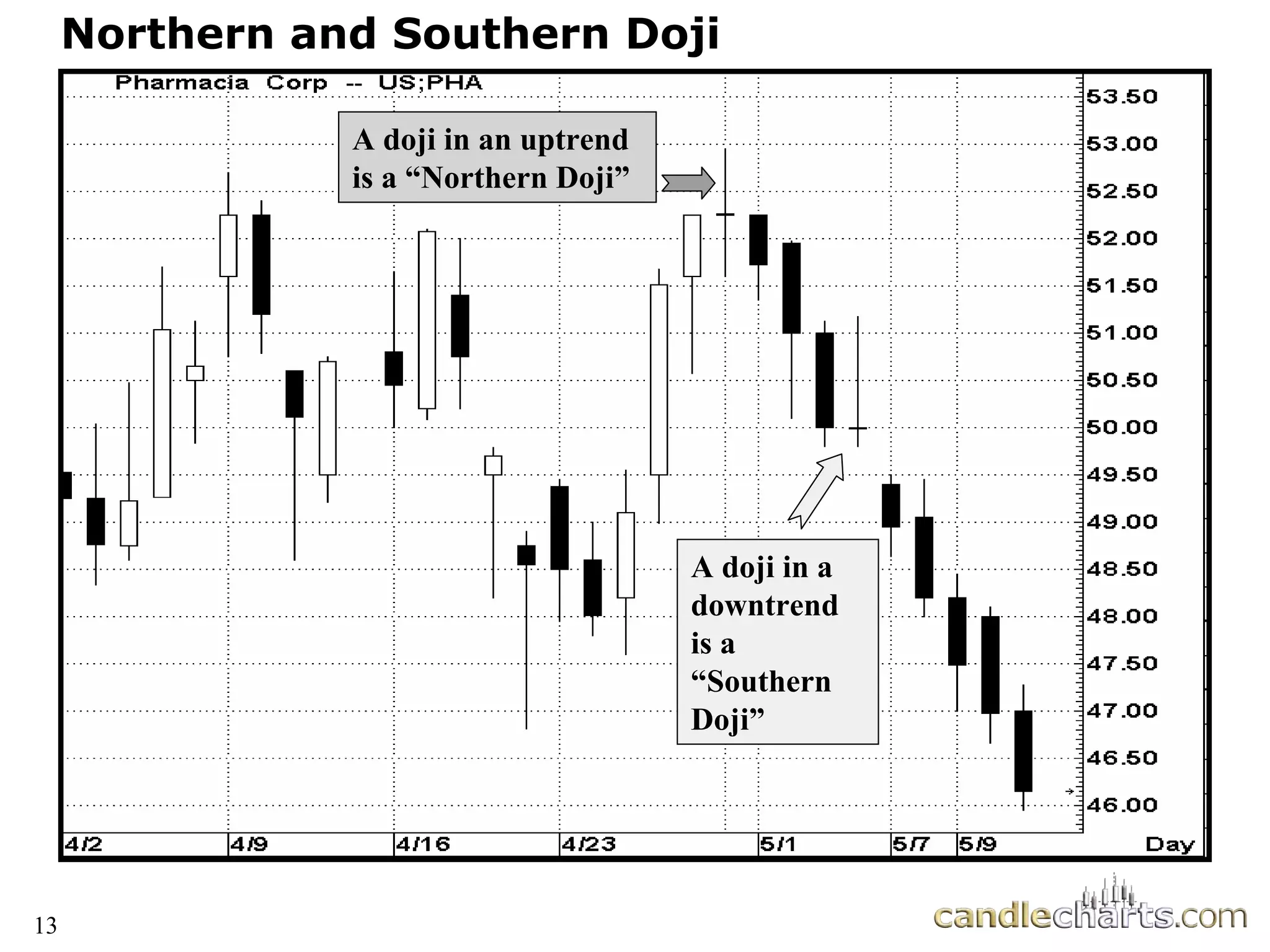

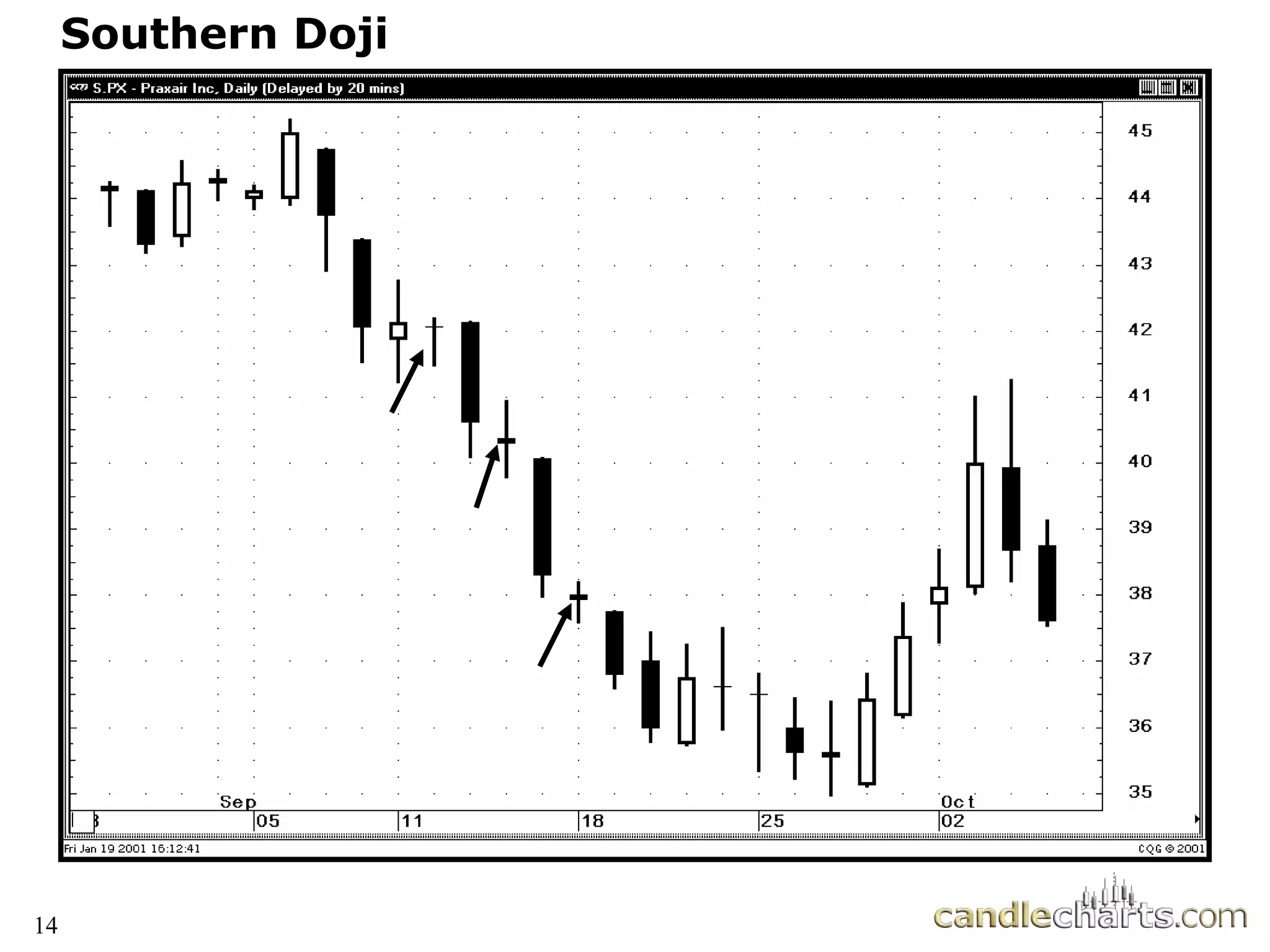

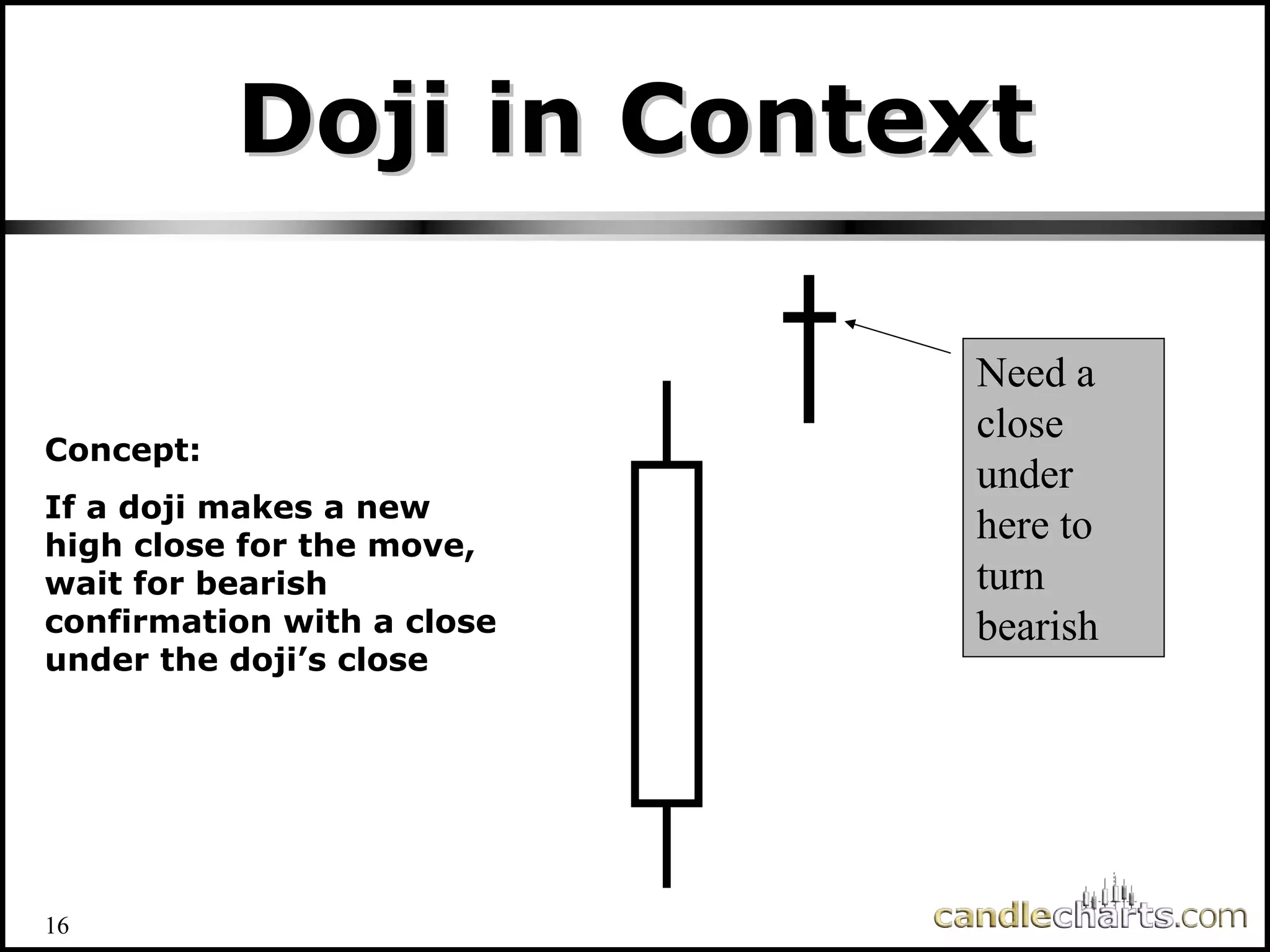

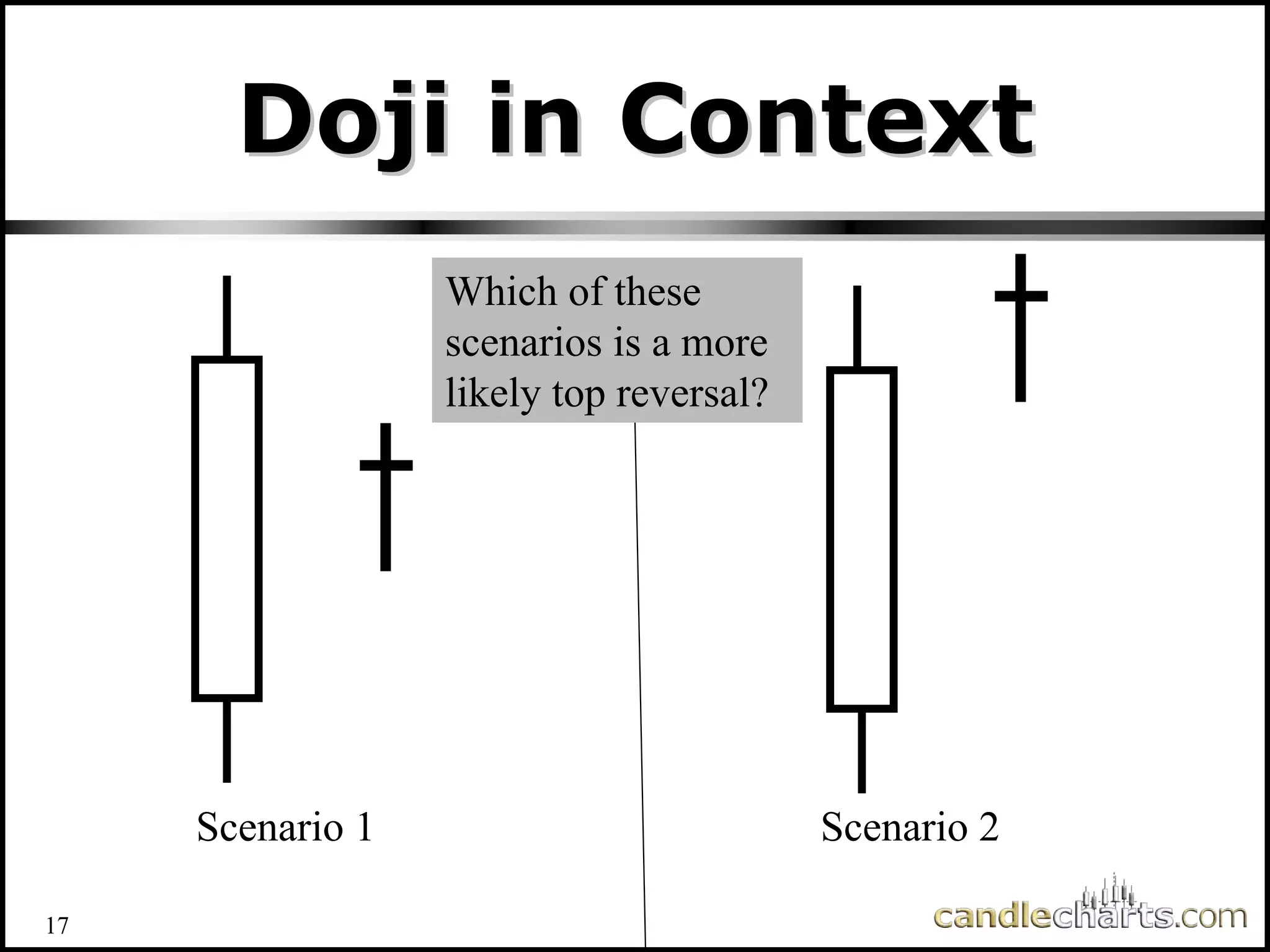

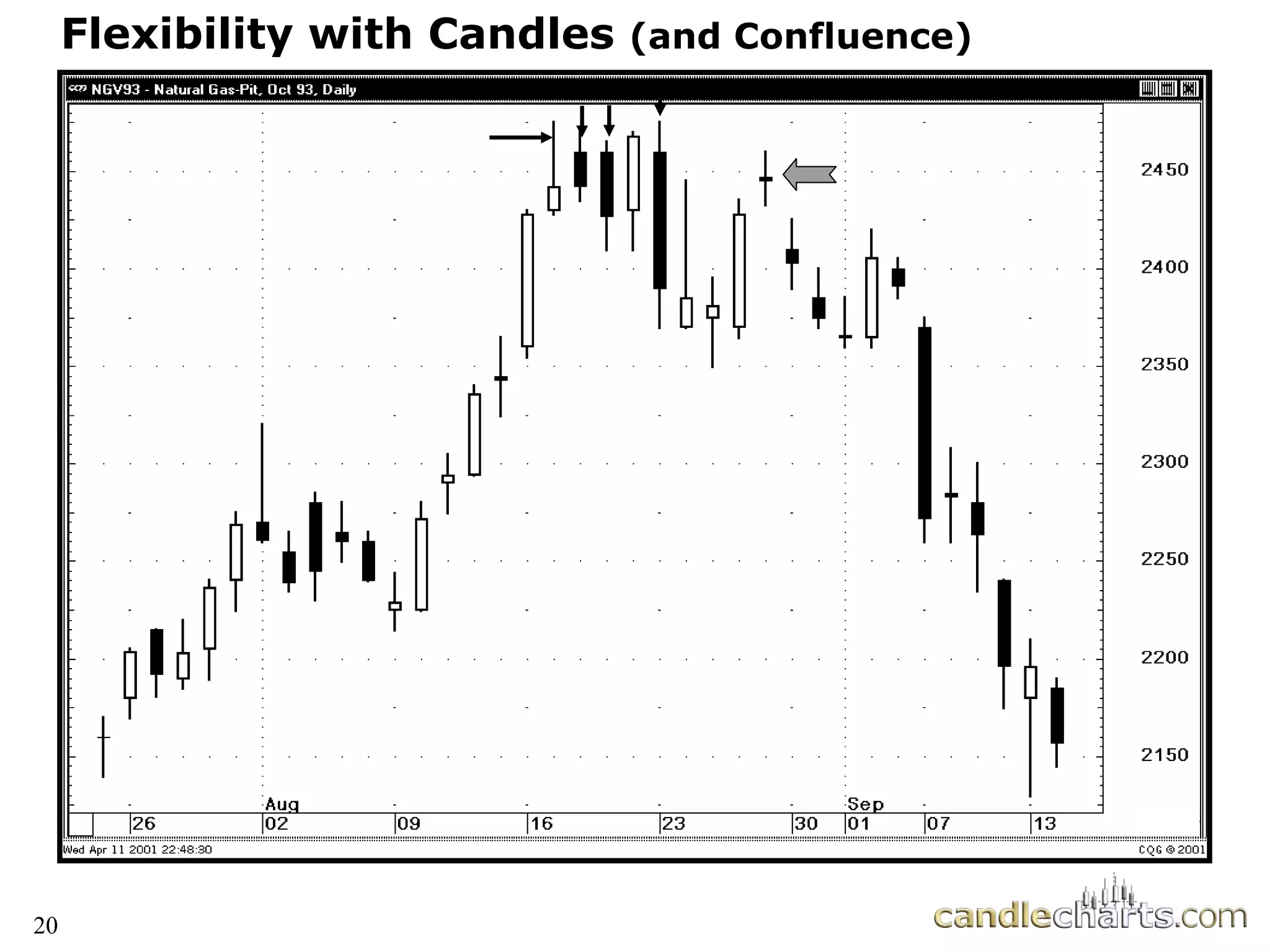

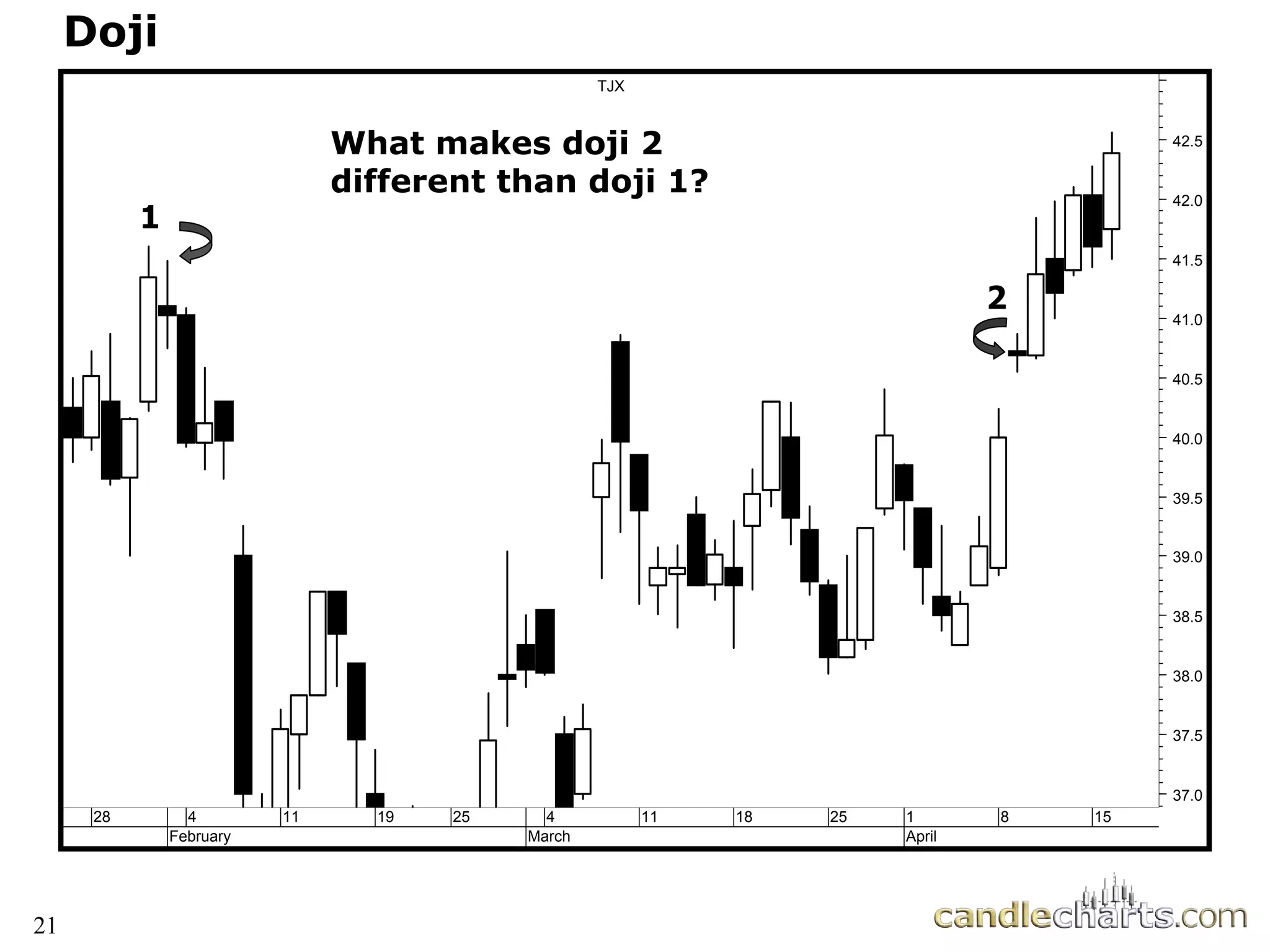

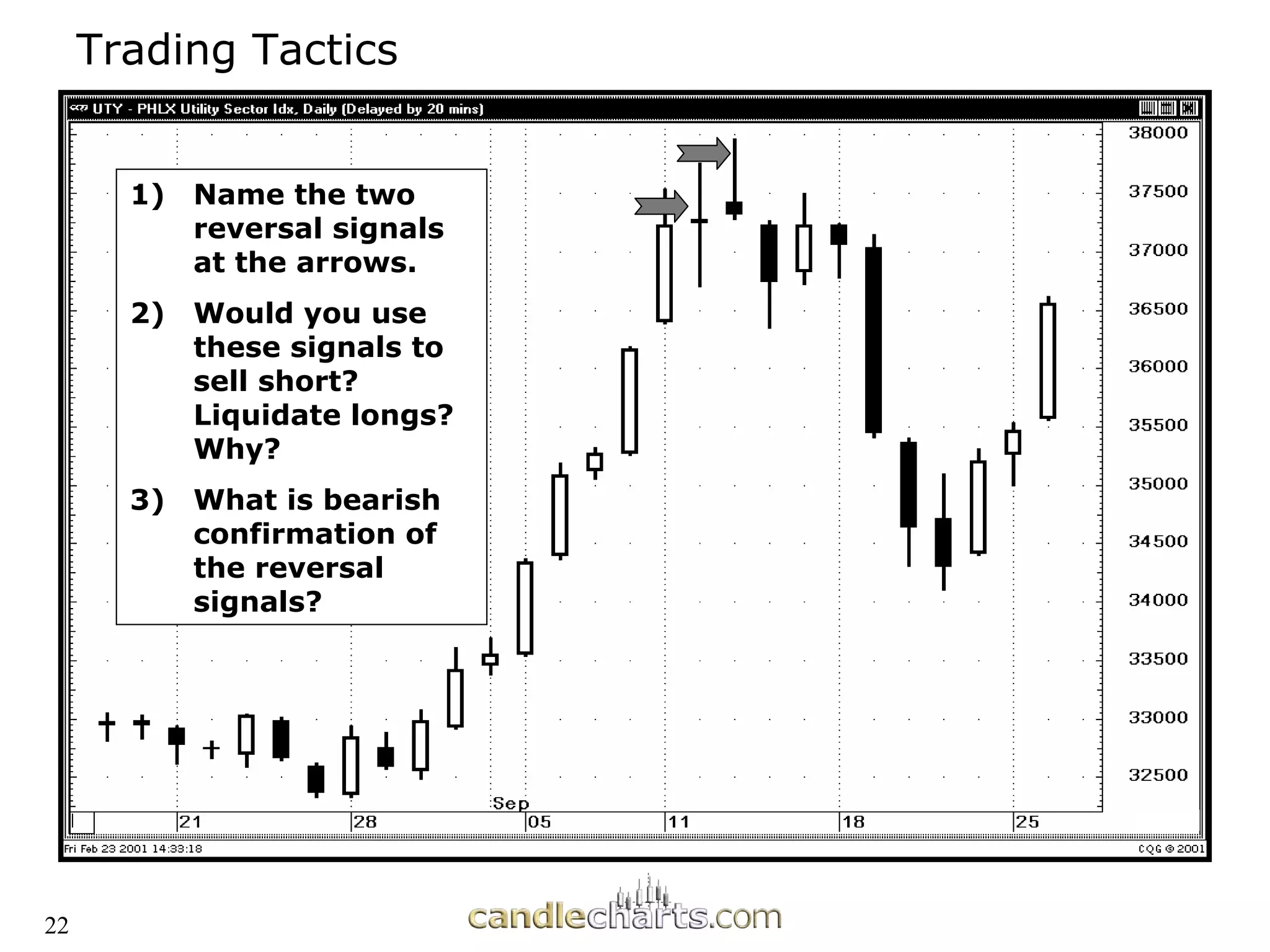

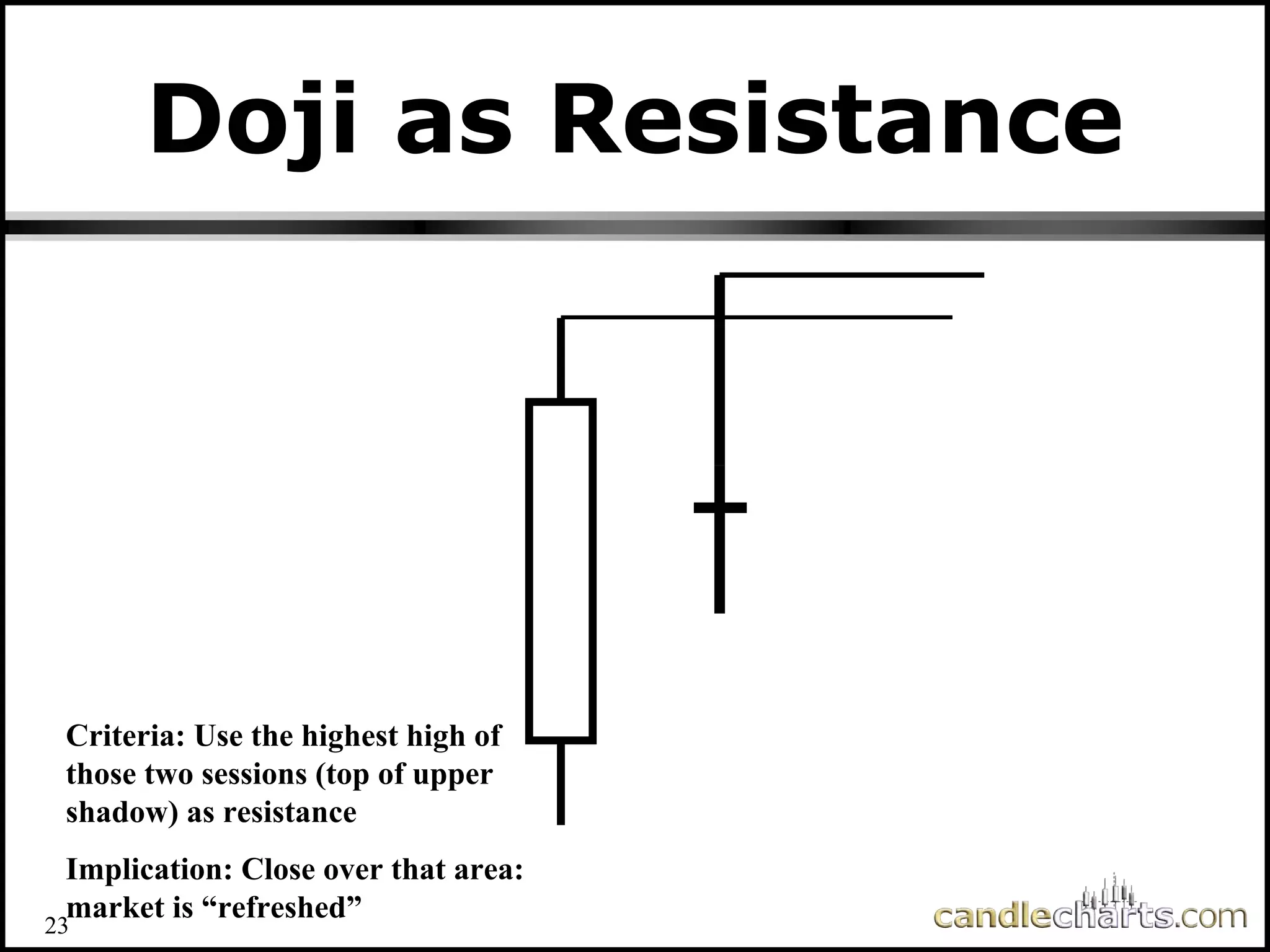

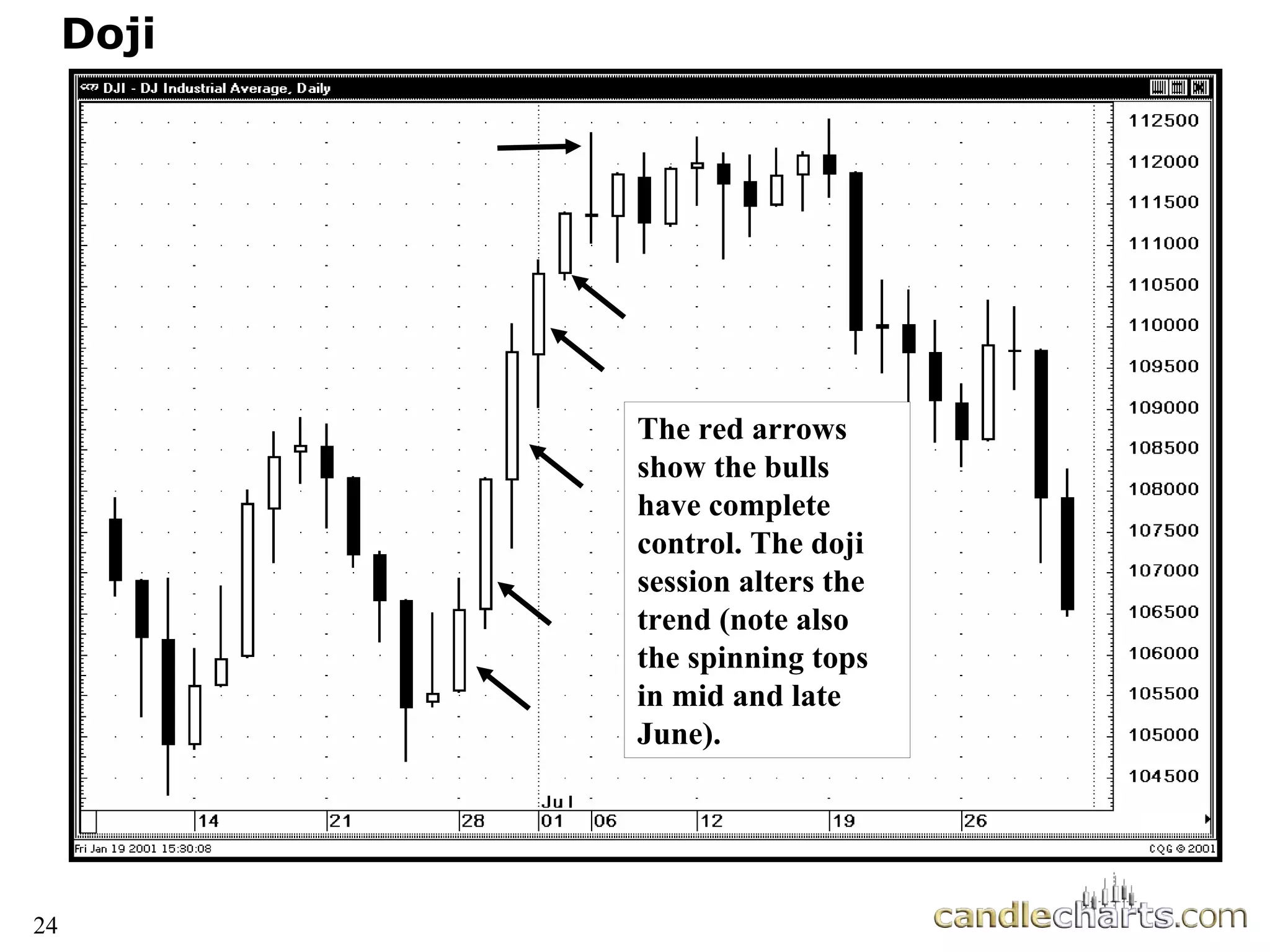

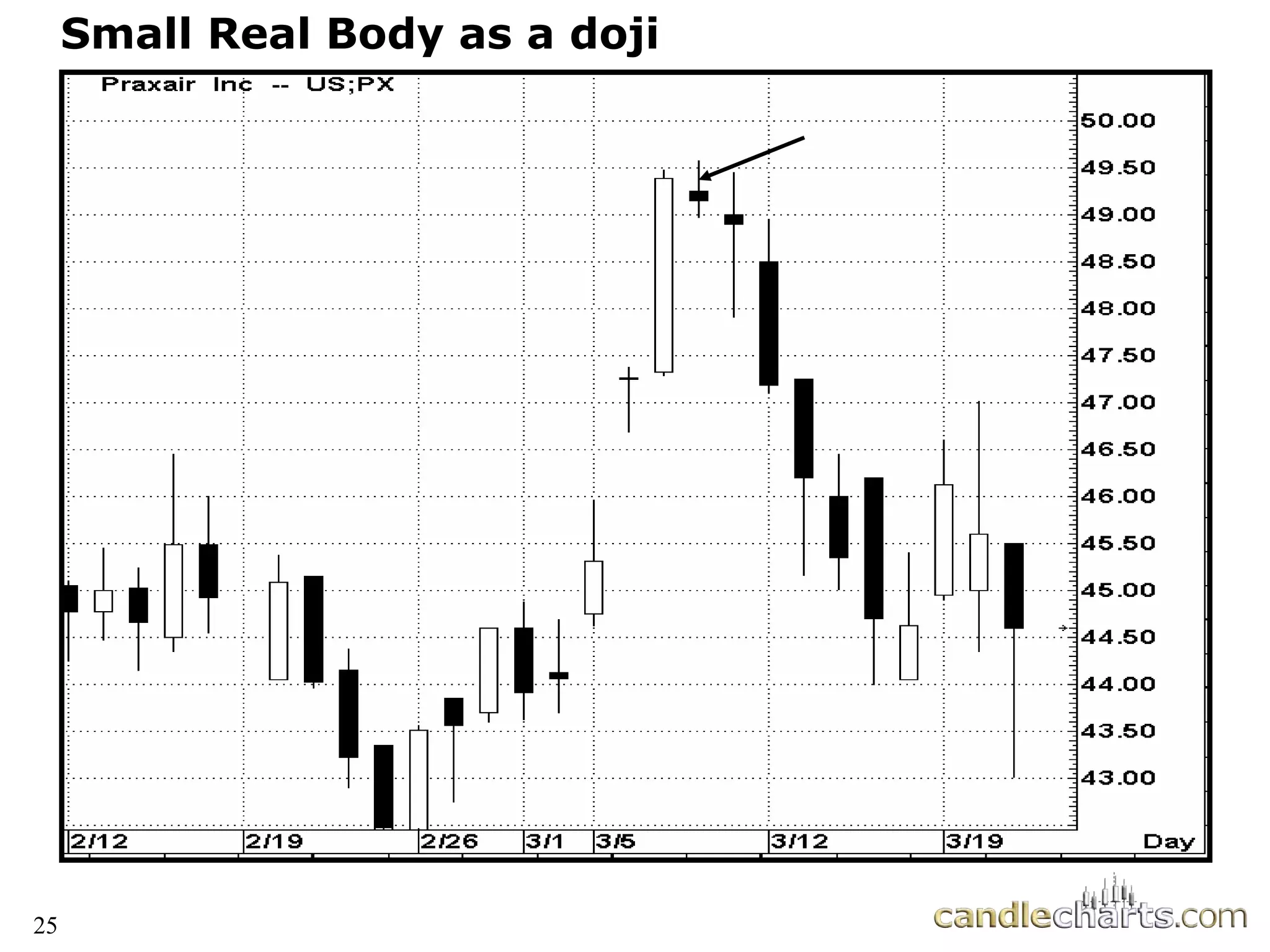

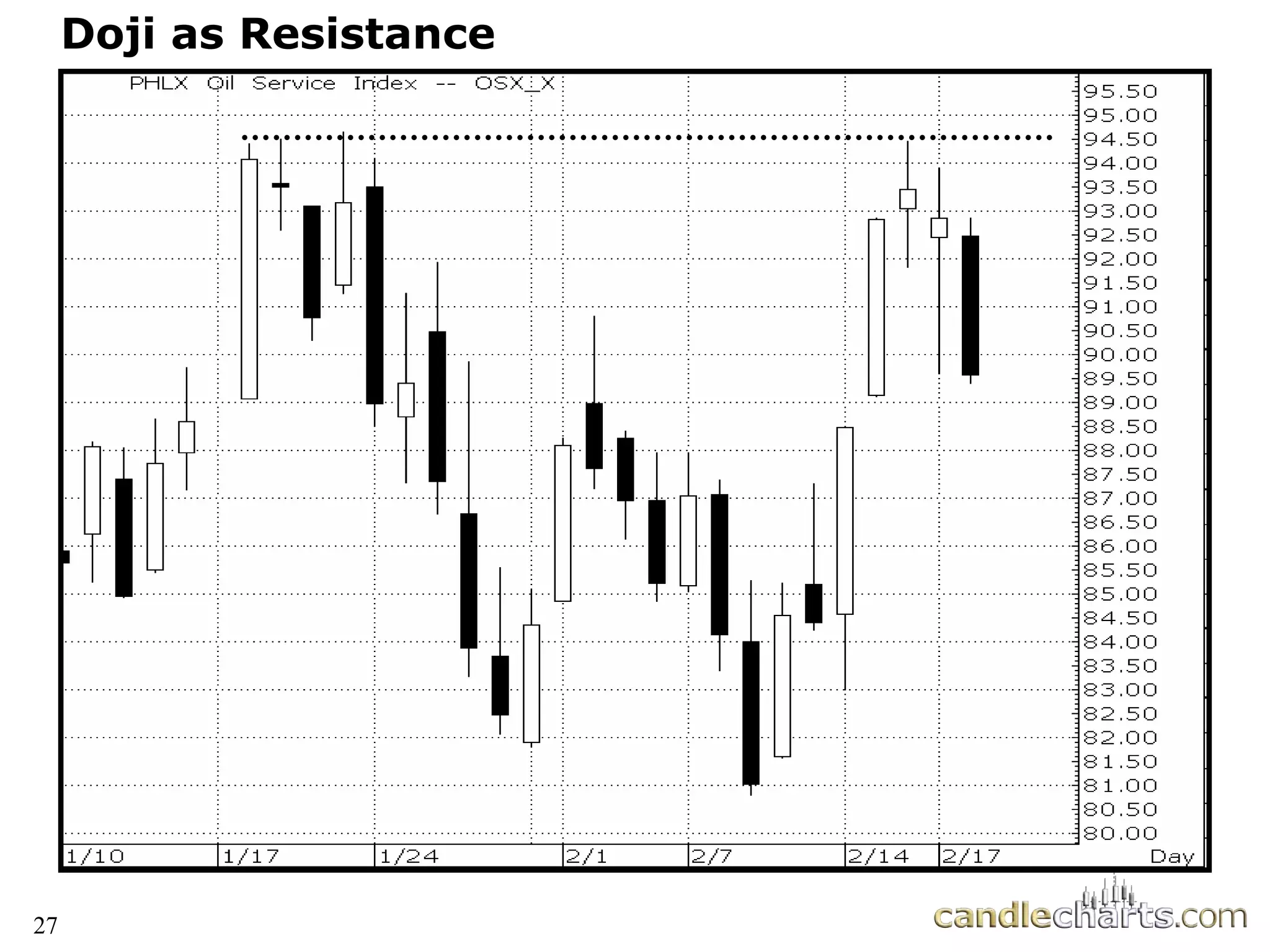

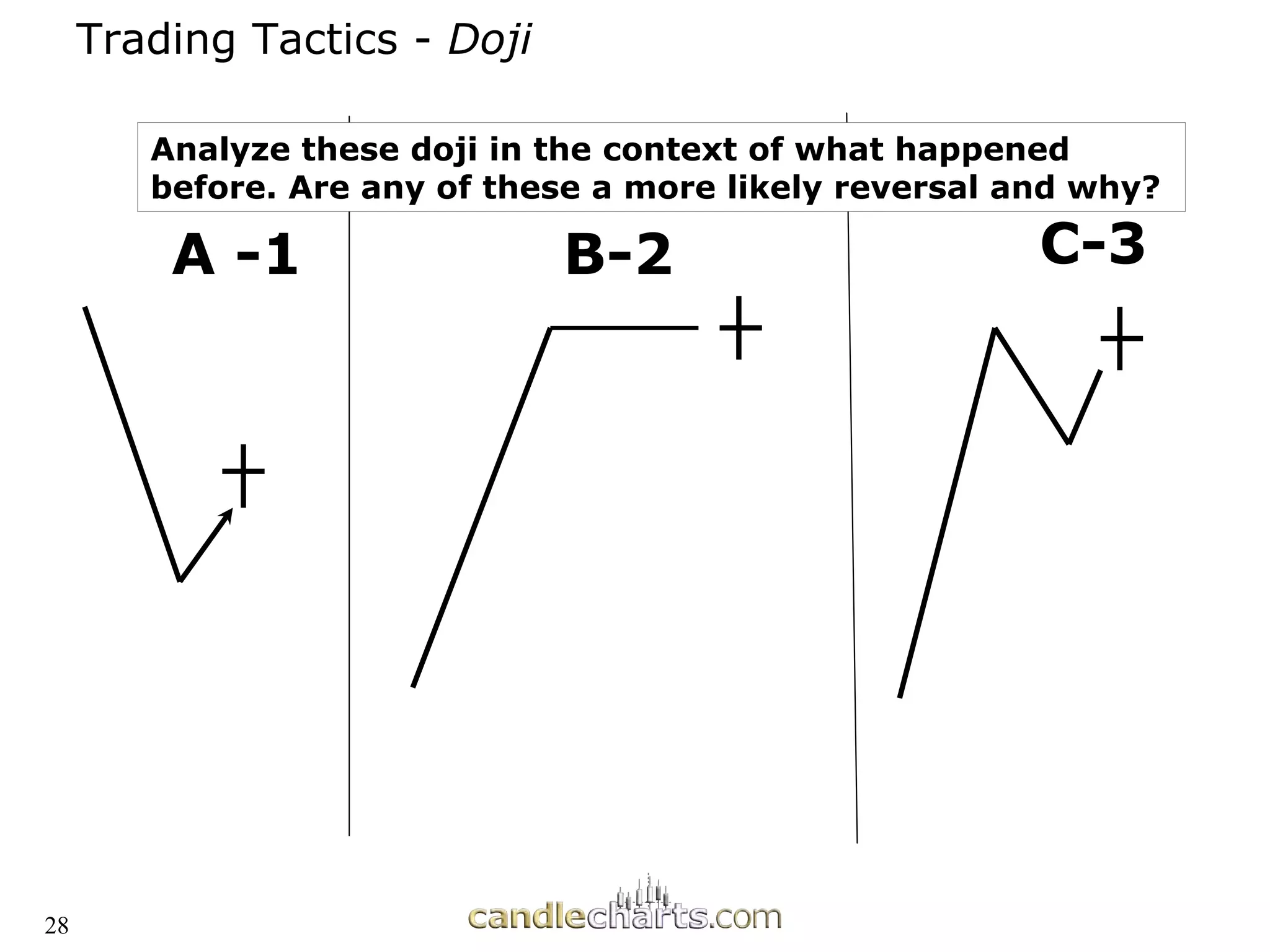

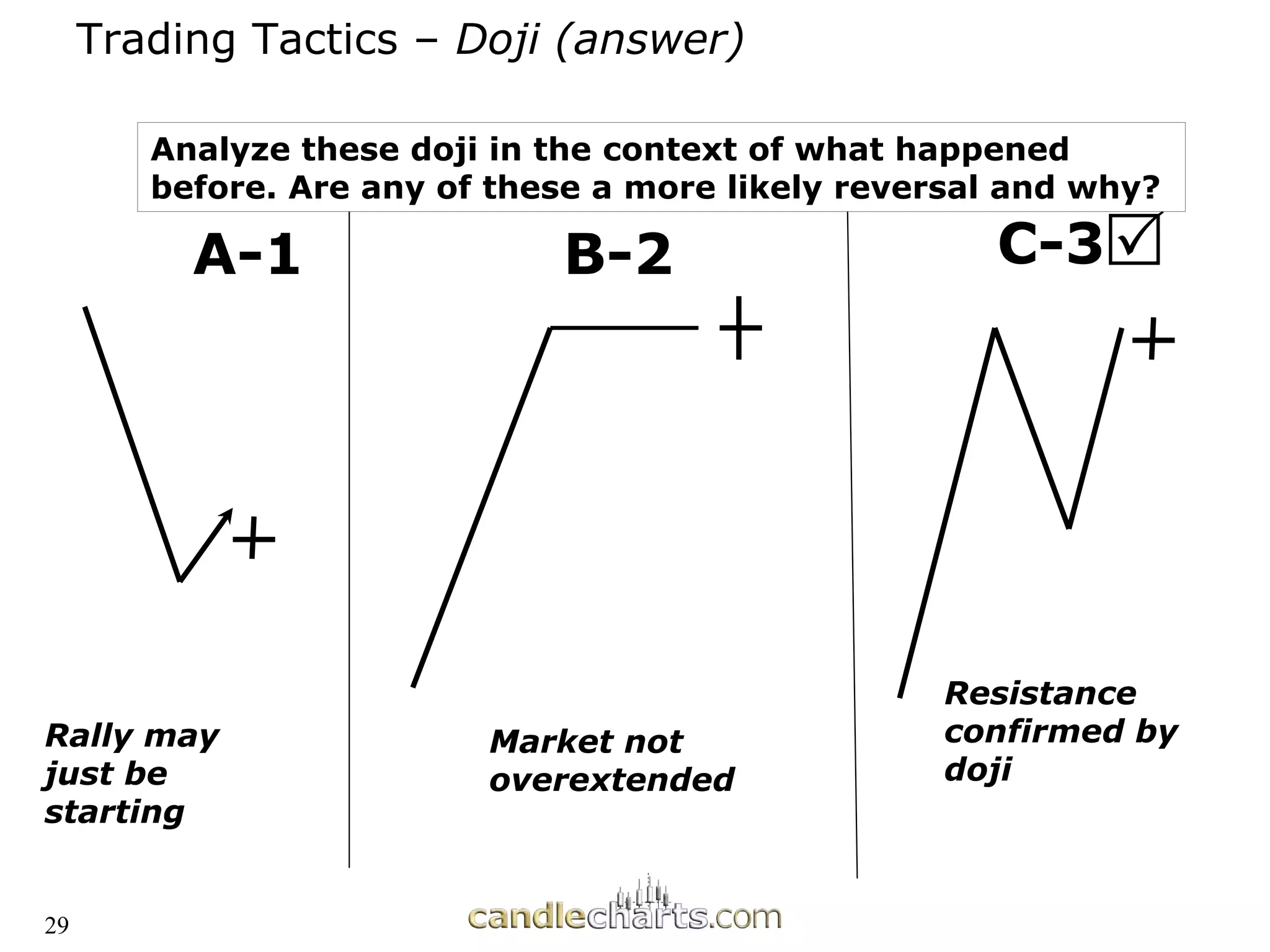

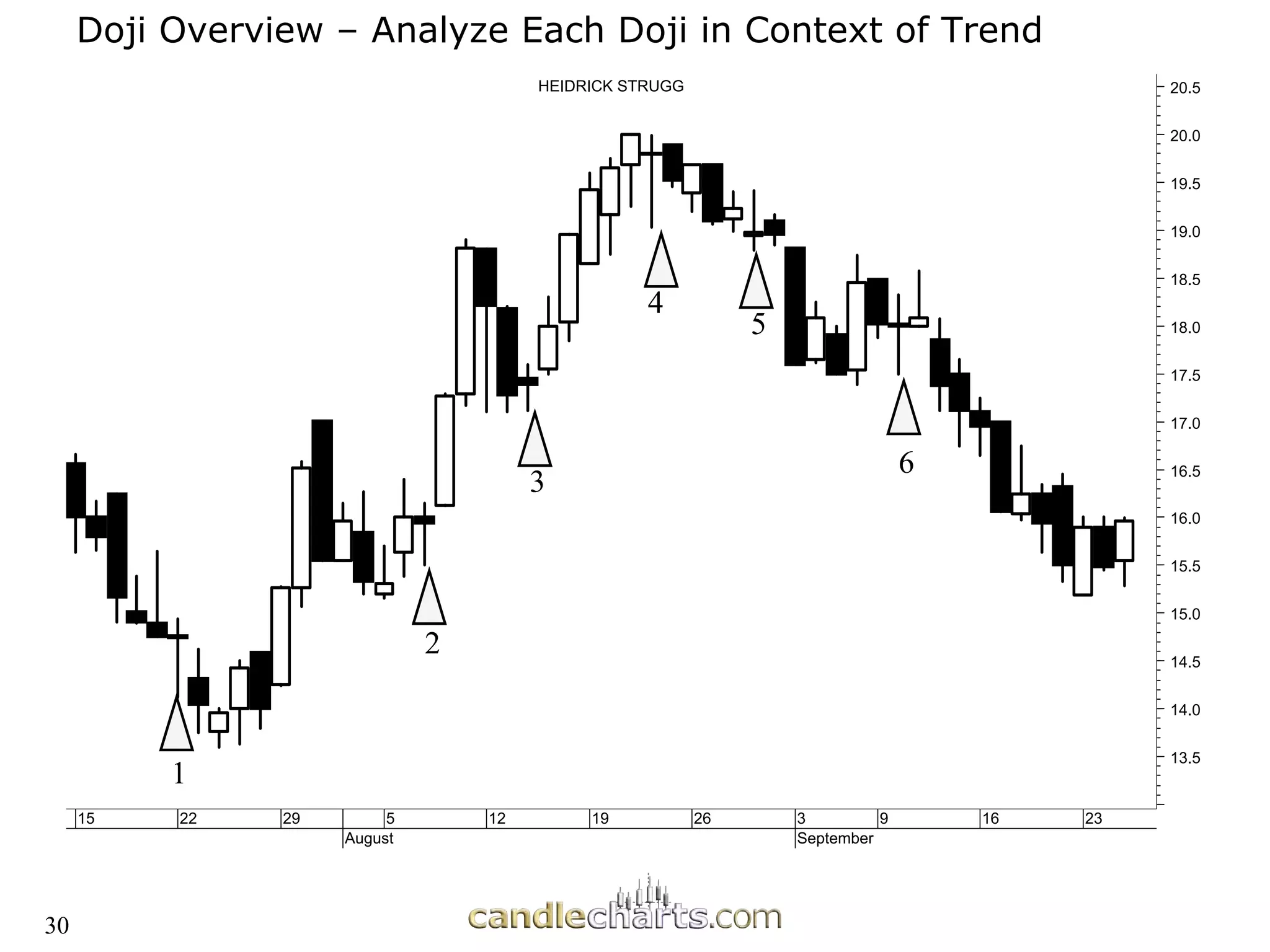

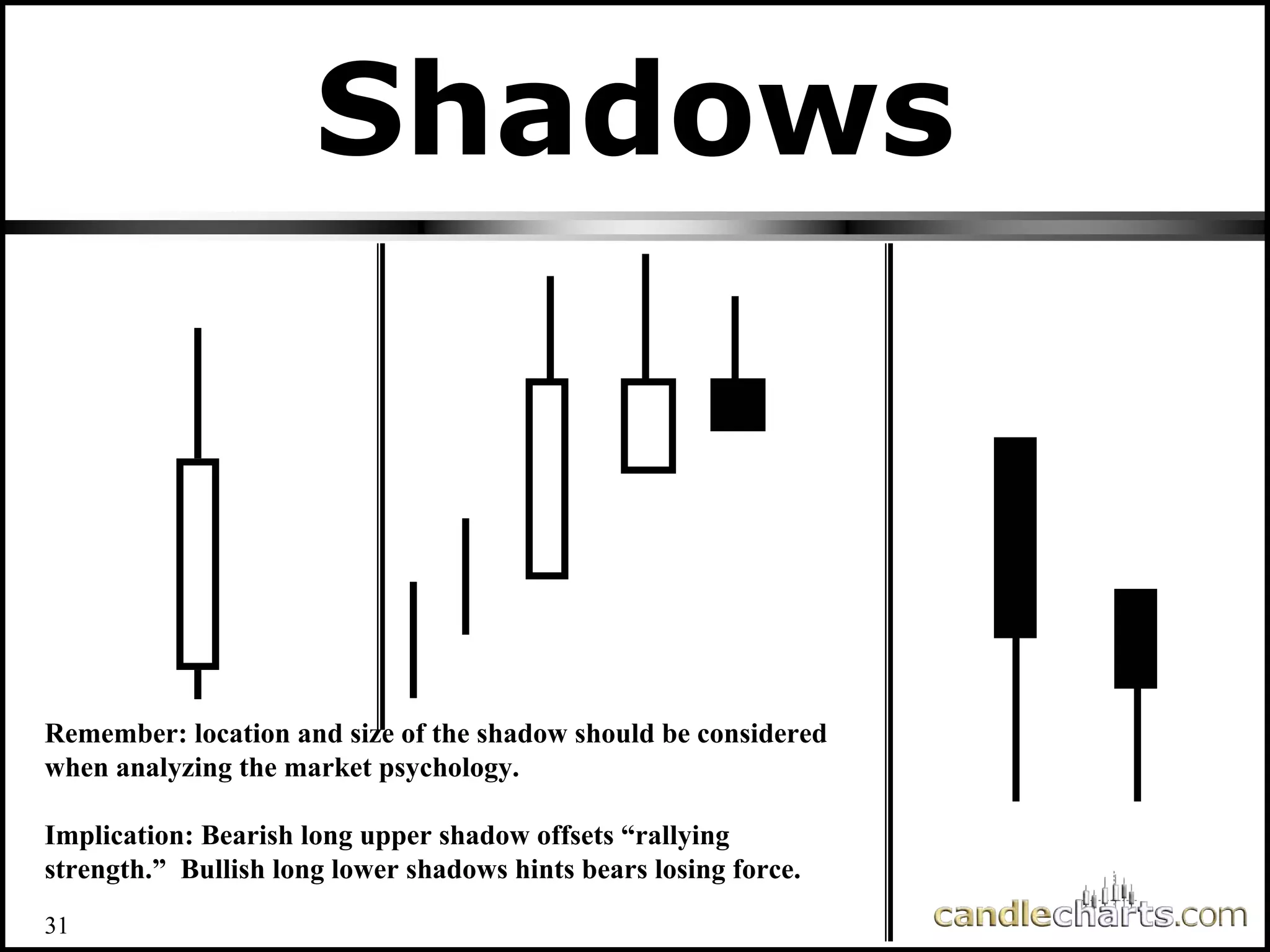

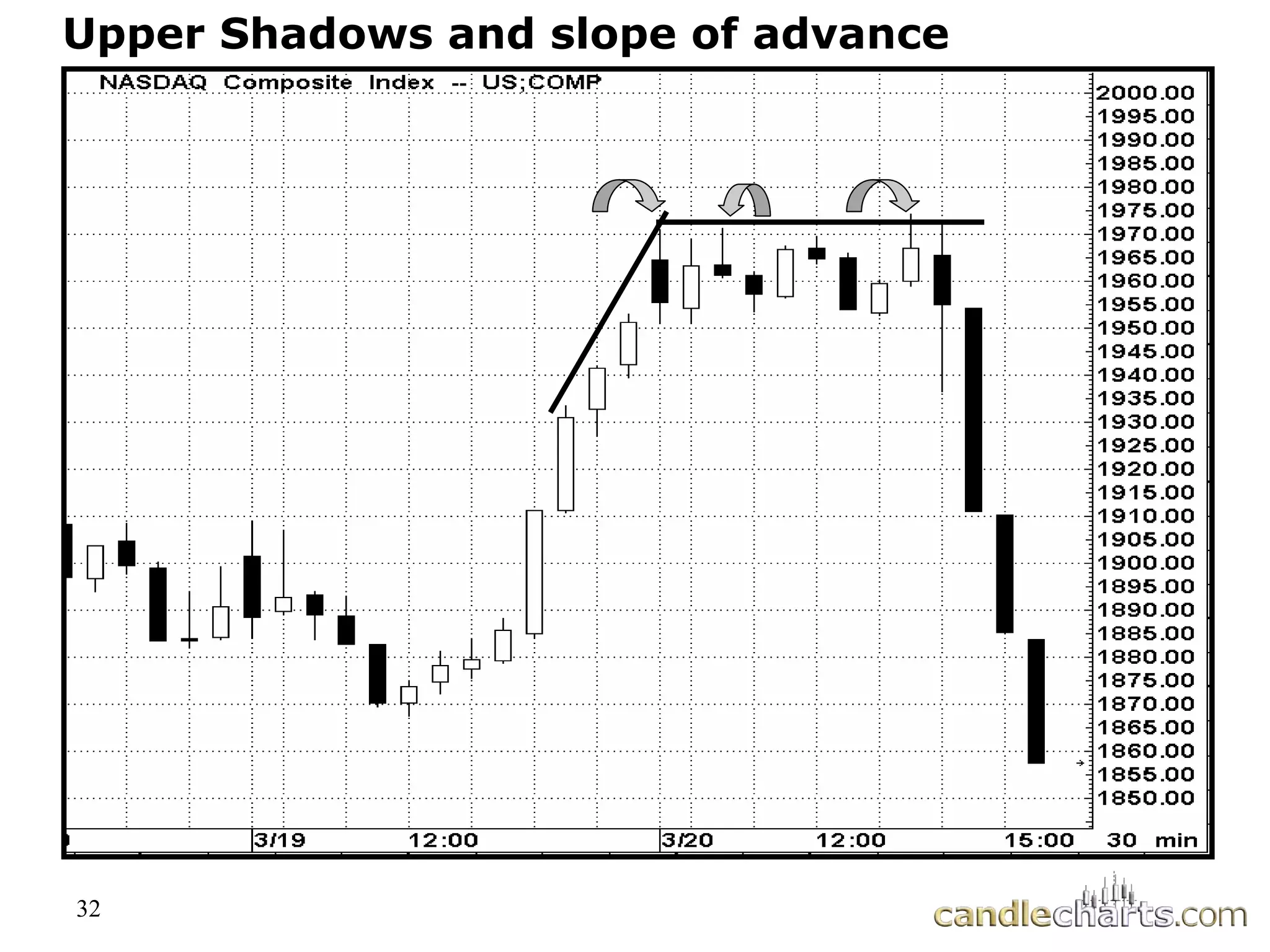

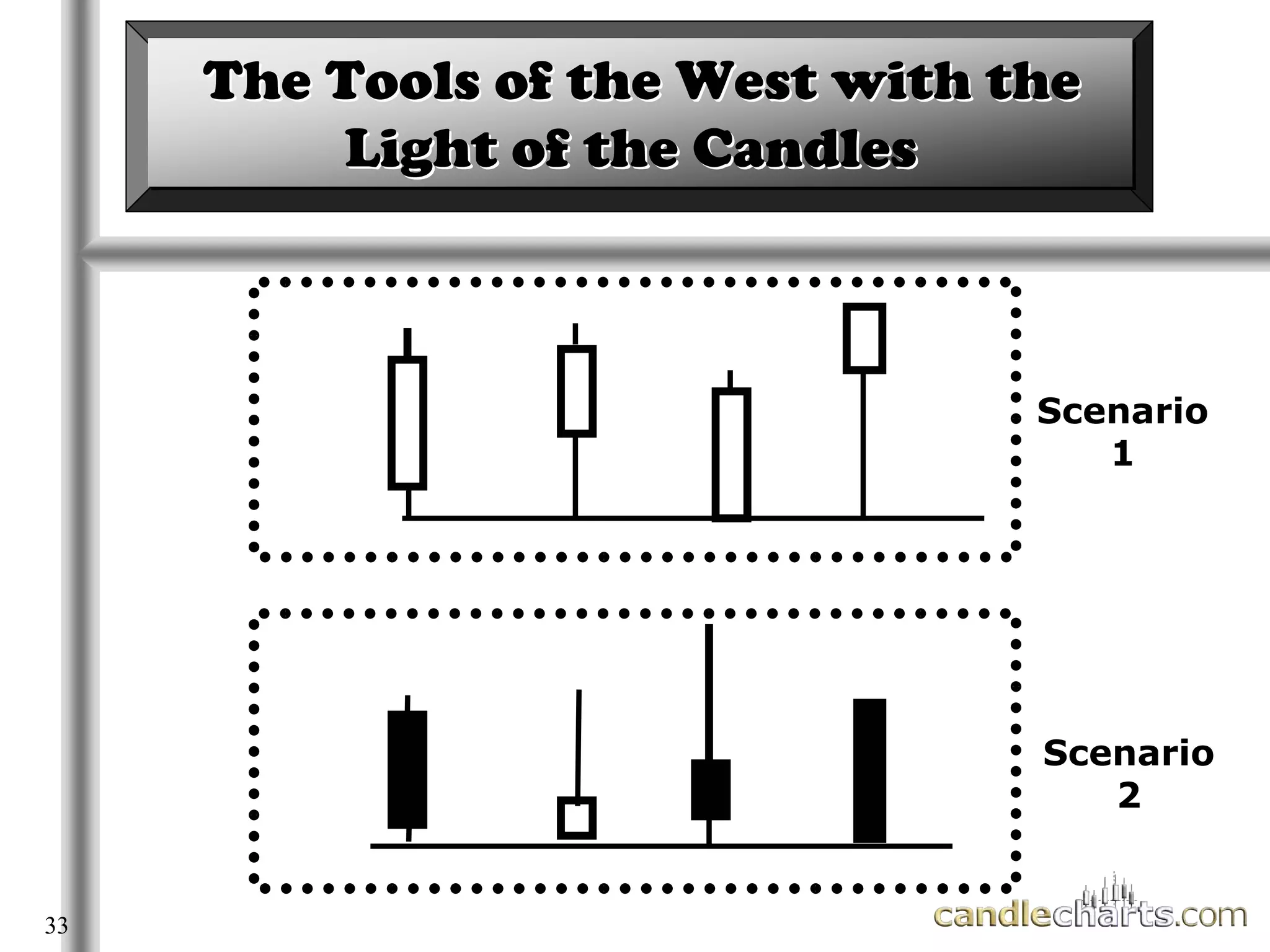

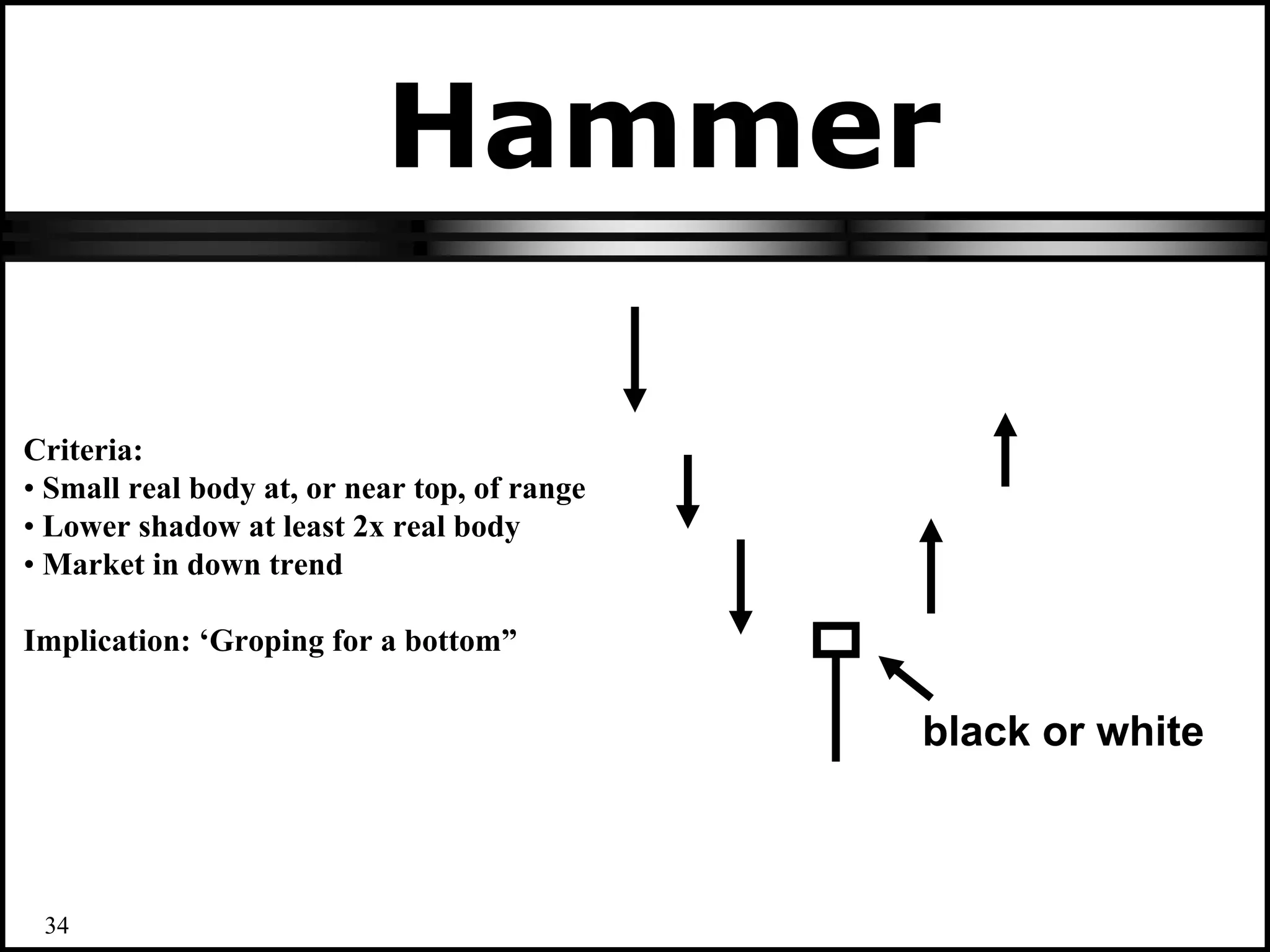

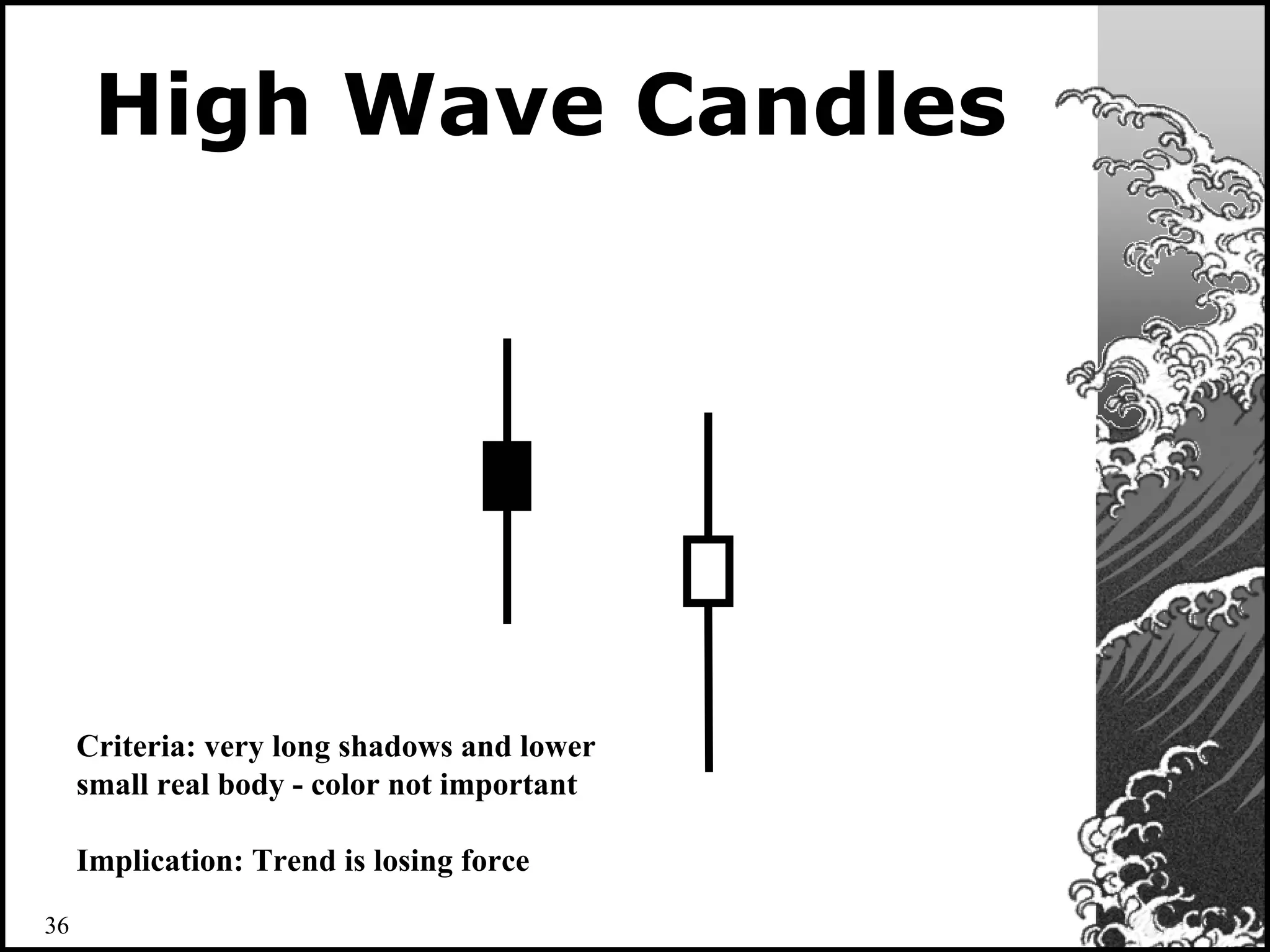

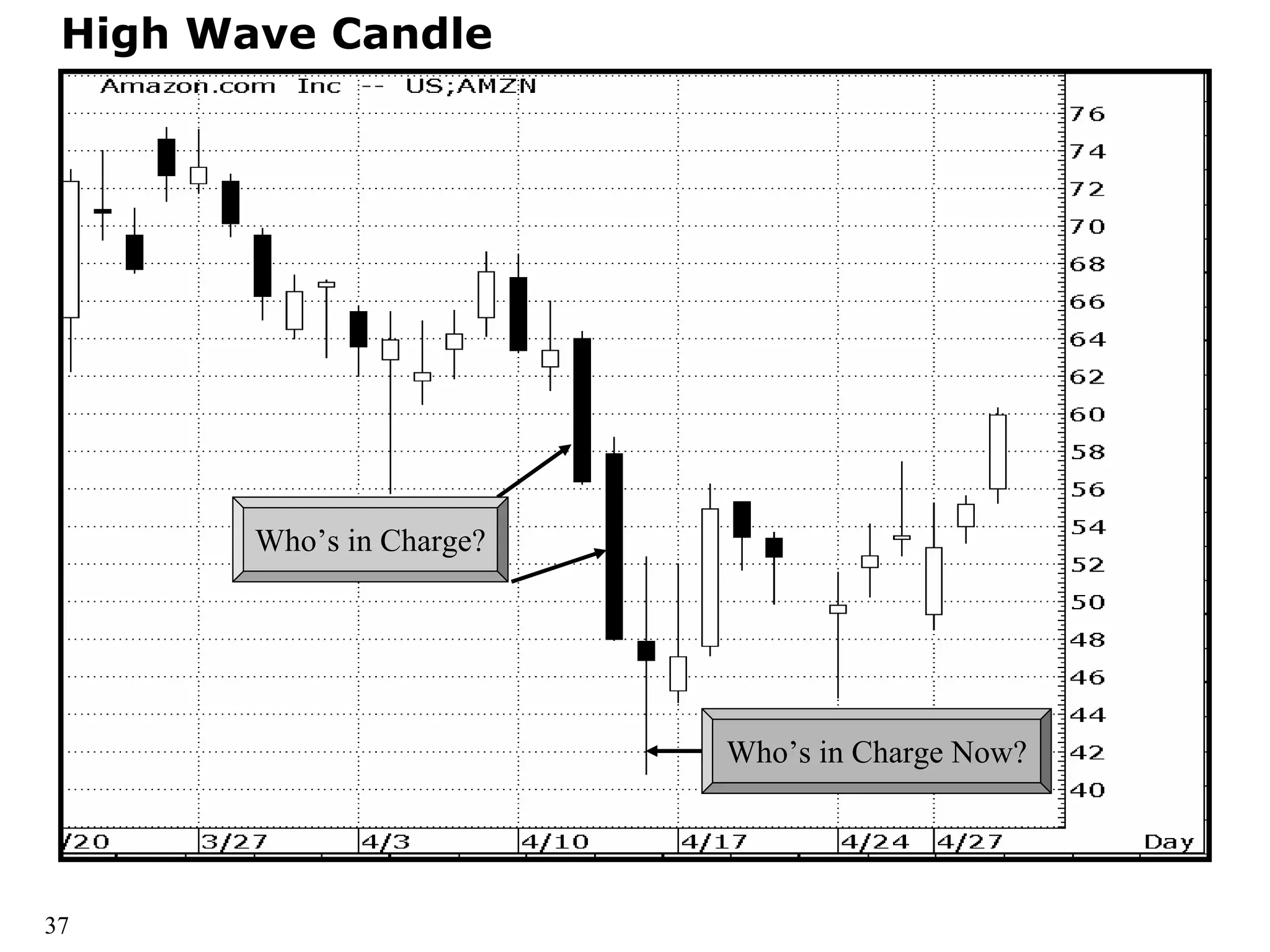

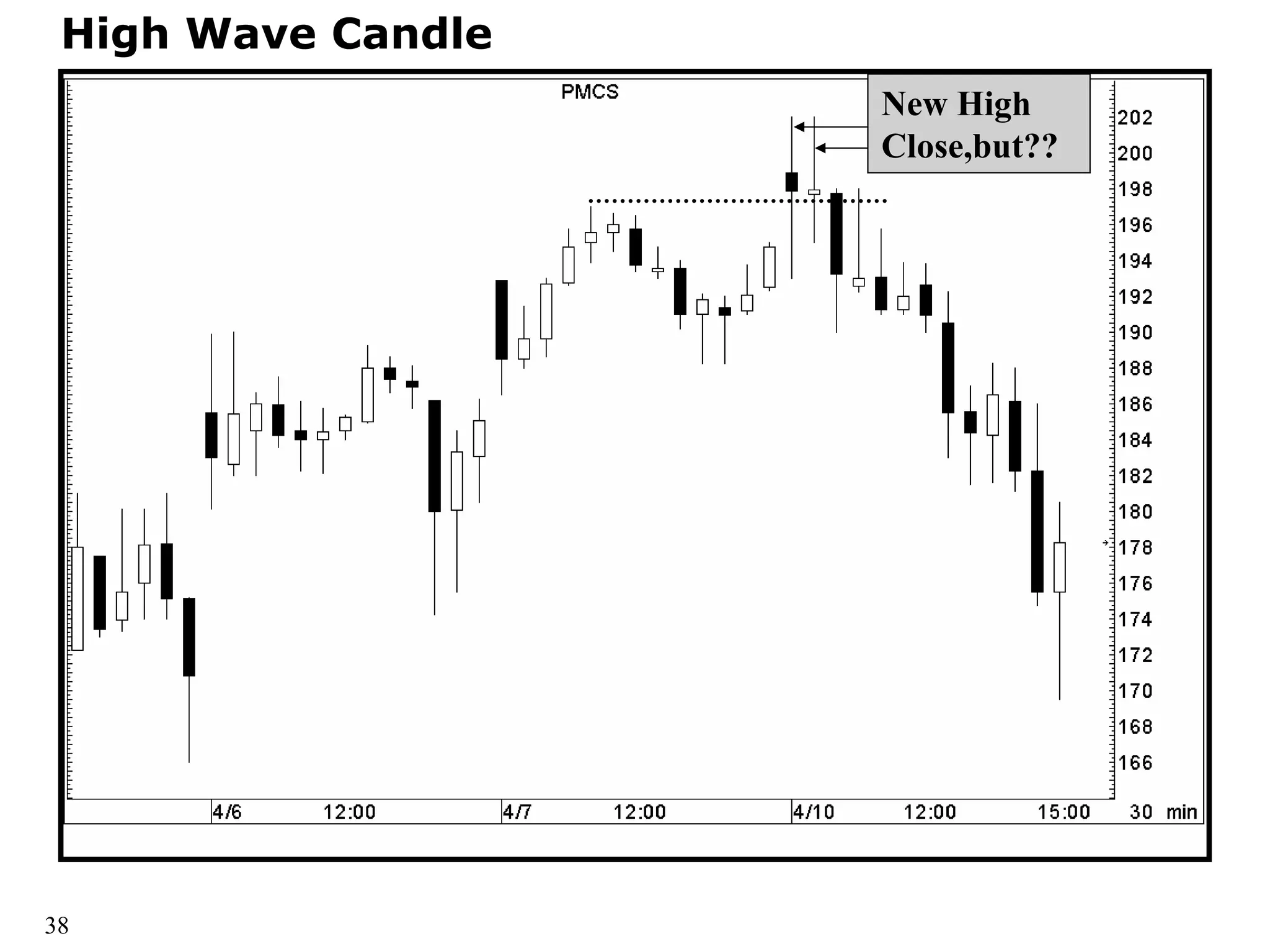

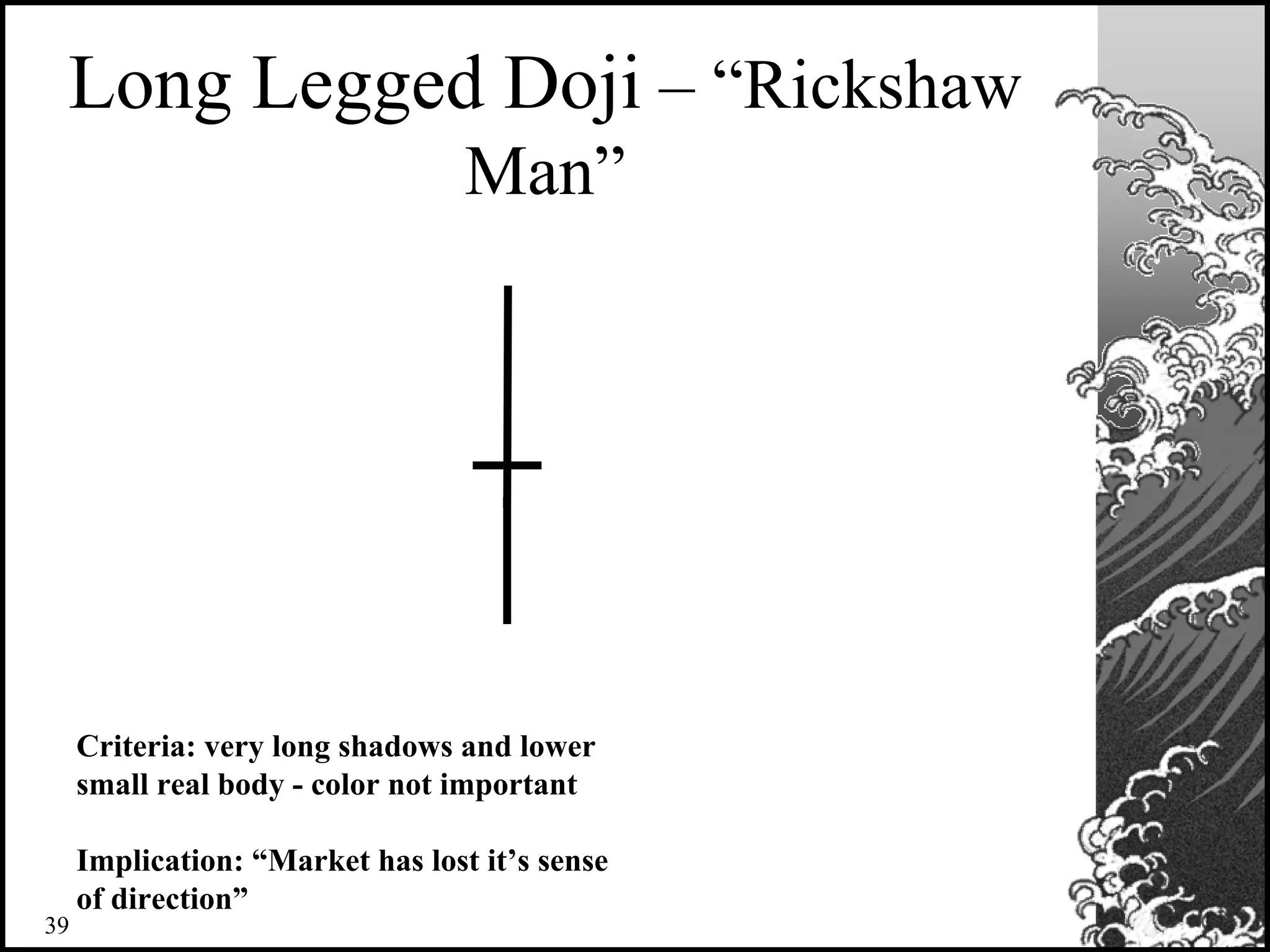

