This document provides definitions and explanations of key business terms:

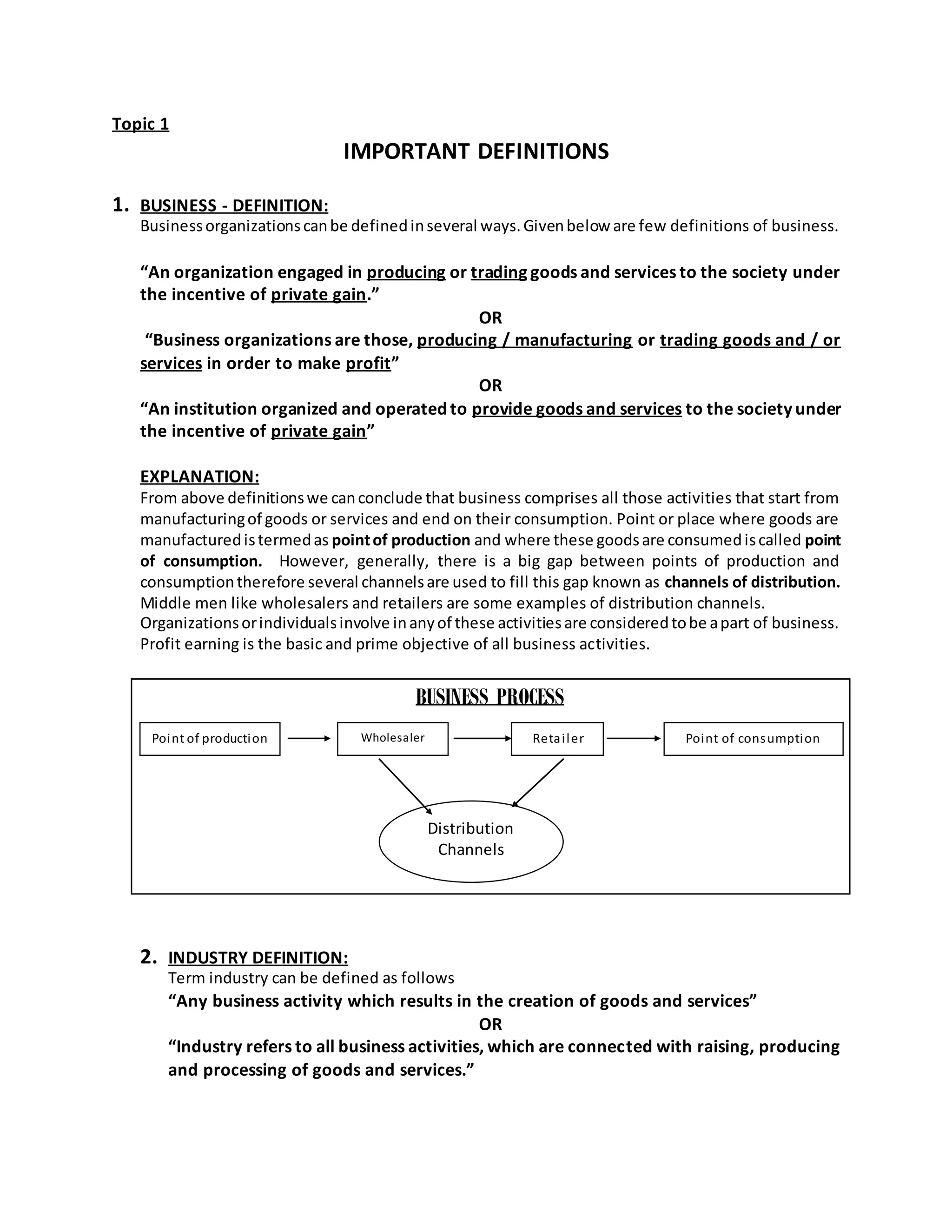

1. It defines business, industry, commerce, and trade. Business involves producing or trading goods and services for profit. Industry refers to manufacturing units that produce goods and services. Commerce facilitates the transfer of goods and services. Trade is the exchange of goods or services.

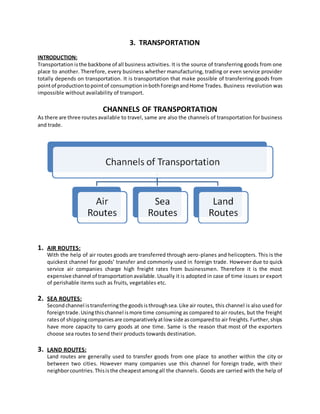

2. It discusses auxiliaries or aids to trade, which support the trade process, such as transportation, banking, insurance, and warehousing.

3. The scope of business includes production, trade, and auxiliaries to trade activities done to transfer goods and services from production to consumption for private gain.

4. It introduces problems in establishing a business, like selecting