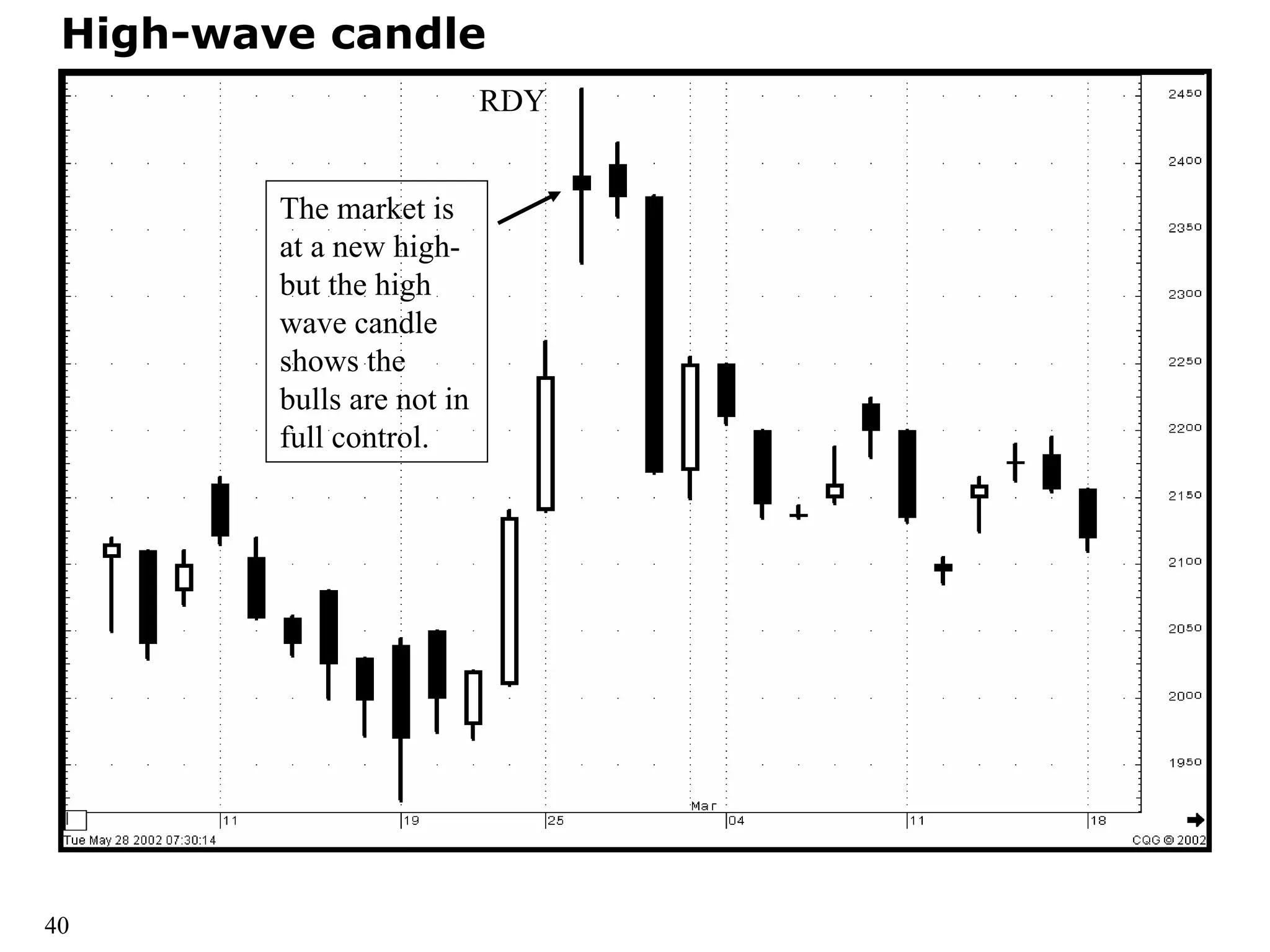

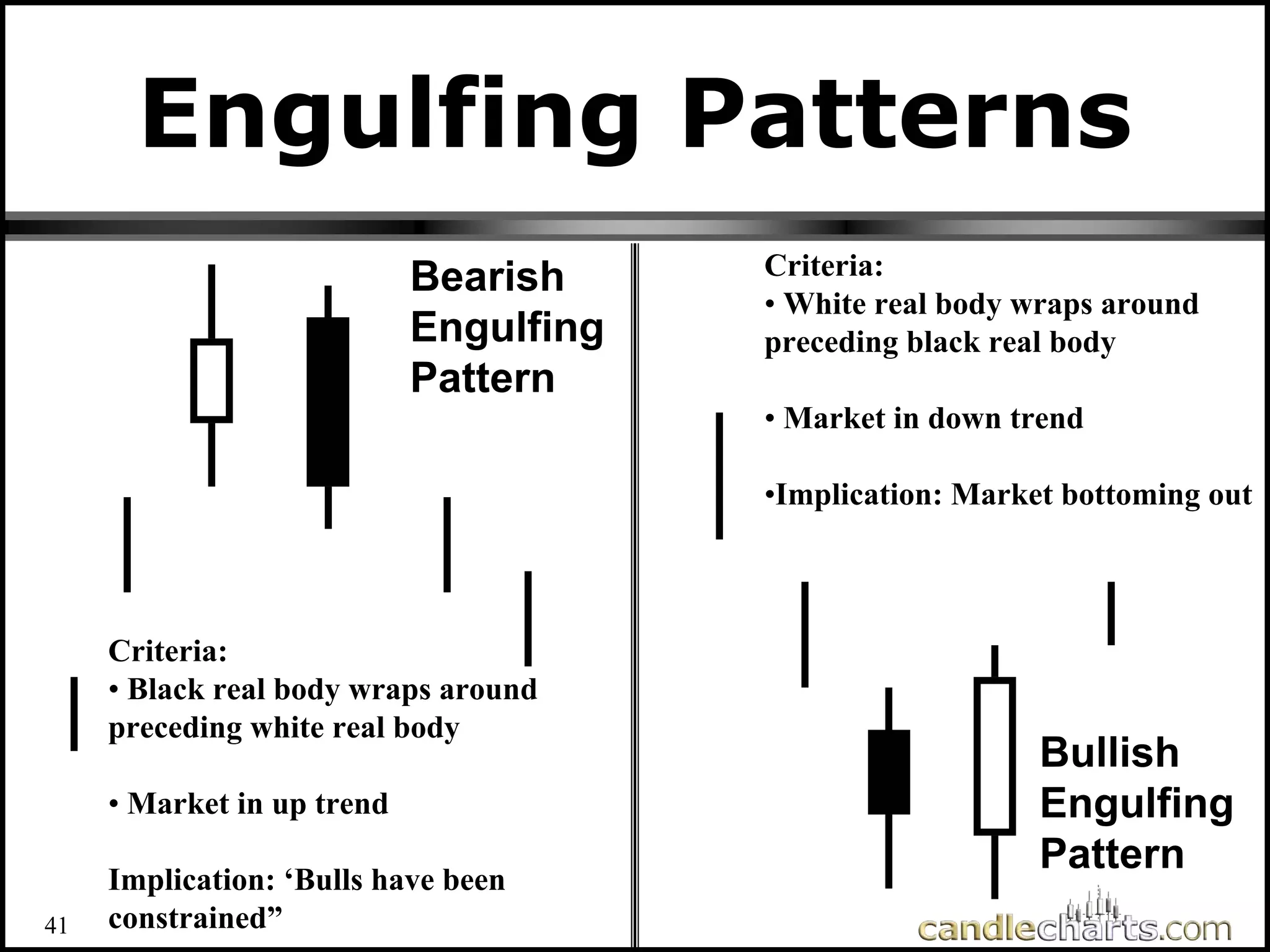

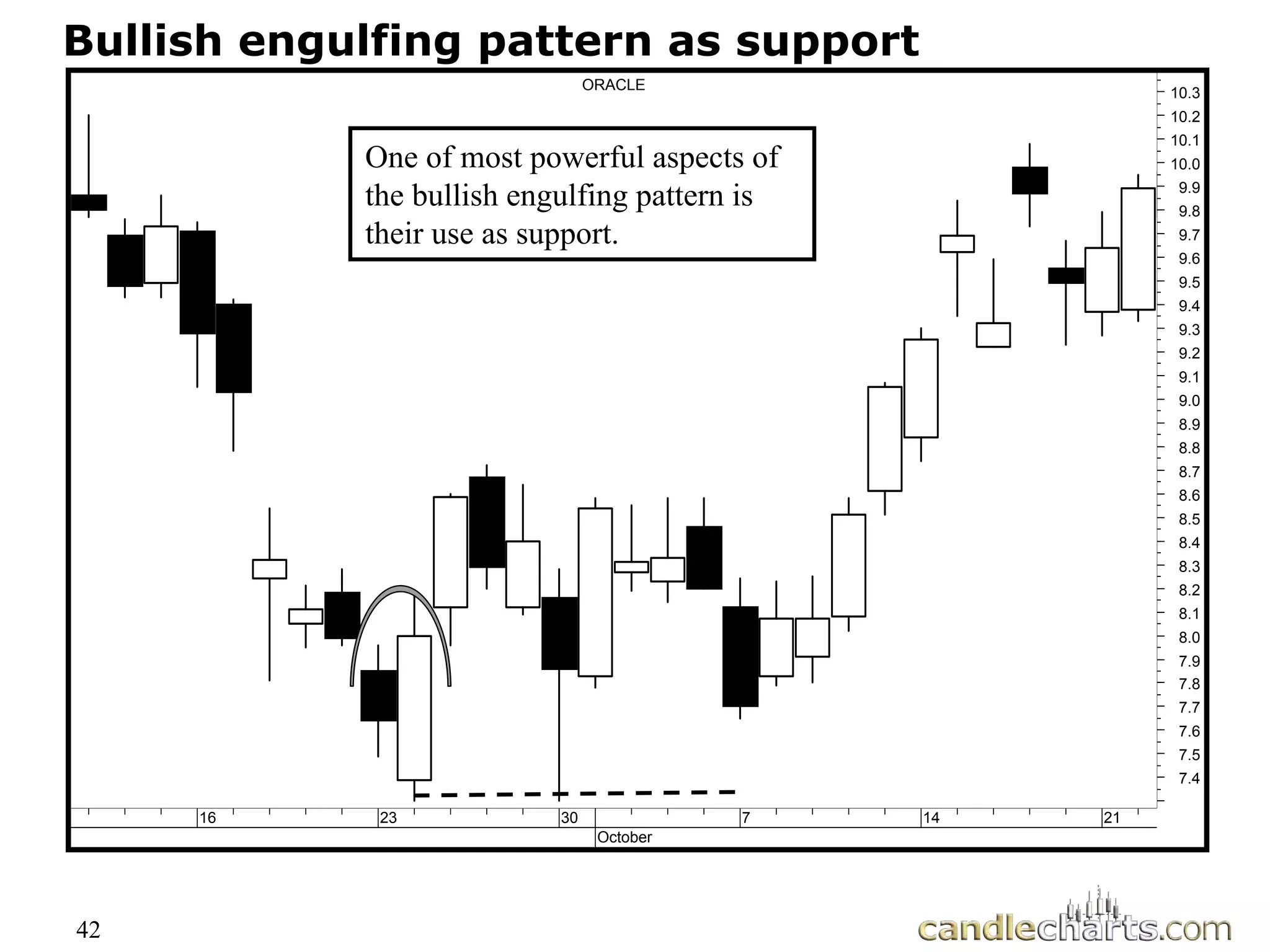

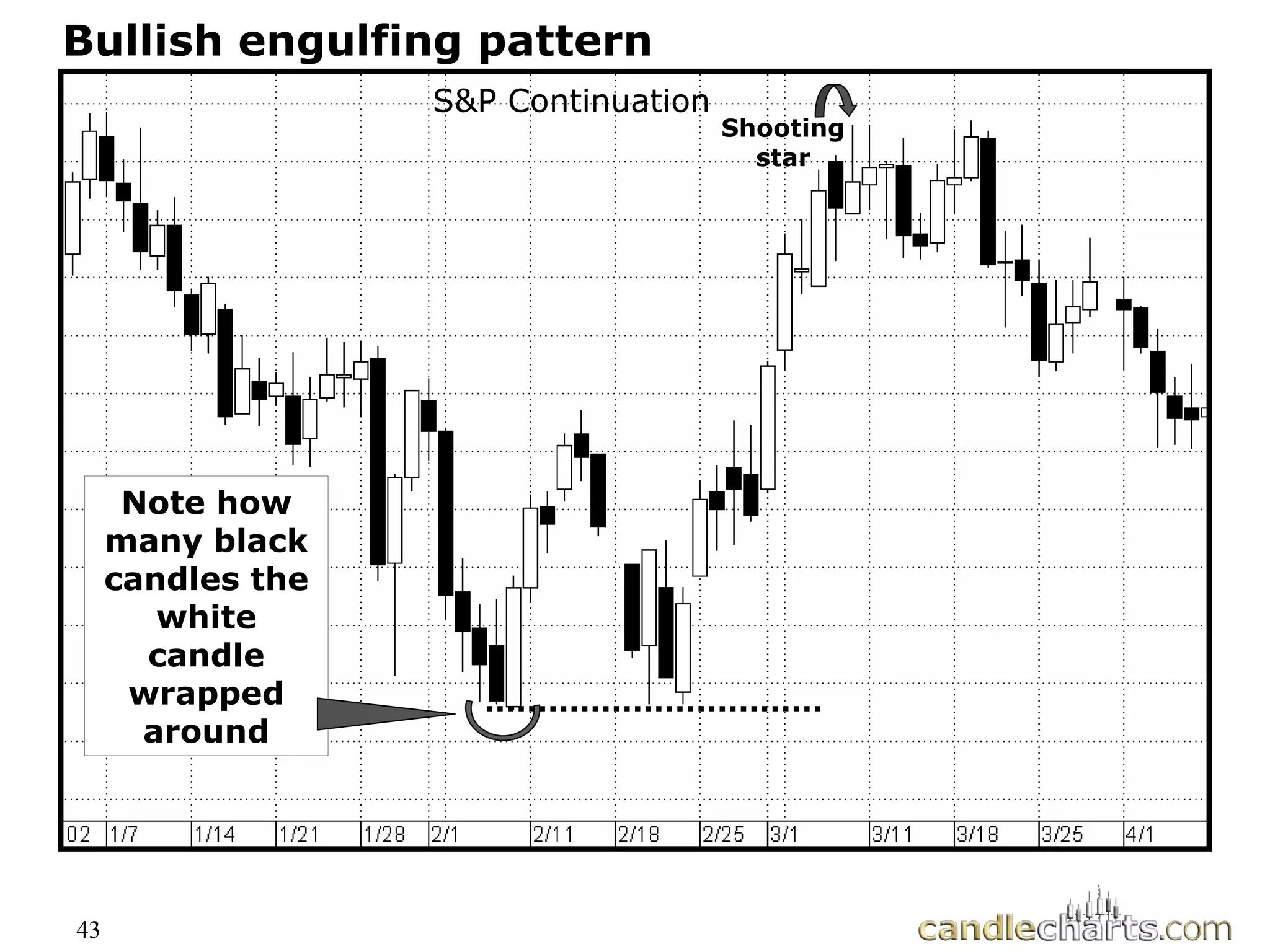

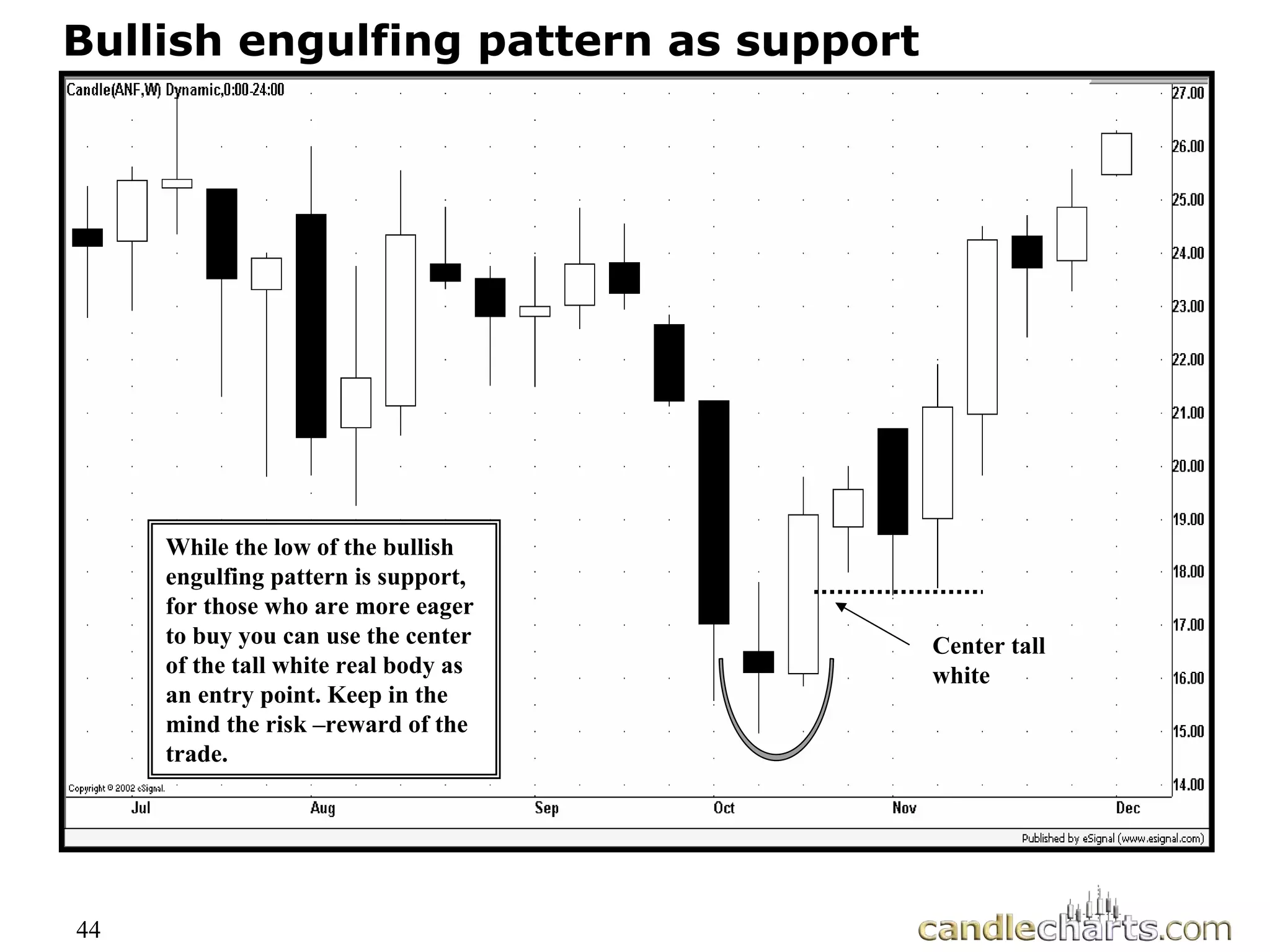

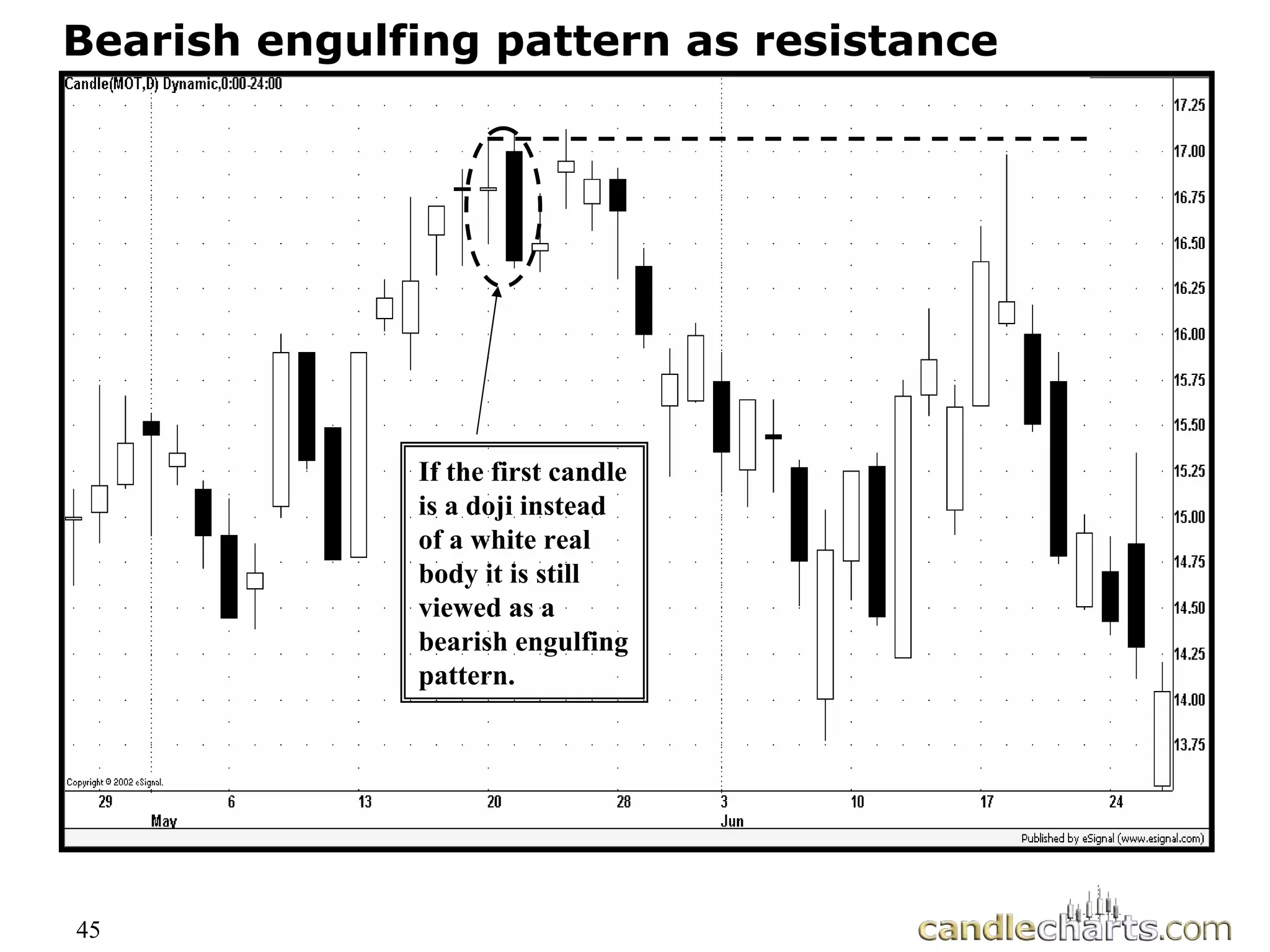

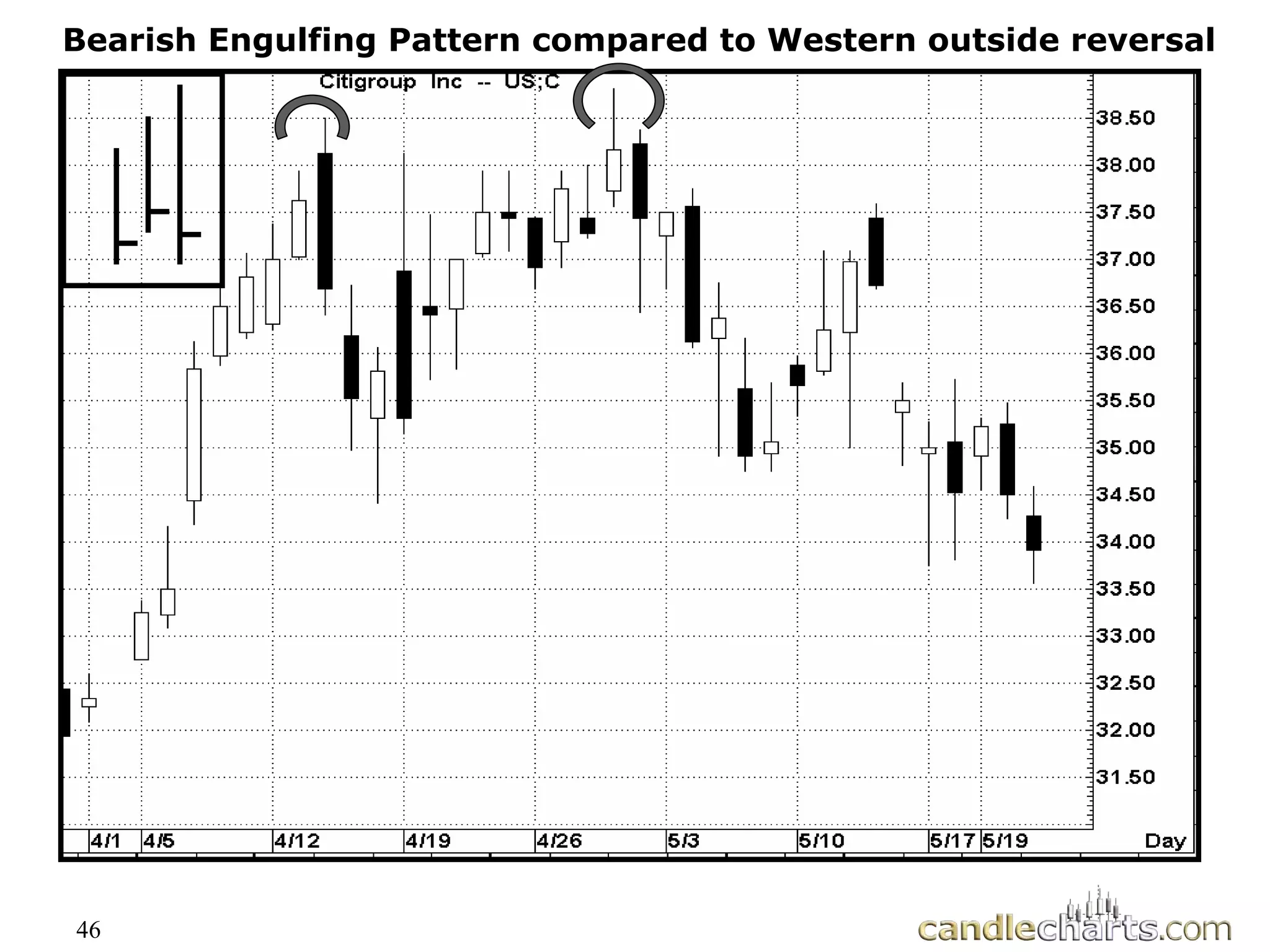

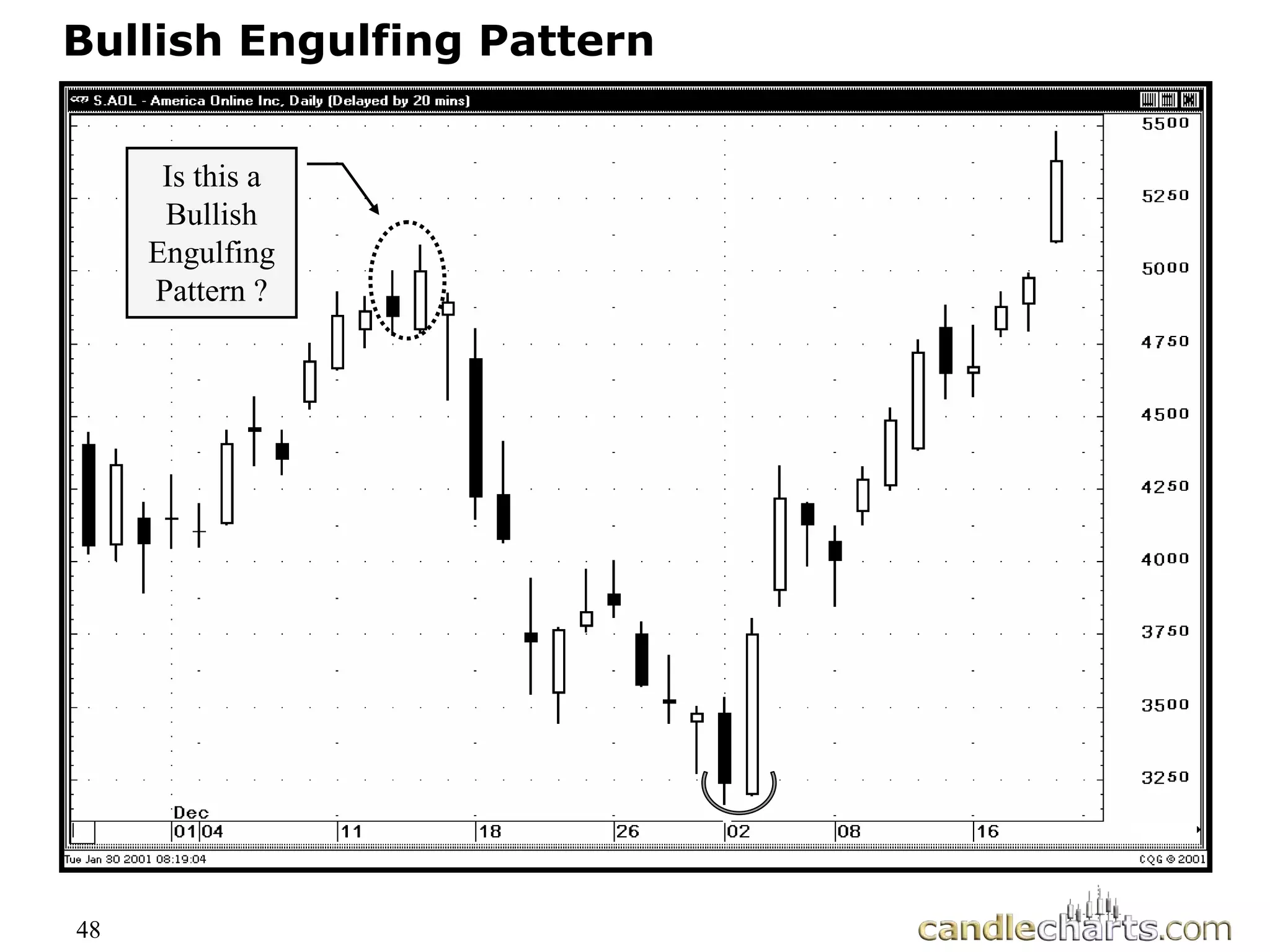

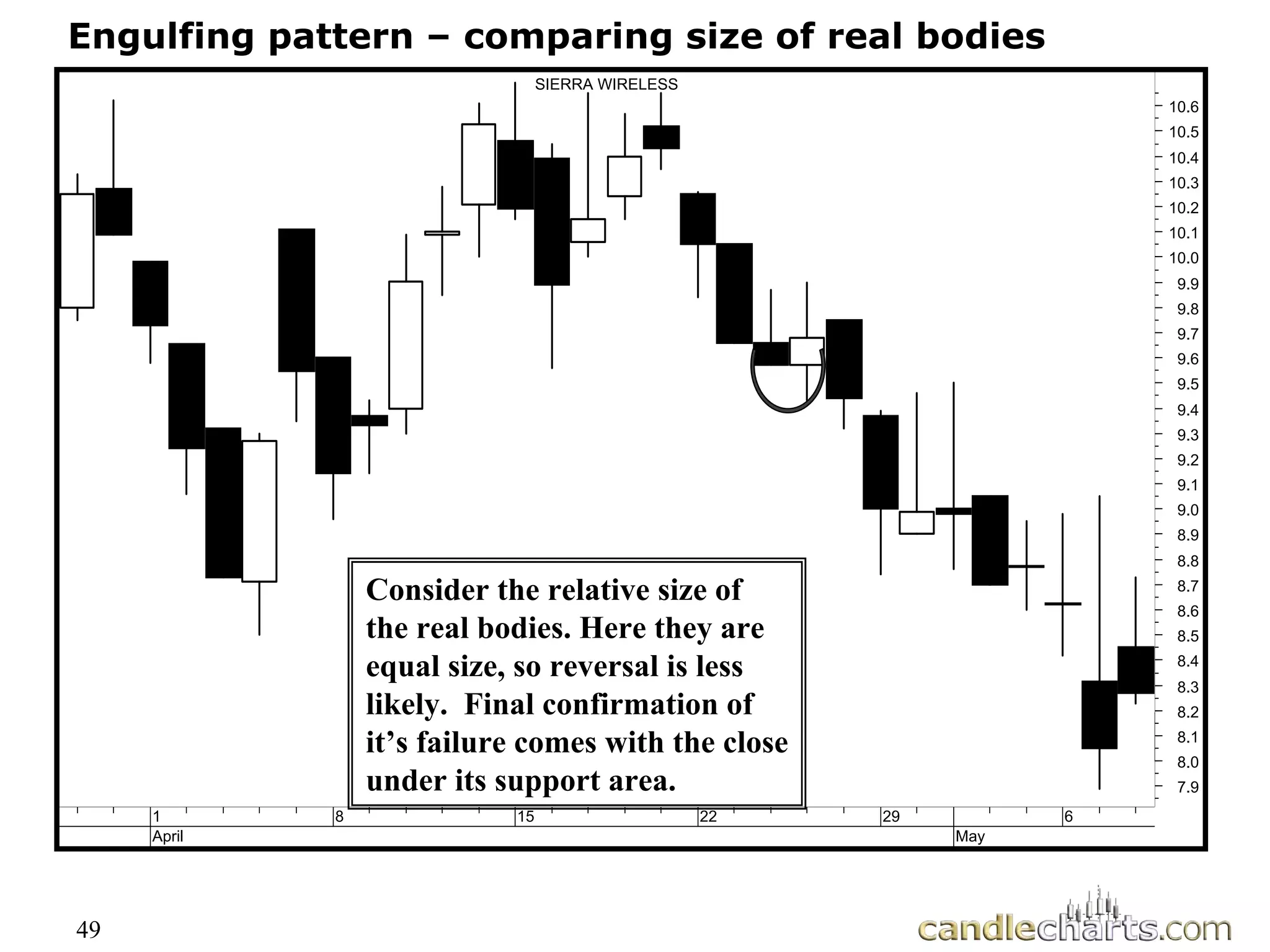

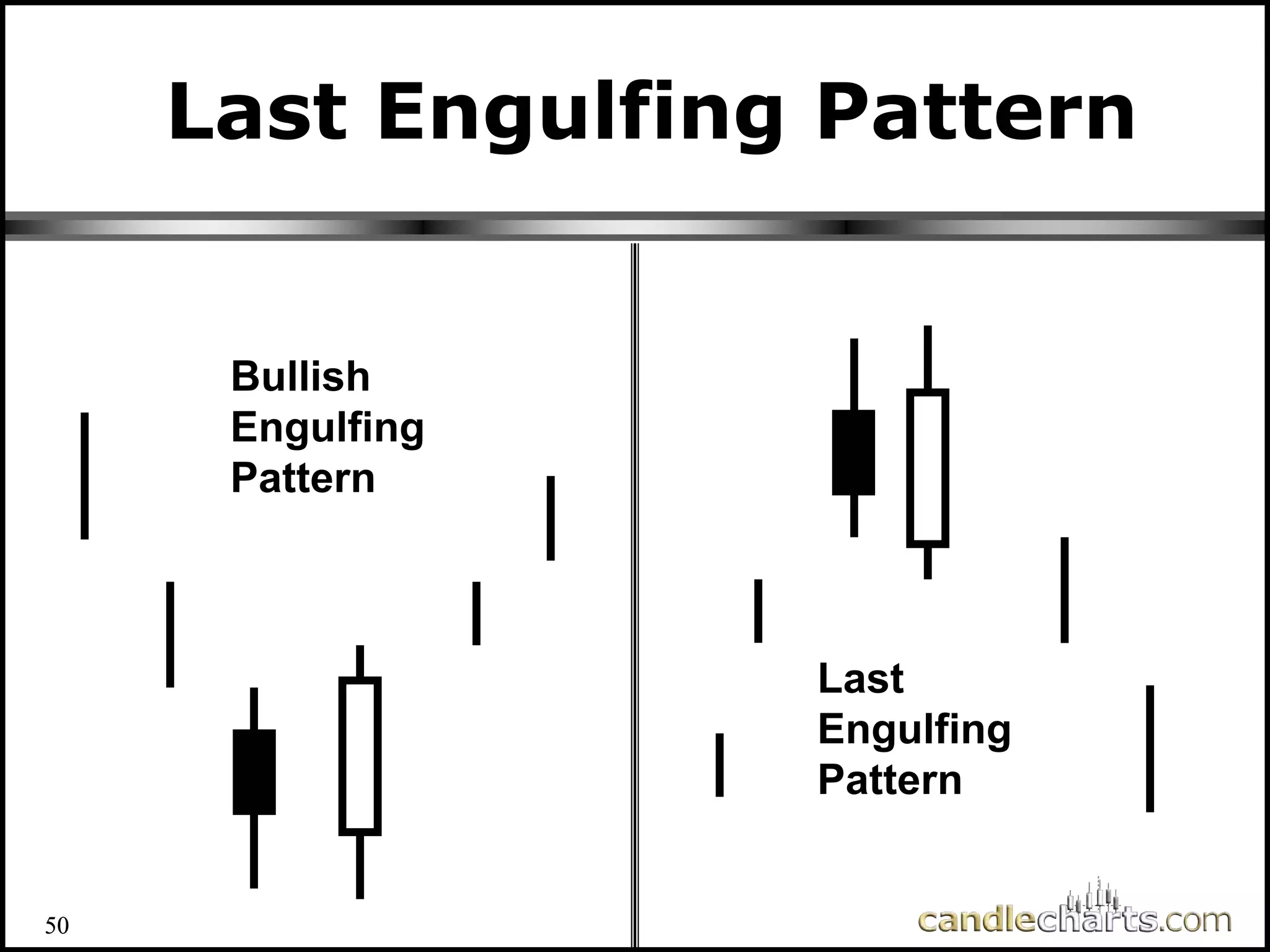

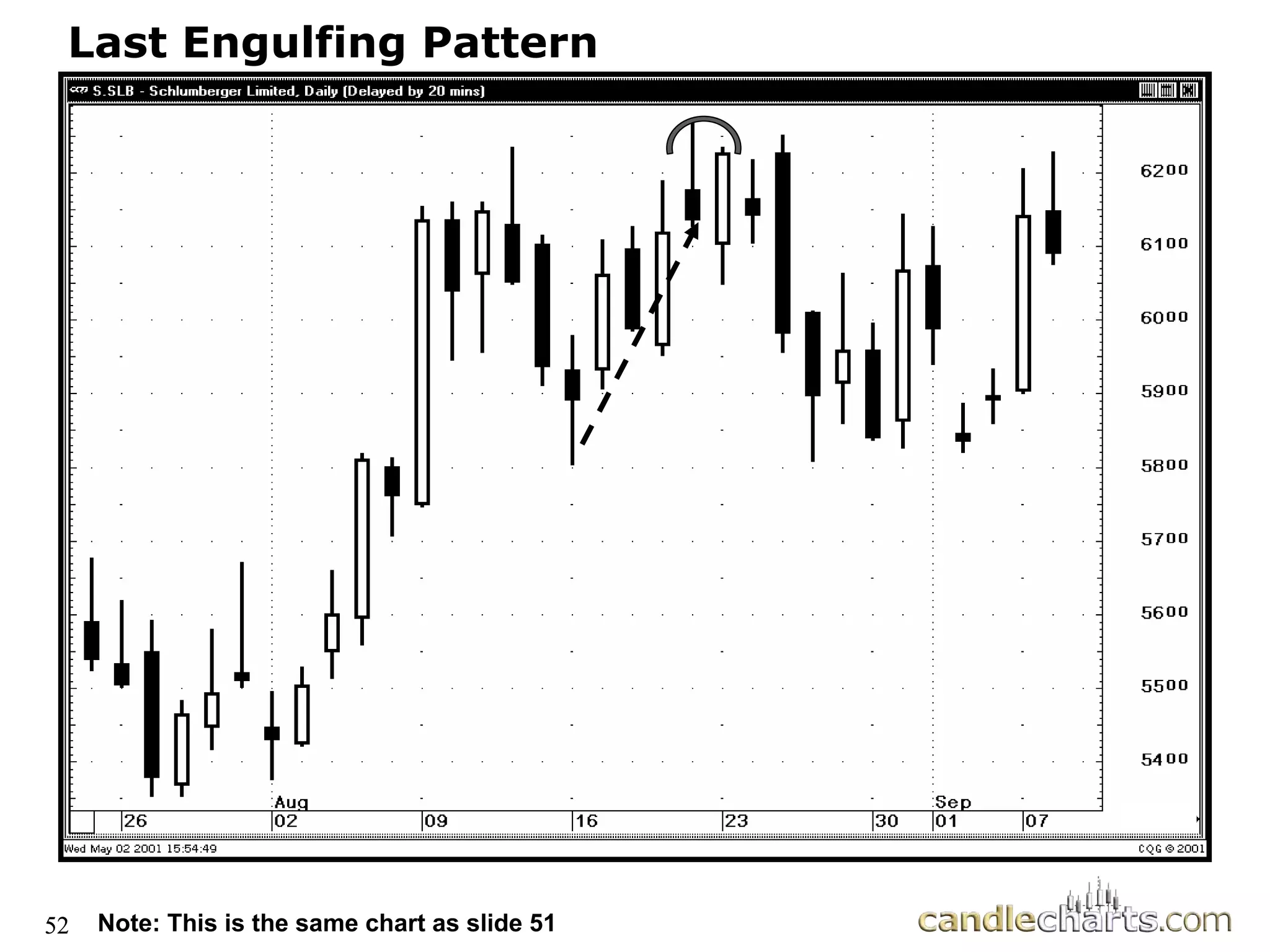

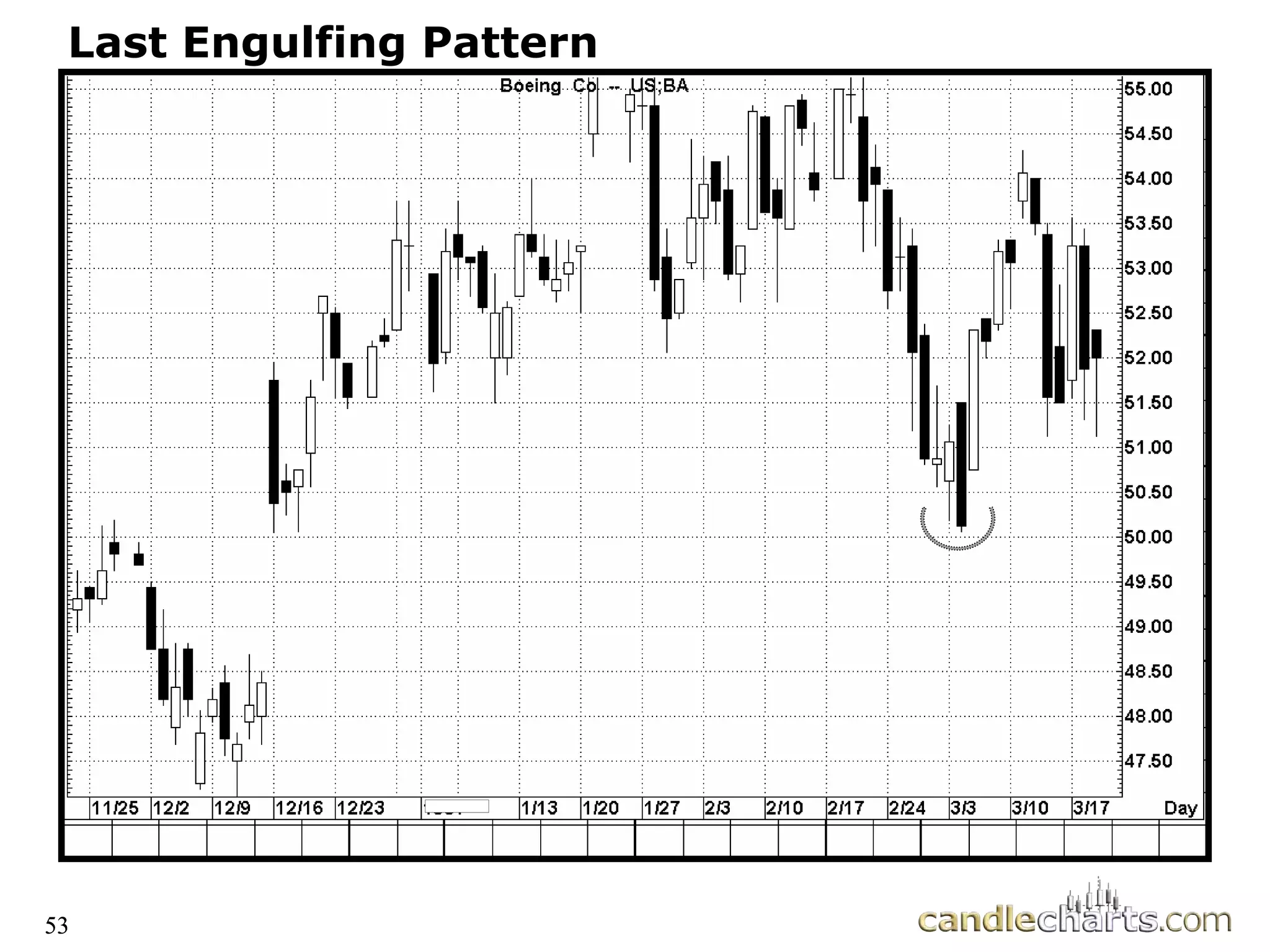

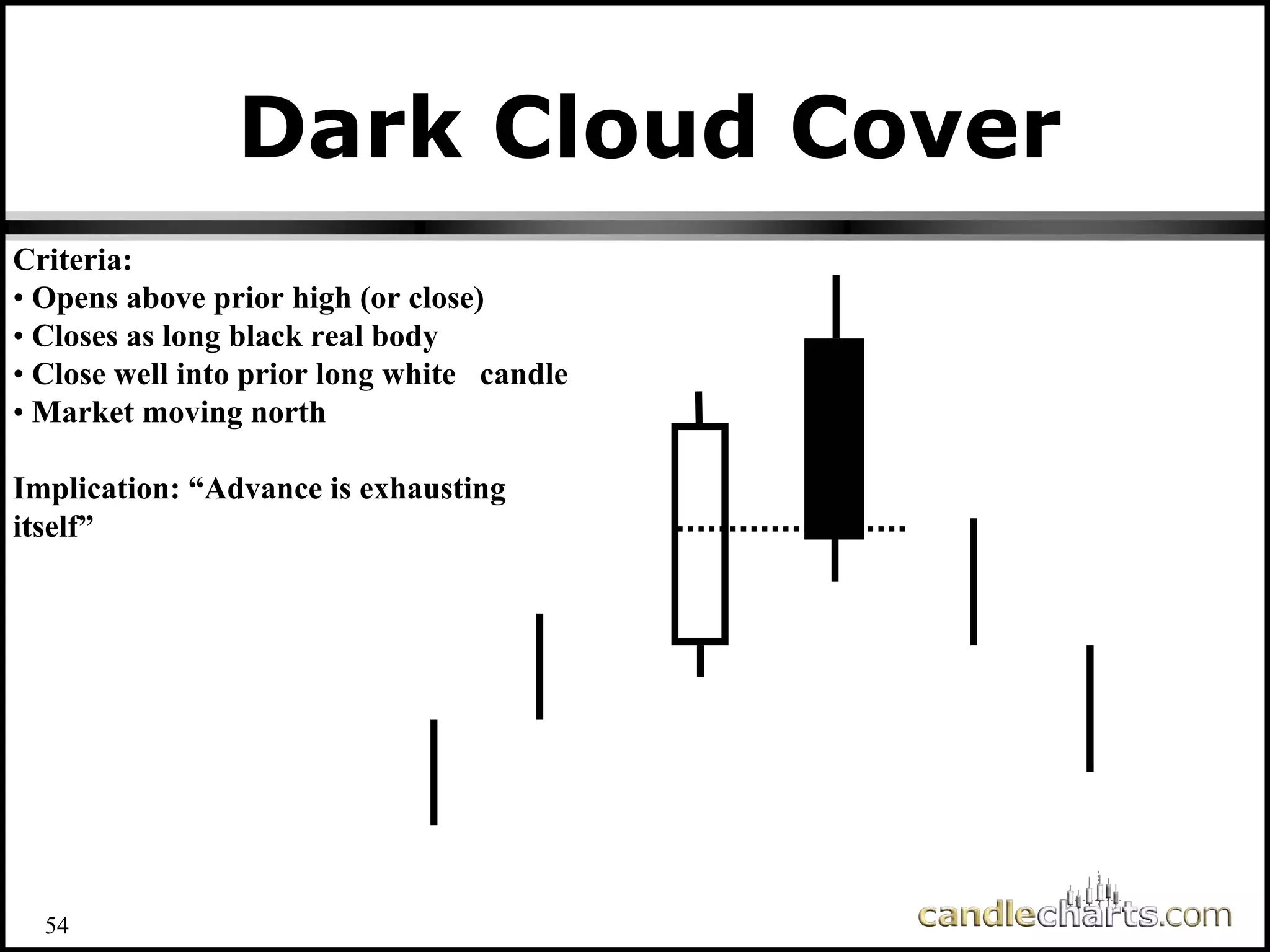

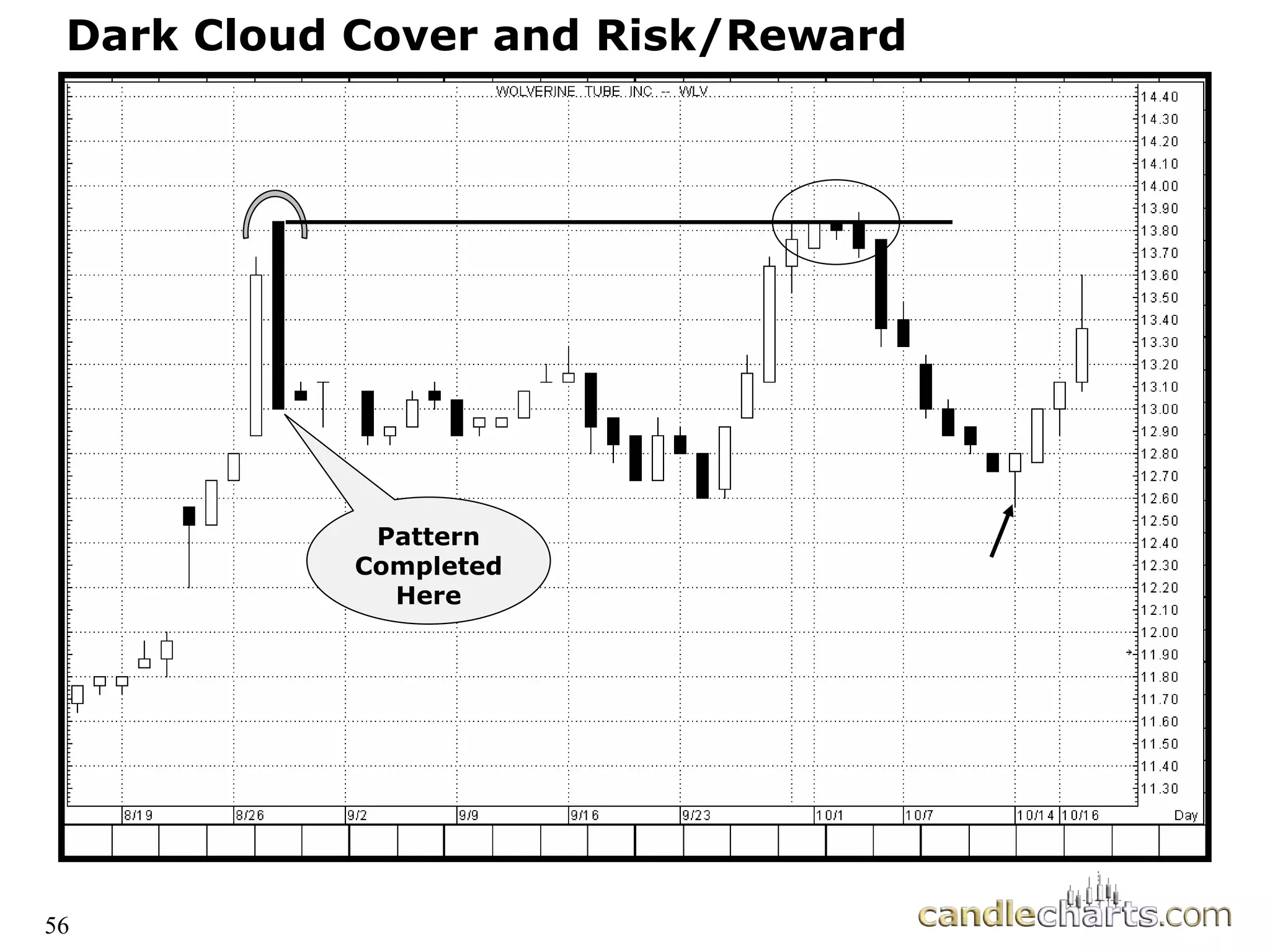

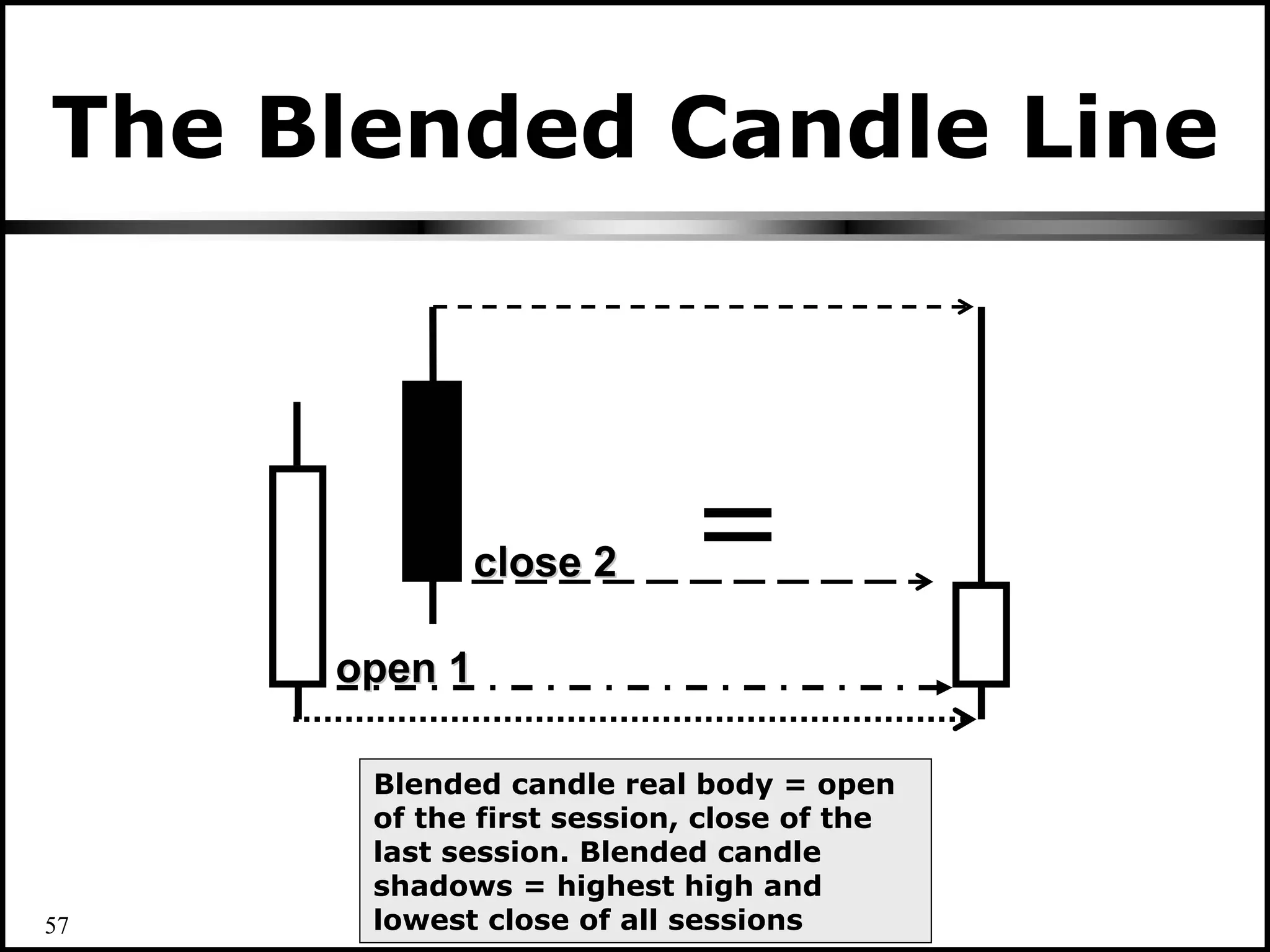

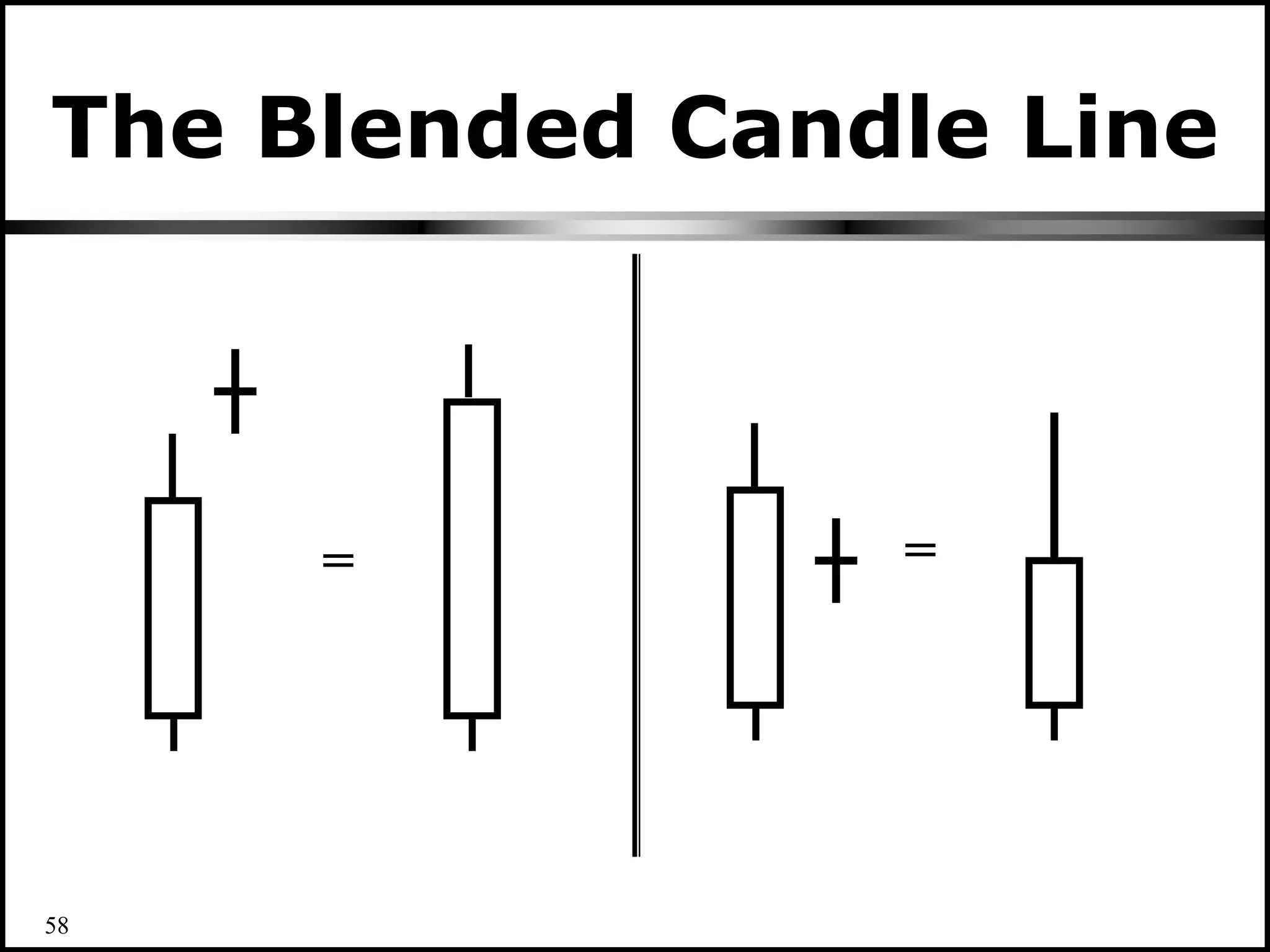

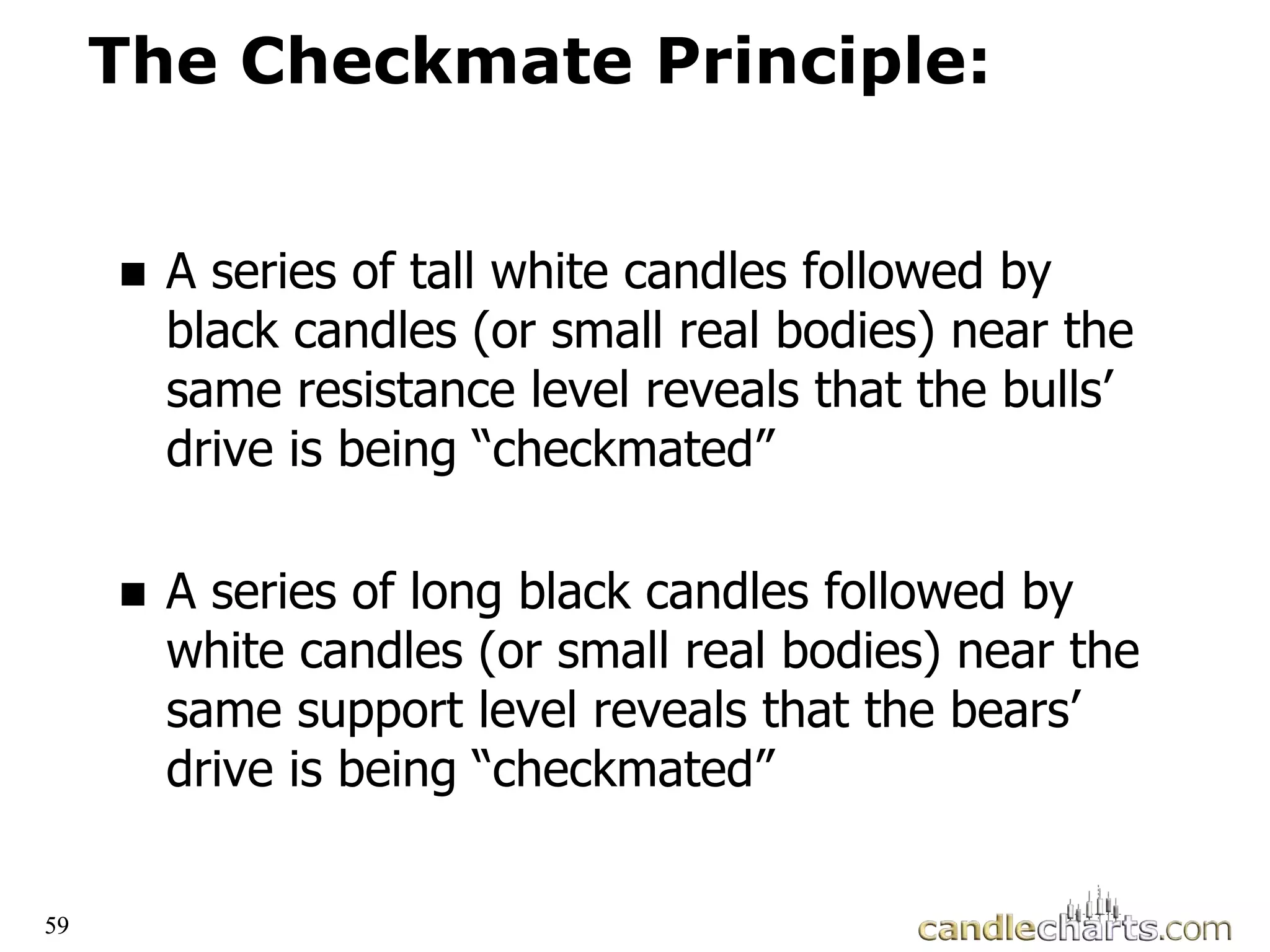

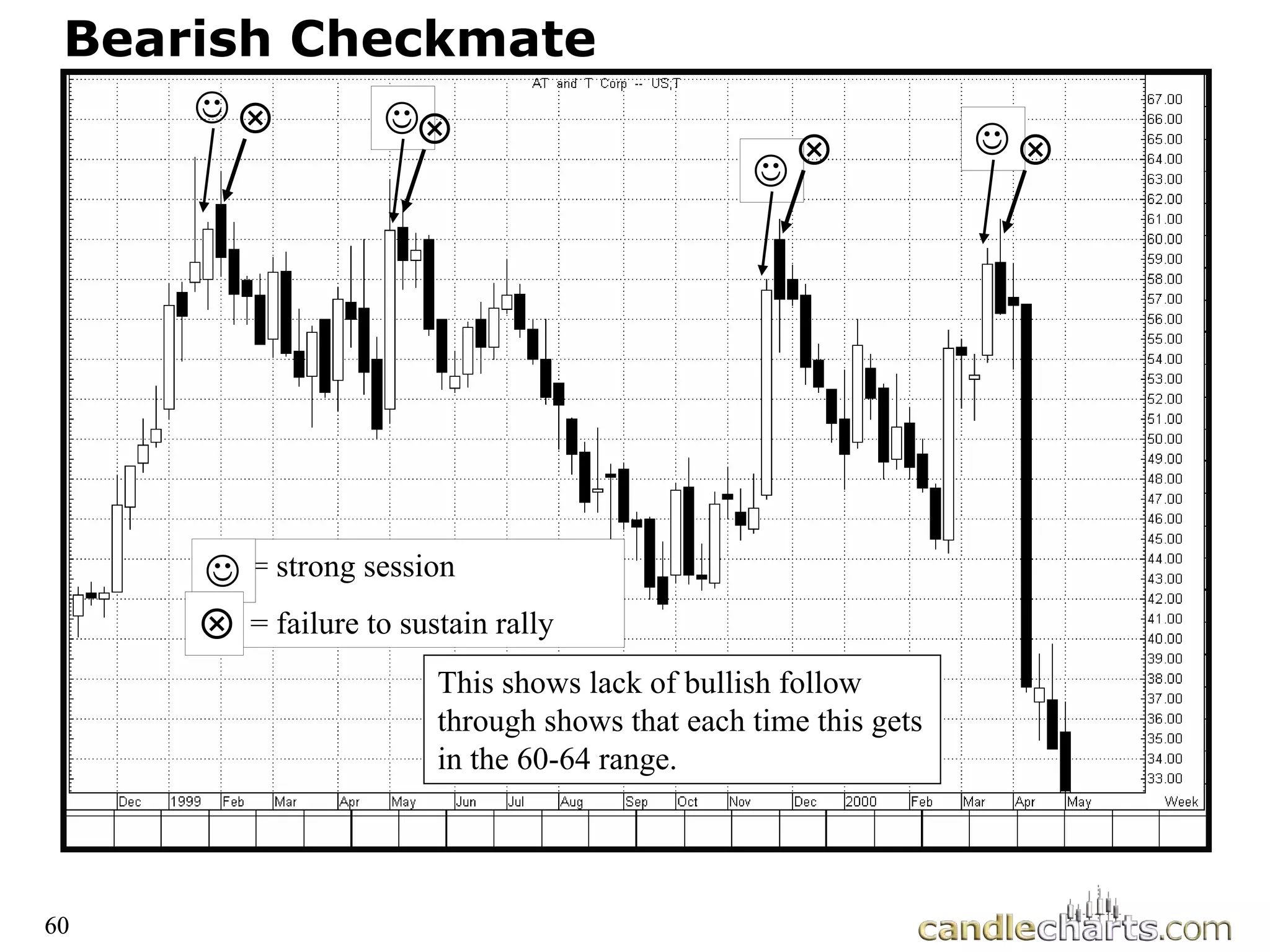

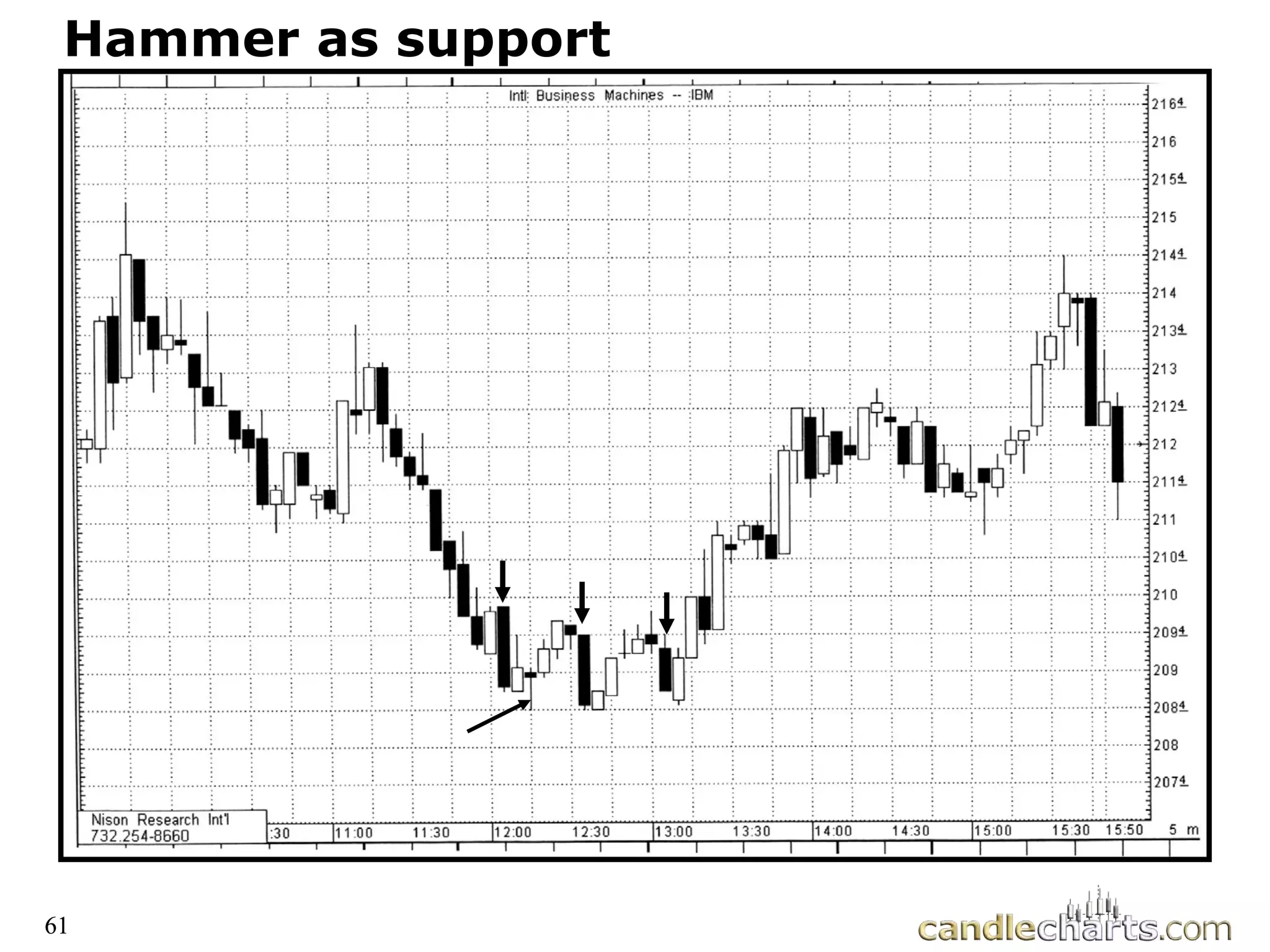

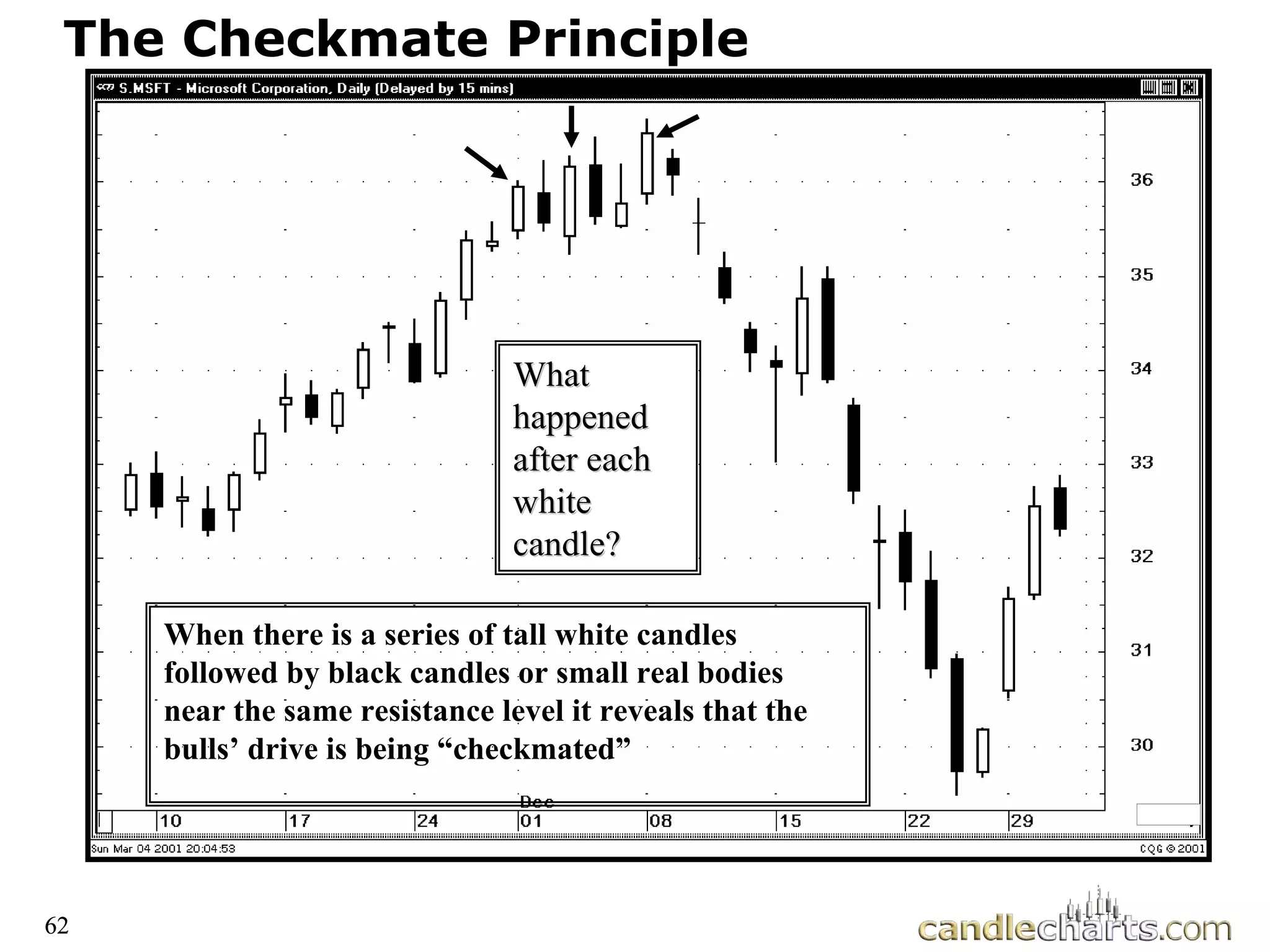

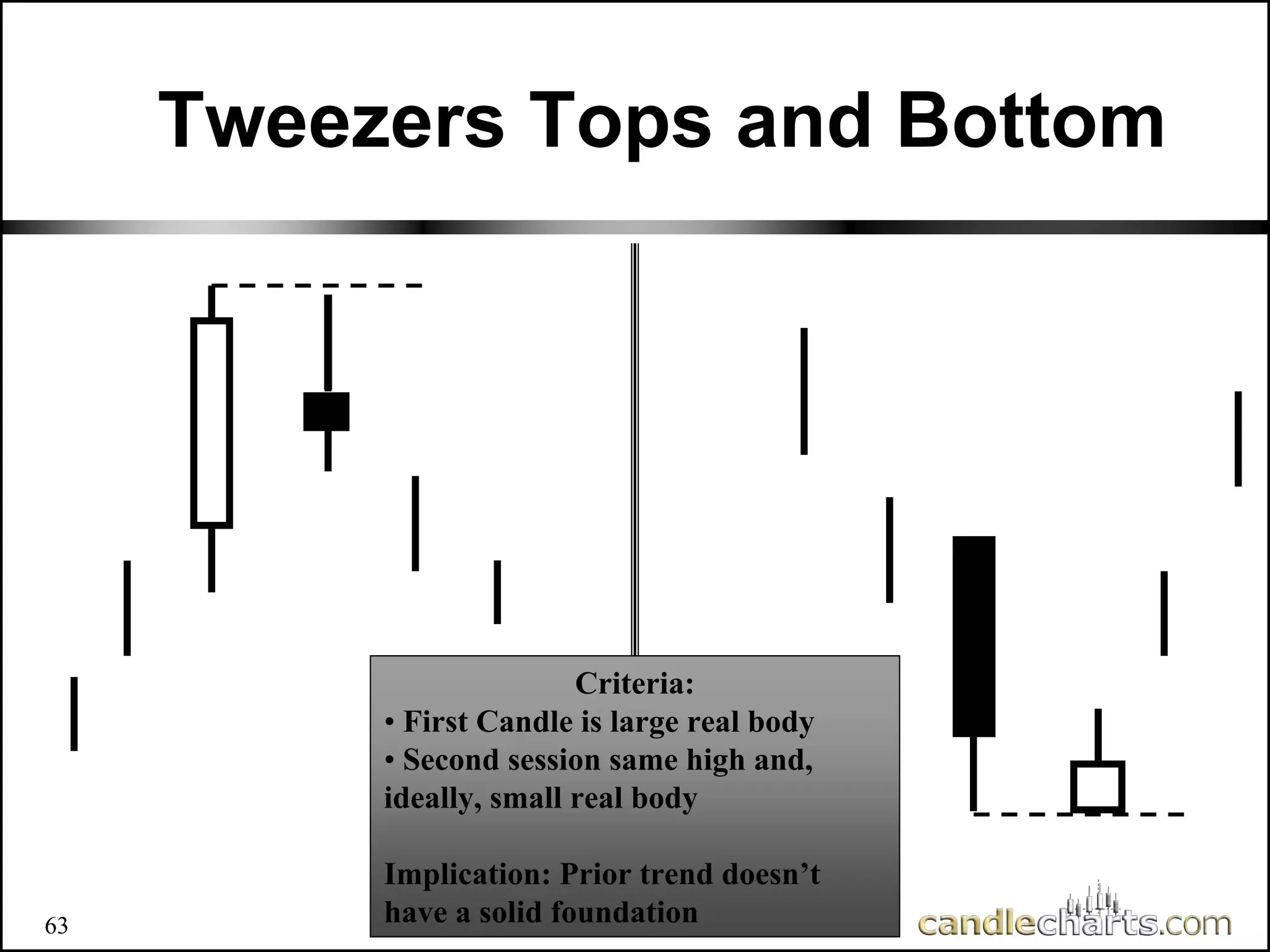

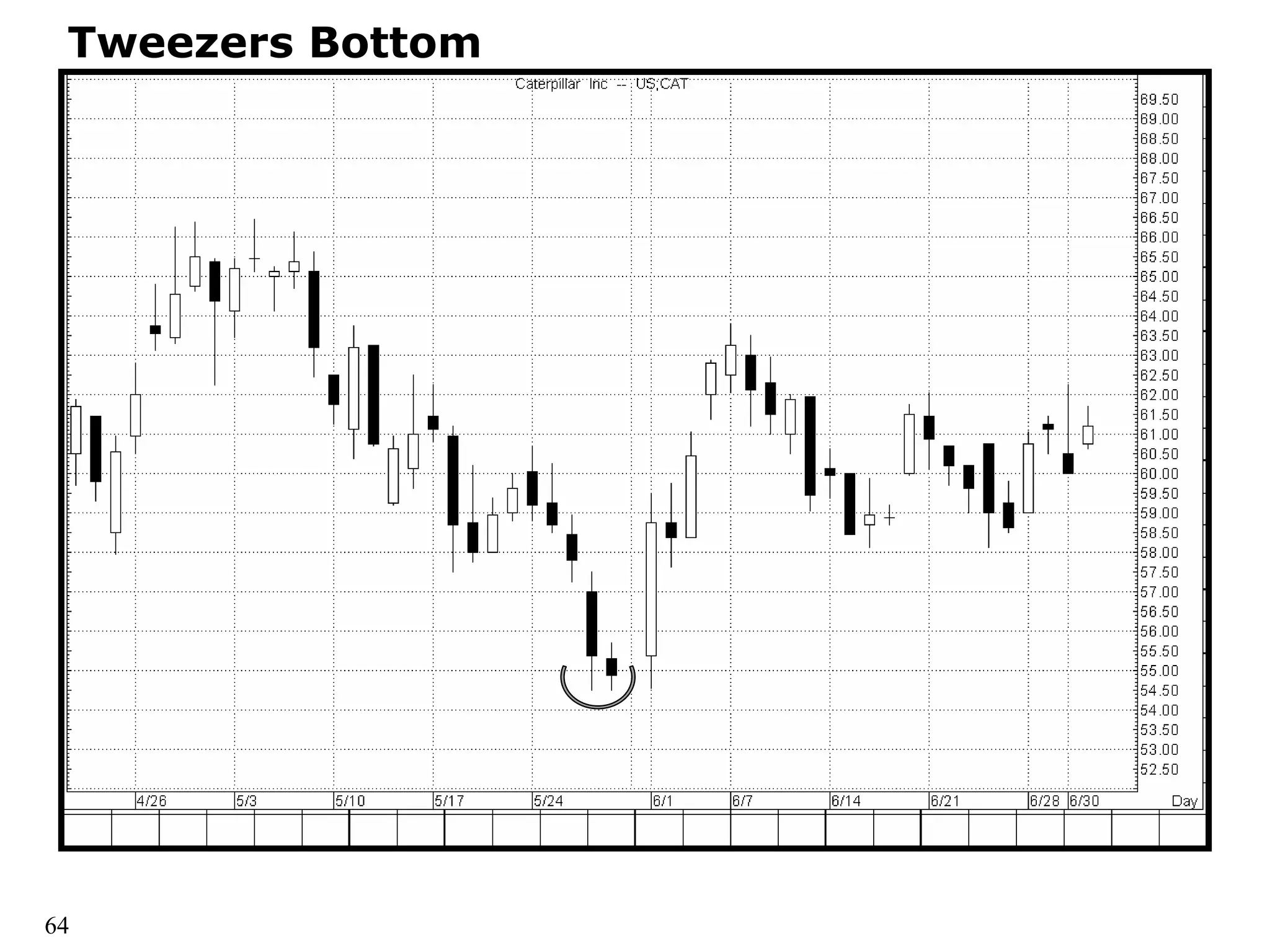

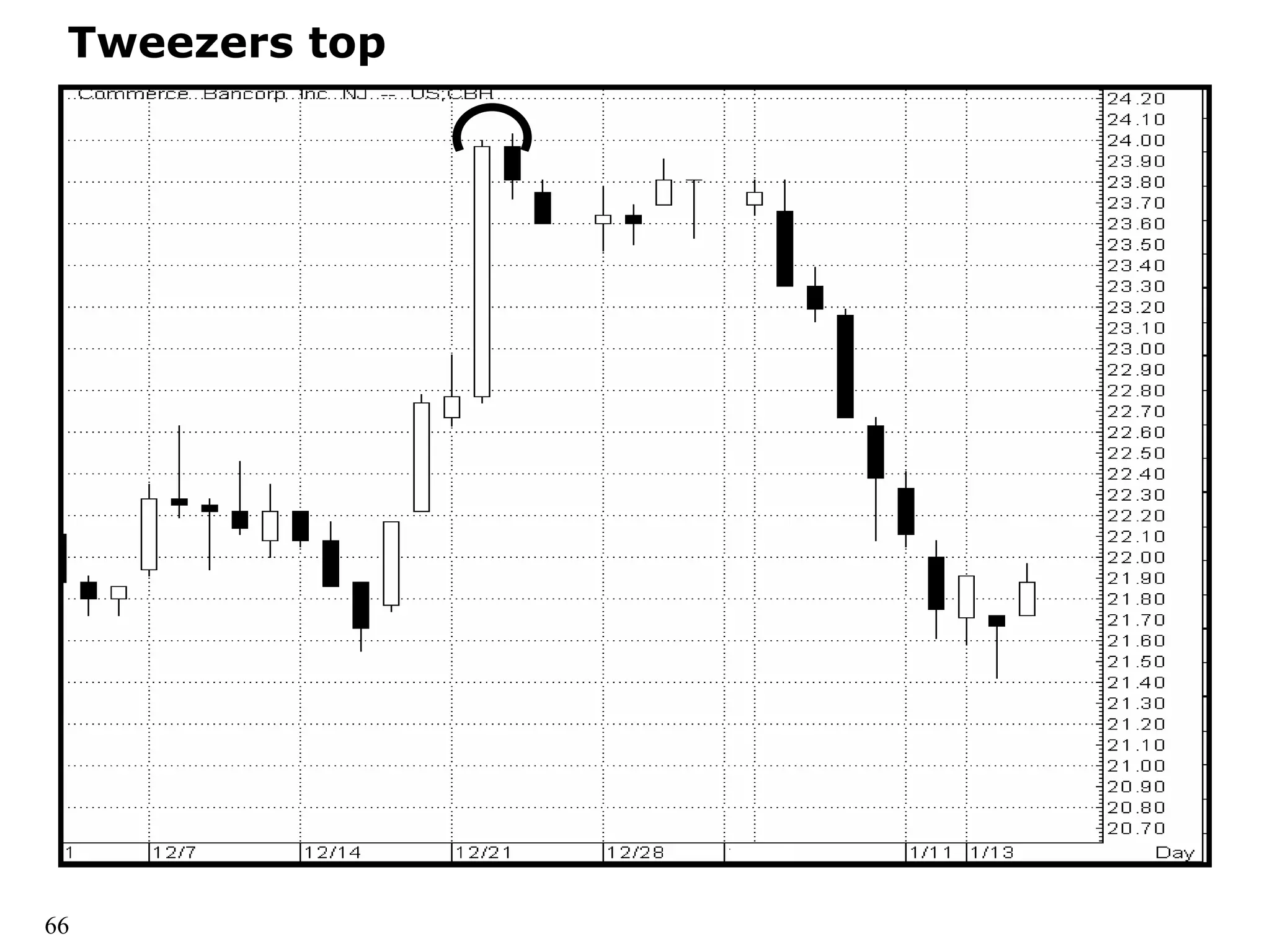

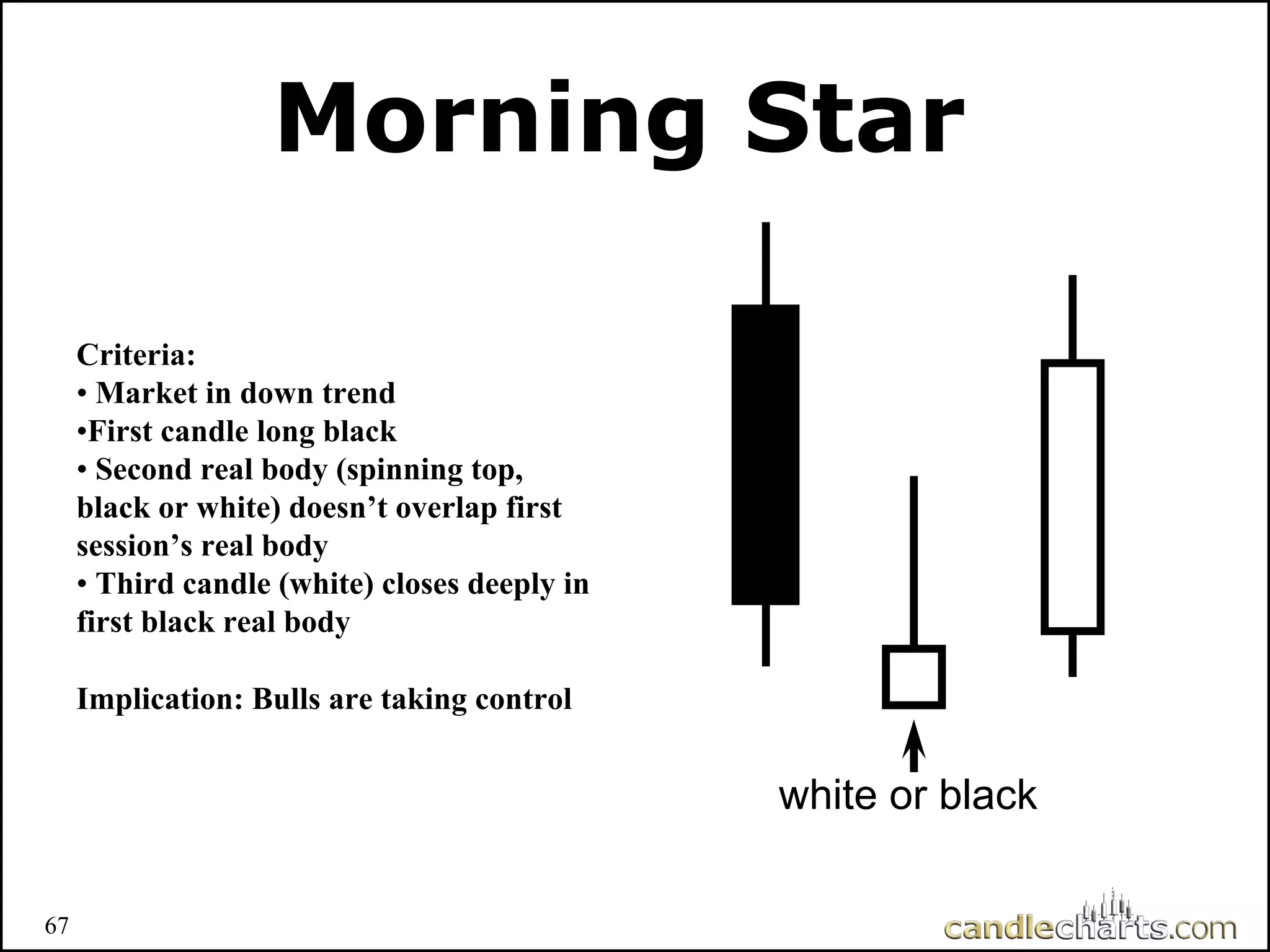

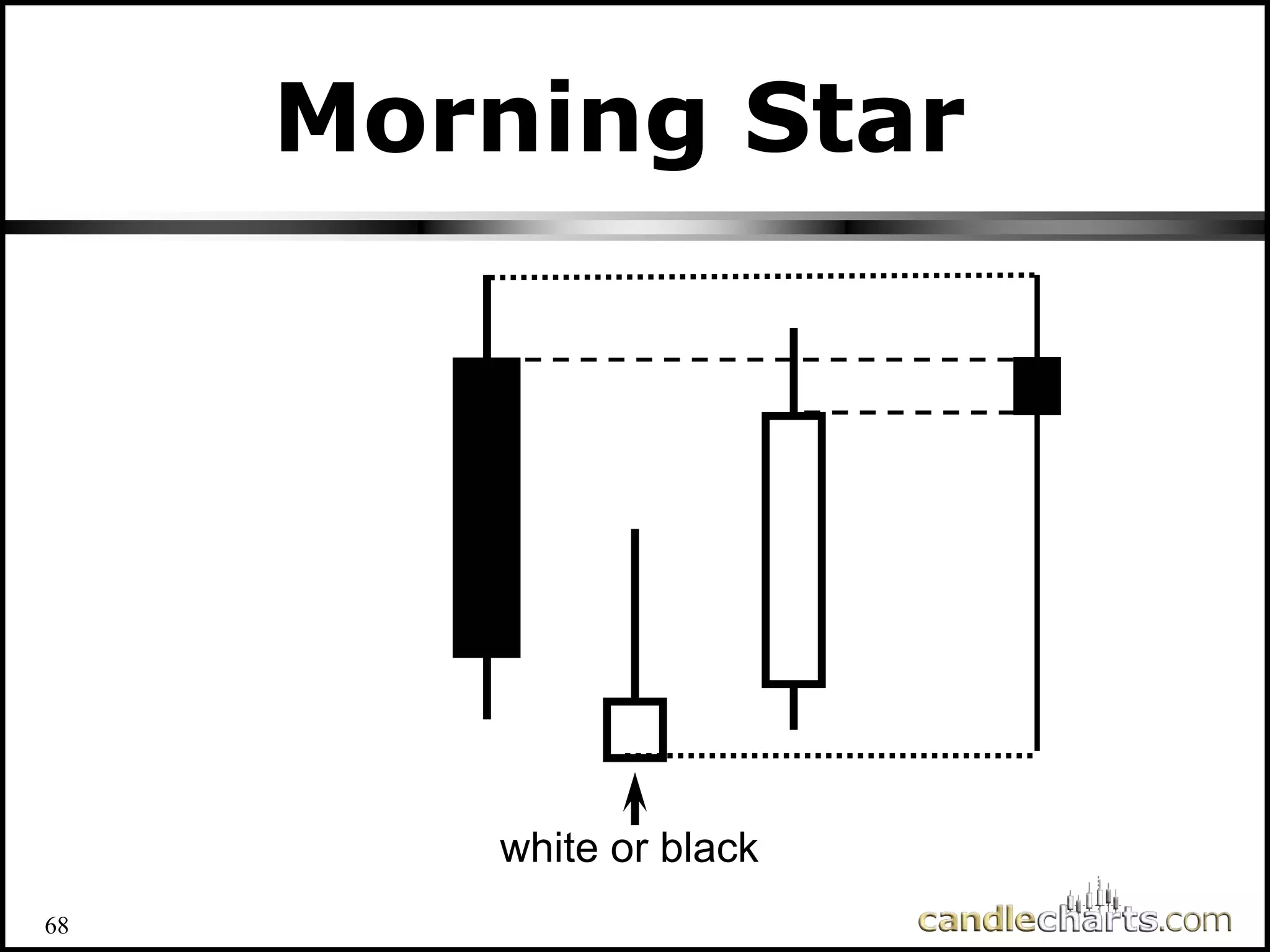

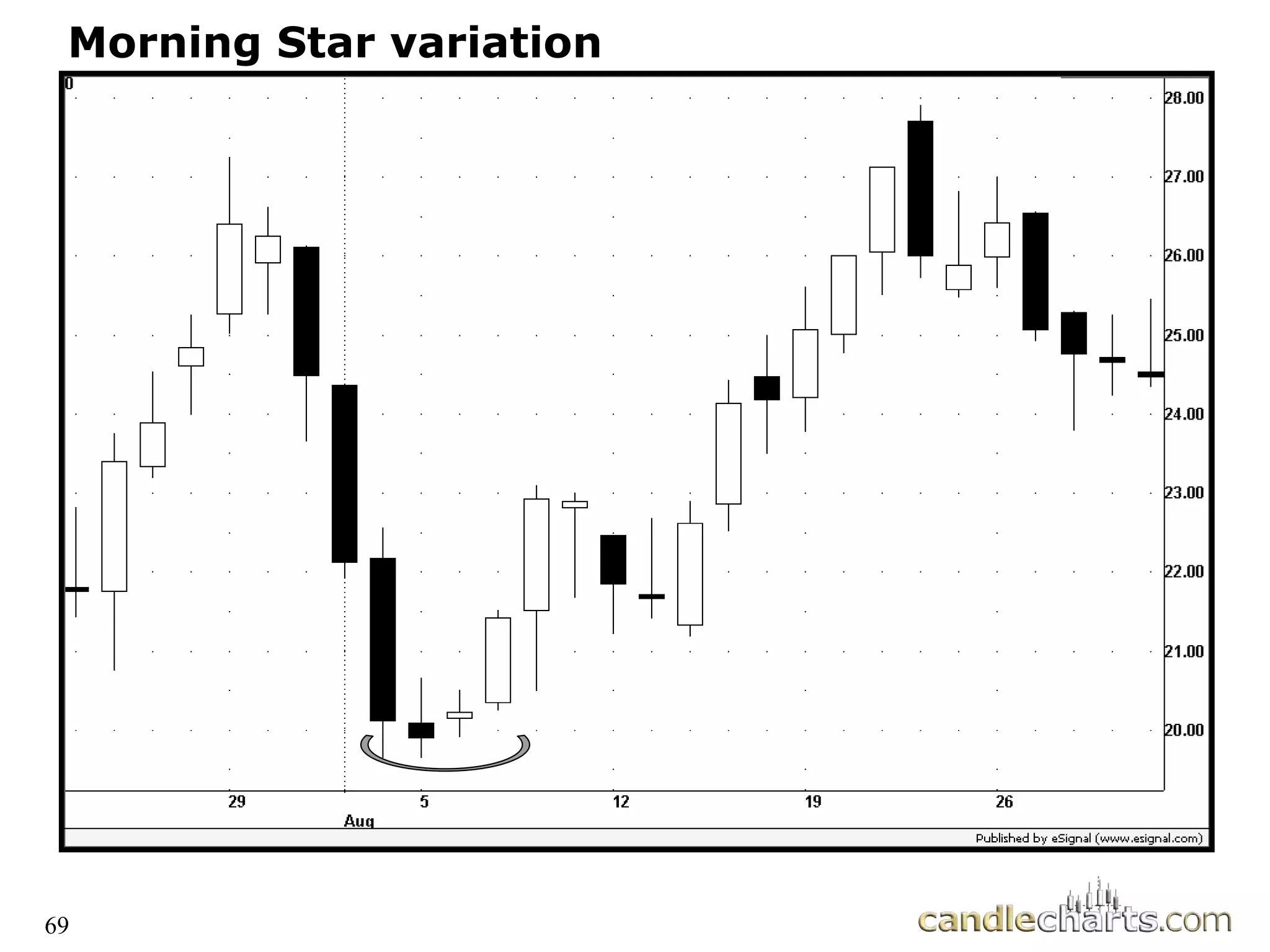

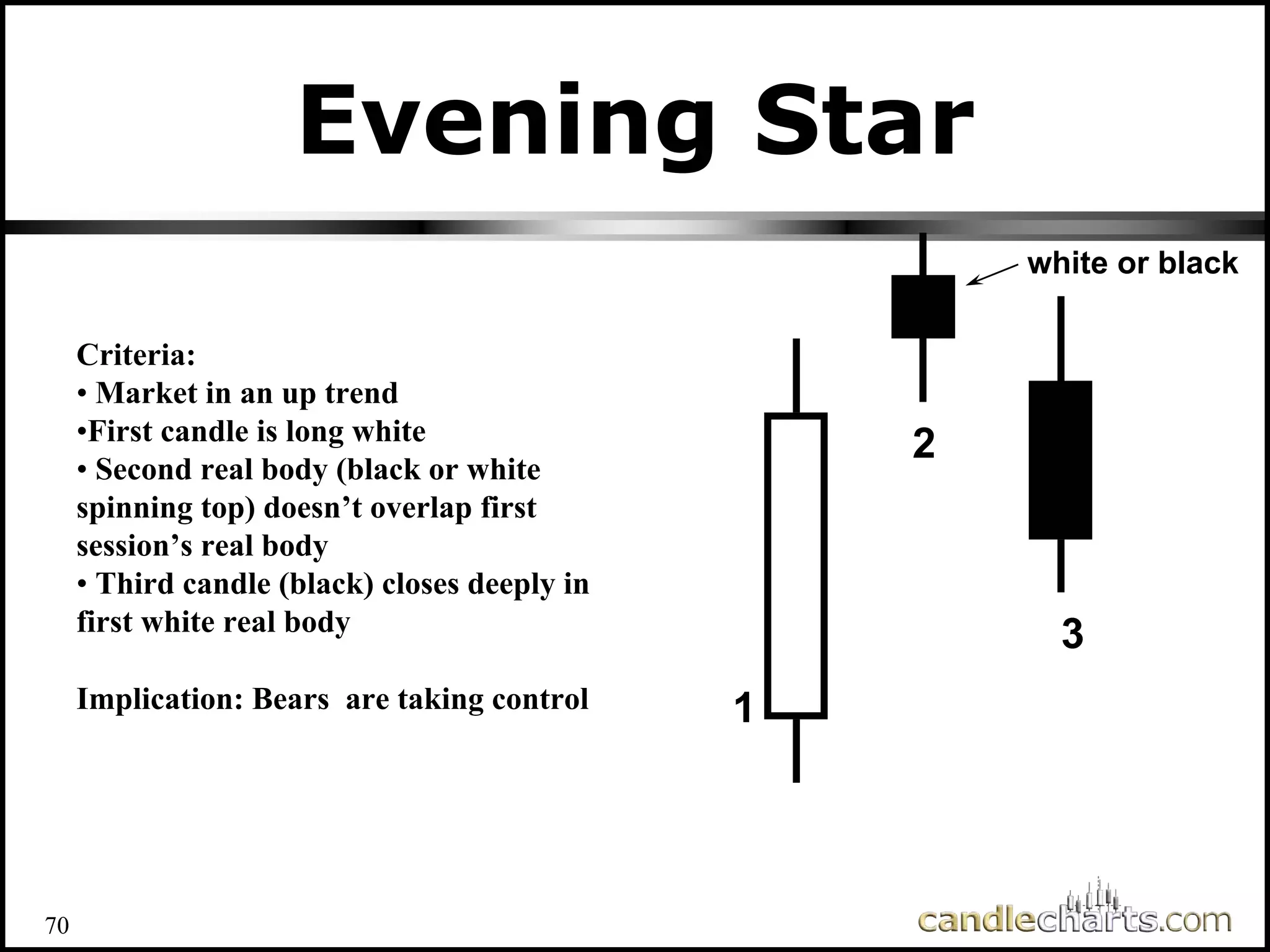

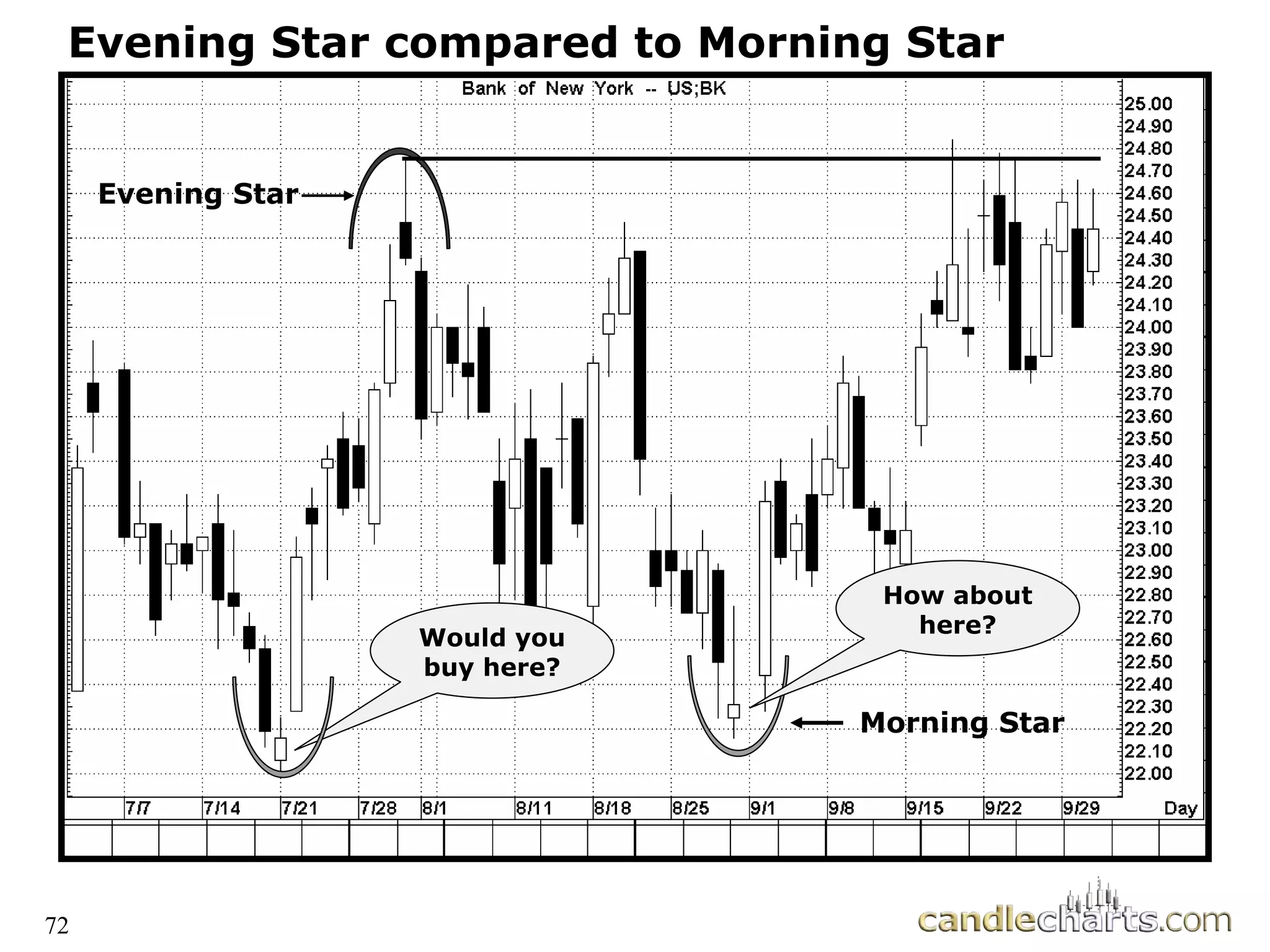

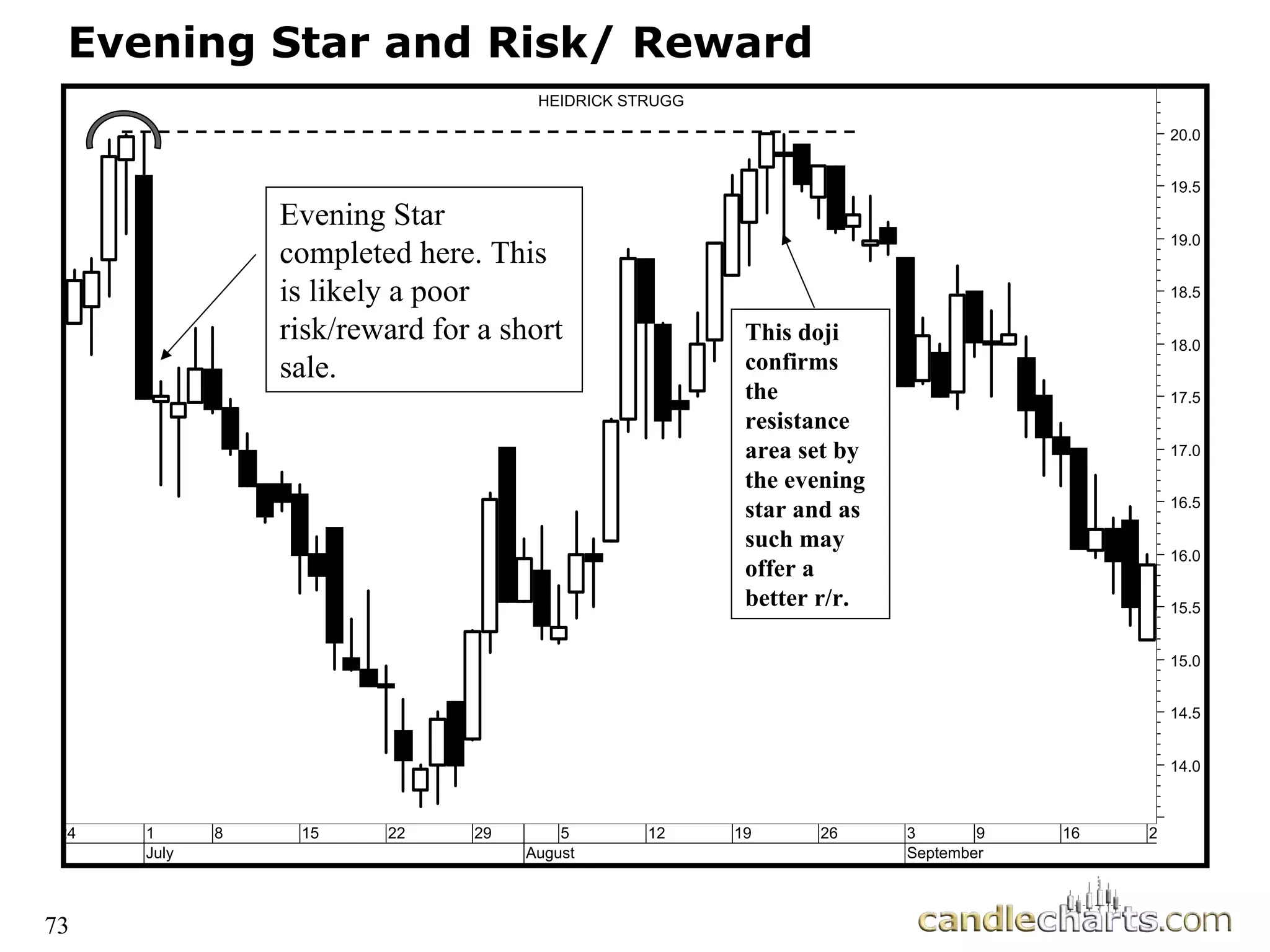

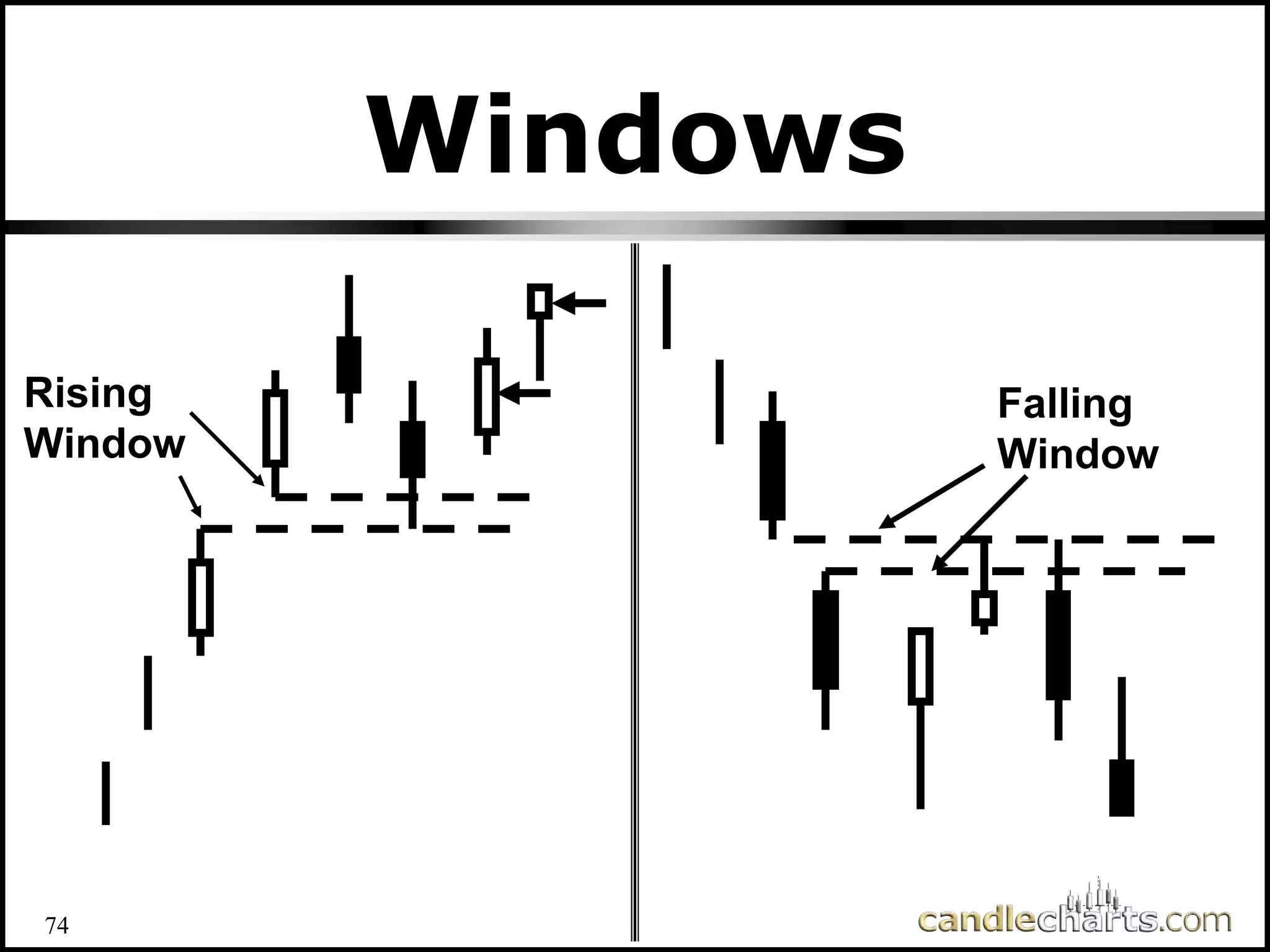

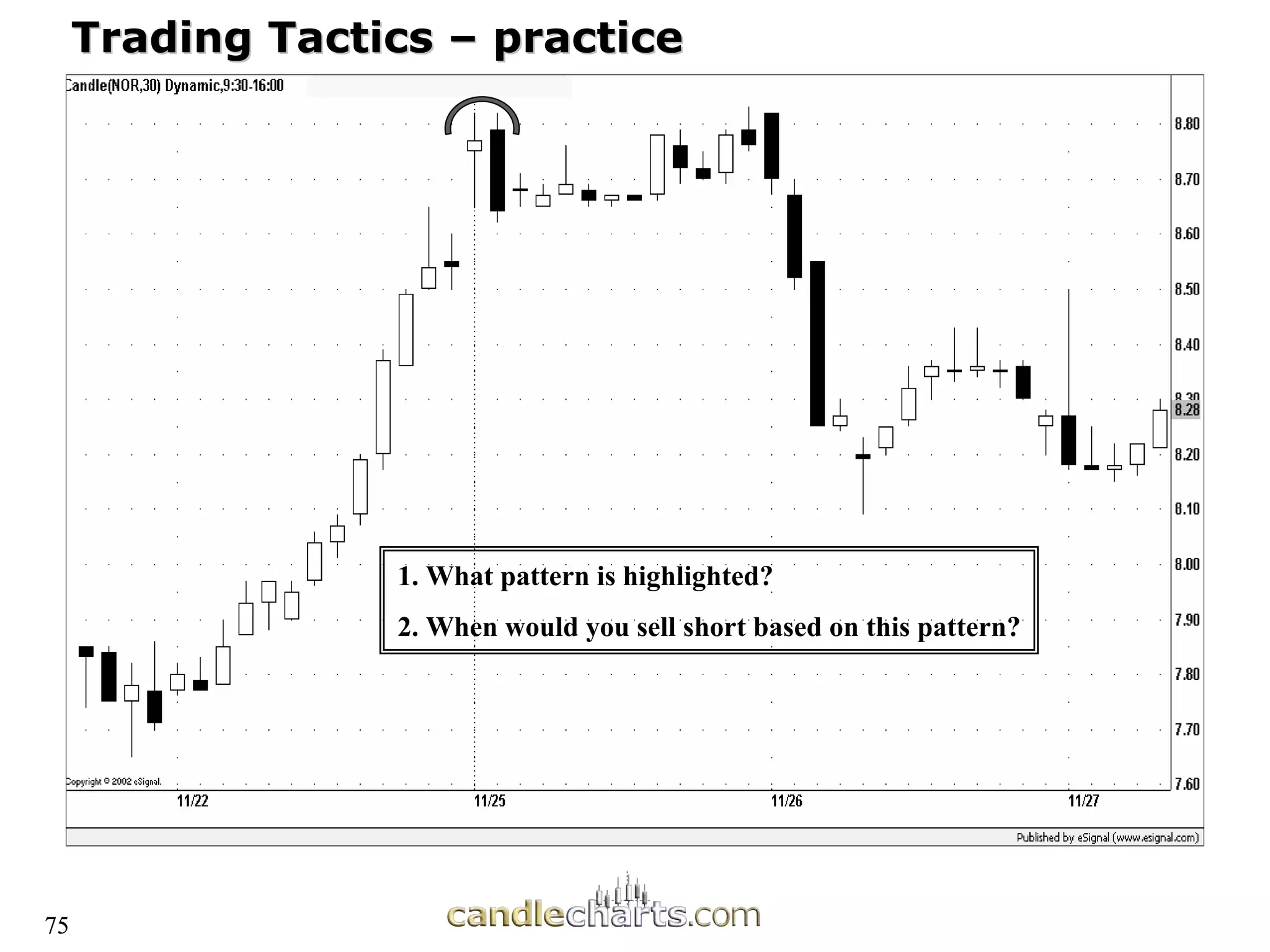

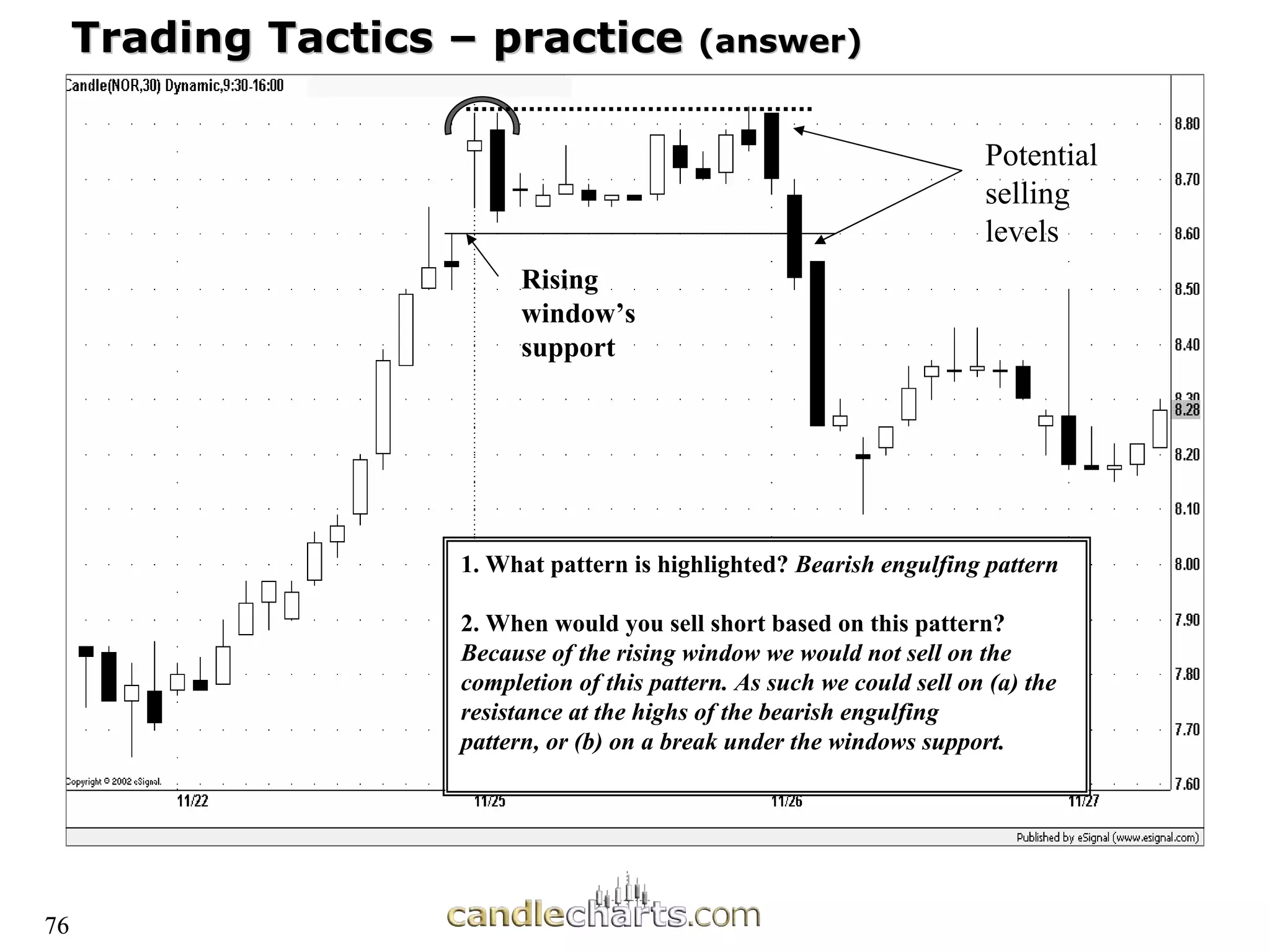

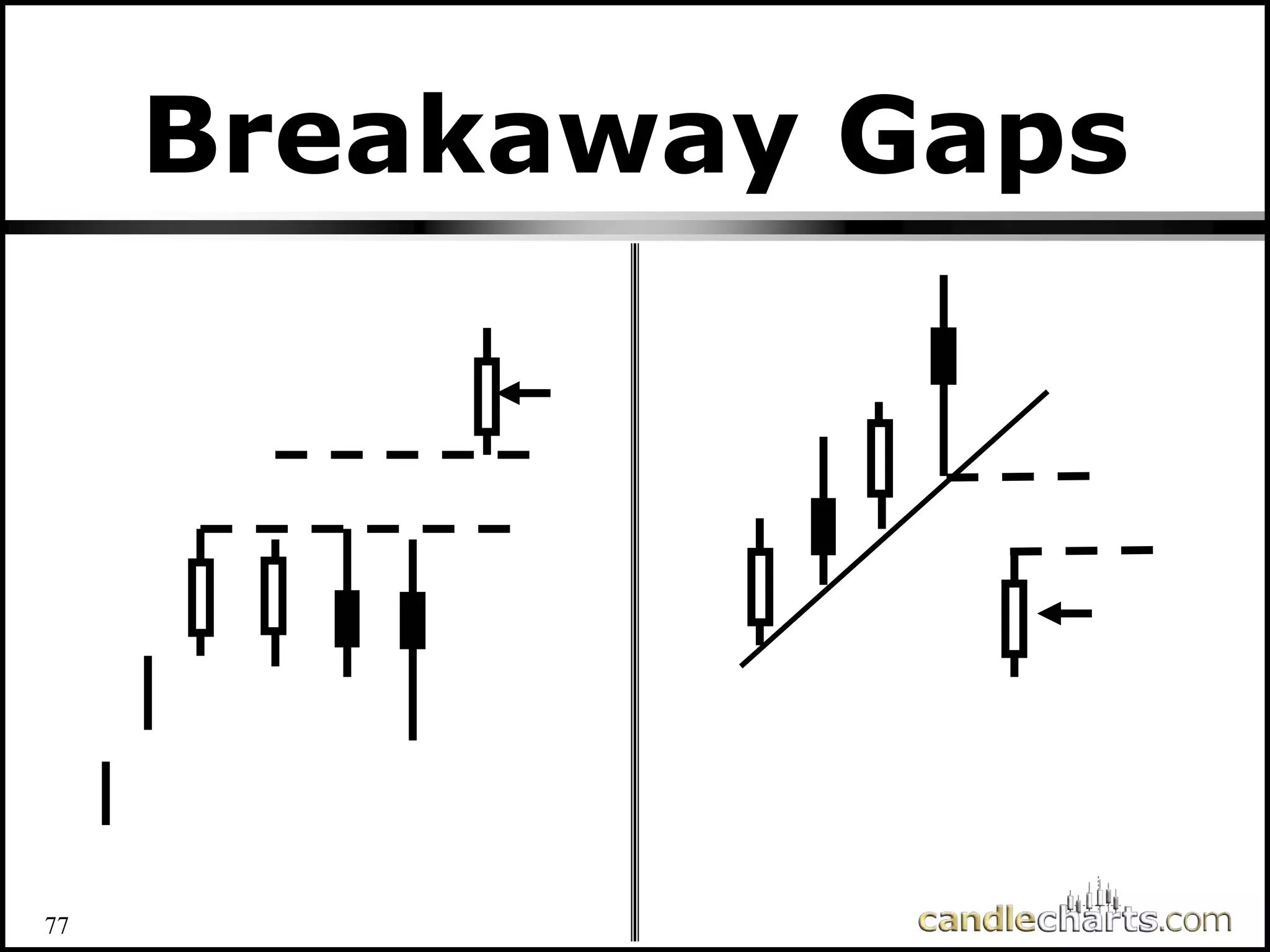

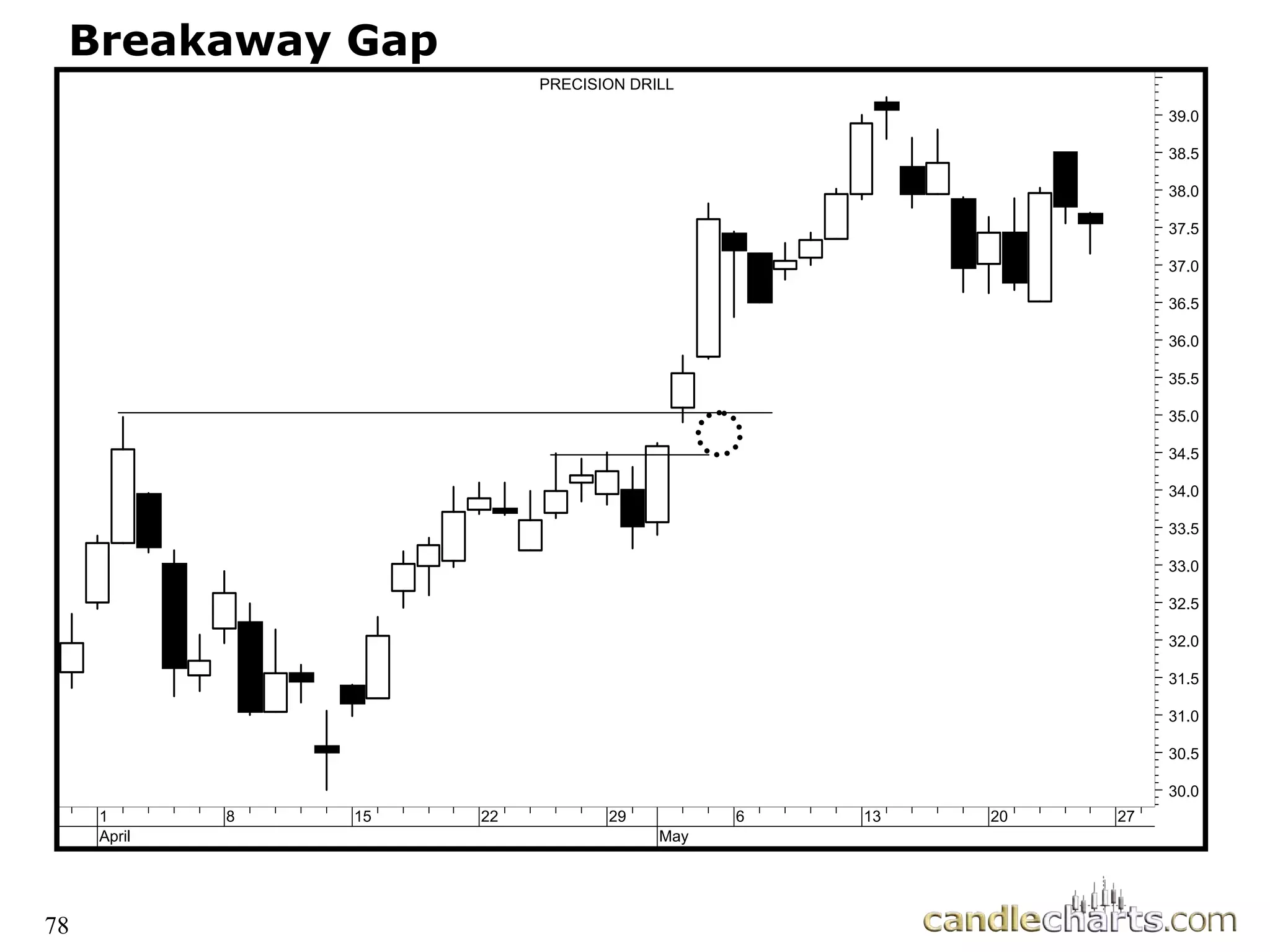

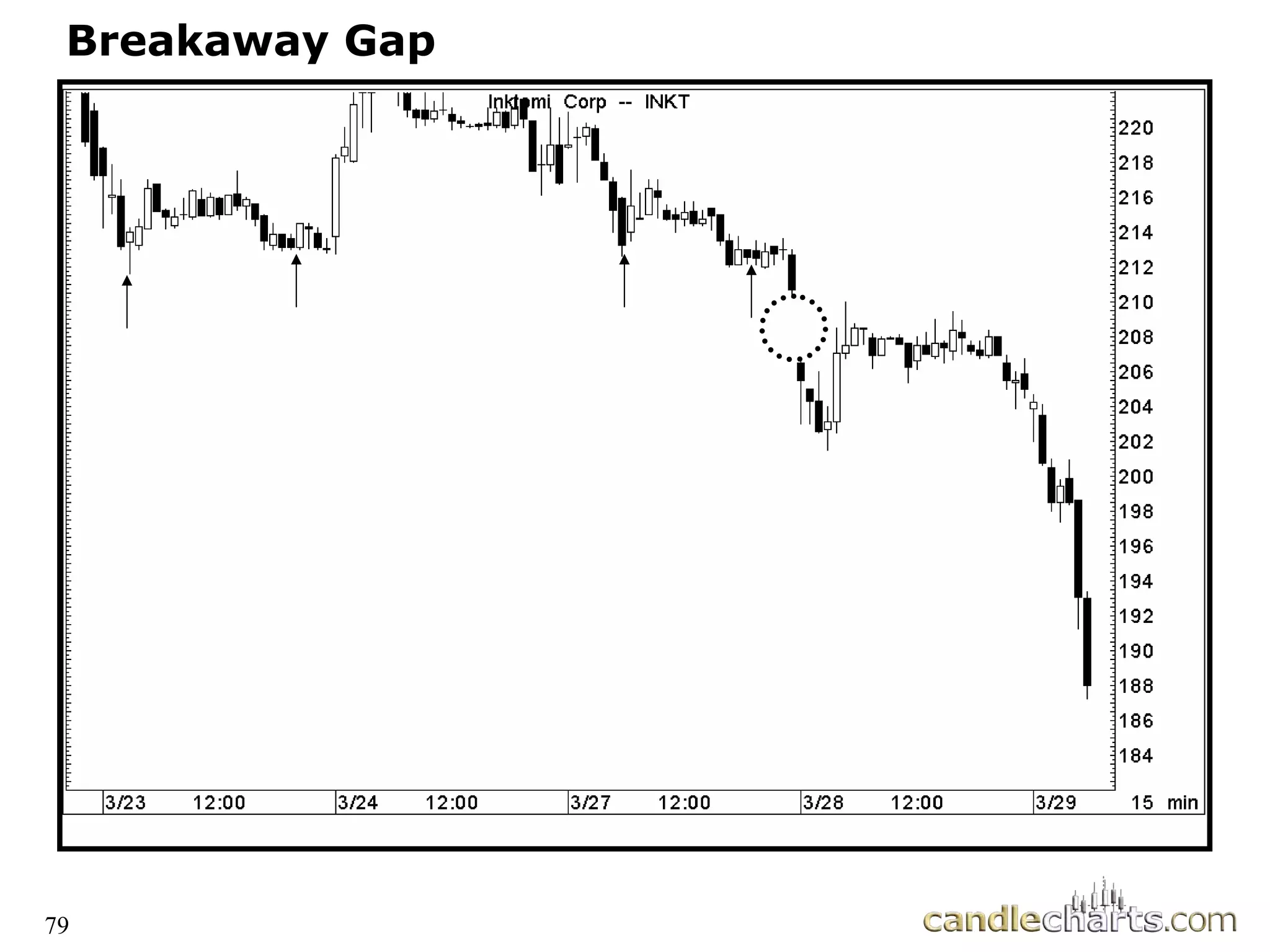

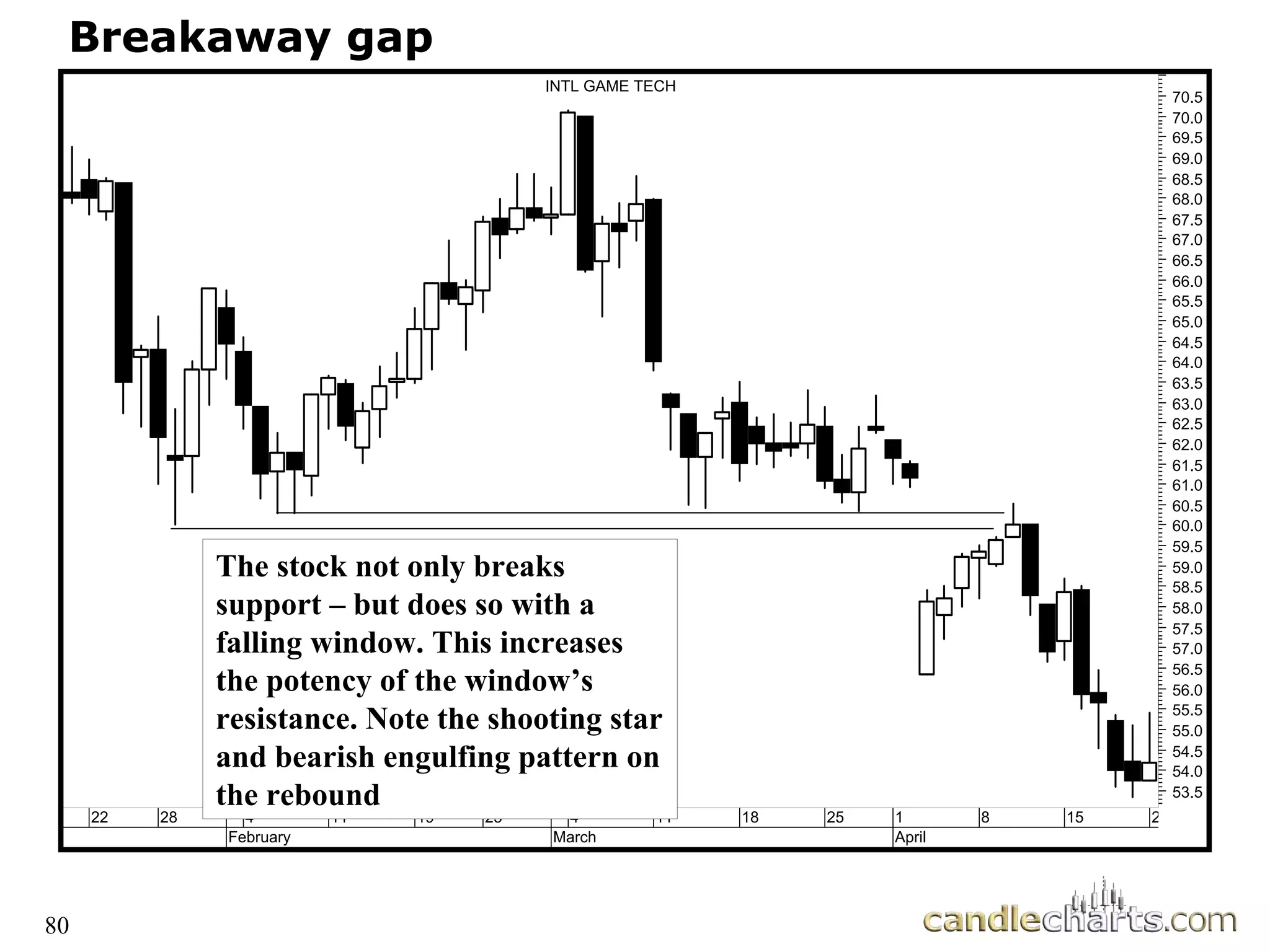

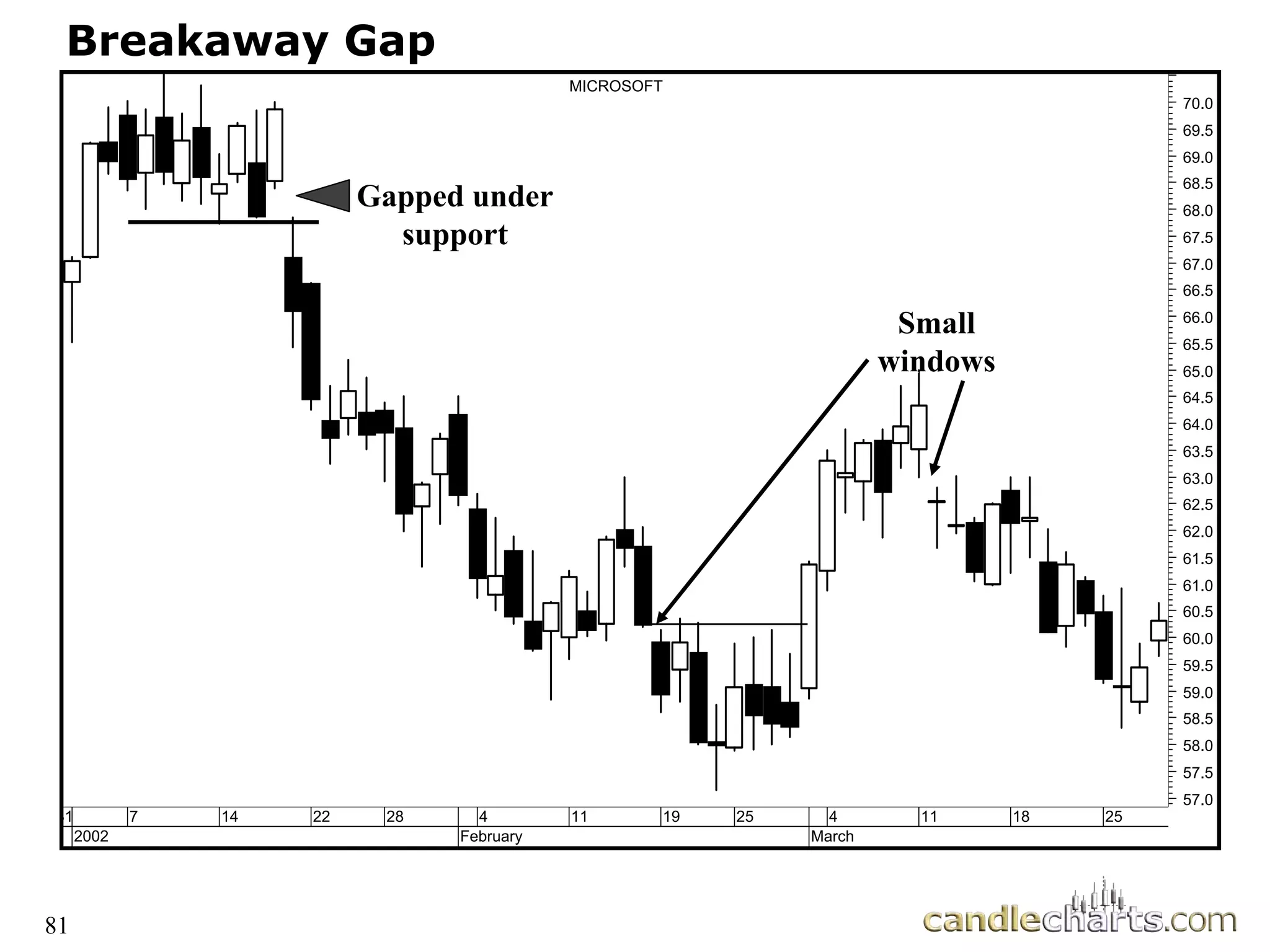

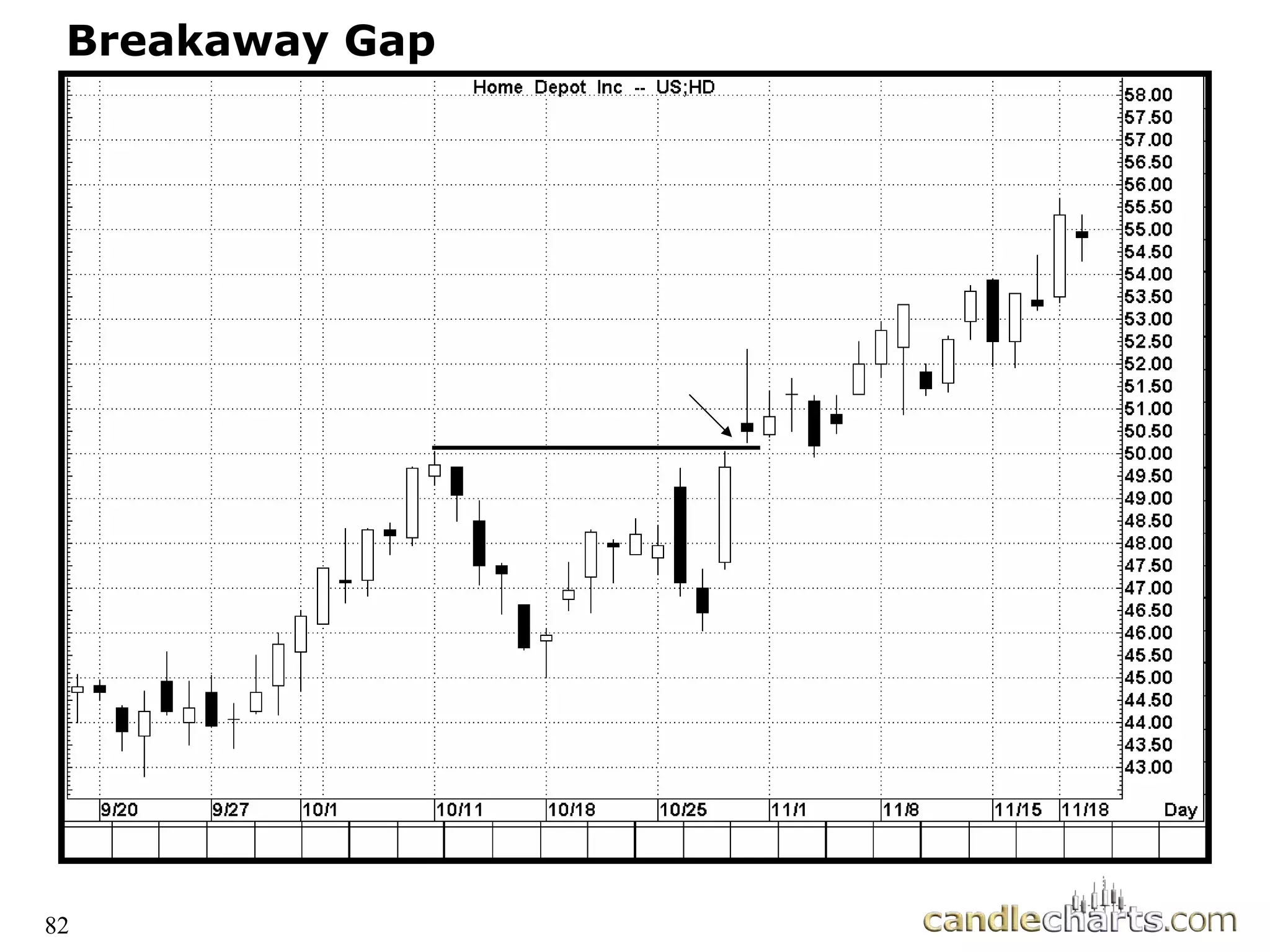

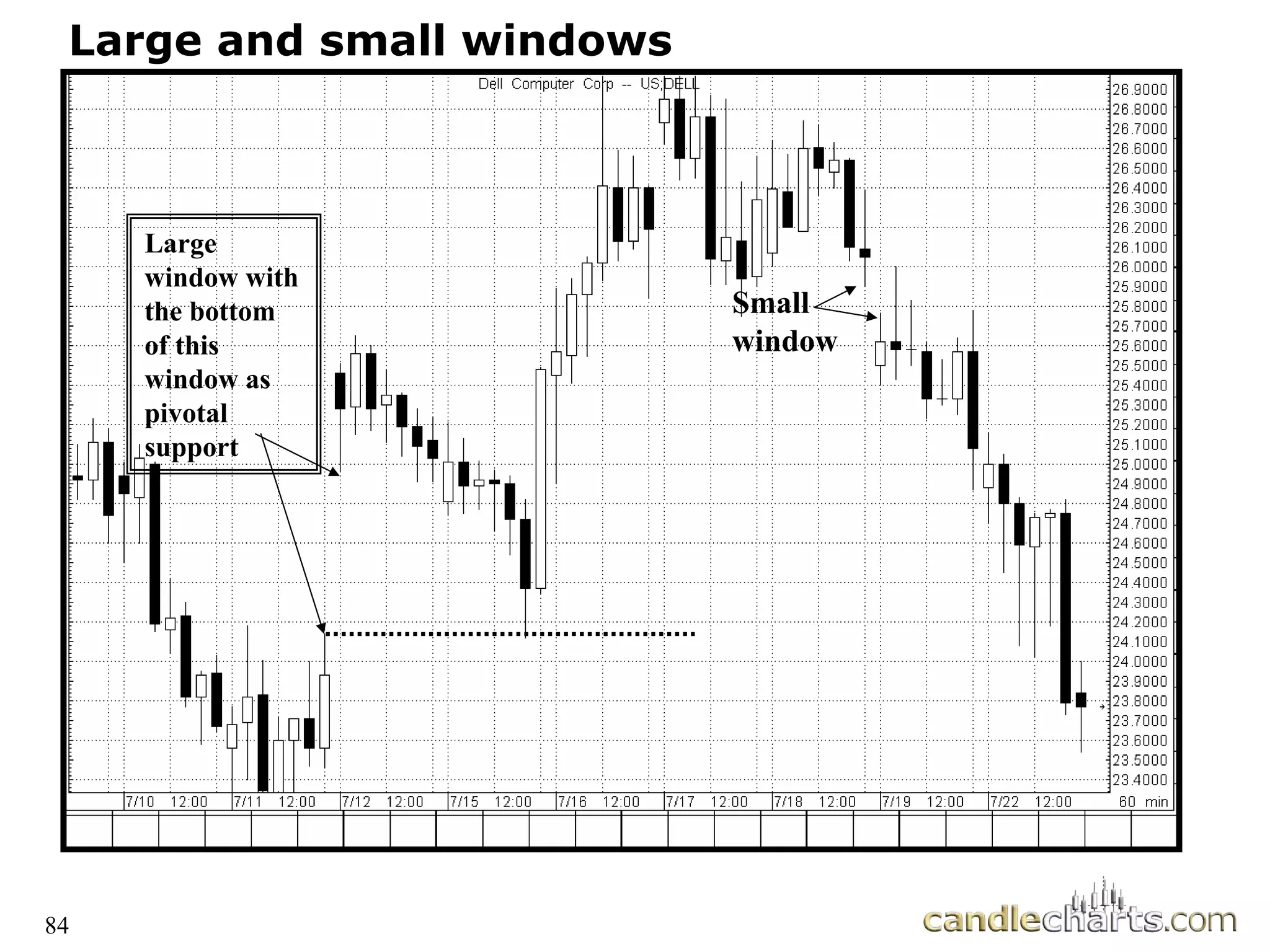

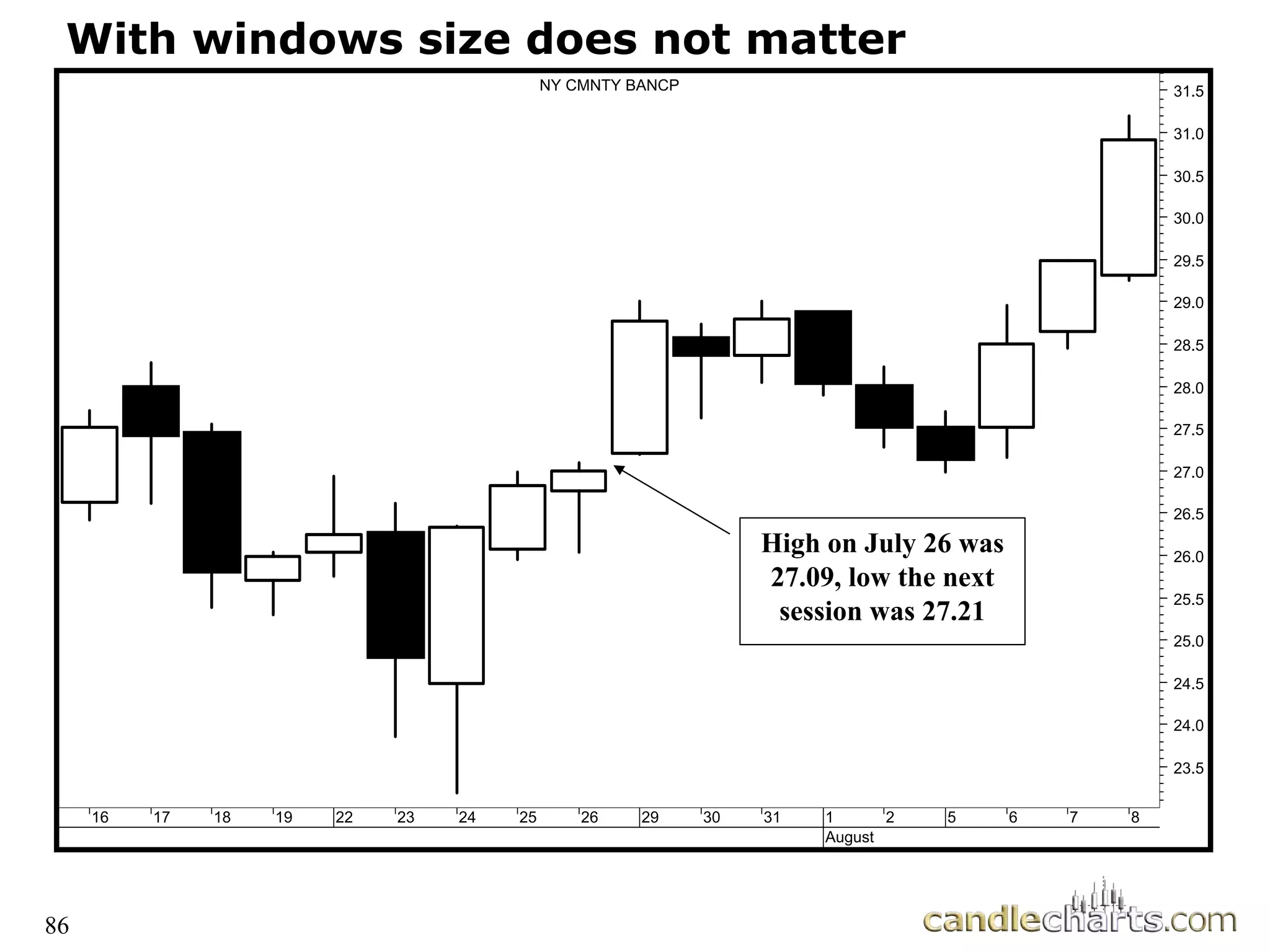

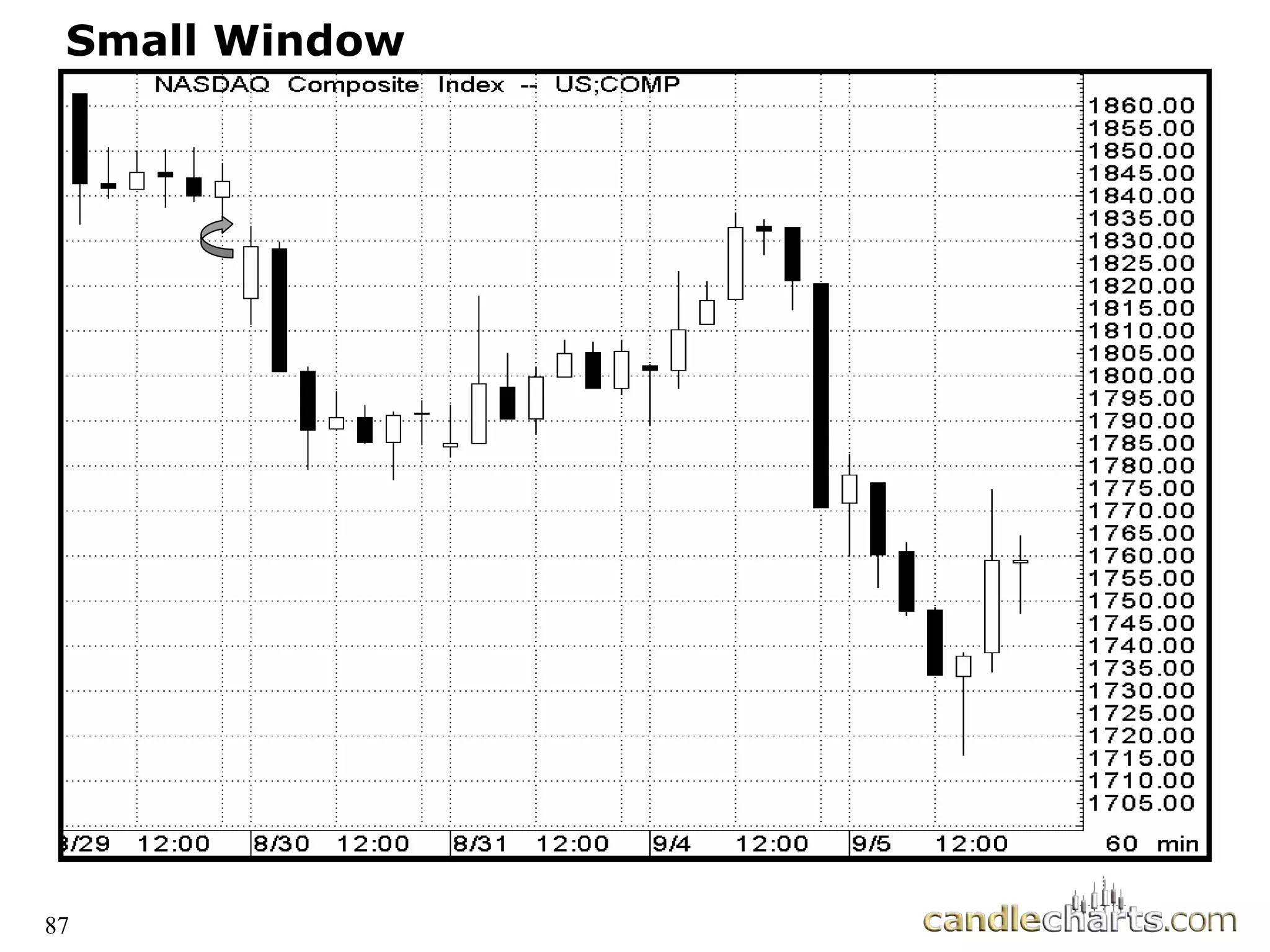

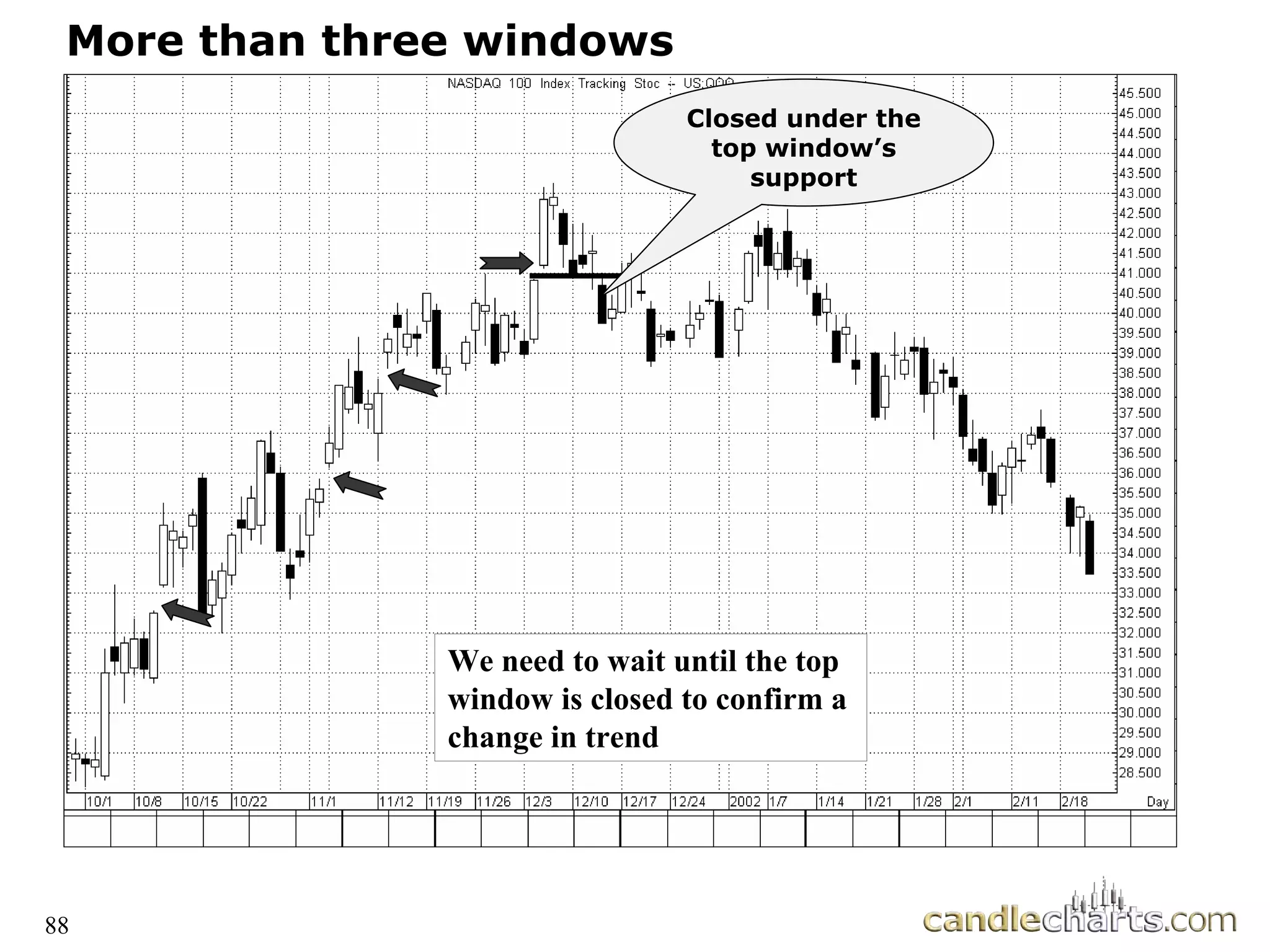

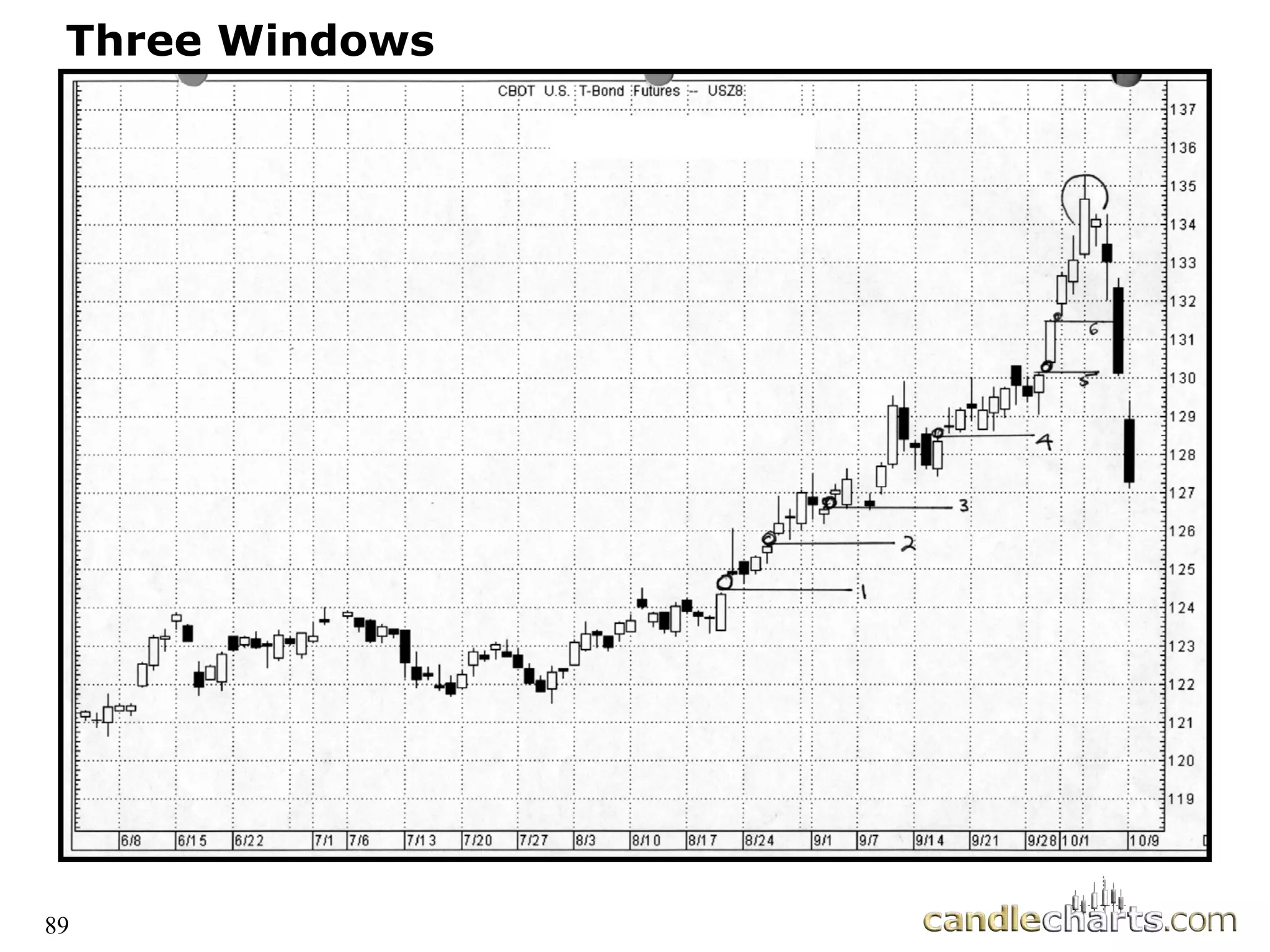

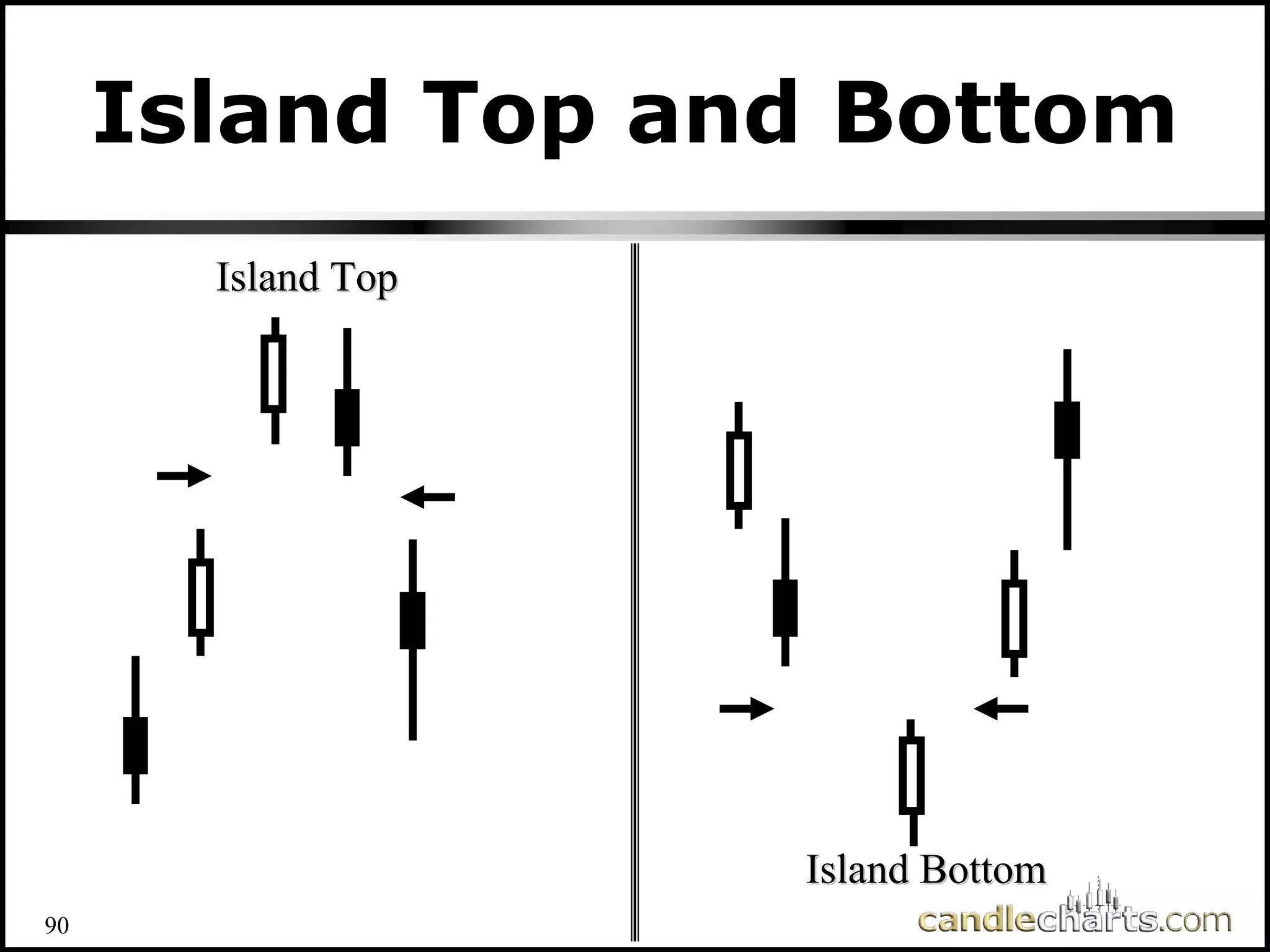

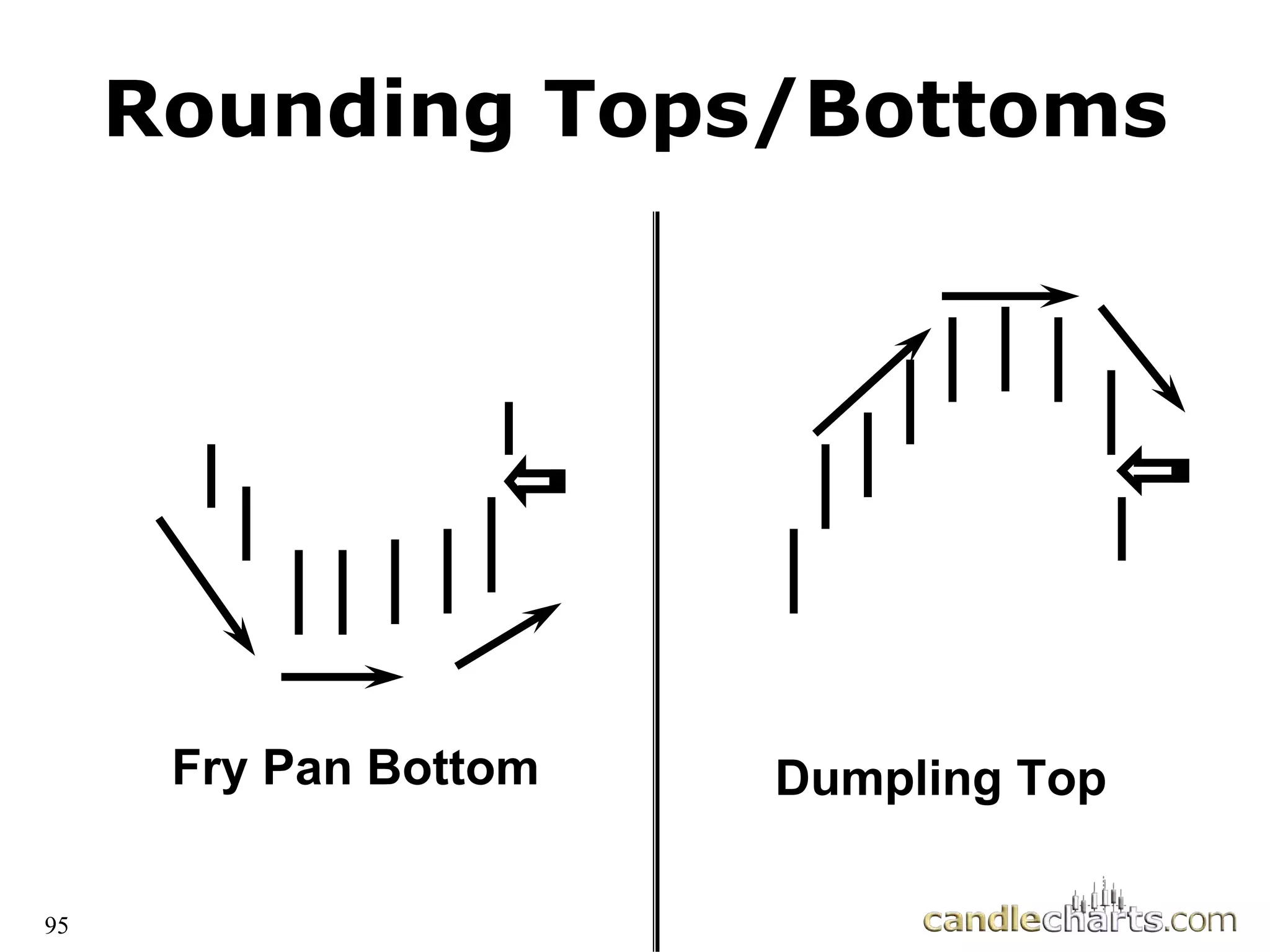

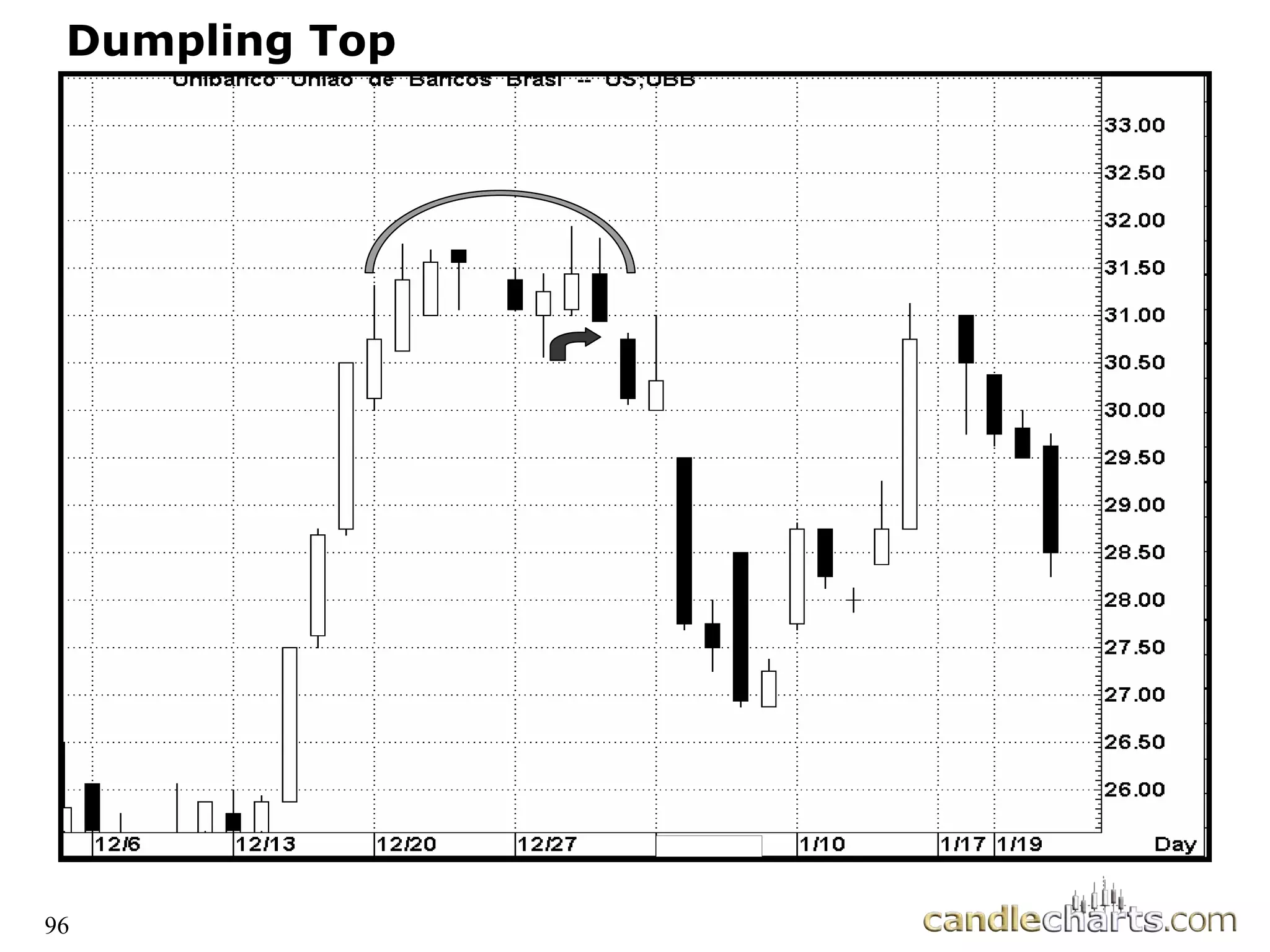

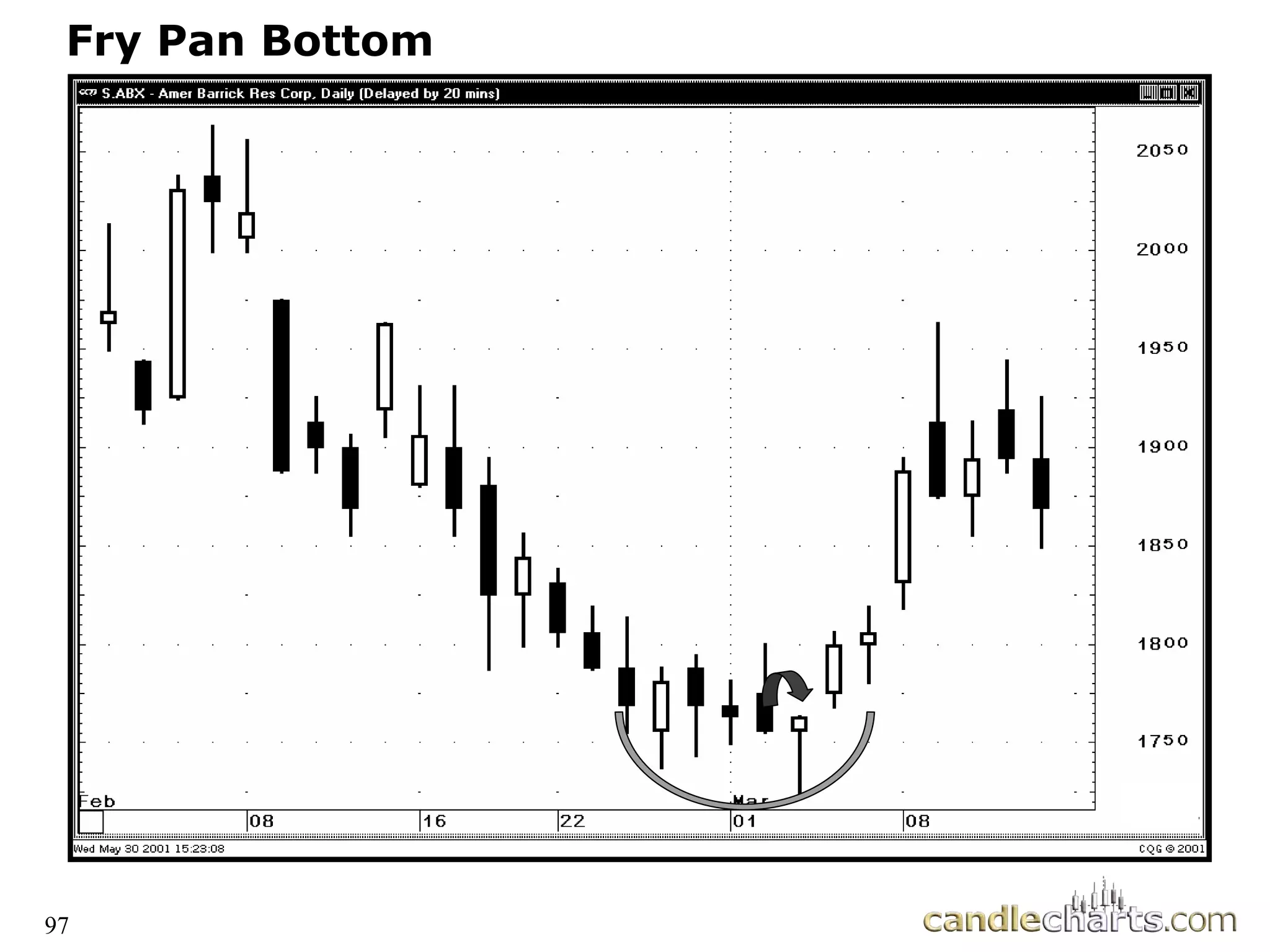

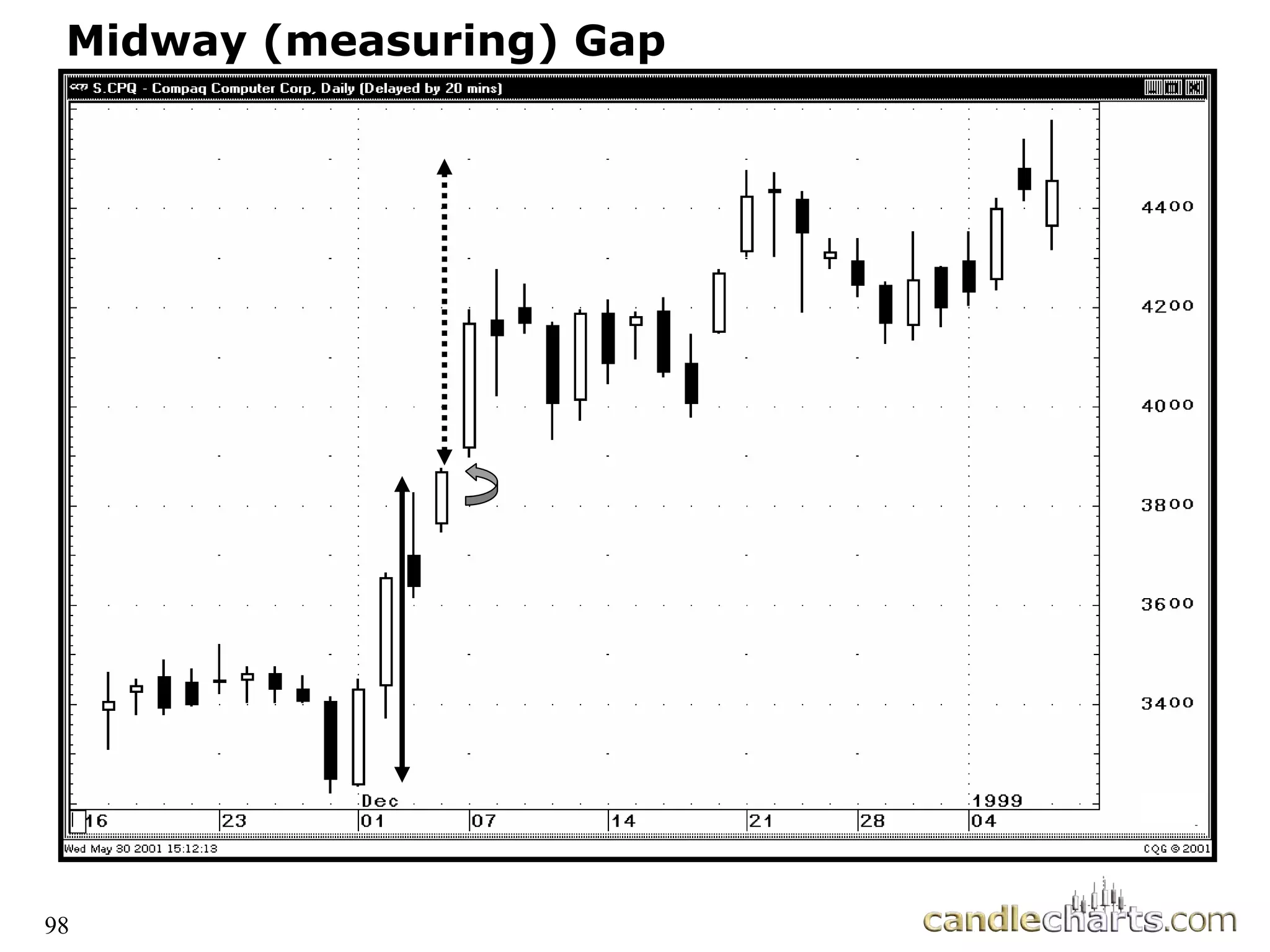

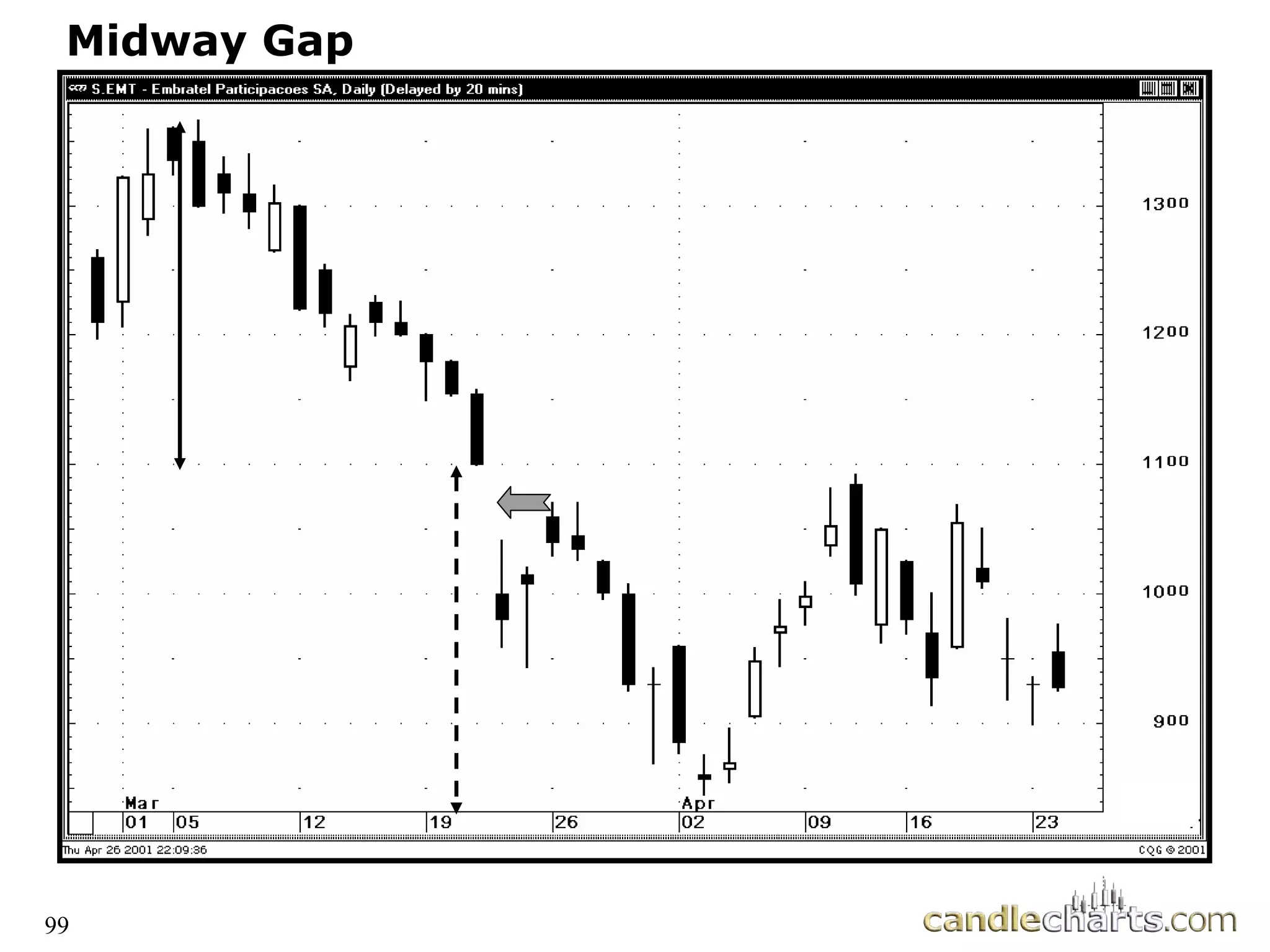

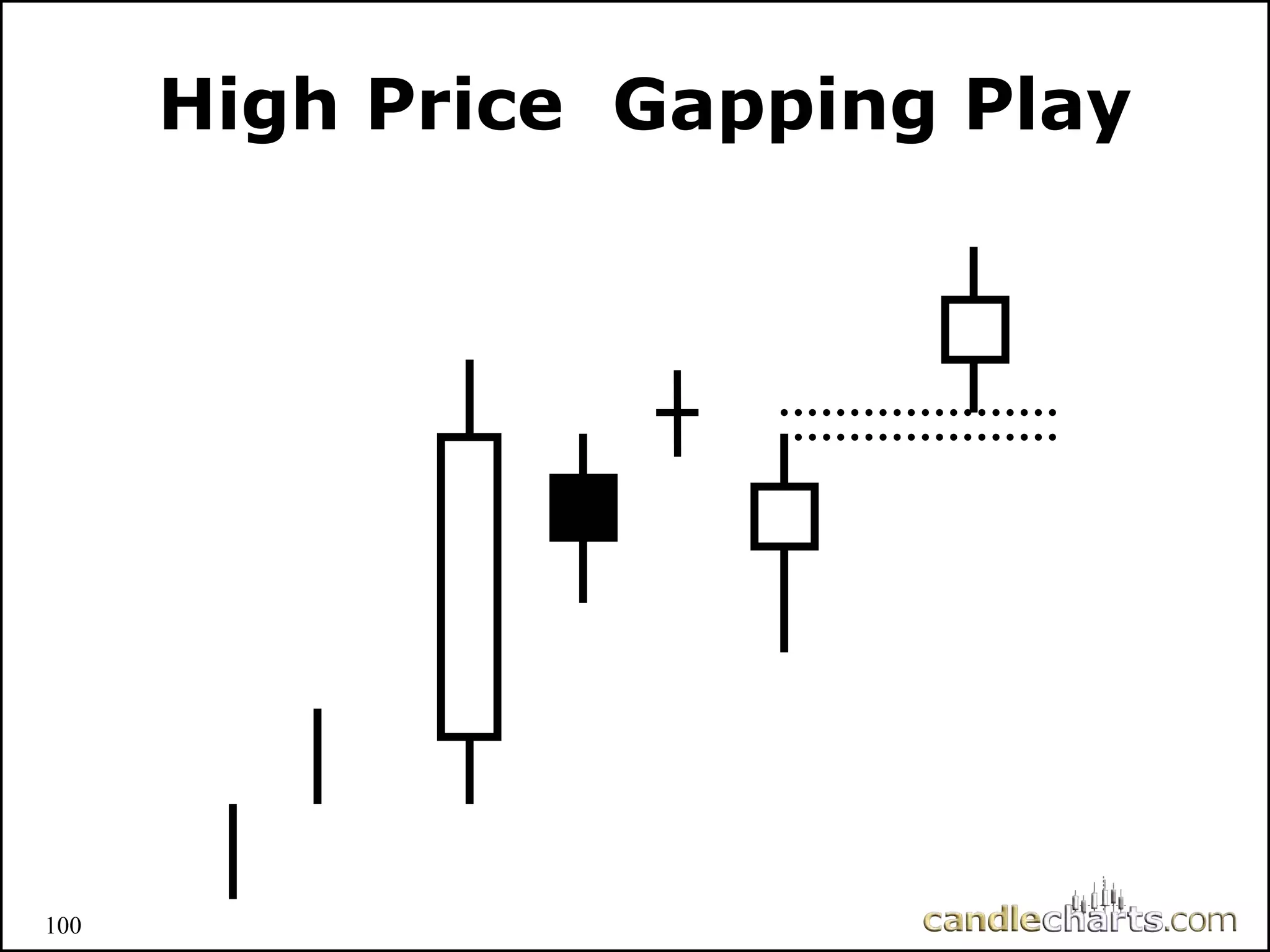

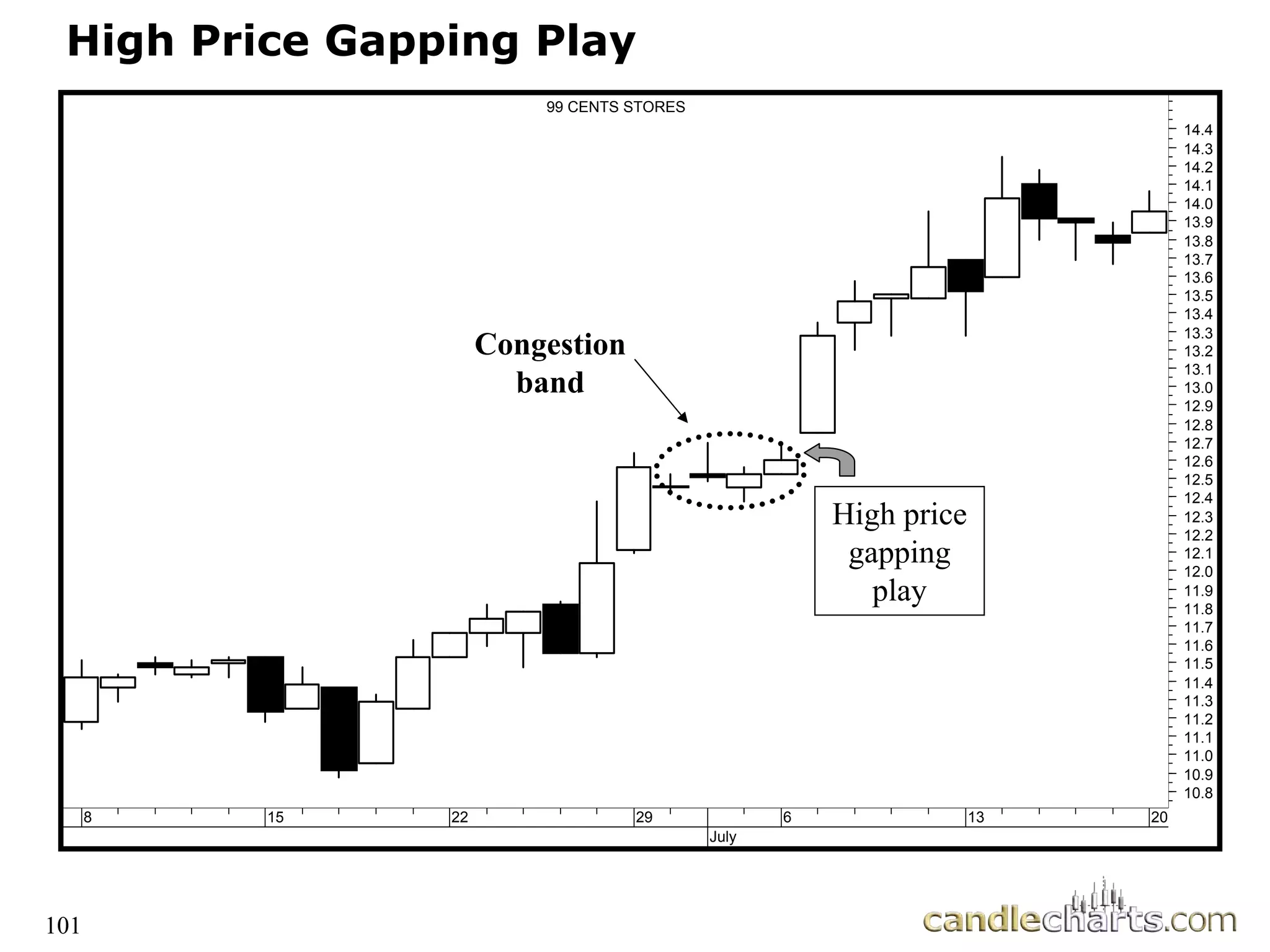

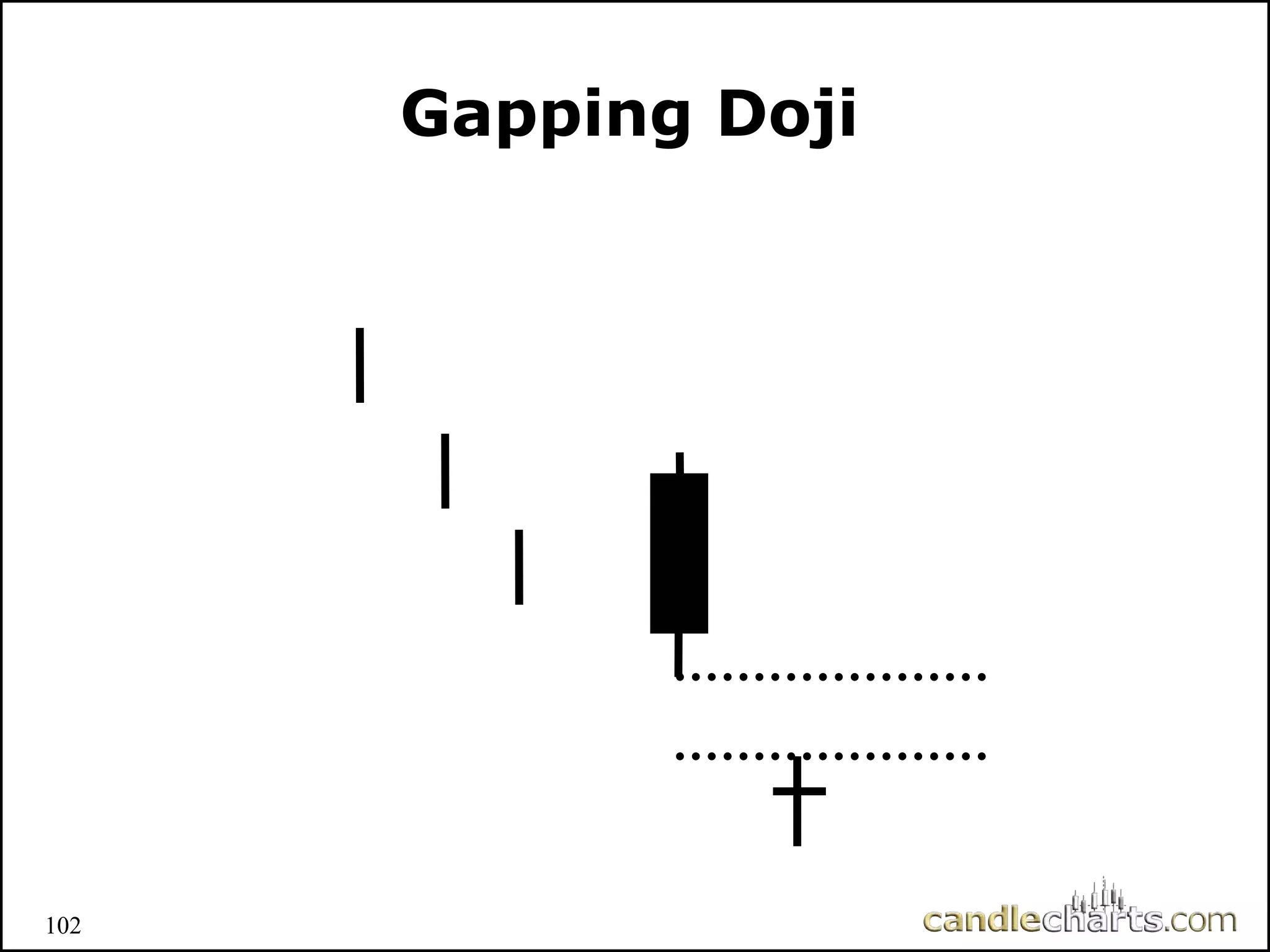

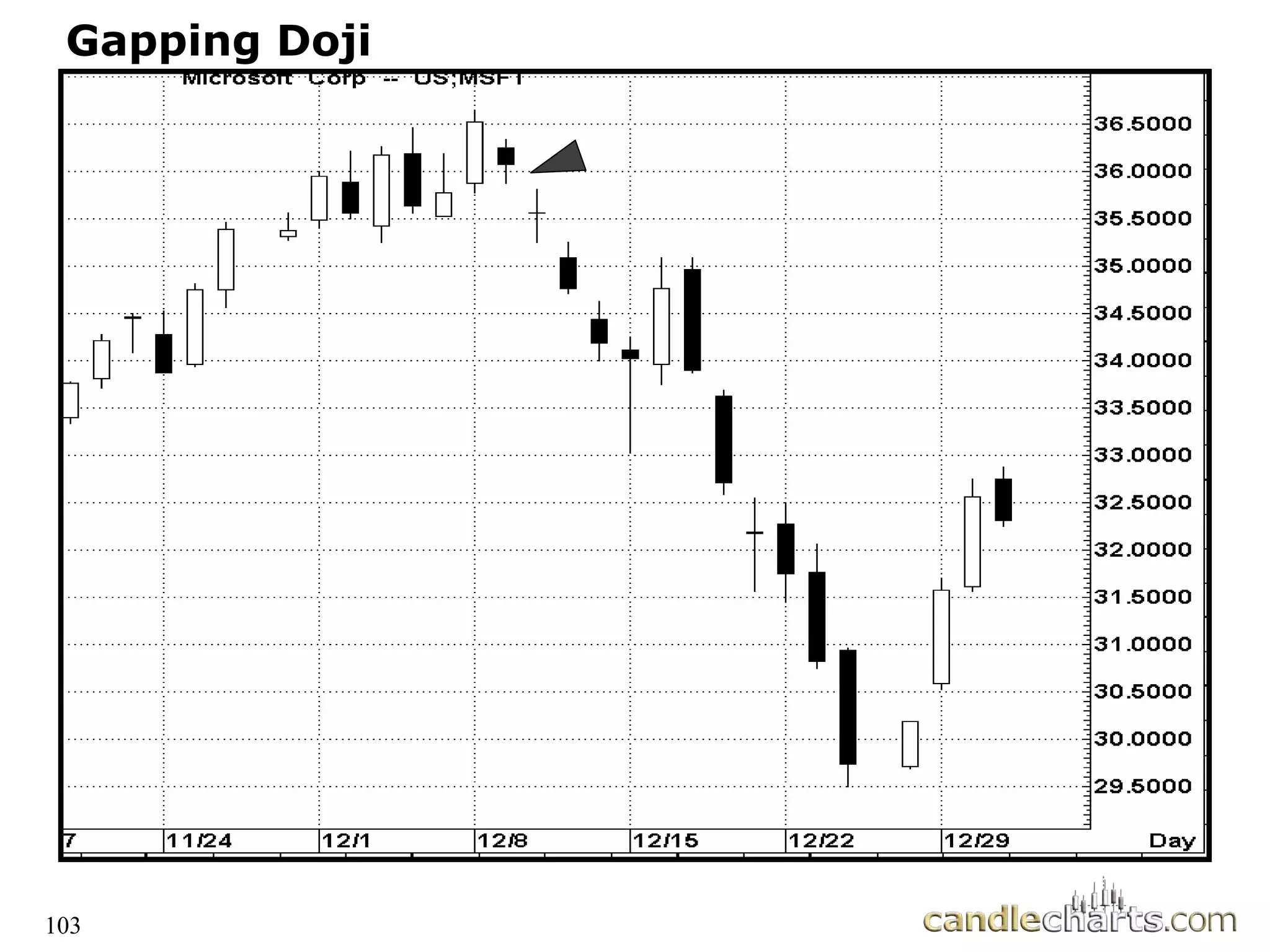

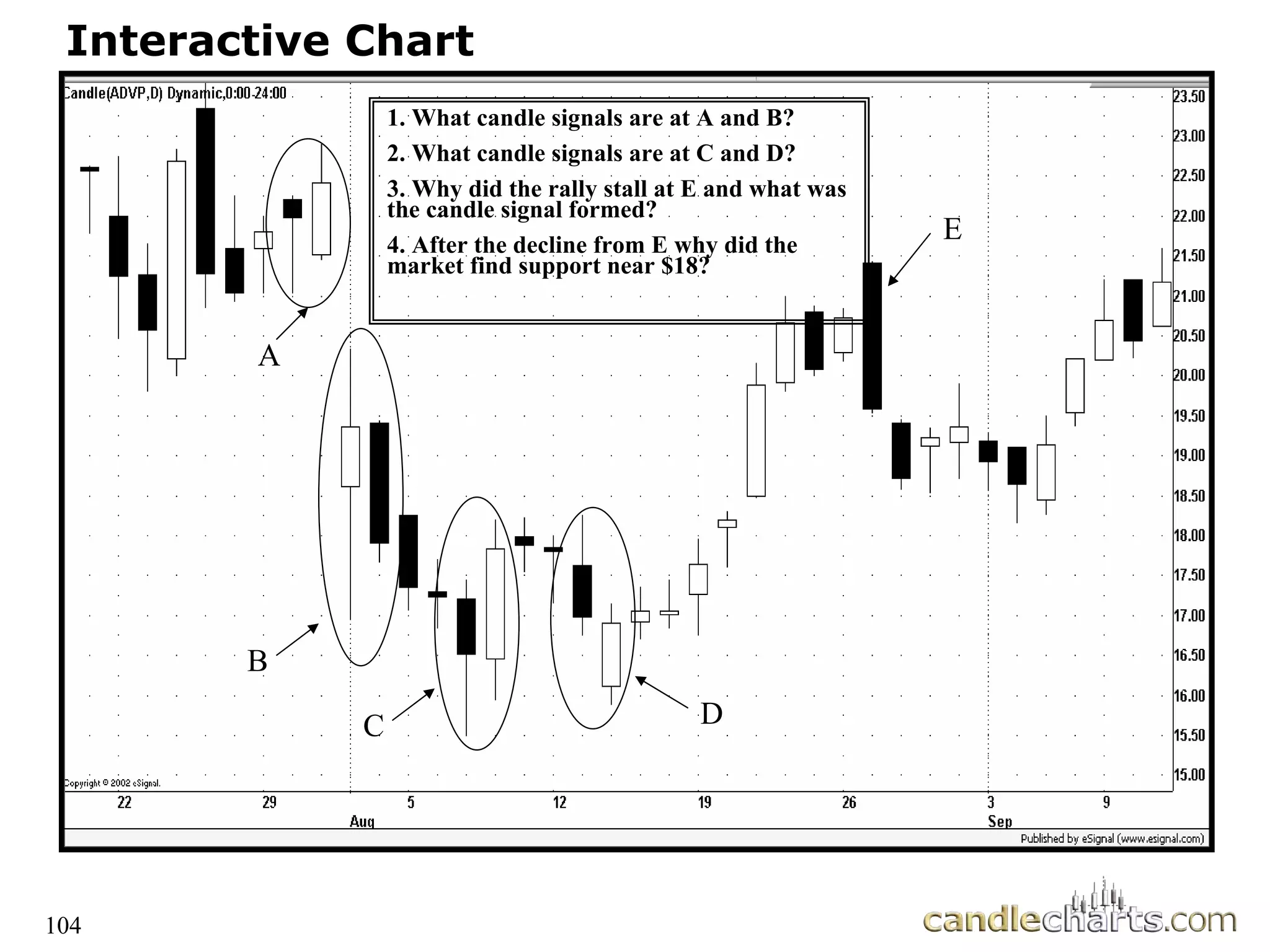

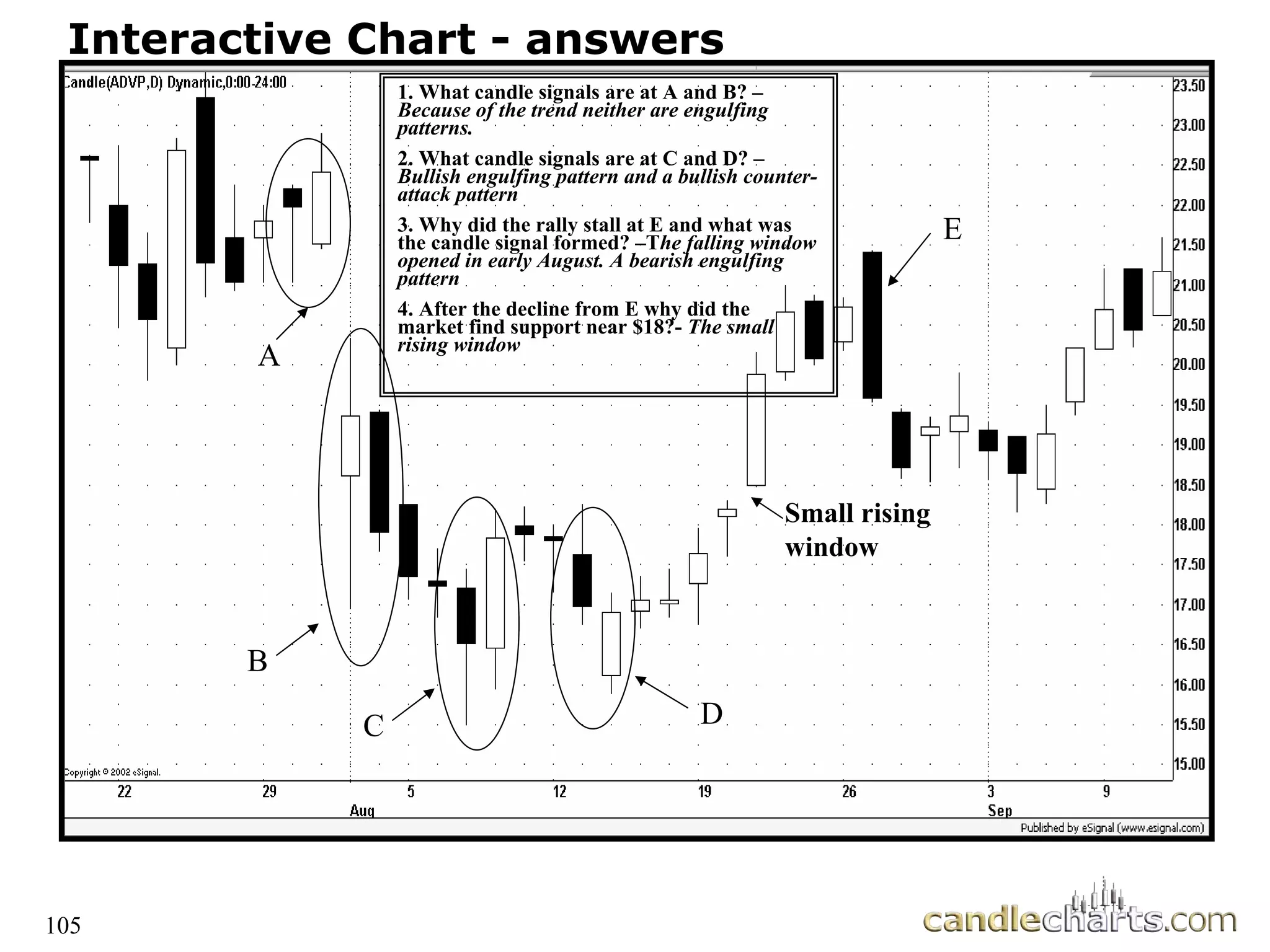

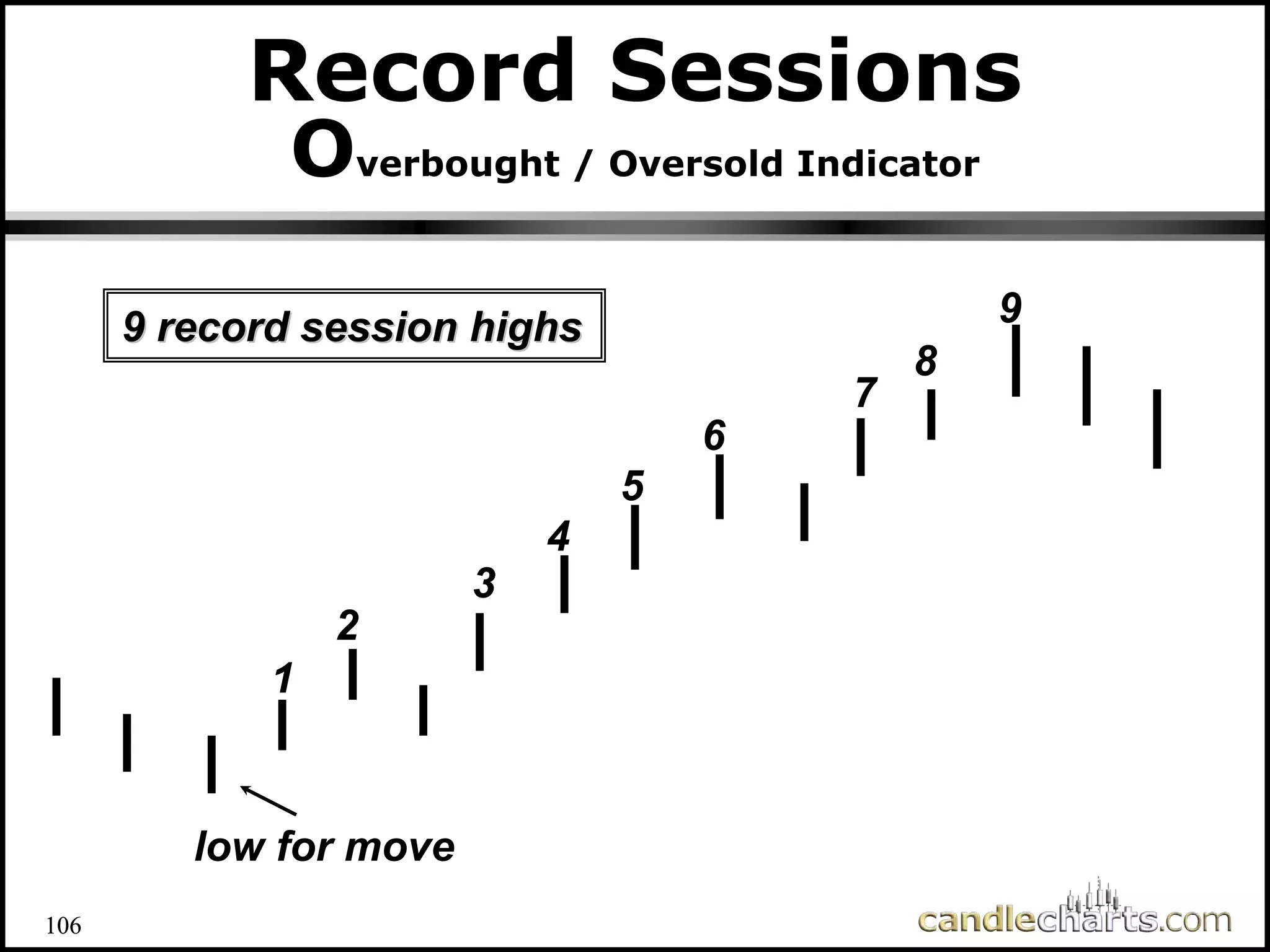

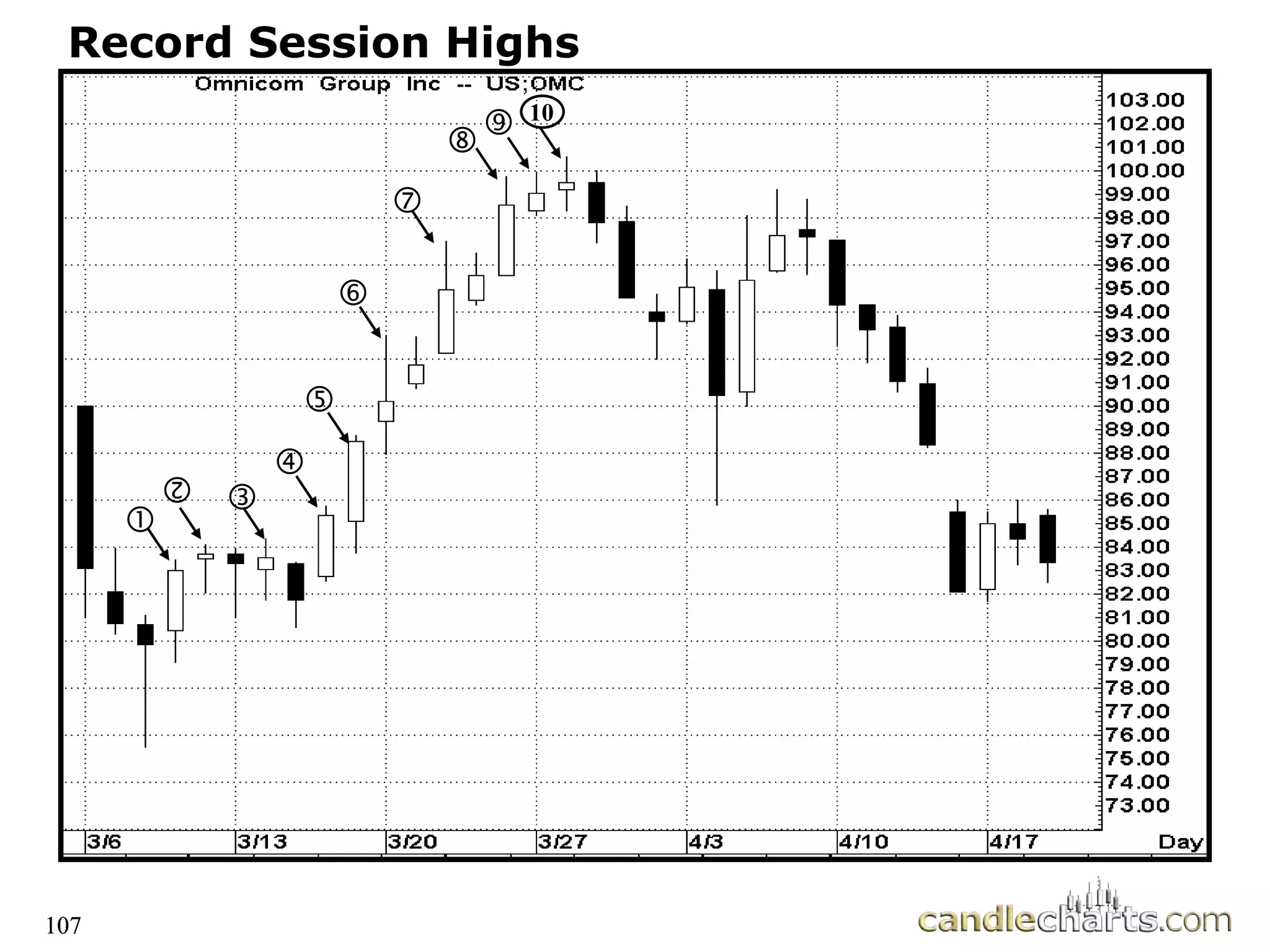

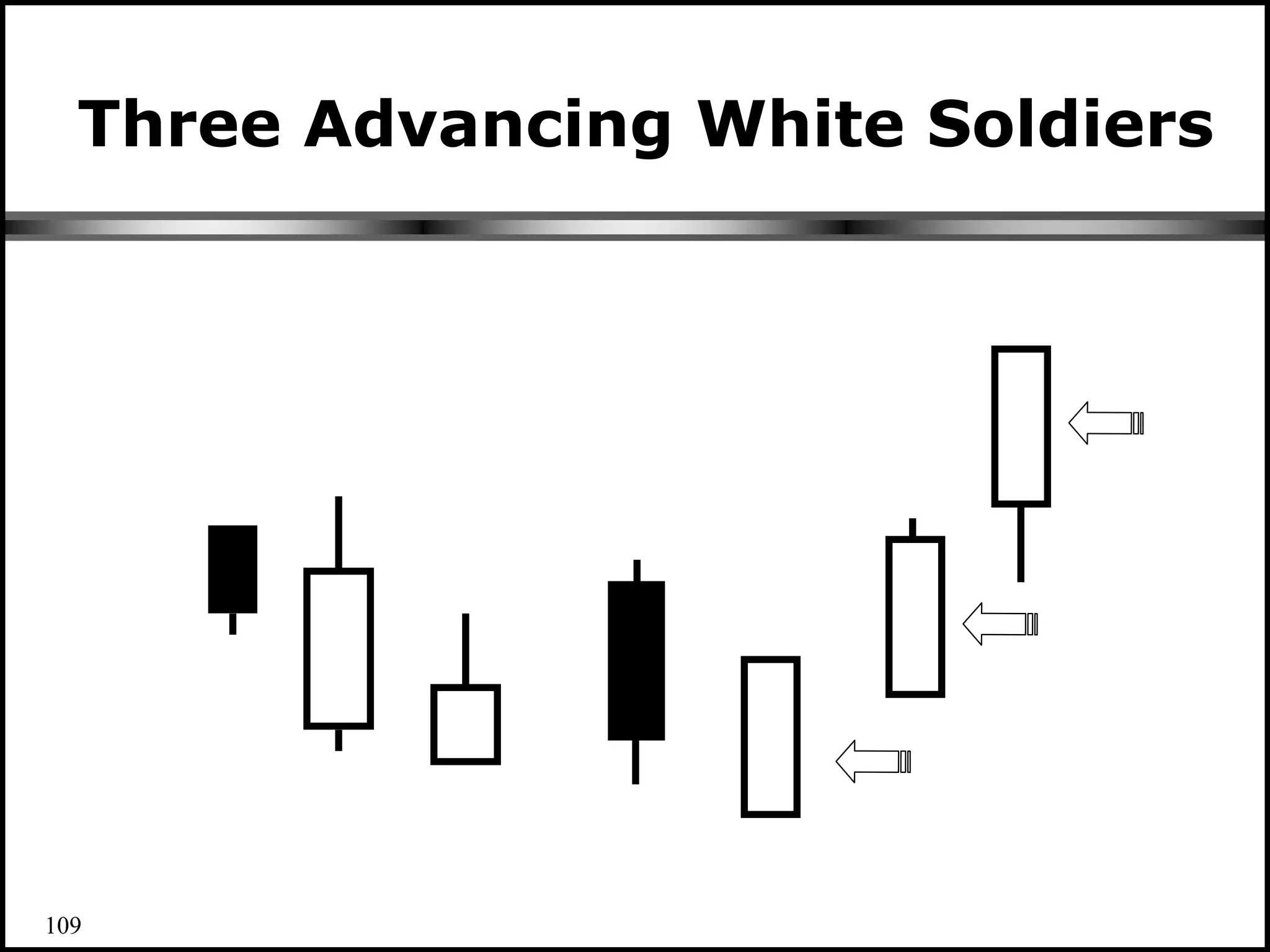

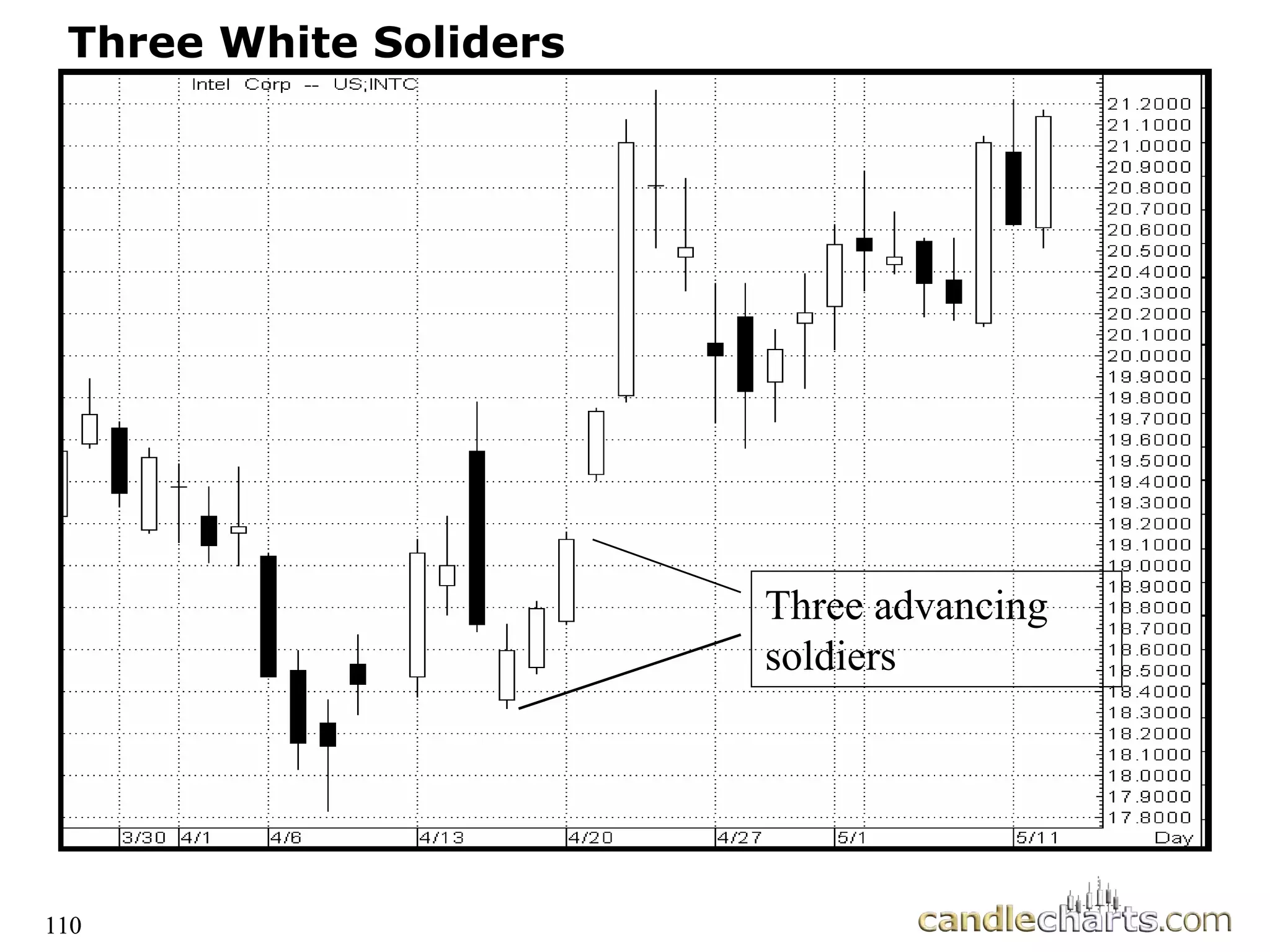

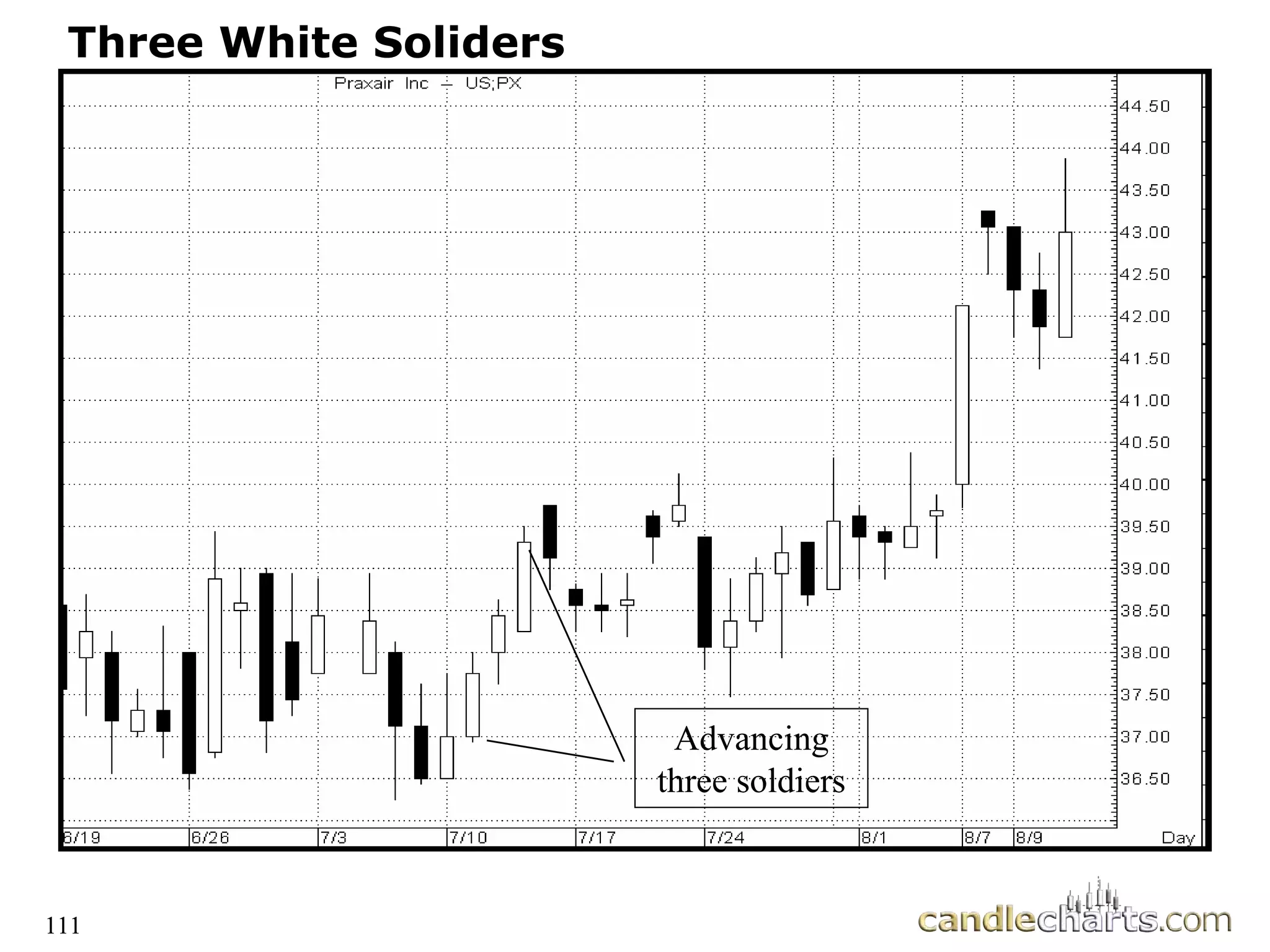

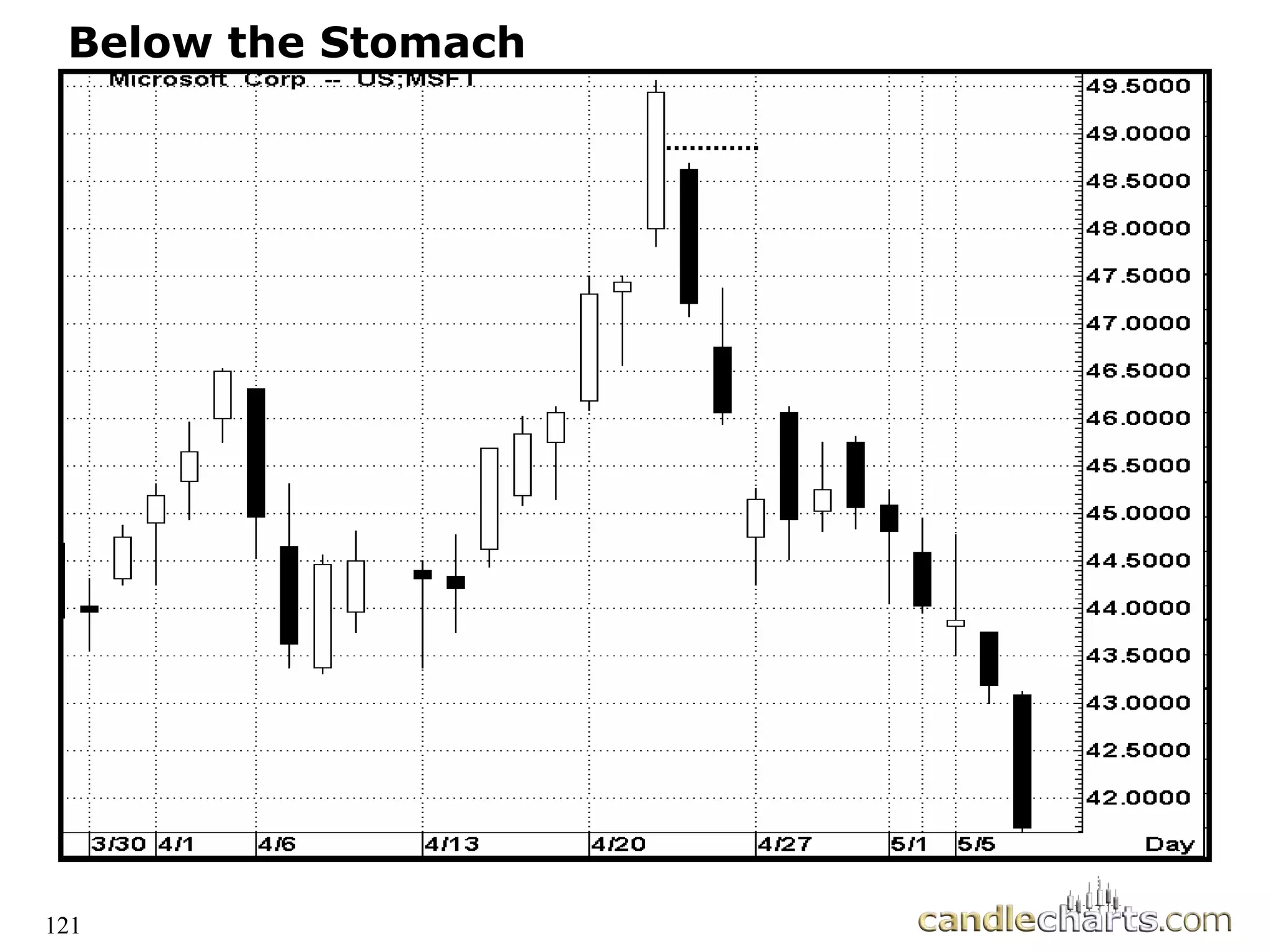

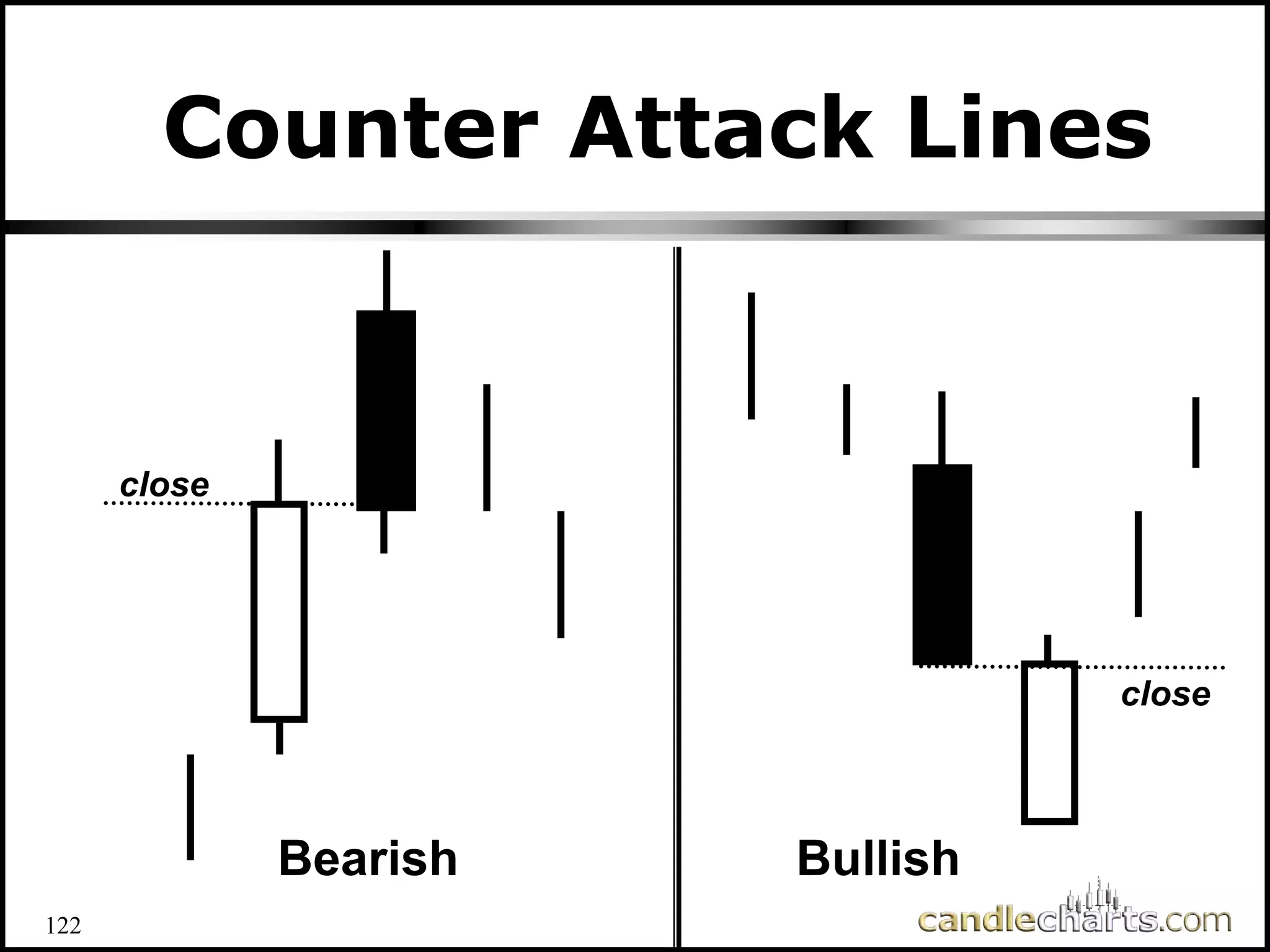

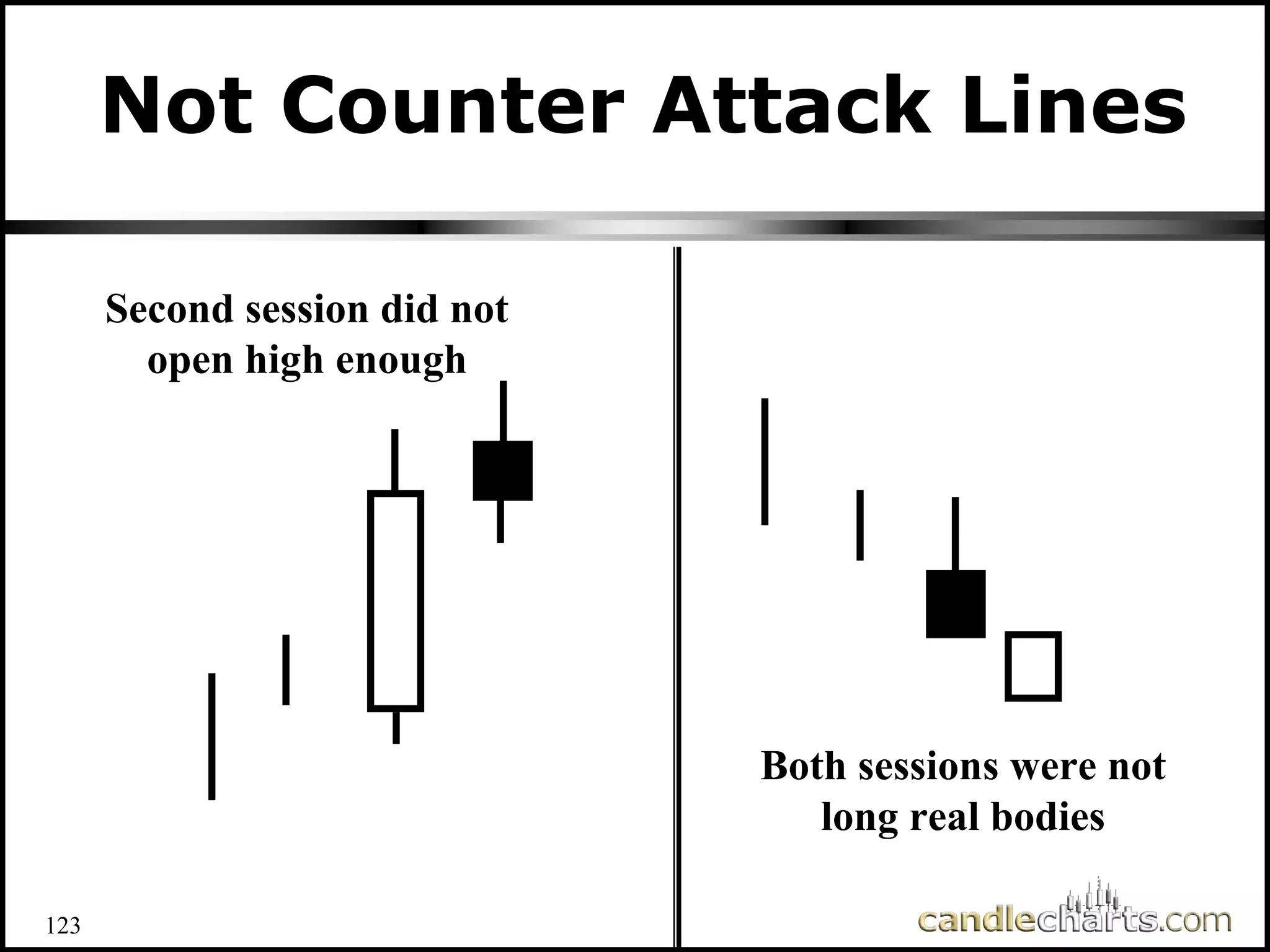

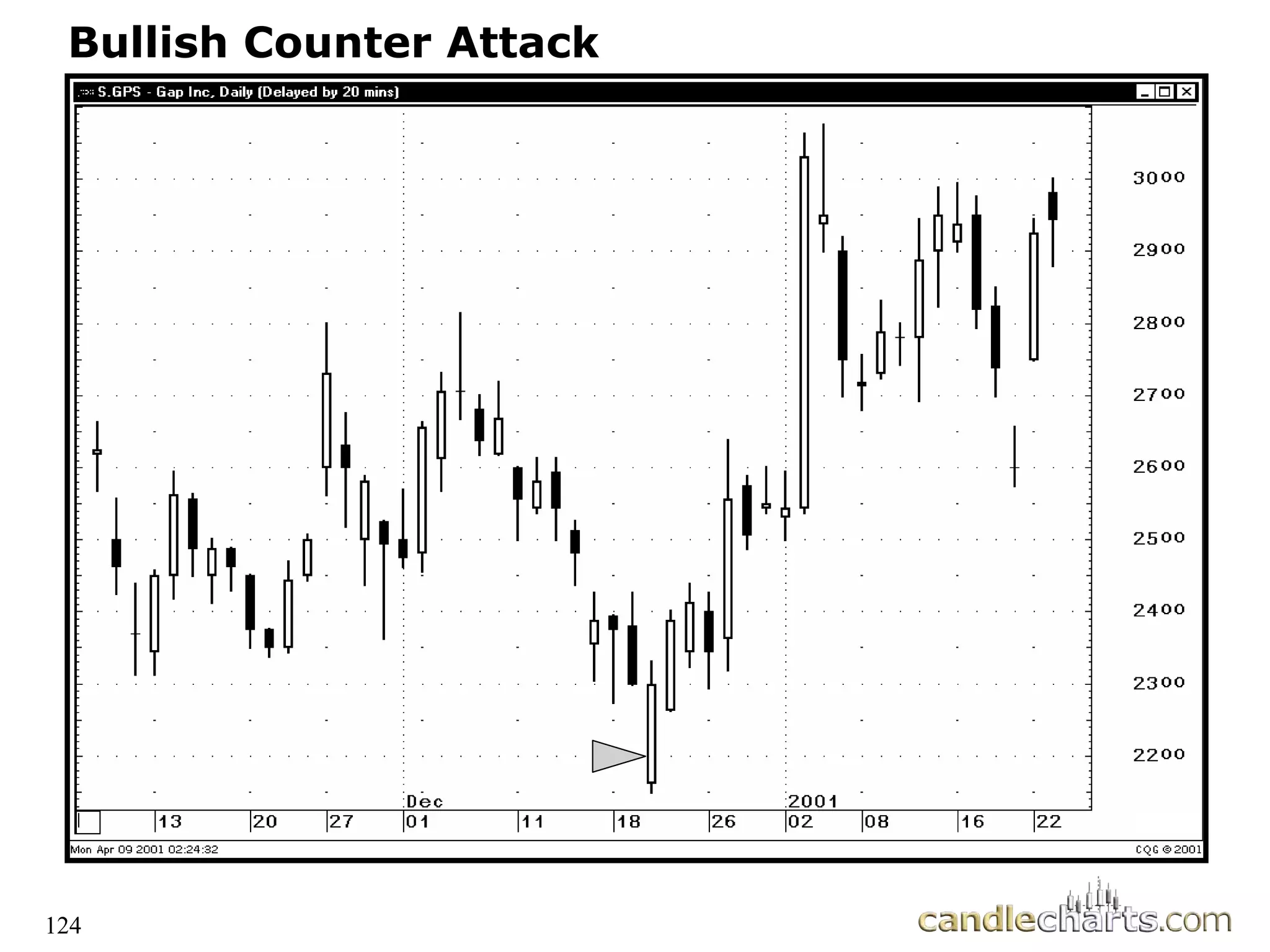

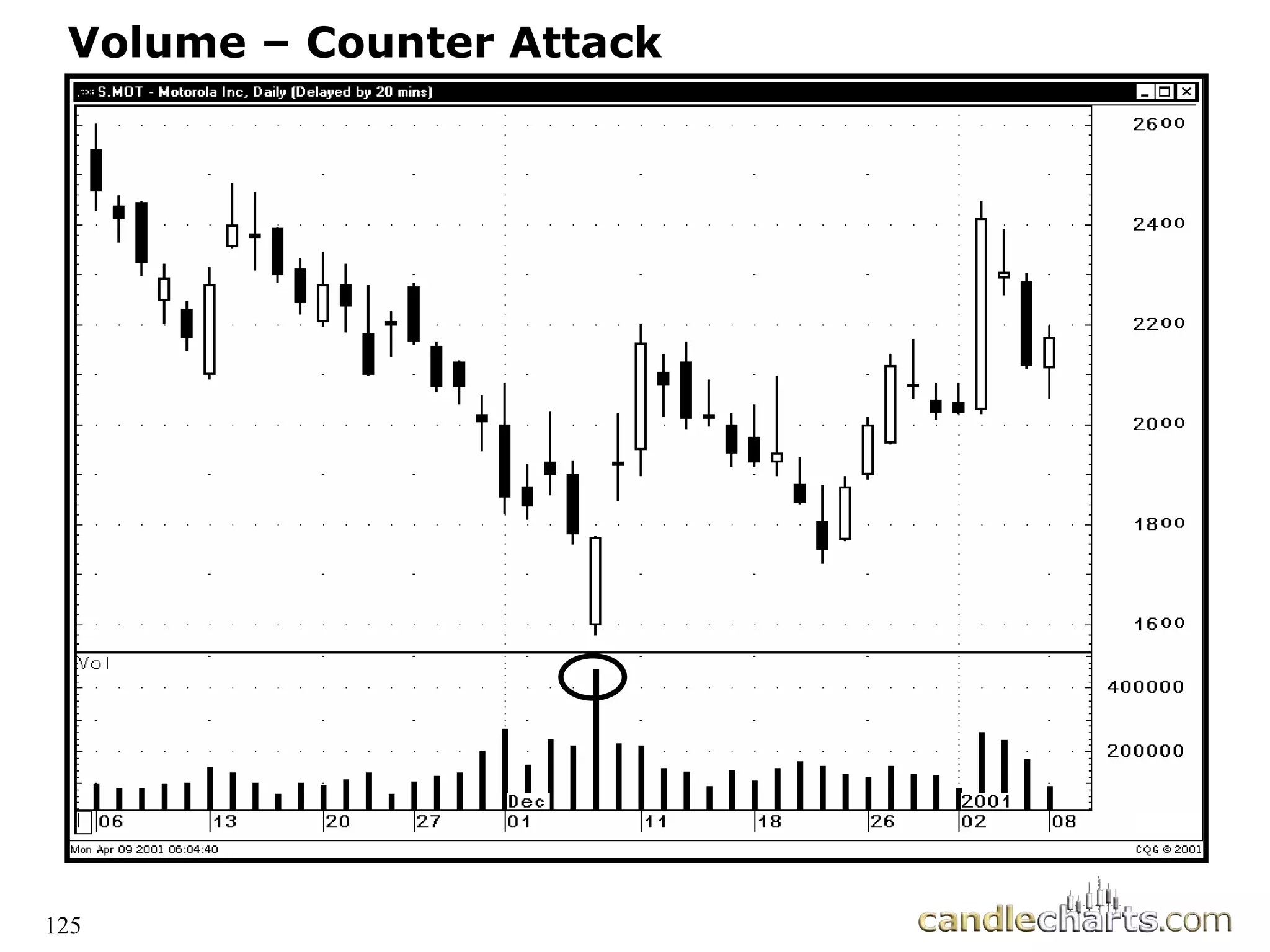

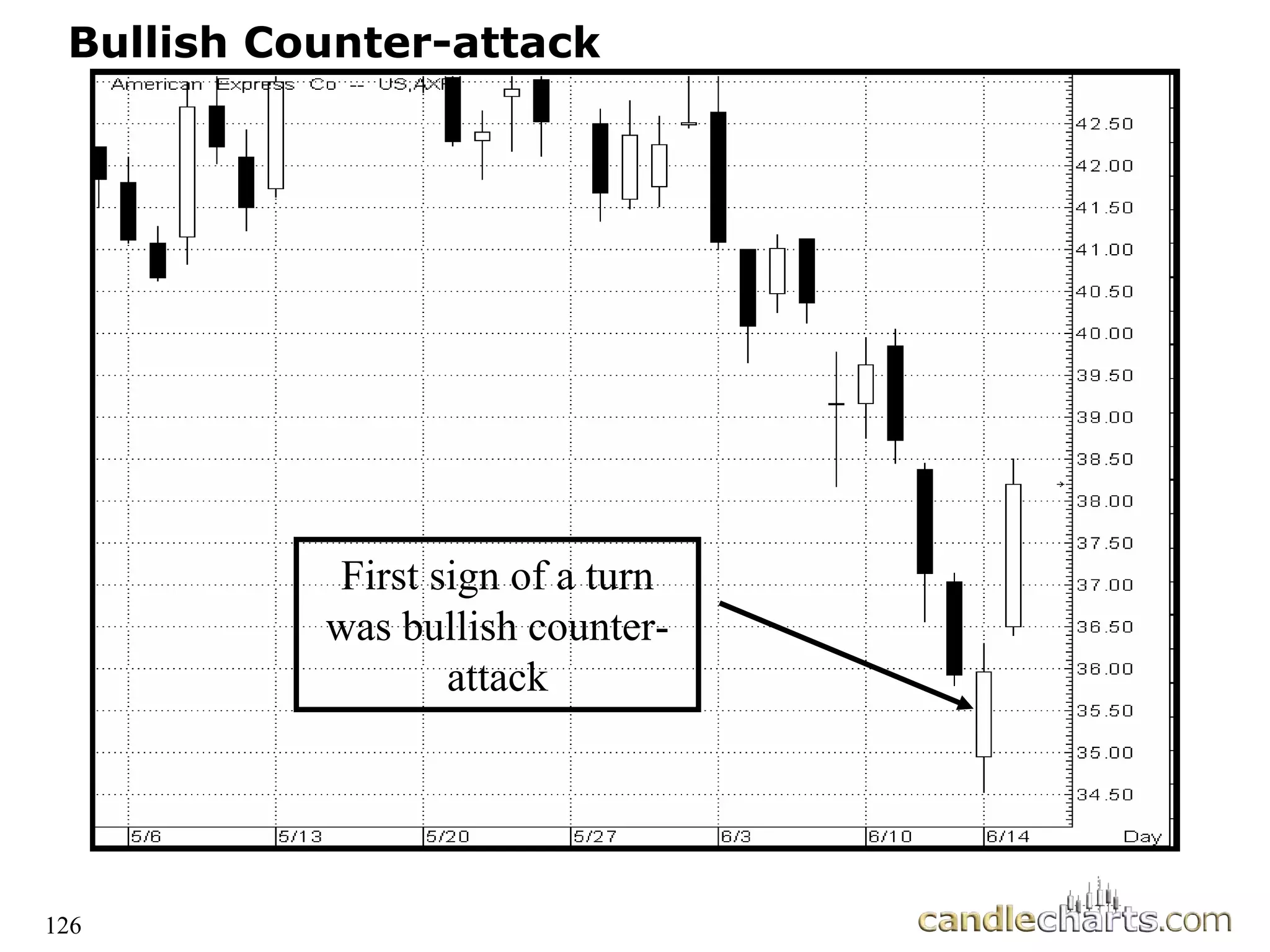

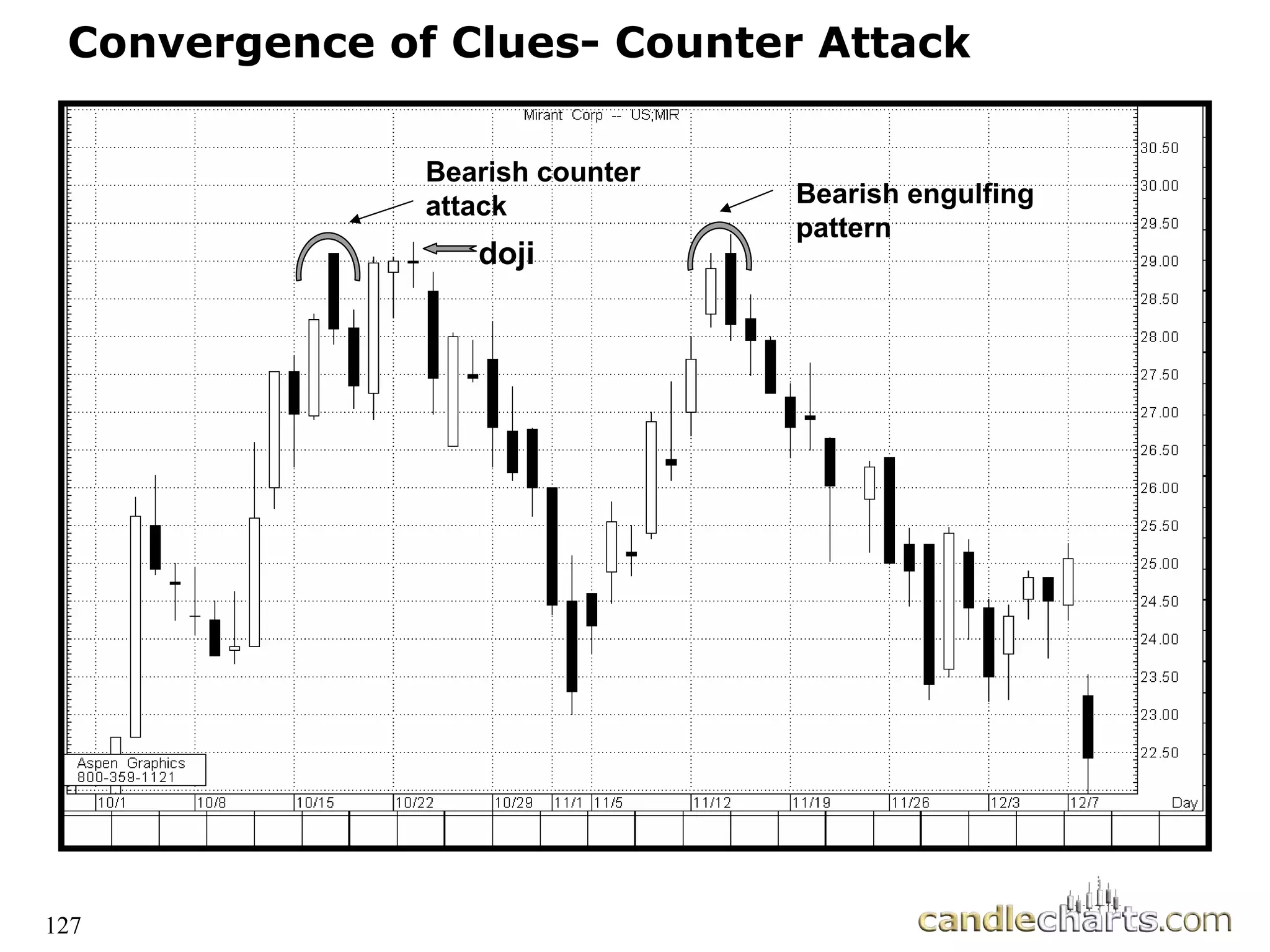

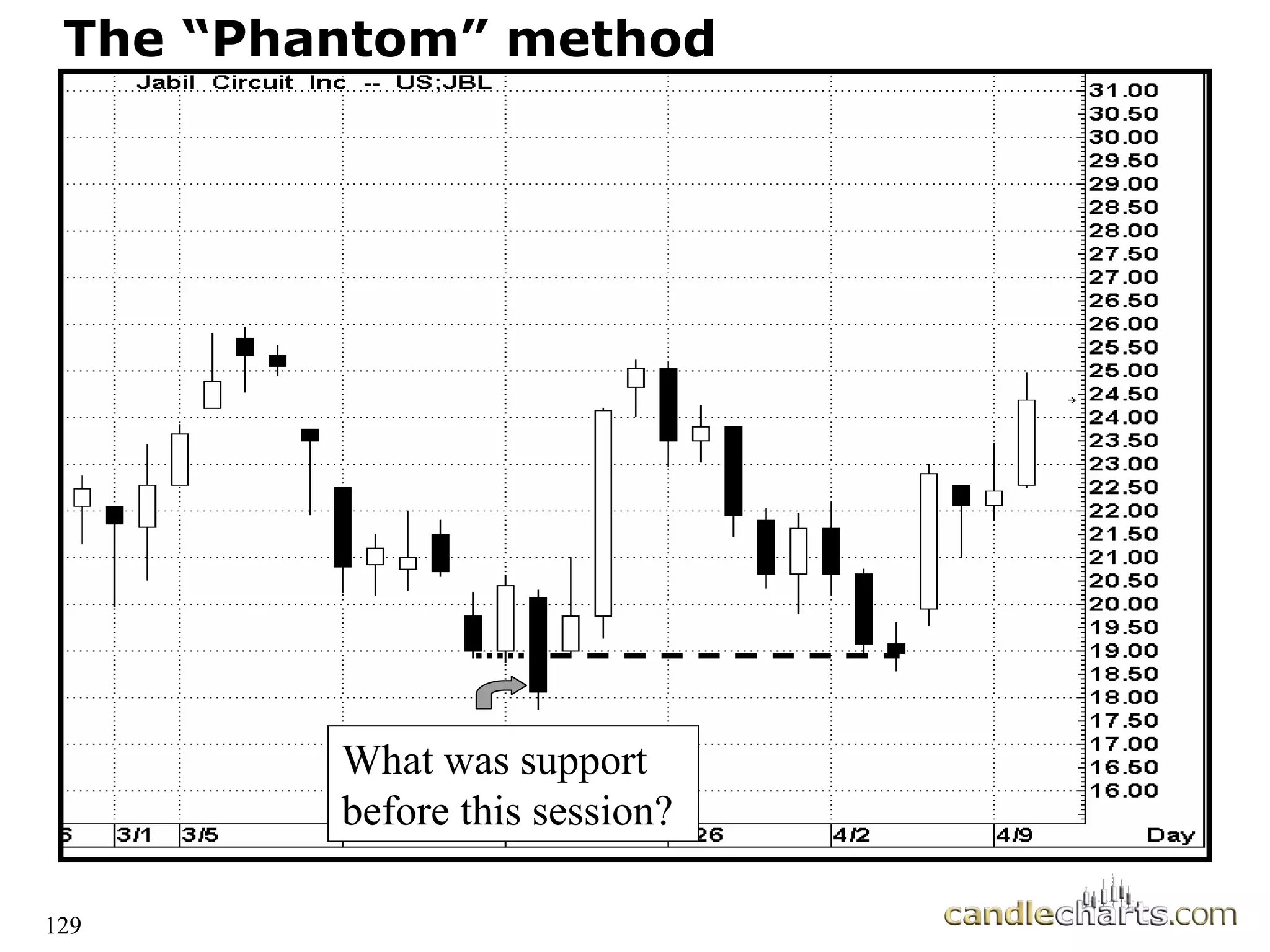

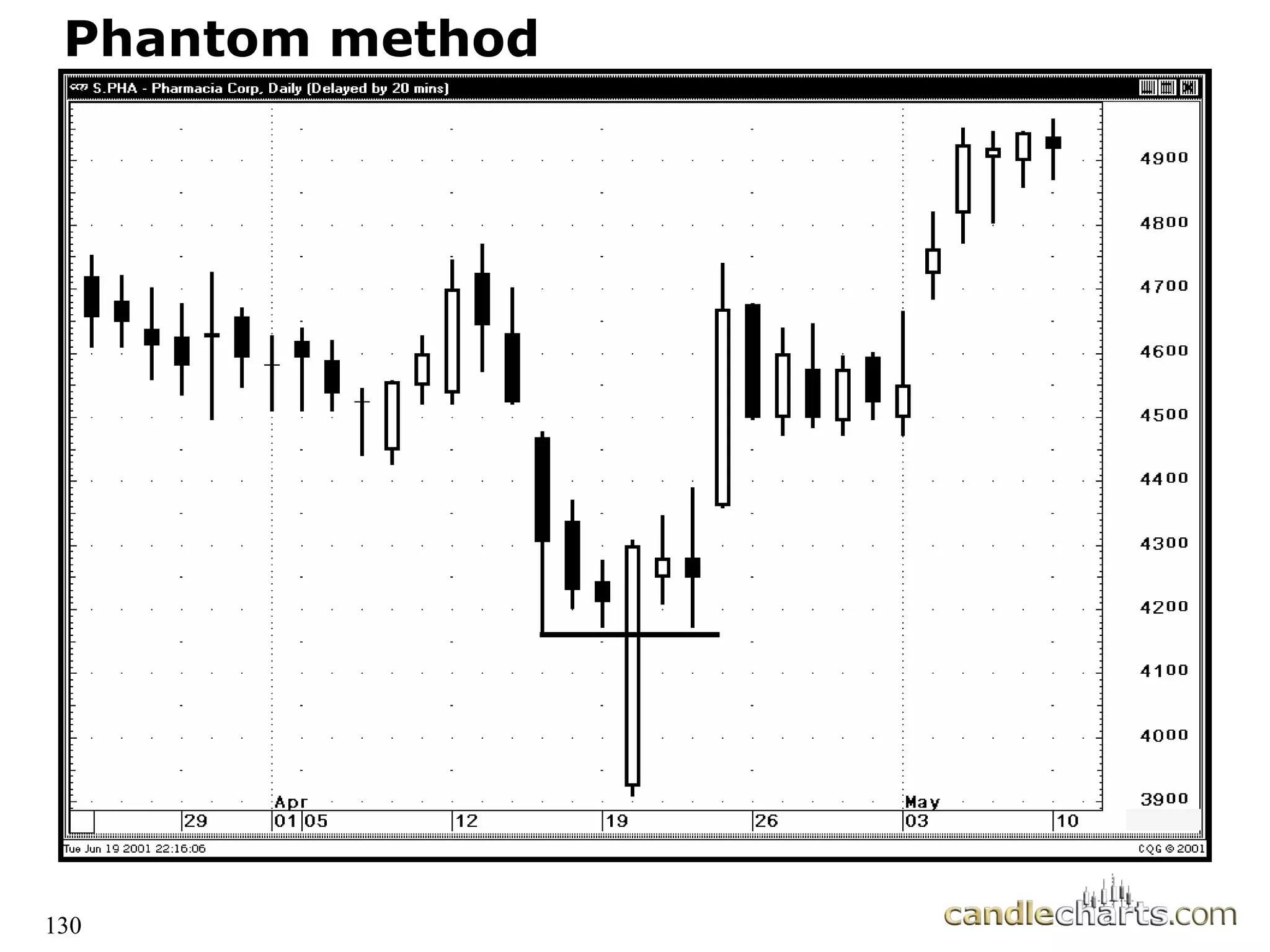

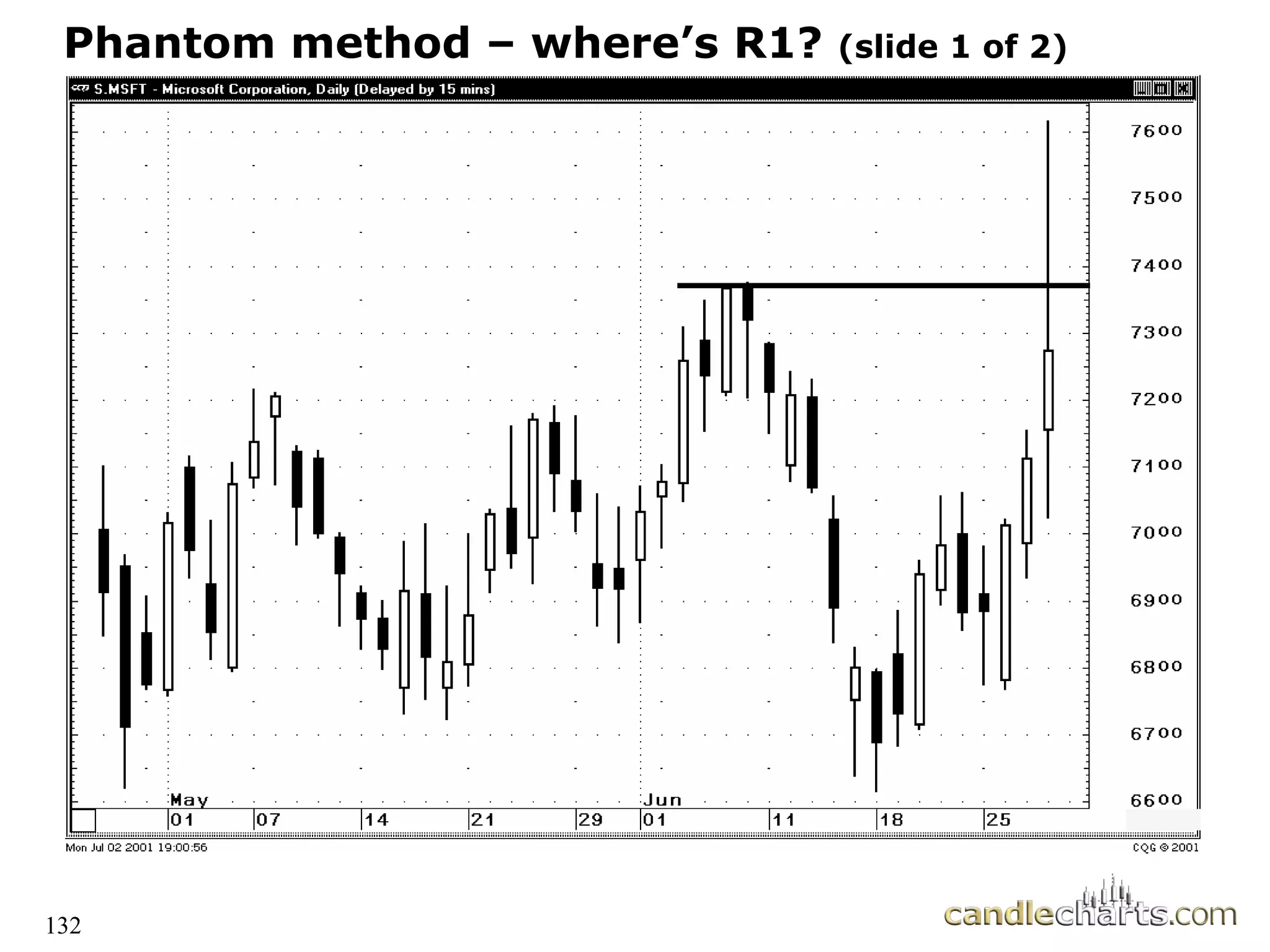

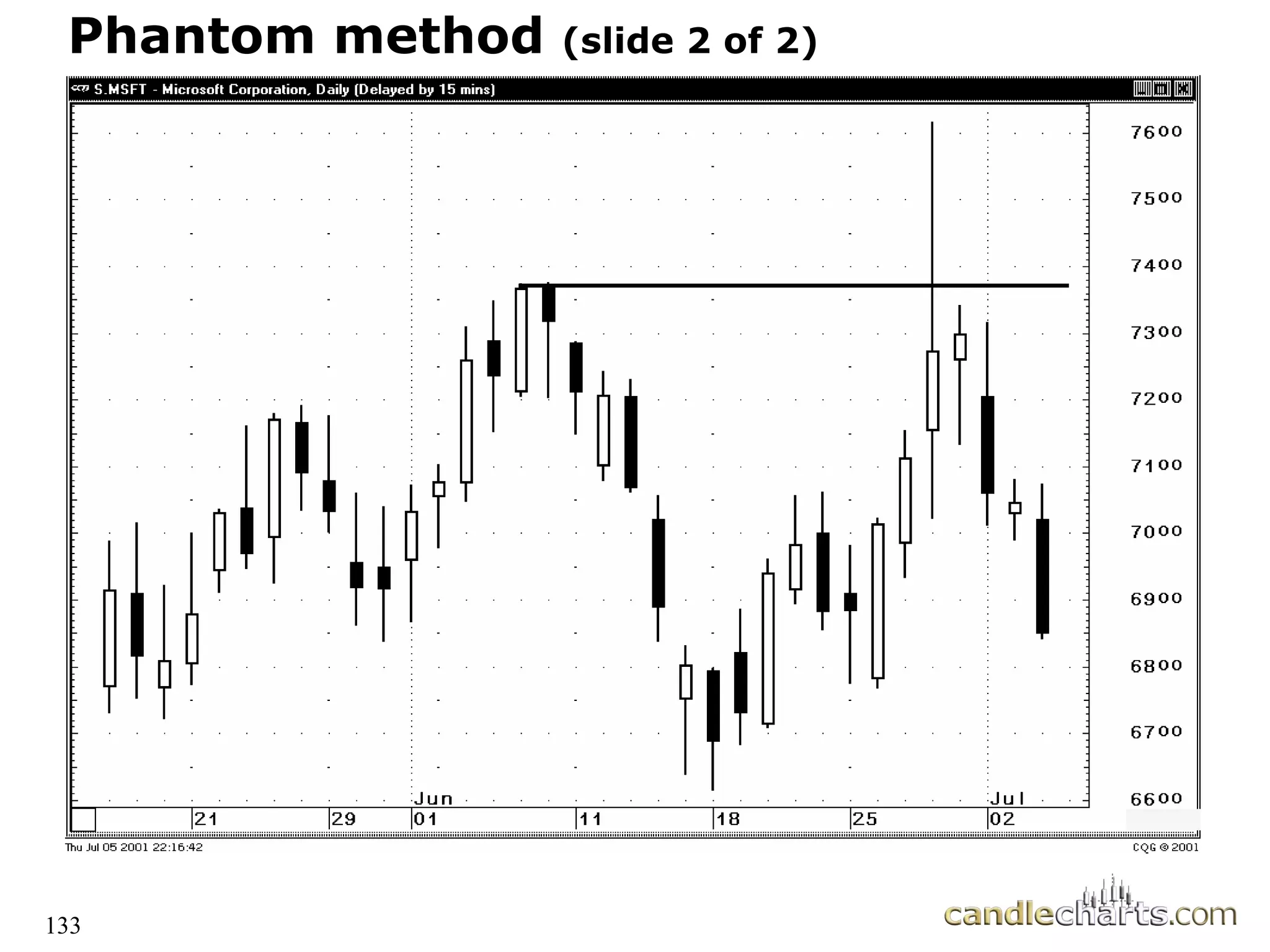

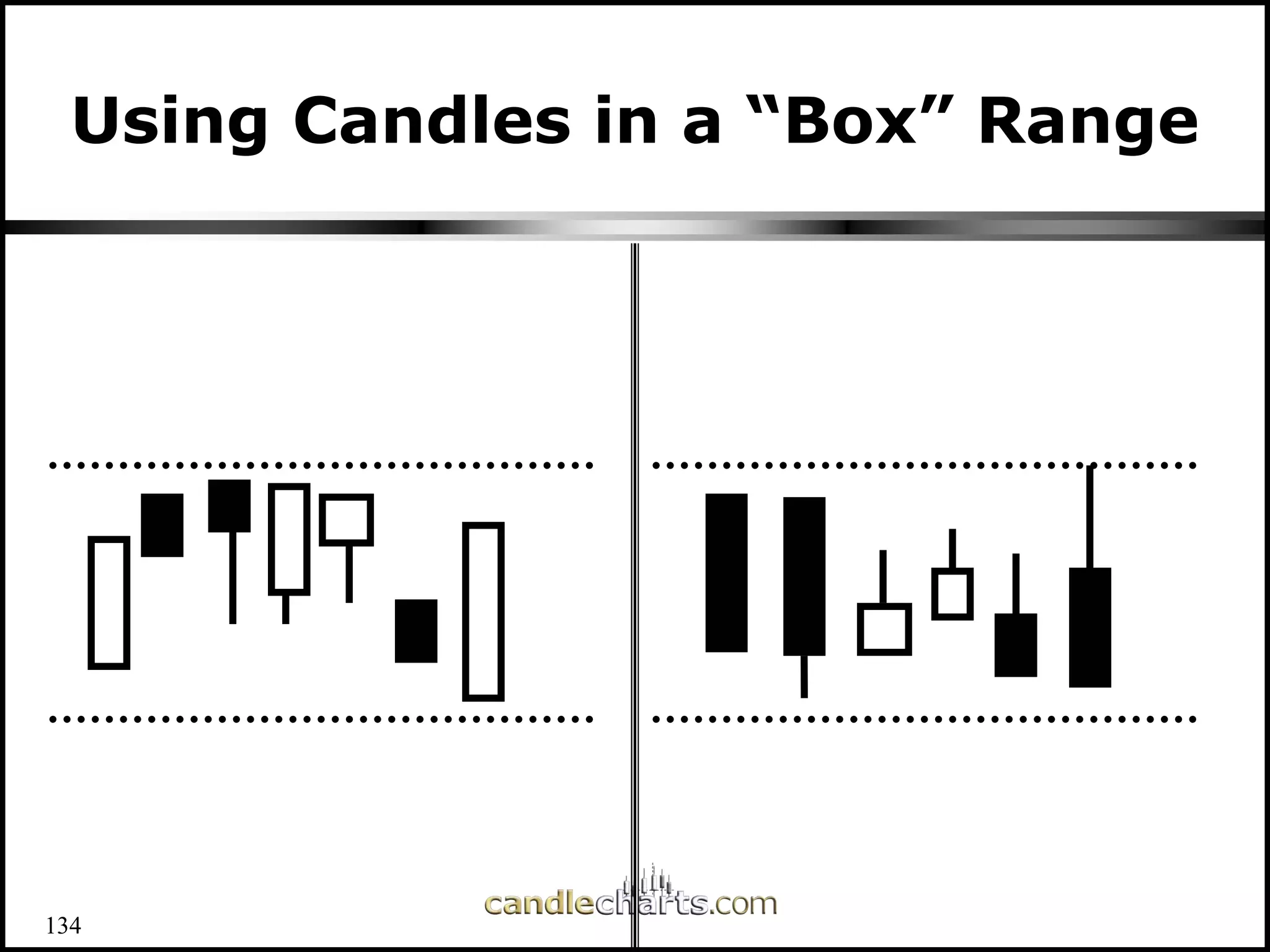

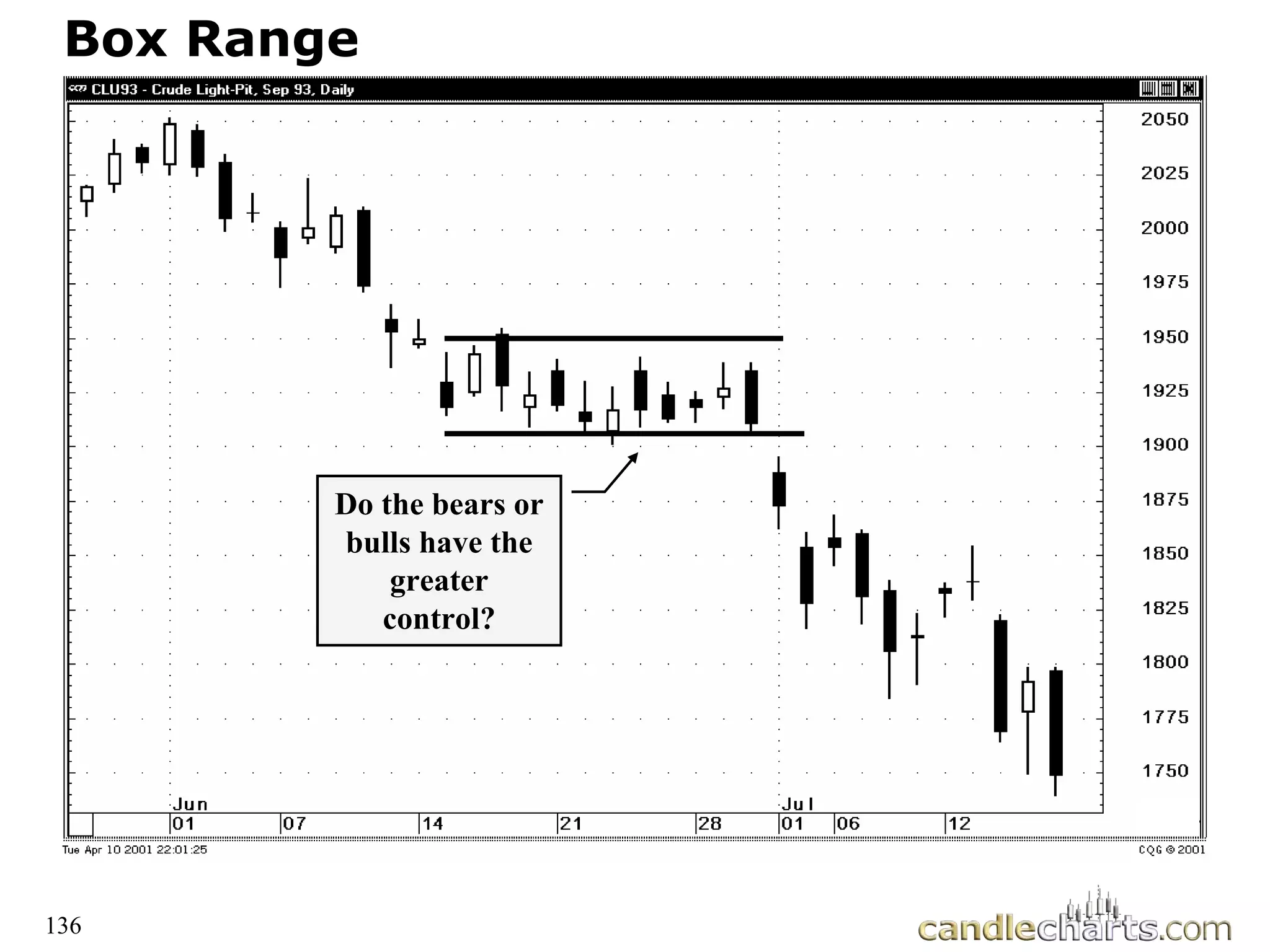

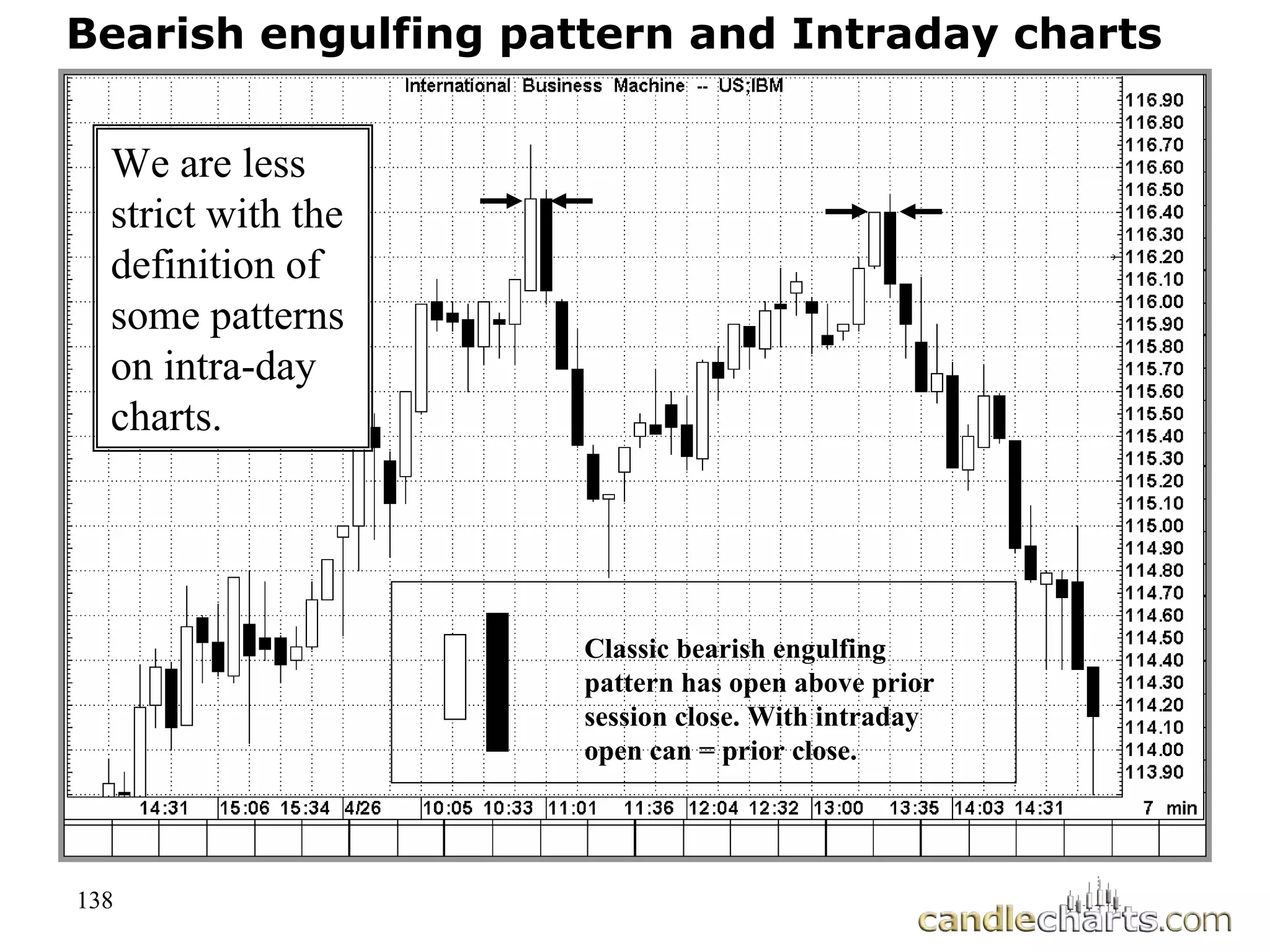

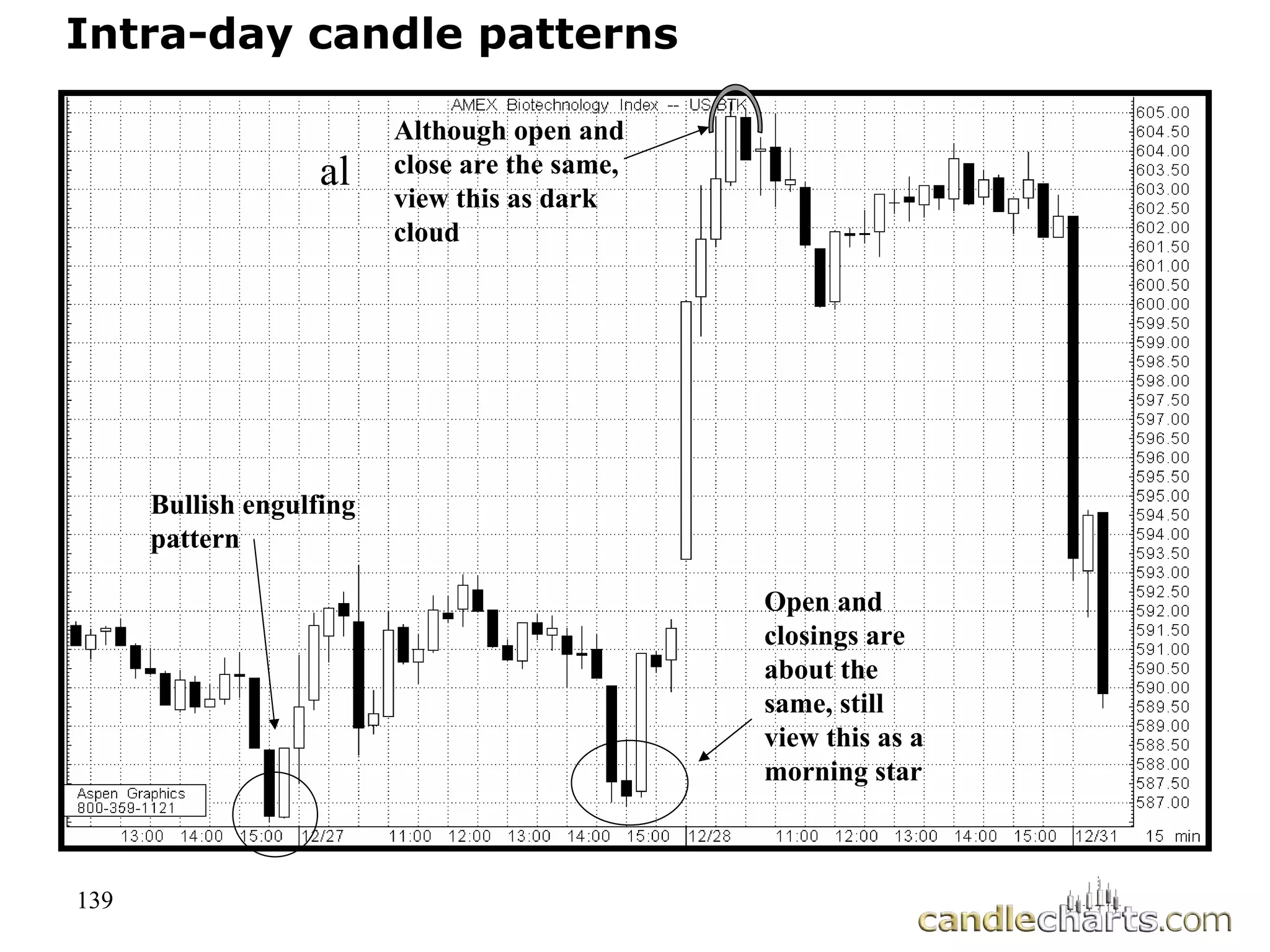

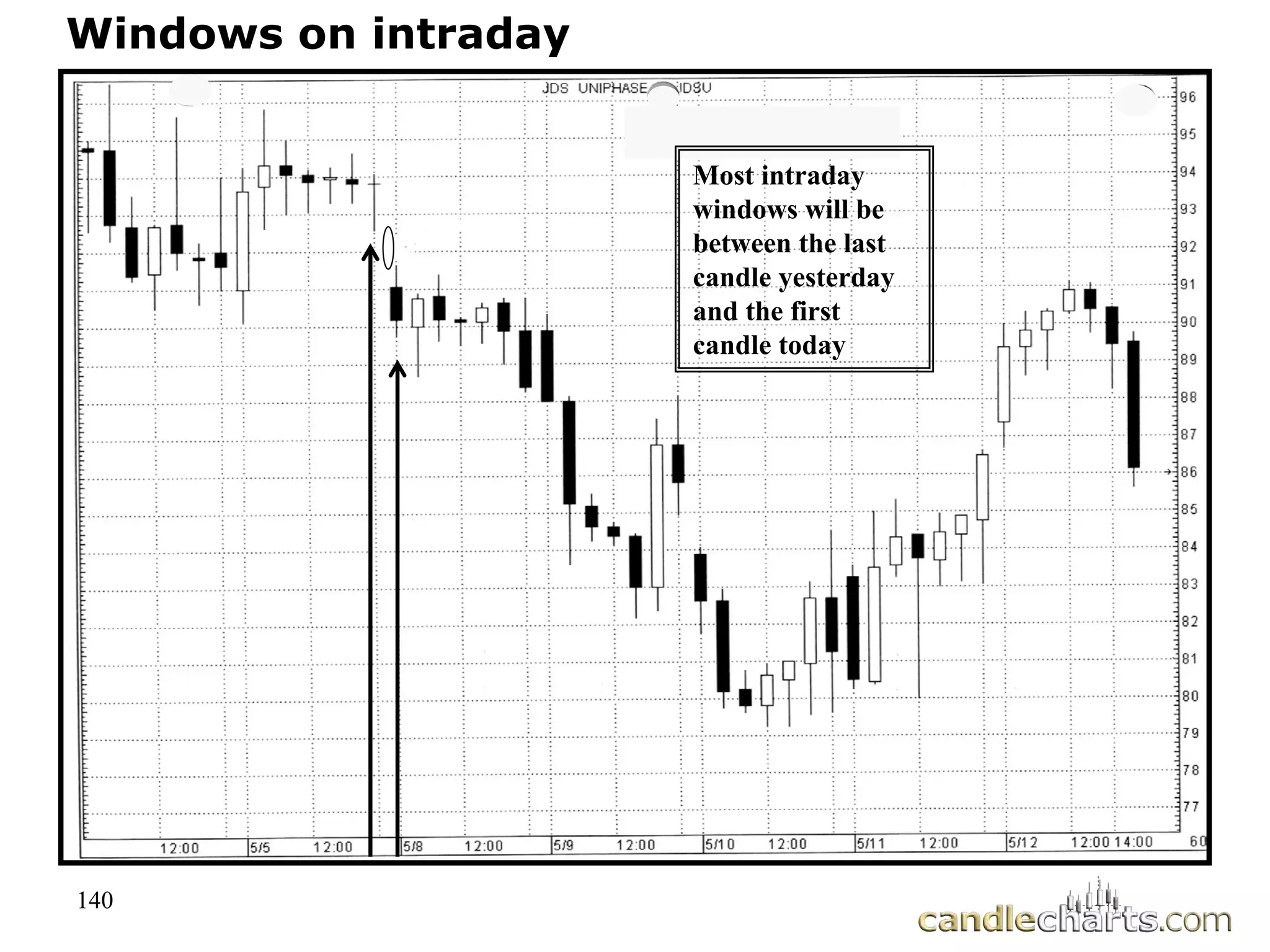

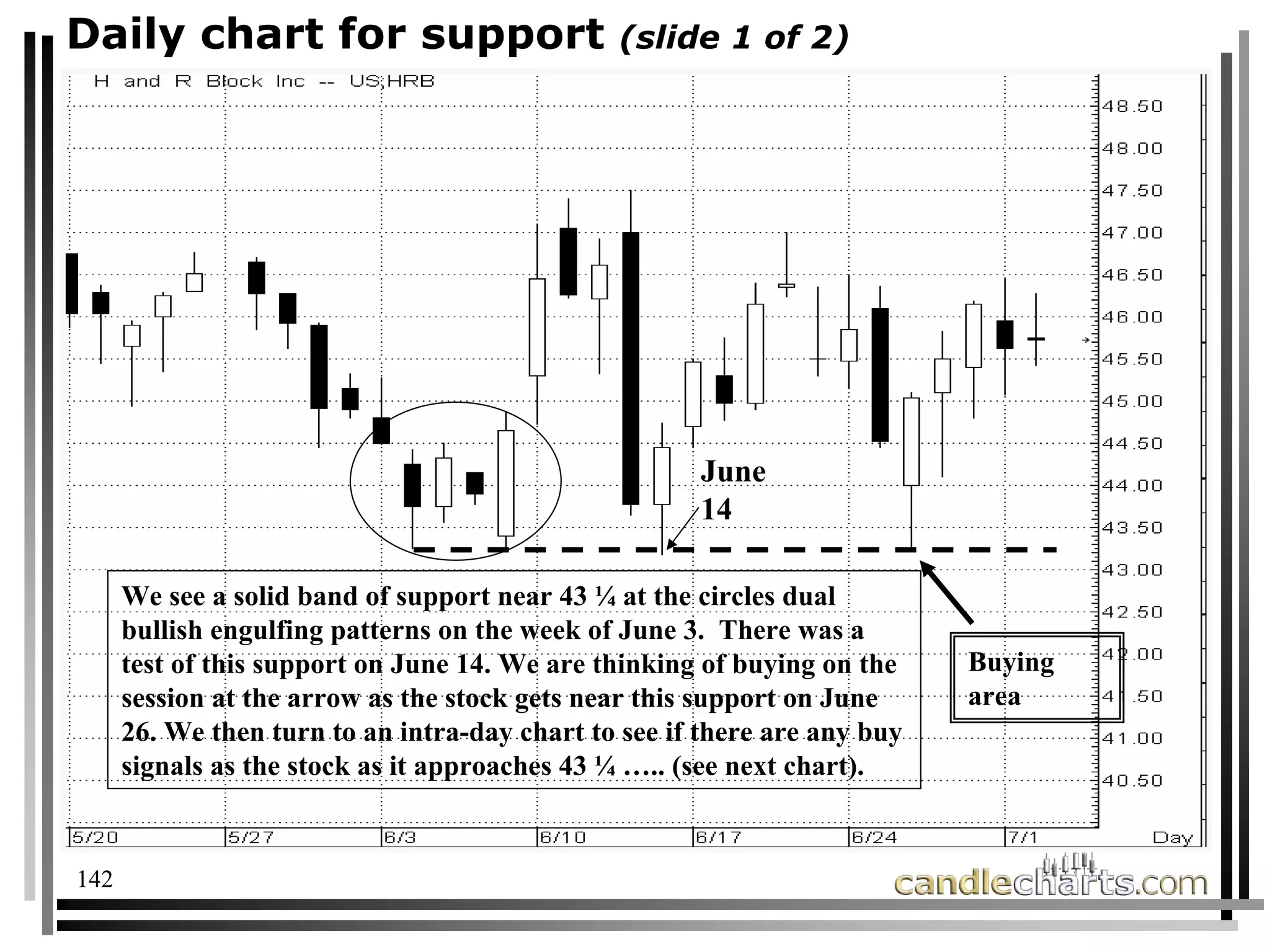

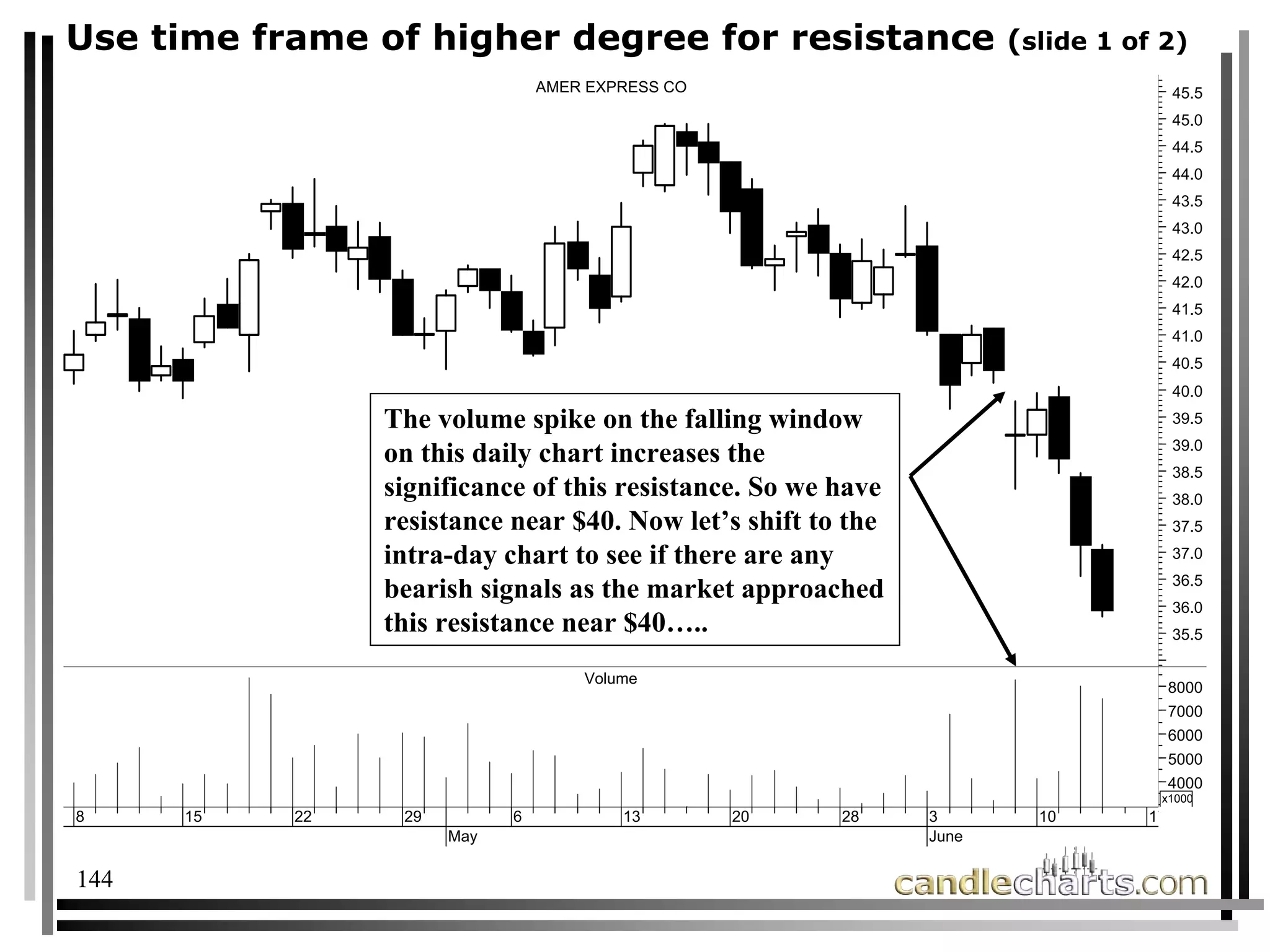

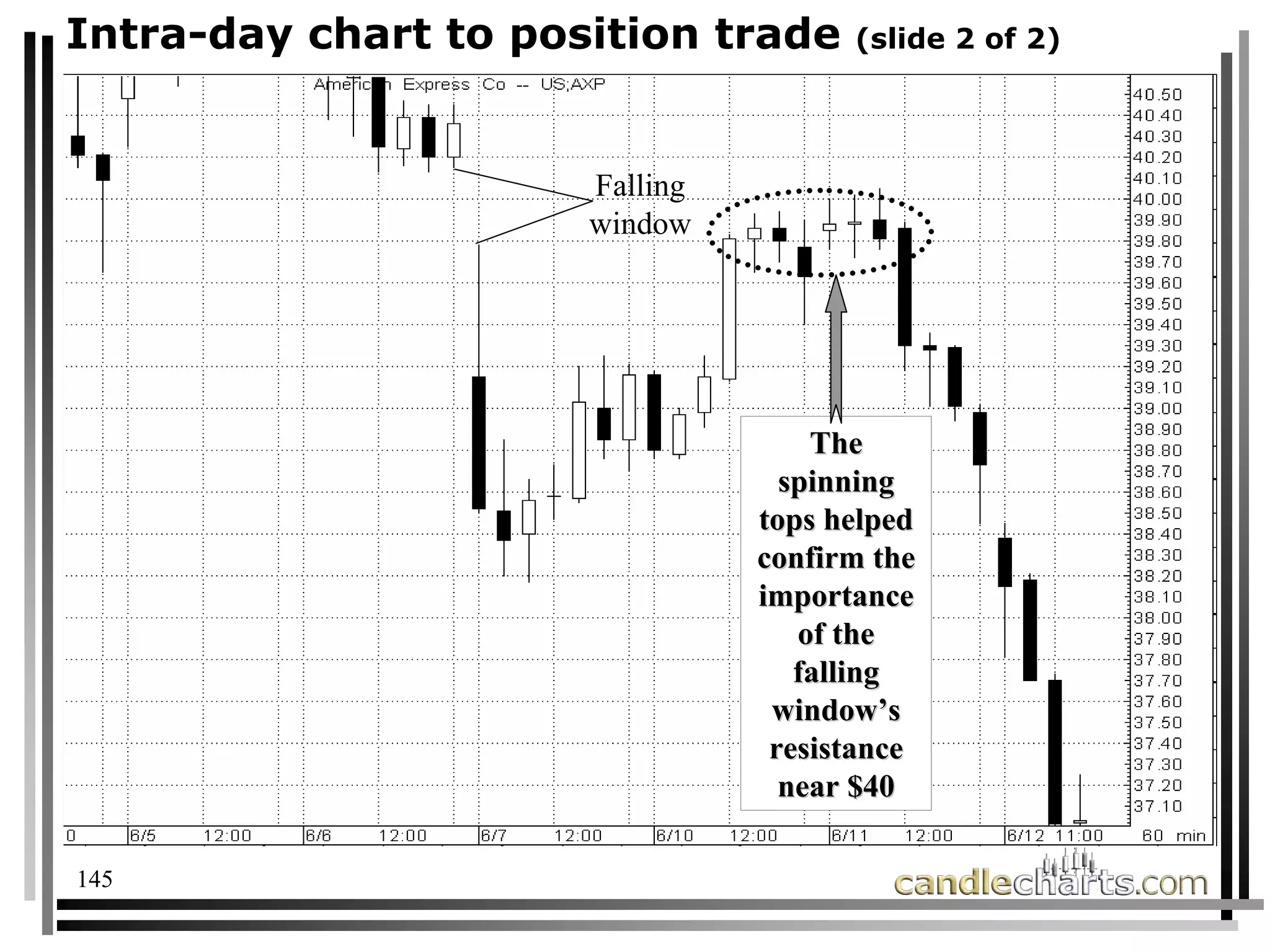

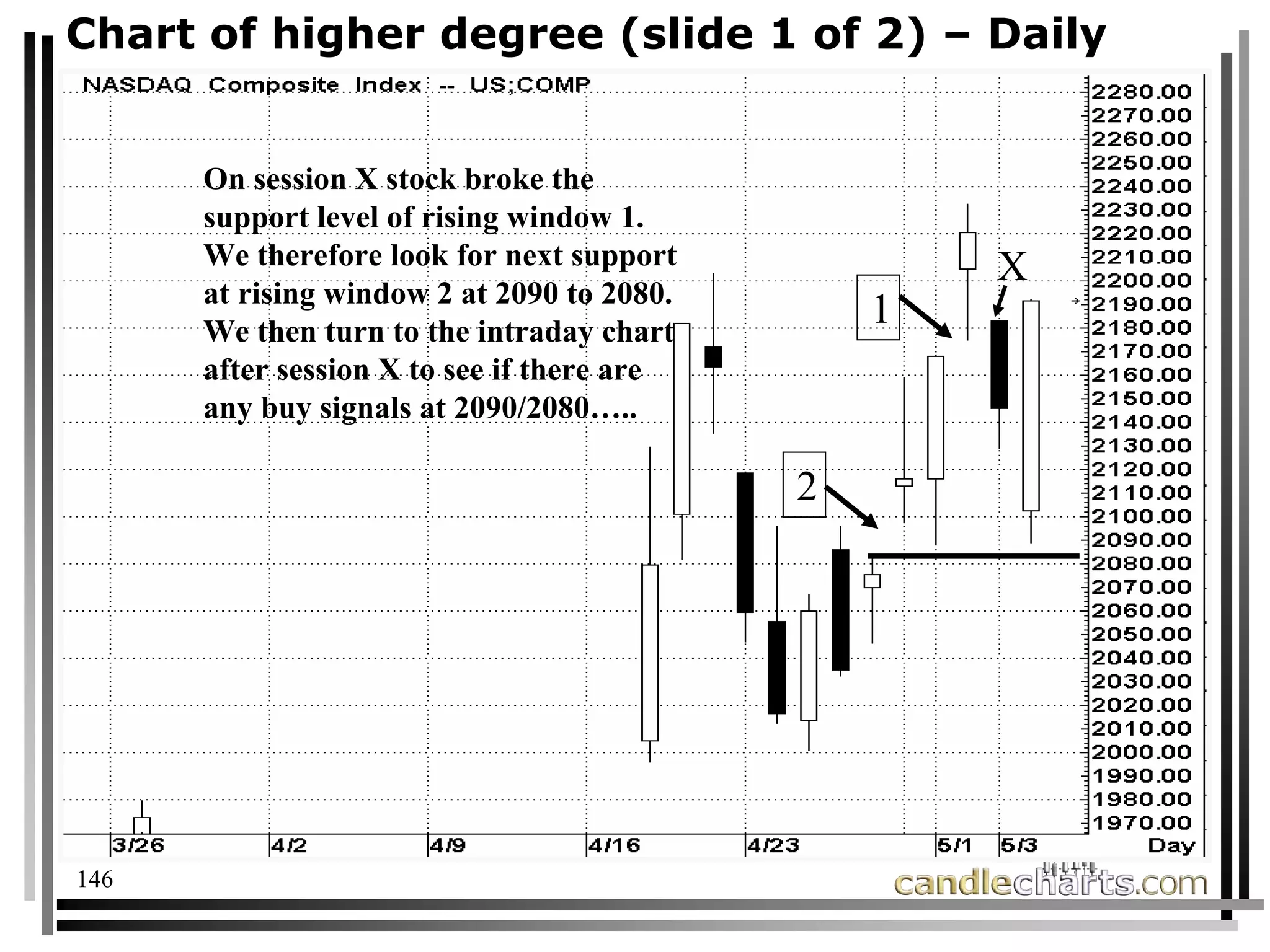

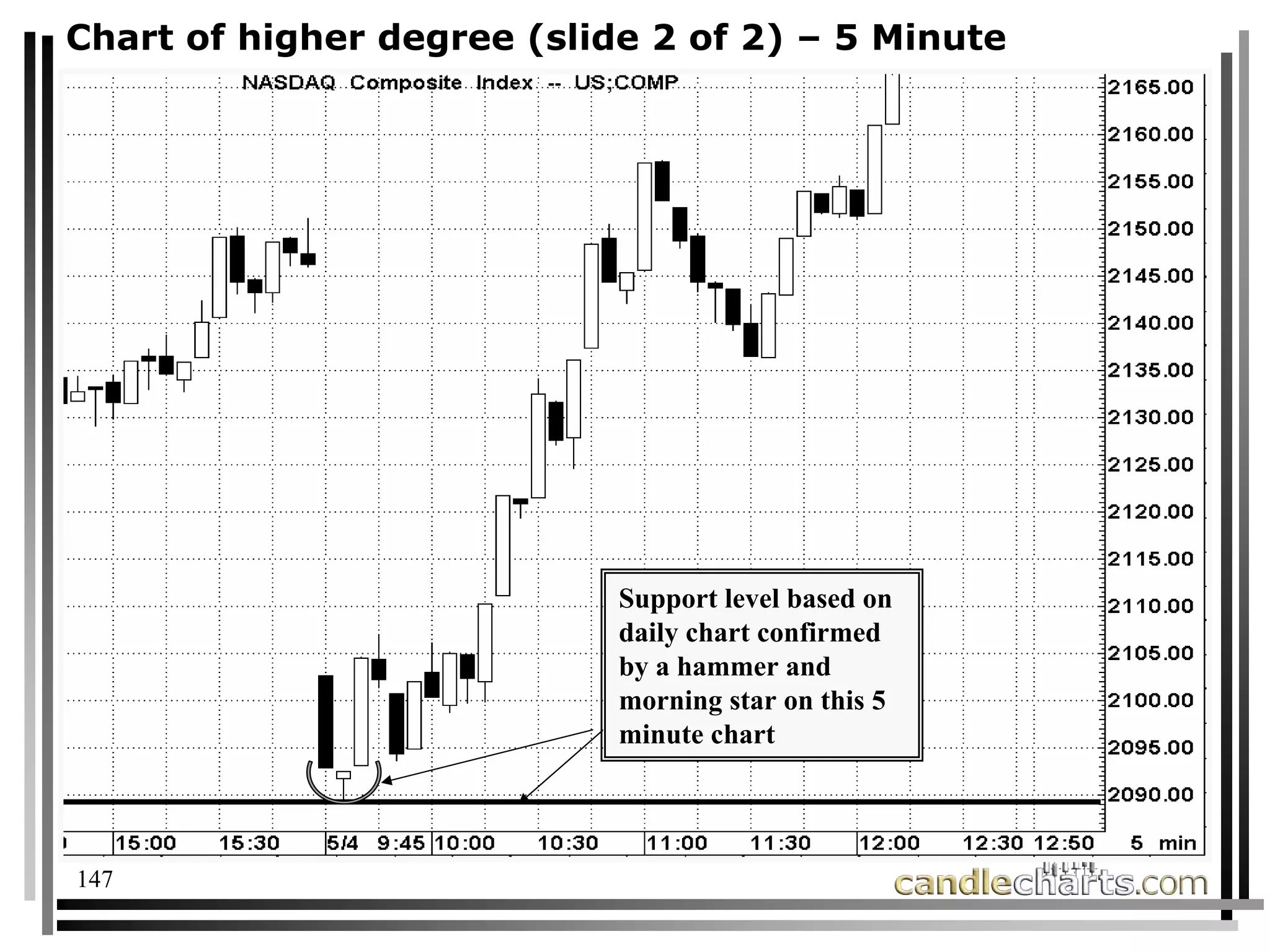

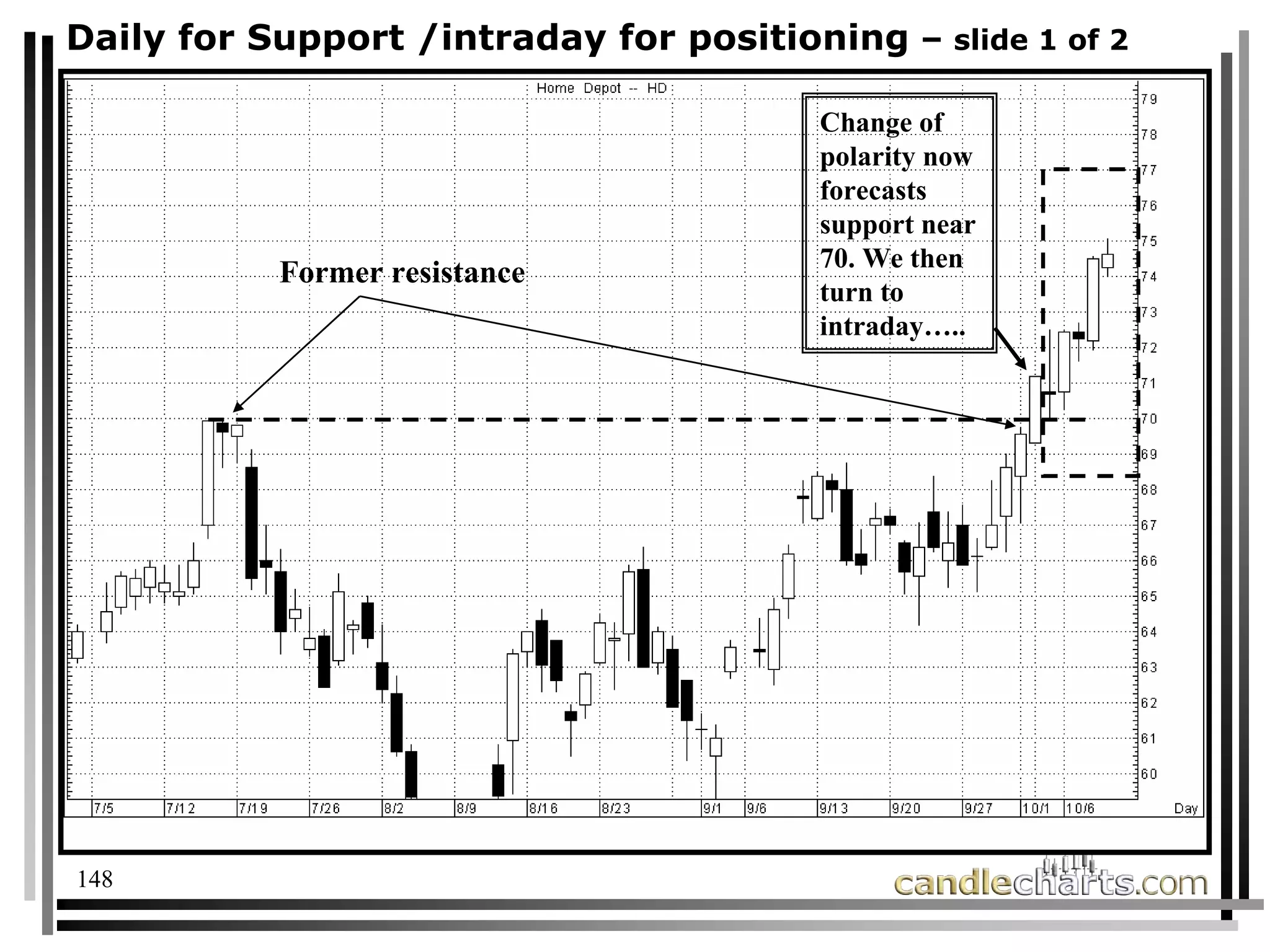

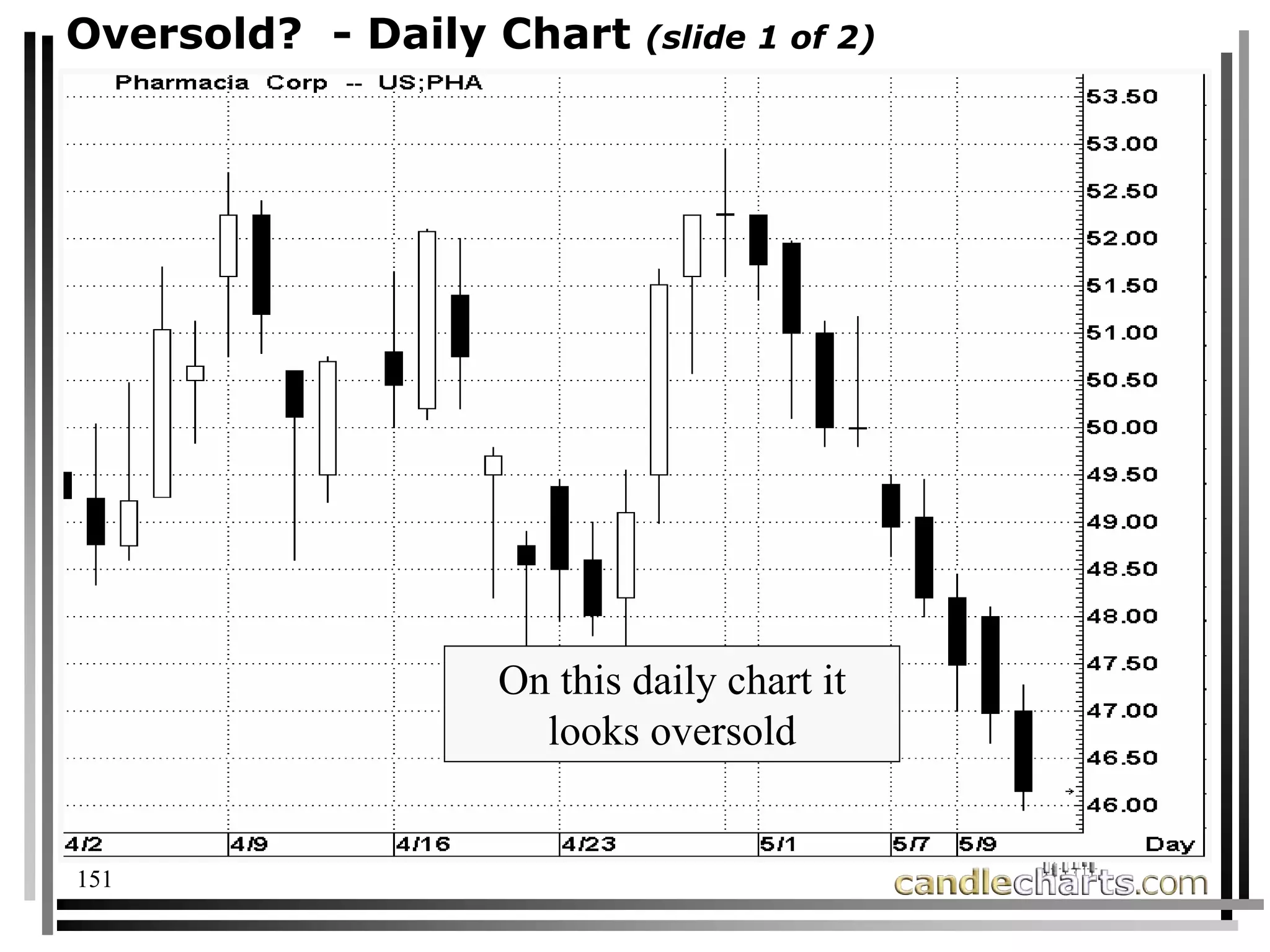

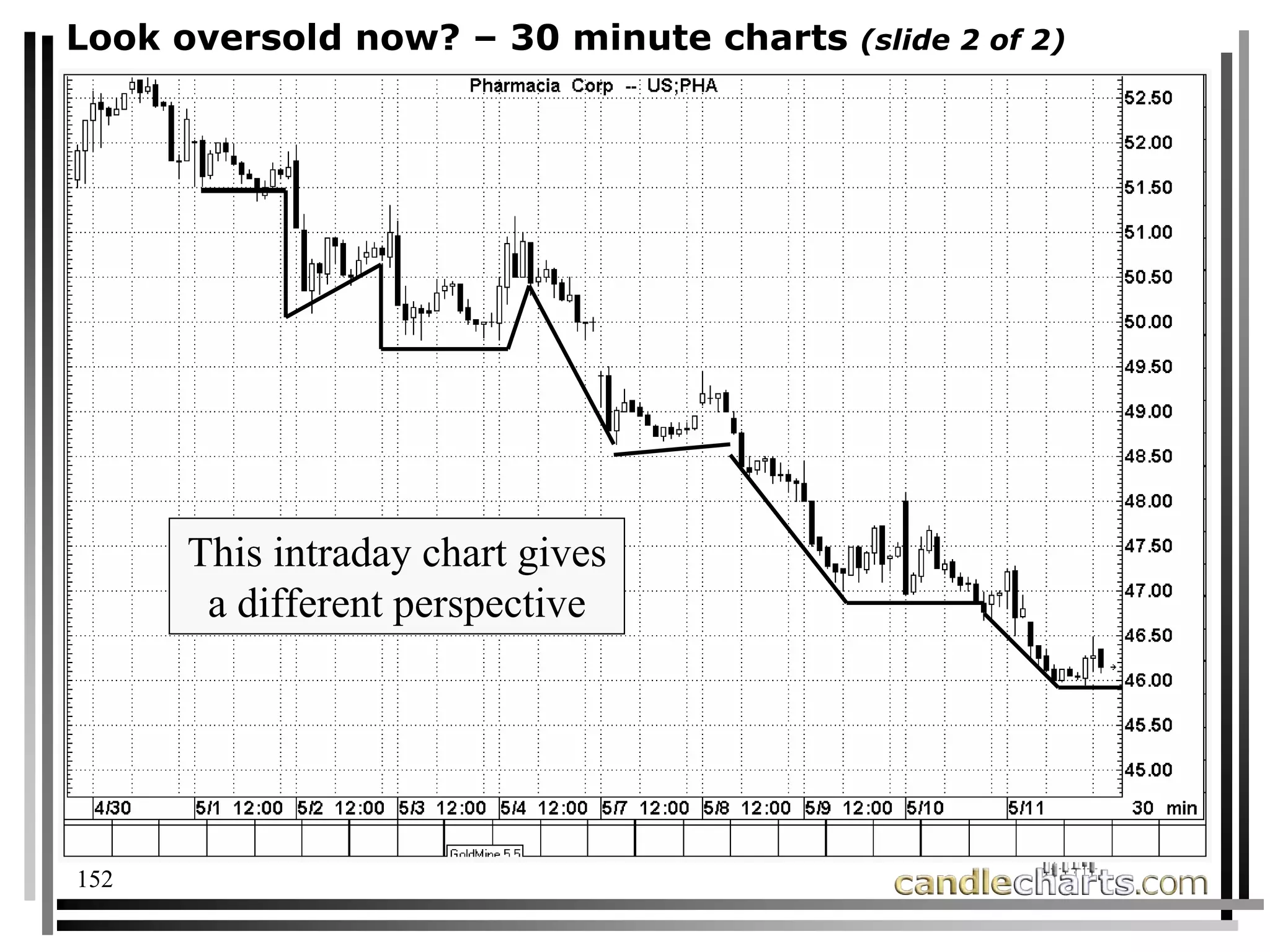

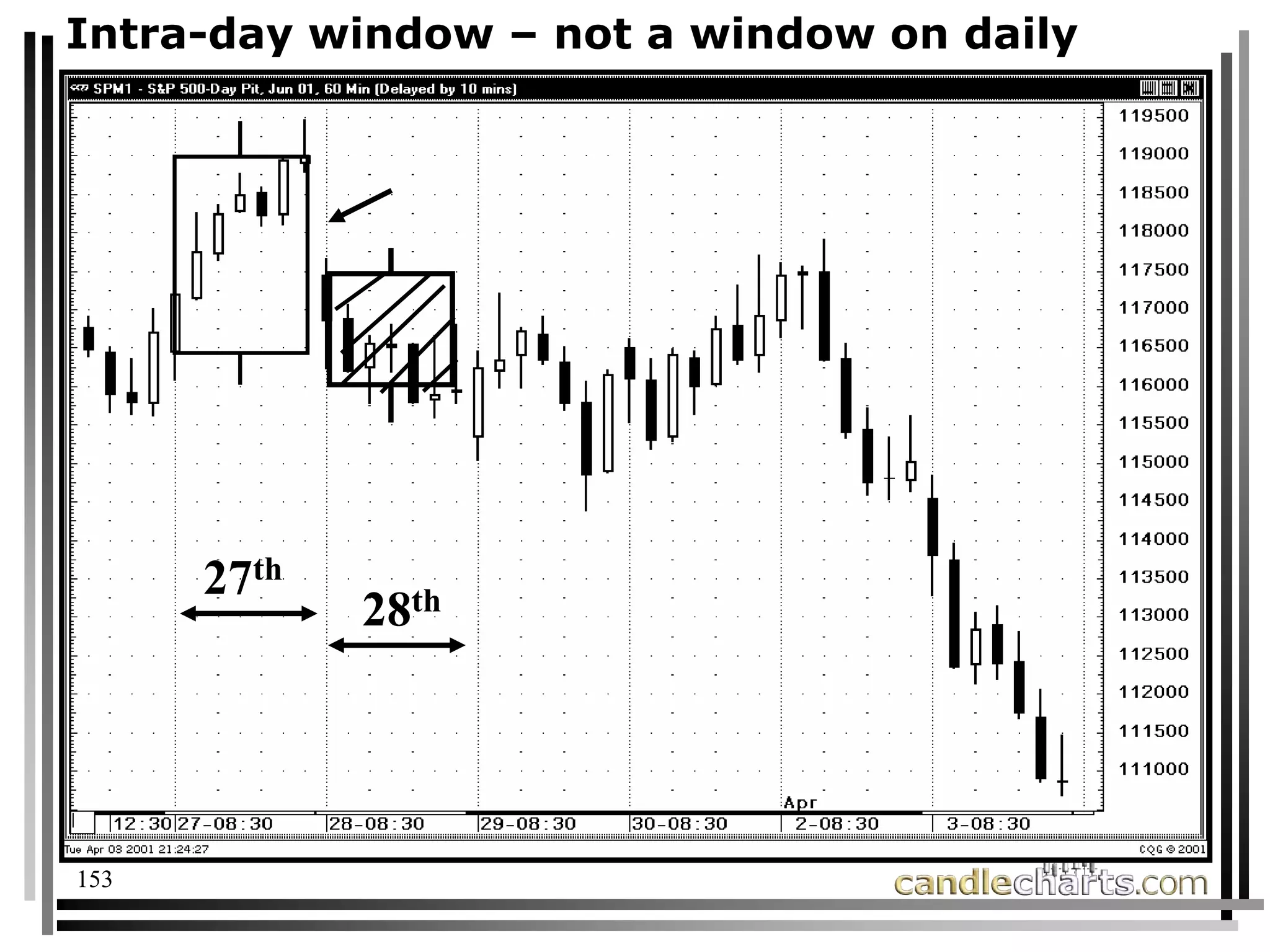

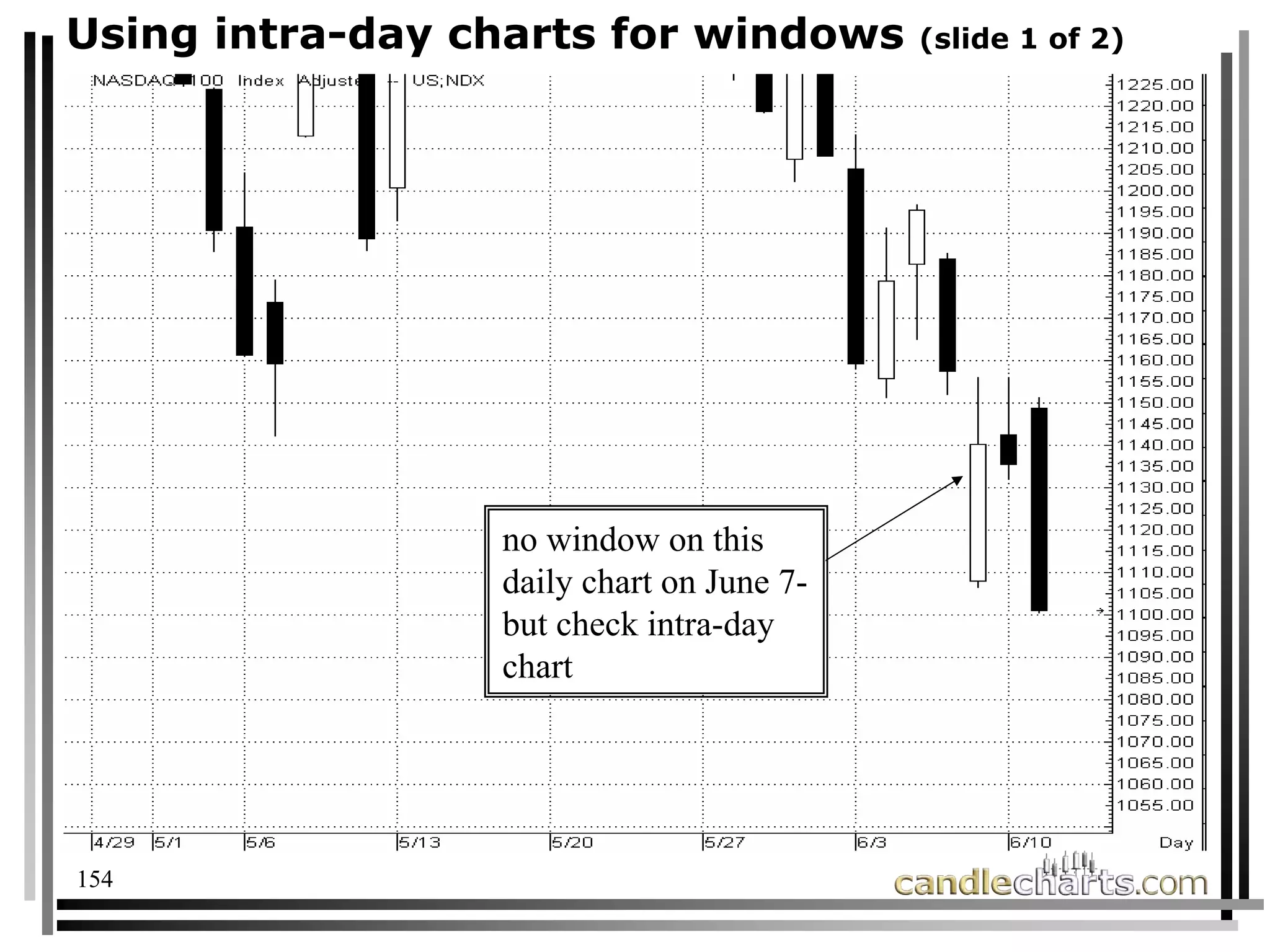

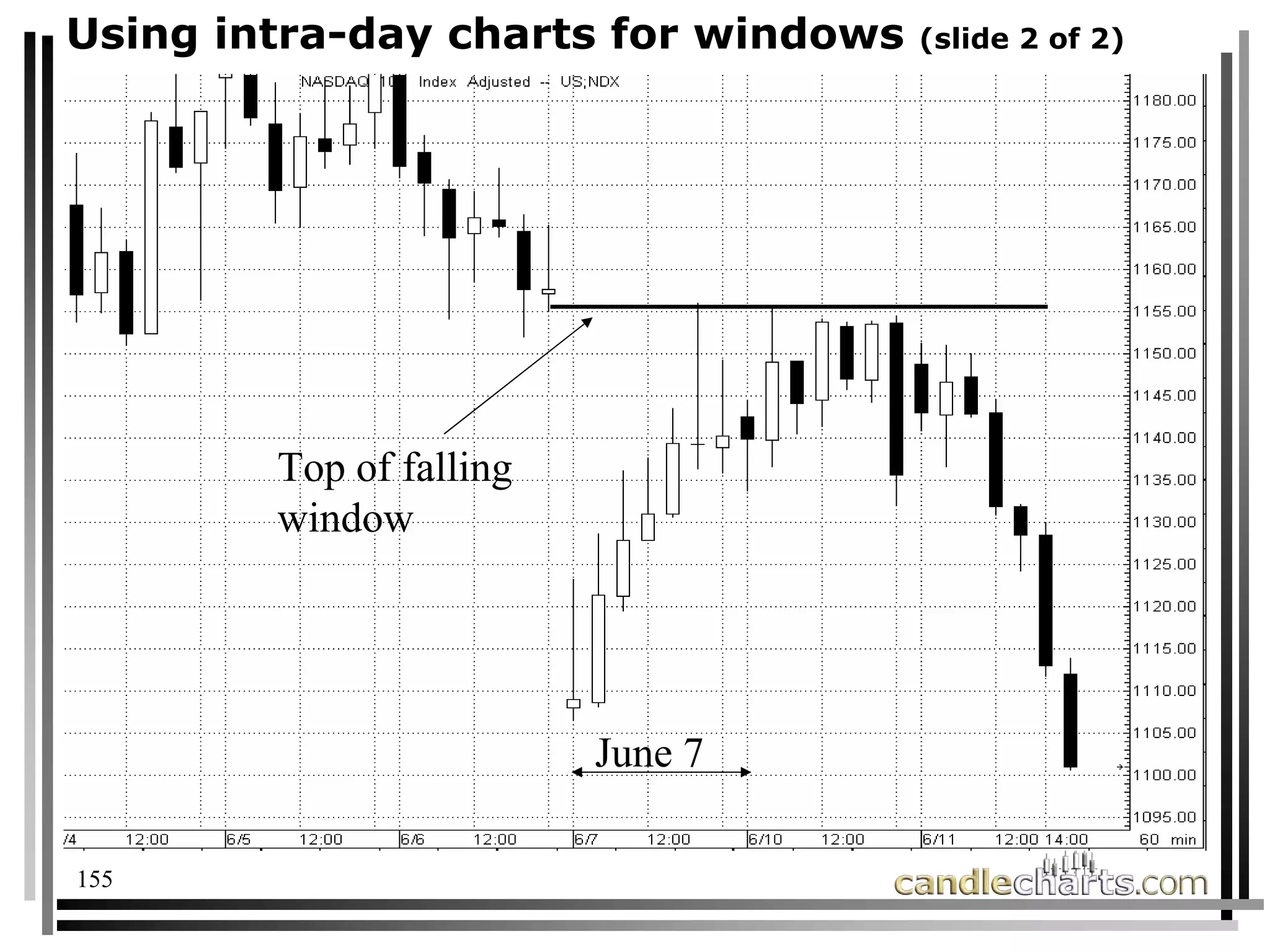

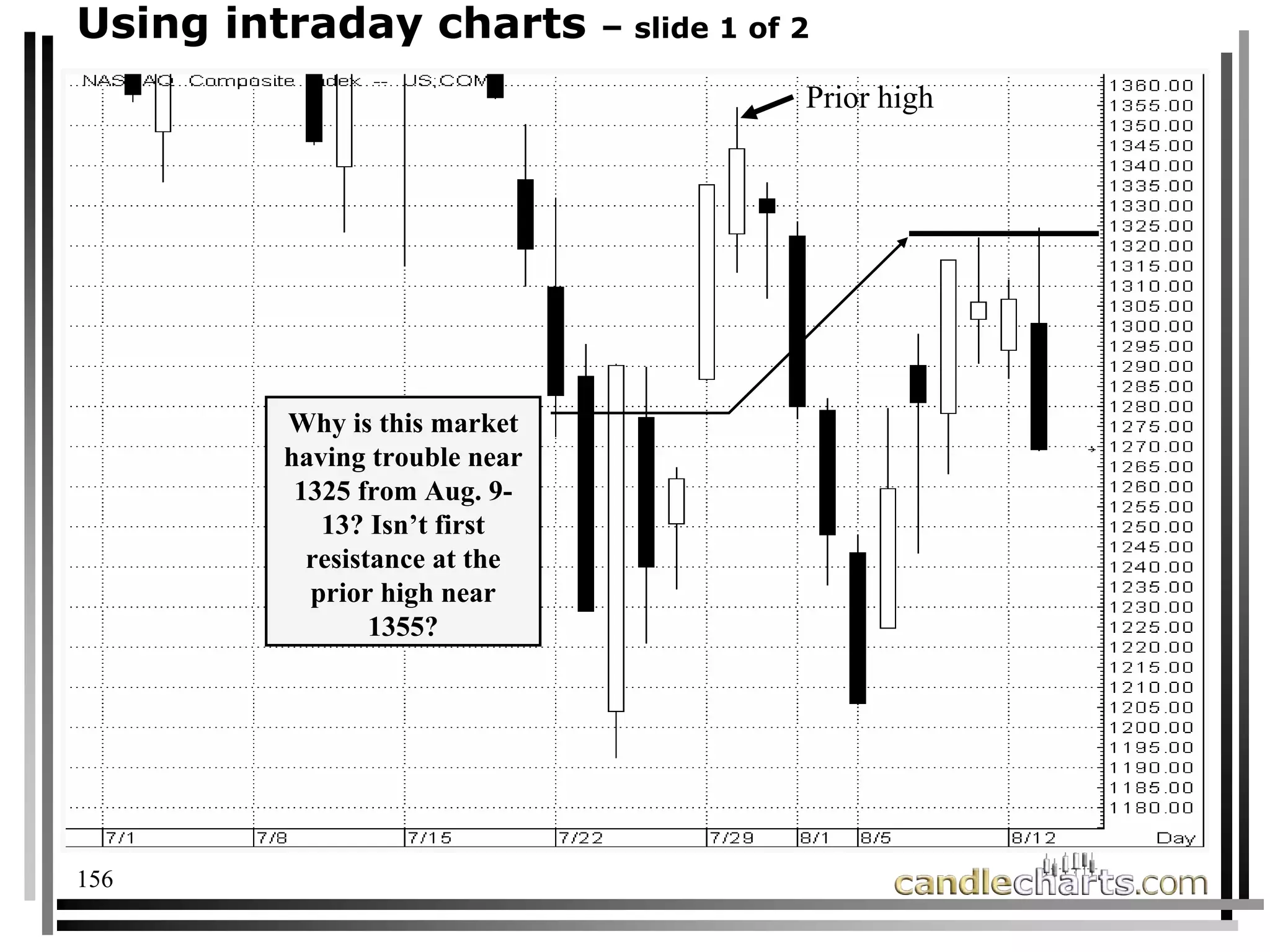

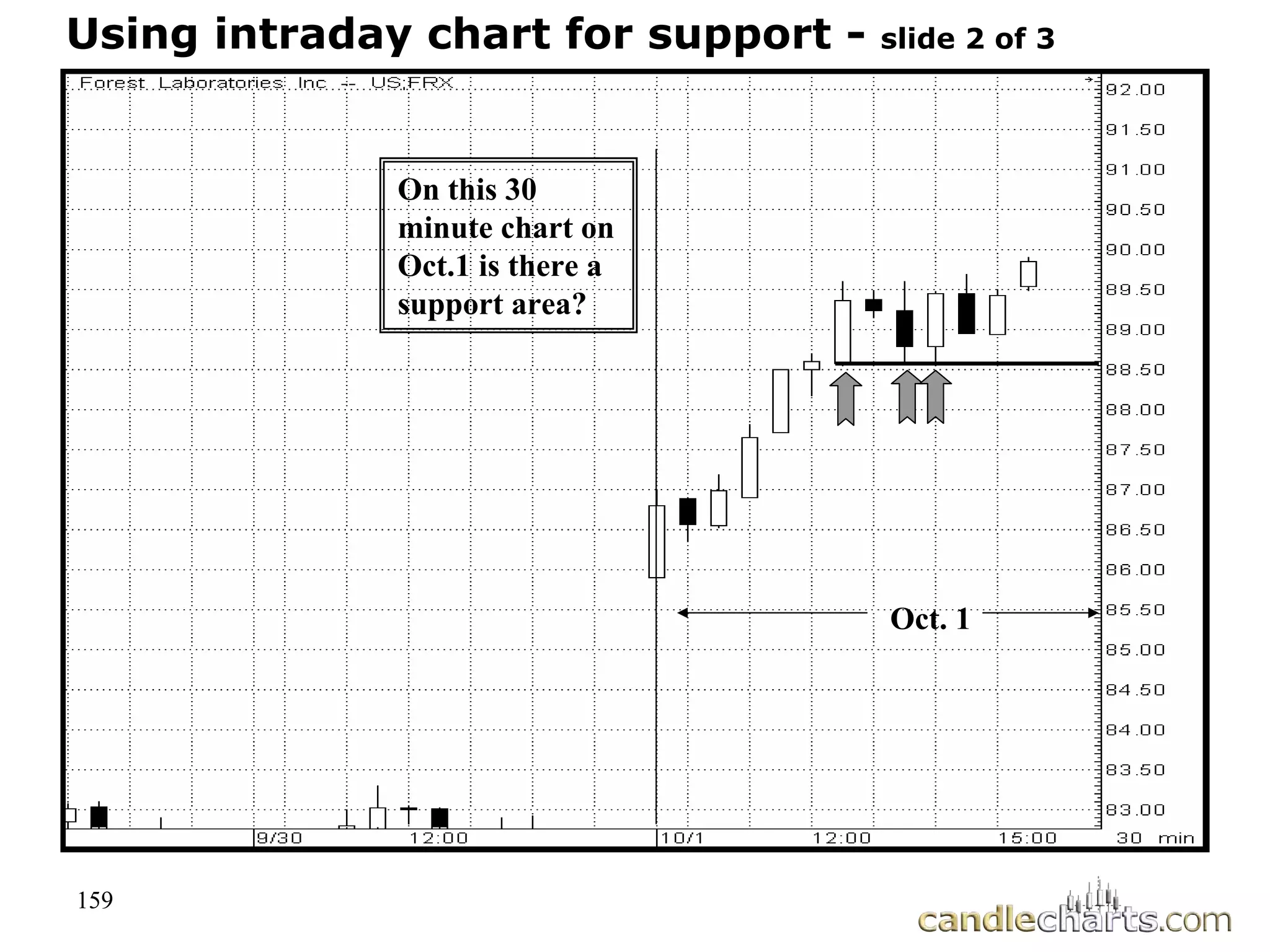

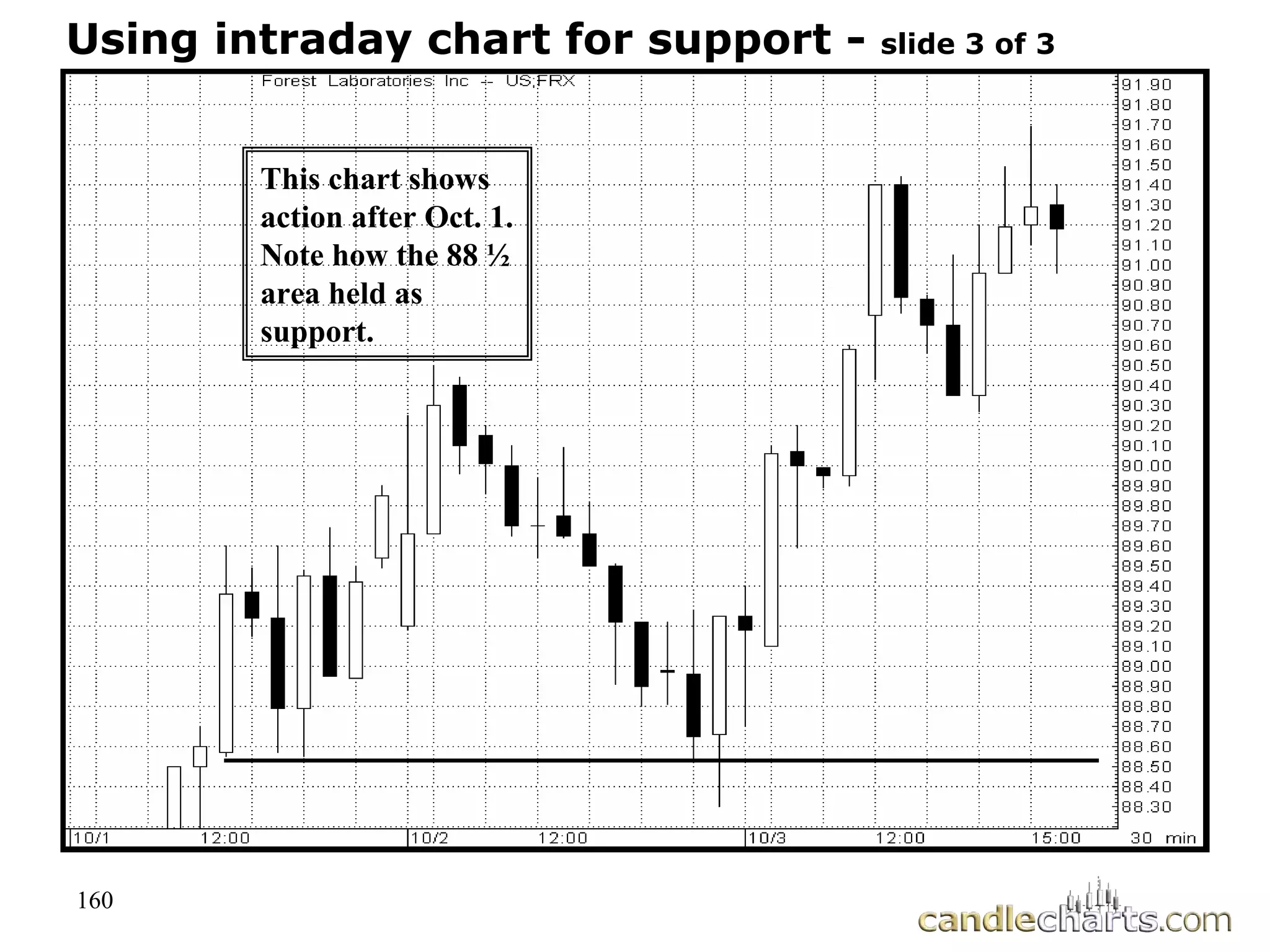

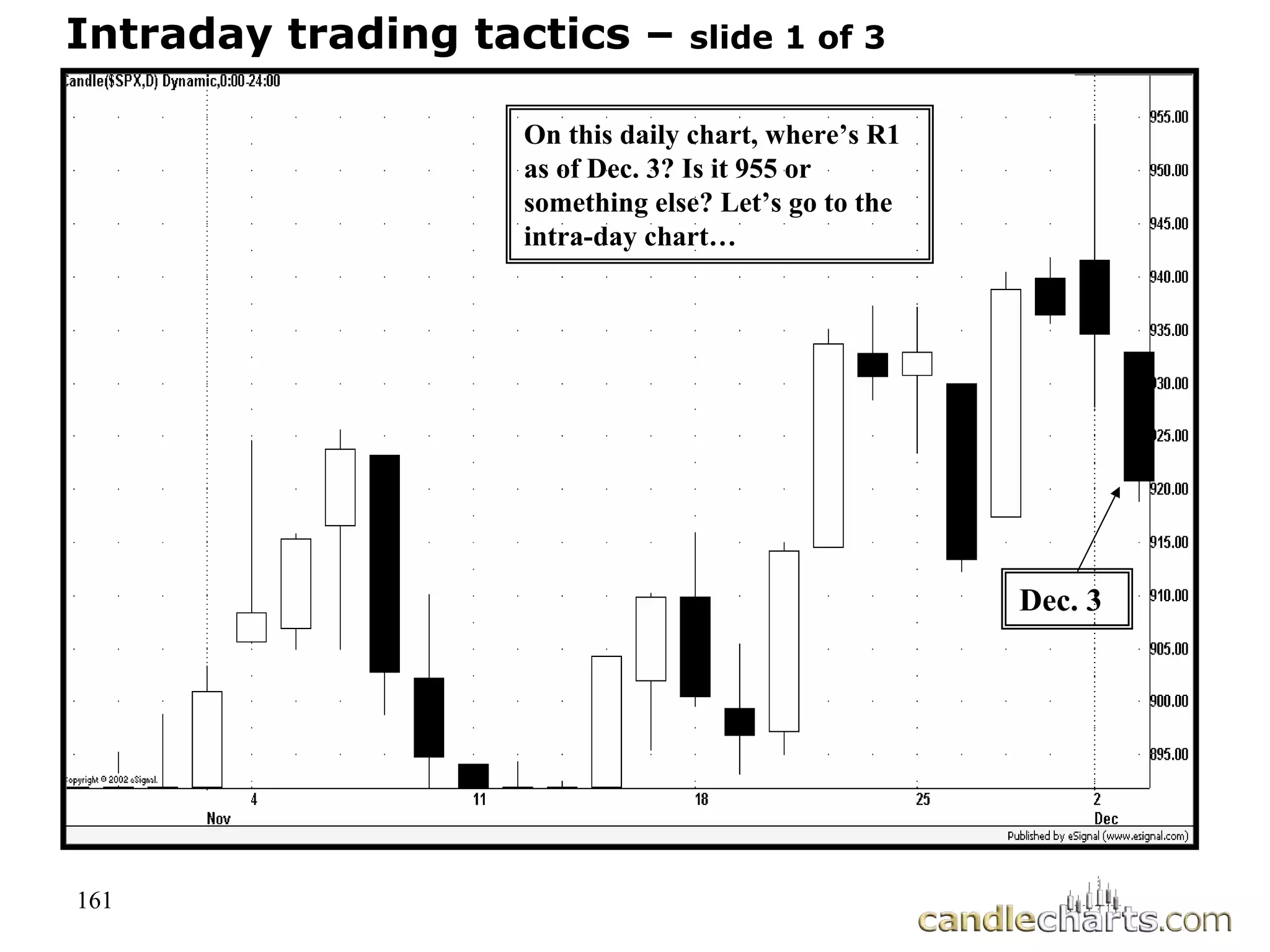

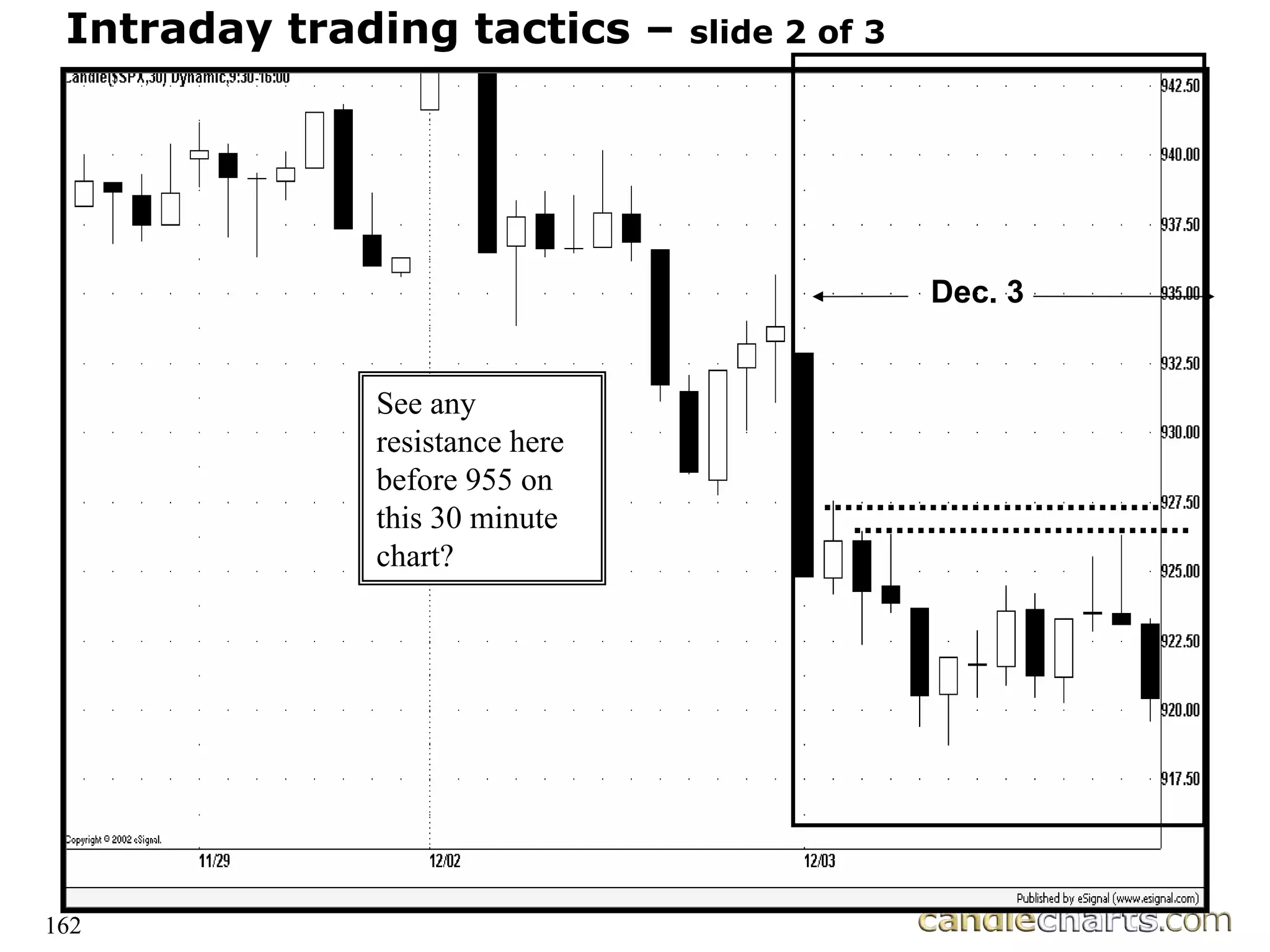

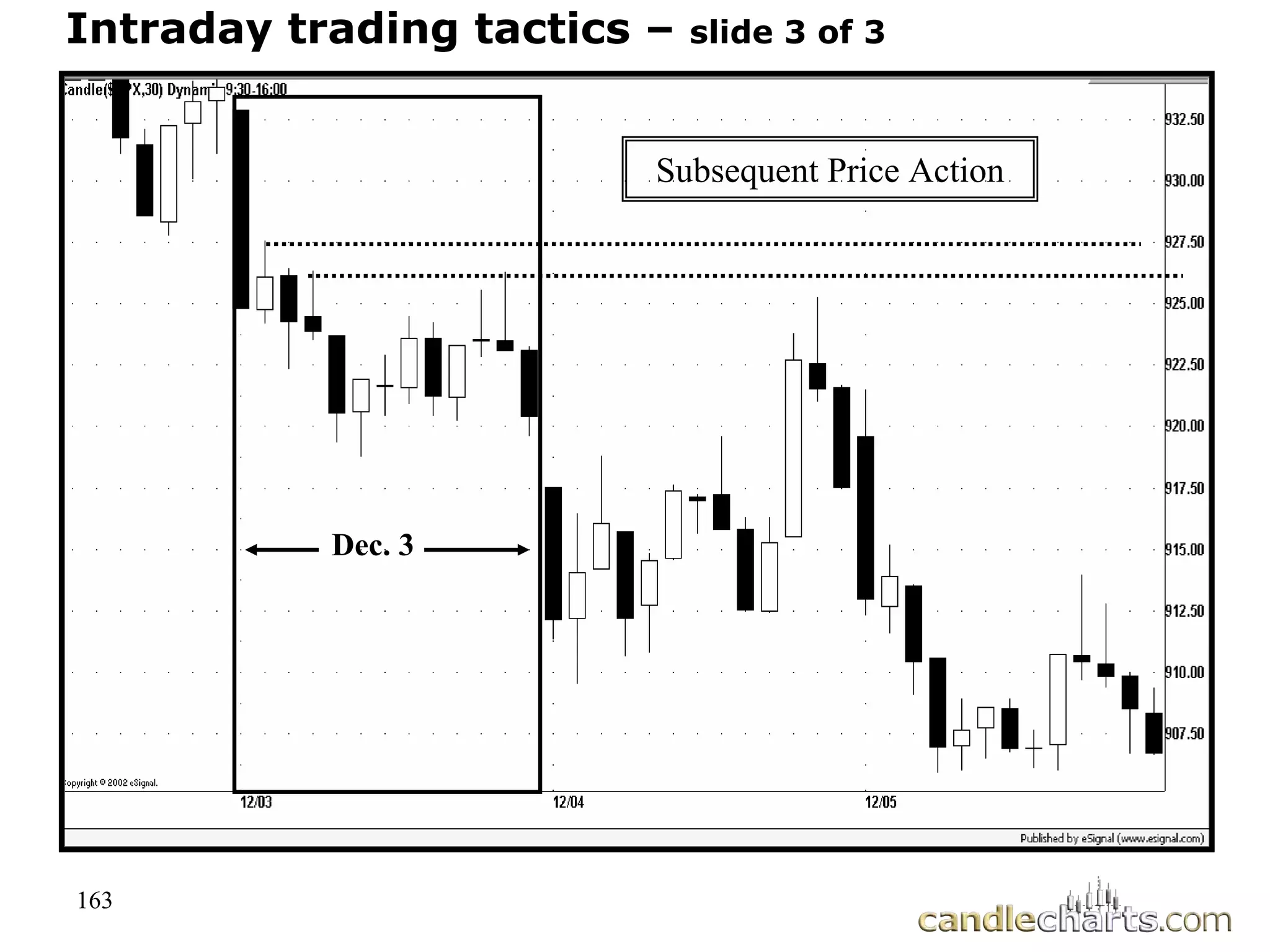

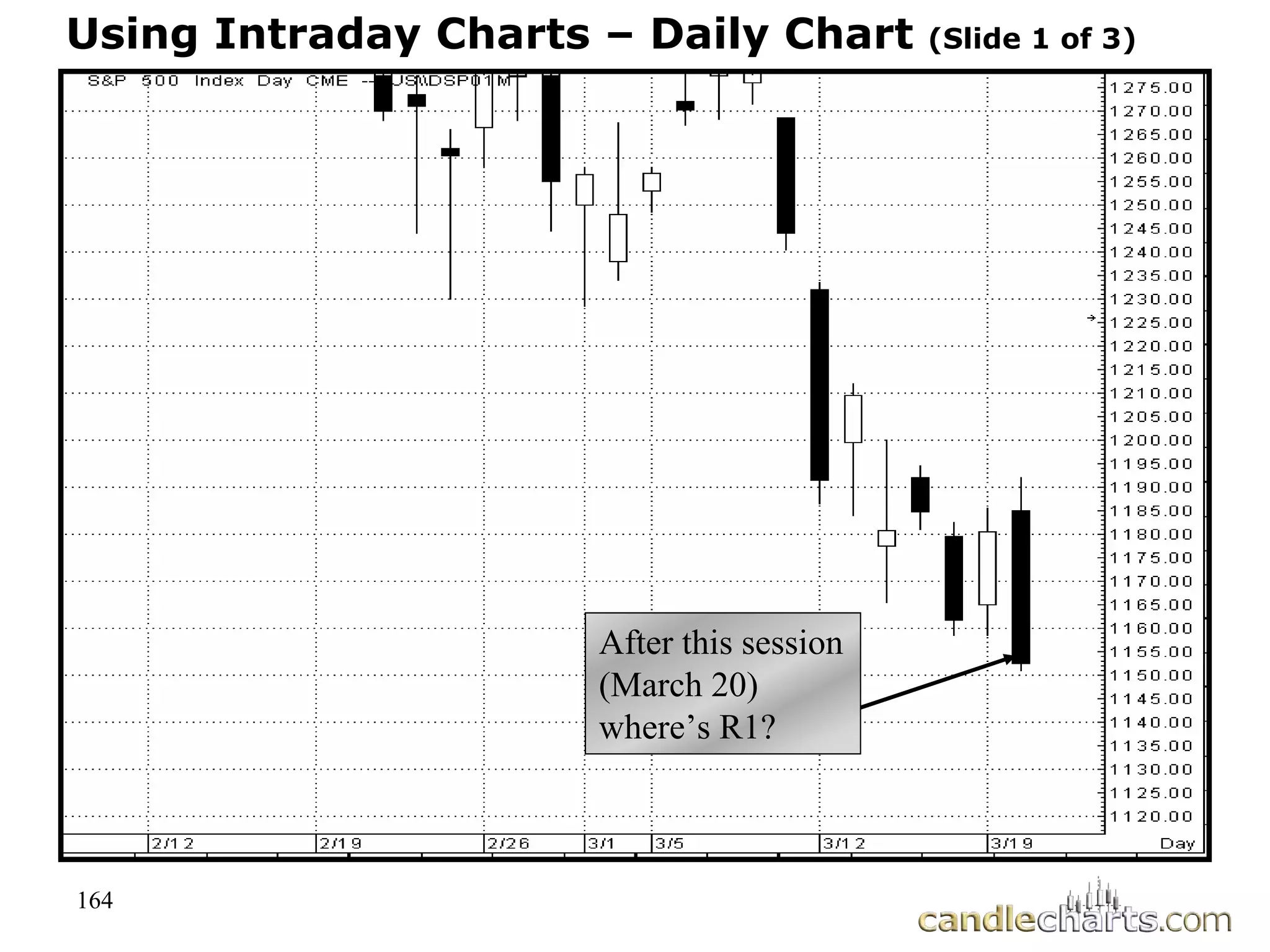

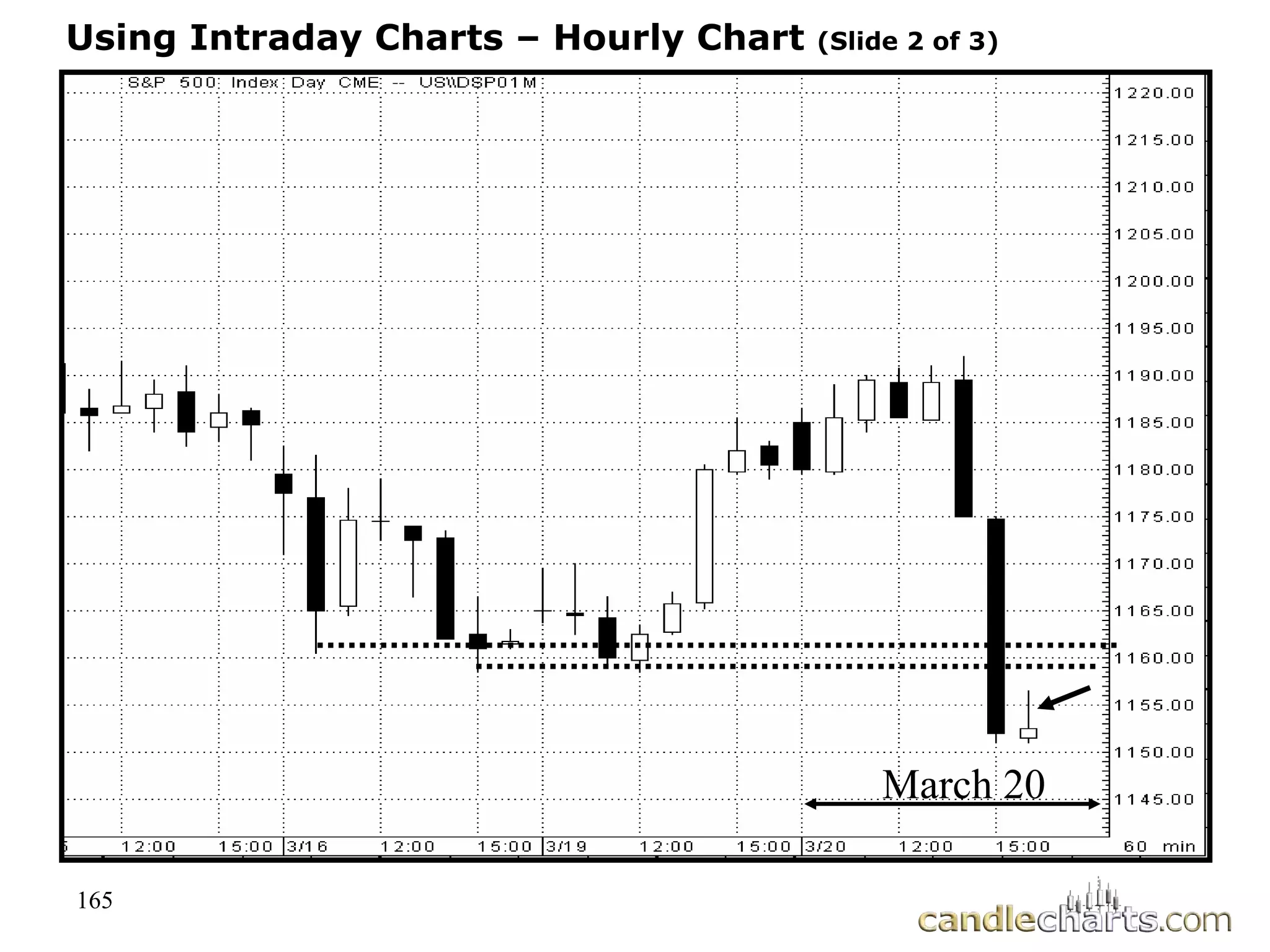

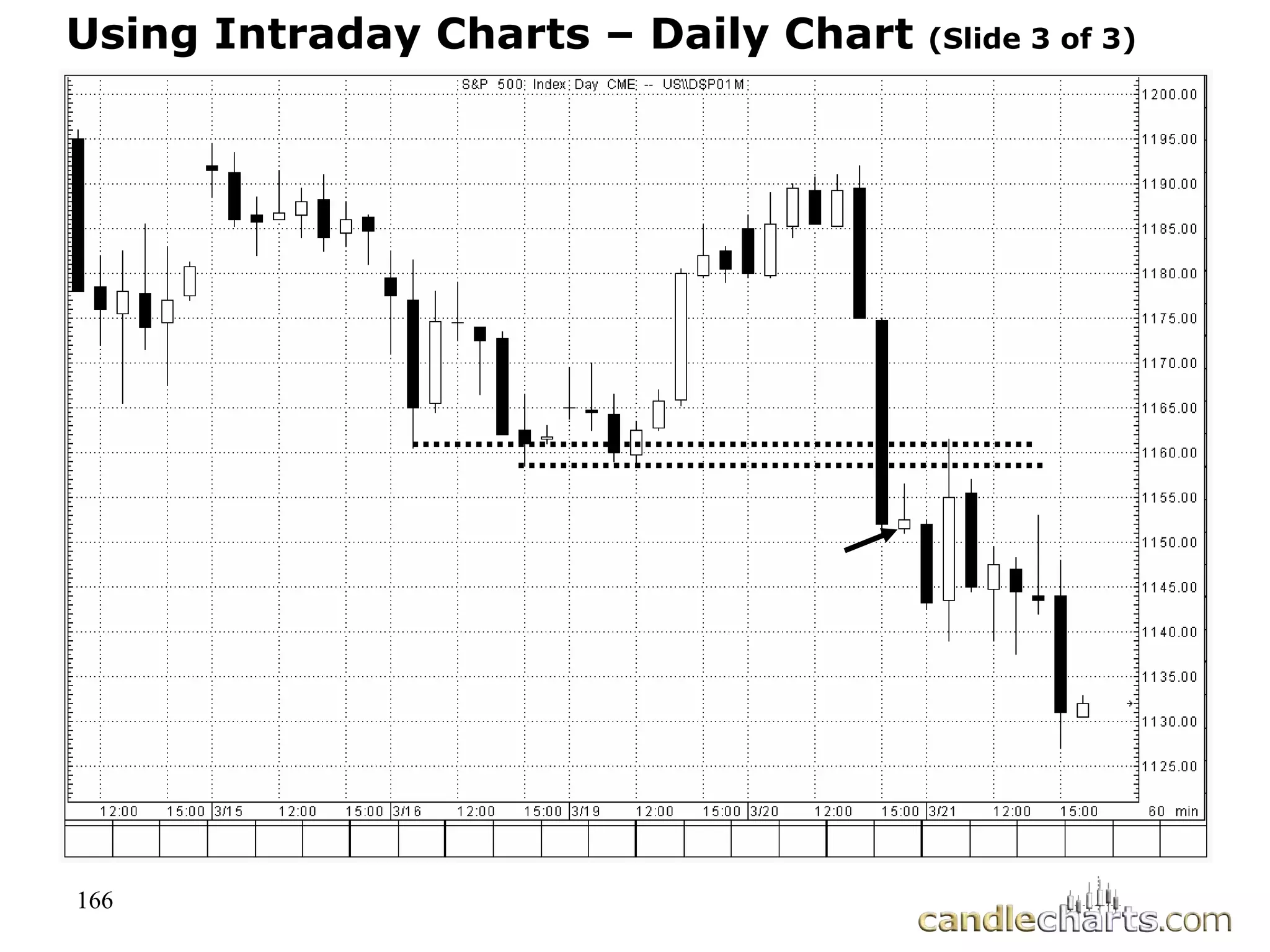

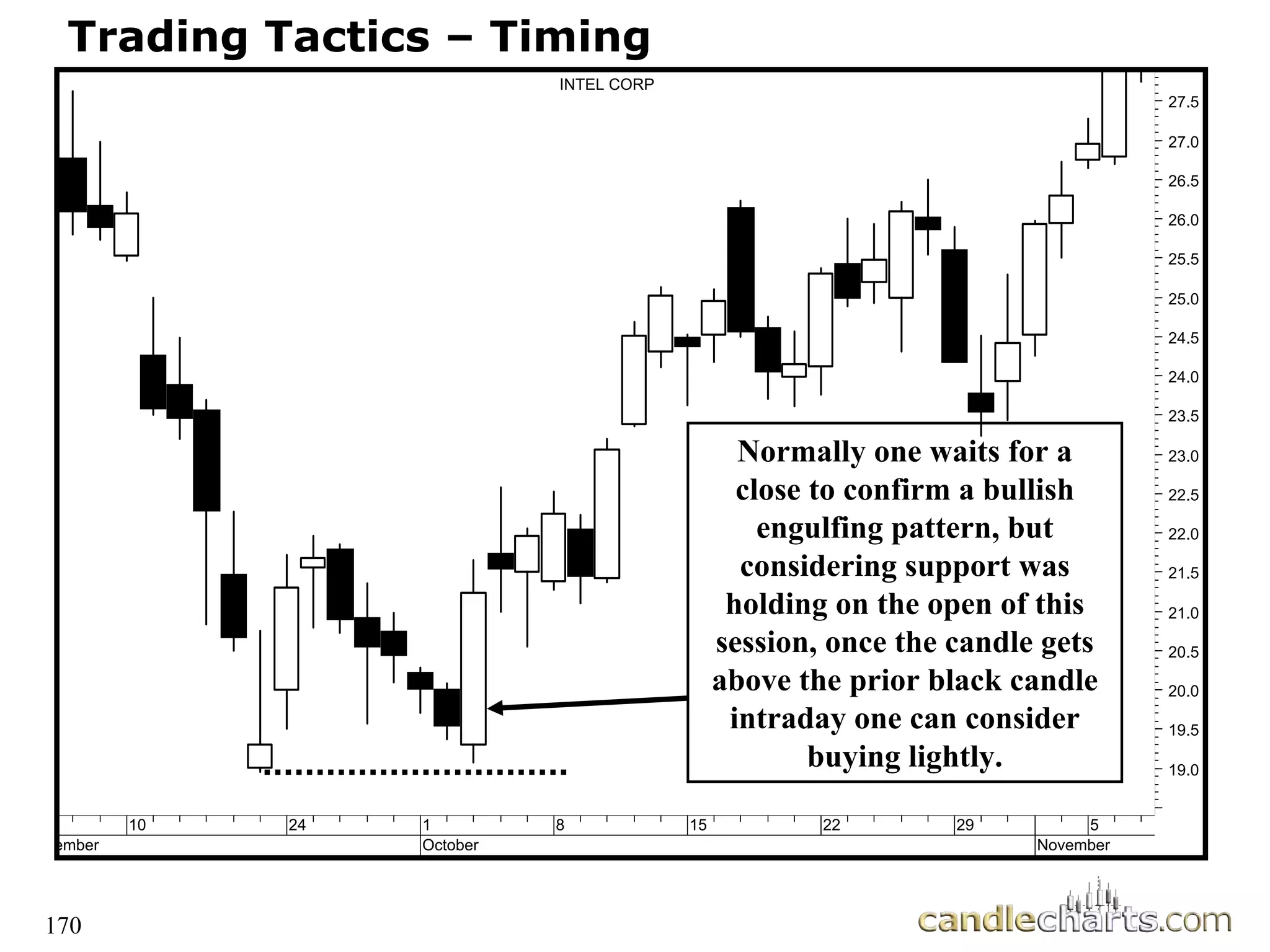

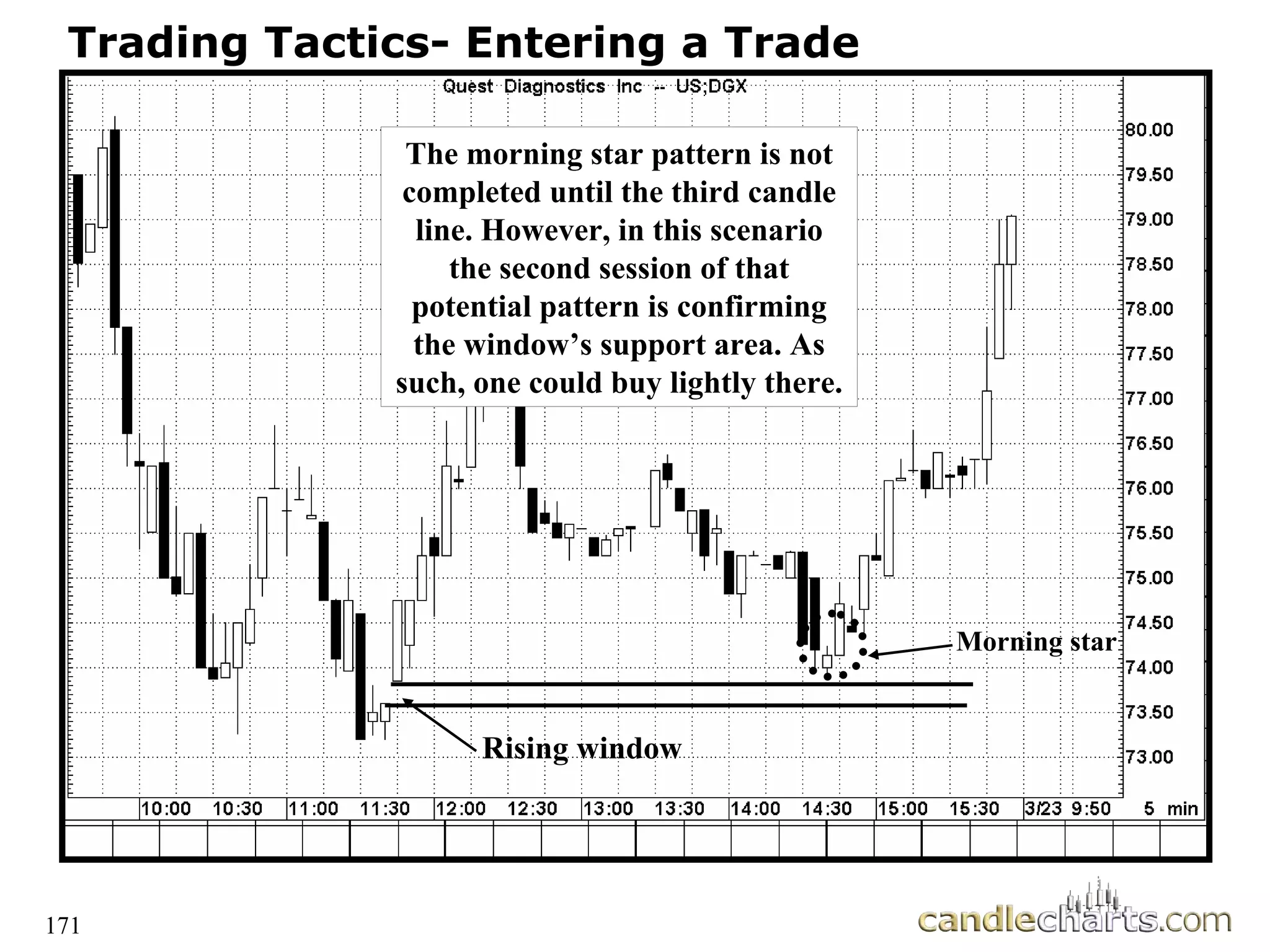

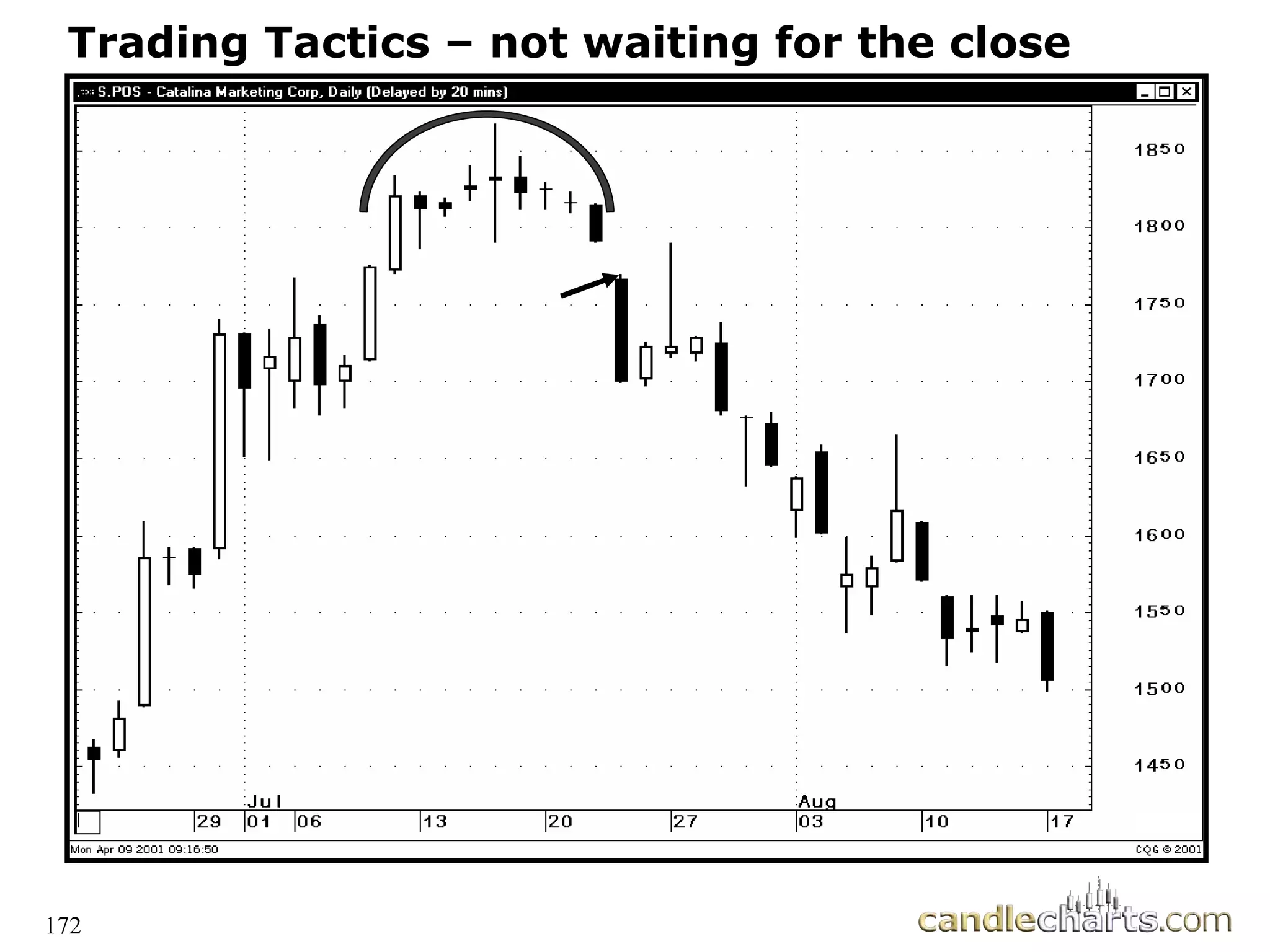

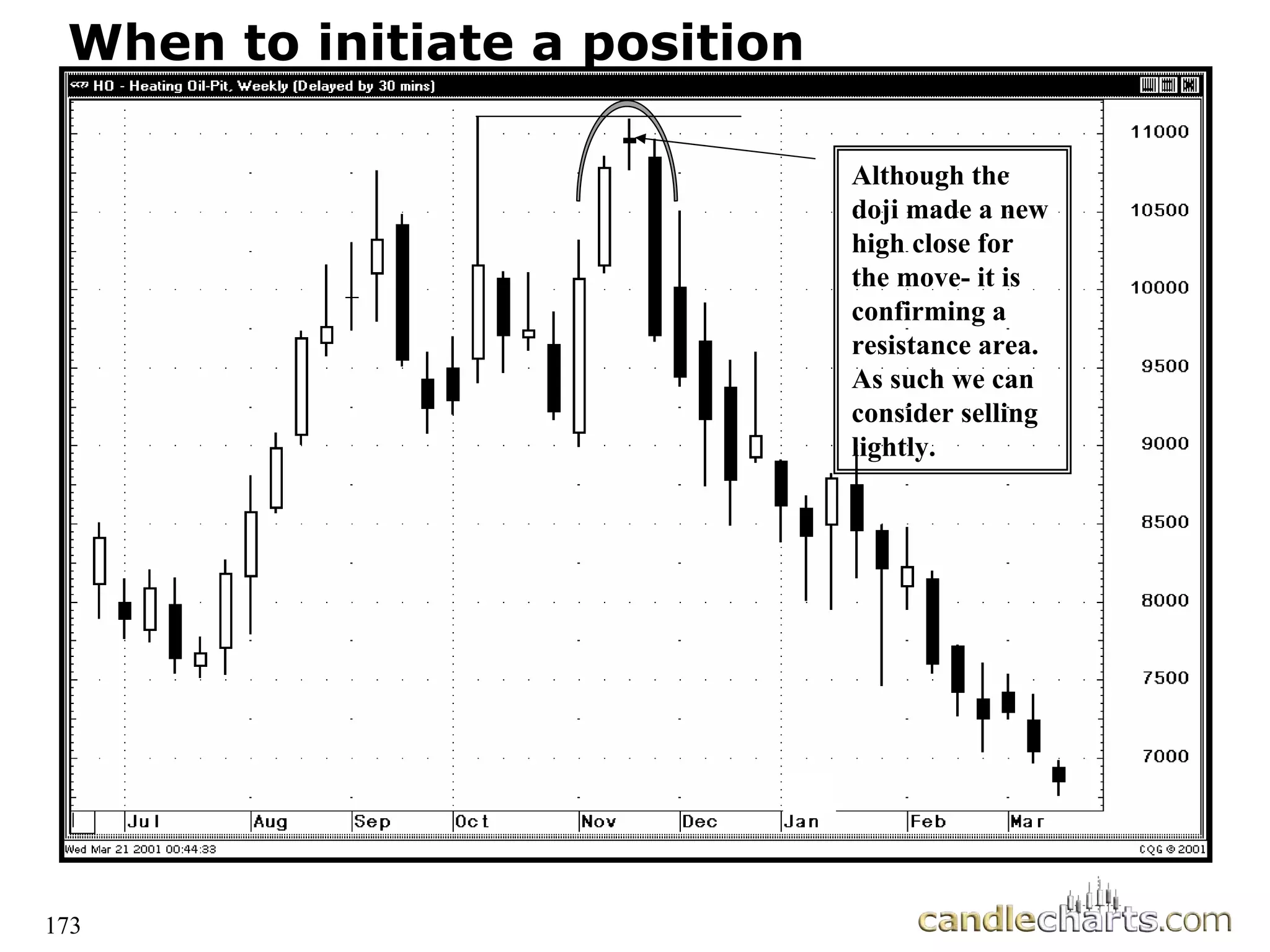

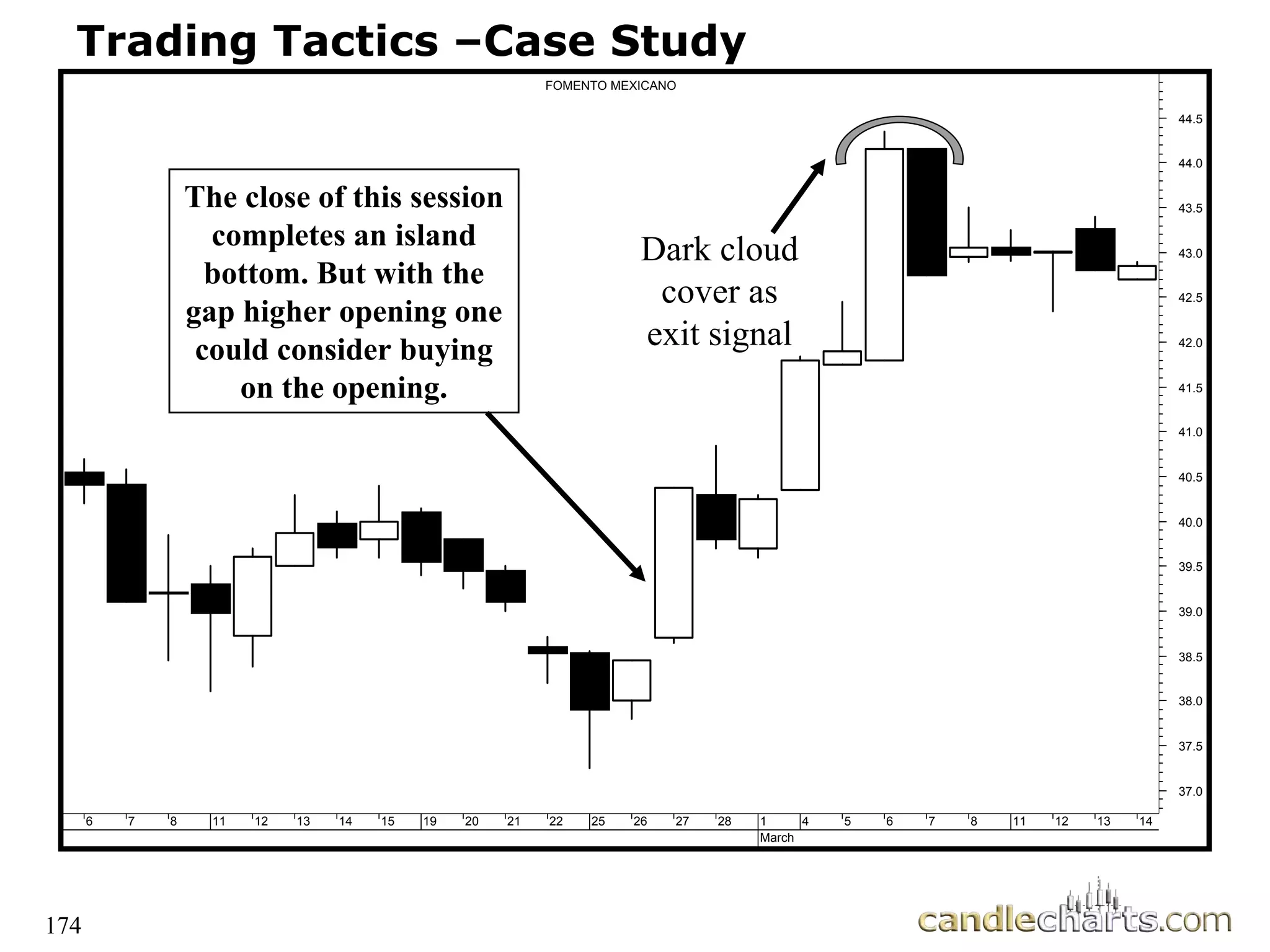

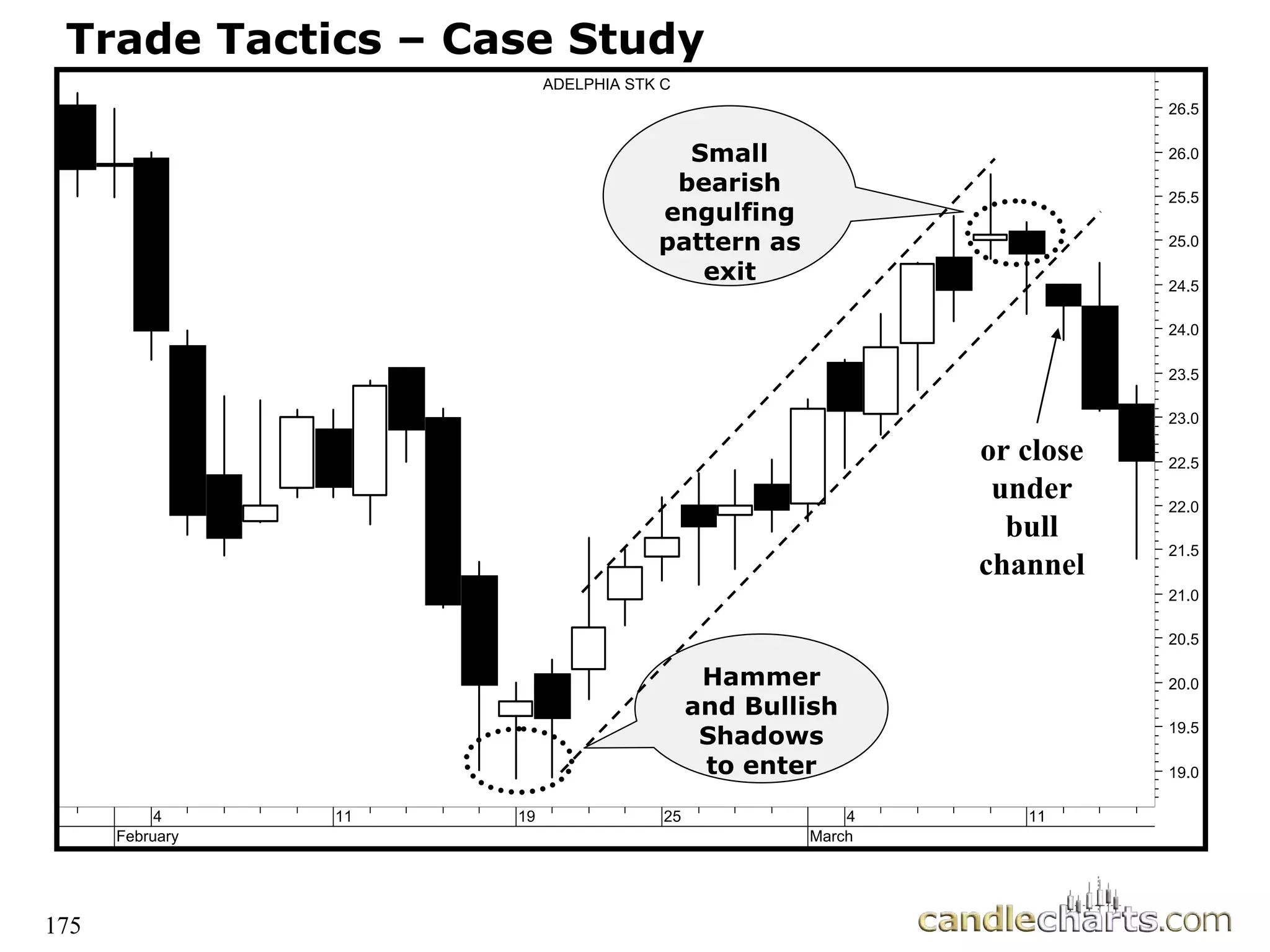

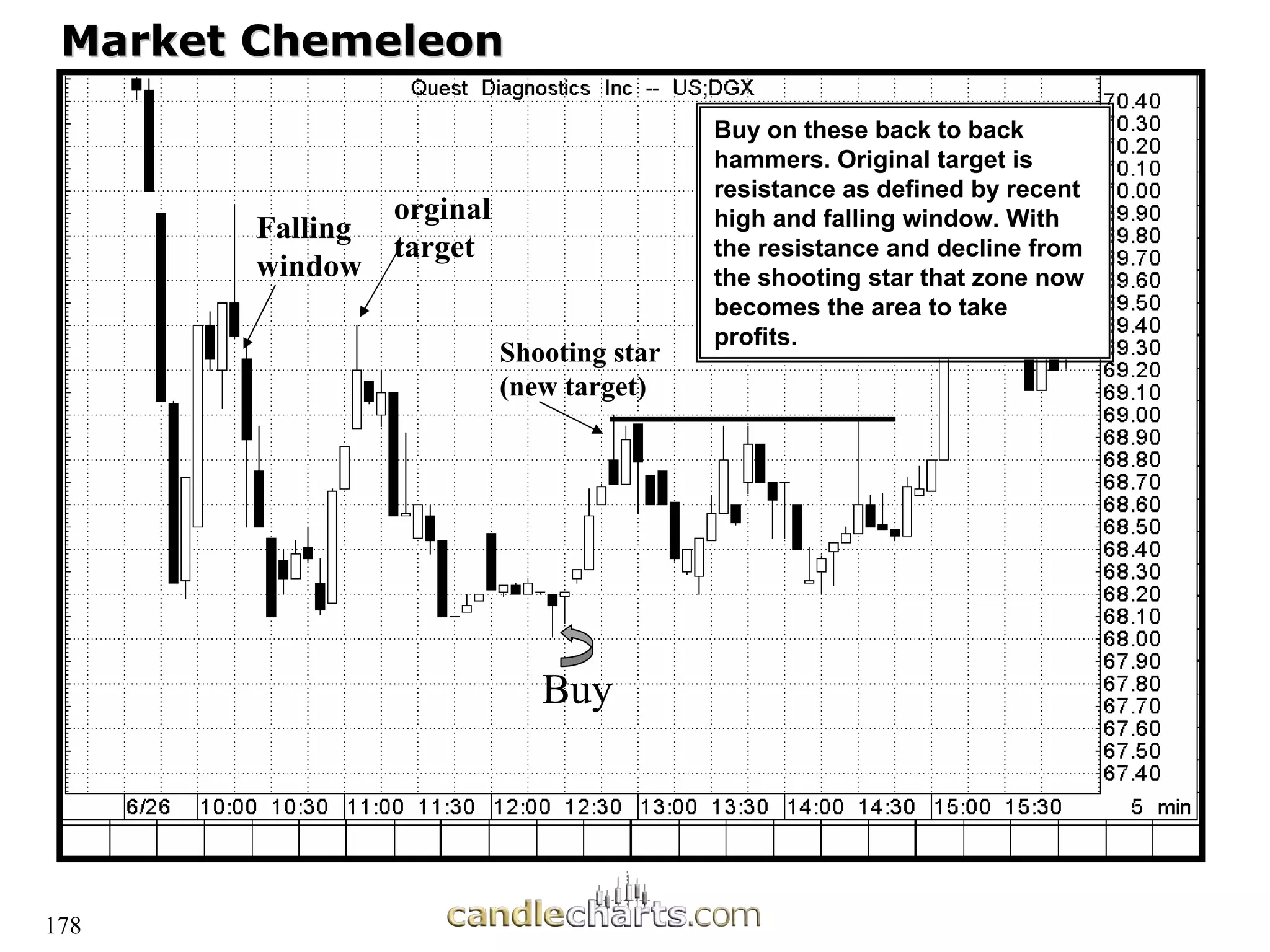

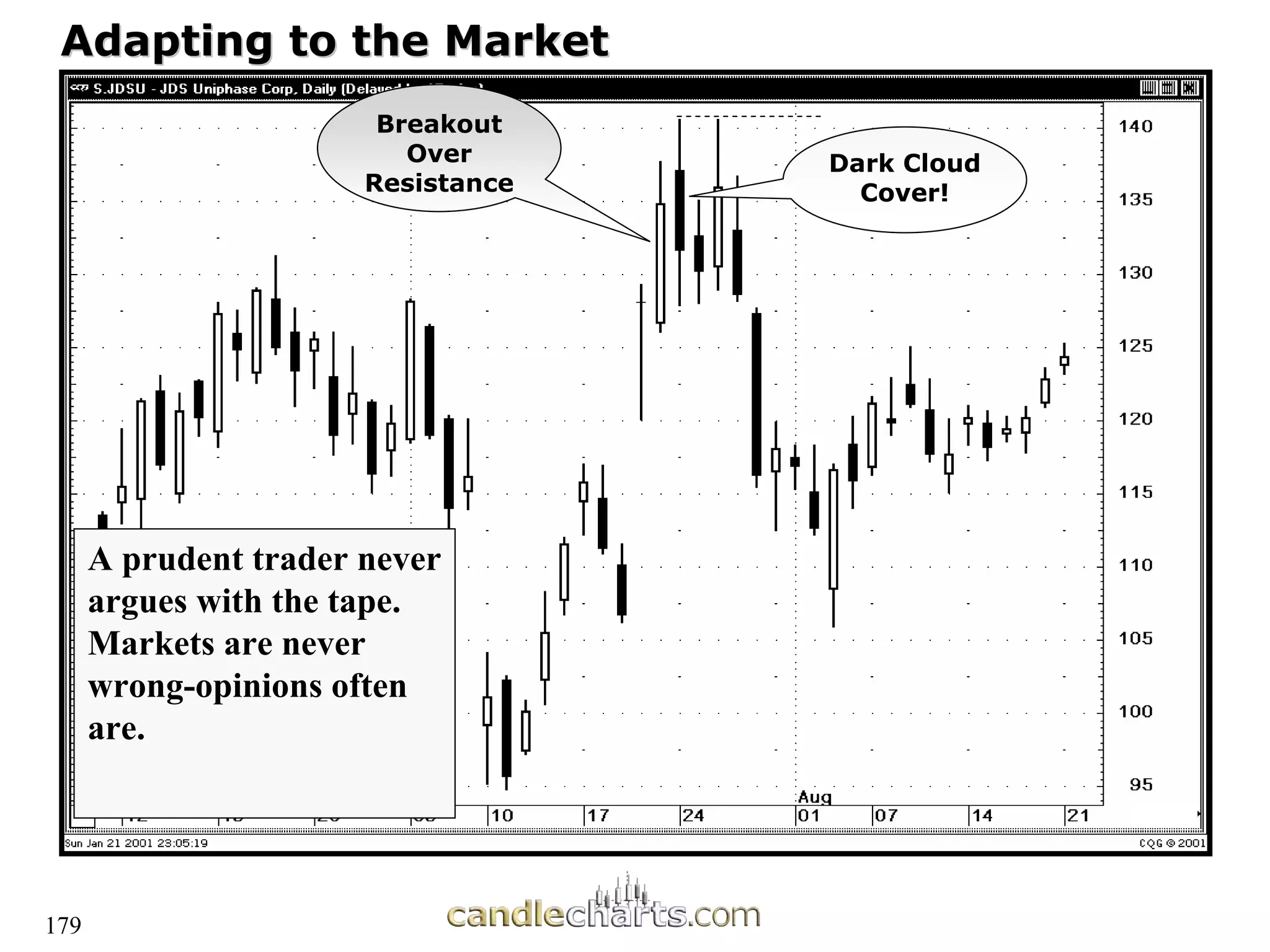

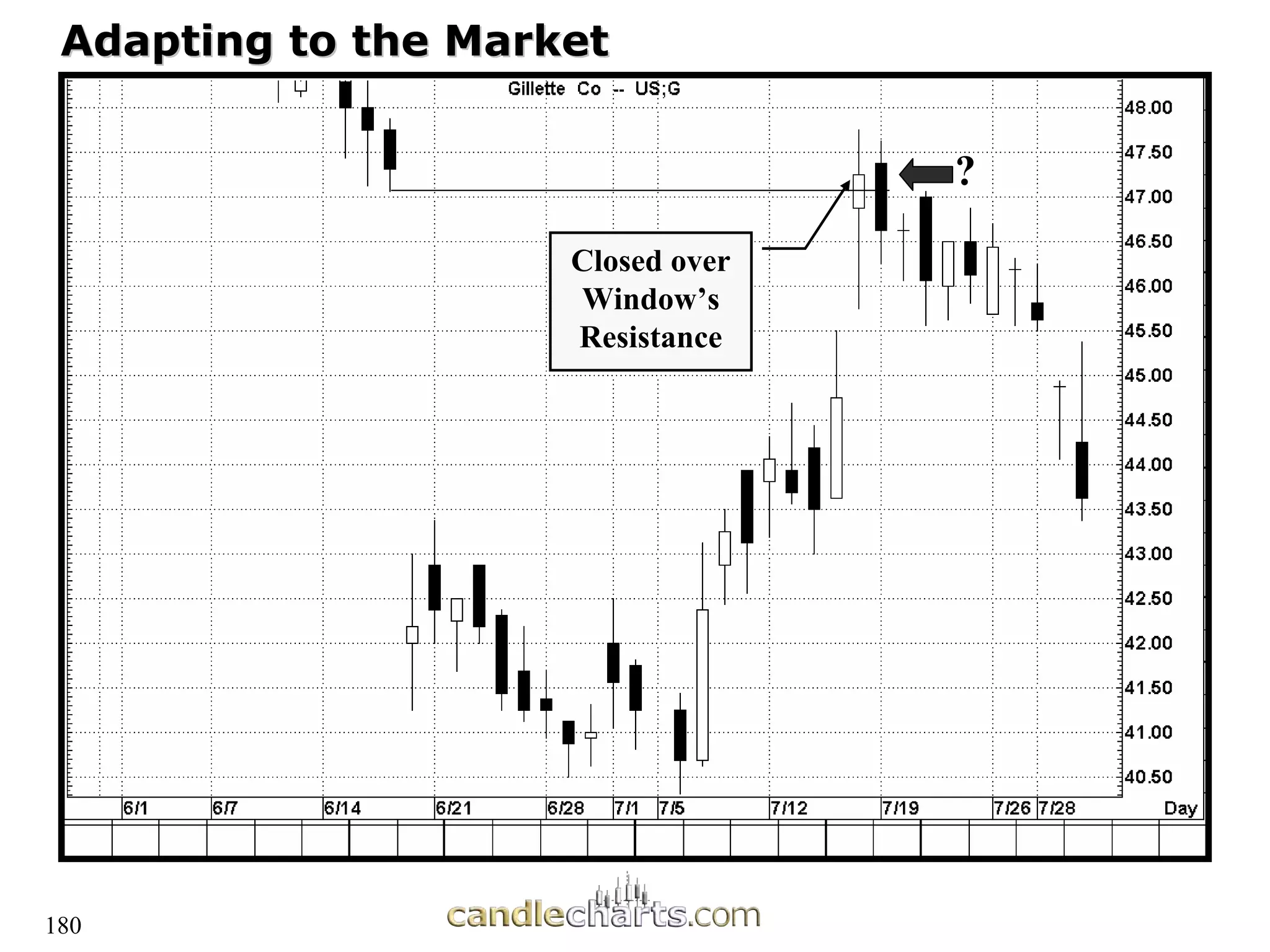

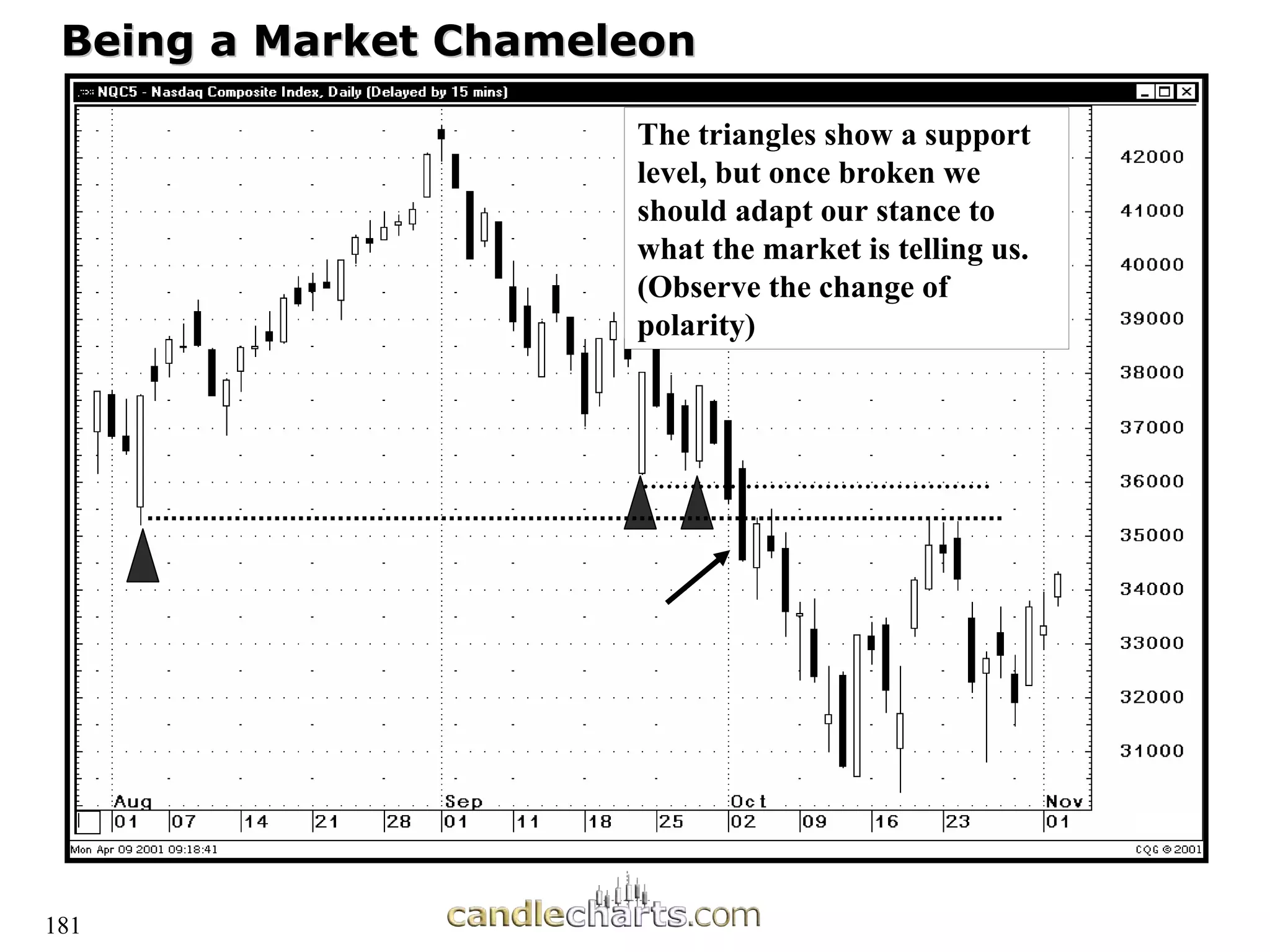

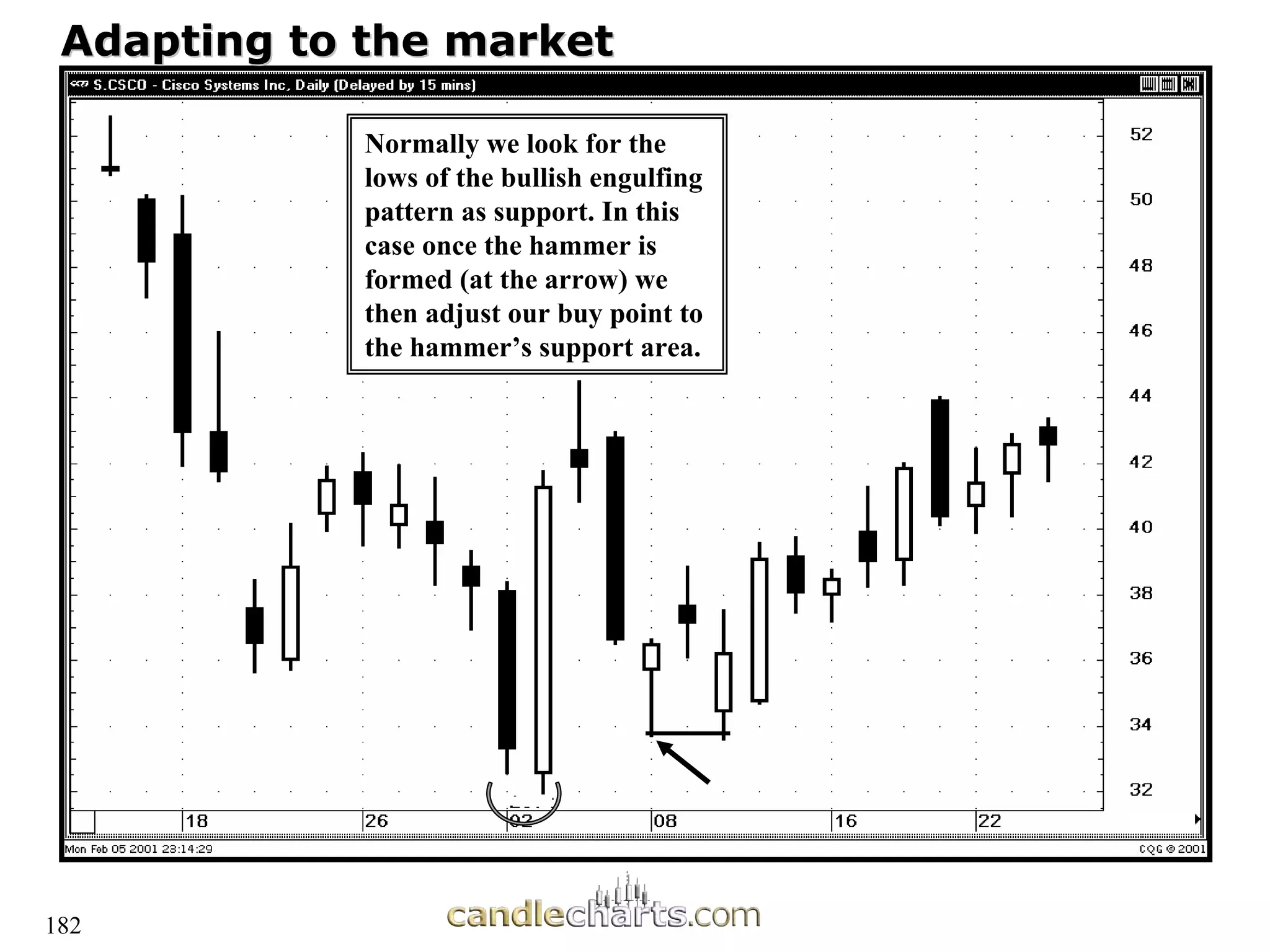

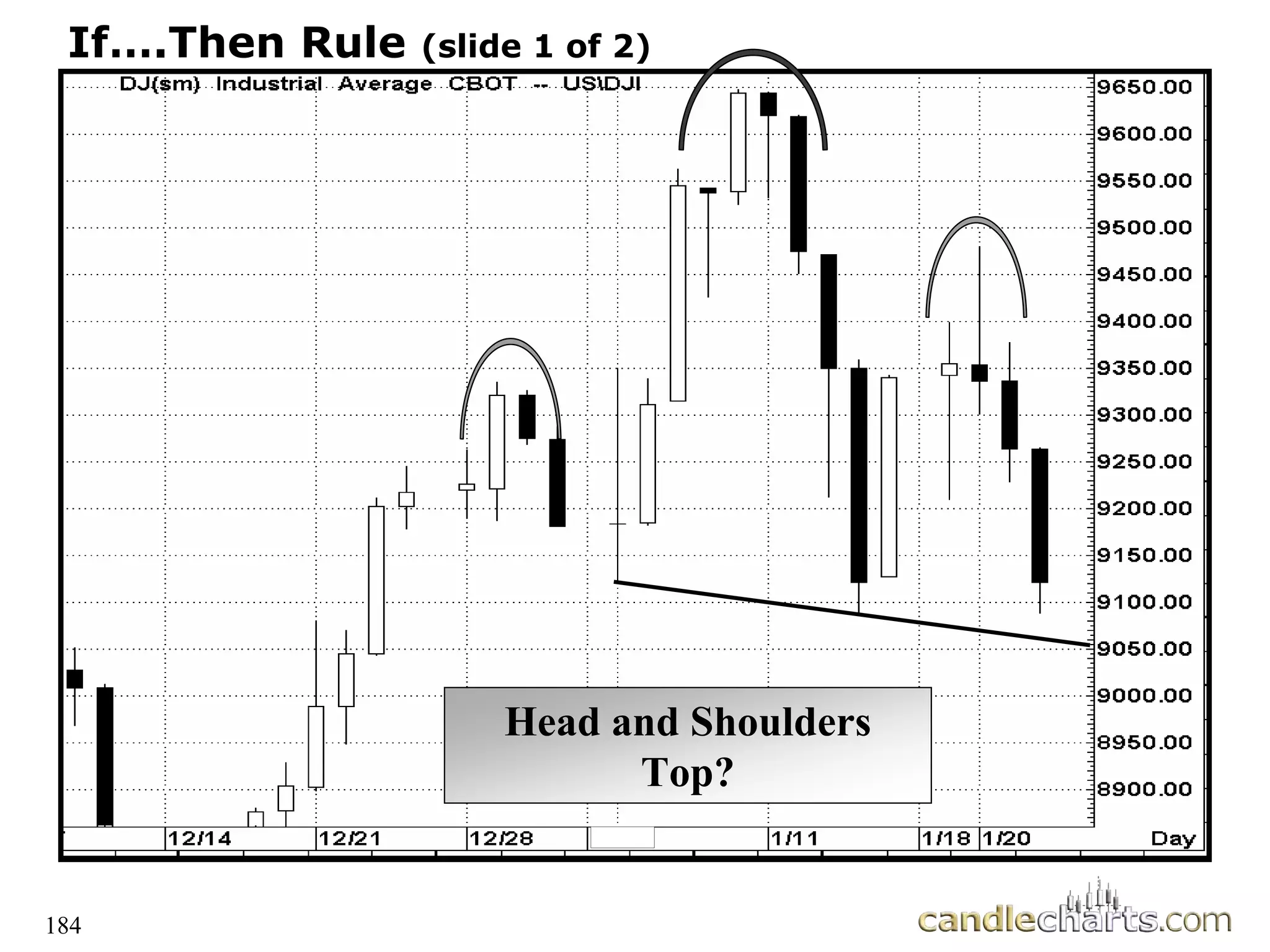

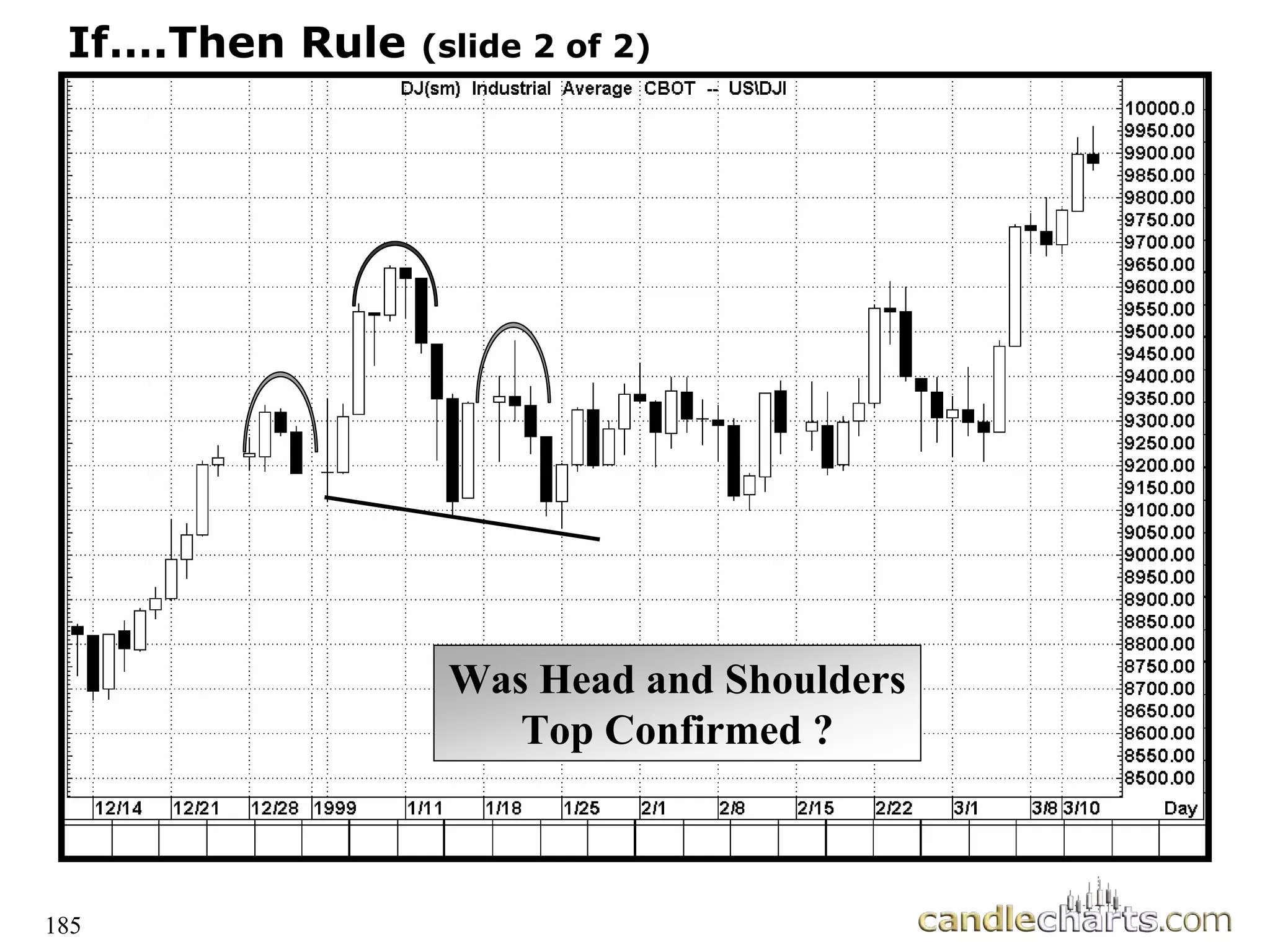

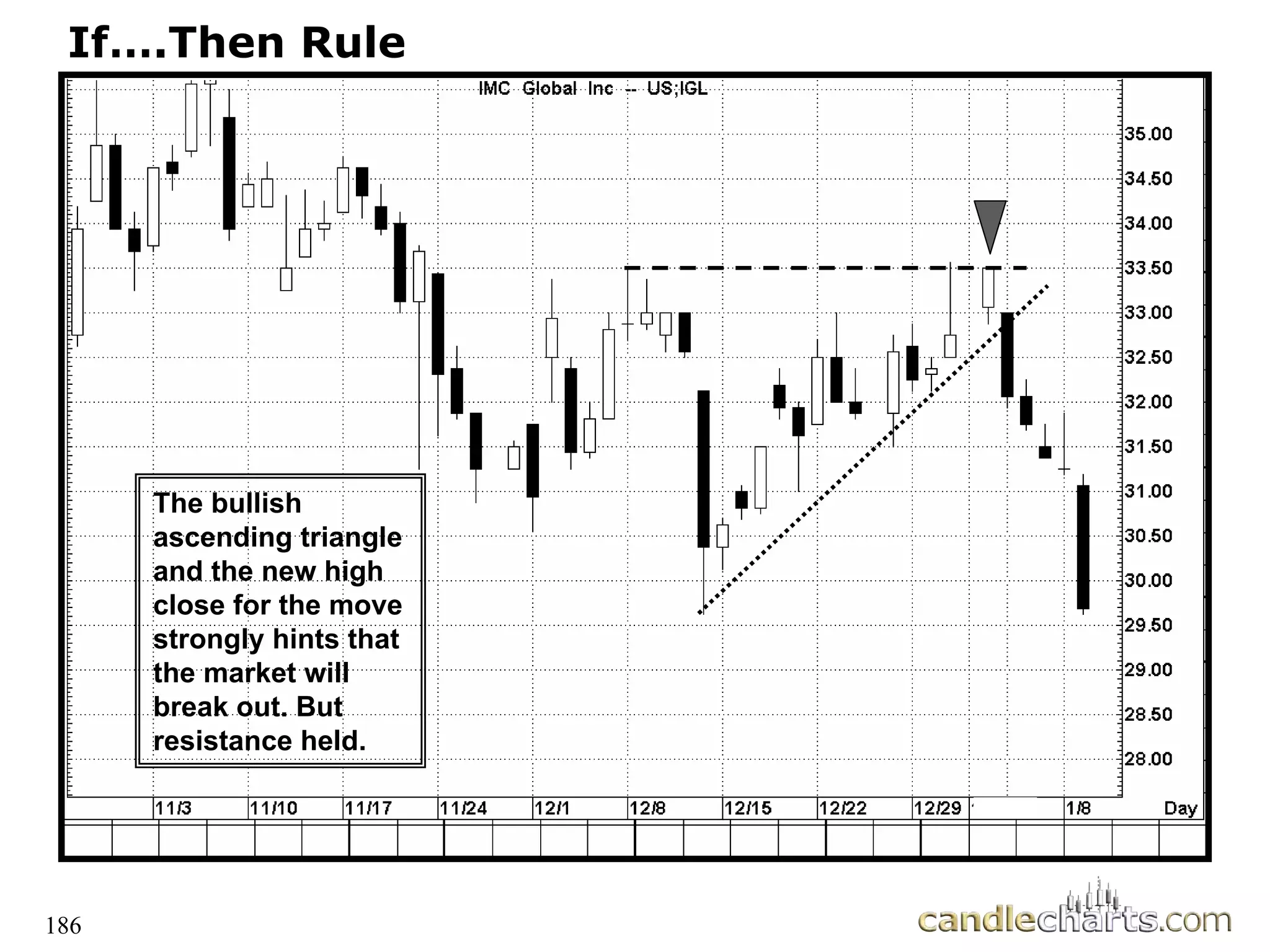

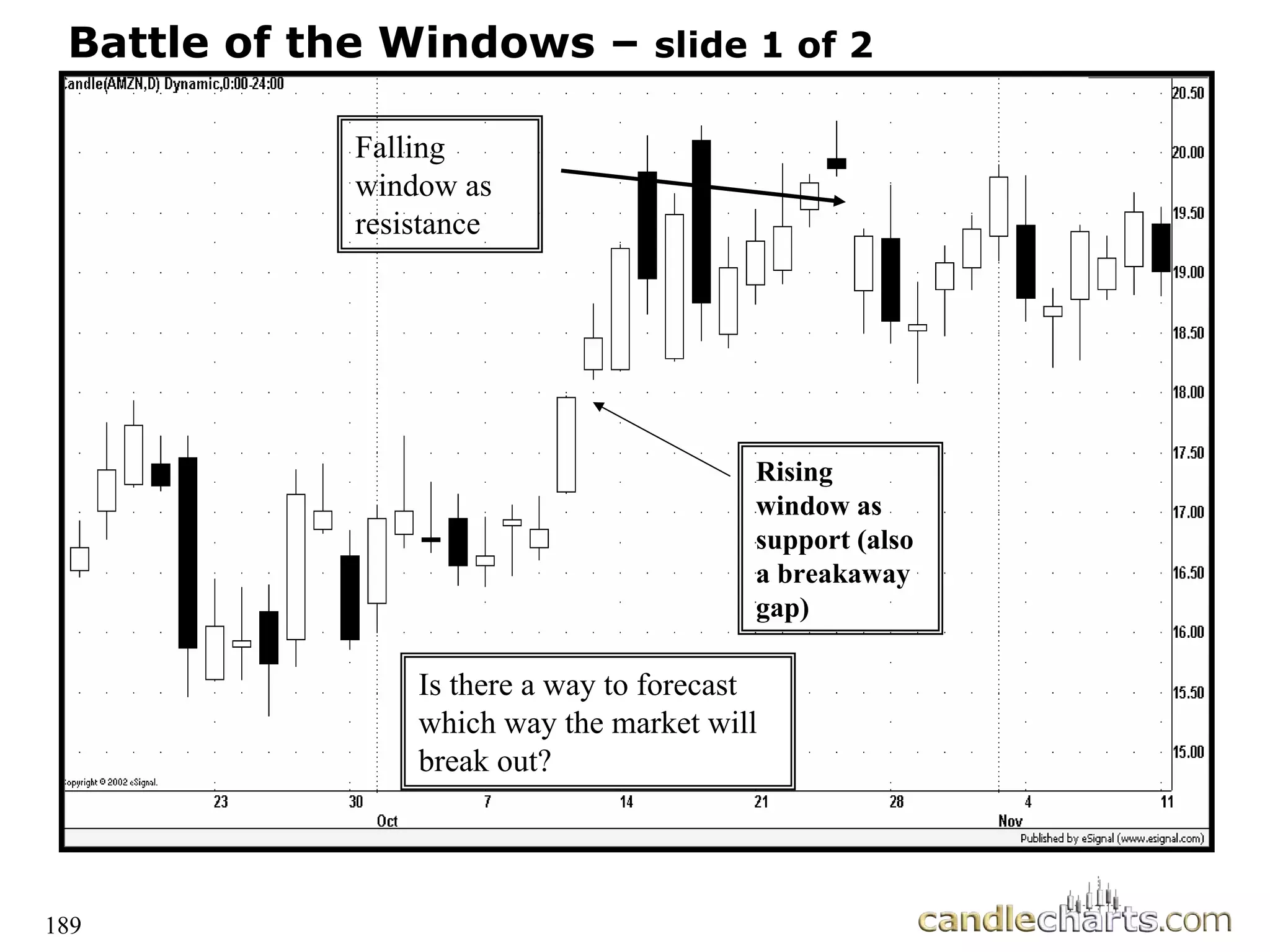

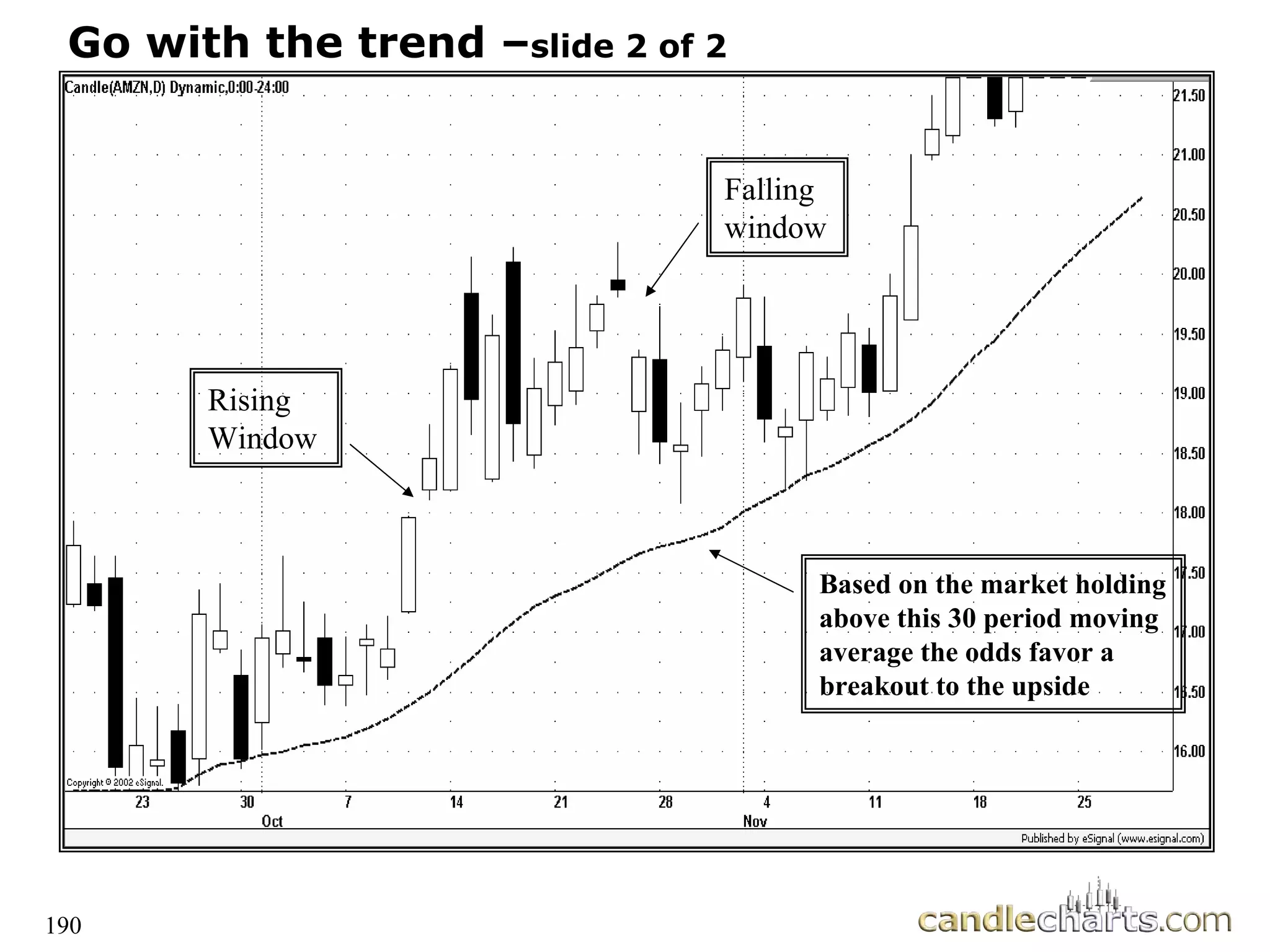

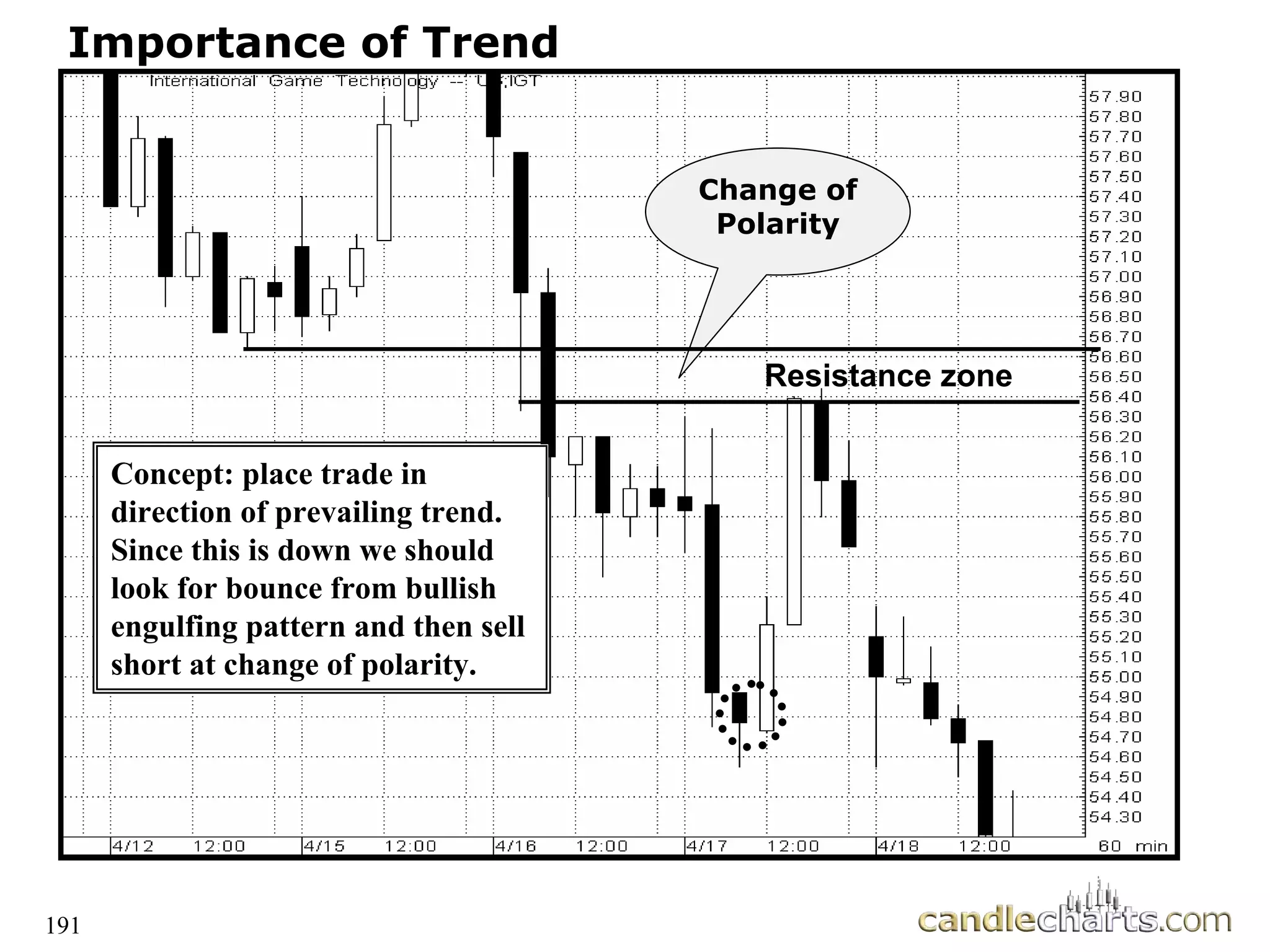

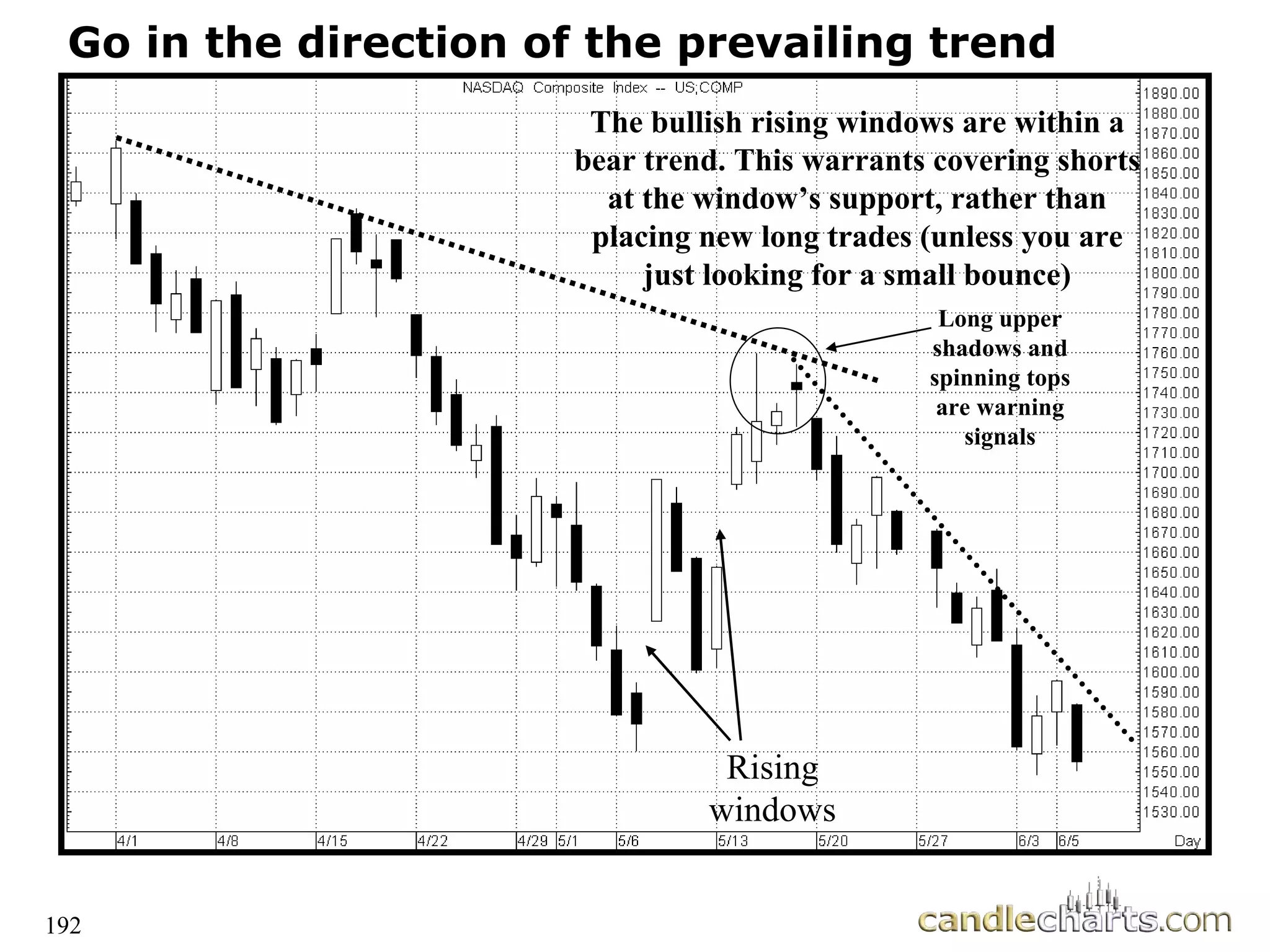

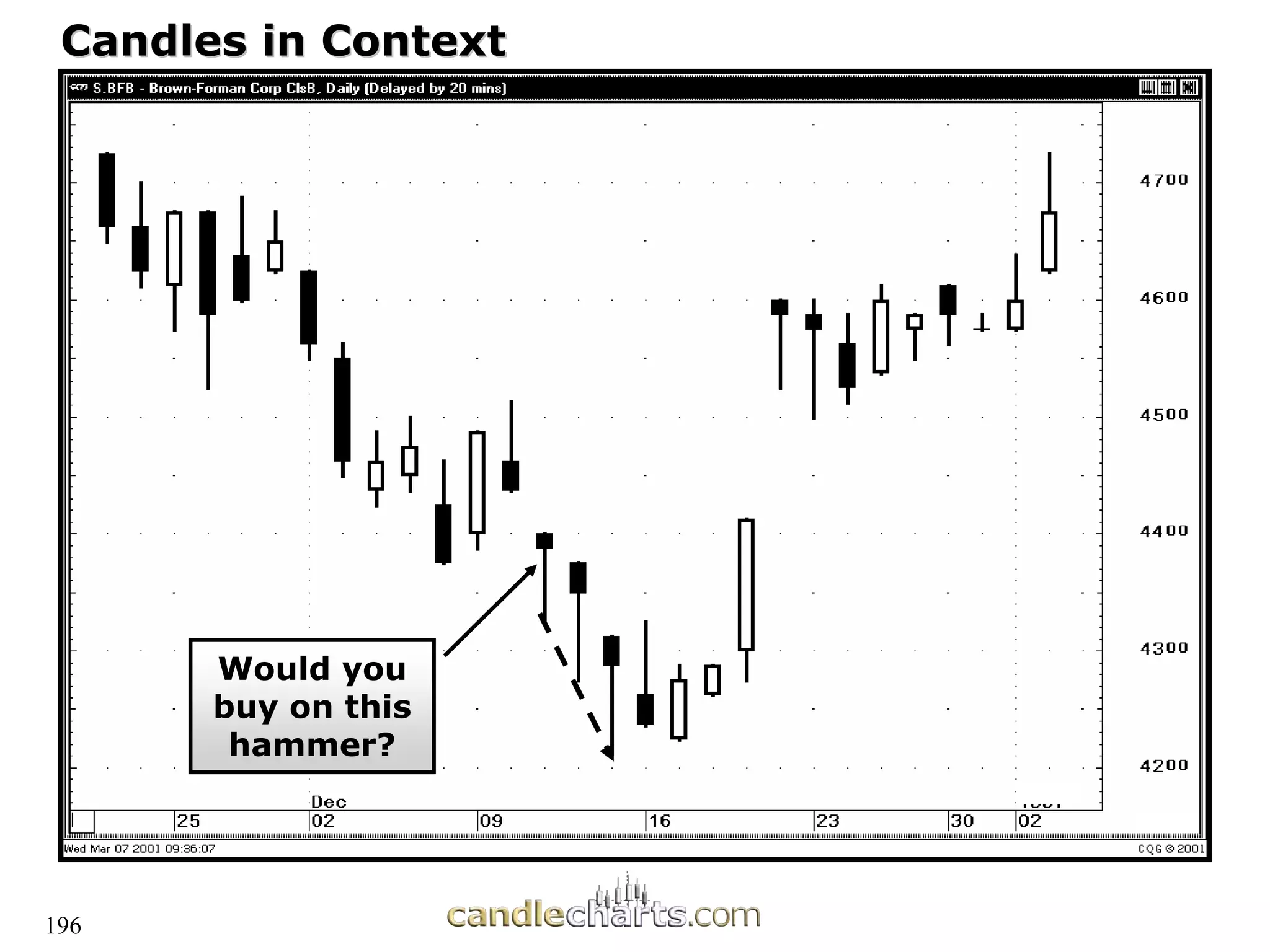

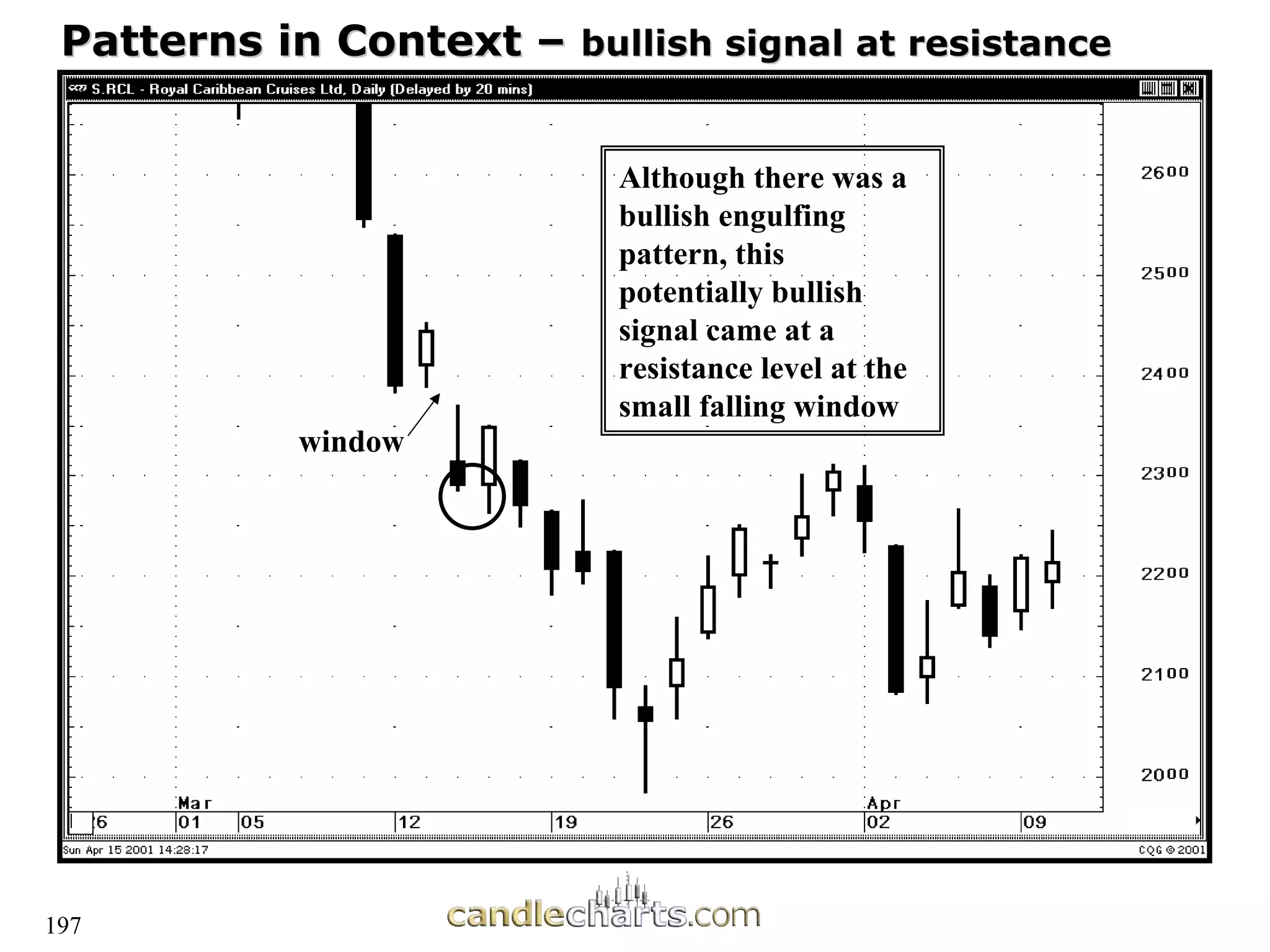

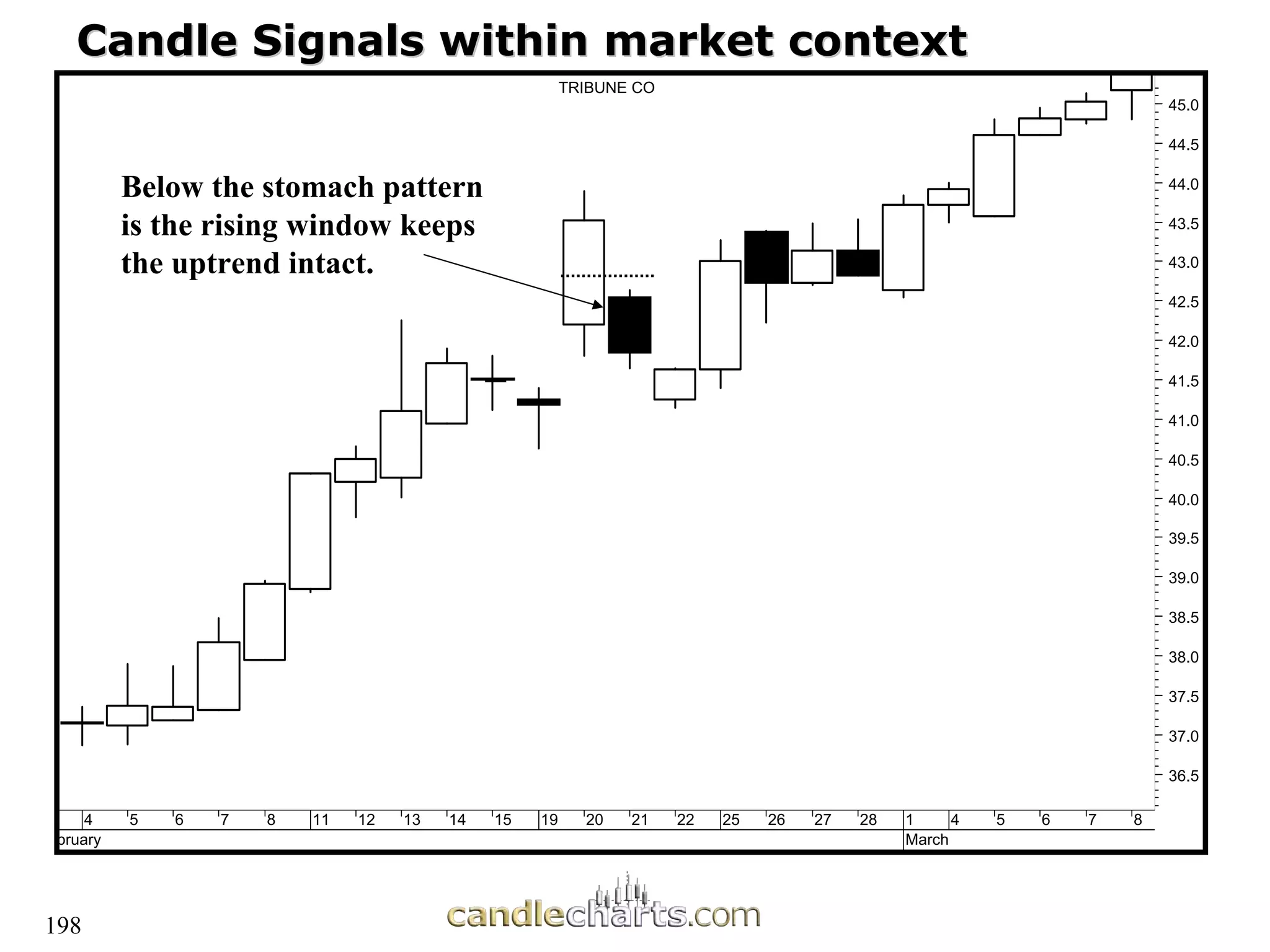

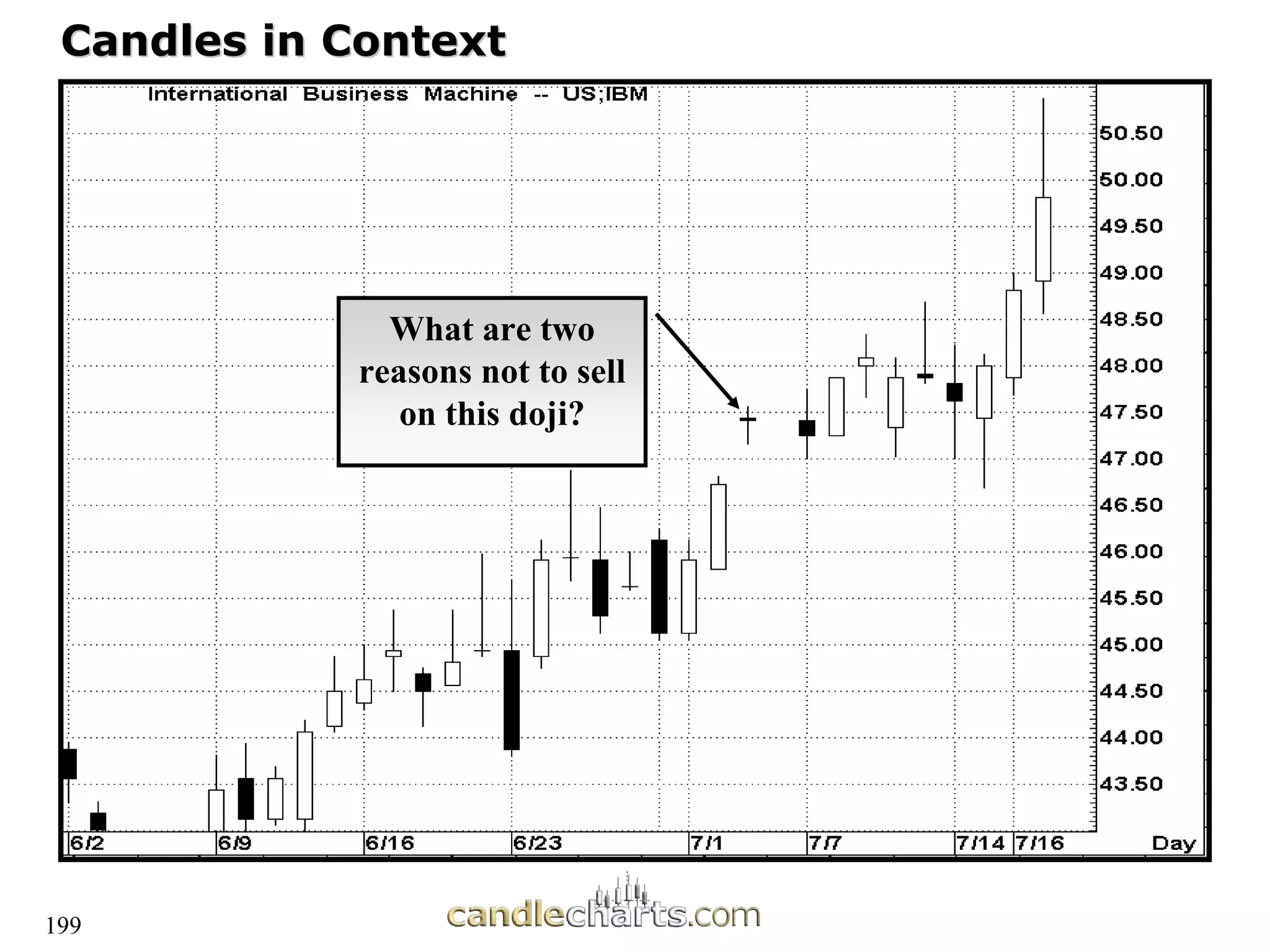

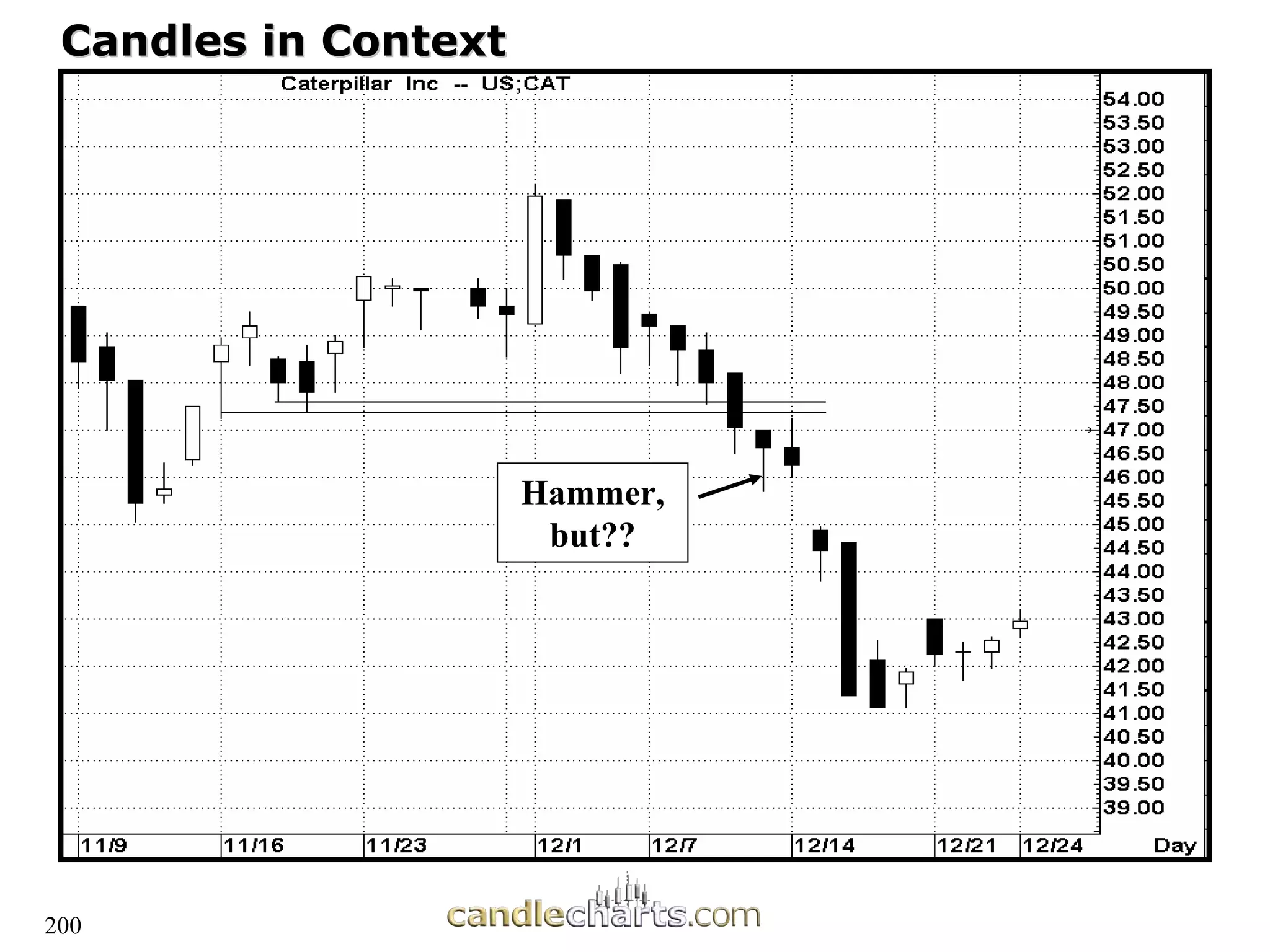

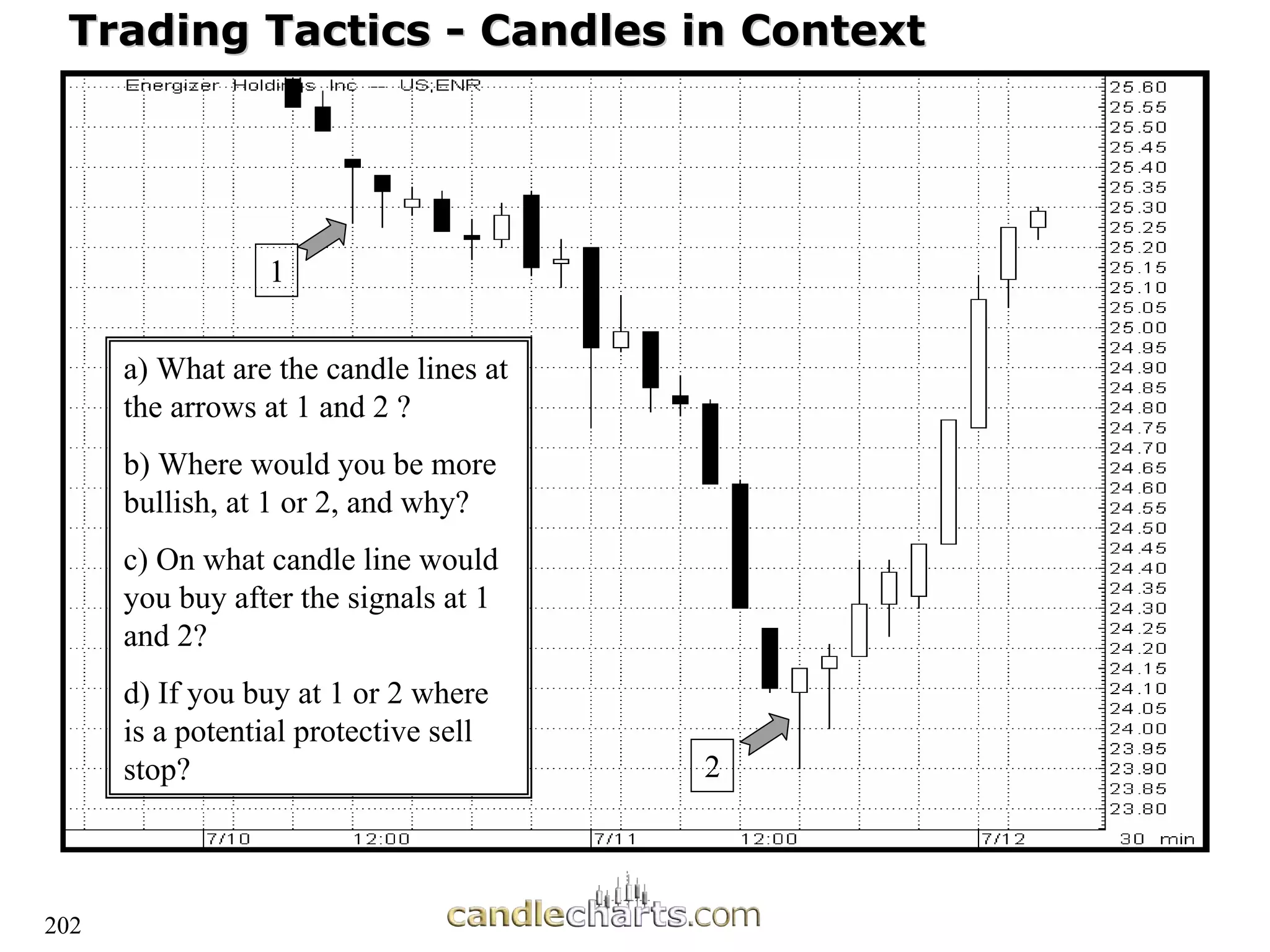

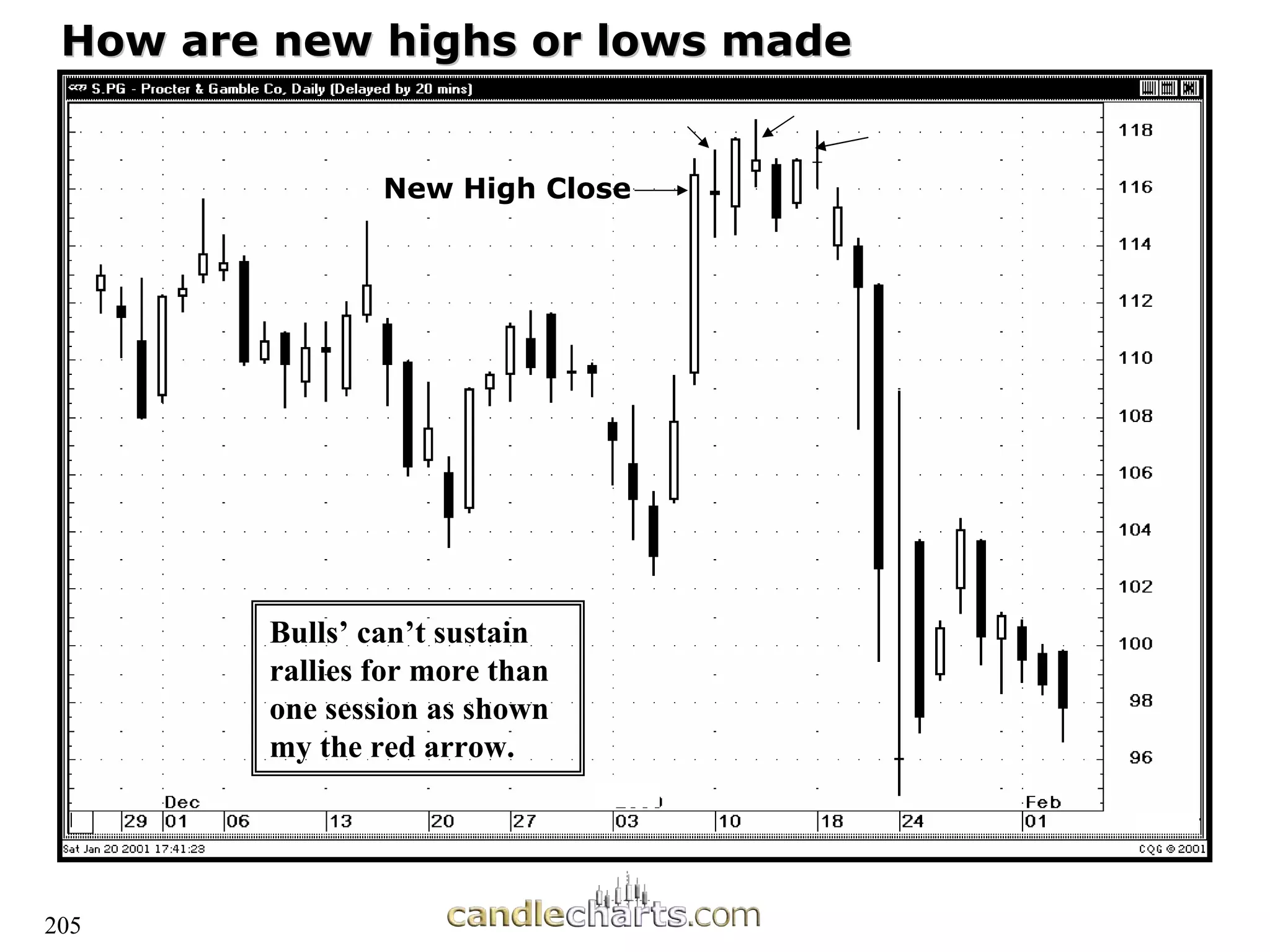

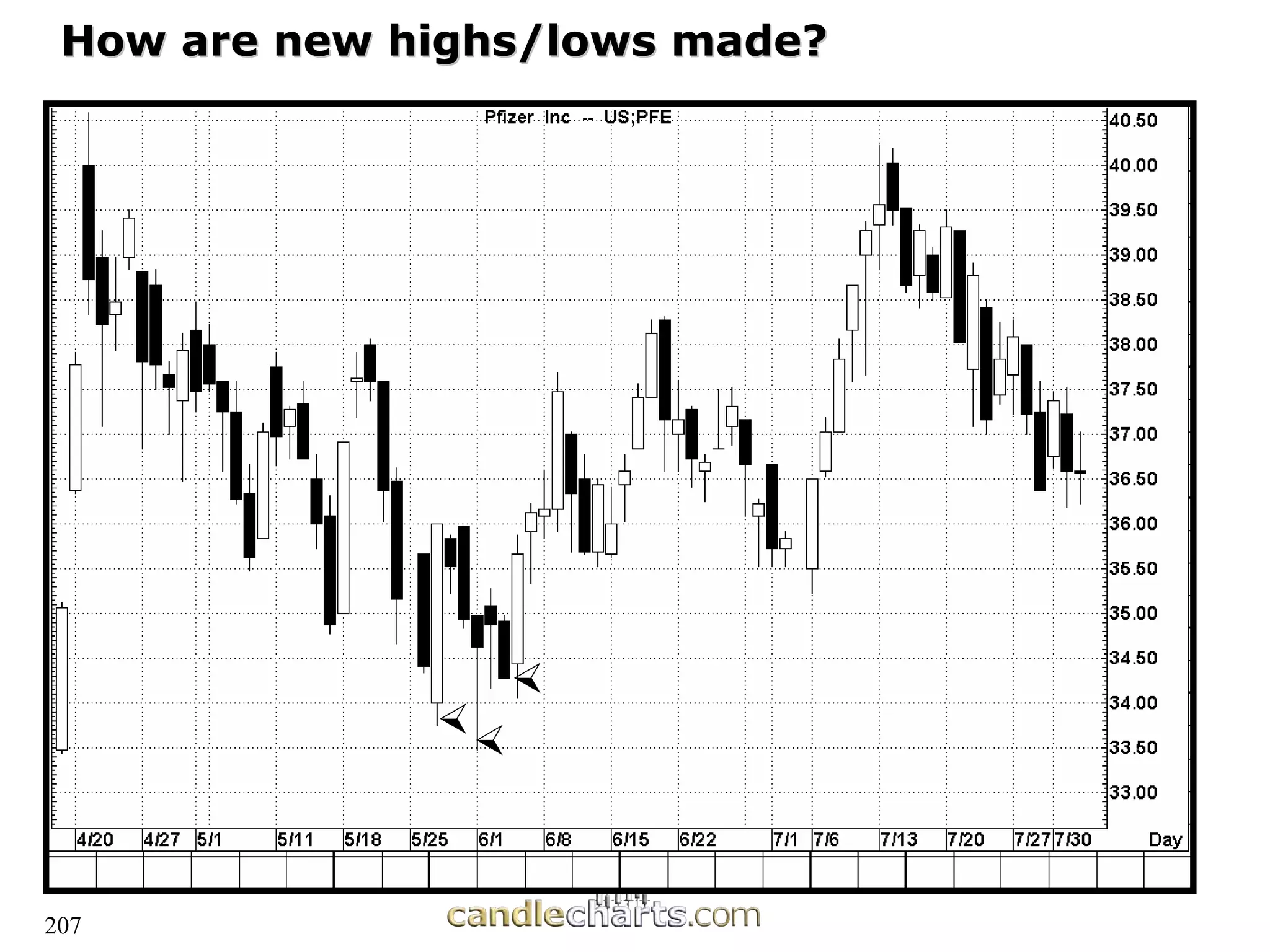

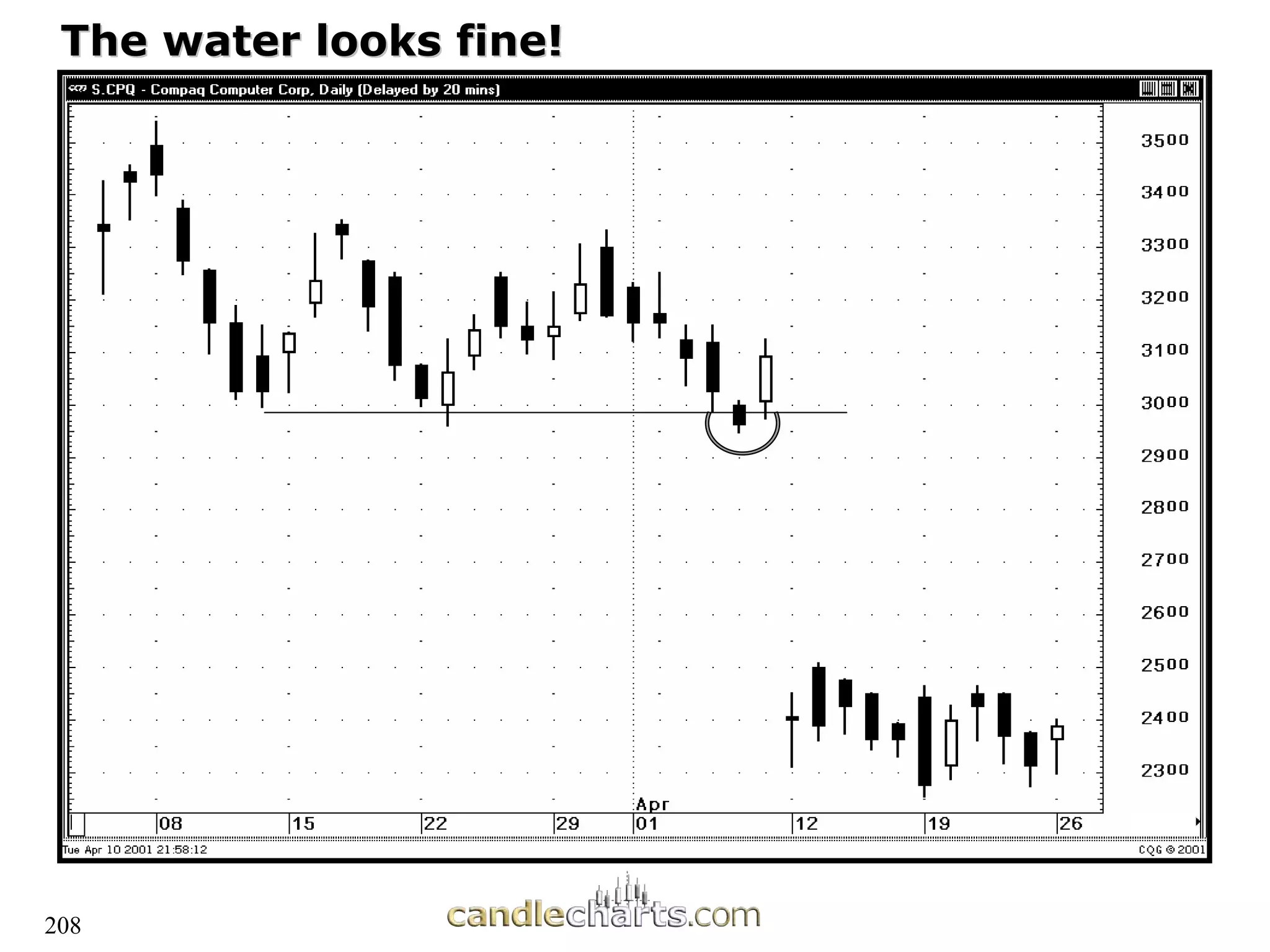

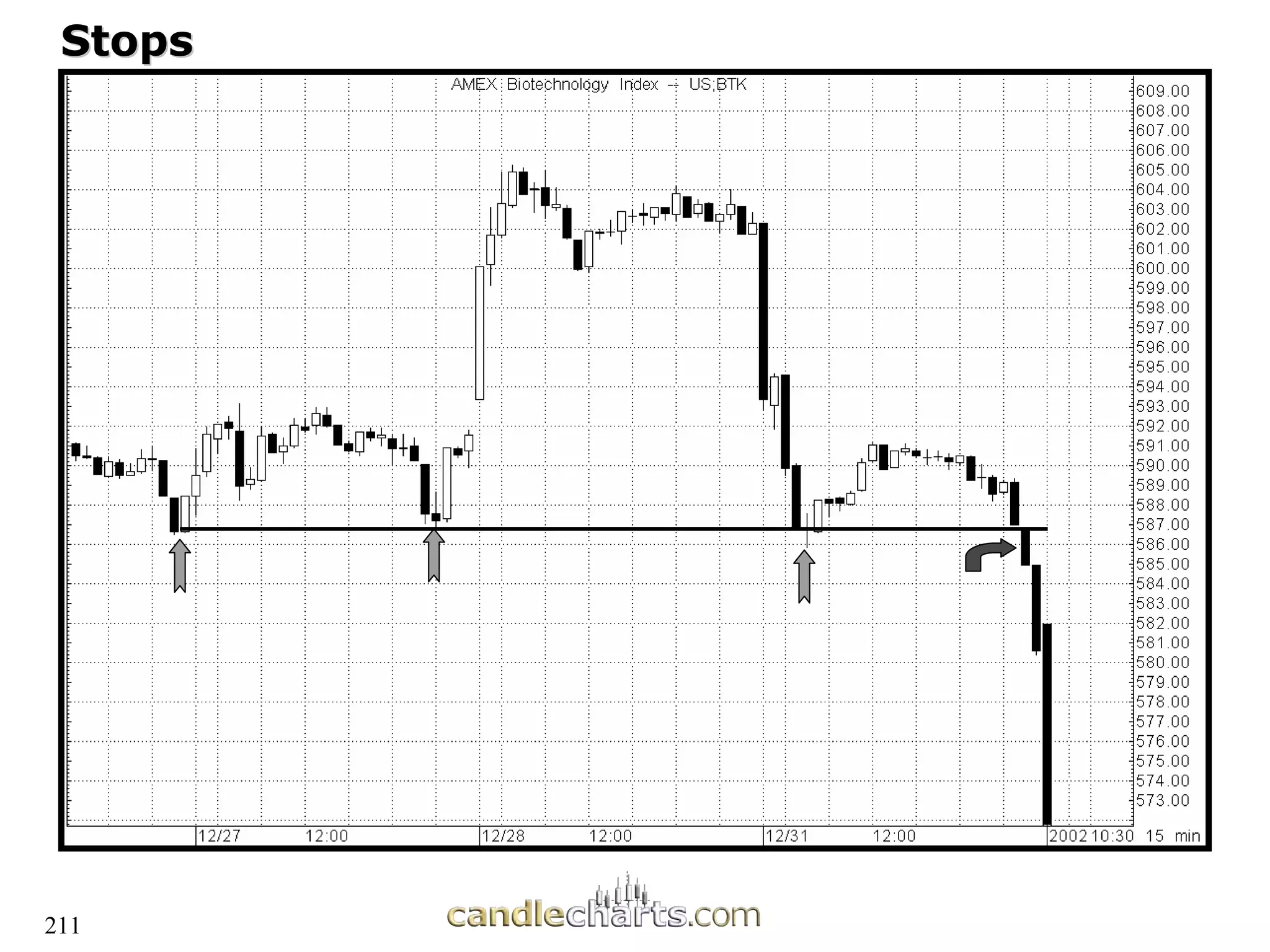

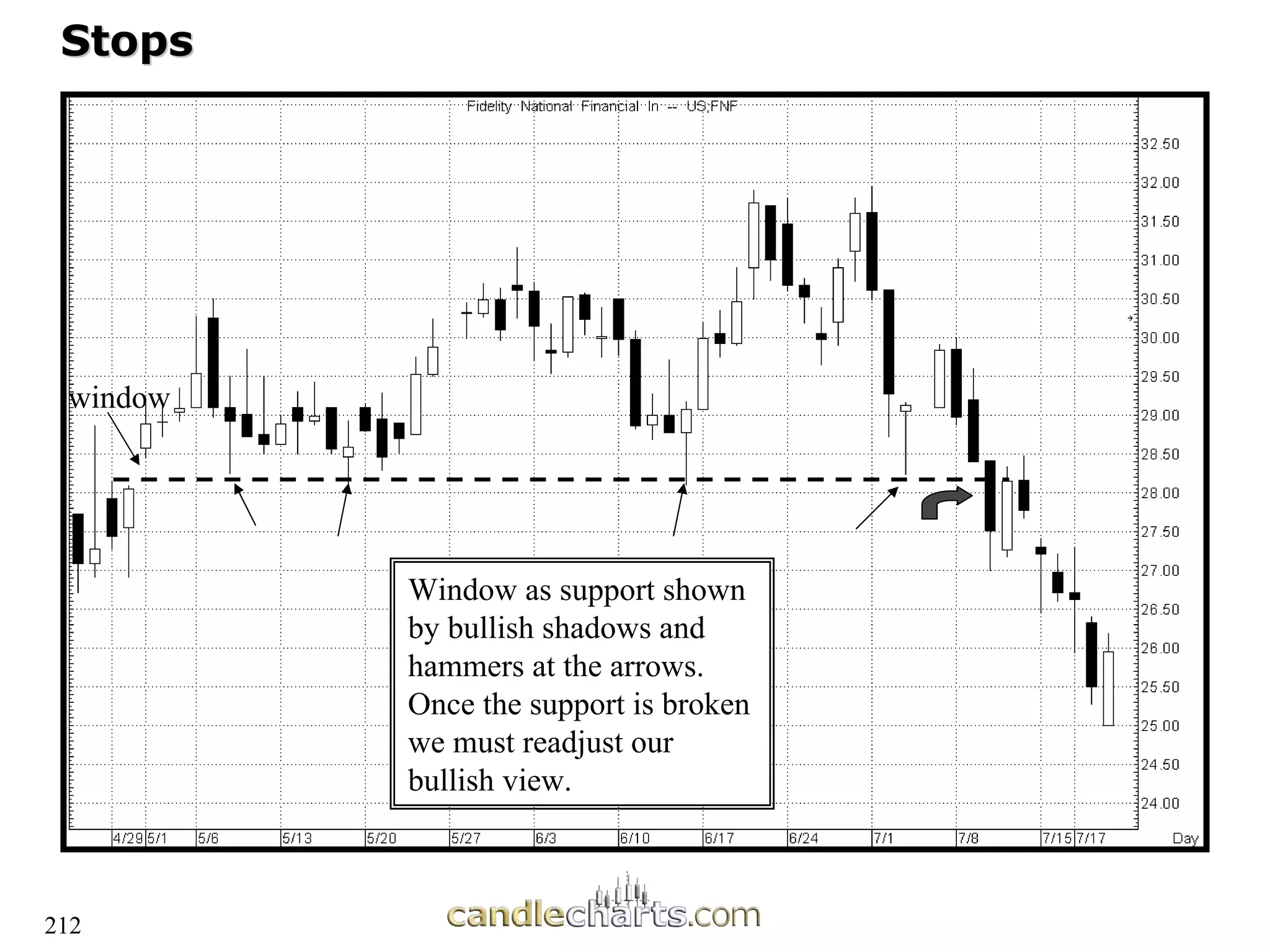

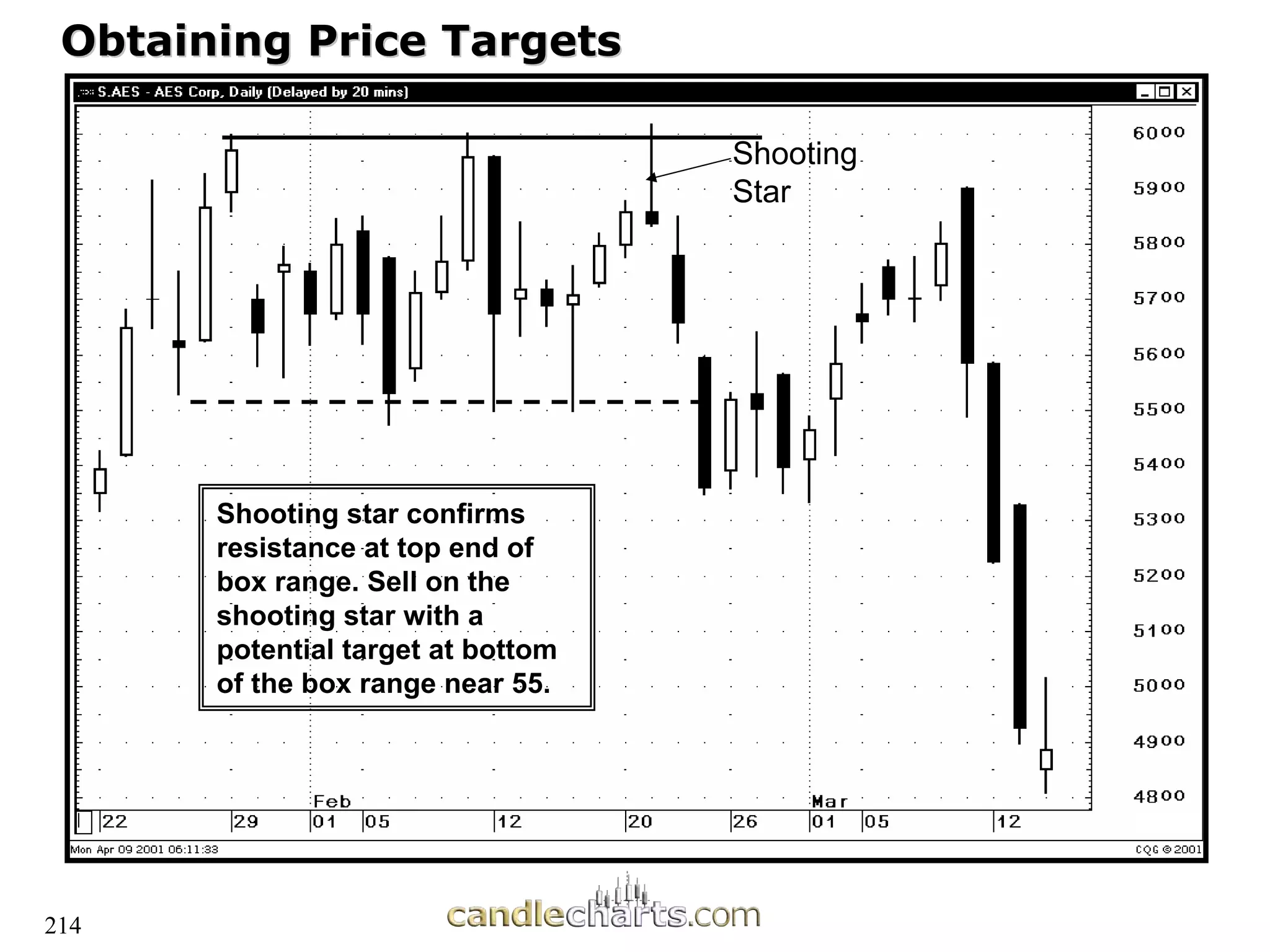

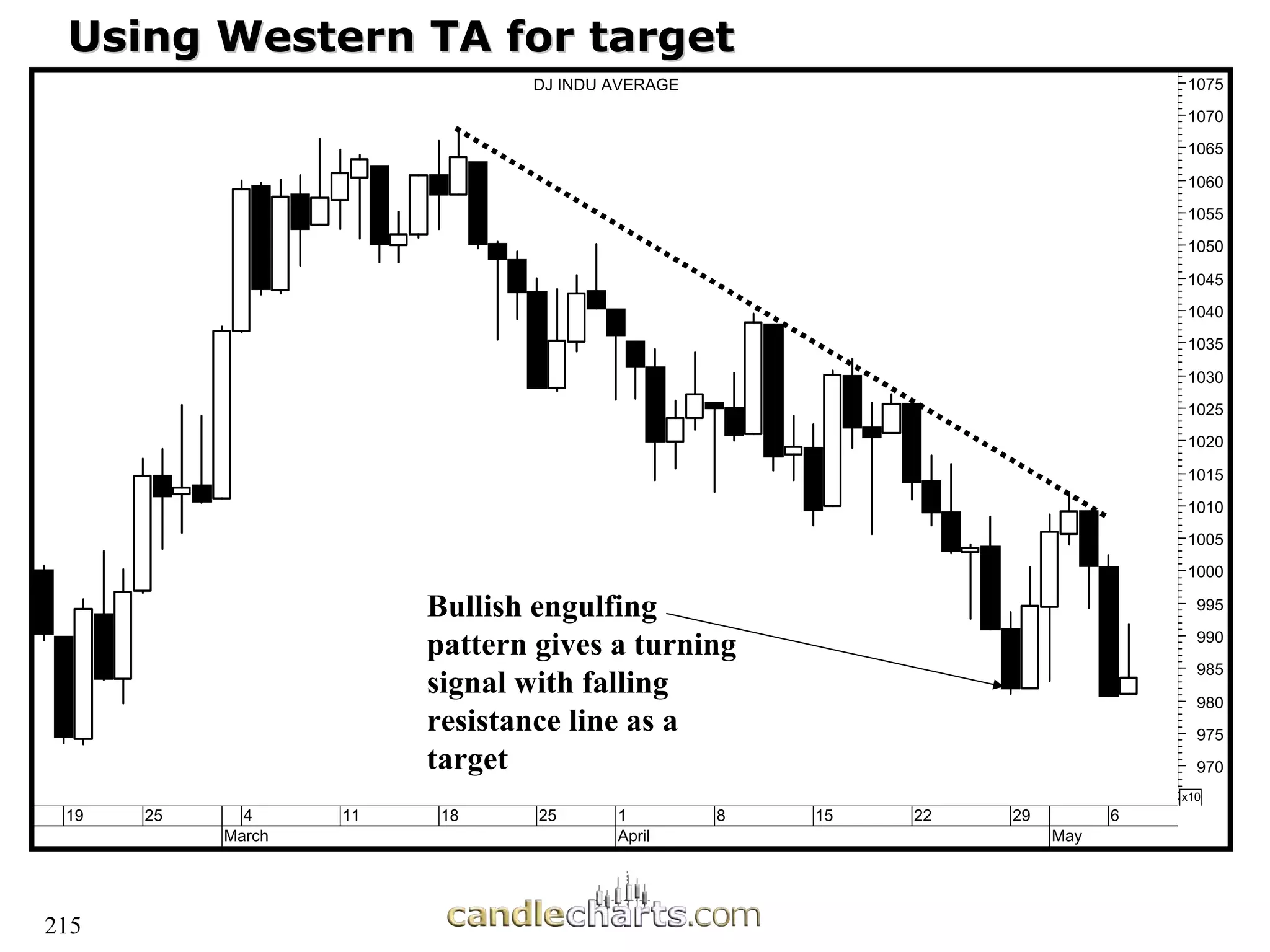

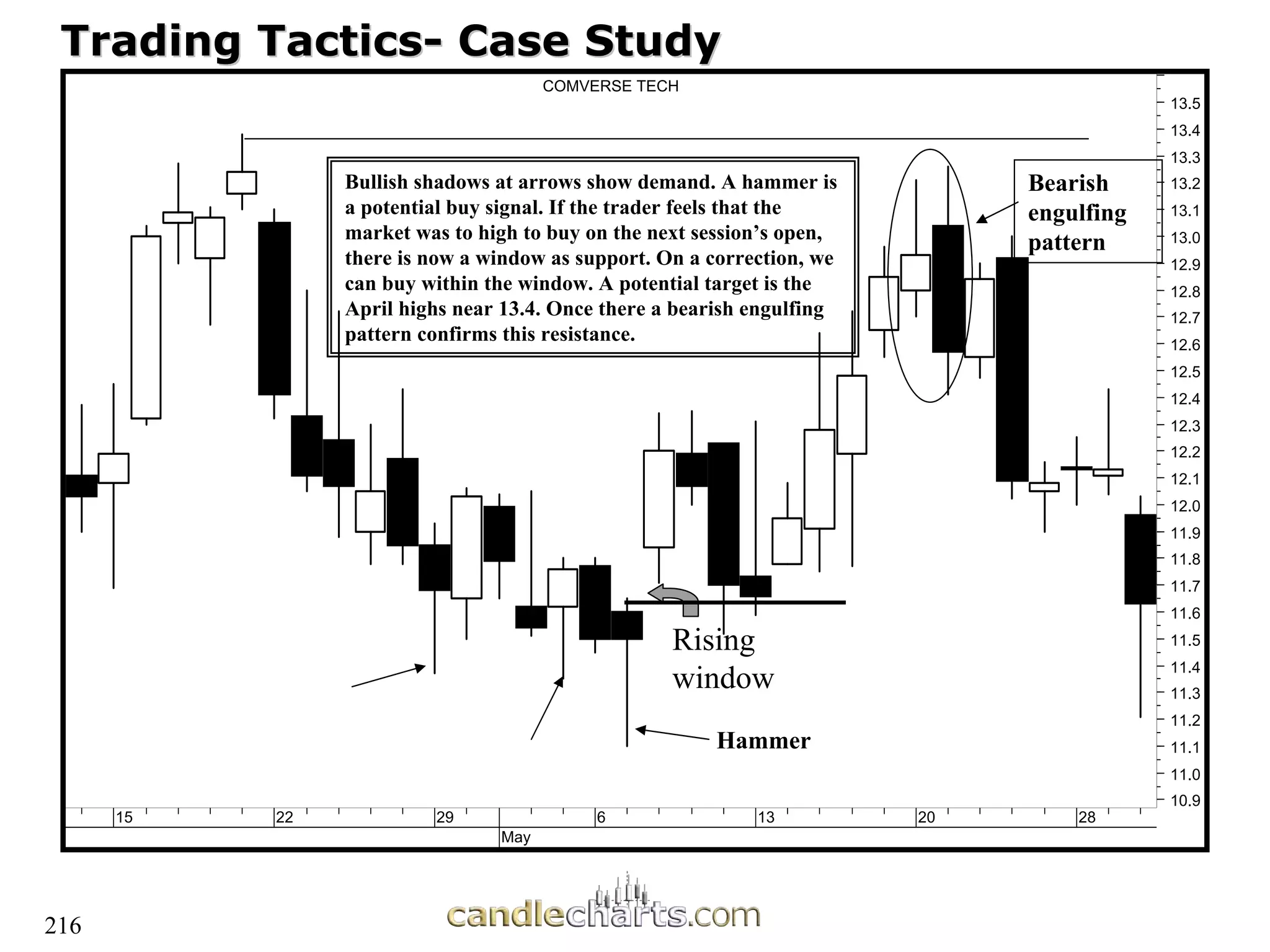

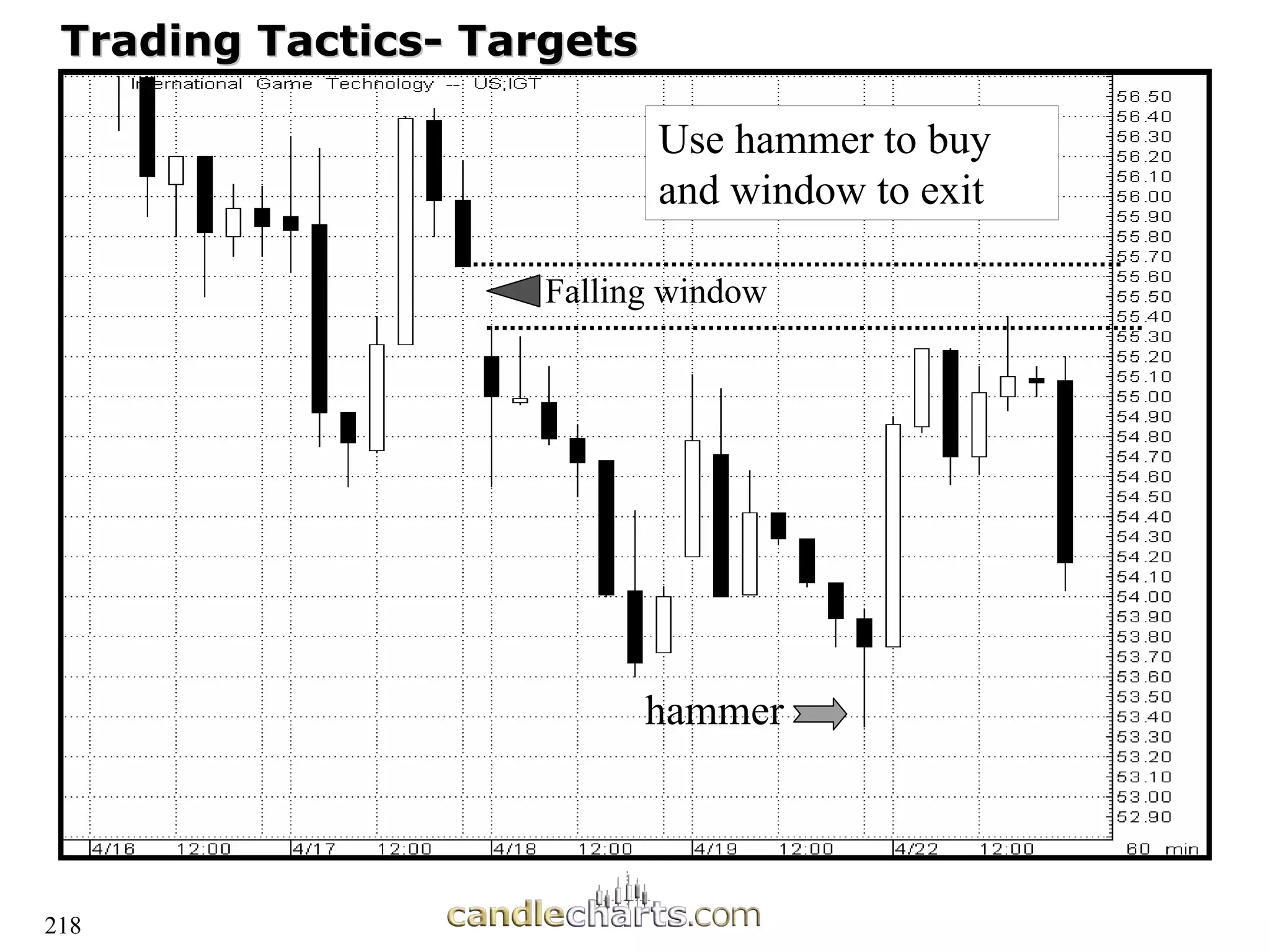

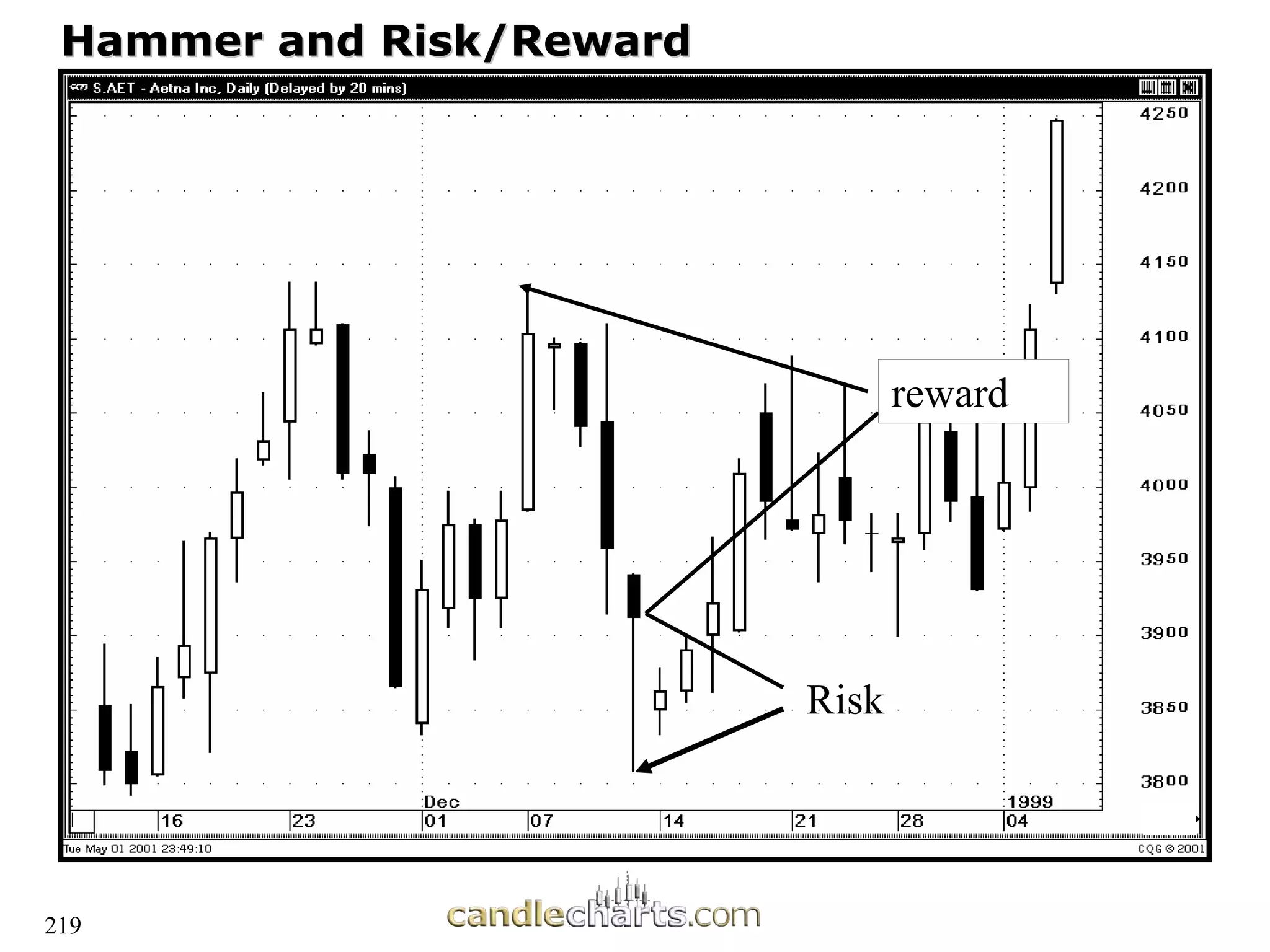

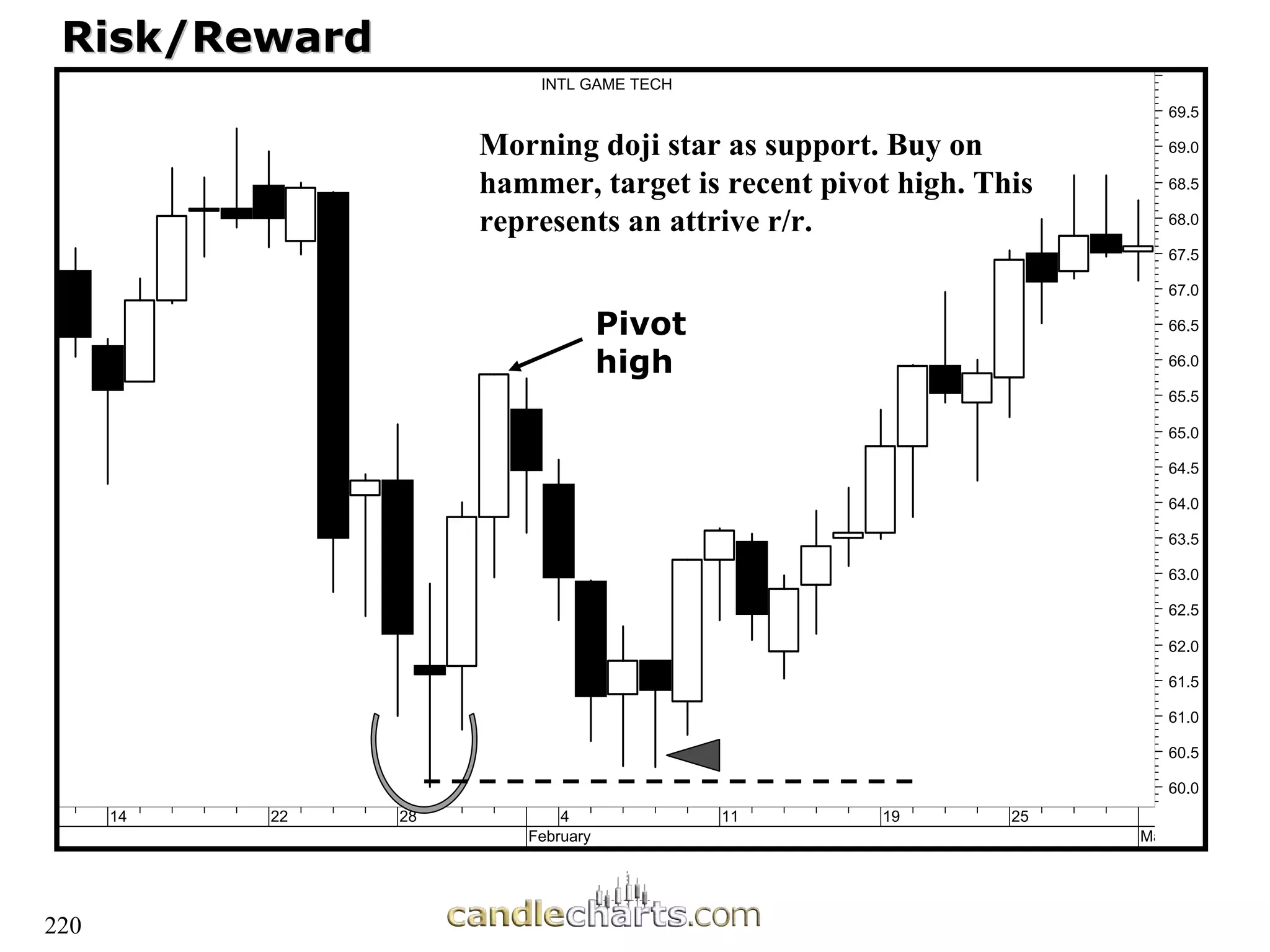

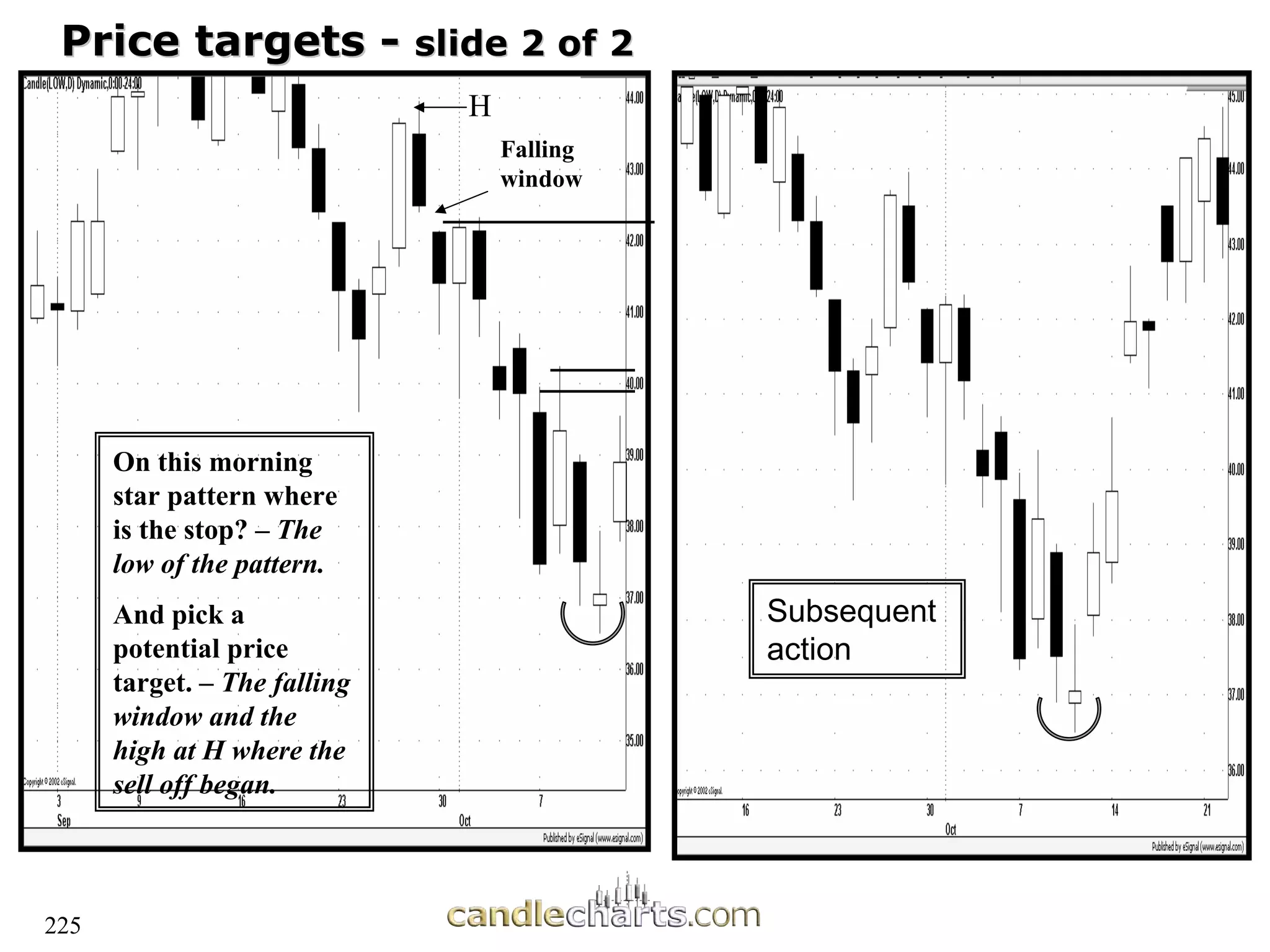

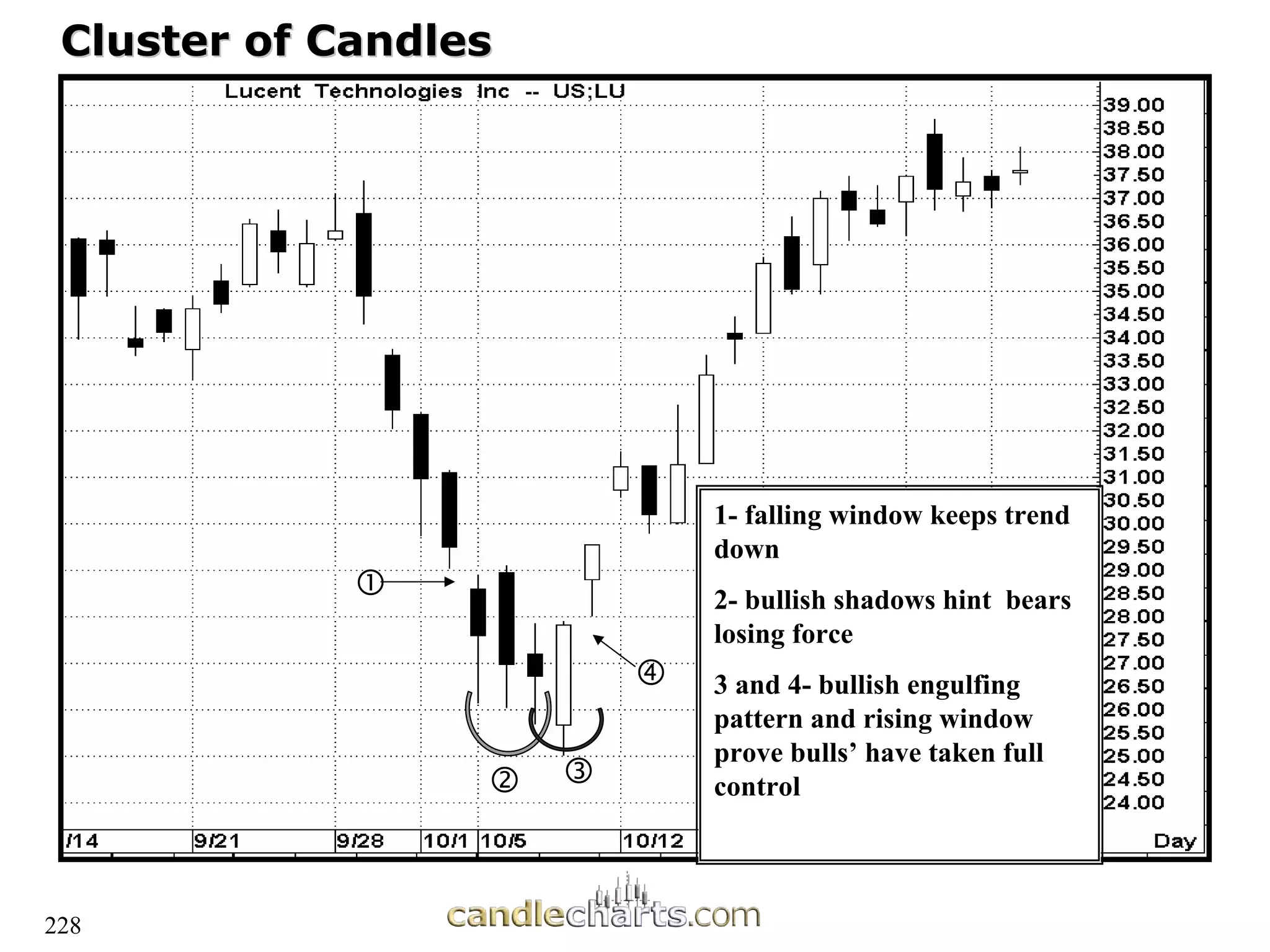

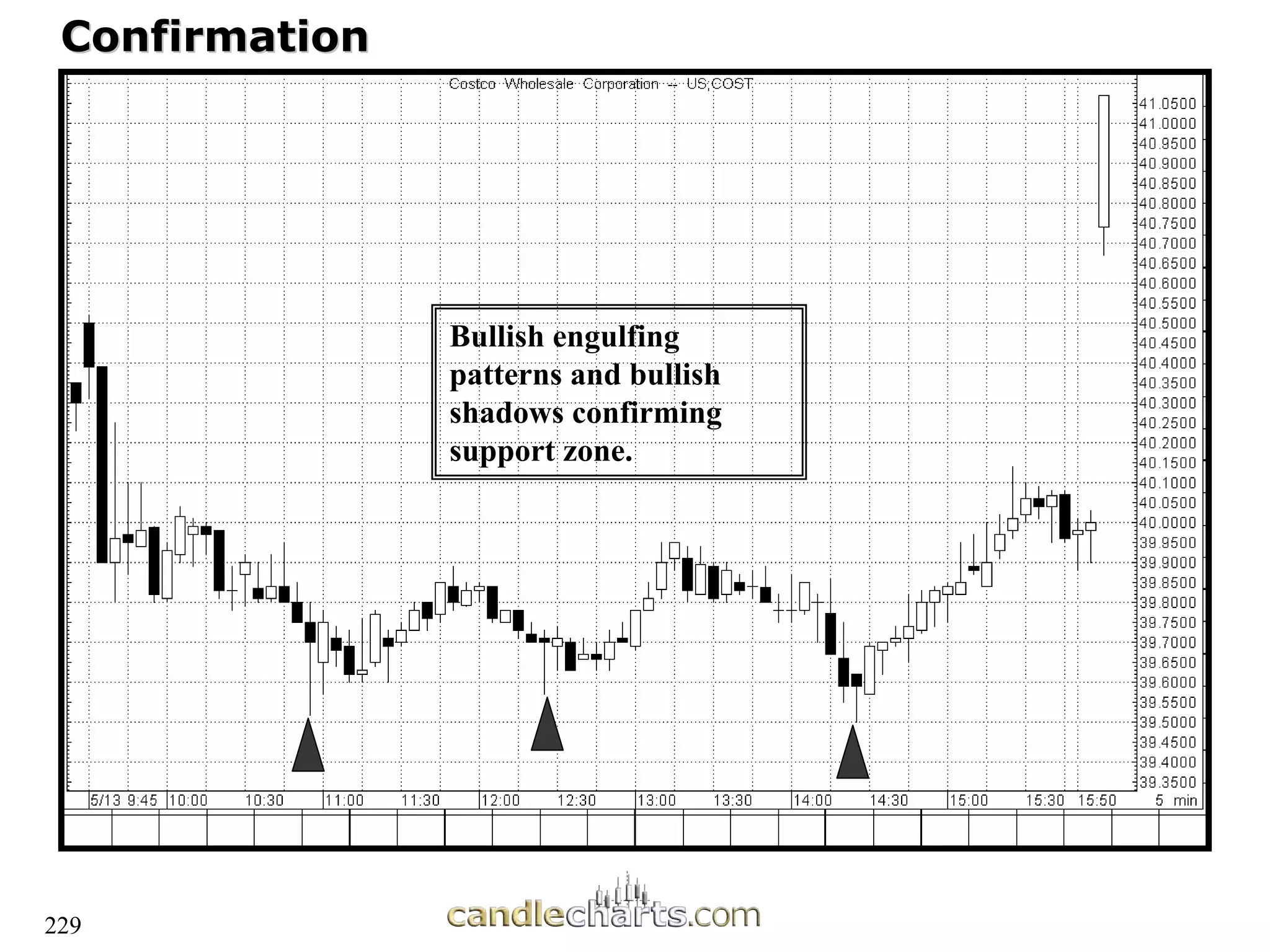

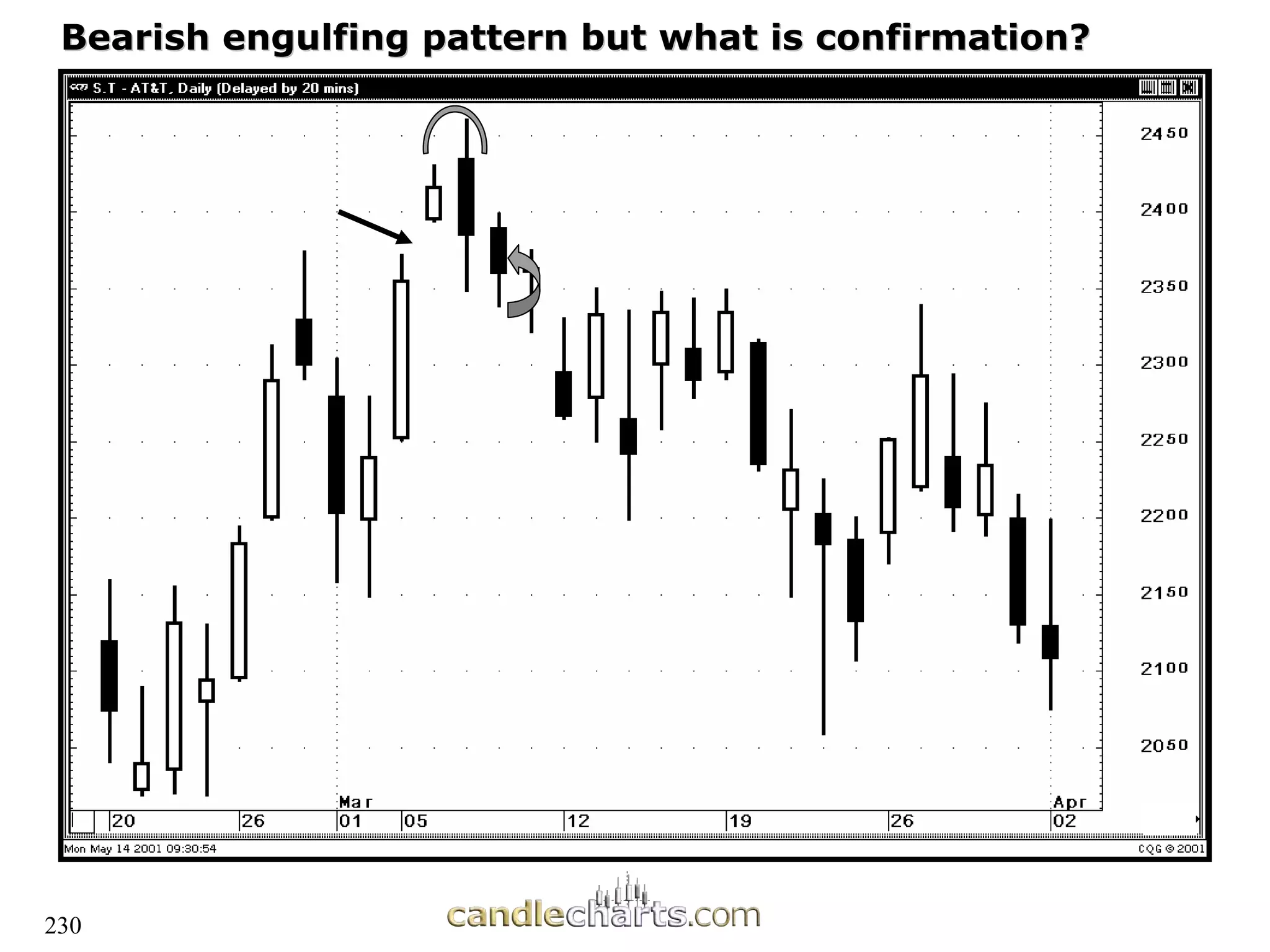

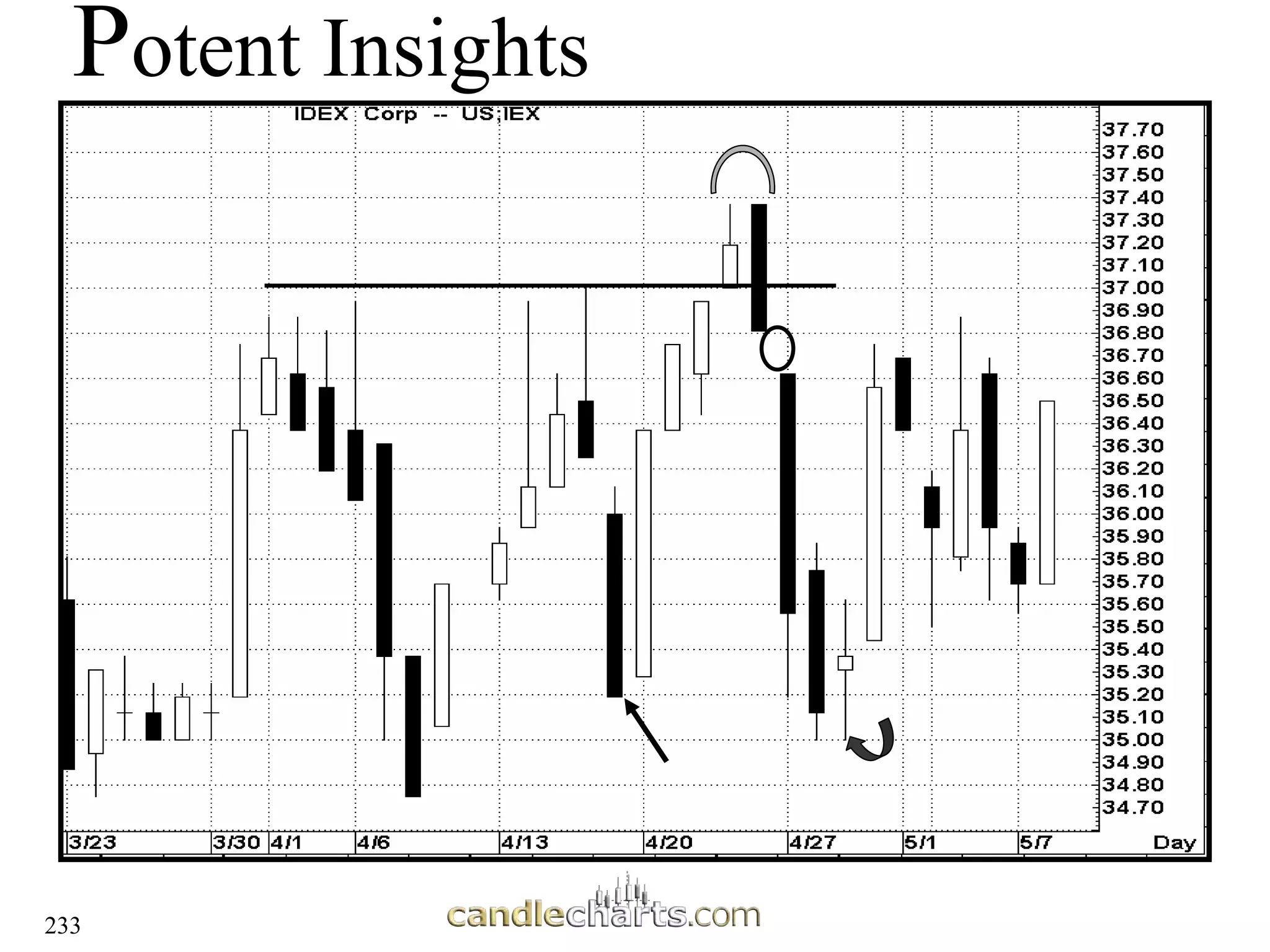

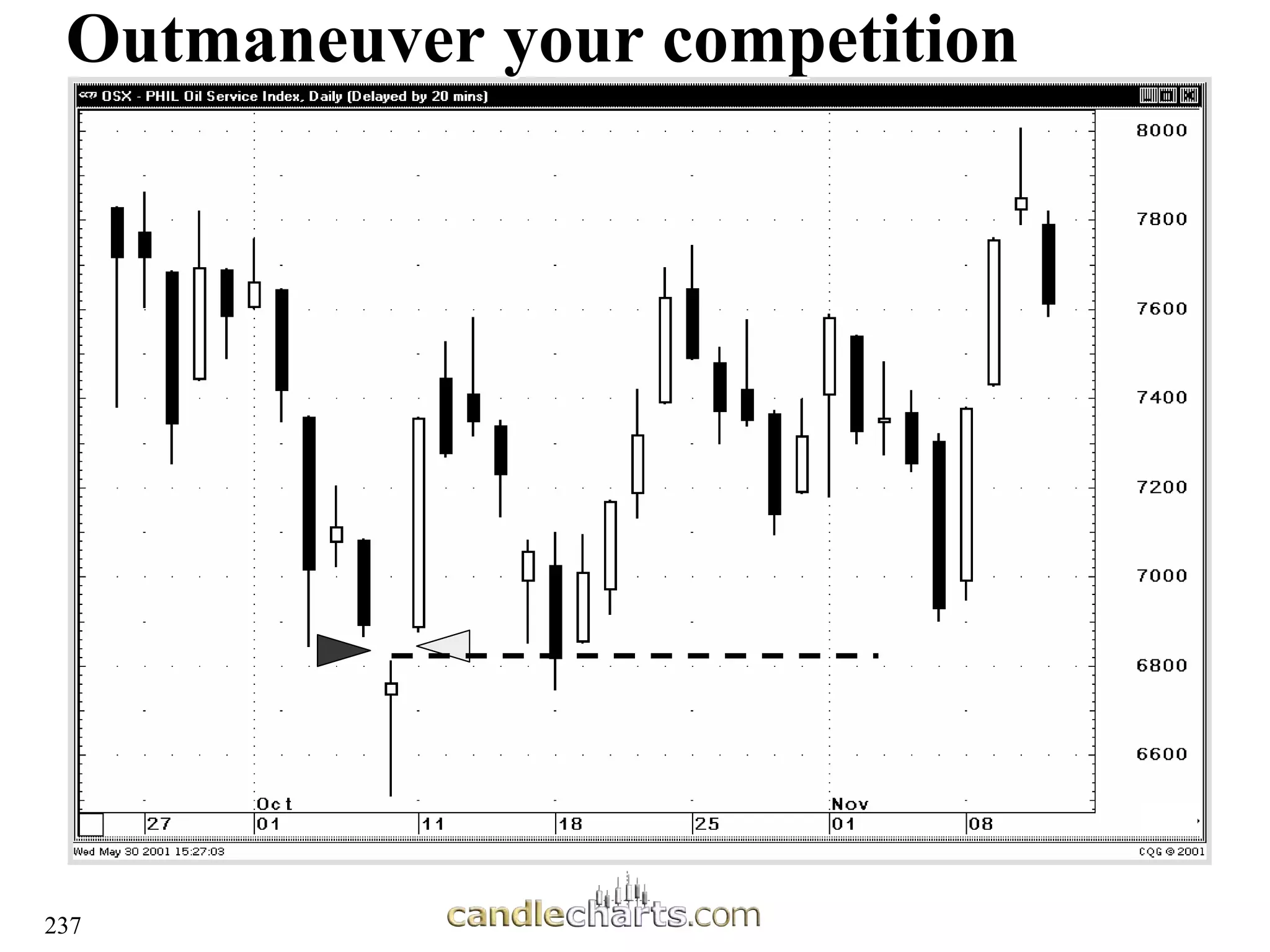

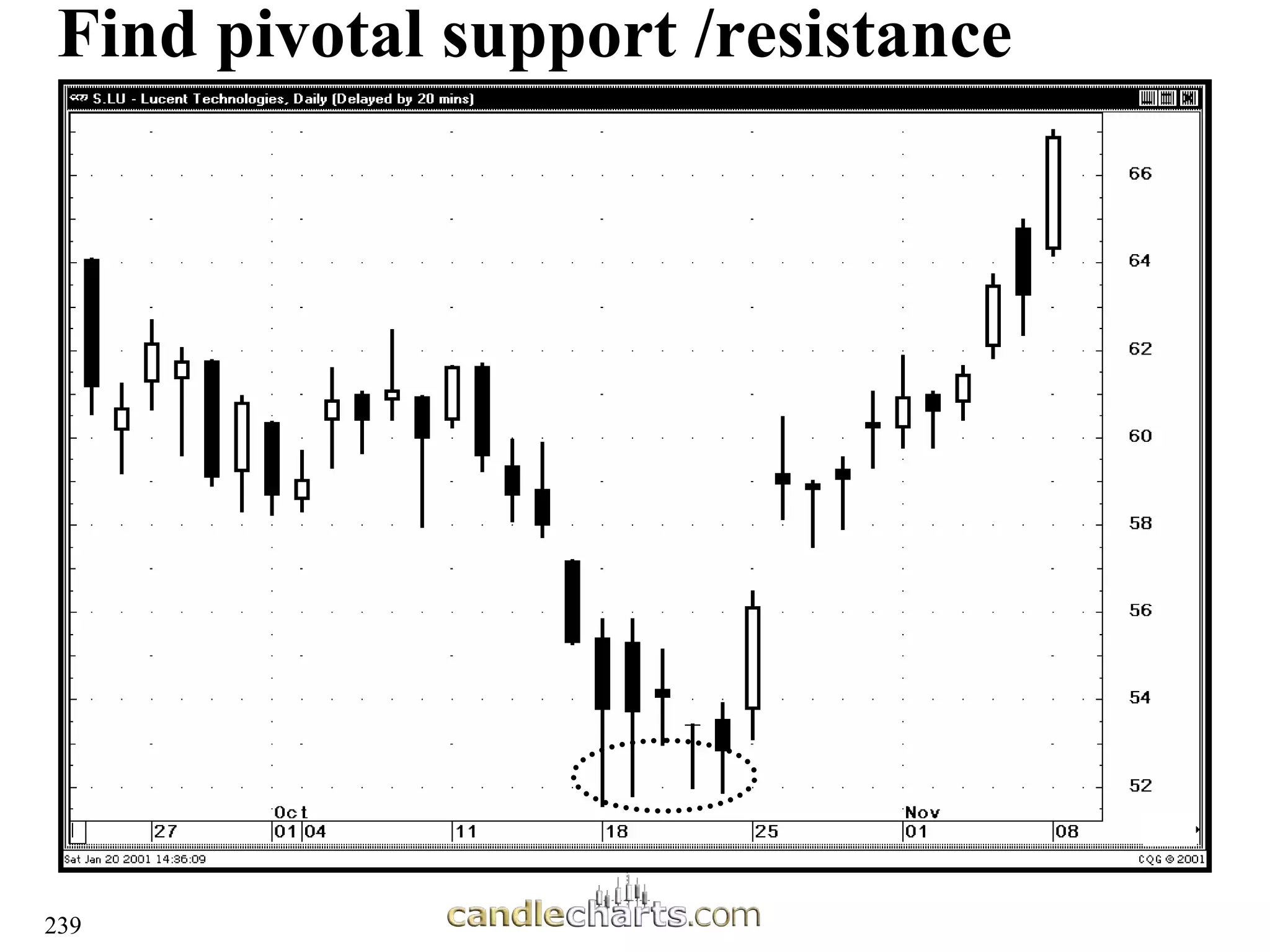

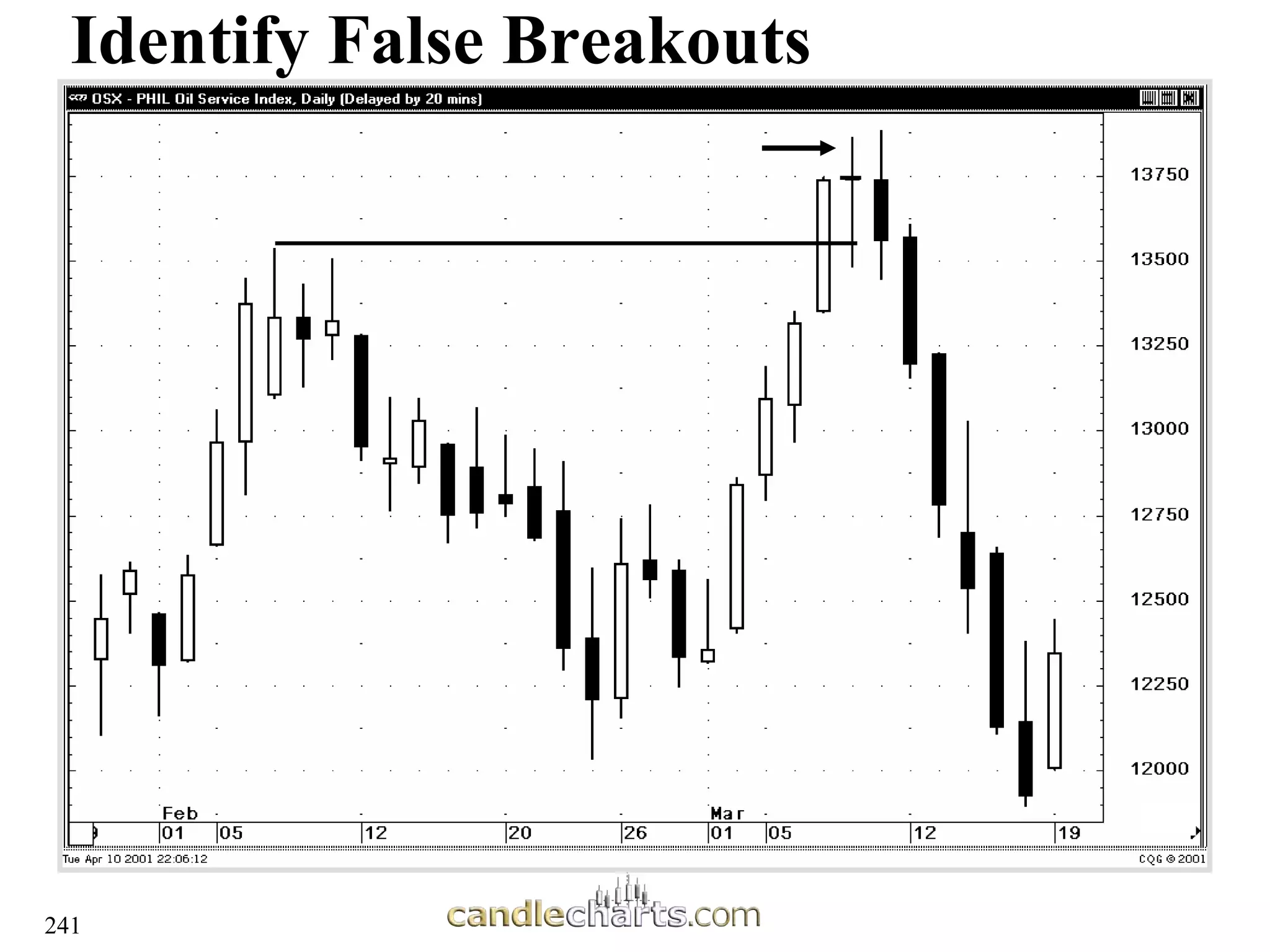

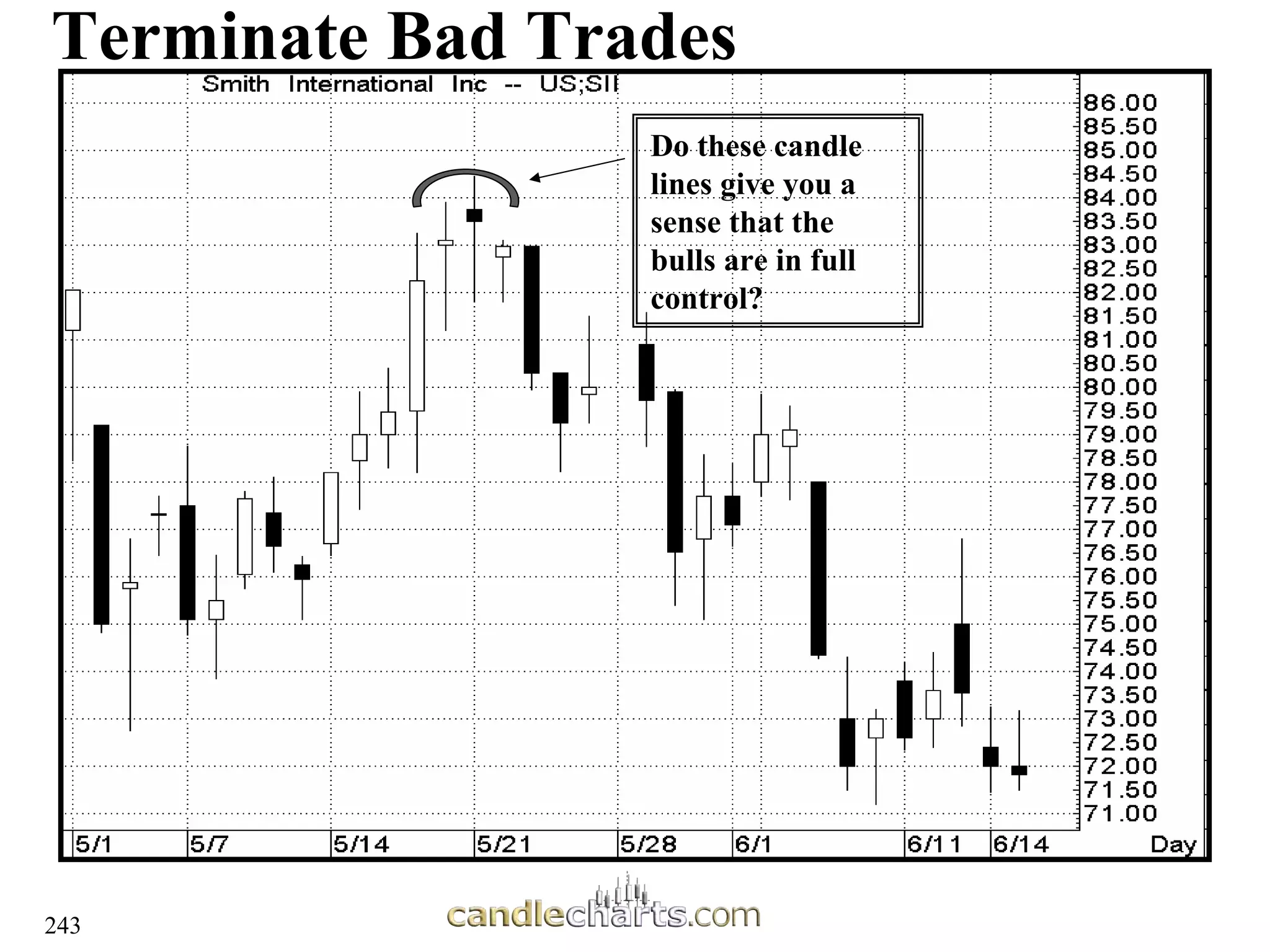

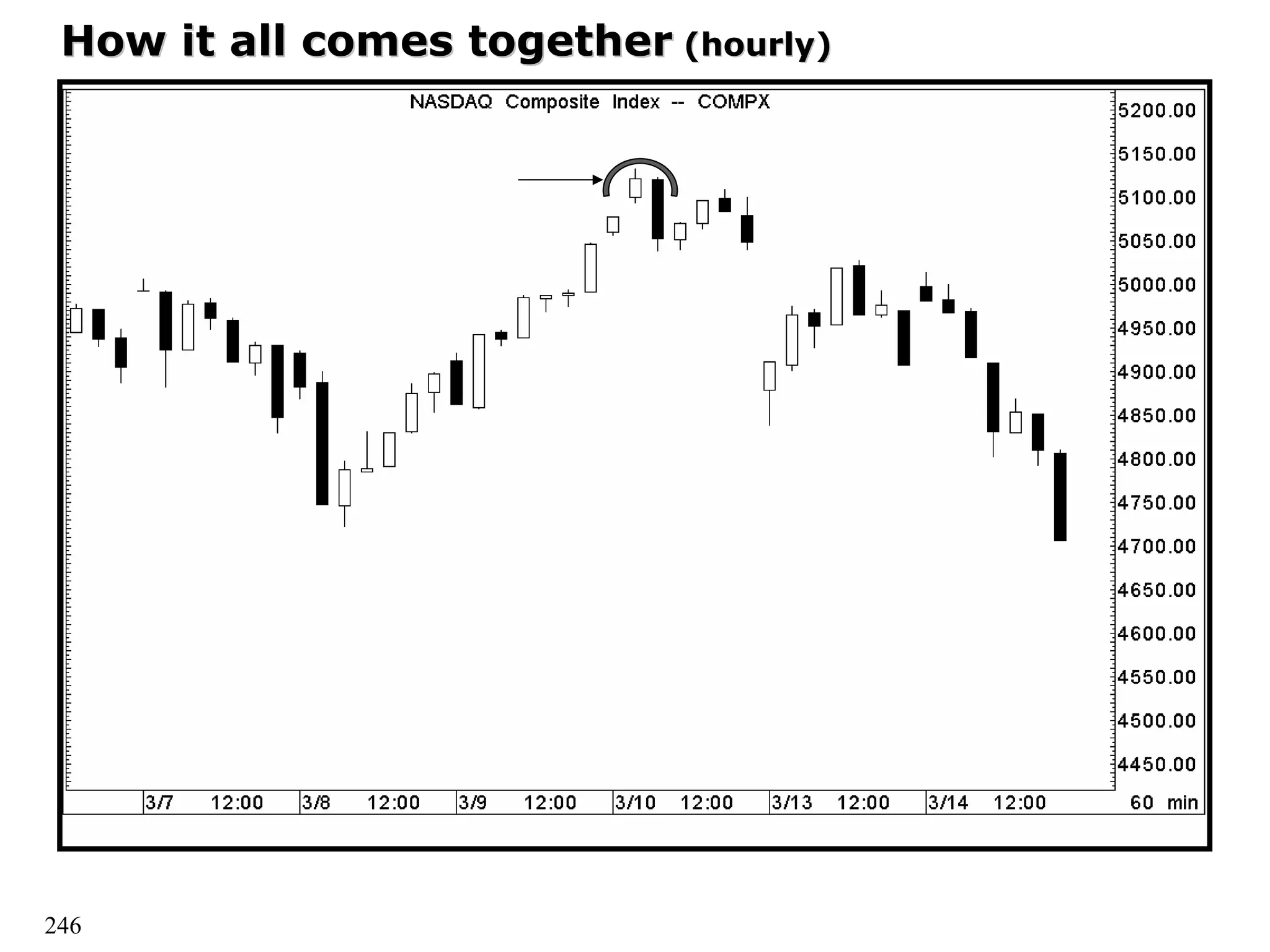

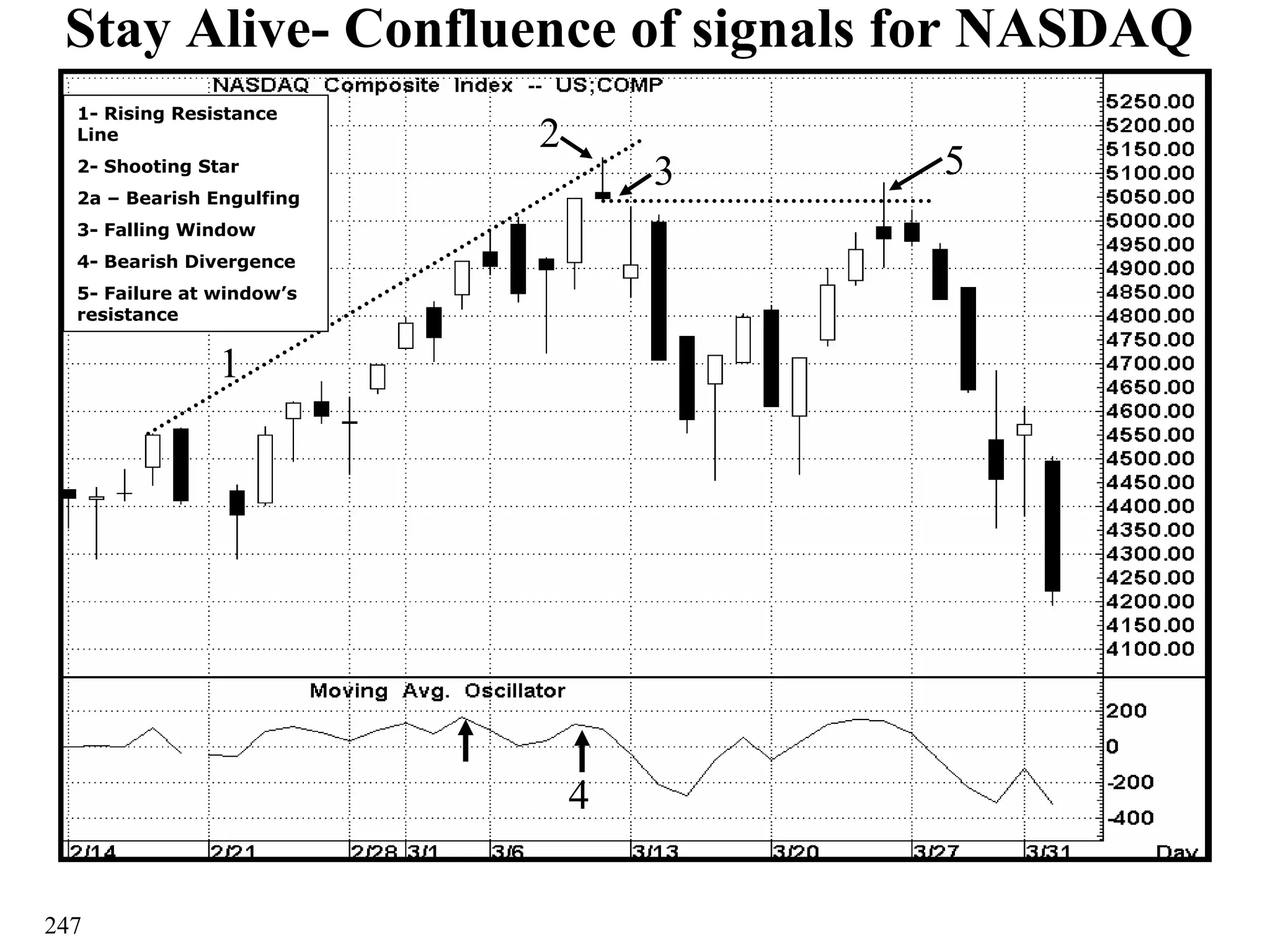

This document provides an overview of advanced candlestick charting techniques for traders. It discusses new refinements and enhancements for successful trading using candlestick charts. The document covers topics like seeing when to ignore candlestick signals, using candlestick patterns on intraday charts, and learning the six principles every candlestick trader must know. It also provides examples and analyses of various candlestick patterns like dojis, hammers, engulfing patterns, and discusses how to evaluate them in the context of trends and previous price action.